NEWS

12 Oct 2021 - Misunderstood Multiples

|

Misunderstood Multiples Amit Nath, Montaka Global Investments September 2021

This is one of the most used and repeated phrases of market commentary. In fact, multiples are probably the most enduring pieces of investment analysis of all time. Unfortunately, they are often completely useless. The law of the instrument, or 'Maslow's hammer', is a cognitive bias where people rely too much on a familiar tool. The renowned American phycologist, Abraham Maslow, articulated this concept with his hammer and nail metaphor -

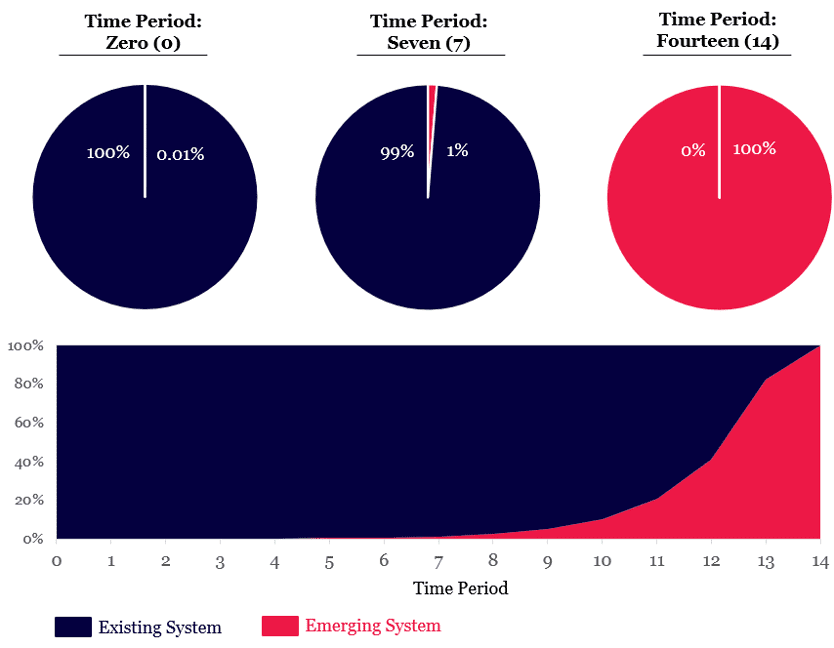

Multiples are a short-cut, lazy approximation for valuing a business For many market commentators and armchair enthusiasts, valuation multiples are their Maslow's hammer, and they apply it indiscriminately - perhaps because it is the only valuation tool they possess in their toolkit. Valuation multiples are a simplified, abbreviated and short-cut methodology for thinking about the value of a company. They blindly take a company's price (market cap, enterprise value) and divide it by a fundamental metric (revenue, operating income, EPS, etc). But they don't tell the whole story or give a complete picture of underlying value and are prone to sizeable error when applied in isolation. And, sadly, multiples have never been less useful than they are today. If investors can understand how multiples can mislead, and how to value companies in this new complex market, they will be better placed to identify and ride 'multi-decade compounders' - the current and next generation of Amazons and Microsofts that build massive long-term wealth. Multiples were not designed for today's world For traditional valuation multiples to be effective, a company needs stable and predictable cash-flows, which are generally found in mature industries like utilities, real-estate and infrastructure. Multiples do a poor job of valuing privileged businesses models that have advantaged economics, including barriers to entry, network effects, and unique datasets. They also fail to reflect the value of emerging opportunities (aka real options) embedded in the world's best businesses, including the likes of Facebook's AR/VR platform and Alphabet's AI unit. Multiples provide an inadequate view when companies have high and relatively sustained growth rates, particularly for the world's best software-driven ecosystems like Microsoft, Google, Amazon or in the alternative asset management space, like Blackstone, KKR, and Carlyle. Basically, multiples simply break down when investors are analyzing a disruptive company in the midst of an inflection or an industry that is adapting to a new world, a world we are seeing across myriad of sectors such as technology, healthcare, financials, transportation, and energy. The problem: Humans are very bad at exponential thinking The core of the problem can be traced back to the fact that humans are very bad at exponential thinking. We prefer to use a simplifying linear concept (like a multiple) for a more complex non-linear concept (high growth business). But we lose information, and that mapping mismatch can lead to errors and ultimately incorrect conclusions. Google's world-renowned futurist and Director of Engineering, Raymond Kurzweil, believes humans are linear thinkers by nature, whereas technology, biology and our environment are often exponential. That, he says, creates enormous blind spots when we pursue higher-order thinking and seek to solve increasingly complex problems. Let's consider a simple thought experiment often sighted as Kurzweil's 'law of exponential doublings'. It takes seven doublings to go from 0.01% to 1%, and then seven more doublings to go from 1% to 100%. So within 14 time periods an emerging system has gone from being completely invisible in the linear world (0.01%), to entirely encompassing it (100%). The Covid-19 pandemic and the exponential spread of the virus gave us a real-world look at what exponential growth feels like as our lives were significantly disrupted. Yet most of us are simply not built to intuitively reconcile this phenomenon. Visualizing exponential growth through doublings

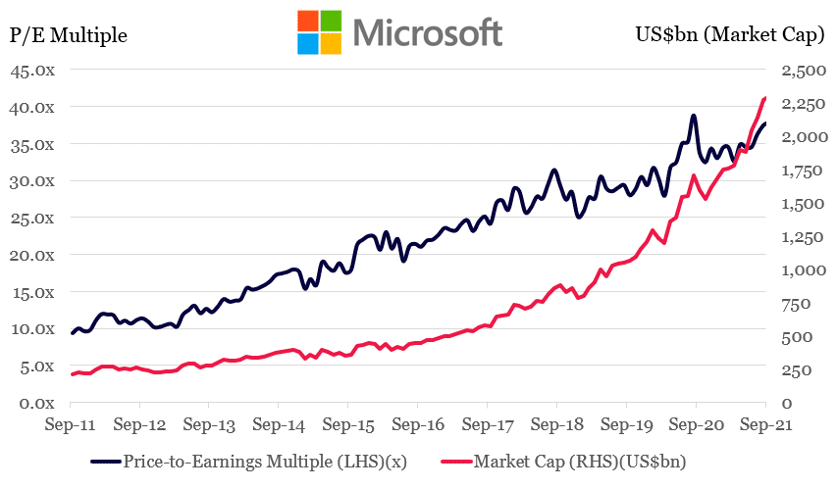

Source: Montaka Multiples meant investors missed massive Microsoft gainsMicrosoft is an example of a company where the use of multiples fail. For the last decade the company has been consistently criticized by some investors for having an 'extremely high multiple' and is on the verge of a sharp pull-back. This narrative continues to persist in parts of the market even today. Yet Microsoft's multiple has consistently expanded for the entirety of that time. A linear conversation about Microsoft's multiple ignores several underlying drivers of Microsoft's valuation, from its virtual monopoly in enterprise computing (Windows), strangle hold on productivity applications (Office), to the enormous opportunity ahead of its cloud business (Azure). Some six years ago Azure was an invisible real option within Microsoft. But it certainly feels pretty real today after growing from basically zero revenue to an estimated $40 billion annualized run-rate (June-2021). Azure continues to grow at around 40-50% year on year with enormous runway ahead. It demonstrates the exponential growth that many investors still struggle to believe or comprehend. Another fallacy those decrying Microsoft's 'high multiple' is that its market capitalization gains have been entirely driven by multiple expansion and the low-interest-rate environment. Those factors certainly play a role, but multiple expansion only explains a third of Microsoft's value gains. While Microsoft's multiple has expanded four-fold over the last decade, its market cap has increased nearly eleven-fold during that time - driven by a massive earnings inflection and exponential growth within the Azure business. That's an extremely significant error produced by the unhelpful market heuristic of multiples. Entrenched habits and lazy analysis have a very long-tail and multiples are a seductive short-cut. Microsoft's multiple has expanded for a decade

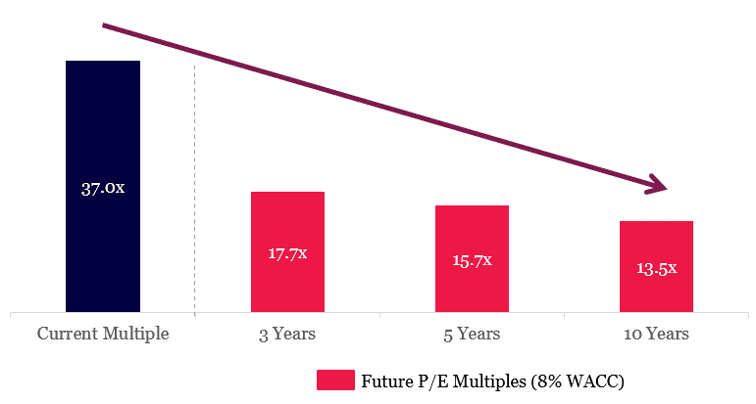

Source: Bloomberg, Montaka How to value companies in today's complex marketSo if multiples mislead, how do investors value companies in this new environment? The truth is, there are no short-cuts in valuing a business. It is a hard, detailed, and rigorous exercise that takes considerable time and insight to get right. At Montaka, all our investment theses are fundamentally driven and while not an exhaustive list, we look to gain insights across the following areas: - Detailed, bottoms-up, DCF (discounted cash flow) assessment of each company we invest in with an exploration of business model economics, TAM (total addressable market), competition, etc - Top-down perspective of the markets the company currently serves and potentially will serve in the future - Considerable time is spent considering what the business and industry will look like in 5 to 10 years and what challenges / opportunities may be encountered (this is a never-ending cycle of course) - We also establish a set of valuation scenarios that are weighted by the probability of the scenario being reached. They guide our view around upside and downside, and color our level of conviction in the position. We then effectively take a 'time machine' to several points in the future. For each time period we observe the multiple our valuation implies. This helps us check whether we are being too conservative, or too exuberant relative to what the market is willing to pay for the business today. In fact we often find instances where our DCF has compressed multiples in an unreasonable way or the market is being too conservative with its current price level. Get comfortable with high multiplesIf we continue with Microsoft as an example. The current share price (US$300) implies the market is being extraordinarily bearish on the Azure cloud business, and also believes Microsoft's future multiple will materially compress over the coming decade. We strongly disagree with the market's assessment on both fronts and believe it is significantly underestimating Microsoft's earnings potential and opportunity set, plus unreasonably discounts the quality of these earnings by slashing its multiple by more than half. In fact, under our bullish scenarios, we believe Microsoft's share price could increase several fold, even from here. Significant multiple compression implied by current share price

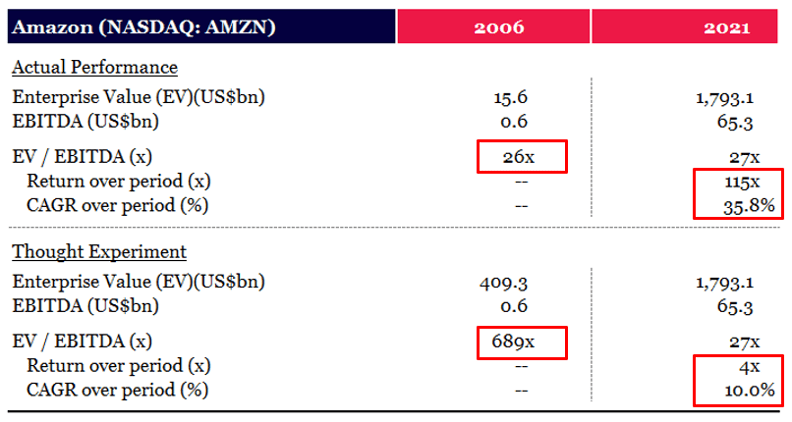

Source: Montaka Compounding your wealth over decadesWhen an investor looks at a multiple, it may seem high at first glance. But it is essential to focus beyond this and understand the underlying business, its growth opportunities and what current market expectations imply. Certainly, a high multiple can be a red flag for overvaluation. However, in isolation an investor can't draw any real conclusions from that multiple. As we've seen, in certain situations the current multiple may be outrageously low despite the incessant noise claiming the opposite. Let look at Amazon for example, in 2006, it was trading at an EBITDA multiple of 26x versus the market (S&P 500) which was trading at 10x. Certainly not cheap by typical measures. But as a thought experiment, if we were to discount the current Amazon enterprise value at an annual rate of 10% back to 2006, an investor should have willing to pay close to 690x EBITDA and they still would have quadrupled their money today. The market, however, materially undervalued Amazon and it went on to deliver investors 115x over that period. In fact, you could have paid double the share price for Amazon in 2006 and still made nearly 60x your money today.

Source: Montaka. Based on June-2021 LTM earnings for 2021 column. At Montaka we have a single clear goal: to maximize the probability of achieving multi-decade compounding of our clients' wealth, alongside our own. We are convinced that the months and years ahead will present opportunities to make attractive, multi-generational investments and we are prepared and well-positioned to take advantage of these. To achieve that, we won't let multiples become our Maslow's hammer! Funds operated by this manager: Montaka Global 130/30 Fund, Montaka Global Fund, Montaka Global Long Only Fund |

11 Oct 2021 - 3 common features of inflation-proof businesses

|

3 common features of inflation-proof businesses Stephen Arnold, Aoris Investment Management September 2021 Central banks remain steadfast in their message that the current bump in inflation will prove short-lived. Companies are less sure. A frequent message we have heard from businesses through the June quarter global earnings season was that inflation is 'not transitory'. Who will prove prescient? Time will tell. As investors, the best we can do is recognise the possibility of sustained higher inflation, and to own businesses that can prosper regardless of the course inflation takes. Below, we highlight three characteristics of these inflation-proof businesses, illustrated with examples from the Aoris portfolio. 1. Sell on value, not on price, and make sure that value is rising If you sell basic household products that don't improve year-to-year, rising inflation is bad news. The likes of Campbell Soup, Kimberly-Clark, Unilever and Procter & Gamble face stiff resistance from consumers, and retailers, when seeking to charge a few percent more for the same product. It's no surprise that these brands have lost market share in times of inflation as consumers seek out alternatives, including retailers' own private label brands. Nike, on the other hand, invests heavily in the aesthetics and technical features of their footwear and apparel. Their products are always improving, and the brand itself remains highly desirable. You may have noticed a high proportion of gold medal winning athletes at the Tokyo Olympics were wearing Nike, such as Eliud Kipchoge, the men's marathon winner in Nike's Alphafly NEXT% Flykit shoes. Inflation hasn't historically been a problem for Nike - their average price per item has risen at a rate of about 7% p.a. in recent years, but this is because the value offered by their products is rising. 2. A culture of continuous cost improvement Some companies build up fat through the good years. Each year, costs grow a little more than is necessary, then once each economic cycle the problem reveals itself. The burden of rising inflation on such companies is amplified by their layers of excess costs. To reign in the rampant expenses, a restructuring program is undertaken. This looks straightforward on paper but can be very demoralising and destabilising internally, as skills and experience are lost. I was told by a colleague recently of (yet another) redundancy round at a major Australian bank. Employee costs are removed, but for those who remain 'the loss of roles and changes in responsibility creates inefficiency, and now it just takes longer to get stuff done'. Companies that are effective at trimming the fat every year are generally going to be the ones who pull ahead of their peers through an inflationary period. Graco, a manufacturer of pumps and fluid handling equipment in the US mid-west, has an objective of creating factory floor efficiency each year to offset cost inflation. If input costs are rising at a rate of 3% then Graco seeks an equivalent productivity improvement, which it achieves through investment in manufacturing technology. It's able to do this because it is vertically integrated; it makes all the components that go into its products, while its competitors are just assemblers. Graco's factory workers are highly skilled and management treats them as an asset, not an expense. Impressively, Graco went through 2020 without a single redundancy. 3. Supply chain excellence and purchasing scale When costs are rising, smaller firms are often at a significant disadvantage. They have less buying heft when it comes to negotiating purchasing terms, and less sophisticated supply chains when it comes finding alternative suppliers and utilising data to navigate a period of rising costs. Consider Costco, one of the world's largest retailers with $250 billion of annual purchasing power. Part of Costco's 'secret sauce' is that it stocks only 4,000 items compared to over 100,000 at a typical Wal-Mart, so its vast purchasing power is focused and its supply chain is simple. Costco's highly regarded store brand, Kirkland (see image below), accounts for about one-third of sales, giving it a valuable optionality. If a national brand won't come to reasonable terms on price, Costco can replace it with Kirkland. In an environment of supply chain disruption and rising logistics and labour costs, Costco is in a highly advantaged position compared to most of the retailers it competes with. Inflation has been dormant for such a long time that it's hard to imagine it increasing to levels that might create problems for companies; but as investors it's a risk we must consider. At Aoris, we have no views on the direction inflation may take but have a clear view of the characteristics necessary for businesses to be 'all weather' and to prosper even if higher inflation persists. All 15 companies in the Aoris International Fund embody the characteristics of selling on rising value, a culture of continuous cost improvement, and supply chain excellence and purchasing scale. Find out more by visiting our website. Funds operated by this manager: |

8 Oct 2021 - Why have investors become theme junkies?

|

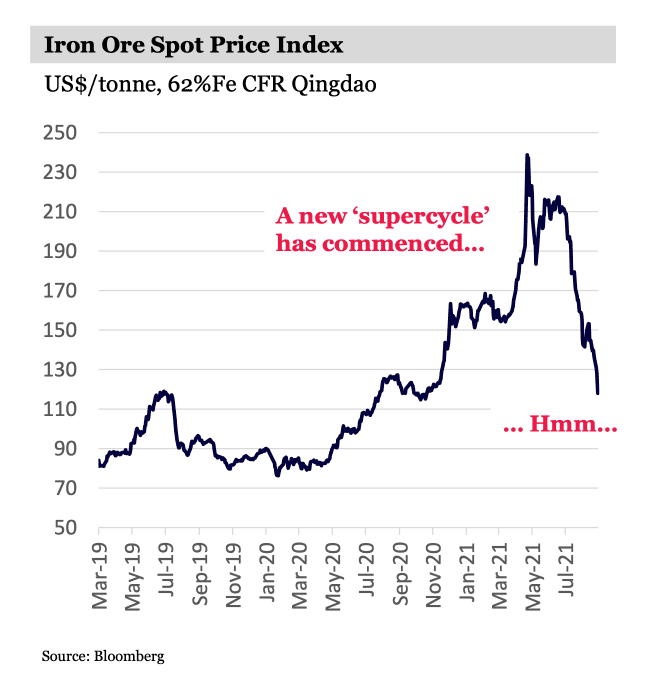

Why have investors become theme junkies? Andrew Macken, Montaka Global Investments October 2021 Most investors love a good theme. A long-term industry-shifting thematic trend provides fantastic structural support to a portfolio. Today there are no shortage of themes being spruiked to investors. New themes to emerge in just the last year include a commodities supercycle, the return of inflation, and a maturation of the world's mega-tech businesses, to name just a few. The only problem is, it remains far from clear if these new themes are even themes at all. Are we really experiencing a commodities supercycle?The iron ore price has collapsed by 50% in the last four months. This is not entirely surprising given the recent sharp weakening in Chinese credit growth - the primary economic fuel that underpins higher commodity prices. Iron Ore Spot Price Index

Is inflation really returning?Bond markets are certainly far from convinced. The last time markets expected some semblance of normal inflation in 2018, the US 10-year government bond was yielding around 3% per annum. Today, with a 'booming' economy and inflation 'taking off' the US 10-year yield remains at approximately 1.5%. And have the world's mega-tech businesses really maturedThis was the consensus view late last year. Conventional wisdom then said the likes of Amazon, Alphabet (Google) and Microsoft were now so big and had done so well for investors that, surely investors would find better returns elsewhere. Markets seem to have revised this view in recent months, acknowledging instead that we remain in the early innings of a digital transformation of corporates, governments and consumers that massively benefits these mega-tech stocks. (Investors will remember a similar falling-out-of-favour for mega-techs in 2018 - only to be back in favour again by 2019). In today's noisy market, there is a real danger that investors become 'theme' junkies where it's easy to mistake short-term trends and movements for real, long-term changes that deliver huge compounding returns over years. If investors can recognise this danger, they will not only be able to avoid the proliferation of fake themes, but they will also be better placed to identify and ride the real themes that deliver the big long-term returns. Have we all become 'theme junkies'?Like most investors, for me, there is nothing better than a reliable long-term theme. If you can position your portfolio on the right side of a strong theme it acts like a powerful tailwind and allows you to really compound your capital over the long term. For example, take the long-term structural reallocation of marketing spend to the world's leading digital channels, such as Facebook and Google, that drive superior ROIs through intelligent targeting. This theme is unquestionably reliable and has underwritten a meaningful part of Montaka's portfolio for more than five years. But it's easy to forget that durable long-term themes are exactly that: long-term. They evolve slowly but surely. Demographics and the aging populations of many of the world's largest economies is a classic example of a long-term structural theme that continues to play out as most long-term themes do. Slowly but surely. Today, however, it almost feels like investors are looking for a new decade-long theme … every two weeks. Investors have become theme junkies. On the one hand, this makes sense. Surely if owning one strong theme is great, then owning three, five or 10 themes is even better, right? Not necessarily. If you own a small handful of great themes, there are strong arguments to simply leave it at that. By adding additional 'less-good' themes, you are simply diluting your overall returns. But the human mind often doesn't appreciate this - we tend to think that more themes must always be better than fewer themes. And it's rarely the case. When an investor learns about a new theme, it is one of the more intellectually gratifying moments of investing. In today's high-gratification world, it is natural for investors to chase these intellectual hits and gravitate towards sources of new themes. Those in the business of competing for your attention are willing suppliers and will seek to give you what you want with a supply of never-ending themes.

The danger of too many new themesBut most of these new themes are not real themes. Investors are being sold short-term cycles as long-term themes. Some are not even short-term cycles, but merely the ebbs and flows that result from the natural moodiness of 'Mr. Market' himself. Chinese tech names were recently sold off hard after the Chinese Government introduced new competition, privacy and national security regulations. Many investors, including famed thematic investor, Cathie Wood, sold down their China positions. In July, Wood explained her move by citing a "valuation reset" and believed that Chinese tech valuations "probably will remain down". The new "theme" was that China was now too dangerous to invest in. But by the following month, news reports said Wood had repurchased many of the same China positions that had been sold. Investors can and should change their minds as often and as significantly as is necessary. But from month to month, or even year to year, a strong long-term theme typically doesn't change much at all.

How to overcome theme saturationSo how do investors avoid becoming theme junkies? Less is more. Stick to investment themes that are unquestionably reliable and resist the temptation to add new, weaker-form themes to your portfolio. Of course, a strong theme doesn't guarantee a good investment on its own. (Good investments always stem from under-priced assets - irrespective of any theme at play). But a strong theme can often transform a good investment into a great investment by lifting the earnings power of a well-positioned business to new heights previously unanticipated by the market. Montaka, for example, retains significant exposure to the world's leaders in cloud computing. This is not a new theme, of course. But it remains highly attractive: the ongoing shift to cloud computing remains in its early innings. It is unquestionably persistent and a small handful of leaders, such as Microsoft and Amazon, will be the big winners. Other reliable long-term themes in Montaka's portfolio include the continuing:

The path to long-term successWhen an investor builds their portfolio on a bedrock of strong investment themes, most of the daily machinations of the market simply become noise. Interesting noise, for sure - but noise, nonetheless. You can look past the daily noise with renewed confidence when you realise clearly that people are competing for your attention by spruiking fake 'themes'. Online social channels are also amplifying this noise. Riding real themes, of course, often means a portfolio's performance will look different from other investors. Owning the right long-term theme does not mean that a portfolio won't underperform from time to time. Long-term themes can just as easily fall in and out of favour as individual stocks do. But it pays to stay the course. Performing differently to others is a pre-requisite for superior long-term compounding. And remaining focused on the forest for the trees - investing in real themes and not fake themes - is the path to long-term investment success. Funds operated by this manager: Montaka Global 130/30 Fund, Montaka Global Fund, Montaka Global Long Only Fund |

7 Oct 2021 - Touch gives investors a slice of Afterpay talent

|

Touch gives investors a slice of Afterpay talent Graeme Carson, Cyan Investment Management 01 October 2021 |

|

"The next Afterpay" has to be a candidate for the most overused phrase in investment circles at the moment. Companies and investors alike are finding comparisons to draw, growth ambitions to conquer and lofty pricing to justify, in the hope that they have uncovered the next global growth super start-up.

Touch Ventures (ASX:TVL) is an investment company that listed on the ASX on Wednesday 29 September. It was founded in late 2019 and Afterpay, its largest shareholder, now owns about 24% through its wholly owned subsidiary Touchcorp - hence the name. Touch's strategy is to own up to 10 material investments in unlisted companies that are truly scalable, operating in the retail innovation, consumer, finance and data segments. These opportunities, into each of which Touch will initially invest $10-$25m with the aim of acquiring a 10%-40% non-controlling interest, will be identified by Touch Ventures' own management and investment team or referred by Afterpay through a formal collaboration agreement, which is in place until at least 2025. To date, Touch has made 5 investments, 4 of which have been originated by Afterpay. It appears this is the vehicle Afterpay has assembled to work with, invest in and add value to some of the best emerging businesses it finds as it works with retailers, consumers, investment banks, financial markets and investors around the globe. Since Cyan first encountered this business just over a year ago, three things have caught our eye:

This is a winning teamBy team, we mean everyone involved, including management, board, shareholders, investors and advisers. The easy starting point was obviously Afterpay. Since we invested in that business at its initial public offering in 2016, it has become an international success story. Afterpay has built a powerful position with the biggest players in the biggest markets in the world in retail, data and consumer finance. Not a bad potential investment partner! The team within Touch, led by Hein Vogel, is also high-pedigree. Then there's the board and advisers, including Mike Jeffries and Hugh Robertson, both of whom have been directly involved in Afterpay since its unlisted days. Touch looked compelling a year ago but then earlier this year a material investment from US firm Woodson Capital Management, now its second largest shareholder, and a board seat for the highly regarded Jim Davis offered further validation. Follow that strategistIt's not easy to get exposure to a portfolio of high-growth, scalable, emerging businesses that have come from a reliable source. This portfolio also comes with a shareholder that can enhance these businesses either directly within the Afterpay ecosystem, or by providing expertise and a supported pathway to scalability. This is a unique opportunity to get a listed vehicle that offers liquidity while investing in emerging companies with exposures well beyond Australia's shores. What's in the boxSince we first invested in Touch it has expanded its portfolio to 5 investee companies, deploying around $75m in invested capital. This table from the recent prospectus shows the portfolio. Source: Touch Ventures Prospectus The portfolio is expected to grow to around 10 large holdings in the short to medium term, with potential for smaller investments (generally less than $2m each) in even earlier stage companies. The next round of investments will be funded by the $100m raised through the IPO, in which all the larger existing shareholders invested. Touch is a listed investment company. It aims to make money via growth in the value of its underlying investments rather than their revenue. All investments are carried at their original entry-point valuation until there is a capitalisation event or very clear reason for a revaluation. The collective value of all the investments is the net asset value. It's likely that the stock market will value Touch at a significant premium to its net asset value. The carrying value of these businesses is largely unchanged from Touch's entry point (Happay has been increased but offset by PlayTravel). If I owned an emerging tech business and an Afterpay-led investment company took a stake, I would assume my business had been strongly validated and its value had just increased - and that's before any value my new share holders could add. It's worth noting that at the price investors paid in the IPO, the company has the same valuation it had when Woodson Capital Management invested in February. We think Touch Ventures is a unique vehicle and a compelling opportunity. It's also worth remembering that Square will be acquiring Afterpay early next year, which could lead to greater value creation for Touch shareholders. |

|

Funds operated by this manager: Cyan C3G Fund |

6 Oct 2021 - Webinar Invitation | Paragon

|

Webinar: Performance Update & Outlook Friday, 8 October 2021 at 12:00PM AEST

Funds operated by this manager: |

6 Oct 2021 - 6 lessons from our wild, 50-bagger Afterpay ride

|

6 lessons from our wild, 50-bagger Afterpay ride Andrew Mitchell, Ophir Asset Management September 2021 |

|

In our Investment Strategy Note Andrew Mitchell takes a look back at our wild Afterpay ride from the very beginning and outline our six key lessons from our journey with this 50-bagger. I met Nick Molnar for the first time in 2017. I had walked out of a meeting with a founder now considered one of Australia's best-ever CEO entrepreneurs. But back at the office, I said to colleagues: "The CEO is too young. And isn't layby dead?". Yet something had stood out. How, I asked, does a microcap layby business attract Cliff Rosenberg and David Hancock to the Board. I knew them both. I had met Cliff through another listed business (Nearmap) where he had an incredible track record. That was before he went to LinkedIn in Asia-Pac as managing director. I'd worked with David at CBA where he was the enormously respected Head of Equities. Lesson 1: Sometimes you need a bit of luck. I often wonder if we'd have invested in Afterpay - or been too late to the party - if we hadn't known and respected Cliff and David. It goes to show it's often not what you know, but who you know and listen to. Sometimes the best investments are the ones you make because you've built a fantastic network. My initial mistake was to view Afterpay through the eyes of a late-30-something-male who thought this was too obvious to work. I wasn't viewing it through the eyes of their original target market: a 20-year-old millennial female shopping in the fashion and beauty industries. I needed to throw off the shackles of my own experiences. As Warren Buffett has said, "if past history was all there was to the game, the richest people would be librarians". When I sat down with Cliff following Afterpay's listing, he got me excited. He said the founders were dynamite. He hadn't seen a visionary like Nick before. Nick, Cliff said, was 25 going on 40 years' old. And Anthony Eisen's business acumen was first rate. They made a dream team. Importantly, Cliff noted that while Nick and Anthony could have heated debates, they'd always reach an agreement. With a fresh set of eyes, I went and spoke to some of Afterpay's very first unlisted retailers, and it completely changed my mind. They loved it. Afterpay helped them convert more sales, it expanded the basket size, and it slashed returns. Many of these retailers were even taking stock in the IPO. Ultimately, we invested following the IPO, and as time would tell, snag our first 50-bagger (assuming Square's acquisition proceeds as expected). Lesson 2: Have an open mind and be prepared to keep learning. In this case, we really needed to understand Afterpay's value proposition from the perspective of its target market. To do so there was no substitute to talking directly to Afterpay's customers. Afterpay's addressable market exploded. It was broadening out of fashion and beauty into the likes of dentistry and airline tickets. More men used it. As, crucially, did older customers. This was vital for the share price. It meant 'Customer Lifetime Value' (how much a single customer is worth to the business), was expanding rapidly. As it swiftly increased its percentage of the checkout, we quickly started seeing the business as relevant for not just retail 'some things' but retail 'almost everything'. Then, in 2018, the stock halved. It was Afterpay's first big test. ASIC was reviewing regulation of the Buy Now, Pay Later (BNPL) sector. Newspaper headlines blared doom and gloom about the company. Brokers sent through 'short reports' and many an Aussie fund manager bailed out. But rather than being caught in the headlights, we remembered the insights we got speaking to Afterpay's first retailers in Australia. So we got on a plane to speak to their first retailers in the US. And wow! It was going so well for them, driving online sales, and changing customer behaviour. It was like hitting replay on a recording of what those first Australian retailers said. As more negative headlines filled papers, and sellers were out in force, we bought a huge amount of Afterpay stock at dirt cheap prices, and our timing couldn't have been better. Lesson 3: To perform as a fund manager, you can't follow the herd. It would have been easy to get worried out of our holding in Afterpay. But Australia was going to be a sideshow if Afterpay successfully launched in the US, a market 15 times its size. Don't be lazy. You need to outwork your competitors. Afterpay share price At this time, I bailed up David on Collins St, Melbourne, and walked with him. He was so excited. Afterpay had just hired a new Head of Risk from Uber, and for the US expansion, they were attracting amazing talent with lucrative options packages. This was one of the company's most important acts because it allowed Afterpay to scale. It was no longer an Australian payments business, but on its way to becoming a global phenomenon. Lesson 4: Pay up for amazing local talent when expanding globally. This has been a hallmark of many of the great overseas success stories we have invested in. It now forms a part of our checklist for Aussie companies expanding internationally. But then the company was tested again. COVID-19 hit. The stock price cratered. Nick, Anthony, and the board thought (as everyone did) they could be in big trouble. Brokers fired off reports telling investors to short the stock. The company pivoted quickly, though. It tightened its purchase approvals process. Then, spurred by lockdowns and massive government fiscal support, spending on 'stay at home' items took off. E-commerce got a shot of adrenaline and retail online adoption accelerated. Commentary from key customers confirmed the pick up in online sales. The company had just passed another big test. We have often been asked over the years with Afterpay: "How can it be valued so high when it doesn't make a profit?" Our answer is simple: Afterpay's valuation, such as its price-to-earnings ratio (P/E), is so high because it is deliberately keeping the 'E' low to non-existent by reinvesting profits for future growth. Its Australian business is highly profitable, but it is using that cash flow to grow and take market share in new geographies. This is crucially important when it is breaking into new markets with virgin soil. It can acquire customers dirt cheap where there is no incumbent. BNPL is a scale game - being slow or late can be deadly. Afterpay needed to win the land grab by expanding quickly and making big investments in marketing and technology. If they had stopped reinvesting for growth, and put today's profits first, we would have headed for the exit given the opportunities that lay in front of the company. Lesson 5: Profit, and the valuation metrics based on it, matter less when a business is rapidly scaling and reinvesting cash flow to grow. When growing rapidly, other metrics matter more to investors, such as return on capital, customer lifetime value, customer acquisition cost, and merchant and customer growth numbers. It's still important, though, not to overpay based on where you think the business will be at maturity. Then, on August 2, Square announced it was going to buy Afterpay in a blockbuster deal that valued the company at $39 billion ... So where to now for Afterpay? I think it's just the end of the beginning. Square seems a good match with lots of synergies. After the acquisition was announced, Square's share price rose significantly, because investors could see that when it came to Square and Afterpay 1+1 = 3. Someone else may bid for the company. Apple and PayPal are two possibilities, although this becomes less likely as time goes by. We still own Afterpay in case a bidding war breaks out. We believe the BNPL industry will consolidate more, with perhaps 2-3 key players left when the market matures. I can see BNPL being just one, albeit very important, offering in a suite of products for the dominant payments providers. But Nick and Anthony are rare. Leaders in the sector and the original entrepreneurs. They have made Afterpay a verb. I couldn't be happier to have had my initial thoughts proven wrong. A large early investor in Afterpay told me they saw Nick present at a TEDx in Sydney when the company was in its infancy and the woman next to him said: "Who is this guy? He has such a presence; he would be perfect for my daughter". The investor replied: "I'm sorry to let you down, but he is very happily married". The Board once told me they had to encourage Nick to fly business class overseas because he was so frugal. If Nick can keep that kind of mindset and culture in the business, it's got every chance of being one of the few established players at the end. Lesson 6: Passionate, talented, visionary entrepreneurs are so scarce and valuable ... to their shareholders, employees, customers, and the economy at large. Finding the next Nick and Anthony is what gets us out of bed in the morning. When we are lucky enough to find these visionary entrepreneurs, we are reminded that there is no better part of the market in which to invest than small caps. |

|

Funds operated by this manager: Ophir High Conviction Fund (ASX: OPH) |

5 Oct 2021 - Traditional Markets Stable in August; Trouble in September

|

Traditional Markets Stable in August; Trouble in September Tony Bremness, Laureola Advisors September 2021 THE INVESTMENT ENVIRONMENT - Traditional Markets Stable in August; Trouble in September The S&P 500 was up 2.9% in August but developments in September suggest trouble. JP Morgan issued a bearish report pointing to warning signs which included huge gains in IPOs, the frenzy for SPACS, contagion from China, the Delta variant, and inflation exacerbated by supply chain blockages and raw material price increases. The China prediction began to unfold in September. The Chinese conglomerate Evergrande owes $90 bn to over 128 banks, $100 bn to suppliers, and has 1300 projects in 280 cities for sale. It can't pay. It has bought a soccer team in China and is part way through building a $1.7 bn stadium for the team. The company's bonds are trading at $0.25. In Europe, the price of natural gas, used in many critical industries including heating and electricity generation, has skyrocketed. Wholesale gas prices are up 50% since February, and some electricity prices are up as high as 7x last year's level. Inventories are at their lowest for a decade and less electricity than expected is being produced from wind. Russia, the main natural gas supplier, is limiting supplies. Higher gas and electricity prices will inevitably lead to higher inflation, lower economic output, and even potential blackouts. The Delta variant appears to be picking up steam. In these uncertain times, investors have few places to seek refuge, but a well-managed portfolio of life settlements can offer genuine shelter from the economic storms ahead. LAST MONTH IN THE LIFE SETTLEMENT MARKETS - Regulatory News from Washington Good; From the States, Mixed Life Settlement Markets were stable in August as IRRs remained in their usual wide range around the 12% to 14% midpoint. (Investors should always remember that this represents the projected IRR on the purchase price, which may not be the amount the seller receives due to transaction costs.) A bill went before Congress to allow insureds to use the proceeds from selling their insurance policy tax free to fund their own long term health care. This bill has bi-partisan support, a rare thing indeed in the current US political climate. It would be a win for the insureds, but also a win for the government as the savings to Medicaid would be significant. Some insurance companies have been offering enhanced surrender payments on a few policies, a move that is being challenged by the Life Settlement Association and its legal team. Such payments have been disallowed in Virginia and Louisiana but allowed in Texas. Florida disallowed them but later allowed them. These enhanced surrender payments have the potential to interfere marginally with the Life Settlement markets, but mostly for investors who rely on policy characteristics rather than an analysis of mortality. As Laureola relies on mortality analysis first and foremost, any negative impact on the LS markets will have little effect on the Laureola strategy. Funds operated by this manager: |

4 Oct 2021 - Space exploration is going private

|

Space exploration is going private Michael Collins, Magellan Asset Management September 2021 |

|

Clive James in his book Fame in the 20th century explained that Armstrong's lapse was overlooked because eloquence, even personality, didn't matter. The first man on the moon would be famous "without ever having emerged from obscurity", even if Armstrong was so chosen because he was dispensable to the Apollo 11 mission rather than, as the official line had it, he epitomised the 'right stuff'.[1] The National Aeronautics and Space Administration supplies a transcript that corrects Armstrong's statement but the accompanying audio shows his slip.[2] Whatever. Armstrong's statement rang true. From the start of the space age in 1957 when the Soviet Union's Sputnik satellite orbited the Earth, six-plus decades of mainly US government-funded, -designed and -staffed space exploration has brought many rewards. Apart from stirring national pride and showcasing bravery, space exploration has boosted knowledge of the universe and led to much innovation related to satellites, global positioning and weather forecasting.[3] Even if Armstrong blew his line, he was more profound than Jeff Bezos on his return to Earth on July 20 after being blasted into the atmosphere just past the Karman line that, 100 kilometres (62 miles) from Earth, generally marks outer space. "Best day ever," was Bezos's verdict on flying for 10 minutes in a pilotless rocket built by Blue Origin, a company he founded in 2000.[4] Perhaps Bezos should have said something more Armstrong-like as did Richard Branson when, nine days before Bezos, he zoomed to an altitude of 80 kilometres in a piloted space plane built by Virgin Galactic, which Branson set up in 2004. "We are at the vanguard of a new space age," Branson said.[5] What's new is that an entrepreneur-led drive into space is underway. Bezos and Branson - joined soon perhaps by other private companies[6] - are vying with Boeing[7] and Elon Musk's Space Exploration Technologies Corp. to commercialise space. SpaceX, as Musk's creation of 2002 is known, is ahead. The company in 2015 pioneered reusable rockets, the "single transformative technology shift" driving today's space race because it has slashed launch costs.[8] Among feats, since 2012, SpaceX has ferried cargo to the International Space Station, Nasa's lab that orbits the Earth. On May 30 last year, SpaceX became the first private company to propel people into space, when it sent astronauts to the space station, the first manned mission there since 2011.[9] In June this year, to the same destination, SpaceX launched a manned reusable rocket for the first time.[10] SpaceX, for US$2.9 billion, is building the 'Starship' for Nasa to land people on the moon for the first time since 1972.[11] Many benefits are likely to flow from the commercialisation of space that already amounts to a US$350 billion industry and one that is forecast to swell to US$1 trillion by 2040.[12] Space tourism is likely to grow, after commencing on September 15 when SpaceX launched its first privately funded three-day spaceflight of just tourists; no professional astronaut was aboard a tripe paid for by US businessman Jared Isaacman who said it cost less than US$200 million.[13] The standard offering (at US$450,000 a pop with Virgin Galactic)[14] will be orbiting the Earth to experience weightlessness and gain an astronaut's view of the world. Another prospect is vacations on commercial space stations - US company Axiom Space is building such a facility that it hopes by 2024 will orbit 400 kilometres above the Earth at 27,000 kilometres per hour.[15] A later step could be tourist trips to the moon. A second, and bigger, commercial motivator is adding to the more than 5,000 satellites already orbiting the Earth, a doubling in the past two years as part of efforts to boost economical internet coverage.[16] SpaceX, for instance, plans to add another 11,000 satellites via its Starlink mega-constellation and has filed for US permission for another 30,000. Private enterprise heading into the cosmos is rekindling and aiding government space efforts. Nasa, as well as employing SpaceX to return to the moon under its Artemis Program, plans more voyages to Mars and intends to search Jupiter's moon Europa for life.[17] China in May landed a vehicle on Mars for the first time,[18] two years after the country became the first to land a craft on the far side of the moon.[19] Beijing and Moscow in June announced plans for a permanent base on the moon,[20] while about 40 countries now have national space agencies.[21] Commercial space efforts are bound to advance scientific knowledge. The hope is that 'microgravity' will allow for unique research that could lead to "discoveries in medicine, materials, and manufacturing previously kept hidden by gravity," in the worlds of Axiom Space.[22] Another motive is to enable people to live beyond Earth. Bezos sees "a future where millions of people are living and working in space".[23] Musk talks of 'terraforming' Mars, by which he means nuking Mars to make the planet habitable for humans.[24] The commercialisation of space comes with risks and disadvantages that could limit such exploration (ignoring complaints about the cost). The biggest risk is that space travel is dangerous. Much can go wrong with rockets. In September, the US Federal Aviation Administration grounded Virgin Galactic flights pending a probe that Branson's flight went off course during its descent.[25] The International Space Station is showing irreparable cracks.[26] Another danger is that much human debris is swirling around in space and could hit a spacecraft, as occurred in March when a Chinese military satellite broke up after it collided with debris left from a 1996 Russian rocket launch.[27] Fatal events could derail space exploration, as they have in the past. Another problem is space exploration is likely to intensify global political tensions. Whoever rules space controls an avenue to deliver thermonuclear weapons via ballistic missiles and much else. China's moves into space look likely to intensify Chinese-US rivalry. The US in 2019 created a Space Command as its sixth military sphere to thwart China in space, such as China's ability to laser-cripple the satellites on which depend the US military.[28] A third drawback is the space race will come with environmental damage, especially with respect to climate change from fossil-fuelled rockets. Scientists worry that satellite re-entries from the Starlink mega-constellation could deposit more aluminium into Earth's upper atmosphere than what is done through meteoroids.[29] But rocket numbers would need to soar to make a noticeable difference. Whatever the doubts or drawbacks about the question, the better economics of space exploration are overriding them. A privately led space adventure has begun that has already notched achievements and, amid controversy and setbacks, is likely to post many more. To be pedantic, private companies have long helped Nasa (Boeing for more than five decades) while the commercialisation of space could be dated to the turn of the century, so it's not new, just intensifying. The role of Nasa and other government agencies in this private quest shouldn't be underestimated. These private companies will need to be willing to lose much money - the listed Virgin Galactic lost US$94 million in the second quarter of 2021.[30] A techno-utopian element bordering on the unbelievable pervades the private space quest. Nasa's response to Musk's dreams, for instance, is that it would be impossible to make Mars liveable due to a lack of carbon dioxide,[31] while the technology for space mining is still to be invented. Some, perhaps much, disappointment lies ahead. No doubt. But the entrepreneurs pioneering today's drive into space are wealthy visionaries who won't be deterred easily. Get set for a space race pursued by people who think they are on a philanthropic mission. Space utopia In 2015, SpaceX's Falcon 9 rocket blasted off. After 45 seconds, the rocket shed its first stage, which then descended to Earth in a controlled manner to a landing pad. "Welcome back, baby," Musk tweeted.[32] A broadcaster had a better technical perspective of SpaceX's third attempt at the feat: It's like "launching a pencil over the Empire State building, having it reverse, come back down, and land on a shoebox on the ground in a windstorm." [33] Time has elevated the financial significance of Falcon 9's safe touchdown that day. The feat is taken as the start of economical near-Earth orbit space flight because it ended the era when rockets were dumped or imploded during re-entry into the Earth's atmosphere, even though Nasa's space shuttles were reusable (and Bezos's Blue Origin had landed an unmanned rocket the month before).[34] Companies are now spared the hundreds of millions of dollars it costs to build rockets for each flight. Since 2015, Falcon 9 rockets have recorded 82 landings and 64 have flown again,[35] though some have bungled the touchdown.[36] US taxpayers are among those benefiting from the improved space economics. SpaceX is ferrying Nasa astronauts and items to and from the International Space Station at far less cost than could the space shuttle that was retired in 2011[37] - Nasa in 2018 said reusable rockets reduced the cost of sending a craft to low Earth orbit by a factor of 20.[38] Nasa is estimated to be saving US$2 billion by using SpaceX's Falcon Heavy rocket for its mission to Jupiter's moon.[39] Having SpaceX and Blue Origin bid for Nasa contracts is another force driving down costs. Bezos in July, for instance, said Blue Origin would waive up to US$2 billion in payments over the next two years if Nasa were to award his company a moon-landing contract.[40] (Blue Origin is suing in a federal court to force Nasa to do so.)[41] Bezos's efforts are part of his drive to populate space and extract resources from space. He is reported to have assembled "the best space-resources team in the industry" to help people live on the moon and send material back to Earth.[42] In what could well be taken as the start of the space-mining industry, Nasa in 2020 handed contracts to four companies to extract small amounts of lunar regolith, loose material that covers rock, by 2024.[43] In August, Nasa conducted its first drilling of Mars, to a depth of seven centimetres, as part of a search for microbial life on the planet.[44] Nasa in 2022 intends to launch a mission to investigate the Psyche asteroid, a unique metal asteroid that orbits the Sun between Mars and Jupiter that some say could contain US$10 quintillion of iron (that will presumably be claimed by whomever reaches it first).[45] Space proponents say that microgravity will mean moon dwellers could create items that can be made only in space. Others talk of asteroid mining, whereby either resources are extracted and sent to Earth or asteroids are directed at Earth for extraction there. Others talk up space-based solar power; China has announced plans for a solar power station in orbit by 2040.[46] One day earth-controlled robots could mine the moon for water, which can become a rocket fuel once split into hydrogen and oxygen. They could mine for helium-3, another rocket fuel, and the rare-earth minerals that are used in electronics.[47] Nasa is making soil for space habitats by seeding asteroids with fungi.[48] Morgan Stanley said satellite technology and space exploration could help assess and address climate change and sustainability on Earth. The benefits could flow to food security as imagery and weather-monitoring boost agricultural yields and farmer efficiency, the US bank says. Space-based aid could help greenhouse-gas monitoring, open remote areas to renewable-energy harvesting, help utilities manage renewable loads, and boost access to the internet for billions of people.[49] Among advocates, the promise of space is essentially limitless. Space dystopia In 1985, US teacher Christa McAuliffe became a national celebrity when she beat more than 11,000 other applicants to win a seat on the space shuttle Challenger. When McAuliffe was asked if she was nervous, she repeated what she had been told: that the shuttle was as safe as an airplane. The Challenger blasted off on 28 January 1986, one of the coldest mornings ever at Cape Canaveral, Florida. The rubber O-rings that sealed the shuttle's rocket boosters didn't work as well in cold weather - a problem known to Nasa officials. The O-rings failed. The Challenger exploded during lift-off. But McAuliffe and her six crewmates didn't die immediately. The crew compartment sheared from the rest of the shuttle and rose for another 20 seconds, then fell for more than two minutes before smashing into the ocean at 333 kilometres an hour and killing all on board. The shuttle program was suspended for two years.[50] The program was suspended for another two years in 2003 when the space shuttle Columbia fell apart on re-entering the Earth's atmosphere, killing its seven astronauts. Nasa's Apollo program from 1961 to 1972 had two notable disasters. In 1967, the crew of three on Apollo 1 choked to death when a fire erupted during a prelaunch test. In 1970, Apollo 13 abandoned landing on the moon and nearly failed to return to Earth after an oxygen tank exploded and destroyed the module's ability to provide electrical power. The reality is that today's ventures are as dangerous. In 2014, a Virgin Galactic space craft disintegrated during a test flight, killing the co-pilot.[51] Only nine days after Bezos's flight, Nasa and Boeing abandoned the launch of Boeing's crewless Starliner space capsule due to valve problems,[52] which followed a botched launch in 2019 due to a software error.[53] Longer flights in space risk confronting 'solar flares', the most powerful explosive events in the solar system.[54] A fatal event could end, or at least suspend, today's space race. An uninterrupted space race comes with concerns too. The exploration comes with "violent potential", in the words of Daniel Deudney, a professor of politics at the US-based Johns Hopkins University who wrote Dark skies: Space expansion, planetary geopolitics and the end of humanity that argues against the space optimism of Bezos, Branson, Musk et al. "What is going to be the likelihood that we'll have - as we have on Earth - wars and violent rivalries?" he asks, especially if descendants of Earth develop over time, possibly with genetic engineering, into different species.[55] The surge into space has led to calls for revamped multilateral pacts to manage any arms race, space debris, satellite traffic and resource extraction, amid warnings present treaties, such as the Committee on the Peaceful Uses of Outer Space[56] of 1959 and the Outer Space Treaty[57] of 1967 that sit with the UN, are outdated. Mars is the likely point of confrontation after the moon. Simon Morden, author of the upcoming The red planet: A natural history of Mars, warns governments and space pioneers need to decide what they want to do with the planet. "Any crewed mission will be at the end of the most precarious supply line in history,' he says. Crews will thus need to rely on what resources Mars can offer "which is why future planned missions to Mars rely heavily on the anodyne-sounding practice of in situ resource utilisation". He suggests that to protect Mars an international agreement is needed similar to the Antarctic Treaty effective 1961 that saves that continent for science. "It's almost inevitable that, if we do nothing, the default (read guaranteed outcome) will be a chaotic and exploitative land grab."[58] Then there are the pollution concerns. The risks for the Earth relate largely to climate change. Rockets are propelled by the fossil fuels such as kerosene that emit carbon dioxide, chlorine and other chemicals. The problem is the pollutants including soot are emitted into the upper atmosphere and can destroy the ozone layer, while heat released closer to Earth can act like greenhouse gases. The greater the number of space flights, the greater the damage and the bigger the political problem confronting the space adventurers.[59] When it comes to pollution in space, the immediate environmental concern is the amount of debris the space race will add into orbit that, if nothing else, increases the chance of collisions. Nasa estimates more than 100 million pieces of space junk are spinning around the earth.[60] The US Department of Defense tracks about 27,000 pieces of 'space junk' that have wrecked satellites (which only puts more debris in space).[61] One solution is that of Japanese firm Astroscale, which is testing magnetic satellites that can help remove debris.[62] A longer-term concern is damage by humans to planets on which they live, work and exploit. Such challenges and no doubt setbacks are part of the space race. At the moment, though, the space joyriders are empowered. Without ever misspeaking, space superhero Buzz Lightyear from Toy Story probably best sums up the enthusiasm of Bezos, Branson and Musk and others as they seek to emulate the space heroes of yesterday. "To infinity and beyond." Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund[1]Clive James. 'Fame in the 20th century.' Pages 123 to 124. Penguin Books. 1994. [2] Nasa. 'July 20, 1969: One giant leap for mankind.' nasa.gov/mission_pages/apollo/apollo11.html [3] See Nasa. International Space Exploration Coordination Group. 'Benefits stemming from space exploration.' September 2003. nasa.gov/sites/default/files/files/Benefits-Stemming-from-Space-Exploration-2013-TAGGED.pdf [4] 'Jeff Bezos blasts into space on own rocket: Best day ever!' The Washington Post. 21 July 2021. washingtonpost.com/business/bezos-riding-own-rocket-on-companys-1st-flight-with-people/2021/07/20/29791bf8-e92c-11eb-a2ba-3be31d349258_story.html [5] Virgin Galactic. 'Virgin Galactic successfully completes first fully crewed spaceflight.' 11 July 2021. virgingalactic.com/articles/virgin-galactic-successfully-completes-first-fully-crewed-spaceflight/ [6] Companies in Japan are interested. See Japan's Lunar Industry Vision Council. 'Toward the planet 6.0 era.' July 2021. ispace-inc.com/wp-content/uploads/2021/07/LIV_EXECUTIVE-SUMMARY_FINAL_20210710_EN_0712_2MB.pdf [7] Boeing Space Launch System is the Boeing arm focused on space. Boeing in space. 'The future of space is built here.' boeing.com/space/ [8] Morgan Stanley. 'Space: Investing in the final frontier.' 24 July 2021. morganstanley.com/ideas/investing-in-space [9] Nasa. 'Demo-2: Launching into history.' 1 June 2020. nasa.gov/image-feature/demo-2-launching-into-history. t [10] National Geographic. 'SpaceX launches first astronauts on reused rocket.' 23 April 2021. nationalgeographic.com/science/article/spacex-launches-first-astronauts-on-a-reused-rocket [11] SpaceX. Starship to land Nasa astronauts on the moon.' 16 April 2021. spacex.com/updates/starship-moon-announcement/index.html. Musk says this could happen before 2024. See 'Elon Musk says SpaceX ready to land humans on moon 'probably sooner' than 2024.' Newsweek. 15 August 2021. newsweek.com/elon-musk-spacex-ready-humans-moon-sooner-2024-1619475 [12] CNBC. 'Bank of America expects the space industry to triple to a $1.4 trillion market within a decade.' 4 October 2020. cnbc.com/2020/10/02/why-the-space-industry-may-triple-to-1point4-trillion-by-2030.html [13] See, The Atlantic. 'Finally, a private spaceflight with a billionaire you've never heard of.' 13 September 2021. theatlantic.com/science/archive/2021/09/spacex-inspiration4-private-crew/620056/. See also, SpaceX. 'SpaceX to launch Inspiration4 mission to orbit.' 1 February 2021. spacex.com/updates/inspiration-4-mission/index.html [14] Virgin Galactic. 'Virgin Galactic announces second quarter 2021 financial results.' 5 August 2021. investors.virgingalactic.com/news/news-details/2021/Virgin-Galactic-Announces-Second-Quarter-2021-Financial-Results/default.aspx [15] See Axiom Space website. axiomspace.com/axiom-station. The facility will orbit 250 miles above the earth at 17,000 miles per hour. [16] Nature.com. 'Satellite mega-constellations create risks in low earth orbit, the atmosphere and on earth.' 20 May 2021. nature.com/articles/s41598-021-89909-7. Other companies with plans to launch satellites in numbers include Amazon, Chinese state firm GW, UK-based OneWeb and Télésat of Belgium. [17] Nasa. Artemis Program. 'Humanity's return to the moon.' nasa.gov/specials/artemis/. See Nasa. Europa Clipper mission. europa.nasa.gov/ See also 'Nasa perseveres through pandemic, looks ahead in 2021.' 5 January 2021. nasa.gov/feature/nasa-perseveres-through-pandemic-looks-ahead-in-2021 [18] Xinhua. 'China succeeds in first Mars landing.' 15 May 2021. xinhuanet.com/english/2021-05/15/c_139947277.htm [19] Xinhua. 'China's Chang'e-4 probe soft-lands on the Moon's far side.' 3 January 2019. xinhuanet.com/english/2019-01/03/c_137716800.htm [20] Xinhua. 'China, Russia invite international partners in lunar research station cooperation.' 17 June 2021. xinhuanet.com/english/2021-06/17/c_1310011788.htm [21] UN. Office for Outer Space Affairs. 'World space agencies.' unoosa.org/oosa/en/ourwork/space-agencies.html [22] Axiom. 'Why space?' axiomspace.com/why-space [23] 'About Blue Origin'. blueorigin.com/about-blue [24] Space.com. 'Elon Musk floats 'nuke Mars' idea again (and he has T-shirts). 17 August 2021. space.com/elon-musk-nuke-mars-terraforming.html [25] Reuters. 'US grounds Virgin Galactic flights pending mishap probe.' 3 September 2021. reuters.com/business/aerospace-defense/us-bars-virgin-galactic-rocket-plane-flights-pending-mishap-probe-2021-09-02/ [26] The Times. 'Cracks in International Space Station cannot be repaired, Russia claims.' 1 September 2021. thetimes.co.uk/article/cracks-in-international-space-station-cannot-be-repaired-russia-claims-59dhbzs6r [27] Space.com. Space collision: Chinese satellite got whacked by hunk of Russian rocket in March.' 16 August 2021. space.com/space-junk-collision-chinese-satellite-yunhai-1-02 [28] US Defense Intelligence Agency. 'Challenges to security in space.' January 2019. dia.mil/Portals/27/Documents/News/Military%20Power%20Publications/Space_Threat_V14_020119_sm.pdf See Department of Defense. US Space Command. spacecom.mil/#/. See also 19FortyFive (a US-based publication focused on national security). 'Don't let China turn space into the new South China Sea.' August 2021. 19fortyfive.com/2021/08/dont-let-china-turn-space-into-the-new-south-china-sea/ [29] Nature.com. Op sit. [30] Virgin Galactic. Second quarter result 2021. Op cit. [31] 'Inventory of CO2 available for terraforming Mars.' Nature magazine. 1 August 2018. nature.com/articles/s41550-018-0529-6.epdf [32] Twitter. @elonmusk. 22 December 2015. twitter.com/elonmusk/status/679127406813188097 [33] National Geographic. 'Touchdown! SpaceX rocket makes a perfect upright landing.' 23 December 2015 nationalgeographic.com/science/article/151222-spacex-landing-rocket-video-space. [34] See National Geographic. 'How SpaceX became Nasa's go-to ride into orbit.' 12 November 2020. nationalgeographic.com/science/article/how-spacex-became-nasas-go-to-ride-orbit [35] SpaceX. Falcon 9. spacex.com/vehicles/falcon-9/ [36] Cnet. 'SpaceX Falcon 9 missed its landing last month because of a hole in the boot.' 1 March 2021. cnet.com/news/spacex-falcon-9-missed-landing-last-month-because-of-a-hole-in-a-boot/ [37] Forbes. 'Why SpaceX is a game changer for Nasa.' 4 June 2020. forbes.com/sites/niallmccarthy/2020/06/04/why-spacex-is-a-game-changer-for-nasa-infographic/ [38] Nasa Technical Reports Server. 'The recent large reduction in space launch cost.' 8-12 July 2018. ntrs.nasa.gov/citations/20200001093. See also Nextbigfuture.com. 'SpaceX starship is bigger and cheaper than the external shuttle tank.' 28 May 2020. nextbigfuture.com/2020/05/spacex-starship-is-bigger-and-cheaper-than-the-external-shuttle-tank.html [39] arsTECHNICA. 'SpaceX to launch the Europa Clipper mission for a bargain price.' 24 July 2021. arstechnica.com/science/2021/07/spacex-to-launch-the-europa-clipper-mission-for-a-bargain-price/ [40] Blue Origin. 'Open letter to administrator Nelson.' 26 July 2021. blueorigin.com/news/open-letter-to-administrator-nelson [41] 'Jeff Bezos's Blue Origin files suit in federal court as it pursues a campaign to win a slice of Nasa moon contract.' 16 August 2021. The Washington Post. (Bezos owns the Post.) washingtonpost.com/technology/2021/08/16/blue-origin-spacex-rivalry-lawsuit-nasa/ [42] arsTECHNICA. 'Blue Origin has a secret project named 'Jarvis' to compete with SpaceX.' 27 July 2021. arstechnica.com/science/2021/07/blue-origin-is-developing-reusable-second-stage-other-advanced-projects/ [43] Nasa. 'Construction with regolith.' 6 March 2017. nasa.gov/api/citations/20170002067/downloads/20170002067.pdf [44] Nasa. 'Assessing Perseverance's first sample attempt.' 11 August 2021. mars.nasa.gov/mars2020/mission/status/320/assessing-perseverances-first-sample-attempt/ See WIRED. 'Why Perseverance's first Mars drilling attempt came up empty.' 12 August 2021. wired.com/story/why-perseverances-first-mars-drilling-attempt-came-up-empty/ [45] Nasa. Mission pages. 'Psyche overview.' nasa.gov/mission_pages/psyche/overview/index.html. See Financial Times. 'Space mining: black holes await investors.' 14 August 2021. ft.com/content/7ede2b1e-2872-4c04-b0ba-0ae6486ea9ee [46] China Daily. 'Scientists envision solar power station in space.' 27 February 2019. chinadaily.com.cn/a/201902/27/WS5c75c8b3a3106c65c34eb8e3.html [47] Milken Institute Review. 'Space mining is coming.' 26 April 2021. milkenreview.org/articles/mining-in-space-is-coming [48] Nasa. 'Making soil for space habitats by seeding asteroids with fungi.' 26 February 2021. nasa.gov/directorates/spacetech/niac/2021_Phase_I/Making_Soil_for_Space_Habitats/. See also Scientific American. 'Future space travel might require mushrooms.' 3 August 2021. scientificamerican.com/article/space-travels-most-surprising-future-ingredient-mushrooms/ [49] Morgan Stanley. Ideas. 'Does Earth's future depend on space?' 10 July 2020. morganstanley.com/ideas/space-earth-sustainability [50] Kevin Cook, author of 'The burning blue: The untold story of Christa McAuliffe and Nasa's Challenger disaster.' Henry Hold & Co. August 2021. This excerpt is from 'The case against space tourism.' 22 July 2021. The Wall Street Journal. wsj.com/articles/blue-origin-spacex-bezos-musk-galactic-branson-tourism-space-11626968962 [51] c|net. 'Branson on Virgin Galactic crash: Space flight is hard - but worth it.' 1 November 2014. cnet.com/news/branson-on-virgin-galactic-crash-space-is-hard-but-worth-it/ [52] Boeing. Tweet from @BoeingSpace. 4 August 2021. twitter.com/BoeingSpace/status/1422716652727250945 [53] 'Boeing space flight postponed after mishap at space station.' 29 July 2021. The Wall Street Journal. wsj.com/articles/boeing-space-flight-postponed-after-mishap-at-space-station-11627589940 [54] Nasa. 'What is a solar flare?' nasa.gov/content/goddard/what-is-a-solar-flare [55] Aie.org. Blog post. 'Space expansion, planetary geopolitics and the end of humanity. My long read q&a with Daniel Deudney.' 19 June 2021. aei.org/economics/space-expansionism-geopolitics-and-the-future-of-humanity-my-long-read-qa-with-daniel-deudney/. See also World Political Review. 'Colonising space is not the solution to our problems here on earth.' 26 July 2021. worldpoliticsreview.com/articles/29832/despite-dreams-of-colonization-space-won-t-solve-our-problems-on-earth [56] United Nations. Office for Outer Space Affairs. 'Committee on the Peaceful Uses of Outer Space.' unoosa.org/oosa/en/ourwork/copuos/index.html [57] United Nations. Office for Disarmament Affairs. The Outer Space Treaty is formally the 'Treaty on Principles Governing the Activities of States in the Exploration and Use of Outer Space, including the Moon and Other Celestial Bodies.' treaties.unoda.org/t/outer_space [58] Simon Morden. 'We are on the brink of a new space race - it's time to talk about Mars.' 9 August 2021. independent.co.uk/voices/mars-nasa-space-race-b1898113.html. The red planet: A natural history of Mars. Simon Morden. To be published by Elliott & Thompson September 2021. [59] See The Guardian. 'How the space race could be one giant leap for pollution.' 19 July 2021. theguardian.com/science/2021/jul/19/billionaires-space-tourism-environment-emissions. See also, 'The rise of space tourism could affect earth's climate in unforeseen ways, scientists worry.' 26 July 2021. space.com/environmental-impact-space-tourism-flights [60] Nasa. Office of inspector general. 'Nasa's efforts to mitigate the risks posed by orbital debris.' 27 January 2021. Page 3. oig.nasa.gov/docs/IG-21-011.pdf [61] Science and history. 'Space is getting crowded with junk.' 3 July 2021. sciencendhistory.blogspot.com/2021/07/space%20debris%20in%20orbit.html [62] Spacenews. 'Astroscale complete first test of satellite capture technology.' 25 August 2021. spacenews.com/astroscale-complete-first-test-of-satellite-capture-technology/ Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

|

|

1 Oct 2021 - Banning unvaccinated workers could impact our economy

|

Banning unvaccinated workers could impact our economy Tim Hext, Pendal 22 September 2021 |

|

THIS WEEK has been relatively quiet for bond markets, despite an attempt at excitement around China. I learnt long ago that little happens by accident in China. The government has the ability and the smarts to control what is going on. Letting Evergrande wobble is more about sending a message than a misguided step that will send the economy into freefall. Of course the usual chorus line of doomsdayers have lined up to predict just that. I am not one of them. Maybe eventually they do stumble, but you'll go broke betting on it long before then. The impact of banning unvaccinated workersOur attention is more focused on what is happening domestically - in particular the how and when of re-opening in NSW and Victoria. The area of concern for us is how unvaccinated workers are treated. The concern is less ethical - I will leave readers to their own views - but what it means for the workforce. If one in ten workers end up unvaccinated, whether for health or personal reasons, their potential exclusion will have a significant impact on the supply side of the economy. Most employers are currently awaiting government guidance, but until rapid testing is widely available it seems many will be banned from working. The demand side of the economy is likely to return quicker than the supply side. We are increasingly confident that 2022 will see higher - not lower - inflation and the RBA will be tested on its benign view. Wages should also pick up faster. Future inflation as measured by markets remains stuck around 2%, which to us provides an opportunity. |

|

Funds operated by this manager: Pendal Total Return Fund |

|

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at August 11, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided. This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. |

1 Oct 2021 - When selling, what's better than a monkey throwing darts?

|