NEWS

13 Sep 2023 - Quay podcast: How high rates are impacting REITs

|

Quay podcast: How high rates are impacting REITs Quay Global Investors September 2023 Quay's Co-Principal and Portfolio Manager, Justin Blaess, speaks with Bennelong Account Director, Jodie Saw, about the impact of high rates on REITs (less of an issue than most expect), the mismatch between supply and demand (the main drivers of return), the opportunities emerging globally, and Quay's long-term earnings outlook.

Timestamps:

Funds operated by this manager: Quay Global Real Estate Fund (AUD Hedged), Quay Global Real Estate Fund (Unhedged) For more insights from Quay Global Investors, visit quaygi.com The content contained in this audio represents the opinions of the speakers. The speakers may hold either long or short positions in securities of various companies discussed in the audio. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the speakers to express their personal views on investing and for the entertainment of the listener. |

12 Sep 2023 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]

12 Sep 2023 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

12 Sep 2023 - Cultivating change - Nestlé's leading approach on sustainability and creating shared value

|

Episode 37: Cultivating change - Nestlé's leading approach on sustainability and creating shared value Magellan Asset Management August 2023 |

|

In this episode, Magellan's Portfolio Manager Elisa Di Marco, and Investment Analyst, Tracey Wahlberg discuss how environmental values are driving corporate culture with Rob Cameron, Nestlé's Global Head of Public Affairs. They talk through the company's net zero approach, and its commitment in leading its supply chain to embrace regenerative agriculture, recycling, packaging innovation and human rights. And Rob Cameron explains how these initiatives benefit shareholders, through growth opportunities and cost discipline. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

11 Sep 2023 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]

11 Sep 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|||||||||||||||||||

| Altor Emerging PIPE Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| CCM Systematic Macro Plus Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Trovio Digital Asset Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Capital Prudential Wholesale Real Estate Income Opportunity Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|

|||||||||||||||||||

| MA Priority Income Fund | |||||||||||||||||||

|

|||||||||||||||||||

| MA Secured Real Estate Income Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| MA Secured Loan Series - Class A | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| MA Secured Loan Series - Class B | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Tectonic Opportunities Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |

11 Sep 2023 - Performance Report: Rixon Income Fund

[Current Manager Report if available]

8 Sep 2023 - Hedge Clippings | 15 September 2023

|

|

|

|

Hedge Clippings | 14 September 2023 After all the machinations which have surrounded Qantas over the past few weeks, and which have taken the focus of Hedge Clippings away from the real task of looking at economic issues and the performance of managed funds, it is probably time to get back to basics. Having said that, the trials (literal and figurative) facing Qantas, and in particular the new CEO, Vanessa Hudson, and Chairman Richard Goyder are far from over. Hudson of course can, and will claim - or blame - her predecessor, although it seems like she either endorsed his policies, or didn't or couldn't stand up to his overbearing style. She'll no doubt get away with that excuse, but Goyder has nowhere to hide as chairman, and one who was cheer-leader-in-chief for the recently departed Irish elf. Goyder either believed Joyce was the "best CEO in Australia by a length of a straight" as he described him, or he was fooled into thinking so. Either way, it was a massive character judgment failure on his part, as well as one of corporate governance. The upcoming Qantas AGM is scheduled for November 3rd, and should be a jam packed and fiery event. Qantas might even resort to selling non existing tickets to it, but even though it's scheduled just a few days before the Melbourne Cup, it's doubtful if the chairman will be referring to his previous racing analogy when farewelling his disgraced former CEO. What the whole Qatar / flightless tickets debacle has done is to call into question the level of overt, or maybe covert, influence membership of the Qantas Chairman's Club wields throughout the corridors of Canberra and beyond. Power corrupts: Absolute power corrupts absolutely, or so the saying goes. The issue in this case is not power, but undue influence, or the perception of it. Didn't we say it was time to get back to basics of the economy? The hard/soft landing debate continues, both here and overseas - at least in the US, as it appears the landing in the UK is unlikely to be anything but hard. China's landing is likely to be bumpy at best, but getting an accurate picture of the world's second largest economy is anything but easy, coupled with the centralised and authoritarian decision making process. Australia's tightening phase would appear to be over, although it looks like rates won't come down anytime soon, given the unemployment rate remains sub 4%. There are a few wild cards out there, as always. Saudi Arabia and Russia are in lockstep to reduce oil production and keep oil prices, and therefore inflation, high. Tensions around Taiwan remain, even if overshadowed by China's economic issues, and of course Ukraine remains an unknown outcome. Thankfully it's footy finals season to take one's mind off such issues, although you can always stay up late / get up early to watch the Wallabies trying to get out of their pool into the quarter finals of the RWC. Watch this space! News & Insights Cultivating change - Nestlé's leading approach on sustainability and creating shared value | Magellan Asset Management Quay podcast: How high rates are impacting REITs | Quay Global Investors August 2023 Performance News Bennelong Concentrated Australian Equities Fund Argonaut Natural Resources Fund Bennelong Long Short Equity Fund Delft Partners Global High Conviction Strategy Glenmore Australian Equities Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

8 Sep 2023 - Hedge Clippings | 08 September 2023

|

|

|

|

Hedge Clippings | 08 September 2023 Yesterday marked what will probably be Philip Lowe's final speaking engagement whilst RBA Governor before handing over to his deputy Michele Bullock on 18th September. Free from the shackles of his position and convention, the outgoing governor took the opportunity to set the record straight on what he had (and had not) promised, whilst also taking a few shots at the level of reporting and attention his previous statements and comments had received. Of course, whilst in the role he had carefully avoided having an all out war with the media (Eddie Jones, take a lesson in humility) understanding that one rarely gets the last word in - no doubt remembering the old adage "never to argue with the person with the microphone". Whilst being pretty direct in his comments and opinion of the media, he was somewhat more subtle, but equally correct in also having a go at government in his speech entitled "Some Closing Remarks". Lowe stated the obvious: Government should carry some of the can for inflation and interest rates, and thus the property market and mortgage stress. In reality the RBA is very much the messenger, in spite of the so called independence. It is the government of the day that has the authority and ability, plus a wide variety of potential policy tools to steer the economy, instead of leaving it to the RBA and the blunt instrument of monetary policy to do the work for them. Fat chance of that happening! As Lowe said, it would require some "innovative thinking" which is a rare commodity in politicians, particularly once they're elected, and don't want to lose the benefits of office - even the unofficial ones, such as membership of the Qantas chairman's lounge, (which really should have been renamed Joyce's Jolly long ago). History has shown we've had multiple examples of "innovative thinking" over the years - think Mark Johnson's 2009 report, Australia as a Financial Centre, or Ken Henry's 2010 Tax Review with its 138 recommendations, most of which are still gathering dust. The major item from the Henry Review which was implemented by the then Rudd Government was the move to create a resources Super Profit Tax. The proposal was highly controversial, and has been suggested as the main reason why Rudd lost power. Both were announced with great fanfare (even if then Minister for Financial Services, Chris Bowen released his response in mid January, 2010, hardly likely to get anyone's serious attention) but neither Johnson's and Henry's efforts or recommendations resulted in little to no "Committed Action". Bottom line - don't trust politicians to actually do anything innovative, even if it is clearly in the national interest, if it also involves personal risk - as Paul Keating said "in the race of life always back self interest - at least you know it's trying". During his term as RBA Governor, Lowe did exactly what was required with the tools available to him, and given the cards he was dealt by the global economy, and policy of the day. He lowered rates to zero in response to COVID and government policy, which resulted in households and corporates being awash with cash, which along with Russia's invasion of Ukraine led to an outbreak of inflation. Like all central banks, he tightened rates (less than the US or UK) to stifle inflation, hopefully without choking the economy in the process. The government takes the credit for low unemployment, but is happy for Lowe and the RBA to take the blame for high interest rates and mortgage stress, to the extent they declined to renew his term in office. It's the government's responsibility to ensure there's sufficient housing to accommodate an immigration level of 300,000+ this year which is helping to keep house prices high, but they won't take the blame when it hurts those under mortgage or rental stress. Lowe will leave with a record of having set and kept to his narrow path, and what may shape up to be a soft landing - no mean feat. He should be applauded. Meanwhile the government has been left with a mess of its own making with - whatever the outcome - a divisive referendum campaign, and egg, or worse on its face over the Qatar fiasco, as has the Qantas board. Alan Joyce is probably public enemy Number 1 in Australia at present, and most people would be lining up to give him the following treatment: News & Insights New Funds on FundMonitors.com Hybrid securities - How risky are they? | PURE Asset Management The Experiences Megatrend | Insync Fund Managers August 2023 Performance News Bennelong Australian Equities Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

8 Sep 2023 - Sorting bubbles from justified inflations!

|

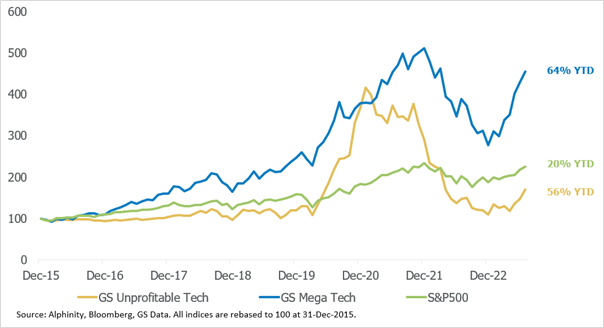

Sorting bubbles from justified inflations! Alphinity Investment Management August 2023 Since Chat GPT3 crashed onto the scene at the end of 2022, the world has been swept up in (generative) Artificial Intelligence (AI) euphoria. AI related stocks have all rallied, companies have expanded their capital plans and gone to great lengths to explain how and why they use AI, and analysts have sharpened their bull case scenarios for future growth opportunities. We've seen similar transformative technology breakthrough exuberance rise and fall in the past, such as Web 3, the metaverse and crypto architecture last year. Is AI just another tech bubble about to implode? Or something much more substantive? The answer is yes to both. In this note, we expand on why we remain excited about the use cases and subsequent earnings potential that can be built off the back of AI in the future and why we believe this technology shift, and the value that it can create, is real. Investors however need to be very selective as the monetisation potential of AI will flow through different elements of the chain at various levels an at different times. Two clear early winners in our view are Microsoft and Nvidia. The AI induced rally The release of Chat GPT did bring the technology sector heavily back into focus in the first half of the year with the Mega (or profitable) Tech index rallying 64% to the end of July. But this reborn tech euphoria also dragged the Unprofitable Tech stocks 37% higher, to outperform the broader US market by more than 40% and 15% respectively. AI enthused rally has boosted profitable and unprofitable tech stocks YTD

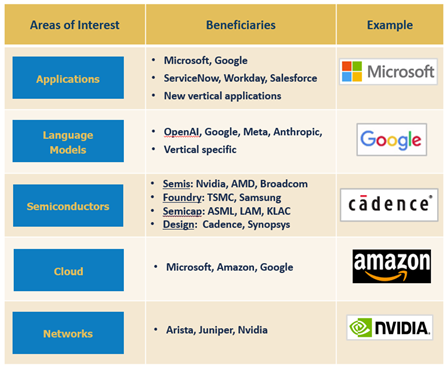

There is undoubtedly an element of AI froth that has come into the technology sector, as some companies have seen AI potential wash into their share prices before a clear articulation of how the earnings that will back these valuations will emerge. And we have seen the downside of this where companies such as Data Dog and Palantir have had solid falls after earnings disappointments, while some of the air has also come out of other companies such as MongoDB, Snowflake and Salesforce. We expect the market to become more discerning in terms of wanting to see a clearer monetisation path to determine who the key winners will be as opposed to the broad lifting of almost all boats even tangentially brushing up against the AI theme that we have seen so far this year. Use cases of generative AI In terms of winners in the AI space, it is all about a clear identification of use cases. AI is not a new theme. The difference now is generative AI developments expand these technological capabilities and put them within the reach of hundreds of millions of new users each month. The IDC estimates the global AI market will see 19% compound annual growth between now and 2026 to reach US$900bn while Goldman Sachs predicts generative AI alone could drive 7% or an almost $7trn increase in annual global GDP growth over the coming decade. There are various elements of the tech ecosystem where value will emerge to varying degrees. At the front end you have the key enablers such as semiconductor designers like Nvidia that will benefit along with foundry businesses like TSMC and Samsung and the semiconductor equipment players such as ASML, Applied Materials and Lam Research who supply them. Then you shift towards the infrastructure names such as networks businesses like Arista, and the cloud players that span Microsofts Azure, Amazons AWS and Googles GCP. But the really exciting opportunities should emerge beyond the initial enablers and infrastructure players and be in those businesses that can create applications based on AI. Established businesses such as ServiceNow, Workday and Salesforce are working to embed AI within their current offering, but the real opportunity is likely to be in the emergence of a business that applies AI to a deep revenue pool and owns that vertical. Whether that be in healthcare, finance or customer service, there is potential for an AI leader to emerge that could be the next big tech name in 5yrs. AI offers a plethora of investment opportunities, but not all created equal

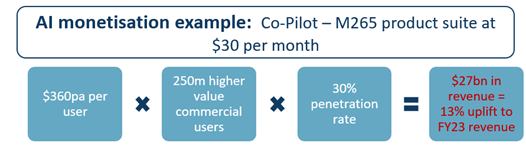

Source: Alphinity, 31 July 2023 Two clear early winners currently - Microsoft & Nvidia Investing in AI is like investing in any other idea for Alphinity; find the investment ideas that are showing earnings leadership, come wrapped in a quality business, and are bound by a reasonable valuation. In AI it comes down to identifying a tangible use case and the monetisation potential that flows off the back of this to driving earnings outperformance, exceptional returns and valuation upside. Microsoft and Nvidia are two clear early winners in AI that display these characteristics. Microsoft (MSFT) - Well positioned for broad secular trends in technology and a leader in AI Microsoft has multiple legs of opportunity flowing from AI. At the front end, it has announced pricing for its AI infused M365 co-pilot product at $30per user per month. Applying this pricing to Microsoft's 250m commercial users of it's higher value products, we estimate Co-pilot can drive an extra $27bn in revenue, or 13%, over a 3-5yr period, assuming a conservative 30% penetration rate. There is also the uplift in consumption that will run through Microsofts cloud business Azure, a potentially simpler Ai product for the extra 200m commercial users on simple product sets, plus incremental gains from any shift in search traffic from Google to Bing. Wrap this together and while the Microsoft share price has risen in 1H23, investors are currently paying 30x Price to Earnings for a business that can grow mid-teens over the next 3 with multiple growth drivers. MSFT offers tangible AI monetisation

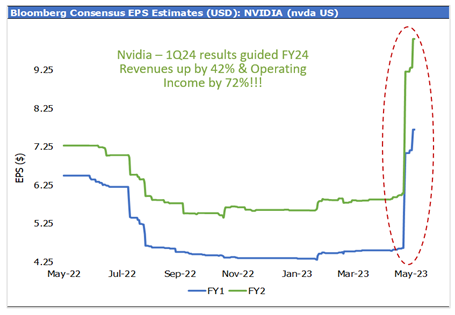

Source: Alphinity, Bloomberg, 31 July 2023 Nvidia (NVDA) - Global leader in Graphics Processing Units with generative AI a gamechanger Nvidia is the other key initial beneficiary from AI, with their most recent result generating an almost unprecedented upgrade in earnings expectations for a business of its scale. Generative Ai is all about GPU's given their ability to run calculations and simulations in parallel; the key tasks for AI. And Nvidia sits front and centre as the leader in terms of GPU performance coupled with a powerful software capability making their GPU's flexible and programmable. The key to the Nvidia investment case is ensuring that the current demand is not just a flash in the pan. To our mind, there is sustainability to this demand given that generative AI has triggered a shift in data centre infrastructure from CPU's towards GPU's. With around $1tr of datacentre infrastructure installed, and this infrastructure turning over around every 4 years, this provides rich structural tailwinds that should drive Nvidia earnings for years to come. On our estimates, NVDA should generate around $30bn in datacentre revenue this year (2/3rds of total revenue). If we push the shift from CPU to GPU through our discounted cashflow model, we estimate that datacentre revenues can increase to $80bn CY27. Investors are paying c40x FY24 Price/Earnings, with what looks like growth to come for the years ahead. Revenue & margin uplifts driving unprecedented EPS upgrades over next two years

Source: Alphinity, Bloomberg, 31 July 2023 In summary, AI is an exciting investment opportunity, with many growth tangents still to be discovered. But like any investment, investors need to be able to have a line of sight to the earnings potential and be disciplined in terms of what they pay for these companies to ensure that they are not riding a bubble that may eventually pop. Authors: Elfreda Jonker, Client Portfolio Manager & Investment Specialist and Trent Masters, Global Portfolio Manager |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |