Fidante sat down with Head of Research at Ardea Investment Management, Dr Laura Ryan and Portfolio Manager, Tamar Hamlyn to discuss the role of government bonds in an equity heavy portfolio. Dr Ryan in an article published in the Journal of Investing argues that bonds don't need to be negatively correlated with equities to reduce portfolio risk. She says, "that the bond/equity correlation should be a secondary consideration after relative volatility and that bonds will continue to provide diversification if bond volatility is lower than equity volatility, even if the correlation is positive". Her analysis also shows that, while better outcomes can be achieved under negative correlation, this is secondary to the impact of relative volatility. This means negative correlation is not a necessary requirement to deliver better diversification.

Dr Ryan's analysis largely excludes the impact of returns, and while her analysis holds true for any return environment, Tamar Hamlyn argues that the current environment presents a greater opportunity set in terms of the potential returns on offer.

But first, let's examine the history. Over the last 20-years or so, it has been widely accepted that government bond and equity returns have mainly been negatively correlated, with the perception emerging that this is how bonds provide diversification. It is taken as implying that when equities are down, bonds should be up. As a result, some commentators have suggested that the positive stock/bond correlations[1] they have observed over the last year or so led to a breakdown in the benefit of government bonds in an equity heavy portfolio. They argued that bonds no longer reduced risk (volatility), and at best they provided a modest offset to declines in equities and presented downside risk if bond yields rise further and the bond-equity correlation shifts further into positive territory.

To counter this argument, Dr Ryan first demonstrates that negative correlation doesn't mean an inverse relationship between returns per se, and that bonds and equities have never exhibited a consistent strong negative correlation. In which case, correlation must not be responsible for the historically observed risk (volatility) reducing properties of bonds.

It's not just correlation that matters

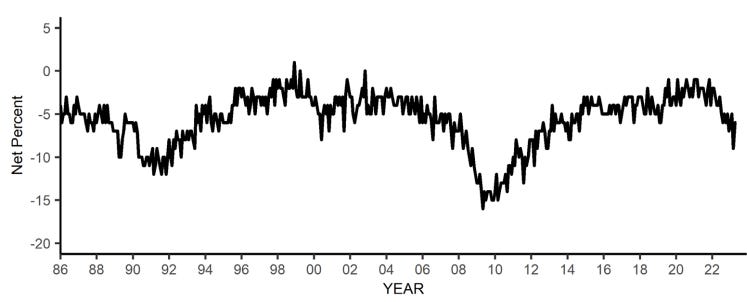

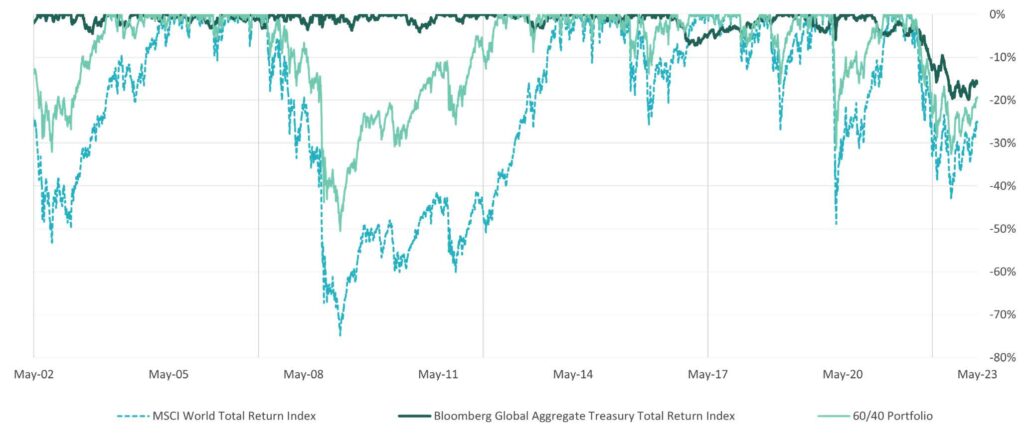

It is useful to look at some history of the market. The graph below, plots drawdowns from 2001 to 2023 of the MSCI World Total Return Index (equities), the Bloomberg Aggregate Total Return Index (bonds) and a 60:40 portfolio of world equities and bonds. Drawdowns measure the percentage decline in the value of an asset from peak to peak and are thus an indicator of volatility.

This chart shows that bonds have been consistent in delivering lower volatility. The key point however is that the correlation between the return of world equities and Treasury bonds has fluctuated markedly over time (ranging between plus 0.9 and about -0.9 between 2003 and 2023). Clearly, the lower volatility of bonds is dominating over correlation effects.

Looking at the relative importance of bond volatility against correlation using scenario testing

Because both volatility and correlation are affecting the result, Ryan conducted a series of scenario tests to examine the relative importance of each. This helps to isolate the impact on volatility of an equity-heavy portfolio if the ingredients (exposure, volatility, and correlation) are changed. The contribution of each asset to total portfolio volatility is a function of exposure (weight of that asset in the portfolio), the individual volatility of that asset and the correlation to the rest of the portfolio. (Menchero & Davis 2011).

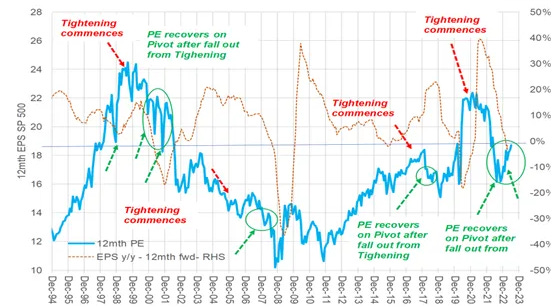

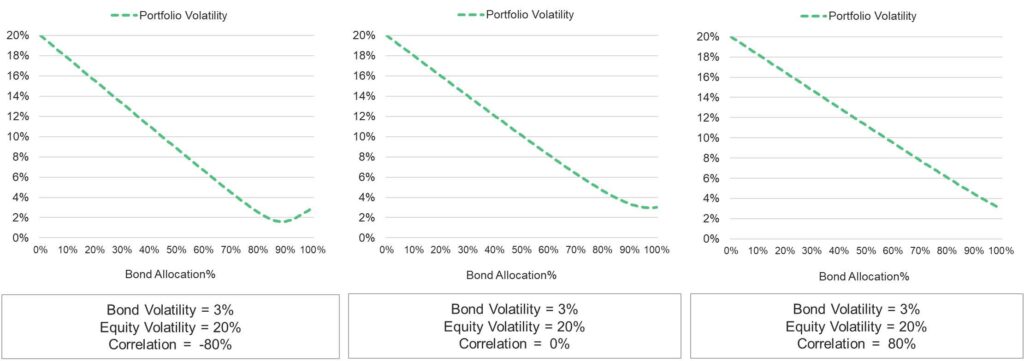

As a first example - with low bond volatility and varying correlations - she looked at three scenarios - with bond and equity volatility remaining constant at 3% and 20% respectively but correlation varying from -minus 80% to 0% to plus 80%.

If we compare the total portfolio volatility line across charts, we can see volatility decreases faster at the portfolio level when correlation is negative. That is, better outcomes can be achieved if correlation is negative.

However, what matters most is the relative volatility between equities and bonds. When bond volatility is relatively low, bonds still provide diversification even if correlation is positive.

A second example used a constant minus 40% correlation but varying bond volatility using 3%, 9% and 15%. In these three scenarios, the higher the rate of bond volatility, the less the value of additional bond holdings in reducing portfolio volatility.

Both examples indicate that bond volatility is more influential than correlation.

This analysis holds true regardless of the expectations for returns. But let's consider how the current environment may influence the question of how much an investor may be willing to sacrifice to lower portfolio volatility.

A new opportunity set for the decade ahead

Fidante asked Tamar what his thoughts were on the return potential of government bonds currently.

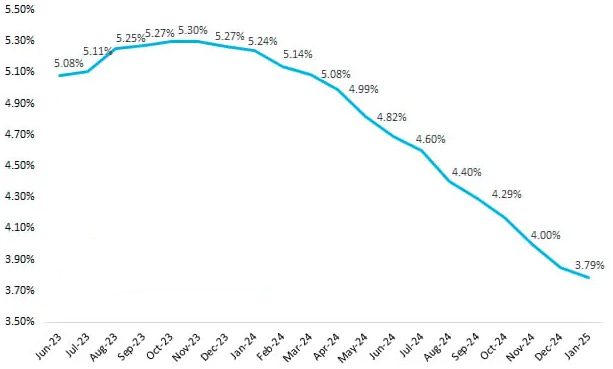

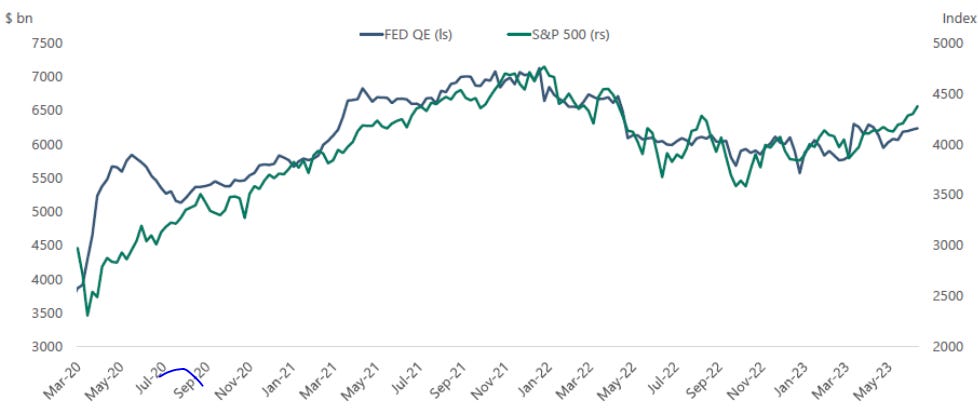

"The twin shocks of the pandemic and the resulting surge in inflation have left markets in turmoil over recent years. These same changes have however delivered an entirely new opportunity set for investors, and one greatly different from that seen over the past decade. The properties of this opportunity set have the potential to deliver greatly improved portfolio outcomes for investors. This can arise through the use of defensive asset classes that now offer considerably higher yields, and thus higher returns".

Implications for portfolio construction

The evidence laid out above demonstrates the benefits of low volatility assets for portfolio construction, without the strict requirement that correlations are negative. This has considerable implications for how investors build portfolios for the years and decades ahead.

One key takeaway is that the importance of allocations to defensive asset classes is likely

underappreciated throughout the industry. This means that portfolios that do incorporate these

considerations are likely to not only lead to better outcomes on an absolute basis but may also capture

better performance on a relative basis, compared to portfolios that don't take this into account.

Another takeaway is that forward-looking expectations of volatility are at least as important as expectations of return, if not more so. It is therefore important that expectations of future volatility of returns are wellfounded, robust, and likely to persist. This is likely to introduce some differentiation into notionally defensive asset classes such as corporate bonds, compared to traditional highly defensive asset classes such as government bonds. While both offer an emphasis on capital preservation given the senior ranking of bondholder claims over equity, the linkage between corporate bonds and the general performance of a company's stock may mean that these assets are less likely to maintain their low volatility during all potential future scenarios.

Conclusion

Lastly, they asked Tamar and Laura for what they want the key takeaways from this discussion to be (in one sentence).

Tamar: "The post-covid, high-inflation world means that forward-looking return and volatility expectations

have changed - be sure that your assumptions reflect this."

Laura: "Bonds don't need to be negatively correlated with equities to reduce volatility on an equity heavy

portfolio".

[1] THIS IS A VERY GENERAL STATEMENT AND DEPENDS ON THE MARKET, THE FREQUENCY OF THE DATA AND THE LENGTH OF THE SERIES OBSERVED.