News

10 Jun 2021 - Everything is so expensive

|

Everything is so expensive Mark Beardow, Darling Macro 03 June 2021 In a follow-up to our last blog on lessons from 2020, Andrew Baume and I discuss some of the challenges for investing when everything is so expensive. Investors find it very difficult to feel enthusiastic about deploying capital in markets that are priced well above their historical norms and away from the investor's measure of value. Compounding this unease are periods where the outlook seems so uncertain. If anything, 2020 taught us that this is no reason not to deploy that capital. It also told us that an explicit expense such as a manager fee is very persuasive compared to the more subtle question of paying for a manager with a value or risk adjusted return focus. Keynes is often quoted as saying "markets can stay irrational longer than you can stay solvent", but the current asset inflation is by no means irrational. It is the only possible response to liquidity injections designed to combat the most scary of diseases - deflation - at a time when the global savings pool is bigger than at any time in human history, not only by amount but also per capita in the Developed World. In March 2020 the immediate response to a global shutdown was market action presuming significant slowing of world GDP with concurrent massive unemployment and dissaving. Governments and central banks who have discovered the joy of free money responded incredibly quickly, pulling asset prices off the floor. The German DAX had dropped 35% and the UK FTSE lost 30% by the time COVID shocks were fully priced. Ultimately GDP fell nearly 10% in the UK and Europe. Though prices have now recovered faster than economies with the DAX comfortably above Feb 2020 highs and the FTSE just below. So, the fundamental analysis that has been the backbone of the investment process for a hundred or more years is giving us signals that the weight of money seems to completely ignore. The deluge of liquidity means that most assets are now extremely exposed to the risk-free interest rate which drives the dividend discount model of valuation. Despite this, 2020 shows us we need to remain invested, the option of waiting for a 'buying opportunity' is loaded against those allocated to zero rate cash. Many allocators have been disappointed by the performance of their "liquid alternatives" allocations, partly because there had been a presumption that they would not behave in step with equities when there was a significant price pullback. This proved not always to be the case, some managers allowing the view they were un- or negatively correlated with equities in times of stress to persist even if not stating it explicitly. In fact a symptom of the new low rates case is for the markets to tend towards a positive correlation (even towards 1) in both down and up markets. The sense that many "alpha" strategies were actually correlated with beta was borne out by performance. Assets that were less liquid and tended not to be marked to market fared much better in March 2020 as new buyers vanished in the most liquid markets. Central banks managed the crisis via liquidity, bringing buyers back in to markets and evening out the performance gap between the liquid and less liquid. As the liquidity crisis was so short lived it is difficult to estimate how the less liquid asset classes would have performed under longer term redemption pressure. Human nature is often seen in corporate behaviour as well. As people we often conflate familiarity with understanding, in fact it is much easier to act on our familiar triggers than to delve into the true nature of an event. Daniel Kahneman is a psychologist who won a Nobel Prize in Economics by recognizing this trait. A couple of easy but potentially dangerous learnings from 2020 may be to remove liquid alternative sources of returns from portfolios and focus more on illiquid ones. Both courses of action are understandable responses but need to be taken in the context of all scenarios, not merely the one we have just witnessed. So disappointment needs to be viewed in context. We all fall into the common trap of analysing the performance of each component of a portfolio when the outcome of all of the components working together was within expectations. Disappointment should be confined to when the overall portfolio performed outside expectations (given every portfolio has layers of risk, this expectation needs to be realistic). Secondly disappointment with a particular allocation needs to be seen in the prism of how the allocation was designed to behave and whether the execution failed the design. It is no good complaining about a liquid alternatives not being negatively correlated with equities when the underlying design did not include that characteristic for example. One of the hot topics in Equity and to an extent Fixed Income investing is the cost benefit of indexing rather than active management. The design of that strategy is to outsource your return to the momentum of everyone else in the market. It will be interesting to see whether the mooted return of the value investor puts a spotlight on that design feature. The next article will cover diversification as it relates to whole of cycle investing. Funds operated by this manager: |

9 Jun 2021 - This time it is different?

|

This time it is different? Mark Beardow, Darling Macro May 2021 Recently I sat down with my colleague Andrew Baume to reflect on 2020 and what lessons can be drawn. As he says, with the dubious benefit of over 35 years in Financial Markets, "I have grown weary of commentators who do not accept that this time it is different." The fact that market prices move from one day to the next is evidence that not only this time, but every day in markets is different, otherwise, we could crystal ball gaze and live the simple life.

When Sir Thomas More walked across the iced-over Thames into the Tower of London he contemplated how cold London had become. In the early 1980s, Paul Volcker decided to massively manipulate the overnight cash rate and money supply. Mao Zedong was accused by Khrushchev of ruling via a "cult of personality". Mark Twain famously said history does not repeat itself, but it rhymes. The past 12 months of investment markets have rhymed in an often clanging disharmony with elements of times past, but they are clearly also different. George Soros took a view against the Bank of England in 1992 that was a blueprint for the Reddit warriors to take on hedge fund shorted stocks as a cause célèbre. Soros was backed by deep research and a conviction that the level of the GBP was wrong, but it was might and a squeeze that won the day for him. GameStop was just might and weight of numbers, so soon reversed leading to massive losses for the warriors who bought at either of the tops (so far). The COVID-19 asset pricing crisis of March 2020 was another driven more by weight of numbers than by deep research or analysis of the future case given the events playing out. Once the liquidity picture became clearer, and the stance of central banks doing "whatever it takes" (rhyming with Draghi) prices responded. Investment textbooks teach that there is an "optimisation" process that over time will lead to smoother and ultimately better outcomes. Academic investing has a tendency to argue away the times when correlations break down, referring to the long term nature of the ideal investment portfolio. The danger of that approach is shown with the more common incidences of increased correlations between many markets over the last 20 years or so. Managers have sometimes found it convenient to be seen as having negative correlations to other asset classes (usually equities) and found that in times of stress that is hard to sustain. Not only does that idea get more regularly tested than historically, by allowing that implication to be held the sector as a whole suffers crises in confidence. How we long for an investment that looks the same once the can is opened as the picture on the label. Optimisation when measured in hindsight can look anything but optimal. Despite that, innovative methods of investing are an essential response to the constant change in conditions. One example of truly uncharted waters is a global middle class saving for their own retirement (rather than receiving a government or employer pension). According to the OECD, the global retirement pool is over US$49 trillion and growing. Once added to the bottomless pit of liquidity being provided by governments globally, it is little wonder markets are staying well bid and commentators call for another crash (they have predicted 27 of the last 3 pullbacks). It is certainly not the first time investors feel impelled to buy assets that feel expensive. FOMO is real as asset prices stay frothy and cash rates are below inflation. Bond rates have already reflected the policy of massive stimulation, the capacity for them to provide relief in the event of an equity selloff has diminished compared to times past. Most asset valuations have benefitted from low discount rates, and assets like bonds that may have a veneer of negative correlation lose that relationship in stress. There is an ongoing need to be invested when being in cash is so penalising. In the midst of this, central banks tempt us with rhetoric that rates are not going anywhere for at least a couple of years. Investors can't rely on an optimisation strategy that worked when interest rates were higher. Diversification of sources of return that don't rely on low-interest rates is a difficult task, one that will improve portfolio outcomes particularly from a risk concentration standpoint. It was not just fixed interest that felt a shiver as US bond rates rose by 66% in the last two months. There is no guarantee that any strategy is negatively correlated with any other during times of stress. Investors have to stay invested but perhaps the rhymes of history can be harnessed to build a more resilient dynamic asset allocation that reflects the way markets are behaving, not just reflecting expectations or hopes. Diversification through relatively static asset allocations needs "time in the market" to generate the academic outcome but can lead to wild rides in the interim. A 70/30 equity/others split works as the tide rises all boats, but clearly, the inverse is also true. Diversification of return sources and an ability to dynamically reallocate has attractive characteristics because as Keynes said, "the market can remain irrational for longer than you can remain solvent". There is no option to be out of the market waiting for a time for assets to "cheapen." Lastly, when markets move in ways that weren't expected, history is clear; more money is lost selling at the lows that made by timing the entry point. 2020's price action where the collapse and subsequent recovery of asset pricing on relatively low volume suggests participants are hearing the rhymes. "Needing" to sell assets in the dip was painful. Funds that had large amounts of illiquid assets had the light shined on them when an externality such as government allowing access to the hitherto always growing superannuation balance of millions of members tested liquidity policies. Illiquidity is not a bad thing at all as it usually comes with a premium and investors with long term horizons can bank that. Strong inflows had a dampening effect on the liquidity drain, but there is a lingering question of equity between the members who withdrew for super at a very small discount to pre-Covid pricing (and potentially reinvested into markets down 20-30%) and those who remained in the fund with even lower liquidity and an asset that might well not have been realisable at the holding price. Access to higher liquidity assets also allow funds to make bigger strategic rebalancing decisions. Although timing the market is hard, there are big events where the need to do that is clear. Entities that seek to maintain fixed weight allocations also need to find flows to do that and top up the allocations for the sector that has fallen most. Some interesting thought bubbles for allocators to ponder. In summary, lessons we can glean from knowing our history and looking for rhymes (not rules) are multiple, but some are straightforward:

This is the first of several pieces that will explore these lessons of 2020 while recognising the environment of 2021. The outcome will rhyme with the past, but history will not repeat. Funds operated by this manager: |

9 Jun 2021 - Australian Banks: Where's the Growth?

|

Australian Banks: Where's the Growth? Marcel von Pfyffer, Arminius Capital 28 May 2021

Last November we said that the big four banks were on the road to recovery, and recommended that investors hang onto the banks as a leveraged play on Australian growth in 2021. Over the last six months the banks' share prices rose by 35% or more: now the question is, can they keep on out-performing? Australian investors have come around to the belief that our economy is on a smooth path to recovery, so they expect bank earnings to recover in line with the economy. Consensus forecasts imply that, after their FY21 rebound, bank earnings per share will grow by less than 10% in each of the next two years. Dividend payouts will not return to their pre-pandemic levels of 75%-plus, so dividend yields will grow very slowly from their FY21 levels of 4.5% to 5.0%. The banks are simply not as profitable as they used to be, because of higher capital requirements and increased competition in key areas. A decade ago, 20% returns on equity were common; by contrast, in the next couple of years CBA will earn about 12% and ANZ, NAB and Westpac 9% to 10%. The changed environment is reflected in the banks' dismal share price performance from 2015 to 2020 as seen in the graph below. CBA alone has just beaten its 2015 share price peak; the other three are still about 30% below their 2015 peaks. The "new normal" after COVID-19 will not be much better for the banks than the old normal before the pandemic.

Australian "Big Four" Banks share prices indexed to Base 100 = March 2015

Source: FACTSET

In the longer term, the banks still face the four strategic threats described on our 22 July 2019 paper (available on the Arminius website): higher standards, cryptocurrencies and payment systems, fintechs and neobanks, and ultra-low interest rates. The pandemic diverted attention from these threats, but the threats are still there. We believe that the combined effects of these threats will erode the banks' growth rates over the next five years, with the result that their total returns will be about 1%pa below the 10.2%pa long-term return of the Australian share market. The banks have already remediated almost all of their customers and updated their systems to cope with higher regulatory standards. Their CEOs have begun to lay out their post-pandemic strategies, and it is clear that they are based on very different visions of the future of banking. We do not regard cryptocurrencies as a threat to the standard banking model, partly because acceptance is limited to the true believers, and partly because the regulators have barely started to supervise the sector. Payment systems, however, are undergoing dramatic changes which could change the banking model over the next five years. In particular, all of the major central banks are now looking at issuing their own digital currencies, and some of them may copy the Chinese model. The pandemic killed off some of the weaker neobanks and fintechs, but the stronger players (e.g. Judo) have survived and are winning market share. Ultimately, their owners will probably succumb to the temptation to sell out to the big banks, but over the next few years they will nibble away at the incumbents' margins, in the same sort of process that we have seen in other disrupted sectors such as airlines and telecommunications. Ultra-low interest rates are not a permanent feature of the Australian financial landscape, and the Reserve Bank's response to the pandemic included assistance to the banks. It is likely that the strength of the recovery, the jump in house prices, and the emerging inflationary pressures will encourage the Reserve Bank to begin raising official interest rates sooner than the market is expecting. In addition, there is the challenge issued by the Reserve Bank of New Zealand. During the GFC, the Kiwi regulators could hardly fail to notice that the Australian banks operating in NZ made decisions to suit their Australian regulators and shareholders, without regard to their Kiwi stakeholders. The RBNZ has told the banks that it wants much higher capital ratios in their NZ businesses, ring-fenced so that Kiwi stakeholders come first. The Aussie banks must either comply, and see their Kiwi return on equity drop, or they must divest their NZ businesses. Most importantly, the big four Australian banks are no longer cheap. In terms of price-earnings ratios and price-to-book ratios, they are more expensive than most banks in the developed world, even their much stronger US counterparts.

All data is in local currency terms. Blue data points are country level section averages, with the exception of Mkt Cap which is a sum total.

Source: FACTSET They are also slightly expensive relative to their own history. Relative to the Australian market, however, they are still slightly cheap, and their strong capital positions leave room for share buybacks. Therefore we recommend that investors maintain their bank holdings, at least until the next set of results in November. Funds operated by this manager: |

8 Jun 2021 - Why Does Private Equity Outperform Listed Equity?

8 Jun 2021 - Capturing Relative Value in Today's Credit Markets

7 Jun 2021 - Webinar: Cryptocurrencies

|

This week Fund Monitors held a webinar on the subject of cryptocurrencies and were joined by Clint Maddock from Digital Asset Funds Management (DAFM) to try to lift the level of understanding for those interested or intrigued by the opportunity, but unsure where to start or who to listen to. The subject is complex, the risks considerable, but what emerged was that there are also opportunities to achieve returns without taking the levels of directional risk symptomatic of Bitcoin and other digital currencies.

|

7 Jun 2021 - The Six Sectors We Favor Most as Market Sentiment Shifts

|

The Six Sectors We Favor Most as Market Sentiment Shift Olivia Engel, CFA, State Street Global Advisors May 2021

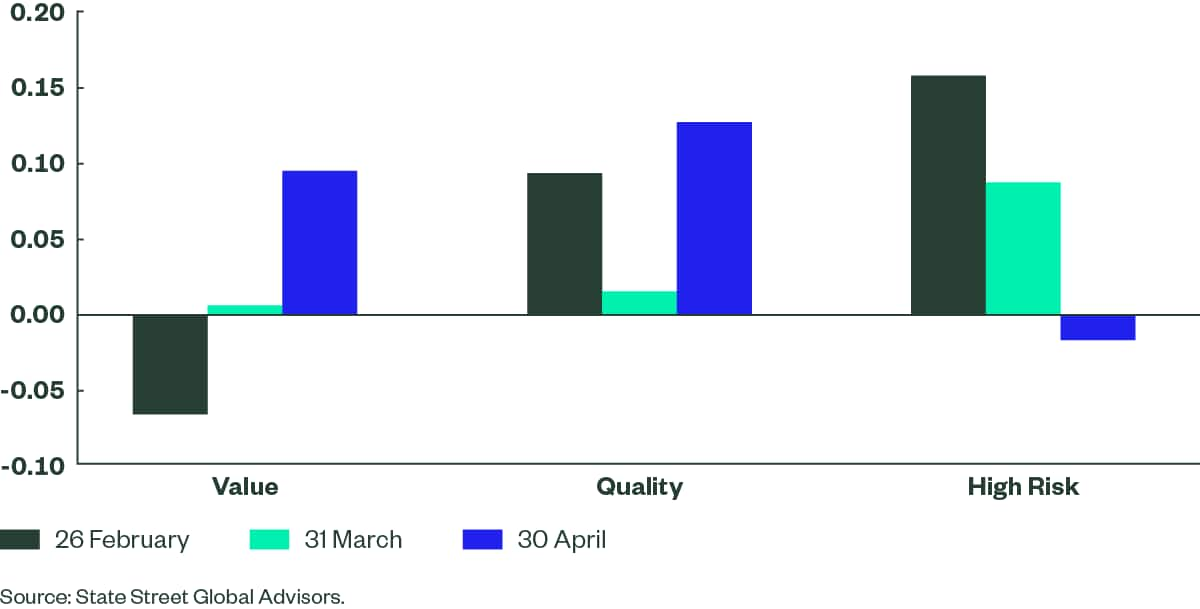

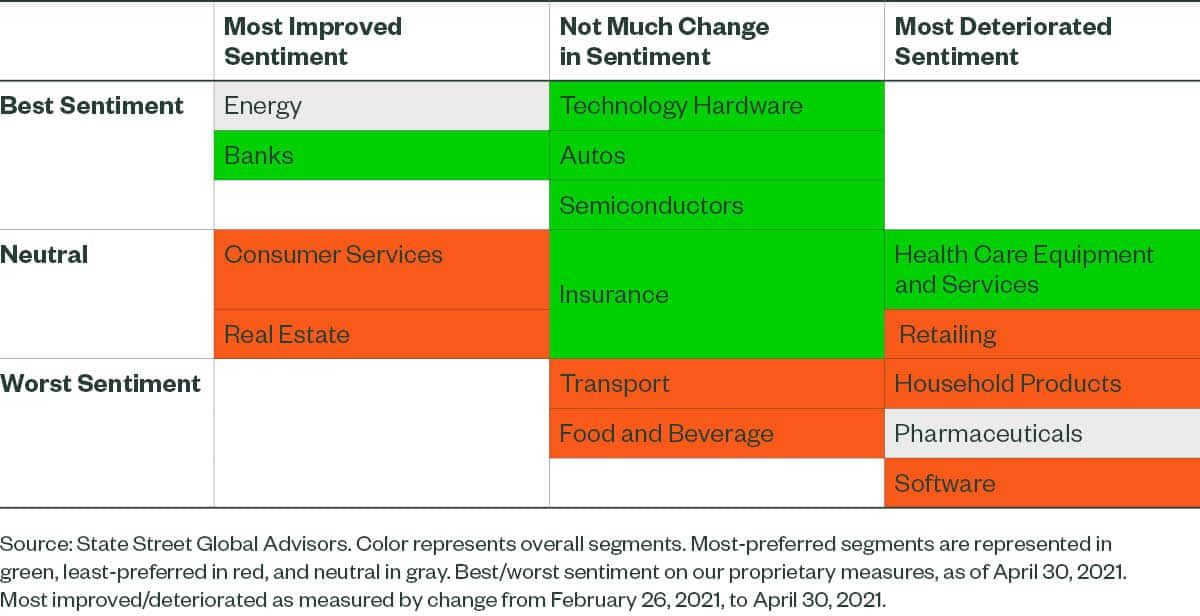

In recent weeks, market sentiment has undeniably shifted away from relatively expensive, high-risk, low-quality stocks. To illustrate the magnitude of this aggregate shift, it's helpful to compare our measures of sentiment with our assessments of value, quality, and risk. The correlation between sentiment and value has shifted from negative to positive over the past two months; the already positive correlation between sentiment and quality has become higher over the same period. At the same time, the correlation between sentiment and high risk has plummeted. Figure 1 shows the extent to which investors recently have been turning their attention toward more reasonably valued, higher-quality, lower-risk stocks. Figure 1 Correlation of Active Quantitative Equity's Proprietary Sentiment Scores with Proprietary Scores for Value, Quality, and Risk That said, in our view not every area of the market with improving sentiment is a good place to invest, and not every segment with deteriorating sentiment should be avoided. Consumer Services and Real Estate both remain unattractive on our measures, despite their improvement in sentiment in recent months. In general, Consumer Services firms still represent very poor value (when taking quality considerations into account). And although many Real Estate companies continue to be of high quality, our signals - which quantitatively analyze the language used in earnings conference calls and in the explanatory notes of financial reports - are concerning. The six market segments we most favor in this environment of shifting sentiment (in no particular order) are Health Care Equipment, Banks, Insurance, Technology Hardware, Autos, and Semiconductors. Our preferences are not always based on improvement in sentiment (see Figure 2). For example, although the broader Health Care sector has experienced heavy deterioration in market sentiment, we still like Health Care Equipment and Services, especially in the US. The language signals from Health Care Equipment and Services companies' conference call transcripts and financial reports are very strong, valuations are reasonable, and quality is high.

Figure 2 AQE's Current Most-Favored and Least-Favored Sectors

Banks have benefited from improving sentiment in recent weeks. While we favor banks overall, that improvement in sentiment is not the sole source of that positive assessment. Drilling down to examine banks by region reveals some important distinctions. European banks have seen a much larger improvement in sentiment than their North American counterparts, but we view European banks as only neutral in attractiveness compared with cheaper North American banks. The same multi-dimensional view informs our negative assessments as well. Sentiment toward real estate stocks across the developed world has improved a lot in recent weeks, but in Europe sentiment toward real estate stocks has actually gotten worse. Our language signals for European real estate names are also very poor. Bottom Line Sentiment has turned to favor attributes we like, including high quality and cheaper valuation. When choosing stocks, however, it's important to weigh all important attributes, including value, quality, and risk - as well as sentiment - in order to avoid simply riding the latest sentiment trends. ssga.com Marketing Communication State Street Global Advisors Worldwide Entities For use in EMEA: The information contained in this communication is not a research recommendation or 'investment research' and is classified as a 'Marketing Communication' in accordance with the Markets in Financial Instruments Directive (2014/65/EU) or applicable Swiss regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research. Important Risk Information The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor. All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. The views expressed are the views of Active Quantitative Equity through May 12, 2021, and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investing involves risk including the risk of loss of principal. Quantitative investing assumes that future performance of a security relative to other securities may be predicted based on historical economic and financial factors, however, any errors in a model used might not be detected until the fund has sustained a loss or reduced performance related to such errors. The trademarks and service marks referenced herein are the property of their respective owners. Third-party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data. © 2021 State Street Corporation. Funds operated by this manager: |

4 Jun 2021 - Ivers Steady on Wild Ride During First Three Years

|

Ivers Steady on Wild Ride During First Three Years Prime Value Asset Management 19 May 2021 Richard Ivers, portfolio manager for the Prime Value Emerging Opportunities Fund, has notched up his first three years in charge of the small caps investment fund. Markets have thrown just about everything at investment managers during this time: from flat spots to record highs, and the 'fastest bear market in history', which happened as COVID-19 panicked investment markets. Ivers steered the Prime Value Emerging Opportunities Fund to several key milestones, including being the second best performing Australian equities fund for the 2020 calendar year. He has delivered returns well above the market by prioritising capital protection. "Protecting capital is the most important step for us because if we minimise losses we maximise opportunities. "Every market event creates opportunities. The volatility we have seen in small caps across COVID has provided us with excellent chances to invest in quality companies poised to do well during the recovery and beyond. "But it all starts with a commitment to preserving capital, which means avoiding the speculative stocks and looking through the hype to find real quality." Key numbers for the Prime Value Emerging Opportunities Fund: For the last three years the Prime Value Emerging Opportunities Fund has delivered 20.7% per annum to investors while the index returned 9.1% per annum - this means the Fund has outperformed the index by 11.6% per annum net of fees. During this three years:

The last time the Prime Value Emerging Opportunities Fund underperformed in a falling month was December 2018 - over two years ago. For the year to 30 April 2021 the PVEOF has delivered 54.91%, outperforming the small ordinaries accumulation index by 15.14%, outperforming strongly during 12 months of rising markets. The Fund has delivered 13 consecutive months of positive returns, while the index has had three negative months during that 13. The Prime Value Emerging Opportunities Fund's last negative returning month was March 2020 (during the COVID crash). Performance has been achieved at a lower level of volatility than the market: risk, as measured by volatility, (standard deviation) has been 13.8% below the index. This results in a far superior Sharpe ratio, which measures risk-adjusted returns. Funds operated by this manager: Prime Value Equity Income (Imputation) Fund - Class A, Prime Value Growth Fund - Class A, Prime Value Opportunities Fund, Prime Value Emerging Opportunities Fund |

3 Jun 2021 - Why we sold out of Redbubble

|

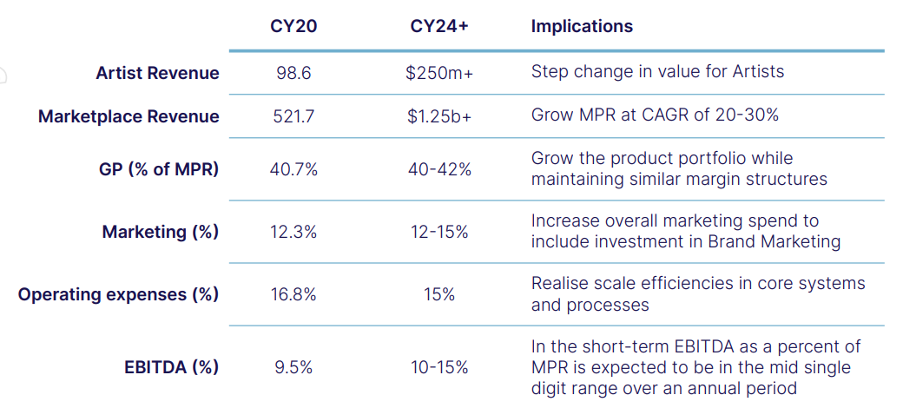

Why we sold out of Redbubble Joseph Kim, Portfolio Manager, Montgomery Investment Management 24 May 2021 Most articles we read are about hot stock tips to buy. Occasionally there are articles about "shorting" opportunities, albeit most are directed to sophisticated investors given the risks around shorting (i.e. a potential loss that exceeds your initial investment). Very few articles talk about when to sell. However, it can be just as important to know when to sell as when and what to buy, a key skill in active management. The Redbubble thesis revisited Last year, we highlighted Redbubble as a COVID winner with global aspirations. The business was a significant beneficiary of lockdowns and stimulus payments - with their years and dollars of investment in the artist platform, logistics and supply chains - paying dividends during the global e-commerce boom, especially in their key US markets. The company's execution during this period was stellar as it managed the significant spike in sales volume during the COVID work-from-home period. It was quick to take advantage of the boom in facemask demand - an entirely new product category - which immediately became a major contributor to revenue. The marketplace platform also demonstrated the power of operating leverage, as 96 per cent growth in Revenue delivered 1,028 per cent growth in EBITDA (albeit off a low base) in the December 2020 half. Incremental margins of 25-30 per cent helped drive improved profitability. The Redbubble flywheel helped generate interest during lockdowns, with significant social media interest on Tik Tok and Twitter as well as more mainstream media articles drive users. With all these positive tailwinds, why did we sell out of our holding in Redbubble? In my previous article, the empirical paper "Selling Fast, Buying Slow" referred to three discrepancies between the buying and selling performance of investors:

It is the final point which is relevant in our decision to sell our remaining holding. Assessing earnings risk At Montgomery, we not only focus on the price vs valuation of our investments but also the earnings risks - either higher or lower than market estimates. In many cases, it is these earnings risks that provide significant upside or downside potential relative to the current share price - especially for less mature businesses - as they drive the growth trajectory of future earnings. For Redbubble, the share price faced its first significant road-bump following its DecH20 result released in February. The update revealed some additional costs related to paid acquisition and shipping, as well as reduced gross margins related to promotional activity in the December quarter. Some of these took the market by surprise, and the share price sold off ~15 per cent in the weeks following the release as it too caught up in the broader "rotation" out of e-commerce winners. Earnings risk assessed for March quarter underpins exit thesis The next stock-specific catalyst was the March quarter sales update. With the share price re-based to $5-6/sh after some margin-related earnings downgrades, it was important to assess the likely trajectory of earnings for the June half of FY21. There were two key areas that underpinned our decision to sell prior to Redbubble's March quarter earnings release: Contribution of face masks to revenue While many investors were aware of facemasks being a significant contributor to revenue growth, there were few estimates of the quantum of revenue contribution. After peaking at ~25 per cent of revenue in July, we assessed facemasks had declined to ~5-7 per cent of revenue exiting December. This has a significant impact not only for Redbubble's revenue for March, but also the difficulty in "comping" elevated face-masks sales that were unlikely to be repeated in the September quarter 2021. We also assumed even if COVID did not recede, facemasks were unlikely to be a significant repeat contributor in the key US market due to i) greater competition in masks; and ii) warmer months in the northern hemisphere in conjunction with vaccine roll-out. Impact of currency on revenue growth Given the volatile moves in currency and the US' contribution to revenue, this represented a significant swing factor in our estimates of Redbubble's revenue trajectory. With >70 per cent of Redbubble's revenue from North America and the strength of the AUD vs USD, this represented ~15 per cent headwind to its top line versus the prior comparative period, which we assessed had yet to be fully factored in market earnings estimates. Where we could have been wrong While the decision to sell ahead of its April earnings release may appear to be obvious in hindsight, there were factors which we had to consider where we may be wrong:

All of these factors (and other unexpected positive developments) may have resulted in a higher share price. Despite this, we deemed the risk skew to the earnings and subsequent share price impact was to the downside. Where to given sell-off? With the Redbubble share price having re-based once again (more significantly than we had anticipated) - and with incremental new future sales targets, earnings and profit margins and investment focus areas, it may be worth re-assessing the shares once again as an investment opportunity.

Many of the aspects which initially attracted us to the Redbubble business - the flywheel, operating leverage, investment in supply chains, global reach and aspirations - remains intact. There is also increased awareness of the Redbubble brand given the spike in website viewer traffic and new customers acquired during COVID. It is also clearly a much more valuable company coming out of COVID than it was going in, and should new CEO Michael Ilczynski and the Redbubble team start delivering on its aspirational targets, will likely become more valuable over time. Funds operated by this manager: Montgomery (Private) Fund, Montgomery Alpha Plus Fund, Montgomery Small Companies Fund, The Montgomery Fund |

2 Jun 2021 - Manager Insights: ESG | Longlead Capital Partners

|

ESG investments grew considerably in the Asia-Pacific region in 2020 and there were a number of net-zero emissions targets released by Asia-Pacific countries in late 2020. Dr. Andrew West, Managing Director & Founder of Longlead Capital Partners, speaks about how this has changed the way Longlead look at companies and build their portfolio.

|