NEWS

22 Sep 2023 - Performance Report: Kardinia Long Short Fund

[Current Manager Report if available]

22 Sep 2023 - The good news? We're avoiding recession. The bad news? Living standards are going backwards

|

The good news? We're avoiding recession. The bad news? Living standards are going backwards Pendal September 2023 |

|

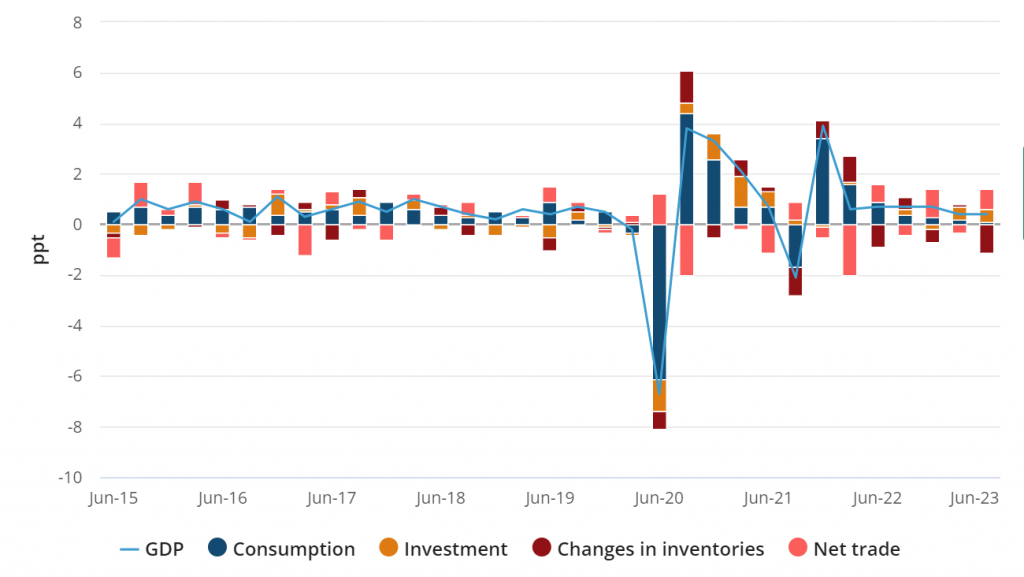

Australia is in a 'per-capita recession', which means economic growth is not keeping pace with population growth. TIM HEXT explains the problem and what's likely to happen next AUSTRALIA'S national accounts -- quarterly estimates of economic flows such as GDP, consumption, investment, income and saving -- land two months after the end of a quarter. Many therefore ignore them as old news. But they are the most comprehensive picture of the Australian economy from a macro and micro lens. So what does the latest data reveal about Australia at the end of June? In short, it is a very mixed picture. More than ever how you are feeling depends on where you sit. This ABS graph below shows the various contributions: First, the good news. We are avoiding a recession. GDP is 2.1% higher than a year ago, though slowing. It's been 0.4% for two quarters now and will likely end the year near 1.2% -- slightly higher than the RBA forecast of 0.9%. Inventories are unlikely to be a drag next quarter, but net trade should also stabilise. Now the bad news. We are clearly in a per-capita recession. In other words, this level of economic growth is not enough to keep pace with population growth. Which means the average person is going backwards in their standard of living. Our population grew by 0.7% in Q2, the economy only 0.4%. GDP per capita is now 0.3% lower than a year ago and 0.6% lower than six months ago. We are importing growth, not growing from within. Per-capita recession Why are we in a per-capita recession? We are seeing more hours worked as employment rises along with our population. But we are going backwards in GDP per hour worked -- down a staggering 2% in the quarter. This is one of the worst results since deregulation in the 1980s. Remember this is a volume measure -- not price or value. Productivity is going backwards. It has now gone nowhere since 2016. Put simply, the RBA is facing labour costs rising at 4% -- with stagnant or even negative productivity. Unless businesses wear the squeeze, inflation is not coming back too far below 4% for some time. Consumers tighten belts How is the consumer holding up in the face of rate rises? Household consumption barely grew in the June quarter at 0.1%. Services were up 0.2% but goods were flat. We are tightening our belts in discretionary spending, which fell 0.5%. This is consistent with a soft landing and is not disastrous, at least for now. Motor vehicle sales are still strong, so maybe cashed-up baby boomers are buying four-wheel drives for their lap of Australia. Pandemic stimulus savings are a thing of the past -- the savings rate has fallen to a cycle low of 3.2%. In the national accounts savings is a residual (income less consumption) and not directly measured -- so it is not always an accurate indicator. But it shows buffers are falling, albeit very differently across age groups. The growth we did have came through a rebound in export volumes and ongoing government investment. This continues a pre-pandemic theme and shows as a country our ongoing reliance on these two sectors, which is concerning. Likely we will commission another productivity report -- having ignored previous recommendations -- and kick the can down the road. The immigration lever In the near term, the RBA would be a little less comfortable about this national accounts picture. But we think labour supply via immigration will push unemployment back up to 4% and ease some wage pressures. This should buy the RBA more time while the full impact of 4% in rate rises in little over a year feeds through. (We are still only 80% of the way there). If Australia was a company these accounts would be causing analysts to downgrade their outlook. Workers are less productive and costs are rising. But some of this may still be the lingering impact of the pandemic. Cue discussions on working from home. The RBA will be hoping this can turn around in the year ahead. Immigration will slow in the next 12 months to around 1%, because the sharp increase in foreign student numbers was a one-off return from the pandemic. An outright recession (not just a per capita one) is not a base case -- but the chances of it will rise. Dr Bullock will be facing the dilemma of a slowing economy under full employment and high wages as she takes over as RBA governor in a fortnight. We wish her luck trying to work out what all this means for rates. Author: Tim Hext, Portfolio Manager and Head of Government Bond Strategies |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

21 Sep 2023 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

21 Sep 2023 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

21 Sep 2023 - Climate change solutions in Japan

|

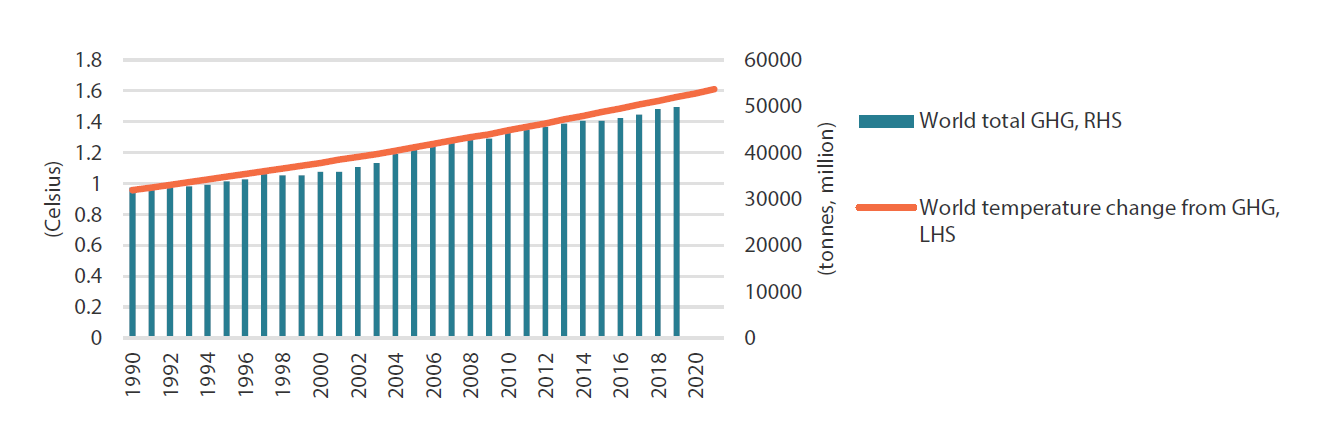

Climate change solutions in Japan Nikko Asset Management September 2023 "Hottest on record" is on repeat In scenes now repeated every summer, not a day seems to go by without headlines of record-high heat somewhere on the planet, whether in Europe, Asia, Africa or North America. The World Meteorological Organization said it was "extremely likely" that July 2023 will be the hottest on record1. As temperatures climb, news images of raging wild fires have become all too common, along with other hallmarks of extreme weather such as violent storms and destructive flooding. We have been spared the worst of extreme weather patterns here in Tokyo. Nevertheless, we have acutely felt the impact of climate change. In Tokyo this August the mercury rose above 30 degrees Celsius every day of the month for the first time since records started being kept in 1875. As the country becomes more tropical in climate, long-standing traditions are being challenged. An example is in baseball, Japan's national pastime. The sport is usually played without any breaks. However, a "cooling time" rest period was introduced for the first time at the 105th edition of the National High School Baseball Championship, a nationwide tournament held annually in August. This break with tradition caused a national debate, with many of us wondering if children in the future will even be able to enjoy pastimes long associated with the summer in this country such as tennis, soccer and rugby? It is no secret that greenhouse gas (GHG) emissions play a role in global warming. Yet, despite pledges by governments around the world to reduce GHG output, global emissions have been increasing steadily (Chart 1). Our tendency to ignore a looming catastrophe was satirized in the 2021 movie Don't Look Up. Two astronomers played by Leonardo DiCaprio and Jennifer Lawrence discover a comet hurtling towards earth and warn the world of the impending disaster, but to no avail. In desperation, the two scientists beg the world via social media to just look up, but the US president, portrayed by Meryl Streep, advises to do just the opposite, telling people "don't look up". Chart 1: Global GHG emissions and corresponding temperature change

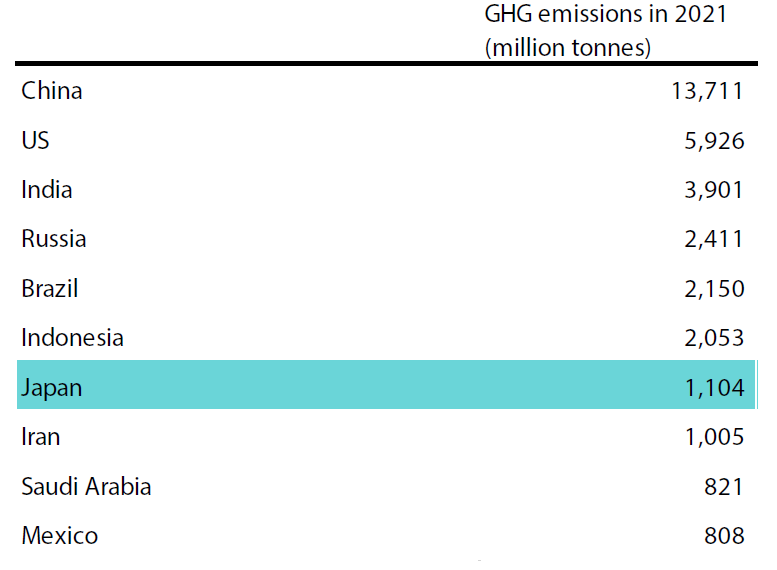

World total GHG: Total greenhouse gas emissions including land-use change and forestry, measured in million tonnes of CO2-equivalents.World temperature change from GHG: Change in global mean surface temperature (in °C) caused by greenhouse gas emissions. Source: Out World in Data material compiled by Nikko AM Japan: a major GHG emitter with room for improvement Unlike fictional characters in a movie, in reality we have no option but to look up and consider what is driving climate change. Let us take our home market of Japan as an example. The country was the seventh largest GHG emitter in 2021 (Chart 2). Japan's significant emissions are a result of its heavy reliance on fossil fuels to generate power, having slashed its dependency on nuclear power plants following the earthquake and tsunami-induced nuclear disaster in 2011. Chart 2: The world's top GHG emitters

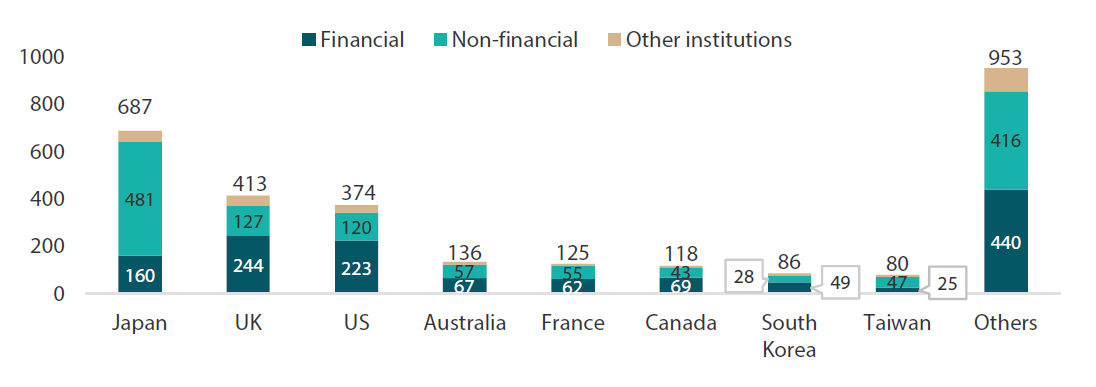

Source: Our World in Data material compiled by Nikko AM Seen from a different perspective, being a large GHG emitter means there is plenty of room for Japan to improve its environmental standing. In 2020, the country made an ambitious pledge to reach carbon neutrality by 2050, and in 2021, it set a goal to cut GHG emissions 46% by 2030 from 2013 levels. The share of renewable energy that generates Japan's electricity has risen to 22.4% in 2021 from 12.1% in 2014, according to the Institute for Sustainable Energy Policies2. There are other concrete signs that Japan is indeed improving its standing, in particular among its private sector. As Chart 3 shows, Japan has the highest number of companies that support the Task Force on Climate-Related Financial Disclosures (TCFD). Upon request by G20 central bankers and finance ministers, the Financial Stability Board established the TCFD in 2015 to help the financial sector assess and price climate-related risks as well as opportunities. The TCFD Recommendations were released in 2017 and widely credited with shaping the voluntary climate-related financial disclosure landscape. However, whilst support for the TCFD is encouraging, the quality of disclosures still has room for improvement. Chart 3: TCFD-supporting institutions by country as at July 2023

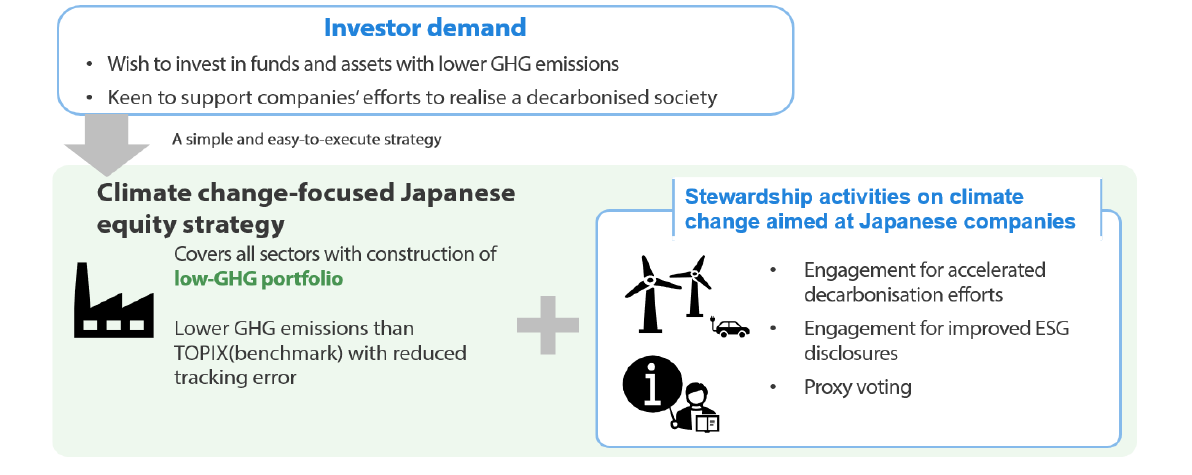

Source: TCFD Consortium material compiled by Nikko AM Awareness towards sustainability within Japanese society is expected to increase, with companies taking a more proactive role in promoting it. Interest towards ESG investment is also rising among individual investors, led by those of the younger generation. According to a survey by Japanese news provider QUICK's ESG Research Center, 48% of respondents in their 20s were interested in ESG investment, compared to 44% in their 30s and 42% in their 40s3 . Equity strategy focused on climate change In addition to Japanese companies and individuals, awareness towards sustainability is also increasing among the country's financial institutions and investors. Until recently, only a few financial institutions disclosed their financed emissions, which are GHG emissions linked to investment and lending activities. However, more such institutions are now hiring sustainability specialists to estimate their financed GHG emissions, and their disclosure is seen gathering pace going forward. Against such a background, we expect increased demand among investors to reduce GHG emissions linked to their investments. One strategy asset managers use to meet such demand for portfolios with lower GHG emissions focuses on urging companies to accelerate decarbonisation efforts via stewardship activities. Nikko AM's climate change-focused Japanese equity strategy takes such an approach (Exhibit 1). Exhibit 1: Climate change-focused Japanese equity strategy's objectives

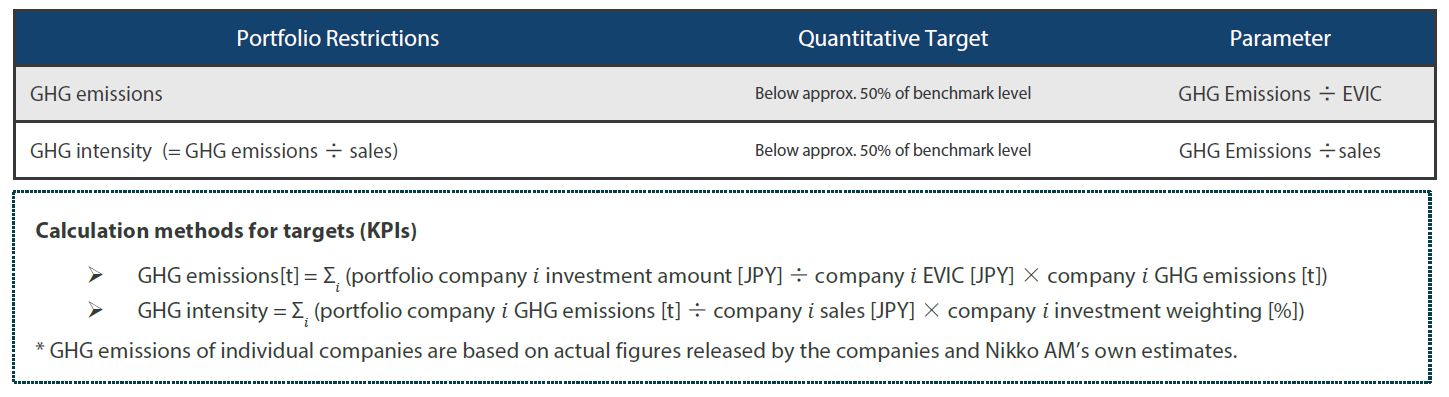

Source: Nikko AM The strategy covers all sectors to construct a low-GHG portfolio, providing exposure to Japanese stocks that is similar to the TOPIX while simultaneously aiming to limit financed emissions. As at end-July 2023, the portfolio's estimated tracking error versus the benchmark TOPIX was 0.34%, of which the estimated risk attributed to industry allocation was a modest 0.13%. GHG emissions and intensity are maintained approximately below 50% of those of the benchmark TOPIX (Exhibit 2); GHG emissions by companies are based on publicly disclosed information as well as estimates calculated using an in-house model. Exhibit 2: Portfolio-wide GHG restrictions and targets4 (KPIs)

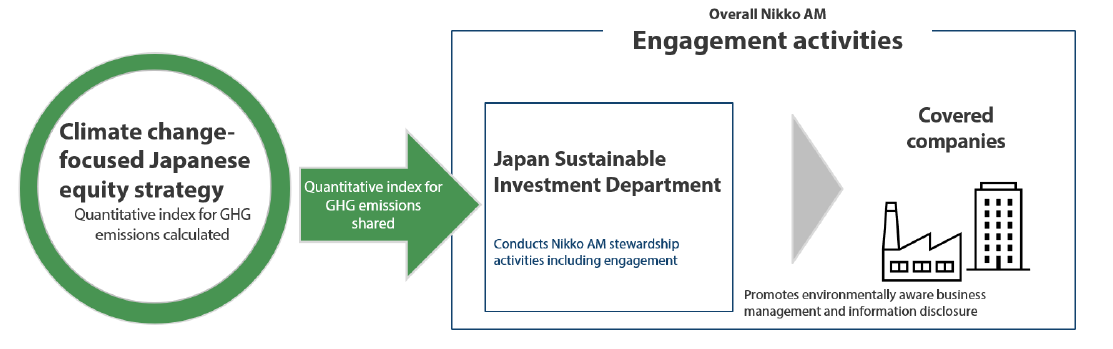

Source: Nikko AM A key feature is the utilisation of in-house GHG emission estimates, which enable us to expand our coverage significantly from approximately 600 companies to the entire TOPIX universe of roughly 2,100; the weight coverage has also increased from 82% to 100%. We are able to cover almost the entire TOPIX on a market cap basis through the use of our own estimates as well as actual reported results. In addition to such a quantitative approach, another important feature is engagement with the investee companies. The quantitative data obtained is utilised in engagement undertaken by Nikko AM's Sustainable Investment Department. This interaction encourages companies to operate in a more environmentally conscious manner and disclose relevant information (Exhibit 3). The department's on-the-ground stewardship specialists are well positioned to leverage Nikko AM's influence on investee companies. Their well-established relationships with local companies give Nikko AM an advantage over foreign peers. In addition, our stewardship activities in all global regions follow the highest international standards, with the firm having been recognised in 2023 for the second consecutive year by the UK's Financial Reporting Council as a signatory to the UK Stewardship Code. Nikko AM was the first Japanese asset manager accepted to the Code based on a global, firm-wide application. Exhibit 3: Driving decarbonisation initiatives through engagement

Source: Nikko AM Engagement example: a major Japanese steel company

Summary The climate change crisis we are witnessing presents both challenges and opportunities. Focusing on the latter from an investment perspective, in our view asset managers are in a position to help facilitate society's goals of reducing GHG emissions and decarbonising. An important way of meeting investors' needs for portfolios with a lower carbon footprint is through direct engagement with investee companies. Japan is currently a major GHG emitter but the country's ambitious plan to become carbon neutral by 2050 has made it necessary for companies to ramp up decarbonisation efforts. The intent is not in short supply as Japan has the highest number of companies that support the TCFD and they are increasing the quality of their data disclosures. We believe strategies focused on climate change-related initiatives in Japan are uniquely placed to help with the construction of a greener portfolio while assisting society as a whole in its decarbonisation efforts. Author: Masayuki Teraguchi, Head of Investment Technology Fund Management Department Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund

1 "July 2023 is set to be the hottest month on record", World Meteorological Organization, 27 July 2023 2 "2022 Share of Electricity from Renewable Energy Sources in Japan (Preliminary)", Institute for Sustainable Energy Policies, 26 April 2023 3 QUICK sustainability awareness survey, December 2021 4* Figures for reductions in GHG emissions and GHG intensity are target values that could become difficult to achieve due to the market environment, AUM, changes in companies' emissions or other such factors. The figures are target levels as of the time of portfolio construction and rebalancing. They do not constitute a guarantee that the figures will be constantly maintained within a certain range during the investment management period. * The above quantitative targets (GHG emissions to be no more than approximately 50% of the benchmark level, etc.) may be subject to change in the case of changes in the market environment, etc. Important disclaimer information |

20 Sep 2023 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

20 Sep 2023 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

19 Sep 2023 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

19 Sep 2023 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

19 Sep 2023 - 10k Words | September 2023

|

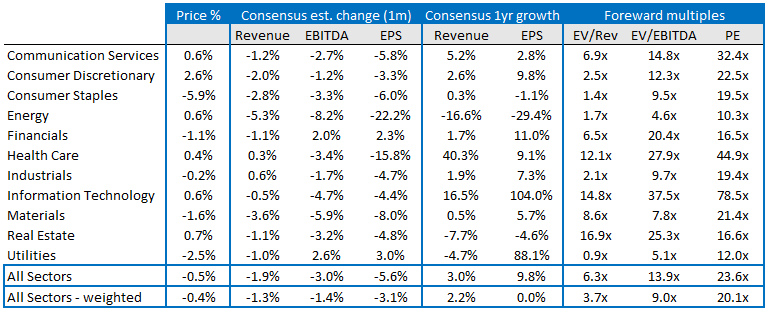

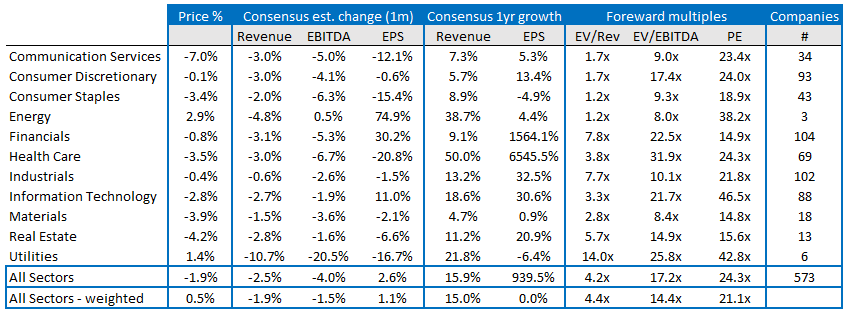

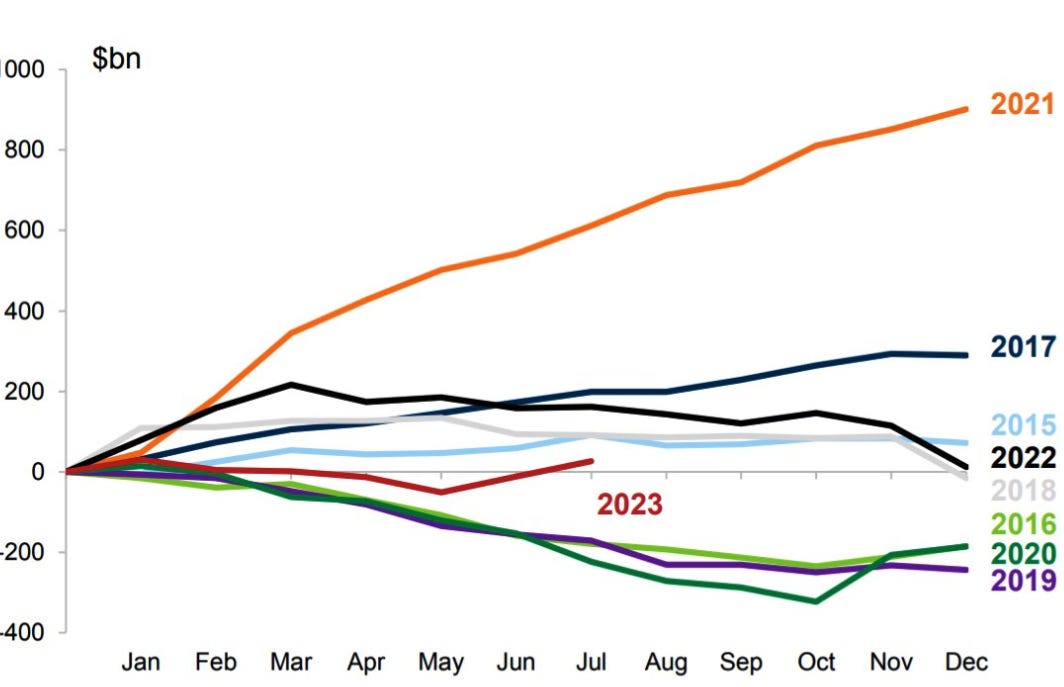

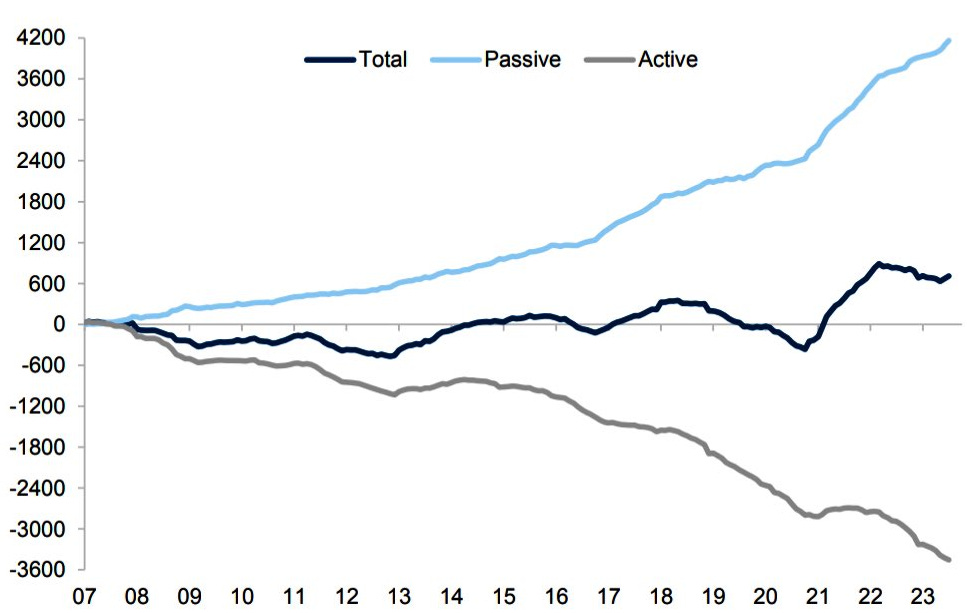

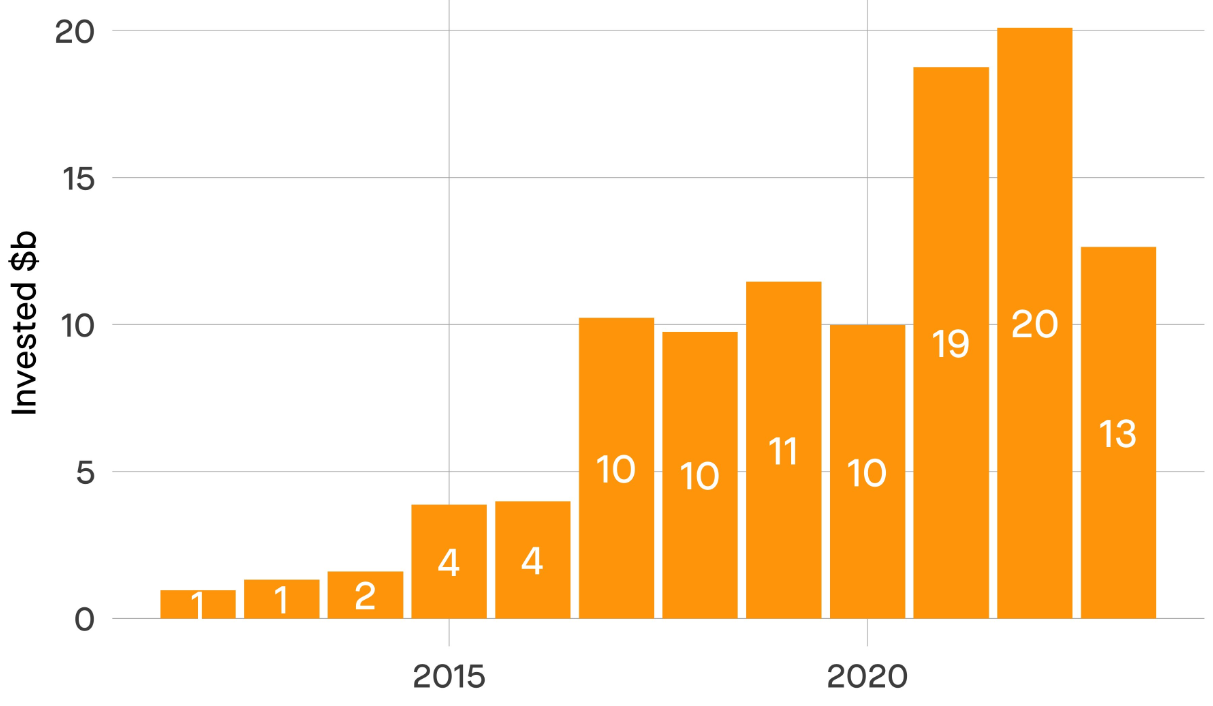

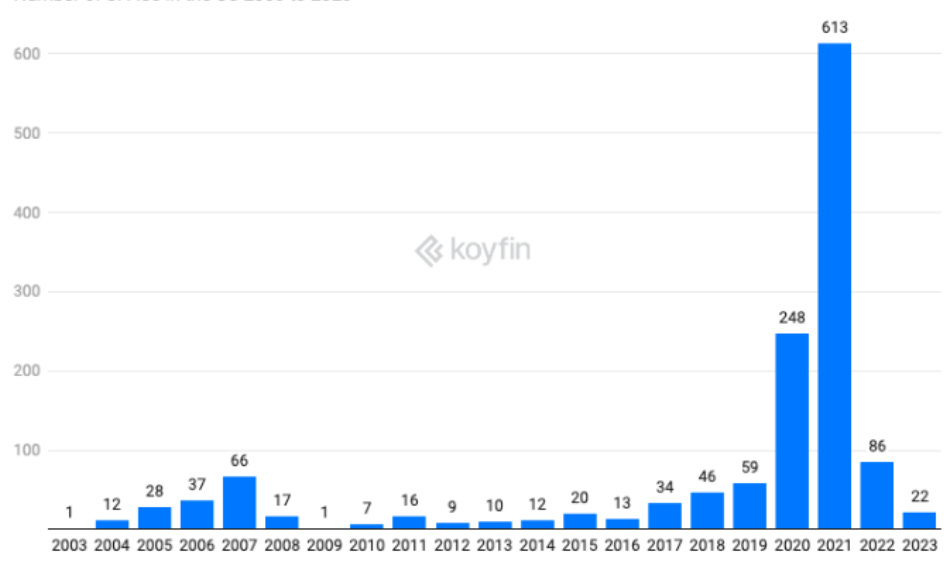

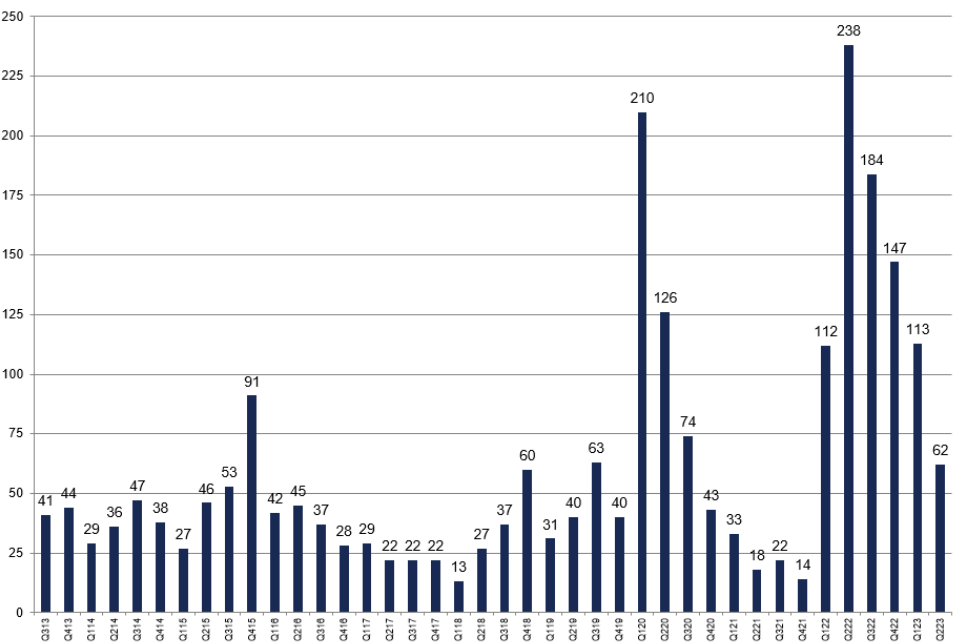

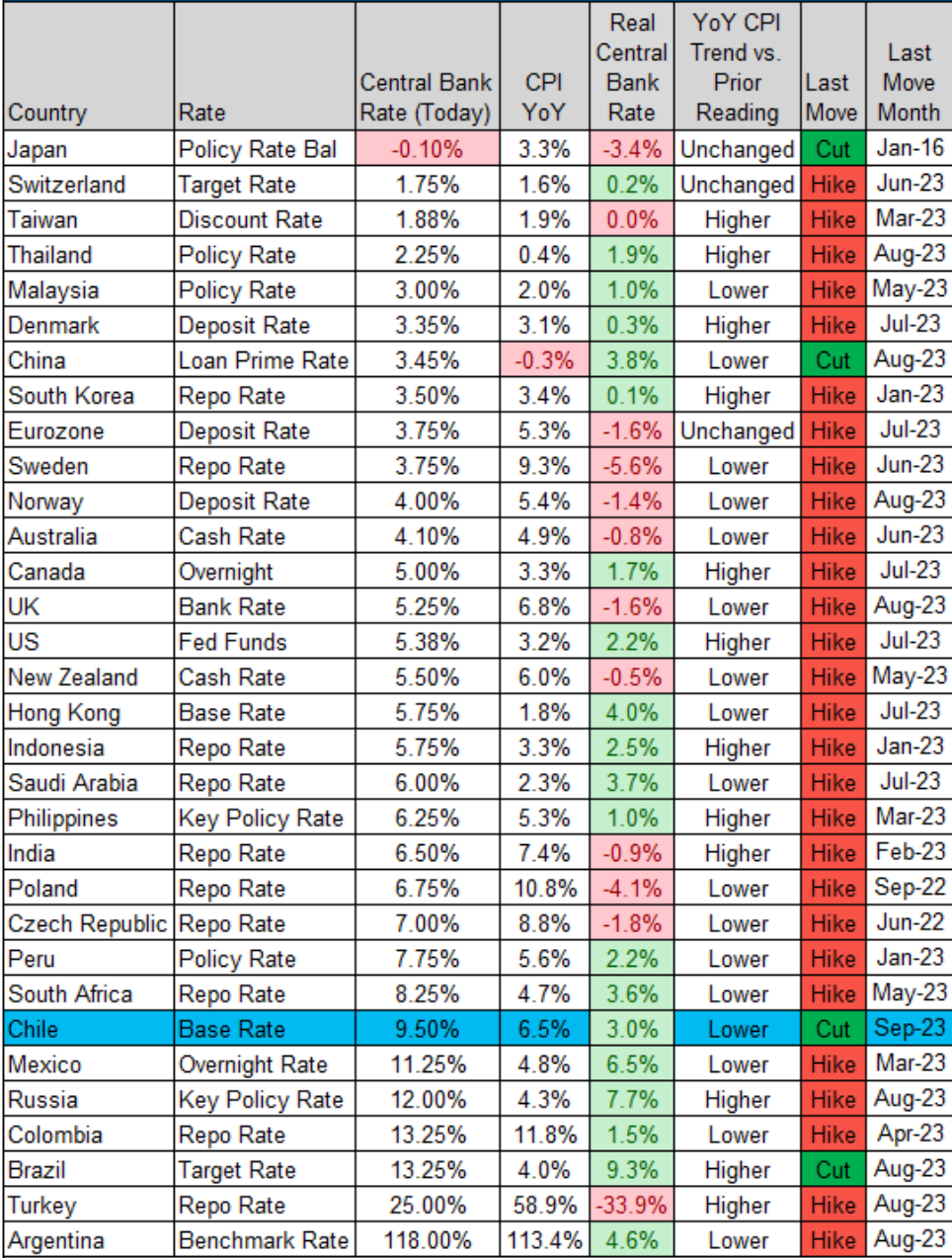

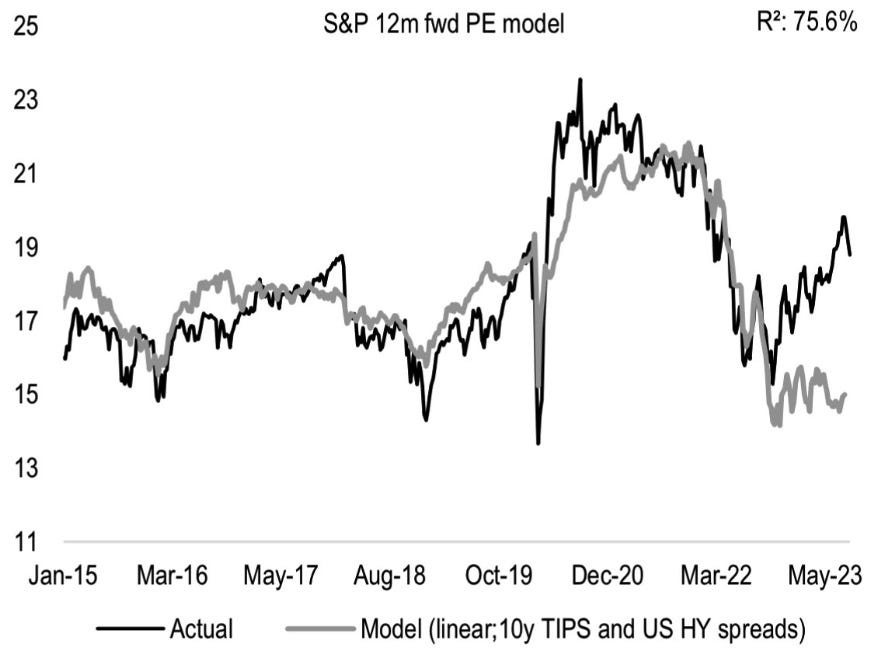

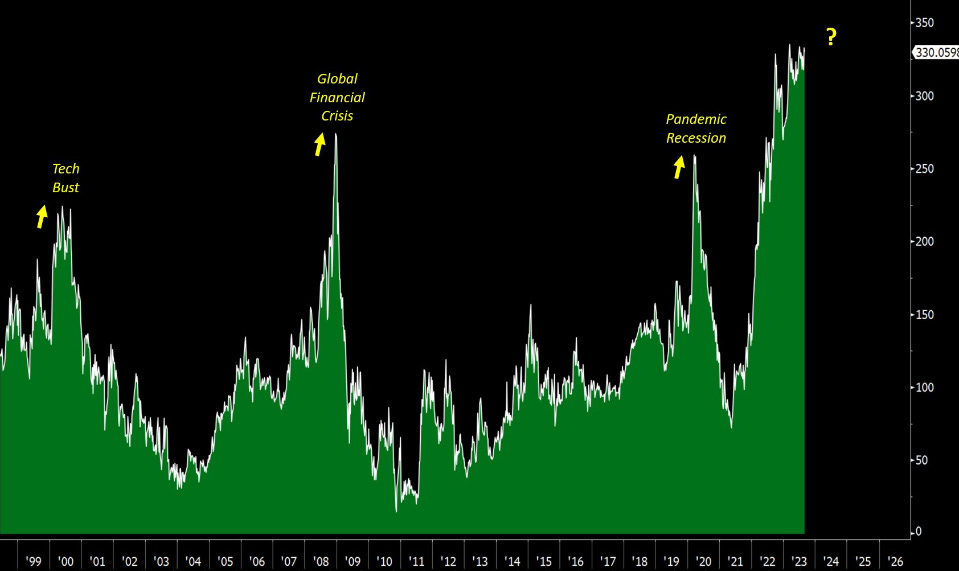

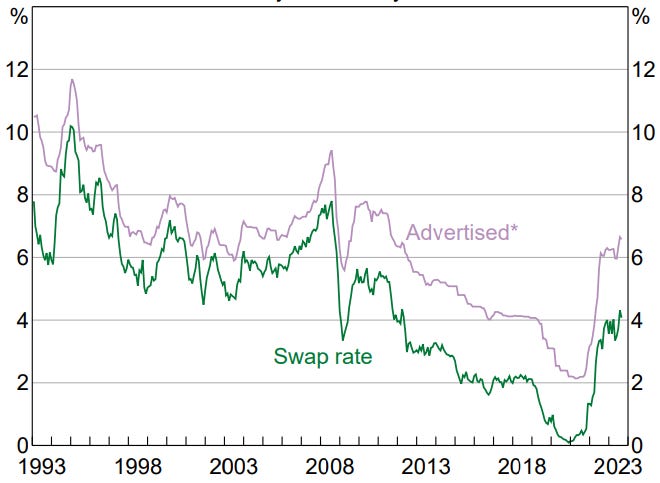

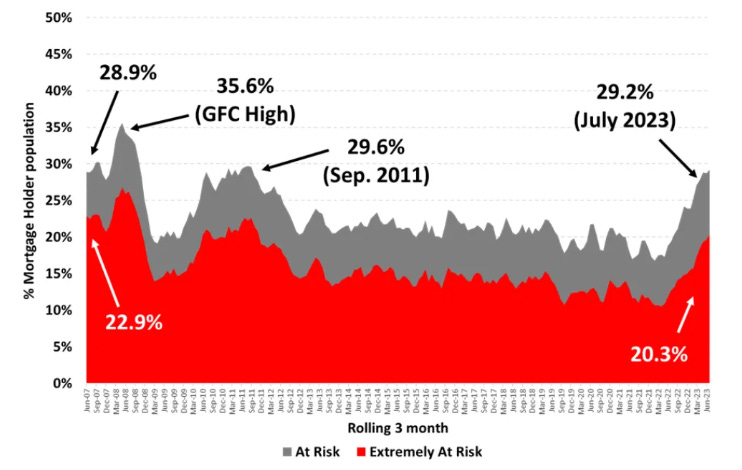

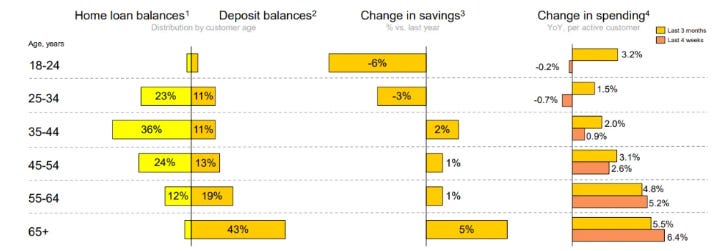

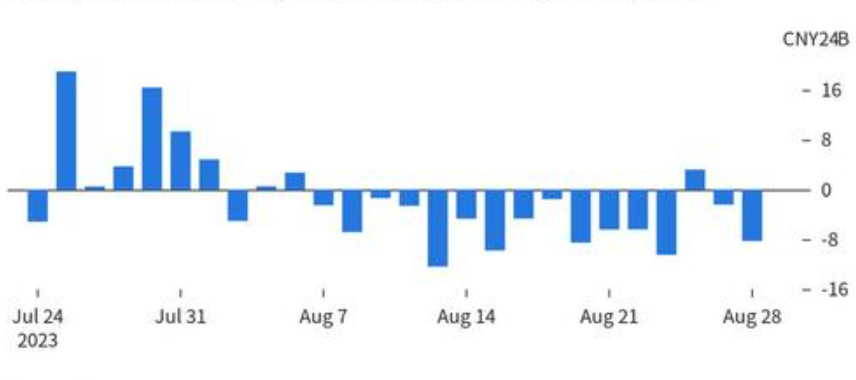

10k Words Equitable Investors September 2023 Earnings expectations dropped post the August reporting season on the ASX; global fund flows have been subdued - as have tech sector buyouts and SPACs. While the number of companies talking about recession has receded, rates are still in focus with the inflation-adjusted treasury yield spiking - a move not reflected in the S&P 500 valuation relative to a Credit Suisse model. US mortgage rates have the greatest spread on treasuries in decades. Australians are seeing their rates climb too and are feeling the stress - which ties back into the earnings downgrades for consumer stocks. China equity outflows, by the way, have been notable based on the actions of Hong Kong investors. ASX 100 consensus estimates - changes over past month & current metrics Source: Equitable Investors, Koyfin ASX "FIT" micro-to-mid cap consensus estimates - changes over past month & current metrics Source: Equitable Investors, Koyfin Flows from global investors into Developed Markets and Emerging Markets funds, by calendar year Source: Goldman Sachs Global Investment Research Active and passive fund flows into Developed Markets and Emerging Markets funds Source: Goldman Sachs Global Investment Research 2023 Tech buyouts Source: tomtunguz.com No. of SPACs in the US over past decade Source: Koyfin No. of S&P 500 companies citing "recession" on earnings calls Source: FactSet Global central bank policy rates Source: @CharlieBilello 10-year TIPS yield Source: @Scutty Credit Suisse model for forward PE v actual for S&P 500 Source: Credit Suisse US mortgage rate v. 30 year treasury yield Source: Crescat Capital Australian fixed housing interest rates - 3-year maturity Source: RBA Australian mortgage stress - owner-occupied mortgage holders Source: Roy Morgan Impact of higher rate by age (change in savings & spending year-on-year) Source: CBA FY23 Results Presentation - released August 9, 2023 Chinese equity outflows by HK-based investors Source: Bloomberg, Zero Hedge September Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |