NEWS

24 Aug 2023 - Digital assets: unlocking value in the technology of the future

|

Digital assets: unlocking value in the technology of the future abrdn August 2023 Blockchains and other forms of distributed ledger technology (DLT) are set to transform the way organisations across industries operate and, ultimately, the way individuals live their lives. Fast, transparent and secure, they offer more efficient, lower cost and permanent ways to process, verify and store data. In many cases, DLTs can vastly improve existing processes both within, and between, organisations and individuals. They can also create new opportunities to innovate. Investors wishing to participate in the adoption of DLTs can do so by investing in their native digital assets, which are needed to pay for usage. Given the short history of the industry, a diversified approach across several is preferred. DLT and how it worksDLTs use cryptography to store data securely on digital ledgers. These ledgers are then distributed across networks of nodes (individuals or groups who operate the network), where the nodes validate updates of their respective ledgers through a consensus algorithm. DLTs can vary in the way they reach consensus and have different characteristics in terms of speed, security, running costs, transparency and options for customisation. Proof-of-workThe Bitcoin blockchain uses a proof-of-work (PoW) consensus algorithm which requires the operators (in this case, 'miners') to update the blockchain by solving a simple, but extremely large, mathematical puzzle. Miners are rewarded for performing this service in the form of Bitcoin, the native token of the Bitcoin blockchain. As miners compete for rewards, the mathematical puzzle increases in size, requiring more energy to be expended to solve it. PoW is very secure by design as 'bad actors' would be required to expend more energy (and thus more cost) to alter records on the blockchain. However, PoW is also slow to process updates and can be extremely energy intensive, resulting in high running costs and large carbon emissions. Proof-of-stakeProof-of-stake (PoS) is another consensus algorithm whereby, instead of solving a puzzle, nodes (called 'validators' in this case) check and come to a consensus on the updates to their respective ledgers. Validators are rewarded in the native token for validating transactions on ledgers. To ensure that PoS is secure, nodes must own some of the native DLT token (hence the 'stake'). This means a bad actor would need to acquire a large proportion of tokens to attack the DLT. PoS consensus DLTs vary in how they treat this token ownership and the rights it confers. Importantly, PoS requires significantly less energy to validate transactions than PoW. For example, when Ethereum, the largest PoS consensus blockchain, moved from PoW to PoS last September, energy consumption for the network dropped by 99.95%. Some DLTs, such as Hedera Hashgraph, are able to reduce energy consumption for validation even further. The power of DLT to improve...DLTs process and store data quickly and securely, and are immutable, meaning they can't be altered. As such, they have broad applications across most industries where data processing is required. For example, in financial services, DLT can be used to streamline 'know-your-client' processes. Individuals and groups can have sensitive data verified seamlessly, without the need for openly presenting this data (and having information divulged unnecessarily). In the manufacturing and consumer goods industries, supply chains can be monitored and analysed on a digital ledger. In a world where transparency of supply chains is becoming increasingly important, a public distributed ledger can provide the trust that consumers and intermediaries require. The health industry is home to some of the most sensitive personal data, with public and private healthcare providers across the world suffering data breaches. DLT can provide a safe and secure solution to storing sensitive data while also making it usable only by authorised people, such as medical professionals. Additionally, interoperability between DLTs would allow for easy access and transfer of information for patients moving healthcare providers. ...and to create something newIn addition to making existing processes more efficient, DLT opens up the possibility for new forms of data management that would otherwise be impractical. The technology can also be used to tackle piracy issues in music and entertainment by memorialising the unique data behind songs or films on a ledger, while artists can benefit from greater financial democratisation and autonomy through royalty distribution built into smart contracts. In financial services, DLT offers powerful democratisation benefits through the tokenisation and fractionalisation of financial assets. Investment opportunities previously available to only the largest institutional investors (such as direct real estate, infrastructure and other alternative asset classes) can now be offered to individuals seeking greater control and diversification of their financial investments. The investment case for digital assetsValidator 'rewards' in a PoS consensus DLT are provided by users of the technology. When a company uses the technology, they must purchase and 'spend' the native token for that DLT. For example, in the case of Ethereum, validators are rewarded by users in ether (also known as ETH). Many DLTs have a controlled and, ultimately, finite issuance of tokens. Therefore, as adoption and use of public DLT increases, demand for digital assets will increase, leading to a rise in their value. Currently, speculation clearly dominates these markets. However, this is a nascent technology and adoption is at an irreducible fraction of its ultimate potential. In that sense, it is reasonable to expect that, in the future, a far greater proportion of the demand and activity in digital assets will come from the application of DLTs rather than from speculation. Investing earlyGiven what we now know about the success of Excel, most people would jump at the chance to go back in time and invest in that technology (were it investible). However, we now have the benefit of hindsight, while in its infancy, Excel was competing with several other spreadsheet packages as well as resistance from users of 'old' tech. The DLT industry is in a similar position now. We can see the momentum of adoption building but it's still unclear which technologies will see the greatest adoption over time. Investors can participate in, and profit from, the growth of individual DLTs by purchasing and holding the related digital assets. Over time, adoption metrics may provide an indicator for future price movements. However, it is still too early to make these predictions. Therefore, the suitable approach for most investors is to allocate to a diversified basket of assets, with some consideration for liquidity and market capitalisation. This would be considered better than an 'eggs in one basket' strategy, while also giving broader exposure to the industries that may adopt different DLTs based on their specific use cases. Author: Duncan Moir, Senior Investment Manager, Alternatives |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

23 Aug 2023 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

23 Aug 2023 - AI reaches an inflection point

|

AI reaches an inflection point Insync Fund Managers August 2023

Insync Funds Management believes Artificial Intelligence (AI) has reached an inflection point, brought about by a new phase in the creation of generative AI and large-language transformer models such as ChatGPT. It sees this new leap forward in AI as highly disruptive to most industries, and as such will have a profound impact on where to invest, and importantly where not to. 'We are heavily engaged in deep specialist research to gauge who will be empowered, what to avoid, and where the most significant value and differentiation lies,' says Insync CIO, Monik Kotecha. 'One key area of more immediate benefit is in data.' RELX is one global company in the Insync portfolio that has a distinct data advantage, making it a major beneficiary of the acceleration of AI. A global provider of information-based analytics and decision tools, RELX provides products that help researchers advance scientific knowledge across medical, legal, financial services, and government industries and sectors. 'What RELX does so well is gather, analyze, and deliver valuable knowledge and insights to businesses and professionals across industries globally, empowering people and organizations to make better-informed decisions.' Mr. Kotecha said. The company has been using machine learning natural language processing for well over a decade and has been experimenting with generative AI for over 18 months. It employs 10,000 technologists spending about $1.6 billion a year on technology alone. 'Similar to one of our other holdings, Adobe, it possesses multiple gargantuan databases that result in reliable and trusted sources of data its customers can depend on,' Mr Kotecha said. 'Like all companies in our portfolio, both Adobe and RELX are highly profitable companies based on their Return On Invested Capital (ROIC), have a long runway of growth, modest levels of debt, substantial R&D, and are generating prodigious amounts of cash flow year after year,' Mr Kotecha said. 'While investors are fretting over when interest rates will peak, and the impact on both the economy and company earnings, a select group of companies often deliver excess relative returns versus the benchmark again and again,' he said. 'This is especially so during historical periods of monetary tightening and general gloomy headlines, such as we are experiencing today.' Results from such companies, even in the current environment, should not be surprising he said. 'We find they often maintain and even strengthen their strong competitive advantages during challenging times, and this enables them to consistently generate economic value even as the cost of capital is rising.' Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

22 Aug 2023 - Performance Report: Collins St Value Fund

[Current Manager Report if available]

22 Aug 2023 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

21 Aug 2023 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

21 Aug 2023 - Australian Secure Capital Fund - Market Update July

|

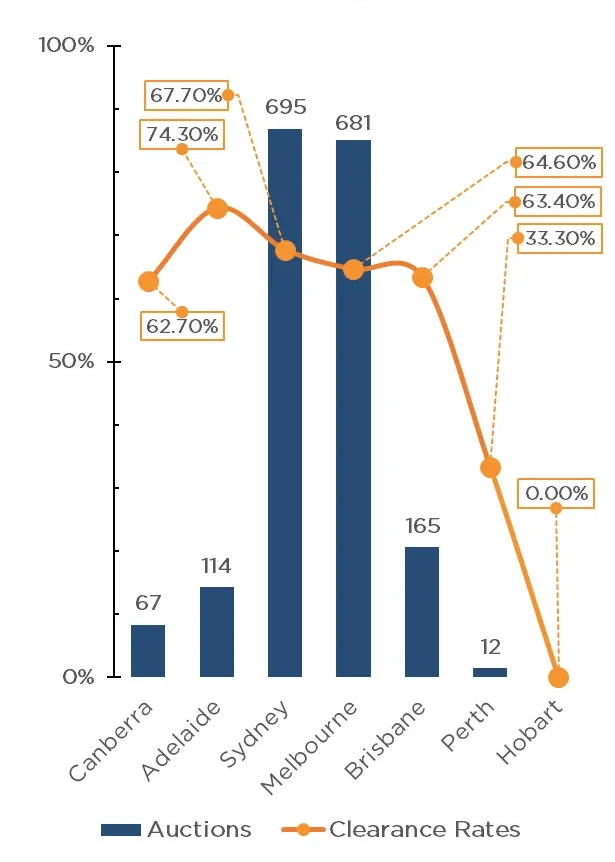

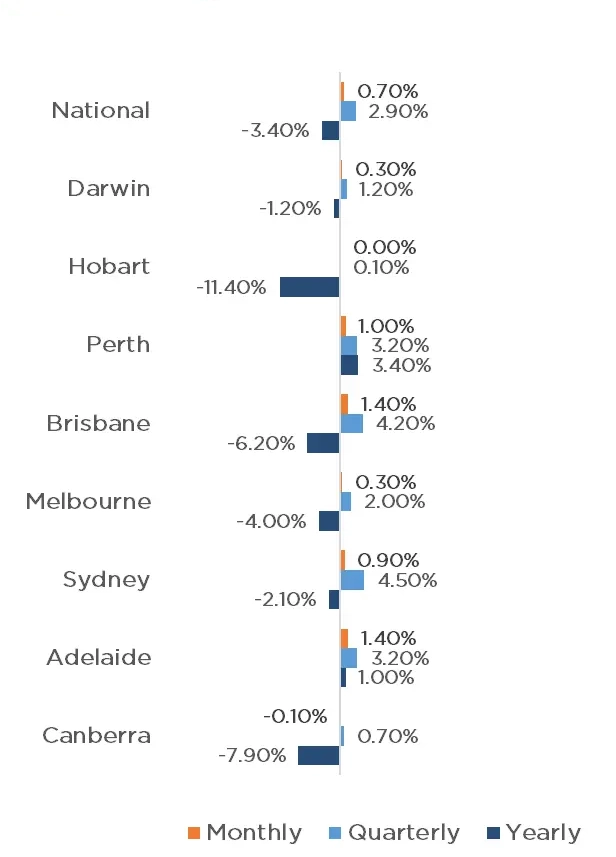

Australian Secure Capital Fund - Market Update July Australian Secure Capital Fund August 2023 In a positive sign for Australian property prices, the RBA has elected to keep the cash rate on hold for the second consecutive month, suggesting that interest rates may have peaked, or at a minimum, are close to peaking. The CoreLogic Home Value Index shows that property values experienced growth across all capital cities except for Canberra (-0.1%) for the month of July, with Brisbane and Adelaide performing strongest with 1.4% monthly growth. Perth (1%), Sydney (0.9%) Melbourne (0.3%) and Darwin (0.3%) also received strong monthly growth. These strong monthly results have lead to all capital cities now recording positive growth for the quarter. The regions have not performed as strongly, with only regional South Australia (1.1%) and Queensland (0.7%, primarily driven by strong growth on the Gold Coast) recording growth for the month, with Victoria (-0.4%), Western Australia (-0.3%) and Tasmania (-0.1%) experiencing a reduction in value. In a sign of slowly increasing supply, Auction numbers for the last weekend of July were above those of the same weekend last year, with 1,961 auctions taking place, up from 1,913 in 2022. This was predominantly due to strong auction numbers in Melbourne (846, up from 809) and Sydney (760, up from 624), however Brisbane (174), Adelaide (113), Canberra (53) and Perth (14) were not far off last year's results. Despite the number of auctions increasing, clearance rates remain strong, suggesting buyers and sellers are "on the same page" in regards to property price expectations. Adelaide (82.8%) leads the way, followed by Sydney (72.4%), Canberra (70.6%), Melbourne (69.9%) Brisbane (58.3%), contributing to a weighted average clearance rate of 70.2% for the weekend, well above the 54% result of the previous year. Clearance Rates & Auctions 17th June - 23rd of July 2023

Property Values as at 1st of August 2023

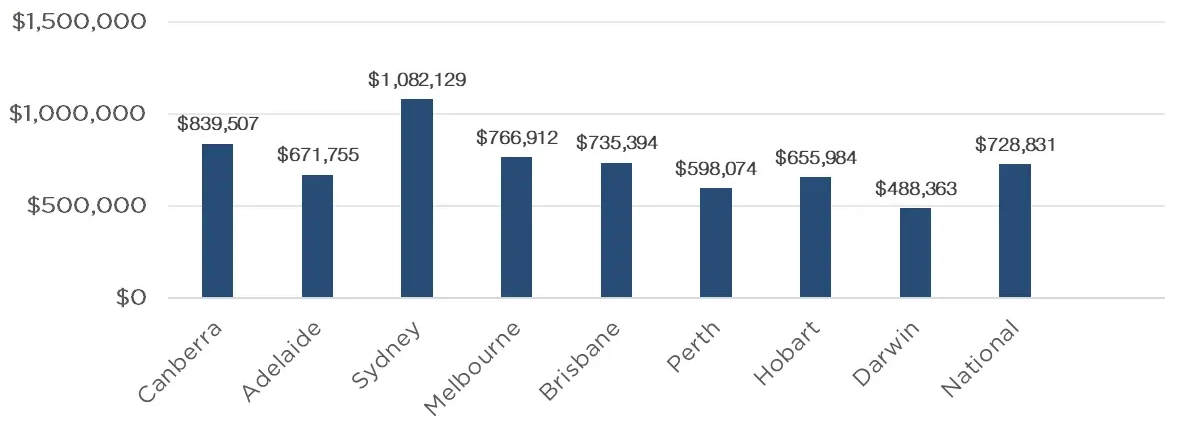

Median Dwelling Values as at 1st of August 2023

Quick InsightsWay High WestpacAccording to Westpac's latest forecast, Sydney house prices are expected to rise as much as 10% this year, propelled by surging migration, a tight rental market and scant housing supply. Sydney prices are anticipated to gain another 6% in 2024, and 4% in 2025. Perth is expected to achieve the second strongest growth, with an 8% gain this year, followed by Brisbane with 6% and Melbourne prices at 4%, said Westpac senior economist Matthew Hassan. Source: Australian Financial Review The Harborside HomeDavid Waterhouse, the estranged member of the famous racing clan, has sold his iconic harborside home Villa Biscaya for about $28 million. Designed by prominent architect Alan Edgecliff Stafford in 1929, the three-bedroom home features a grand stone staircase flanked by wrought-iron balustrades. The sale comes just three years after the former art dealer and options trader paid $10.25 million, almost tripling the purchase price. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

18 Aug 2023 - Hedge Clippings | 18 August 2023

|

|

|

|

Hedge Clippings | 18 August 2023 Chinese property dominoes are looking wobbly All is not well with the Chinese property market - and given its importance to the overall Chinese economy, and thus to our major trading partner, there are some worrying signs on the horizon. Domestically, the property sector has been a major driver of China's growth, and thus the overall economy. And for a snapshot of the importance of China's economy on global trade, China is 1st in the world by maritime trade volume, 2nd in the world by shipping capacity, 1st in the world by port foreign trade volume and container throughput, and 1st in the world in shipbuilding by completed gross tonnage. Back to the property sector itself, and the empty or partially completed high rise buildings mean that the worrying horizon is not too far away. In the past week, two of China's most visible property developers' problems have hit the headlines for all the wrong reasons. Country Garden, the largest privately owned development company in China suspended interest repayments on a small number of on-shore bonds, and Beijing-backed developer Sino-Ocean conceded it had missed almost USD 21m of interest repayments on a series of off-shore bonds. As a result, Moody cut Country Garde's rating from B1 to Caa1, and Country Garden shares fell 18% in one day in Hong Kong. Country Garden sales in H1 2003 are down 30% YoY, and according to John Browning's excellent "Letter from Shanghai" the reluctance of buyers to place large deposits - which are then used to complete projects - is causing the developers' liquidity and cash flow problems. The problems in the property sector don't end there, as Browning explains: "The market is looking at the maelstrom that circulates around Zhongrong International Trust, and its connected parent Zhongzhi Enterprise Group. Zhongzhi acts to pool the deposits of its clients to invest in real estate, equities, bonds, and commodities. The guaranteed rates offered investors head towards 8%. Zhongrong International Trust has 270 products, which in totality offer an average yield of 6.88%. Coupled with a sales team that reportedly received 2-3% of the initial deposit, if we then throw in management fees, the investment managers of these pools would have to find investment opportunities that earn in the area of 12% P.A. just to break even after costs." As Browning rather drily notes: Looking at it dispassionately, there would be at first glance a temptation to manage the pool according to the Book of Madoff. Elsewhere in China retail sales figures disappointed, with July YoY coming in at 2.5% vs. previous 3.1% and expected 4.5%, followed by Industrial Production, July YoY actual 3.7% against previous 4.4% and expectations of 4.4%. Hedge Clippings has always been wary of Chinese data being shall we say "massaged", but our concerns were not helped (or were possibly confirmed) by a report that the numbers will no longer be published for the Chinese Youth Unemployment Rate - those unemployed between the ages of 16 and 24 - which is running at 21.3%. The official reason for the non-publication was the need to "further improve and optimise labour force survey statistics." Obviously not publishing bad news won't solve the problem, but it will save having to explain it (except to those unemployed). Maybe the unemployed youth could be conscripted and used to invade Taiwan? The Chinese authorities will no doubt act to revive their slowing economy, but longer term the social and demographic issues they face (population growth fell by 0.2% in 2023, having flatlined in 2022 in spite of the end of the One Child policy) are significant. According to this report, the UN forecasts that China's population will decline from 1.426 billion this year to 1.313 billion by 2050 and below 800 million by 2100. If you're interested in receiving John Browning's daily "Letter from Shanghai" you can register using this link https://mailchi.mp/ News & Insights Market Commentary - July | Glenmore Asset Management Investment Perspectives: Thinking about the cycle | Quay Global Investors July 2023 Performance News Bennelong Australian Equities Fund Delft Partners Global High Conviction Strategy Bennelong Long Short Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

18 Aug 2023 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

18 Aug 2023 - How can we ensure affordable housing?

|

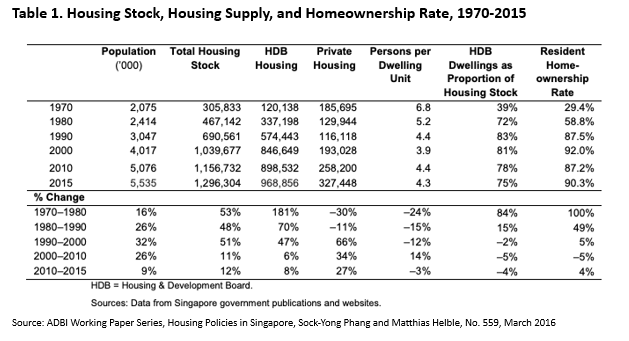

How can we ensure affordable housing? Montgomery Investment Management August 2023 As I note below, solving housing affordability won't be enough with just a massive supply of affordable dwellings rapidly built by state and federal governments. The market for these properties will have to be tightly regulated, and controlled, with continuous maintenance and updates. It's doable, as is its financing. The protected species: residential real estate owners If you've been following the blog for the last decade, you will know I have argued residential real estate owners in the country are a 'protected' species. Whether it's negative gearing, zero capital gains tax on primary places of residence, stamp duty concessions, the $25,000 homebuilder grant or the First Home Owners Grant, there isn't a government policy that does anything other than help support property prices or at least prevent any kind of crash. And if we consider our entire financial system, it's built on the back of loans to fund property purchases. That means not only has the government incentivised people to buy property (and therefore doesn't have any incentive to see prices decline), but the Reserve Bank of Australia (RBA), Australian Prudential Regulation Authority (APRA), the Council of Financial Regulators, and the banks are all aiming to maintain stability in the financial system by avoiding, at all costs, a collapse in house prices. The illusion of first homeowners grants So, if you're an economist or a commentator who believes property prices could fall 30 or 40 per cent, you've not considered the real underlying drivers. The First Home Owners Grants offered by the states is a particularly humorous attempt to make housing more affordable. In Victoria, the $10,000 grant is available to those buying or building a home valued at up to $750,000. In New South Wales, $10,000 is also available to those purchasing an existing dwelling up to $750,000, or a new build worth less than $600,001. Up north, in Queensland, $15,000 is extended to those buying or building up to $750,000, while in Western Australia, a $10,000 grant is provided for purchases up to $750,000 or $1 million, depending on location. In the Northern Territory, various incentives are available including a $10,000 grant, the First Home Guarantee, which supports eligible purchasers to buy with a deposit of as little as five per cent and as little as two per cent for eligible single parents. Meanwhile, in South Australia, $15,000 is offered for purchases up to $650,000, and finally in Tasmaia, first home buyers receive $30,000 for the acquisition of a property of any value. Consider giving everyone in Australia a First Share Portfolio Buyers Grant, or a First Car Buyers Grant; prices would surge. It's inevitable. If you give people more money to buy something, the price rises. We gave everyone money during the pandemic and are now dealing with inflation. You don't need a PhD to work that out. In the last decade, Australian state and federal governments have outlaid $20.5 billion for various first home buyers schemes. What do you think happens to a property market if an additional $20.5 billion is injected into it? It only helps to accentuate the influences already pushing property prices higher. Of course, it serves the government, the financial regulators and the banks. But it doesn't serve those who cannot afford to buy in the first place. Henry George and progress and poverty During the 19th century, American political economist Henry George made a profound revelation regarding the unprecedented surge in industrial output, which, in turn, led to an escalation in urban land prices. As landowners reaped substantial windfalls, a tumultuous wave of land speculation and real estate bubbles ensued, triggering an era of volatility and uncertainty. The Gilded Age saw the accumulation of vast fortunes by industrialists, bankers, and landowners, but it coincided with a surge in poverty, inequality, and societal unrest. Singapore's housing system: A solution to affordable housing? Sound familiar? In 1879, Henry George boldly presented his critique of the capitalist system in his seminal work, Progress and Poverty (1879). Progress and Poverty, achieved global acclaim with millions of copies sold. It delved into the perplexing paradox of rising inequality and poverty amidst remarkable economic and technological advancements. George advocated for solutions to social issues caused by extreme greed, particularly concerning the laborer's who contribute real economic value through their hard work in production. Among these remedies, George proposed implementing rent capture measures like land value taxation, where higher taxes are imposed on more valuable land. What would widely be regarded today as going too far, George's thought-provoking stance proposed a radical concept: the communal ownership of land, with society collectively benefiting from any upsurge in land rents. The daring proposition that lay at the heart of his proposal was a single tax on land values, the idea being that by taxing land values, society could recapture the value of its common inheritance, raise wages, improve land use, and eliminate the need for taxes on productive activity. The mechanics of Singapore's housing scheme While it challenged convention and is arguably anathema to capitalism, it nevertheless draws attention to the structure of our society and should still promote debate about a fairer, more equitable one. Singapore has attempted to deal with the issue, with what appears to be a nod to George. Singapore today enjoys a very high homeownership rate of 91 per cent, and the government's involvement in the housing market is extensive and unique. Despite one of the world's highest concentrations of millionaires and one of Asia's most expensive housing markets, young newlyweds can easily afford to buy a well-located property close to their place of employment. Financing Singapore's housing scheme This is possible because the Housing and Development Board (HDB), a statutory board of the Ministry of National Development, is the largest housing developer. It is important to note, however, that in Singapore, more than 75 per cent of the land belongs to Singapore Land Authority (STA), while the remaining freehold land belongs to statutory boards like HDB, JTC, PSA and other private owners. There are three land 'ownership' types: 99-year lease, 999-year lease and freehold. Established in 1960, and superseding the Singapore Improvement Trust (SIT), the Housing Development Board was tasked to solve a housing crisis by rapidly increasing the supply of homes for the poor to rent. By the middle of the decade, it had housed 400,000 people. The dual property market in Singapore In 1960, just nine per cent of Singaporeans lived in rental public housing. In 1964 the decision was made to offer subsidized flats for sale under the government's "Home Ownership for the People Scheme". By 1985, four-fifths of the resident population were living in HDB flats. Today, more than 90 per cent of HDB's housing has been sold - at below-market prices - on 99-year leases to eligible households. Singaporeans typically purchase their first home from the HDB, and buyers can sell their HDB flats in an active secondary market at market prices only after five years. The pace of supply can be seen in Table 1. Table 1. Housing Stock, Housing Supply, and Homeownership Rate, 1970-2015

Applying lessons from Singapore to Australia A quick look at www.propertyguru.com.sg reveals genuinely well-located (everything is close to the city in Singapore) HDB flats for sale for S$550,000, alongside opulent S$30 million penthouses and colonial-era homes that have sold for as much as S$220 million. And remember Singapore's HDB was set up in 1960. Even after 63 years, inner-city apartments are still available for S$550,000. It's also worth noting the buyers of affordable HDB flats don't treat them like slums, they take great pride in property ownership, often renovating with the assistance of professional interior designers. HDB apartment blocks are meticulously designed. Each cluster of buildings are communities, with essential amenities such as playgrounds, food centers, and local shops. More recent developments include health clinics, community centers and libraries. Importantly, the management of these estates is integrated into comprehensive servicing policies that incorporate the city's transport system and racial integration. Perhaps in its appreciation of George's 1879 trestise Progress and Poverty, Singapore acknowledges that HDB homes represent the most significant stake its citizens have in the country's prosperity. Consequently, the HDB maintains its buildings and grounds and periodically upgrades them. Residents and businesses pay for maintenance, maintenance is carried out by Town Councils and their funding comes from government grants. At the end of the 99-year lease, the dwelling is practically worth S$0 and the resident (usually a second-generation occupant who didn't pay for the apartment) is no longer given the right to continue living in the apartment and can apply to buy it or another. Typically, after an HDB apartment turns 39 (with 60 years left), buyers tend not consider the unit, because Central Provident Fund (CPF) usage to pay for the house is restricted, and bank loans are tightened. While Singapore is yet to see any HDB units' leases expire, it is expected interventions, such as a renewing of the lease for a fee, will occur. In 2020, Singapore had more than a million HDB flats, sold at least 16,600 new apartments and had another, almost 70,000, under construction. Financing the scheme in Singapore To finance the scheme, the HDB provides up to 25-year mortgage loans, at an interest rate of 2.6 per cent. Homeownership is financed through CPF savings. Most public housing in Singapore is lessee-occupied. Under Singapore's housing leasehold ownership program, housing units are sold on a 99-year leasehold to applicants who meet certain income, citizenship and property leasehold ownership requirements. The estate's land and common areas continue to be owned by the government. HDB prices are below market prices, and buyers enjoy additional discounts in the form of housing grants calibrated to incomes. Subsequent sales of HDB flats in the private market originally had to be to buyers who satisfied the requirements for purchasing new flats. Since 1978 a resale levy was implemented. The HDB also provides public housing for rental, mainly for lower-income households and households waiting for their purchased flats. Rental public housing has lower income requirements than lessee-occupied public housing. Meanwhile, the government also sells land to the HDB, and fully finances its annual deficit. Within Singapore's housing sector, there is a high degree of progressive taxation. Higher-income households, foreigners, and investors pay market prices, implicitly higher land taxes, higher stamp duties, and are subject to higher rates of property taxes. And for those who might immediately recoil at the thought of higher taxes, they haven't prevented some properties commanding the highest prices in the world. Challenges and future plans The system isn't perfect - property prices continue to rise and solving the end of the 99-lease issue appears pending. According to Wikipedia "On 4 October 2022, The Minister of National Development, Desmond Lee, elaborated further on the government's policies to intervene to keep public housing relatively affordable and available. In hopes of cooling the housing market, the government plans to implement a fifteen-month waiting period before homeowners can buy an HDB resale flat, continued supply of significant grants for first-time buyers, and tightened maximum loan price limits. Likewise, to keep providing a counter to the resale market, the HDB ramped up its Build-to-Order supply, which is on track to place 23,000 apartments on the market between 2022 and 2023." Whatever your views, it is clear, however, a dual property market exists in Singapore. If Australia's government is serious about making housing affordable, it needs to stop handing out grants for buyers to meet market prices, which only fuel further increases. It must consider a dual market approach with one market supplied, controlled and regulated by the government. As an aside, there is no First Home Buyers Grant offered in the Australian Capital Territory, and coincidentally, it has been the worst-performing real estate market during the latest sell-off in prices and has recovered the least in the more recent recovery. Does that make Australian Capital Territory property more affordable? Maybe Victoria thinks so. That state is considering following the Australian Capital Territory and scrapping its First Home Owners Grant scheme. Before doing so, it should think about working with the other states and the Federal Government on a wholesale review of their role in the property market, perhaps with a working group visiting Singapore (who doesn't love a Junket?) to understand what is working there. Of course, one of the biggest incentives for people to buy property is to make money, or at least to avoid being left behind. Whatever system replaces the various governments' current involvement, it will need to consider this aspect (which Singapore seems to have preserved) while satisfying the other reason people buy; to provide security for themselves and their family, and a roof over their heads. Author: Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |