News

22 May 2023 - 4D podcast: The golden opportunities for infrastructure in a challenging environment

|

4D podcast: The golden opportunities for infrastructure in a challenging environment 4D Infrastructure May 2023 Bennelong Account Director, Jodie Saw, speaks with Chief Investment Officer and Portfolio Manager, Sarah Shaw, about how infrastructure has been performing, 4D's portfolio, and the opportunities for infrastructure growth despite a tumultuous few years. "There is a place for infrastructure in all portfolios and in all markets. It offers defensiveness with growth, and sector and regional diversity, which means infrastructure can be fundamentally positioned for all points of an economic cycle. And we think allocations to the asset class should be more representative of this opportunity set."

|

|

Funds operated by this manager: 4D Global Infrastructure Fund (Unhedged), 4D Global Infrastructure Fund (AUD Hedged), 4D Emerging Markets Infrastructure Fund For more information about 4D Infrastructure, visit https://www.4dinfra.com/ The content contained in this audio represents the opinions of the speakers. The speakers may hold either long or short positions in securities of various companies discussed in the audio. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the speakers to express their personal views on investing and for the entertainment of the listener. |

19 May 2023 - Hedge Clippings | 19 May 2023

|

|

|

|

Hedge Clippings | 19 May 2023 This week's labour market figures showed a surprise monthly increase in unemployment from 3.5% in March to 3.7%, having reached an all time low of 3.4% last October. It has taken over 12 months of increased inflation, and as a consequence 13 months of interest rate increases, to flow through to the economy, and specifically to the labour market. To date, in spite of all the anecdotal evidence in the media, and reports from NAB and others that a combination of inflation and interest rates were causing severe stress to household budgets, there was little statistical evidence for the RBA to show for their efforts when setting monetary policy. (The possible exception to this has been the building industry, where a number of well publicised failures have been reported, no doubt as a result of fixed price contracts, supply chain delays and rapid increases in material costs in the interim.) Looking behind the headline unemployment rate of 3.7% (i.e. those actually looking for a job), the underlying numbers confirm the change in trend: According to Trading Economics, with data from the ABS, the total number of unemployed people in April increased by 18,400 to 528,010, while labour costs increased, with Average Weekly Wages rising over the quarter to $1,378.60 from $1,344.70, and Manufacturing Wages increasing to $1,545.60 from $1,464.50. Where this leaves the RBA's June decision will be the subject of much debate: Obviously, the 11 rate increases totaling 3.75% over 13 months are starting to have some effect, which may lead to a further pause in June, but while the RBA's forecasting unemployment to reach 4% by the end of this year - a rate they may have to adjust upwards - they won't be taking their eyes off the inflationary effect of higher wage costs recently awarded or announced. The RBA's nirvana is a soft landing, but just as Nirvana is difficult to achieve for a Buddhist, so will be the economic equivalent for Philip Lowe (or his successor!). |

|

|

News & Insights Collins St Special Situation Fund No.2 (Global Gold & Precious Metals) Webinar Update / Round 2 Investment | Collins St Asset Management Airlie Quarterly Update | Airlie Funds Management 10k Words | May Edition | Equitable Investors April 2023 Performance News Argonaut Natural Resources Fund Bennelong Concentrated Australian Equities Fund Bennelong Emerging Companies Fund Glenmore Australian Equities Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

19 May 2023 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

19 May 2023 - The blue sky for rare earths now a bit cloudier

|

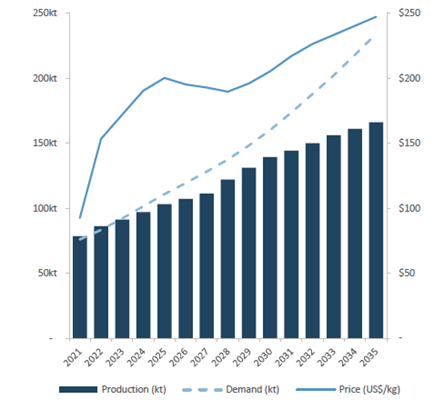

The blue sky for rare earths now a bit cloudier Tyndall Asset Management May 2022 Tesla claims it will eliminate the use of Rare Earths in its Electric Vehicles. Portfolio Manager Jason Kim investigates how realistic this claim is, drawing on insights from Adamas Intelligence, a leading research consultancy on critical minerals, and industry consultant Yoo Cheol Kim (YC Kim). During Tesla's 2023 Investor Day in March, the global electric vehicle behemoth claimed that their next generation electric vehicles (EVs) will no longer contain rare earths. Rare earths are used in some permanent magnets that are a critical component of motors in electric vehicles. These magnets contain rare earths called NdFeB magnets (Nd - the rare earth elements Neodymium and Praseodymium, in conjunction with some Terbium and Dysprosium, Fe - Iron - and B - Boron). Tesla CEO, Elon Musk, is known for making hyperbolic statements and although his statement contained no details on how this would be achieved, the impact on rare earths stocks was immediate and dramatic. Lynas, a large producer of rare earths listed on the ASX, saw its share price decline by almost 7% on the day, with further declines over the subsequent three weeks - a cumulative 23% decline during March alone (although part of this decline may also reflect the coincident announcement of an increased Chinese production quota of rare earths). Similar declines were seen elsewhere, including in China, the dominant producer and processor of rare earths, with key stocks in China falling anywhere from 4% to the daily limit of 10% on the day after Tesla's statement. Ferrite Magnets - the only feasible option currentlyTesla had previously used AC induction motors (with no rare earths) in their earlier models but replaced them with permanent DC magnet motors which contained rare earths (NdFeB magnets). Tesla's decision to switch away from AC induction motors was driven by a range of factors, including problems with unbalanced voltage supply, rotor locking, and interference with the complex network of sensors found in modern vehicles. In light of these challenges, a number of experts in the field of EVs and rare earths predict that Tesla will not return to using AC induction motors. According to Adamas Intelligence, the only current feasible alternative to rare earth-containing magnets is ferrite magnets. Moreover, ferrite magnets are currently being used by Proterial (formerly Hitachi Metals) in its latest EV motor design and have previously been used in vehicles such as GM's 2016 Chevy Volt. Germany's BMW has been active in steering away from rare earth magnets, with the company prompted to reduce its rare earths consumption to limit over-reliance on Chinese-based supply chains given growing geopolitical tensions. However, while ferrite powered motors can match the performance of NeFeB powered motors to some extent, this performance comes with a significant weight and efficiency penalty that has made the switch unattractive to date. This means that the manufacturer must accept a reduced driving range or an additional cost for a larger battery to maintain the driving range. There is also the issue of a material reduction in torque with the ferrite powered motors. Given the bigger batteries, as well as more copper required, some experts believe there is no material cost advantage to using ferrite powered motors to NdFeB powered motors. Why is Tesla looking to stop using Rare Earth (NdFeB) powered motors?Tesla's move reflects concerns that there is insufficient supply of rare earths to meet the projected demand for EVs over the coming years. Rare earths industry consultant, YC Kim, subscribes to this view. He has stated that the global EV market is projected to grow from 8.2 million units in 2022 to 39.2 million units by 2030, a nearly 5-fold increase in eight years. While these numbers are forecasts and subject to significant uncertainty, there is little doubt that the switch away from internal combustion engine (ICE) vehicles is accelerating. The result will be an increase in demand for EVs such that production volumes will be multiple times higher by the end of the decade. In 2022, Adamas Intelligence data indicates that passenger EV motors were responsible for 12% of global NdFeB magnet consumption.¹ According to YC Kim, if global EVs production grows to 39.2 million units by 2030, then EVs will account for roughly 50% of the NdFeB magnet consumption in 2030. This would see total demand for NdPr (Neodymium and Praseodymium) growing to almost four times its current size by 2030.² Where will all these Rare Earths come from?This fourfold increase in demand for rare earth minerals appears difficult to satisfy based on current supply forecasts. Indeed, the supply-demand forecasts of both Adamas Intelligence and YC Kim indicate a substantial shortfall in the supply of these rare earth elements (refer Figures 1 and 2). Figure 1: NdPr demand-supply balance (LHS) vs price (RHS) Source: Adamas Intelligence, and Australian Rare Earths Ltd. Figure 2: Dysprosium and Terbium demand-supply balance (LHS) vs price (RHS)

Source: Adamas Intelligence, and Australian Rare Earths Ltd. This supply shortfall will be very positive for pricing, as higher prices will be necessary to incentivise new supply to come to market. If Tesla wants to meet its target, it is clear that based on current supply forecasts, there simply won't be enough rare earths to produce their targeted number of EVs using NdFeB powered motors. YC Kim's discussions with major auto manufacturers suggest the first preference is to use NdFeB powered motors. He is of the view that while ferrite powered motors will work, given the significant trade-offs, they will only be suitable for lower priced mass market cars. It is simply a matter of rationing the limited supply of rare earths. YC Kim is also concerned that the growing demand for EVs within China could result in the cessation of rare earth exports as soon as 2025. Further, China has issues with its own supplies currently and has stepped out to neighbouring countries such as Myanmar (via China-controlled entities) to produce rare earths. This looming supply shortfall and potential cessation of Chinese supply has not gone unnoticed by Western governments, as detailed by Stefan Hansen in his note The Value in Securing Critical Mineral Supplies. ConclusionDespite Tesla's ambitious claim that it will cease using rare earths, it appears the demand for rare earths will continue to grow and that supply growth still remains an issue. This will most likely result in the various industries increasingly using lower quality alternatives purely out of necessity and not out of choice. There are some possible advancements that may result in true alternatives to rare earths in motors, such as manganese bismuth magnets. However, they are all still in their development infancy, and their commercialisation, if they prove to work, is still several years away. Iluka Resources, which is predominantly a mineral sands miner with a very large presence in titanium dioxide and zircon markets, has been a beneficiary of government support aimed at increasing the supply of critical minerals including rare earths. This support will assist in the acceleration of Iluka's emerging, but potentially very large, rare earths mining and processing business. As we transition towards a net-zero world while being in a period of heightened geo-political tensions, Tyndall AM believes that Iluka Resources offers a unique and undervalued opportunity. The market has not fully understood the potential upside from their rare earths opportunity, and the significance of the government support that this project has received. Author: Jason Kim, Portfolio Manager Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund

References

Important information: This material was prepared and is issued by Yarra Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252 AFSL No: 237563 (YCML). The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation, and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. |

18 May 2023 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

18 May 2023 - Learning the lessons of history

|

Learning the lessons of history JCB Jamieson Coote Bonds May 2023 Investors have been faced with more historic events in the past three years than most people see in two decades. Charlie Jamieson and Mark Burgess share their views on what's ahead and how lessons from the GFC have prepared investors.KEY TAKEAWAYS:

Investors have been through a range of extreme events in the past three years. Those trials have included zero interest rates followed by the fastest rate hiking cycle in history, oil prices turning negative, two of the largest banking collapses in US history, several crypto crashes and - most obviously - a global pandemic. Now, three years on from the start of the pandemic, Jamieson Coote Bonds (JCB) Chief Investment Officer, Charlie Jamieson and Mark Burgess, Chair of the Advisory Board, have shared their views on the path ahead for markets. SKILL TO DRIVE FUND MANAGER RETURNSIn the years following the global financial crisis (GFC), falling cash rates drove better returns from bonds, according to Mr Burgess. When central banks cut their cash rates following the GFC (and abruptly 'raced to zero' during the early stages of the pandemic), it helped fund managers deliver generally better results, he said. Typically, banks lower their borrowing costs as the cash rate trends downward. As a result, falling rates reduce the cost of capital for businesses and increase the expected return on investments*. Lower borrowing costs also encourage businesses to invest more in new capital assets. But that situation has changed with significant lifts to cash rates worldwide in the past 12 months. Mr Burgess said fund performance will come to lean more heavily on the skill of fund managers. Their ability to pick assets, the strategies they employ and the timing of their implementation will be vital to their success. "So the choice of manager matters," Mr Burgess reiterated. "Skill will be the biggest proportion of return, rather than falling rates which has been the biggest proportion of returns in my career. And if you have invested with a fund manager who's not that skilled, you're about to find out about it." NO 'V-SHAPED' RECOVERYMr Burgess explained that while there's little doubt the global economy is in the throes of a bear market, there's some debate over whether this is a normal cyclical bear market, or a structural one. If it's a structural bear market, the correction will be "far deeper and longer" than if it were simply cyclical. Mr Burgess, however, is not in the structural camp. "For that correction to happen, the structure of the system has to break," he said. Mr Burgess went on to explain that while the environment remains fragile, lessons from 2008, interventions by authorities in any failing institutions and better capitalised core banking systems, should allow for less cyclical damage than markets such as 2008 or 1970s which saw severe structural corrections. He noted however that the environment remains challenging, which will limit the ease of an immediate recovery. "It's no longer about creating credit; it's about how we structure debt and refinance. With high levels of debt refinancing is the key and the recovery there will be challenging." Although assessing the current bear market as cyclical, JCB does not expect to see a 'V-shaped' recovery in which asset prices enjoy a sharp rise back to previous highs after a similarly sharp decline. "Barring a catastrophic and systemic shock we're not going to be cutting rates," Mr Jamieson said. "That's why it's such a different go-forward, because all of the things that got carried to that very high place pre-COVID are unlikely to get carried in that same way. "So, as we've had these adjustments through the bond market, through some credit markets and the like, we're not going to get that V-shaped recovery." PLENTY OF CASH ON THE SIDELINESMr Burgess said one of the big surprises is how much money is currently "sitting underneath the market". This, he said, is likely driven by the lessons learned in 2008 during the GFC. "One of the advantages of having had a global financial crisis in '08 is that when you get a financial crisis, you actually get some future benefit, and that future benefit is that you know how to handle a financial crisis," he said. "The way people are preparing for it is that a lot of high-net-worth investors have a lot of cash ready to buy distressed assets." Most institutional investors have already pre-allocated cash to purchase distressed or oversold assets, he said. However, in some cases Mr Burgess said the volume of cash sitting in some areas such as private equity and institutional and high net worth holding is notable. Other areas however will see cash constraints - such as speculative technology. COMMERCIAL REAL ESTATE SECTOR SET TO DIPProperty markets have received significant attention as rising interest rates place the sector under mounting pressure. In the residential space the effects of these rate changes are already being felt, Mr Jamieson noted. "Anecdotally, from talking to my friends, we're all in our 40s - we've got our own families, we've got a high cost base at this point in our family lives - everybody knows it's going to be hard," he said. "I don't feel like anyone's really well set up for it yet. They just think that they'll make the adjustment if and when it comes." In the commercial property sector, however, some interesting themes are starting to take root. Mr Burgess noted that between higher interest rates and the 'work-from-home' revolution that started in COVID-19 lockdowns, office spaces may not be generating the same returns. The outlook for the sector remains negative, he added, and some investors are now looking at strategies to profit off this weakness. He cited Blackstone's newly launched US$30.4 billion distressed property fund as a prime example of this approach. Mr Burgess cautioned that while he expects prices for commercial property in Australia to continue falling, he doesn't think the downturn will be as pronounced as in past cycles. "There's not so much distress out there that people are going to have to give buildings away this time around." BONDS STAGE A RETURNThroughout the past cycle, Mr Burgess said, markets were plagued by "too much capital" chasing select stocks - with buy-now-pay-later businesses, speculative technology areas and video streaming giant Netflix both prime examples. This excess capital pushed distorted valuations and ultimately hurt returns. Mr Burgess said much of this excess capital has already "been washed out" of the market but cautioned "there's other areas that have yet to play out". With this in mind, Mr Burgess predicted a return to "good old-fashioned investing" where investors are wary of too much capital flowing into companies they're looking at. At the same time, Mr Burgess said investors are starting to look to government bonds as another option for their portfolios. "What I hear as a bond manager is that people are buying government bonds through gritted teeth, but bonds have gone back into some sort of normalised range," he said. "Now institutions are gradually allocating to bonds because they're starting to think it actually makes sense. The sharp rise in interest rates have made bonds quickly attractive again". The key to navigating the next 12 months, he said, would be to consider the current market with fresh thinking, weigh up which direction capital is flowing (and how much of it is moving), and using 'age-old' investing techniques to generate returns. True investment skill will finally be back in fashion he noted. * Reserve Bank of Australia, 'The Transmission of Monetary Policy: How does it work?', September 2017, accessed 20 April 2023.Author: Charlie Jamieson and Mark Burgess Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) References

|

17 May 2023 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

17 May 2023 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

17 May 2023 - Cashflow matching

|

Cashflow matching abrdn May 2023 In UK, the bulk purchase annuity (BPA) market has seen around £150bn of value transferred from pension schemes to insurers over the last five years. 1 Projections for the next decade suggest further transfers of over £500bn, fuelled in part by higher interest rates improving schemes' funding ratios. Although the backdrop may seem irrelevant in APAC, the capability to efficiently construct cashflow-matching portfolios is of increasing importance to both insurers and pension schemes in the region. In this article, we take a look at how novel portfolio construction techniques offered by asset managers can allow insurers and pension schemes to accurately match their liability cashflows whilst also ensuring their risk appetite and specific fund tolerances are fully considered. HolisticWith a holistic cashflow match framework, it is possible to optimally construct portfolios which offer desirable levels of yield, whilst reflecting all possible specific client specifications and restrictions. This includes clients who want their matching portfolio to meet the requirements for Matching Adjustment (MA) compliance under Singapore RBC 2 currently and the upcoming Hong Kong RBC. An investment manager can also offer pre-trade modelling and optimisation capability As well as portfolio construction, efficient ongoing portfolio management ensures assets also continue to be rebalanced and optimised throughout mandate life cycle. Later in this article we will examine the range of assets and different client specifications that can be embedded into a flexible portfolio construction and management framework. But first, what about risk appetites and tolerances? FlexibleA cashflow matching framework is centred around maximising the correspondence between the asset cashflows and the client's liability cash flow. The latter can be on best estimate basis, or based on guaranteed cash flow, depending on the nature of the mandate requirements. The asset cashflows may also include haircuts reflecting the imperfect FX hedge, necessary for example in matching adjustment mandates. It is through the additional constraints, however, that the portfolio can be tailored to meet client and regulatory requirements. For example, asset managers' tools can include:

Such a framework is flexible enough to meet any requirements or risk appetites. It's also important that asset managers work collaboratively to ensure clients' views and demands are fully reflected in the portfolio construction and on-going fund management tools. The full client life-cycle and all asset classesCashflow-matching managers are able to incorporate the full client life-cycle and a wide range of asset classes ensuring they are particularly well-placed to work with insurers and pension schemes. But what should these clients look out for in terms of manager skills, tools, capabilities and scale? The best teams benefit from a suite of proprietary, on-desk cashflow matching tools and use these to manage sizable matching portfolios in accordance with regulations in different jurisdictions . These tools aid portfolio managers and clients throughout the full lifecycle of such funds: *Initiation of mandates and fund restructuring e.g., a fund uprisking from government bond to credit or switching from credit to higher-rated supranational bonds whilst maintaining the match *Pre-trade modelling to ensure proposed new purchases and switches are suitable from a cashflow matching or on-going matching adjustment compliance point of view. *Portfolio rebalancing/liquidity management to meet cash requirements in and out of the fund. With a fast growing MA market and a limited supply of eligible public securities in local currency, it's a key requirement for MA portfolios to widen the scope of asset classes in order to continue to offer attractive solutions within a competitive market place. As such, in addition to local currency investment grade fixed income securities, best-in-class cashflow matching solutions can include overseas debt, e.g., USD corporate bonds, paired together with cross-currency swaps or repackaged up as a special purpose vehicle. It's a key requirement for Muli-Asset portfolios to widen the scope of asset classes The capability to model private placements, commercial real estate loans, and infrastructure bonds is also crucial. Naturally embedding such securities allows for efficient management of public credit alongside non-public debt within cashflow matched & matching adjustment mandates. Quantitative portfolio designIn short, proprietary quantitative portfolio design can be applied on a wide and diverse investment universe. This design may be tailored to meet clients' needs and constraints. Such a flexible and transparent process also allows for informed discussion between key stakeholders, enabling comparison of the relative merits of a spectrum of matching portfolios with different 'risk-return' profiles. To illustrate this point, we showcase such an 'efficient frontier' of matching adjustment compliant portfolios for a stylised liability profile and a public credit universe in Chart 1 and Chart 2 below. Chart 1 Matching Adjustment 'efficient frontier' constructed from the public credit universe. Typical portfolio issuer/sector /rating constraints. Liabilities c. 12y duration. Close of Business (CoB) 30-Dec-2022. A "Best cashflow match" portfolio with no yield constraint (meets various portfolio limits & MA CF-Match Tests). B Better yielding MA Compliant Portfolio (still meeting all limits & CF-M tests) C Pushing yield at the expense of cashflow match (portfolio only just matching adjustment compliant). Source: abrdn. For illustrative purposes only. Chart 2 Cashflow match plots for the three highlighted portfolios along the MA 'efficient frontier'. Stylised liabilities of c. £1bn PV (present value) and 12-year duration. All portfolios meet the required'Tests'. CoB 30-Dec-2022. Source: abrdn. For illustrative purposes only. The above portfolios also embed insurers' typical issuer, rating and sector limits and demonstrate the benefits of an optimisation exercise, potentially resulting in a 30bps gain in spread whilst retaining an acceptable quality of cashflow matching. A huge opportunity for insurers and pension schemesWith Hong Kong insurers embracing the upcoming Hong Kong RBC and Singapore insurers moving from RBC adoption to RBC optimisation, we are witnessing a trend in APAC similar to what has been ongoing among their European peers. Asset managers with proprietary techniques and insurance asset management capabilities could be well placed to support this journeys that lie ahead. Author: Mark Cathcart, Investment Director, Liability Aware |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund 1 Source: Professional Pensions, October 2022 |

16 May 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]