NEWS

26 Apr 2021 - Webinar| Laureola Review: Q1 2021

|

|

Wed, Apr 28, 2021 5:00 PM - 6:00 PM AEST Please join us for our quarterly webinar where we will discuss the following: 1. Introduction: Laureola Advisors 2. Q1 2021 performance review 3. Analysis of current portfolio and where we are now 4. Upcoming developments 5. Q&A

ABOUT LAUREOLA ADVISORS Laureola Advisors was founded with the belief that investors deserve access to the unique benefits of Life Settlements, with the advantages of a specialist and focused asset manager. The best feature of the asset class is the genuine non-correlation with stocks, bonds, real estate, or hedge funds. Life Settlement investors will make money when others can't. Like many asset classes, Life Settlements provides experienced and competent boutique managers like Laureola with significant advantages over larger institutional players. In Life Settlements, the boutique manager can identify and close more opportunities in a cost effective manner, can move quickly when necessary, and can instantly adapt when opportunities dry up in one segment but appear in another. Larger investors are restricted not only by their size and natural inertia, but by self-imposed rules and criteria, which are typically designed by committees. The Laureola Advisors team has transacted over $1 billion (US dollars) in face value of life insurance policies. |

26 Apr 2021 - Performance Report: Collins St Value Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The managers of the fund intend to maintain a concentrated portfolio of investments in ASX listed companies that they have investigated and consider to be undervalued. They will assess the attractiveness of potential investments using a number of common industry based measures, a proprietary in-house model and by speaking with management, industry experts and competitors. Once the managers form a view that an investment offers sufficient upside potential relative to the downside risk, the fund will seek to make an investment. If no appropriate investment can be identified the managers are prepared to hold cash and wait for the right opportunities to present themselves. |

| Manager Comments | The Fund has achieved up-capture and down-capture ratios over the past 36 months of 126.86% and -71.73%. This indicates that, on average, the Fund has risen more than the index during the market's positive months while falling approximately 70% as much as the market during the market's negative months. In the past 3 months the fund has made a number of major changes to the portfolio. These include increasing their position in National Tyre & Wheel, becoming a substantial shareholder in Retail Food Group, taking a substantial position in Redflex Holdings and reducing their exposure to Uranium. |

| More Information |

26 Apr 2021 - How to profit from the boom in batteries

|

How to profit from the boom in batteries Roger Montgomery, Montgomery Investment Management 8th April 2021

Funds operated by this manager: The Montgomery Fund, Montgomery (Private) Fund, Montgomery Small Companies Fund |

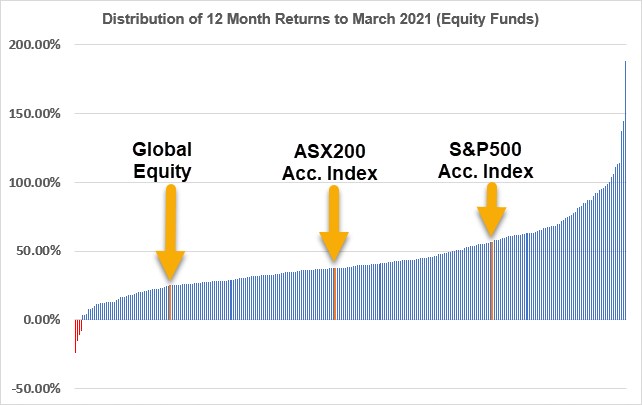

23 Apr 2021 - Top 20 Fund Analysis: April 2020 to March 2021

23 Apr 2021 - Hedge Clippings | 23 April 2021

|

|||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

23 Apr 2021 - Manager Insights | Collins St

|

Damen Purcell, COO of Australian Fund Monitors, speaks with Rob Hay, Head of Distribution & Investor Relations at Collins St Asset Management. The Collins St Value Fund is an index unaware fund which seeks to create strong investment returns over the medium and long term with capital preservation a priority. The fund has performed strong vs the ASX200 Total Return Index since inception, outperforming by 7.0% per annum.

|

23 Apr 2021 - Performance Report: Prime Value Emerging Opportunities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is comprised of a concentrated portfolio of securities outside the ASX100. The fund may invest up to 10% in global equities but for this portion typically only invests in New Zealand. Investments are primarily made in ASX listed and other exchange listed Australian securities, however, it may also invest up to 10% in unlisted Australian securities. The Fund is designed for investors seeking medium to long term capital growth who are prepared to accept fluctuations in short term returns. The suggested minimum investment time frame is 3 years. |

| Manager Comments | Key positive contributors for the month were Mortgage Choice (+64.1%), News Corp (+9.2%) and United Malt Group (+11.5%). Key detractors were EQT Holdings (-7.4%), Oceania Healthcare (-9.8%) and Chorus (-14.2%). Prime Value noted style rotation remained a dominant theme through the first quarter of 2021. A strong rebound in cyclical earnings, a steepening yield curve, optimism around the reopening of economies and expansionary fiscal policy are supporting cyclicals over growth stocks. |

| More Information |

23 Apr 2021 - More inequality. More grievances. More debts.

|

More inequality. More grievances. More debts. Andrew Macken, Montaka Global Investments 30 March 2021

Funds operated by this manager: |

22 Apr 2021 - Fund Review: Bennelong Twenty20 Australian Equities Fund March 2021

BENNELONG TWENTY20 AUSTRALIAN EQUITIES FUND

Attached is our most recently updated Fund Review on the Bennelong Twenty20 Australian Equities Fund.

- The Bennelong Twenty20 Australian Equities Fund invests in ASX listed stocks, combining an indexed position in the Top 20 stocks with an actively managed portfolio of stocks outside the Top 20. Construction of the ex-top 20 portfolio is fundamental, bottom-up, core investment style, biased to quality stocks, with a structured risk management approach.

- Mark East, the Fund's Chief Investment Officer, and Keith Kwang, Director of Quantitative Research have over 50 years combined market experience. Bennelong Funds Management (BFM) provides the investment manager, Bennelong Australian Equity Partners (BAEP) with infrastructure, operational, compliance and distribution services.

For further details on the Fund, please do not hesitate to contact us.

22 Apr 2021 - Performance Report: Montgomery Small Companies Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Montgomery Lucent, a joint venture between Lucent Capital Partners and Montgomery Investment Management, is the investment manager of the Fund. Lucent Capital Partners is owned by its founders Gary Rollo and Dominic Rose. Gary and Dominic have worked together for three years as at February 2020 and have a combined three decades of portfolio management and equities research experience. The manager is able to invest up to 10% of the portfolio in pre-IPO opportunities. They search for companies likely to benefit from secular trends, industry change and with substantial competitive advantages. Cash typically ranges around 10%. |

| Manager Comments | The largest positive contributors for February included Airtasker (ASX:ART), Ramelius Resources (ASX:RMS) and Uniti Group (ASX:UWL). The largest detractors from performance included Aeris Resources (ASX:AIS), Alliance Aviation Services (ASX:AQZ) and Cashrewards (ASX:CRW). Montgomery remains active and pragmatic and are positioning the portfolio to benefit from a number of attractive themes, some of which are structural in nature and therefore expected to play out over the next five to seven years, while others are more tactical with a shorter duration. These themes include Cloud, Sustainable Income, Strength and Stimulus and De-Carbonisation. |

| More Information |