News

20 Sep 2021 - Opportunities and risks for investors in the latest UN climate change report

|

Opportunities and risks for investors in the latest UN climate change report Edwina Matthew, Pendal 11 August 2021 |

|

Key points

THE UN's latest Climate Change report made headlines this week with predictions of irreversible global warming, rising sea levels and climate change affecting every corner of the planet. But it also provides evidence-based information to help investors better understand portfolio risks and identify investment opportunities such as carbon capture and methane-reduction technologies. The 3900-page report from the UN's Intergovernmental Panel on Climate Change (IPCC) -- the United Nations body for assessing the science related to climate change -- is the gold standard for research on the science of climate change and options for adaption and mitigation. Government and corporate decision-makers worldwide rely on the IPCC's findings to inform their climate risk assessments and emissions reduction strategies The report -- which was unanimously endorsed by the governments of all 195 country members including Australia -- is based on a three-year analysis of 14,000 peer-reviewed scientific studies. It will be the central terms of reference later this year at COP26 -- the upcoming United Nations climate conference in Glasgow. The report shows unequivocally that human activities are responsible for the warming world. This warming is increasing the frequency and severity of extreme weather events such as heatwaves, droughts, cyclones and heavy rain. Global temperature rises of between 1.5 and 2 degrees Celsius are expected unless deep reductions in greenhouse gas emissions occur in the next few decades. Regardless of action, changes already occurring due to past emissions are now likely to be irreversible for thousands of years. Low likelihood, high-impact events such as ice sheet collapses, ocean current changes or Amazon dieback cannot be ruled out. "It's a sobering read," says Edwina Matthew, Head of Responsible Investments at Pendal. "And remember that these are averages - different regions, different countries, even different states will be impacted to a greater or lesser degree than this average. "For example, the report finds that average global warming is 1.09 degrees Celsius above pre-industrial temperatures. Australian land areas are already 1.4 degrees Celsius above pre-industrial averages. "This is going to increase the probability of extreme weather events, heatwaves, sea surges and drought." Risks and opportunities for investorsWhat should investors take out of the IPCC report? What does it mean for portfolio construction? And how can investors ensure they understand the risks and opportunities posed by global warming? Matthew identifies three headline risks and opportunities for investors to consider:

The most high-profile litigation so far has been a Dutch court ruling that the multinational oil giant Royal Dutch Shell must reduce its emissions because its contribution to global warming violates human rights. Previous IPCC reports were referenced in the court case and this latest one will likely be used in the appeal hearing. A number of Australian cases have also referenced IPCC findings. Sharma v Minister for the Environment [2021] found the federal environment minister owed a duty of care to children who might suffer potential "catastrophic harm" from the climate change implications of approving a NSW coal mine extension. Investors also need to watch for governments being the target of litigation which could affect regulatory approvals and business permissions in their investments. 2. The report's heightened focus on methane is of interest for investors A "strong, rapid and sustained' reduction in methane emissions is required to help reduce greenhouse gas emissions and hopefully avoid the catastrophic impacts of climate change, the report finds. Methane is not only a vastly more potent greenhouse gas than carbon dioxide, but its concentration in the atmosphere has been increasing rapidly. Importantly, it is short-lived in the atmosphere meaning controls on methane can rapidly reduce atmospheric concentrations. Governments are already acting on methane. The EU is proposing curbs on methane emissions while the US is planning tighter emission rules. But it's a tricky problem to solve. Some gas production emits methane. Raising livestock for meat and nitrogen-based fertilisers are major sources. Rotting waste in landfill also emits methane. "All of these are important challenges that investors can play a part in," says Matthew. "Investors can engage with companies to better understand how they're thinking about these issues, what they're doing to mitigate the risks and how they're transitioning to thrive in a low-carbon economy. "Investors can also direct funds to solutions. For example, CSIRO is working with the private sector to commercialise a livestock feed additive made from seaweed, which has been shown to reduce methane emissions in cattle by up to 80 per cent." 3. Carbon removal solutions can also play a role in investor portfolios "Carbon removal is a vital net zero tool which has a place alongside absolute emissions reductions," says Matthew. "It covers a range of investable methods, from afforestation to wetland restoration to carbon capture and storage (CCS) and ocean fertilisation." However carbon removal technologies such as CCS need more development to work at the scale required. We need more co-ordinated efforts to advance these sorts of emissions reduction solutions in sectors with harder-to-abate industrial processes such as cement and steel production. Future climate scenarios are becoming clearer We now know more than ever how possible climate futures could play out. The report is very clear that without "immediate, rapid and large-scale reductions" in emissions, curbing global warming to below 2 degrees Celsius -- the Paris Agreement goal -- will be "beyond reach". These findings call on us all to accept and act on the reality of the situation, including policymakers, investors, businesses and consumers. In the words of the UN Secretary-General Antonio Guterres the report is a "code red for humanity". |

|

Funds operated by this manager: Pendal Total Return Fund |

|

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at August 11, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided. This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. |

17 Sep 2021 - Investment Perspectives: Thinking about office

|

Investment Perspectives: Thinking about office Quay Global Investors September 2021 |

|

Imagine you are an office manager for a medium sized firm of 20 employees. Under normal circumstances, you and the staff would occupy around 400 sqm of office accommodation located in the CBD. But these are not normal circumstances. Lockdown orders mean that all staff are currently working from home.

You are invited to a Zoom call by the CEO. In between regular interruptions of your 10-year-old requesting you to help print the Storm Boy quiz, it becomes clear the CEO has big changes in mind for the post-COVID world. You are informed that upon returning to the office, the new company policy will be to allow each staff member 1 day per week to work from home (WFH). You have been given the task of negotiating with the landlord the firm's new office space requirements. The maths is not as simple as it seems Assuming the WFH days are not rostered and are available on a random basis, there are potentially days when a large number of your 20 staff are in the office at the same time. You may even contemplate the possibility that all 20 are in the office on the same day. If so, the decision will be to either have no reduction in office space, or risk an uncomfortable and cramped office conditions on random days. To put some science around the problem, you decide to run a Monte Carlo simulation[1] to calculate the maximum number of employees on any given day over 100 days, and the chance (probability) of hitting that number. Again, assuming the days working from home are not rostered and generally random (for example, no preference for Friday or Monday), the probability of at least 1 day (from 100) of each 'number of staff in office' scenario can be estimated as below.

Source: Quay Global Investors What the above chart shows is that over 100 work days (approx 4 months), there is an 85% chance that at least 1 work day will have all 20 employees in the office. Conversely, there is a 15% probability that at most 19 employees will be in. To be clear, there will be other days when there are less - but this analysis is calculating the maximum workers in the office on any particular day over 100 days, since this is the basis for the required office accommodation. As office manager, depending on how un/comfortable an environment you want for your staff, the overall space reduced will be between 0-5%. Running similar analysis for 2, 3 and 4 days WFH scenarios results in less needed space (obviously), but the relationship is far from linear.

Source: Quay Global Investors So even under the scenario where employees are allowed 4 (out of 5 days) to randomly work from home, there is at least 1 day in 100 where 50% of staff will be in on the same day. So office usage is only reduced by 50% despite 80% days worked from home. How realistic are our assumptions? To us, the idea of a rostered WFH day for staff seems unlikely. It seems to fly in the face of 'flexible work days', which is the main attraction of WFH. We think it is more likely there will be biases for preferred days, which suggests our analysis above is too bearish on overall long-term office demand. The above analysis also assumes every employee will want to WFH 1 day per week. As the lockdowns across Australia drag on (6th time in Melbourne), it is reasonable to think this is an unrealistic assumption. This would again mean our analysis above is too pessimistic. Other considerations? Investment considerations So, when considering office property as an investment we simply ask ourselves two questions:

The purpose of this article is to consider the second question. If the answer to both questions is 'yes', an attractive investment opportunity may well exist. What we don't know is whether office tenants will 'experiment' with WFH scenarios, which will temper short-term tenant demand - at least for the foreseeable future. In other words, it could take a long time for values to recover, and the next development cycle to emerge. But for long-term investors, this shouldn't matter. Whether the recovery is quick or slow, so long as the entry point is below cost, then the capital appreciation from the purchase will exceed a rise in building costs (which should roughly match inflation). If an adequate return on capital is generated in the meantime, then our investment objective (CPI + 5%) total return is achievable.

Source: Quay Global Investors Concluding thoughts Yet, as we have highlighted in previous Investment Perspectives, this is certainly not the case for retail; and we think we have illustrated it is not likely to be the case for office. Investing is about finding opportunities or investments priced for a pessimistic outcome that may not happen. These types of investments can sometimes offer a skewed bet - not much loss if the market was right, but big gains if wrong. The office sector may harbour such opportunities. |

|

Funds operated by this manager: Quay Global Real Estate Fund |

16 Sep 2021 - The Looming Housing Excess

|

The Looming Housing Excess Yarra Capital Management August 2021 |

|

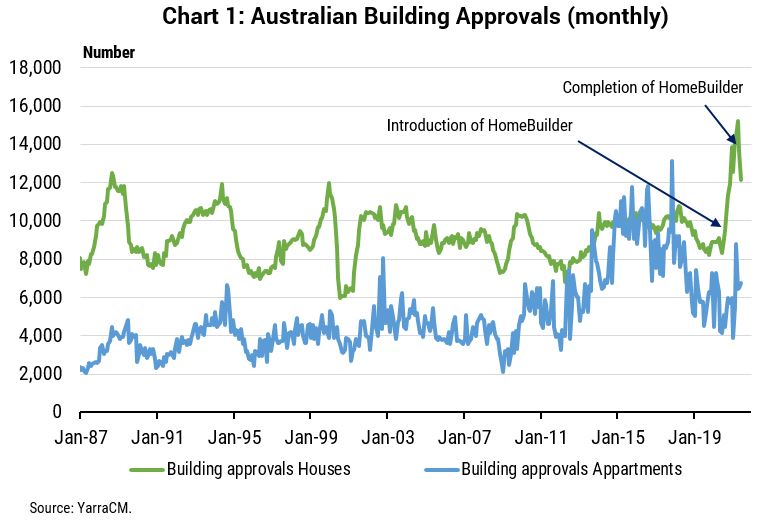

Analysis of Australia's housing sector from Tim Toohey, Head of Macro and Strategy, suggests excess supply is coming on the back of historic government stimulus measures and an absence of net migration. In an apparent suspension of collective logic, it appears few people have asked what happens when you provide massive incentives to bring forward an unprecedented spike in house construction while simultaneously choking off future demand by halting net migration. Away from the fog of COVID, any reasonable minded person would have concluded that unless the starting position was a massive undersupply of housing, then this combination of policy settings would soon generate a large excess of housing. In this note we summarise how large this excess in housing is likely to be and the investment conclusions. What happens when a Government program is too successful in inducing supply?The HomeBuilder program, in concert with generous incentives from State governments and mortgage rate reductions, has proven successful in bringing forward construction. But have they been too successful? Recall that upon the introduction of the HomeBuilder scheme, the Treasury estimated that COVID-19 would see cancellations of housing projects of ~30%, compared with ~17% during the Global Financial Crisis. This reduced the Treasury's pre-COVID housing starts estimate of 171k to just 111k. The HomeBuilder scheme was explicitly designed to offset half of the expected decline in starts, with the aim of backfilling 30k starts in 2020-21. That is, the Treasury was hoping to achieve ~140k housing starts once HomeBuilder was fully implemented. Instead, approvals for houses have exploded to the upside. By the March quarter of 2021 dwelling approvals were annualising at 278k (refer Chart 1), and even though approvals have declined from that peak, by the end of the 2020-21 financial year some 200.4k dwelling were approved. Single home approvals were even more spectacular, with a record 136.6k approved during the year, to be 31% above the prior financial year. Of course, this also excludes the surge in approvals for renovations over the same period.

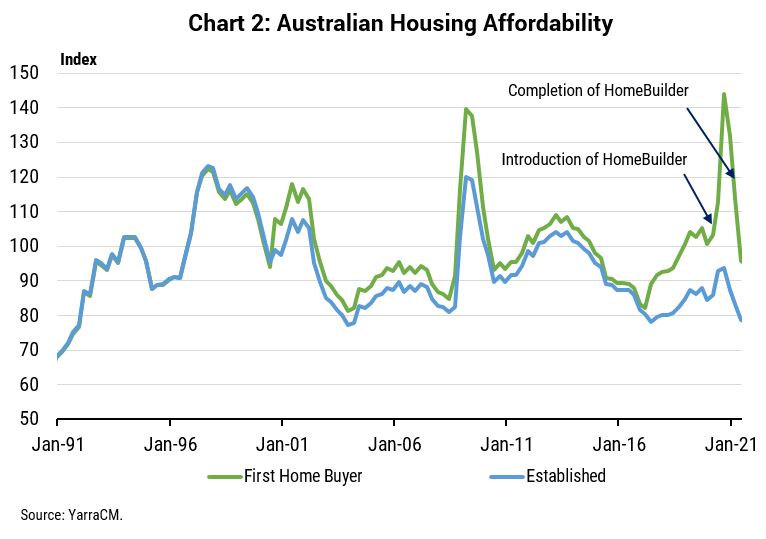

In the end, 99.3k HomeBuilder applications were received by the Government to build a new home and a further 22.1k applications were received for a 'substantial renovation'. Which means the HomeBuilder program exceeded Treasury's objectives for new dwelling construction by 330%. The clear lesson being never stand between an Australian household and an uncapped government program! Taxpayers have effectively handed out almost $3bn in 'free money' to people to build or renovate their home. Such Federal government largess was obviously well received. However, what is less well understood is that State Governments were also busily providing their own incentives, especially via stamp duty exemptions for first home buyers. These incentives varied by state and in many instances were in place prior to JobKeeper. To put the incentives in context, we have created separate housing affordability indices for established and first home buyers. This captures all the incentives and taxes by State and Federally in addition to all the standard factors that influence affordability - house prices, mortgage rates, loan to deposit ratio and household income.

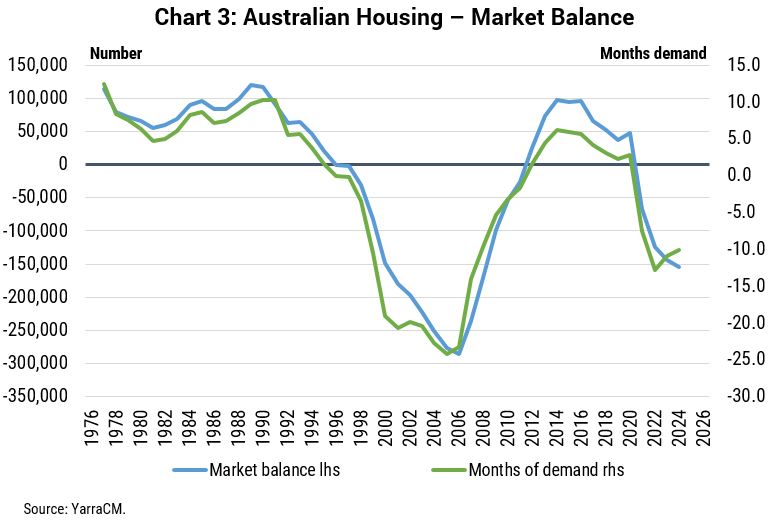

Chart 2 shows the enormous boost to housing affordability for first home buyers that was provided principally by shifting government incentives. The subsequent decline in affordability is mostly due to the lapsing of the HomeBuilder incentive, although 15%yoy growth in house prices by mid-2021 has also weighed heavily on affordability. These seismic shifts in housing affordability ultimately determines the near term path of housing approvals. But it is important to recognise that the incentives and inducements do not create new demand for housing. Rather they merely bring forward housing construction that would otherwise have been demanded at a later stage. The bigger the pull forward, the bigger the decline once affordability declines back to its pre-incentive levels. What happens when a pandemic eradicates future demand?But what if you not only provide massive incentives to pull forward the supply of new houses, but also simultaneously eradicate one-third of future demand for housing? Housing can only be demanded by those who have placed themselves in a situation to form a household. We spend a lot of time modelling the demographic structure of the population in Australia and how that relates to future housing demand. It's a relatively complex process that incorporates factors as diverse as; the relationship type and number of dependants of each household, the type of structural dwelling, the vacancy rate of established dwellings, demolitions, and trends towards second or lifestyle homes. The census data is an important input for the historical analysis, however, the forward projections rely heavily upon the accuracy of the ABS's population projections. Although the ABS provides three main scenarios for future population growth, their projections have been rendered useless by the de facto ban on net migration from travel restrictions. As such, we have recast the population projections by looking at the age characteristics of migrants and assumed that net migration doesn't return to pre-COVID type levels until 2023. By modelling the future supply of new housing as a function of the change in affordability and comparing that demographic demand for housing adjusted for the unprecedented reduction in net migration, we can solve for the likely future oversupply of Australian houses. We define 'market balance' for housing as the most recent year that demographic demand and completions were equal in number. As such the accumulation of the difference between demographic demand for housing and completions of housing from the year of market balance determines the excess or undersupply of housing through time. We estimate that by the end of 2023 Australia will have 150k dwellings in excess of demographic demand (refer Chart 3). This would be the largest excess of housing since 2008, and this rather sombre forecast embeds as a base case of a 30% decline in dwelling approvals by the end of 2022.

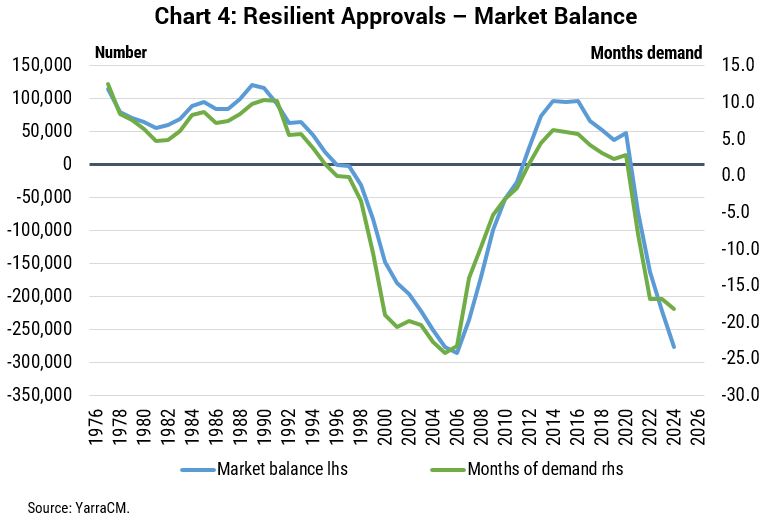

What happens to the excess of established homes if the immigration recovery is delayed or if building approvals remain elevated?What if housing approvals don't fall as sharply as our base case? Demand for housing is ultimately determined by demographic demand, but participants in the housing market typically operate with a more limited information set. And what happens if Australians become so enamoured with recent house price gains that Australia continues to build at an excess rate? If we assume only a 10% decline in approvals is recorded by the end of 2022, then the excess of housing will equal the peak excess of 2006 (refer Chart 4) which on our calculations was greatest excess of housing since our calculations commenced in 1976.

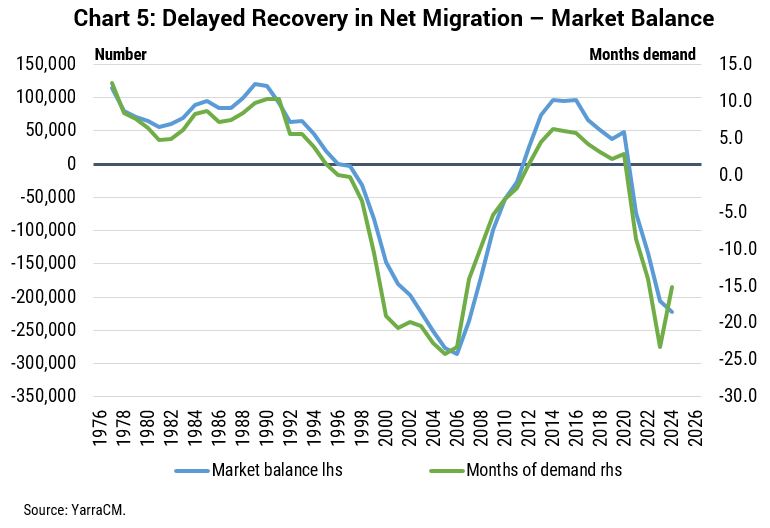

Alternatively, what happens if net migration doesn't bounce back to 200k by 2023? How would that affect the base case? If we assume net migration of +20,000 in 2021 and +75,000 in 2022 (instead of +200,000 under our base case) the oversupply of housing will increase from 150k to some 200k by the end of 2023 (refer Chart 5).

What are the investment conclusions?Just under 70% of all households either own their own home outright or are in the process of paying off a mortgage. Housing remains the largest financial asset that most households own and we estimate that by mid-2021 the value of the housing stock is $8.9 trillion - 3.7 times the market capitalisation of the ASX200 and 4.5 times the size of the Australian economy. Clearly, such large and valuable asset should be managed with care. Moving into a large oversupply of housing does not necessarily mean that house prices are at risk of significant decline. The prime example is that the peak excess of housing in 2006 did not unleash a sharp fall in prices. Price growth did slow significantly during the 2003-06 period, but two important things happened that avoided the housing excess translate into falling prices. Firstly, the combination of stronger household formation rates of the local population and a mining-related boom in immigration transformed the demographic demand for housing. In the 10 years to 1996, we estimate the demand for housing averaged 140k per year. In the 10 years to 2006, housing demand had slipped to just 118k per year. However, in the period since 2007 Australia's annual housing demand has averaged 199k, with a large step change occurring in 2006 due to more Australians moving into key household formation age brackets and the surge in net migration associated with the mining boom. This step change was crucial in gradually absorbing the excess of housing that had previously accumulated. Secondly, the Global Financial Crisis and the subsequent slow economic recovery saw the RBA cash rate decline from 7.25% in August 2008 to 0.75% pre-COVID and just 0.10% post-COVID. Capitalising low interest rates into house prices has become something of a national sport ever since. The problem facing Australia today is two-fold: (i) interest rates are today at the lower bound, and (ii) housing demand is now hostage to the evolution of the pandemic and how fast we choose to ramp up immigration in the post-vaccination phase. Quite simply, the RBA cannot cut any further and politicians may be reluctant to open up immigration from low-vaccinated countries. In our view, repeating the good fortune of the post-2006 period seems highly unlikely. Contrary to the current fervour of house buying, the risk of lower house prices over the next two years is at least as high as further house price increases. As in most financial markets confidence is always highest at the peak in prices. We are not using this analysis of excess housing to suggest a sharp decline in house prices is imminent. Indeed, low real mortgage rates may sustain prices at elevated levels. Rather, we are suggesting that expectations of ongoing house price gains over the next two years may be disappointed and more importantly the boom in new single house construction will be followed by a deep downturn. The first investment conclusion is that Banks should be thinking in terms of building provisions against the risk of weaker prices, rather than continuing to release provisions as seen over the past 12 months. The failure to do so may risk P/E multiples de-rating once the oversupply of housing becomes clear to financial markets. Clearly, bank average LVRs and bad debts are low by historical comparison, providing ample protection against any house price declines. Nevertheless, the boom in new borrowers for single homes on the periphery of the major cities are yet to build equity in their home and are more vulnerable to any decline in house prices. The second investment conclusion is that there is really only one way to avoid a large oversupply of housing, and that is to stop building so many of them. Our base case has a significantly larger decline embedded than the consensus view and is well below that of the RBA which is currently forecasting of dwelling investment declining just 0.5% in 2022, before rising again. Ultimately, it is on this point where we disagree the most. As stated above, you can't create new housing demand, you can merely alter the timing of when that demand is realised. No more rate cuts, lapsing of incentives and damaged affordability via recent price spikes will see dwelling approvals fall sharply, particularly single home approvals. The only way Australia avoids a significant excess of housing by 2023 is if approvals fall far more than anyone expects. With full knowledge that building material company earnings will remain robust as the backlog of homes and renovations to be built remains large, it is the trajectory of housing approvals that has historically governed the share prices of these companies. It has been a great ride up for the building material companies, but we are past the peak, and the outlook today looks increasingly gloomy. The final investment conclusion is that the RBA will not be tempted to raise interest rates while the housing construction sector - the most interest rate sensitive sector in the Australian economy - transitions from boom to bust. The RBA will only be tempted to commence the rate hiking cycle once inflation has been at target for at least six months, wages are approaching 3% growth, net migration is firmly on the path to recovery and the housing approvals downcycle is complete. These criteria are highly unlikely to be achieved prior to 1H23, so regardless of what other central banks do in the interim the RBA's record low interest rate setting is set to remain for a long time yet. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

15 Sep 2021 - The Long and The Short: What reporting season can tell us about life in Australia

|

The Long and The Short: What reporting season can tell us about life in Australia Kardinia Capital 2 September 2021 |

|

Just as the Australian Census promises to provide a comprehensive snapshot of the country and how we are changing, so too the recently-complete Australian profit reporting season can tell us what life has been like for Australians over the past 12 months.

Growth of online sales

Australian online home furnishing retailer Temple and Webster (TPW) is another such example, where FY21 revenue is up 85% on prior calendar period. We also got a glimpse of current trading, with July month to date revenue growth accelerated to +39%. We expect TPW to report a tremendous uplift in gross profit, enabling significant reinvestment in FY22. Savings rate still elevated Internet data usage swelling Solid demand for cars We have seen very strong profit results and growing forward order books from dealers like Eagers Automotive (APE) and Autosports (ASG) - both companies' share prices have appreciated over the previous 12 months, at 145% and 118% respectively. APE's "order bank growth is expected to continue as new vehicle demand remains strong and vehicle supply remains constrained"[3]. Source: Morgans, ABS

Weak travel results "It's not for lack of trying. Australians are ready to travel. Qantas Chief Customer Officer, Stephanie Tully, commented: "So we [have] obviously been researching our customers throughout the pandemic on their desire to travel and doing that monthly and in the last couple of months, particularly for international, we've seen the highest demand levels we've ever seen. When you compare that to pre-pandemic levels of people that are likely to travel in the next 12 months, we're seeing triple the amount of people looking to travel internationally in the next 12 months." Aircraft are being pulled out of storage, including the A380s, and reconfigurations are currently underway with the intention to return to the skies when the magical 70% and then 80% vaccination rates are achieved. Bolstering management's confidence was the strength of the domestic business in the June quarter of FY21 - by the end of June, management basically saw the domestic business booking curves back to pre-COVID levels. Concerning inventory levels Everyone seems to want to 'invest' in inventory as a strategic play. A stretched global manufacturing and supply chain is creating challenges - including longer lead times, higher freight costs and shipping delays - leading to companies growing inventory levels. Supercheap Retail (SUL) management said: "If it's [inventory is] not in the shed or on the shelf today, for Christmas this year I think the chance of it being [in stock] come that peak time is incredibly remote."[7] However, we do not want inventory growth outstripping sales growth, and this is something we'll watching closely in future periods. Retailers (BRG, SUL, KGN) continue to show higher levels of inventory and it's concerning us. Only JBH and BBN have managed to keep inventory days down so far. Whether customers will be the major beneficiaries of heightened promotion activity (for inventory vulnerable to obsolescence such as technology) remains unknown; only time will tell. What does all this mean for the future?

Department of Health We predict the 70% threshold for vaccinations will be reached by the end of October, which will be around the same time as AGM season. Our view is CEOs will start to get more optimistic around this event. This is likely going to continue the rotation towards coronavirus-impacted sectors. The Kardinia portfolio is positioned for re-opening, with stocks that benefit from this comprising ~30% of the long book and lockdown stocks only ~10%. We believe some themes, such as the shift to online, are enduring, and we continue to hold exposure to the technology sector. Of course, new COVID variants and government nervousness around a likely rising death rate (as witnessed overseas) present risks to our view, but the Kardinia fund's ability to shift its net exposure to markets in a range of -25% to +75% allows us to quickly respond to any change in outlook. |

|

Funds operated by this manager: Bennelong Kardinia Absolute Return Fund |

|

[1] Booktopia FY21 Results Presentation [2] Uniti Group FY21 Results Presentation [3] Eagers Automotive FY21 Results Presentation [4] Bluescope FY21 Results Presentation [5] Rex FY21 Results Presentation [6] Qantas FY21 Earnings Call [7] 'Zero chances of it arriving on time', Sydney Morning Herald, 22 August 2021 |

15 Sep 2021 - New Funds on Fundmonitors.com

|

New Funds on Fundmonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

||||||||||||||||||||

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

|

||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

|

||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

|

||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

|

||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

|

||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

||||||||||||||||||||

| View Profile | ||||||||||||||||||||

|

Want to see more funds? |

|

Subscribe for full access to these funds and over 600 others |

14 Sep 2021 - The Rise of the Contactless Economy - A Global Megatrend

|

Covid-19 has created an unprecedented global change in how we pay for things. There's been a profound and permanent change in behaviour in Australia and many parts of the world. Payment apps are easy to use, they offer improved security and the work from home offers balance introduced since Covid means more time to browse from home via laptops and phones, says John Lobb Insync's Portfolio Manager, John Lobb tells us more on The Rise of the Contactless Economy Megatrend. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund |

14 Sep 2021 - 10k Words - September Edition

|

10k Words - September 2021 Equitable Investors 8 September 2021 Apparently, Confucius didn't say "One Picture is Worth Ten Thousand Words" after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy. We kick off with Equitable Investors' updated study on the distribution of five year returns for ASX-listed industrials. The FT highlights the recent surge in global M&A activity. Leading electronics retailer JB Hi-Fi (JBH) suffered a decline in like-for-like sales amid COVID-19 lockdowns in eastern Australia, ending a long sequence of continual growth, as charted by Evans & Partners. And Wilsons shows how ASX stocks were divided into the winners and losers as the latest round of lockdowns in Sydney and Melbourne were initiated. Westpac highlights how volatile iron ore spot prices have become - at the same time the cost of shipping that ore has surged, as illustrated by a Bloomberg chart of the shipping benchmark the Baltic Exchange Dry Index. Finally, Hussman Funds reckons the ratio of non-financial market capitalization to corporate gross value-added (MarketCap/GVA) is "the single most reliable valuation measure we've introduced over time, based on its correlation with actual subsequent market returns across history".

Distribution of five year total returns for ASX industrials

Source: Equitable Investors, Sentieo Worldwide M&A

Source: FT.com, Refinitiv Like-for-like sales growth for JB Hi-Fi (JBH) & subsidiary The Good Guys turns negative

Source: Evans & Partners ASX COVID-19 winners v. losers Source: Wilsons Largest daily fall on record for iron ore spot market - and largest weekly fall too

Source: Westpac Baltic Exchange Dry Index

Source: Bloomberg US market cap / gross value add for non-financials v subsequent 12-year S&P 500 returns Source: Hussman Funds US market cap / gross value add for non-financials Source: Hussman Funds Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog Funds operated by this manager: |

13 Sep 2021 - To invest or not to invest in China?

|

To invest or not to invest in China? Robert Swift, Delft Partners September 2021 |

|

Investing in China remains a moral question, but to not invest now because of more government intervention and capricious legislation is illogical, since that would be to ignore the fact that these trends are clearly evident in other countries. More government, capricious and unexpected legislation to the apparent detriment of companies and shareholders, is now omnipresent as a global systemic risk to equity returns. Consequently, prepare for lower rates of profit growth and 'fatter' tails in your investment outcomes, even if you decide to never invest in China again. There are similarities between Xi Jinping's increasing intervention in the Chinese corporate sector and those by Western governments 1. Policy with social objectives (with a lack of awareness that the years of free money created the wealth inequality in the first place) 2. More taxation and worryingly more centrally directed capital allocation and subsidies (Tesla anyone?) 3. Penalising 'rentier capital' aka private savings 4. Population coercion to behave by scare tactics/messaging, and surveillance; China uses facial recognition software and 'social scores' (but you may care to read this: Amnesty - New York Police Facial Recognition Revealed) At least China has finally done something about moral hazard which would still seem to be prevalent in 'the West'. China Evergrande is 95% certain to default on over $80bn of bonds and we'll have to see how that pain gets allocated between locals and foreigners before making more judgements, but bankruptcy is part of capitalism, or it used to be. In this respect China is ahead of the US perhaps and certainly the Europeans in letting a failed enterprise actually fail. For those of you who think that China's decision making comes without due warning and therefore makes it too risky in which to invest, the second part of the US 'Infrastructure' bill, equal to a 3.5tln $ spend, will take 17 days (!) to debate. Obamacare took 9 months even with a significant Democrat majority, (which is not the case now) and FDR's programmes were spread over his first 2 terms - 8 years. The UK government recently announced hikes on national insurance and dividend tax increases in essentially a unilateral decision by the prime minister. The unelected European Central Bank has essentially decided both monetary and fiscal policy for Europe and the result has been less than stellar growth. The Euro remains a political construct not a valid economic one but it's an ideology akin to 'Mao thought' and so on we go regardless.

In short, governments everywhere are consulting less and intervening more quickly. Government exist to provide essential services but to also redress other imbalances dangerous to national cohesion - or they should. Currently imbalances are very evident in wealth inequality and the share of profits in the economy relative to wages. Using the US data (the best around) we can see from the chart below that corporate profits have been on a rising trend relative to wages. Since the consumers of the companies' products need money with which to buy them, this % allocation tends to oscillate around an average. If wages rise too quickly then companies become less profitable, can't invest and won't hire which the reduces wage growth. Vice versa. Sometimes a nudge is needed - the General Strikes in the 1920s, the Reagan, Thatcher, Laffer curve revolution of the late 1970s and the Schroeder reforms in Germany in the 1990s serve as examples.

Source: BEA, BLS This swing back to wages is needed and will come with the attendant ever bigger government. Don't blame government - blame companies that have indulged in such anti-social behaviour as zero contract hours, and paying no taxes while enjoying the legal protection, trained workforce, and infrastructure that other people's taxes have provided. Could this have been prevented in the last few years had companies perhaps not bought back stock to the tune of c$900bn p.a., significantly benefitting corporate executive share option schemes, and instead raised wages, increased re-investment and improved job security? This imbalance got a big tailwind from ZIRP aka "monetary policy for rich people", and so we would actually view this shift as much need rebalance because without the rebalance...economic distress causes revolutions and if you want examples checkout Wikipedia -The_Great_Wave Two final thoughts. Trickle-down economics is dead and as investors you should prepare for more government, National Industrial Polices, thus more inflation and taxation and lower returns from equities. Our advice is to focus on smaller companies since they are seldom directly in the firing line of legislation, find companies that do 'useful things' such as building a country's capital stock, look very closely at Japan which we think is both cheap and showing change for the good, and increase the volatility of returns if you do such things as portfolio optimisations. |

|

Funds operated by this manager: Delft Partners Global High Conviction Strategy, Delft Partners Asia Small Companies Strategy, Delft Partners Global Infrastructure Strategy |

13 Sep 2021 - The Outlook for China

|

One way or another China is always in the news. The current nervousness by some fund managers surrounding China is a reflection of the risks involved, while others see resulting lower prices as an opportunity. In this video Chris Gosselin explores both sides of the argument with Rob Swift from Delft Partners, Jack Dwyer from Conduit Capital, and Alex Pollak from Loftus Peak. |

13 Sep 2021 - Managers Insights | Premium China Funds Management

|

Damen Purcell, COO of Australian Fund Monitors, speaks with Jonathan Wu, Executive Director at Premium China Funds Management. The Premium Asia Income Fund began in August 2011 and has achieved an annualised return since then of 9.63% with an annualised volatility of 5.52%. The Fund's up-capture and down-capture ratios (since inception), 132% and -60% respectively, highlight its capacity to significantly outperform over the long-term regardless of market direction.

|

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.png)

.png)