NEWS

1 Feb 2022 - Why I think 2022 will be a very good year for investors

|

Why I think 2022 will be a very good year for investors Montgomery Investment Management 05 January 2022 A year ago, I wrote an article in The Australian which set out the factors I thought would make it a very good year for equities. So far, the local market has behaved as expected - despite all the turmoil in the world - with the All Ordinaries up 13.6 per cent for the 12 months to 31 December 2021. Looking ahead, I think markets will continue to reward investors, particularly those who invest in quality businesses. Significant price moves are always determined by the magnitude of surprise. The bigger the surprise, the bigger the move. And so, in the absence of a black swan - something completely unexpected - market returns will be determined by earnings growth. And, completing the idea, the best returns will come from those companies whose earnings grow faster than currently anticipated. For those who believe the market will crash, it is worth remembering such events are typically triggered by the unexpected, the black swan. Those who profited greatly from the Global Financial Crisis were so few and far between a book was written about them. The logic on which they established their trades at the time of the crash was not widely known. When the idea a large cohort of subprime borrowers might be unable to make their first loan repayment was published, it was not widely embraced as a market catalyst. Generally, it won't be what we already know that brings on a correction. For now, we can probably rule out a correction from inflation or the current Omicron strain of COVID-19 because there are as many adherents of these ideas as there are detractors. Most of the headlines warning inflation isn't transitory cite manufacturers and retailers who state emphatically prices aren't coming down. But that isn't tantamount to accelerating inflation. It just means there will be no deflation. If US inflation this year is seven per cent but next year 6.5 per cent, the retailers and the manufacturers will be right - prices aren't going down. It is also true however that price increases are decelerating and that's called Disinflation. Disinflation, when it coincides with economic growth, is historically very good for equities, especially growth equities. Innovative companies and those with pricing power, which tend to be those with sustainable competitive advantages do best in a disinflationary economic expansion. Read any of our documentation and you will find we have always preferred businesses with sustainable economic advantages because it is these companies that produce attractive returns on their equity. Supply chain bottlenecks have impacted almost every corner of commerce and while these bottlenecks remain, inflation will be elevated. Our channel checks of impacted businesses, which include wholesalers, hospitality and retailers, digital, healthcare, IT and advertising, suggest the bottlenecks are lingering. And while that is true it isn't tantamount to further acceleration in the inflation rate. With respect to the inflation discussion, I currently believe only a surprise acceleration would be negative for the market in aggregate. Even fears of such an acceleration won't cause a crash because those fears have persisted for a year now. And don't forget inflation has surged without crashing the market. Following the virus, I believe, is more imperative than following inflation. A new definition for fully-vaccinated is emerging - three doses. On that definition, about one per cent of the world is fully vaccinated, including me. Of course, that means plenty of opportunity for variants to emerge. Understandably, Main Street is worried a variant emerges, able to undermine the current crop of vaccines. Trading at near record highs, market prices suggest such an outcome is not anticipated, so such a development could be an unmitigated disaster. As investors we do have to keep a close eye on the progress of COVID-19. Transmissibility appears to be increasing with each variant. The original variant had a basic R number of about three, followed by Alpha, estimated to have an R0 of 4-5 and Delta, with an R0 of 6-8. Omicron appears to be even higher. Measles has an R0 which has been estimated to be as high as 18 and is therefore one of the most infectious human-to-human diseases. COVID-19 may yet have a long way to evolve. Such developments aren't being widely discussed, so it is these developments, investors should be tracking closely. But of course, through every crisis the highest quality companies, by definition, have fallen less and then rallied first and fastest afterwards. I suggest the same pattern will emerge during and after the next crisis. Take a look at the Buy Now Pay Later (BNPL) sector. We have warned investors about this space since 2018. Describing the players as nothing more than factoring businesses we pointed to three things that investors were missing or deliberately ignoring:

Since we published those many warnings, Afterpay is now down about 49 percent from its 2021 highs and the rest of the field has fallen a minimum of 70 percent from their highs. Investing in quality, avoiding the rubbish and not jumping at the shadows that are already a part of the investment landscape are the keys to navigating markets and it will be no different in 2022. There is the ever-present risk of a 10-15 percent correction but in the absence of a COVID-19 Black Swan, I think investors have little to worry about in 2022. Indeed, if disinflation also emerges, we may just find markets record another strong year. And longer term (sooner if international borders open to migrant workers), I currently expect we will return to structurally lower wages growth and therefore structurally lower inflation and interest rates. All very positive for markets. Written By Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

31 Jan 2022 - Running a life settlements fund

|

Running a life settlements fund Laureola Advisors January 2022 Like any fund manager a life settlements fund has a team of specialists and an asset to analyse and purchase to maximise return. It must be understood that the market is tiny where only 3,200 life insurance policies came onto the market last year in the USA. Given the surrender rate of several hundred thousand each year, it is a small number. A lot of people don't often know what a valuable asset they have paid for over many years and simply let them close down. People buy insurance to protect a family or a mortgage debt in the event of untimely death but once the family has grown up and left home and the house paid for, the need for insurance has gone. Typically the insured will contact the insurance company and just accept the contractual surrender value. Some will instead speak to their agent and learn that there is a chance of a far greater cash sum by selling the policy to an investor. In this instance the agent will contact a Licensed Broker whose job it is to represent the seller. He will prepare a file which will include all the policy details and arrange for the insured to have a medical examination the results of which will be provided to one (or more) of the actuarial firms that provide a Life Expectancy (LE) for the individual where the LE is a number usually given in months. It is worth making the point that the LE is not the month in which the insured is expected to die but rather the midpoint on a probability distribution curve where of 1,000 people of the same age and gender and with the same health issues, 500 are expected to die before the LE and 500 after. The file is then sent to Licensed Providers in the U.S. who are the only people legally able to buy an insurance policy from an insured and who represent the investors who are typically managers; an auction process follows. The managers have a great deal of certainty around many of the metrics of the asset; the death benefit is known; the premium costs are known and the credit risk is immaterial; the only thing that is not known is the maturity date. Managers do have the LE which has been provided by the actuarial firms that service the life settlement market and can have access to the medical records but most simply rely upon the LE. It then remains for the manager to choose what discount rate to apply to the cashflows (given the assumed LE) and to make a bid for the policy on that basis. The market usually trades policies where the purchase price assumes a projected internal rate of return (IRR) of between 12% and 14% (though there is wide dispersion around this range) and on this basis the purchase price offered is usually around four times more than the contractual surrender value offered by the insurance company. Most middle-class Americans do not have sufficient assets to fund a comfortable retirement, let alone pay for all the medical and care costs that might be anticipated. Selling their life insurance contract, rather than surrendering it to the insurance company, in many cases makes a very significant difference to the quality of their lives going forward. If the LEs were right and were in fact the mid-point of the mortality curve then the manager could rely upon the law of large numbers, buy lots of policies and expect gross IRRs across the portfolio to be 12% to 14%. The asset is very expensive to track and fund costs are correspondingly high so management fees and fund costs will reduce this gross return by 4% or 5% leaving a net-to-investor return in this situation of 7% to 10%. Most managers and investors do rely upon the accuracy of the LE and the law of large numbers. However, if instead of 500 dying before the LE and 500 after what happens is that only 450 die before and 550 die after, then the LEs from which the policies were purchased and the portfolio was valued are wrong and where the gross projected IRR was 12% to 14%, the gross actual IRR turns out to be 8% to 10%, with a corresponding net-toinvestor return of 3% to 6%. It is obvious that you can test the accuracy of LEs historically, but how can you be sure if forward-looking LEs are accurate? Consider this: With a probability distribution curve over a large population, for any given LE it is possible to predict how many deaths the portfolio would experience each year with a high level of statistical confidence. So, even though the LE has not yet been reached, deaths should already be occurring and the number can be compared with those expected. If the actual number of deaths is (statistically significantly) less than expected, the LE is too short and should be pushed out to fit the early years' experience. History has shown that the LEs provided by the actuarial firms have been and continue to be too short and consequently investor expectations have not been met. If a manager is able to construct a portfolio where half the insureds die before the LE and half afterwards then the gross projected IRRs are preserved and this is the focus of the Laureola investment approach. The six actuarial firms that provide LEs to the market have strengths and weakness across different illnesses and clusters of illnesses. This fact is known qualitatively by all the participants in the life settlement market, including the Licensed Brokers who first bring the policy to the market. It should be no surprise that the Brokers choose the shortest LE available because this pushes the price (and their commission) up. Laureola's four-person investment team spent two years analysing the strengths and weaknesses of the LE providers and has a much better understanding quantitively of how short or long they are with respect to various health conditions. Additionally, Laureola has a medical and scientific advisory panel which reviews the LE in the light of current research. Areas of expertise of the panel include heart disease, circulatory disease and cancer - illnesses which account for the death of two thirds of American citizens. For example the heart specialist (who is working on the leading edge of new treatments for heart disease and has several patents for medical devices) might advise the investment team that there are treatments being developed which might prolong the life of a particular insured with heart or circulatory problems beyond current estimates, in other words that he/she is more likely on average to live beyond the given LE than die before; this would be a reason not to buy this policy. Or in the case of a cancer patient, the Chief Scientific Officer might advise the investment team that a particular insured with a particular from of cancer with particular features and at a particular stage is more likely on average to die before the given LE which would be a reason to consider buying the policy. It is not enough just to buy cheap policies (as measured by the discount rate) because the real value is extracted from this asset class by choosing policies which mature before the LE; all the value of a cheap policy is lost if the insured lives too long past his/her LE. The added value of the Laureola investment team is its focus on the mortality of every single policy in the portfolio. Once a policy has been purchased and is held within the portfolio, it needs to be understood that the health of the insured might worsen or improve over time, affecting its value within the portfolio. Changes in the health of the insureds is critical information for an investment team focussed on the mortality of every policy. Most managers outsource what is loosely referred to as "tracking" to third parties where the information sought is when there has been a death. Laureola carries out the tracking function internally with a team dedicated to forming relationships with the insureds. In the case where the health of an insured has improved, for example by surviving cancer, the team will quickly learn about it and although the improvement in health and life expectancy is to be celebrated, the mortality of the policy has worsened from Laureola's standpoint and the policy has become an underperforming asset. In these circumstances, the investment team is likely to consider selling the policy to another manager. Policies are valued very conservatively within the portfolio and Laureola's experience is that in those circumstances where they have sold policies they have done so at a price higher than the prices marked on the book, thus making cash profits on the sale. Laureola Advisors is an established boutique manager in the life settlement space with a 9-year track record (and only 2 negative months). Over 80% of Laureola's published returns are realised gains, i.e. profits from death benefits or policy sales. Returns which are derived from mortality secure the non-correlation sought by many investors. It takes a 12-person team to run Laureola's life settlements operation because the qualitative input requires time and expertise alongside the quantitative analysis to maximise returns. Written By John Swallow, Director of Investor Relations Funds operated by this manager: |

28 Jan 2022 - What can you make of highs & lows?

|

What can you make of highs & lows? Frazis Capital Partners January 2022 Portfolio Manager Michael Frazis gives a perspective on what could be driving sell-offs We are in the middle of one of those extraordinary periods where valuations collapse and investor time frames have shortened from years to days. Long term plans are forgotten and the whole market is focusing on where prices will land tomorrow. At periods like this extraordinary transfers of wealth take place. As with similar shocks in March 2020, Dec 2018, and 2008/2009, those liquidating shares will realize sharp short term losses, while the immense long term wealth created by fast-growing technology companies over the coming years will flow to those who hold or buy. A number of indications suggest things have reached the kinds of extremes that lead to buying opportunities. Over 40% of the Nasdaq is now down more than 50% from one-year highs, which includes many of the best companies in the world, and many of those likely to generate the highest returns over the coming years. The rolling quarterly new lows in technology is now as high as it has been since Lehman collapsed in 2008, a generational buying opportunity. The performance of technology over the following decade was phenomenal, painful though it was for everyone holding tech shares at the time. Tech bottomed several months before the rest of the market, and then pushed to significant new highs. We saw this dynamic in March 2020, when our fund sold off well before the market - and much harder too - only to recover long before the indices and push to major new highs.

Fortunately, many of these companies raised money or IPOd recently, so we can all be grateful that scientific progress will continue. There's a narrative around rates and quantitative tightening causing the sell-off. There is some truth to this, but a better explanation is that institutions, as they did in March 2020 and 2008/2009, have rushed to the exit, swinging from max overweight to max underweight technology (as measured by data above). Goldman Sachs reported the heaviest tech selling in over five years and that was earlier on in the sell-off. This institutional shift, combined with rising short selling and no doubt some level of retail panic (data on that is harder to come by) is both causing the current volatility and creating opportunity for longer term investors to take the other side. Of course, the most important thing is not to participate in mass selling, and where possible, take advantage. All the gains from the growth in life sciences, software, fintech, and e-commerce will flow to those who end up with the shares being dumped on the market now. The most important thing to know is that our companies are still performing exceptionally well. Many of them are internet-based so we can track real-time data, and they have made substantial progress since the sell-off began, and most certainly since the highs of early 2021. Strikingly, this sell-off has not been triggered by any operational issues. For example: Sea In November only two long months ago, Sea reported: So far, indicators suggest Sea's e-commerce app Shopee is doing even better in India than it was in Brazil, where it quickly became the most downloaded app and already accounts for ~8% of Sea's GMV. After their October launch, Shopee is already the third largest shopping app in India by daily active users. The main negative news was that Tencent, a major shareholder, sold a small portion of its holding below 10%. But even this has a silver lining - as it allows Sea to avoid foreign ownership restrictions in India. In September, Sea raised $6 billion of capital at $318/share (currently $167) leaving the business with $11 billion of cash and a current enterprise value of $88 billion. If you separate the two businesses, and value payments at zero, this is one of the cheapest e-commerce companies around, as well as the fastest growing and most dominant at this scale. As with many of our companies, Sea is truly an apex predator, entering new markets and rapidly taking share, forcing competitors to react. Throughout the sell-off, estimates have been consistently revised upwards:

The difference between serious losses and returning multiples of your capital depends entirely on whether you are a buyer or a seller at times like this, which always feel like an eternity when you're in them. Our fast growing companies may be both the worst place to be during the sell-off, and the best place to be after markets put in a low. This happens well before people expect, and we are starting to reach consensus bearishness reminiscent of those times, as well as a level of seller exhaustion. In previous sell-offs, reporting season marked a turn as investors refocused on the substantial progress our companies had made, often growing 10-20% over the prior three months with improving economics. There is a very good reason to be invested in these kinds of companies. The bulk of investment returns over the next five to ten years will come from these sectors, and accrue to the companies growing and taking market share - the apex predators. We will be fully invested throughout and catch them in their entirety. For the full report and more company analysis, go to Frazis Profile Page. Written By Michael Frazis Funds operated by this manager: Disclaimer The information in this note has been prepared and issued by Frazis Capital Partners Pty Ltd ABN 16 625 521 986 as a corporate authorised representative (CAR No. 1263393) of Frazis Capital Management Pty Ltd ABN 91 638 965 910 AFSL 521445. The Frazis Fund is open to wholesale investors only, as defined in the Corporations Act 2001 (Cth). The Company is not authorised to provide financial product advice to retail clients and information provided does not constitute financial product advice to retail clients. The information provided is for general information purposes only, and does not take into account the personal circumstances or needs of investors. The Company and its directors or employees or associates will use their endeavours to ensure that the information is accurate as at the time of its publication. Notwithstanding this, the Company excludes any representation or warranty as to the accuracy, reliability, or completeness of the information contained on the company website and published documents. The past results of the Company's investment strategy do not necessarily guarantee the future performance or profitability of any investment strategies devised or suggested by the Company. The Company, and its directors or employees or associates, do not guarantee the performance of any financial product or investment decision made in reliance of any material in this document. The Company does not accept any loss or liability which may be suffered by a reader of this document.

|

27 Jan 2022 - Lithium - Where to From Here?

|

Lithium - Where to From Here? Airlie Funds Management 17 January 2022 |

|

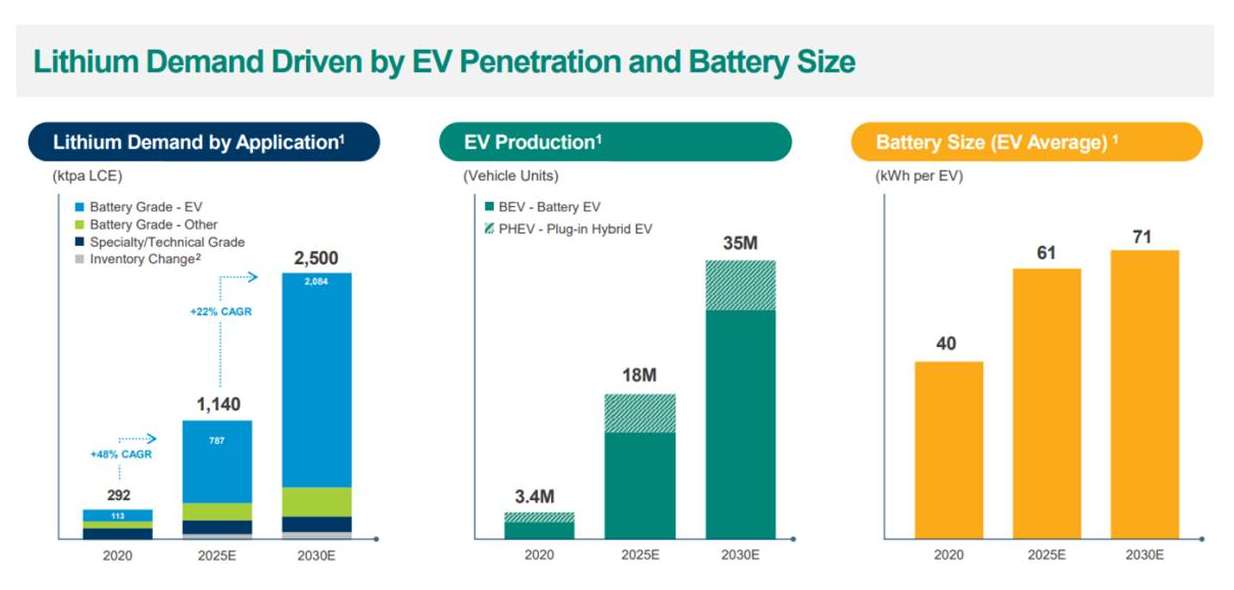

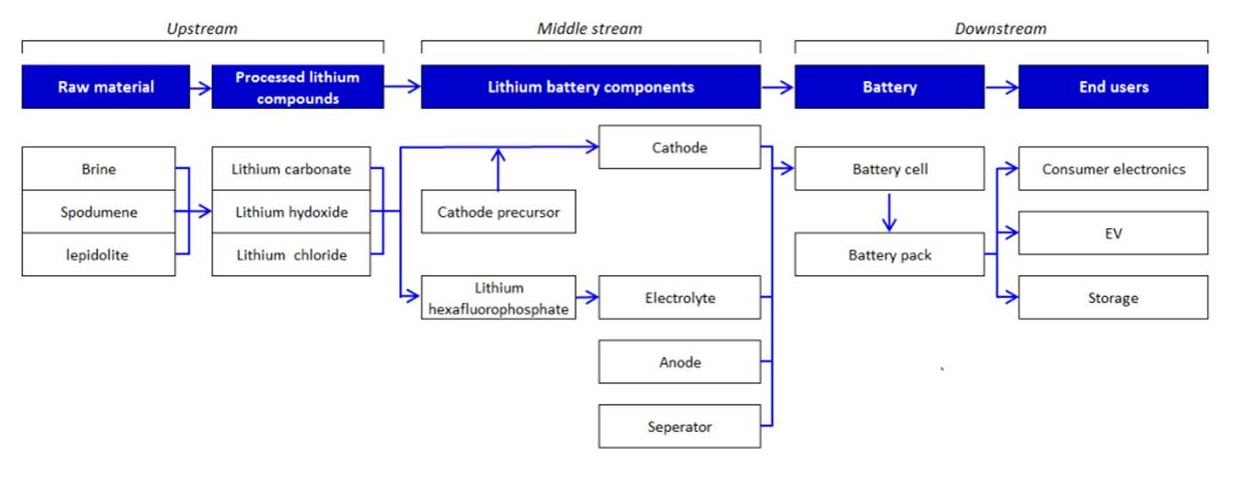

Following on from our report last month on Mineral Resources and in particular its lithium business, we thought our background work on the lithium industry and supply/demand fundamentals might be of interest: Over the past 12 months, the share price movements for ASX-listed lithium producers and developers have been eye-watering. Pure-play producer Pilbara Minerals (PLS) is up +280%. Nickel / lithium producer IGO is up +80%, having completely reshaped their entire business through a procession of transactions to become an integrated "battery metals" business. Iron ore / lithium / mining services company Mineral Resources (MIN - an Airlie favourite) is up +50%, despite a 27% decline in the iron ore price over the same time. Listed developers / explorers Liontown Resources (LTR), Firefinch (FFX) and Core Lithium (CXO) are up +318%, +380% and +270% respectively (!). The sceptic in me is wary of being the greater fool in the lithium sector, but pragmatically the equation is simple - even the most conservative estimates see the lithium market entering a material deficit at some point over the next 10 years as the electrification of transport takes place globally. Figure 1 - Airlie Funds Management The potential for a material lithium supply deficit means prices for lithium raw materials and chemical products could continue to rise. As more lithium extraction volumes and processing capacity comes online, the cost curve for lithium will continue to evolve and potentially result in a range of economic outcomes for companies depending on their cost position and capital invested. Herein lies the opportunity and uncertainty for investing in lithium extractors and processors going forward. DemandLithium mining and processing aren't new industries, but they are experiencing a structural change in their demand profile. Lithium is a chemical element that doesn't occur freely in nature, but only in compounds, and is generally extracted from hard-rock despots or brines and then processed into a useable chemical product. Historically, demand for lithium chemical products has come from applications in glass and ceramics, as well as additives in steel and aluminium production. Today, due to the superior energy-to-weight characteristics of lithium, lithium chemical products have become an important component of the rechargeable battery cells that can be found in most modern electric vehicles. As the world looks to transition away from fossil fuels, the demand for electric vehicles, and subsequently lithium chemical products, is robust. Figure 2 - Albemarle Investor Day September 2021; Roskill The trouble is, while lithium is not exactly scare, the supply chain from raw material to useable chemical product is still developing as demand grows rapidly.

ExtractionAs mentioned earlier, lithium must be extracted (via hard-rock mines or brine lakes) and then processed into a useable chemical product. The Australian lithium extraction industry is dominated by hard-rock assets (mines) that produce an ore which contains the lithium-bearing mineral spodumene. Like all ore bodies, hard rock spodumene deposits can vary in size and grade, which ultimately affects the quantity, quality and cost of the product produced (see Australian spodumene cost curve below). Spodumene must be processed into a concentrate of a suitable grade before it can be processed into a chemical product, and thus higher-grade ore bodies can have significantly less costly pathways to final product. Brine assets (most found in South America) take saline brines with high lithium content and pump them from below the earth's surface into a series of evaporation ponds from which a more concentrated lithium-brine is produced.

ProcessingSpodumene concentrate can be converted directly to lithium hydroxide, while brine assets ultimately produce a lithium carbonate, which can then be further treated to create a hydroxide product if necessary. To further complicate things, not all processing assets are integrated with upstream raw material extraction assets, meaning they must procure raw materials (i.e., spodumene or lithium carbonate) from producers. Currently China has the dominant share of downstream lithium conversion capacity, a function of a historical cost advantage and proximity to customers. Australia's share of global downstream conversion is significantly smaller than its extracted share and will remain so even as assets currently under construction come online. Increasingly, Australian spodumene producers are looking to capitalise on the opportunity for margin expansion via vertical integration into downstream conversion, largely because of the price strength in lithium chemical products and the view that customers will want an ex-China supply chain. Given Australia is long spodumene (and China is short) it makes sense to develop optionality around spodumene concentrate offtake and create a lever around which the "seaborne" lithium products markets can be kept tight. Like extraction assets, processing assets will have different capital requirements and cost positions depending on their location, scale, and access to raw materials. The cost curve for integrated processing assets remains in its infancy, given many projects that make up industry cost estimates are either still under construction or ramping up.

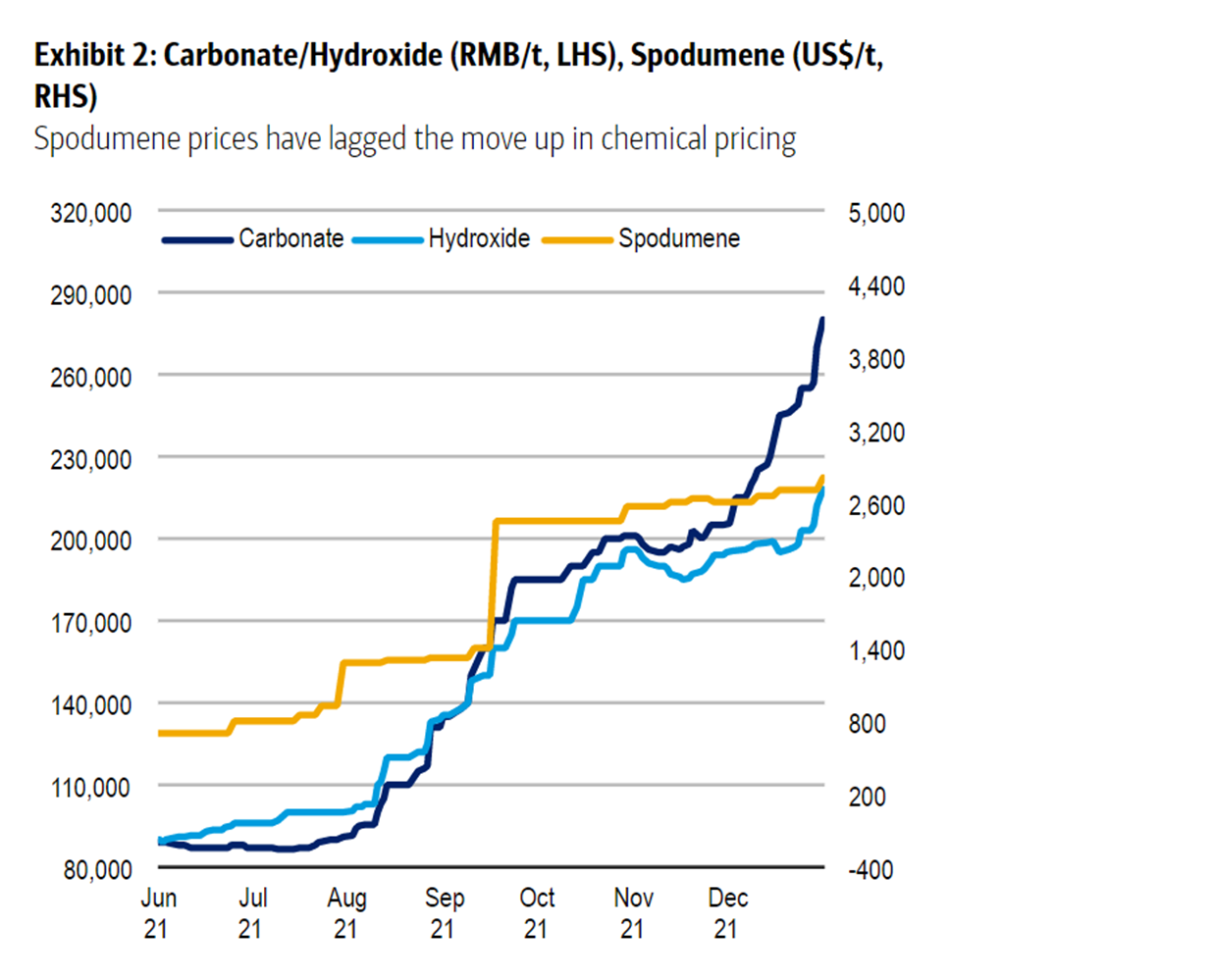

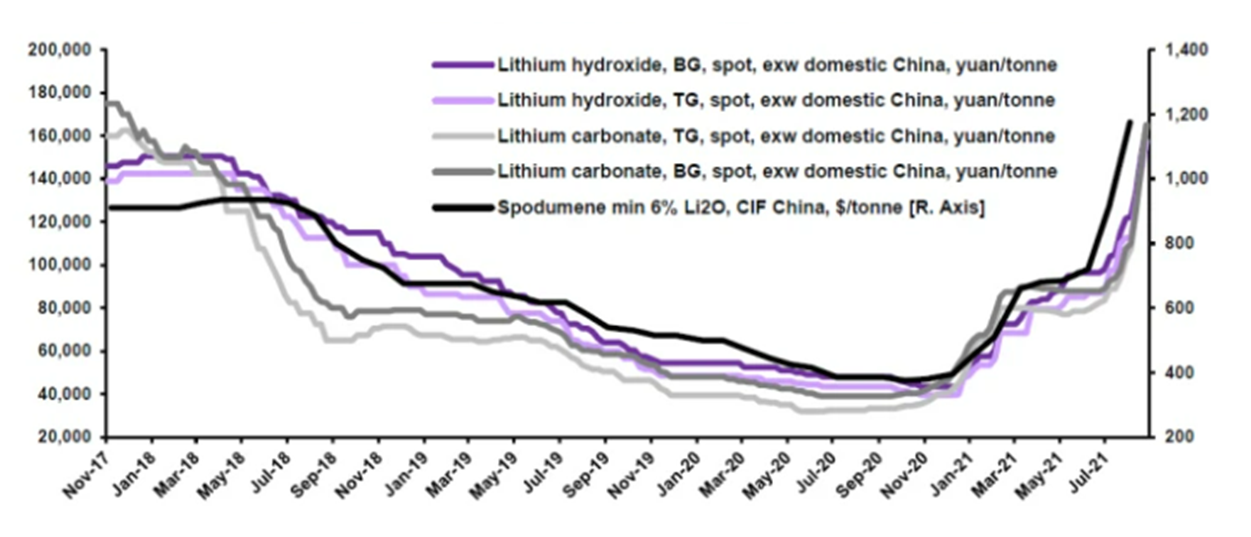

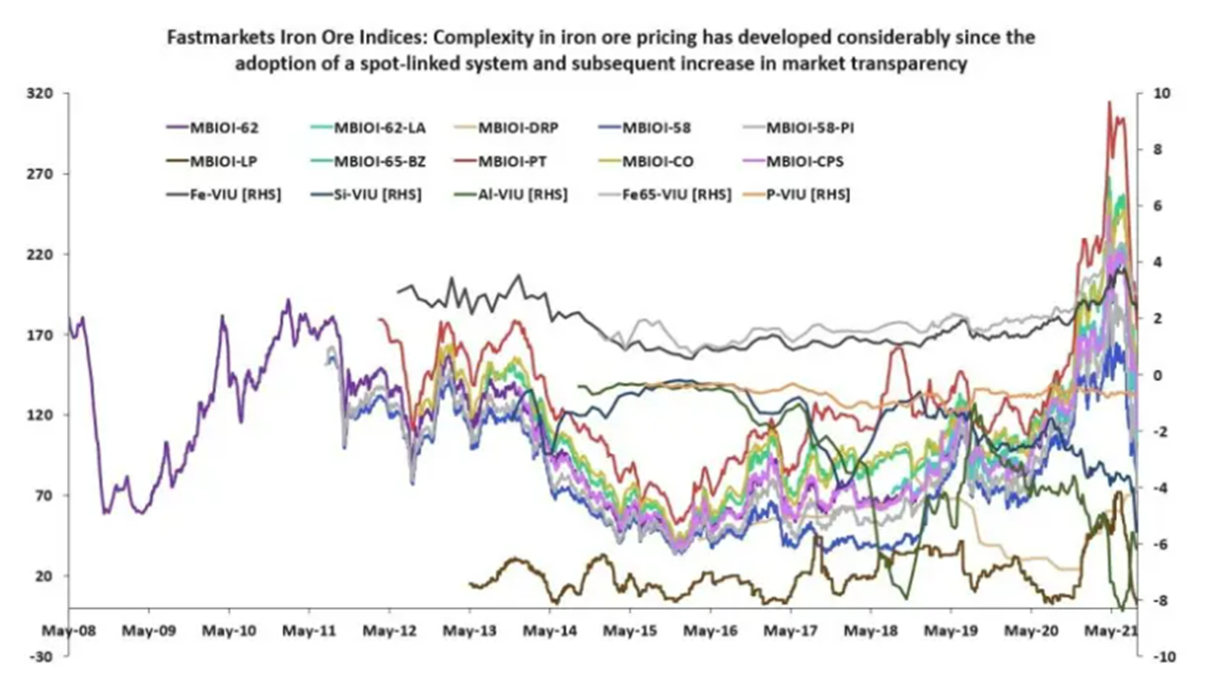

SupplyUltimately to meet demand raw material supply will have to come from both hard-rock and brine assets. Battery chemistry will vary depending on the availability of supply as well as the manufacturers preference, meaning supply of both lithium hydroxide and carbonate will be necessary. The main takeaway here is simply that the lithium battery supply chain is complex, and that given this it should be expected that theoretical supply will undoubtedly differ from realised supply. Below is a consensus estimate of the future supply-demand balance for lithium (as measured in Lithium Carbonate Equivalent tonnes) out to 2030. While obviously these estimates are rubbery, it gives a feel for the extent to which an imbalance may eventuate. Figure 6- Airlie Funds Management PriceOf course, the reason cost curves, and supply-demand paradigms are poured over by investors is to take a view on future prices. Often with resources stocks, get the commodity price right and you'll give yourself a fighting chance investing in the right companies. Over the past twelve months, prices for lithium products have exploded. Figure 7 - BofA Global Research, January 2022 Figure 8 - Fastmarkets 2021 But how should we interpret spot prices given the structure of the lithium industry? Are "spot" prices an accurate reflection of what producers are receiving? At present, spot transactions only account for a small portion of supply of lithium raw materials and chemical product producers, with most volumes traded in fixed price or index-linked contracts (for set periods). For spodumene spot pricing, many market participants have begun relying on Pilbara Minerals (PLS) BMX Platform results, in which the company auctions off small parcels of spodumene to prospective customers. If these "spot" prices reflect what is being paid for the marginal tonne of product, then they still give great insight into the market balance. Without wanting to oversimplify things or draw flawed comparisons, we can look at the development of the iron ore price (and value-in-use price variation) as a guide to how the lithium pricing system could mature. The iron ore market moved to a spot-linked pricing system in 2008, despite considerable variation in product quality and specific end-use. The result has ultimately been a significant increase in market transparency which we believe should be expected for lithium over the next decade.

With greater transparency over market pricing should come greater ability for market participants to allocate capital, and ideally create a smoother transition to electric vehicle use. Yet, as investors we still must take a view on future prices even as pricing systems develop. For mature commodities, long-term price forecasts typically reflect a marginal cost of production, where prices are set by cash operating cost levels that ultimately mean those at the top of the cost curve are not profitable, so as not to induce oversupply. The general rule of thumb most people use here is equivalent to ~90% of the cost curve. An obvious example where this logic is applied is to a mature commodity is again iron ore, where long run prices are usually US$60-80/t, with 90% of the cost curve effective profitable at ~US$70/t. Using this approach for say spodumene, would yield a long run price of ~US$450/t, versus spot of >US$3,000t. Given the lithium market is not "mature" in the sense that pricing is underdeveloped, and the future supply-demand equation remains so unbalance, a marginal cost of production method for forecasting future price is perhaps unreasonable. Instead, to address the future supply-demand imbalance predicted, new production needs to be incentivised - i.e., Long-term pricing must be bid-up to encourage investment in new supply, and so it's not out of the realm of possible that current spot prices can hold for longer than people expect, or for long run prices to settle above the current cost curve (especially given this cost curve will have to change over the next decade). All in all, without a crystal ball and given the plethora of unknowns, we remain open to the possibility that spot prices can hold or go higher despite their impressive run. Even modest changes to the supply-demand equation can see hefty price responses, and it would be foolish to assume to future will not be volatile in both directions. How are we navigating the lithium sector at Airlie?Given the industry dynamics discussed above, we believe it is prudent to have some form of lithium exposure in our portfolio. The uncertainty that features in all aspects of the lithium paradigm means each opportunity warrants a degree of conservatism, and valuation is still important, despite rubbery supply, demand, and price forecasts. Undoubtedly, we will see an endless stream of new explorers-cum-developers front the market over the next decade, some of which will be fantastic investment opportunities and some of which will be looking to take advantage of investor optimism. In our previous Stock Story, we highlighted Mineral Resources (MIN) as our preferred lithium exposure. Mineral Resources represents a compelling investment both in isolation, and when considering its relative valuation versus other ASX-listed producers. For MIN, earnings growth will be driven by the organic expansion of spodumene and iron ore production volumes, as well as the development of a lithium hydroxide conversion plant via a JV with global producer Albemarle. Supporting this growth is MIN's robust mining services business and exceptional management, and it remains a key holding in our portfolios. Written By Joe Wright, Analyst - Airlie Funds Management Funds operated by this manager: Airlie Australian Share Fund |

25 Jan 2022 - Webinar Recording | Paragon Australian Long Short Fund

|

Webinar recording: Paragon Australian Long Short Fund

|

25 Jan 2022 - Some stuff you don't want to think about - but should

|

Some stuff you don't want to think about - but should Delft Partners January 2022 |

|

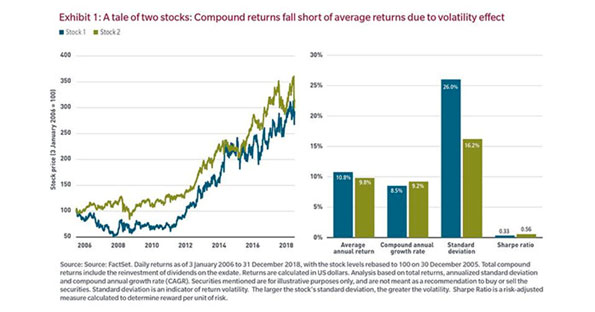

Or Risk is the independent variable and Return, the dependent one. Ever been on a car journey as a passenger where the driver was going too fast; being reckless; and essentially taking chances? Over and under-taking, switching lanes without looking, going too fast and braking too hard. We all have. It's not so pleasant especially as you get older and realise how much is at risk from a needless mistake: your health, your life even; the realisation that family members depend on you staying healthy and not becoming a burden; your enjoyment from their growing old. So, we try to avoid such a scenario. It's relatively easy since reckless driving is usually associated with inexperienced younger members of society in fast cars. So, we can avoid such journeys as being readily identifiable in advance. And yet we often find that a similar journey, multi-generational wealth investing, has older wealthy members indifferent to risk and unaware of the loss of wealth that occurs when insufficient attention is paid to the risk path taken by their managers. Investing Is not so different from a car journey? It's a path to an end point with risk to be managed; speed, comfort, time horizon all matter for investing as much as they do for being driven. Better to get to the end point safely and aware of risks on the way, and how to drive defensively at such times, than to get there at speed dangerously? And yet here we are, perhaps caused by years of unorthodox monetary policy, where many managers and clients perceive risk as irrelevant and an irritant? All focus is upon return - those 'sexy' growth stocks, that 10 bagger PE fund, that property that will inevitably benefit from a lick of paint or a change of use permission, and of course the free put option available to all investors that has been a feature of monetary policy in essentially the last 25 years. So were going to bore you with a brief article on the independent variable known as risk. Return, the glamourous bit, is the dependent variable. No risk, no return. So, if you can't define, measure, and manage risk then your returns are a function of luck. Not a lot of people know that. We spend a lot of time obsessing about risk especially in multi-asset portfolios, whose Alphas and Betas are both correlated at different extents at different times, and where they offer differing opportunities for active and passive approaches at different times. The cost of variance or variance drain The variance of returns over time directly impacts our ability to grow wealth. $100 invested at 5% interest for 30 years grows to become $432. Of that, $100 is of course your initial capital, $150 is the total amount of simple interest paid, and $182 is the effect of compounding - interest on interest. (Let's assume away the taxman?!) Once uncertainty in returns (volatility) is introduced into the mathematics, there is an immediate noticeable drain. If that same investment still yields 5% but now with a volatility of 17% (like a typical equity index ) the cumulative growth rate - the rate your wealth actually grows over time including rises and falls - is now just 3.56%. After 30 years you will have instead of $432 just $285, and you will have lost almost $150 to volatility. Risk is expensive!1 A lower-return investment with a lower risk may often outperform a high-return high-risk alternative.

Multi-asset portfolios of course mitigate the high volatility from equity and many investors choose hard assets to go into the mix since their price is 'not volatile'. However, bonds, especially high yield bonds, can behave like equities at certain times 2 and an absence of price volatility shouldn't be equated with an absence of risk 3. For example, if you own a physical property whose revenues are derived from retail tenants, and your equity portfolio is heavily weighted to retail and consumer companies, guess what happens when a general consumer recession hits. That 'lack' of volatility in the property will suddenly not be so lacking as your cash flows from rental payments dry up and the next valuation of the property will be a jump down in value, and a reduction in re-investable cash flows, just when you most needed to be immune from volatility as a drain on wealth. The infrequent tails that happen too frequently We tend to think of "drawdowns", crashes, corrections, shocks or other sudden unusual "non-Normal" events as a completely different animal from typical market volatility. When we consider investments, we should consider not just volatility or tracking error but also the incidence of these drawdowns. Simple mathematics to transform mean and volatility without drawdowns to equivalent numbers that correctly include the effect of such infrequent drawdowns has been known for almost 100 years 4. If we make this adjustment to historical return series, we observe two troubling effects. First, the historical "alpha" that is often reported in academic papers and relied on by active managers from factors like Momentum, Size, Value, or Beta, once adjustments for drawdowns have been made, either radically shrinks, or disappears, or reverses sign and becomes a persistent drag. This phenomenon is described at length in one of Northfield's recently published journal articles 5. Secondly, adjusted volatility numbers are usually much bigger than the unadjusted numbers - meaning that these investments have both a lower return and a higher risk than would at first appear. The effect of that higher risk is once again, as above, to reduce the effectiveness of compounding. Investments that experience periodic shocks have both lower return than would appear at first glance, and higher risk. Drawdowns are also expensive! The evasive Alpha Another closely related aspect is uncertainty in active management. Unfortunately, Alpha is hard to find, easy to lose, and always changing. Because Alpha is uncertain, we should include that uncertainty in our calculations of risk - in this case it is "the risk of being wrong" or strategy risk 6. It may come as some surprise that usual risk measures completely ignore this and assume that the managers' return is known with certainty. We wish it was. With active management we deliberately move away from the benchmark return and believe that we have a new mean return (our alpha) that is bigger than the benchmark. Tracking error, which originated in passive management, or value at risk, or any other measure that is based on volatility measures variability or uncertainty around the mean (alpha) and says nothing about variability or uncertainty of the mean (alpha) itself. As with all the previous examples - you might be spotting a pattern here - correct inclusion of strategy risk makes the total actual risk of the investment larger, which once again negatively impacts compounding. Active management where big bets are taken is risky and being wrong is very expensive indeed! There is no such thing as linear in the world of risk There is one additional implication of compounding that is utterly ignored - if we consider the compound return, as we should, given its importance to us, then return no longer increases linearly with risk as we are told by the textbooks 7. It is now a convex function, and as risk increases past the peak, our return begins to decline with increasing risk. This has serious implications for asset allocation. In every market there will be a "peak beta", beyond which as explained returns decline with increasing risk, so we must stay to the left of that peak. This tends naturally to send us looking for lower beta stocks, or into multi-asset class portfolios 8. So, what to do? Experienced judgement helps. By experienced we mean professionals whose careers extend back to when corporate failure was possible, when central banks tightened monetary policy as much as they engaged in QE and granted a free put option, and when dividends and balance sheets mattered. Models also help to provide a framework for identifying, measuring, and managing the Betas and the Alphas and their correlations and payoffs. Many fund managers do not use risk models and are ignorant of the absence of diversification of the risk sources in their portfolios. Many don't want to know and prefer a 'pedal to the metal' approach. We acknowledge that all models are 'wrong' but believe that some are useful. The useful ones such as the Northfield model we use (northinfo) allow liquid and illiquid asset forecasts to be combined; have data on bonds as well as equities, allow scenario and stress testing, and incorporate the multi-generational time horizon and planning for periods of investment and consumption that many plan sponsors will have to manage. We conclude that successful wealth management requires carefully nurtured compounding. This compounding can only occur when three forms of risk are carefully managed the exposure to volatility from risk factors and asset-specific sources, the risk of drawdowns, and strategy risk - the risk of being wrong. Portfolios are constructed by focusing risk exposures only in areas the manager has skill. |

|

Funds operated by this manager: Delft Partners Global High Conviction Strategy, Delft Partners Asia Small Companies Strategy, Delft Partners Global Infrastructure Strategy

|

25 Jan 2022 - Airlie Market Outlook, January 2022

|

Airlie Market Outlook, January 2022 Airlie Funds Management 17 January 2022 |

|

Matt Williams, Portfolio Manager, offers his views on the year ahead, the challenges he sees for Australian companies and discusses investments in the portfolio. Funds operated by this manager: Airlie Australian Share Fund |

24 Jan 2022 - Peer Groups

|

Peer Groups FundMonitors.com If you are interested in how a particular fund has performed compared to its competitors or how different sectors have performed against each other, you can use FundMonitors.com to access and compare peer groups. |

|

|

24 Jan 2022 - Why you can be cautious on markets and 100% invested

|

Why you can be cautious on markets and 100% invested Aoris Investment Management 14 January 2022 2022 began with global stock markets around record levels, leaving many investors primed to sell equities. However, timing the market is more likely to reduce your returns than enhance them. Importantly, you can be cautious on the market and 100% invested provided you're in the right stocks. Here's why. A December 2021 Livewire reader survey found that 'overvalued stock bubbles' are the #1 concern of readers, by a factor of two! Many investors have an opinion, often strongly held, on whether the stock market in aggregate is cheap or expensive. If the market is viewed as being too pricey, they may increase the cash weight in their portfolio with a view to buying back into equities at lower prices. While conceptually appealing, history shows that attempting to profit from the market's zigs and zags along its upwards journey is far more likely to detract from investment returns than add to them. Aswath Damodaran, a highly esteemed Professor of Finance at New York University's Stern School of Business, has studied market timing strategies. He looked at asset allocation mutual funds in the US, so called because rather than being 100% in equities they can time the market by moving between stocks, bonds and cash. As such, they should do better than the equity market. Over the 10 years to 1998 these market timing funds on average underperformed the S&P500 by 5.0% p.a. I recall telling clients in January of 2013 that markets are fully priced and to expect a zero return from the index in the coming year (the S&P500 put on 30% that year!). I've learnt a few things since then. Today, I have no view, positive or negative, on the value or the direction of the equity market in totality. Nor do I believe it's necessary to have one as an equity manager. Timing the market is an example of what is known as the fallacy of composition, meaning the belief that what is true of the whole is also true of all the component parts. It's common for investors who've formed a view on the equity market in totality to then project this view onto all equities - all stocks and all funds. However, the returns from any individual security will look nothing like the average. Thinking about equity market indices in aggregate misses the vast dispersion of stock returns within an index. To illustrate this dispersion, in 2021 the returns of the best 20% of the global equity market exceeded those of the worst 20% by almost 90%.

What matters is what you own, which in the case of Aoris is just 15 exceptional businesses. The index is mostly made up of businesses you don't own. I've seen many poor investment decisions made as a result of confusing these two constructs. What matters is what you do own. The index is mostly made up of businesses you don't own. If you own the right type of business, and you own them at or below their fair value, then time is on your side and being fully invested makes sense. By the right type of business, I mean those that have been around a long time, are understandable, have leadership positions in growing markets, and grow earnings per share at an attractive rate on a sustainable basis. I believe the intrinsic value of the 15 companies we own at Aoris is rising at a rate of around 10% a year and I believe we own them at or below their intrinsic worth. Therefore, cash represents a considerable opportunity cost. To hold $1 of portfolio capital in cash rather than in one of our companies, in the expectation that its share price may fall 10% or more from an already attractive level, would not be judicious. I believe it is far better to invest all of one's portfolio capital in these types of businesses and participate fully in that 10% p.a. growth in value. To maximise your long-term returns, recognise the futility of trying to optimise short-term returns. Invest to win the main game, the long-term game. Recognise that your equity portfolio is not the equity index. Rather, it's a discrete set of businesses whose returns will look nothing like the market average. If the businesses you own are profitable, durable, competitively strong and growing in intrinsic value at around 10% p.a., and you own them at or below today's fair value, then it makes sense to be fully invested. Written By Stephen Arnold, Managing Director & Chief Investment Officer Funds operated by this manager: |

21 Jan 2022 - Sitting On The Mountain, Watching The Tigers Fight

|

Sitting On The Mountain, Watching The Tigers Fight Arminius Capital 11 January 2022 According to the Chinese zodiac, 2022 is the Year of the Tiger. Tigers are bold, powerful and dangerous, but in Chinese astrology they are also impulsive, short-tempered, and have difficulty getting on with others. There is an old Chinese saying about "sitting on the mountain, watching the tigers fight", which means that, when the situation is violent and confusing, it's best to stand back and see how things work out. There are a lot of tigers around this year:

The outlook for the Australian share market is better than for most of the world. Inflation is low, wage pressures are minimal, and the Federal election due by end-May is unlikely to produce major policy changes. As investors focus on fundamentals, stocks with solid earnings will come back into favour, and speculative stocks will lose popularity. For the big four banks, 2021 was the year of recovery: 2022 will be much harder, and the big banks are likely to underperform. Funds operated by this manager: |

.PNG)

.PNG)

.PNG)

.PNG)