NEWS

10 Feb 2022 - Sailing into the wind

|

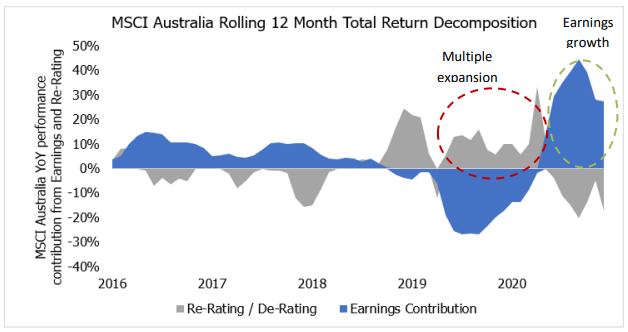

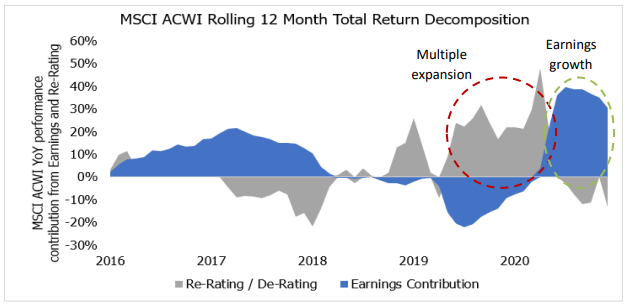

Sailing into the wind (Adviser & wholesale investors only) Alphinity Investment Management 24 January 2022 Sailing into the wind is a sailing expression that refers to a sail boat's ability to move, even if it is headed into the wind. To reach specific points, alternating the wind's direction between the starboard and the port is sometimes necessary. Equity markets similarly require the same agility to adjust for different market cycles and macro implications to deliver consistent returns for clients. The last (almost) two years of Covid-related repercussions have certainly tested even the best skippers' navigation skills and having the flexibility in your process to adjust when necessary has been invaluable. As we head into 2022 with concerns around economic growth and monetary stimulus likely peaking, the earnings cycle potentially maturing, and equity market valuations optically high, investment risks appear to be rising. At Alphinity we continue to let earnings leadership, on a stock by stock basis, guide us through the next phase in the cycle, wherever earnings upgrades may lead us (rather than being tied to a specific style or macro outcome). 2021 - A normal, abnormal yearNothing about the last 24 months since the Covid pandemic started has felt normal. Global equity markets (with Australia no exception) have however followed a surprisingly normal recession and recovery pattern, albeit faster and more aggressive than usual. Consistent with historical patterns, the first stage of the market recovery in 2020 was driven by valuation multiples expanding, with the market pricing in future earnings growth, which did not disappoint and drove the second stage of the recovery into 2021. The two charts below illustrate the similar return drivers of the MSCI Australia and MSCI World Indices, with the former enjoying stronger earnings growth, but also a larger multiple contraction at the index level over the last year. The key question from here is the expectation for each of these drivers (earnings and multiples) as we head into a new year. MSCI Australia following a normal post-recession market pattern - up c60% since the trough with the PE expanding from 14.5x to 20x, currently back down to 18x

Source: BoAML Data MSCI World has added c97% since the trough in March'20 with the PE expanding from 12x to 20x, currently back at 18x.

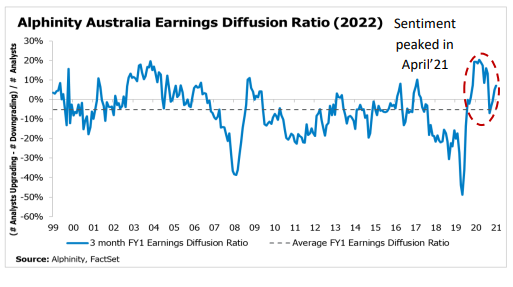

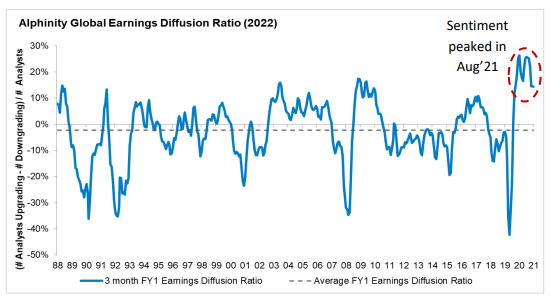

Source: BoAML Data Different points in the earnings cycle heading into 2022Global earnings revision breadth (or earnings sentiment as measured by the Alphinity Diffusion index, being the number of companies getting earnings upgrades vs downgrades) expanded to 30-year highs as analysts started pricing in the strong demand recovery and unprecedented corporate pricing power. Similarly in Australia, earnings sentiment soared to highs last seen in 2003, peaking in April 2021 driven by the early cycle commodity pullback, dropping into negative territory during lockdowns and finally stabilising in November 2021. Generally, these small upgrades still favour pro-cyclical earnings, but we are seeing some selective defensive positive earnings revisions coming through. Australian earnings cycle - Less clouding, but not yet clear

Source: Alphinity, Bloomberg, 31 December 2021 Globally earnings upgrades are still dominating, but the trend is narrowing to fewer stocks. In terms of relative sector earnings revisions, the picture is getting more mixed compared to the clear cyclical and growth leadership we have seen over the last 12 months with some defensive sectors slowly creeping into positive territory. Global earnings cycle - Still positive but losing momentum

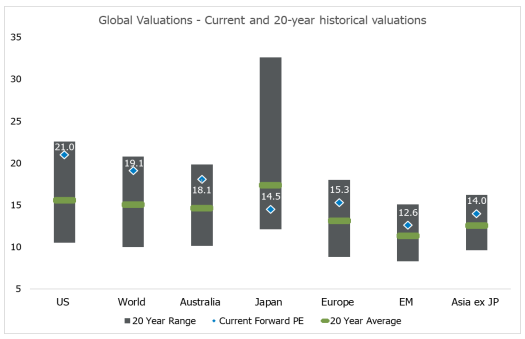

Source: Alphinity, Bloomberg, 31 December 2021 High valuations offer less support and high dispersions increase vulnerabilitiesDespite the recent multiple contractions seen during 2021, most global equity markets are still trading above their long-term averages driven in part by low interest rates and excess liquidity. Strong performance in the last 18 months has seen pockets of the market becoming particularly stretched and therefore vulnerable to material changes in earnings and interest rate expectations, real or perceived. The valuation dispersion between the highest (80th percentile) and lowest (20th percentile) rated stocks is at a record high for the ASX200 and the MSCI World Index, with unprofitable tech a particular standout. Factor and style dispersion were also extremely high during 2020, which makes sense for a year marked by very high uncertainty or a recession and extreme volatility. This dispersion has reduced a bit during 2021 but remains at unusually high levels across several styles, such as value vs growth, given the strong recovery in the economy.

Source: Alphinity, Bloomberg, 31 December 2021 Global equity markets still trading above their long-term average valuations

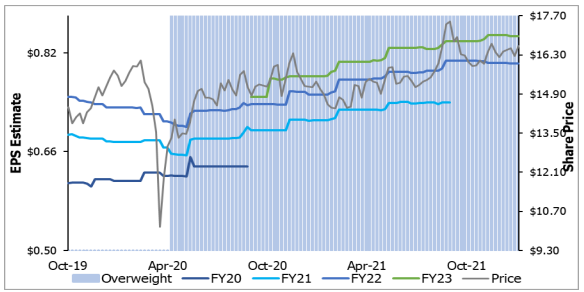

Source: Bloomberg, 31 December 2021 Adjusting the sails for the winds of changeAdd to this peaking, but still robust, global economic growth, stubborn inflation data, likely less central bank support and ongoing uncertainty around new Covid variants such as Omicron, is probably going to make navigating macro influences on markets more challenging this year. The increasing points of uncertainty suggest a more diversified, balanced approach will be required, focused on individual company stories rather than large thematic biases, with flexibility to react to material changes in the investment environment. Introducing some defensive characteristics also seems prudent, as long as you can identify the relative earnings story. Across our Australian funds we continue to follow the individual company earnings and where upgrades are coming from. Along those lines we have added to some more defensive positions such as Sonic, Amcor, Medibank and Treasury Wineries in the last few months. Global packaging company Amcor for example, offers a defensive earnings stream with strong cashflow generation and a solid balance sheet, which allow management the flexibility to do recurring buybacks and potential bolt-on acquisitions. Amcor has beaten earnings and upgraded its outlook at the last 6 quarterly reports, primarily driven by better than expected synergies with Bemis, but also better than feared passthrough of higher resin prices. Amcor's defensive qualities should see it deliver a steady return over the next 12 months and outperform the market on any potential correction. Amcor - offering a defensive earnings stream and strong cashflow generation

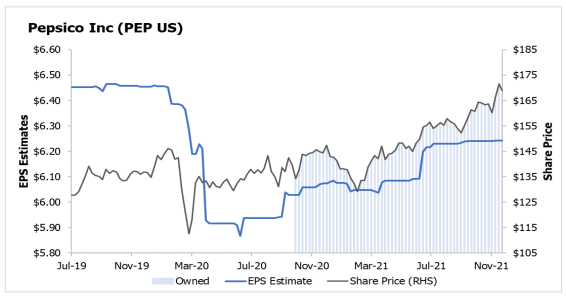

Source: Alphinity, Bloomberg On the global side, we have continued to incrementally reduce our cyclical and higher PE growth exposure in favour of high-quality defensives such as Pepsico, Nextera and Nestle. Pepsi is a high quality, defensive consumer stock with strong pricing power and under-appreciated long-term revenue growth driven by strategic reinvestment under a new CEO, a mix shift to the higher growth snacks segment, targeted M&A and market share gains in beverages. Recent third quarter results displayed broad-based strength across the business, with management committed to offsetting rising inflationary pressures by leveraging strong brand investment and innovation to drive price increases and revenue management. Pepsi - driving earnings growth through strong pricing power and innovation

Source: Alphinity, Bloomberg It seems likely that 2022 will be a more challenging year for markets, especially given the higher valuation starting point. It is through choppy waters like the present that we rely on our agile, style agnostic process to get us to our destination. As Thomas S. Monson once said, we cannot direct the wind, but we can adjust our sails. Author: Elfreda Jonker - Client Portfolio Manager |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund |

9 Feb 2022 - Global equities in 2022: Three key themes to watch

|

Global equities in 2022: Three key themes to watch Antipodes Partners Limited 02 February 2022 In this episode on the Good Value podcast (recorded Monday 31 January, 2022), Jacob Mitchell and Alison Savas discuss three key themes to watch in global markets in 2022:

They also share Antipodes' stock to watch in 2022 - Seagate Technologies (NASDAQ: STX) |

|

Funds operated by this manager: Antipodes Asia Fund, Antipodes Global Fund, Antipodes Global Fund - Long Only (Class I) |

9 Feb 2022 - Time to change your mindset: Prepare for a 5pc cash rate

|

Time to change your mindset: Prepare for a 5pc cash rate Lucerne Investment Partners 04 February 2022 The last time Australia's official cash rate had a five in front of it, the world was going through the biggest financial crisis since the Great Depression. Within the next two years, rates could be back up at that level, bringing a world of pain to borrowers, equity markets and business balance sheets. The prediction comes as share-markets around the world tumble amid expectations the US Federal Reserve will within weeks kick off the next interest rate-rise cycle. "We've already seen rationalisation start to come into the market. We can see that institutions and investors as a whole are no longer prepared to just pay up for these high-growth, expensive companies, many of which are not actually generating profits" If you look at the irrational behaviour happening over the last 12 months, it's resulted in 60 out of the ASX top 200 companies not being profitable. That's alarming. While capital market conditions were favourable over the past two years, with excess liquidity pumped into the system, these hyper-growth businesses were the outperformers. However, these sorts of businesses are highly reliant on capital markets supporting them; they've got to keep going back to the well to survive. That well will run dry quickly if rates jump up to the level, we forecast. I see the Reserve Bank kicking off its own rate-rise cycle by the middle of the year, well before the 2024 start date the central bank was tipping just months ago. The pressure on the RBA intensified last Tuesday, when headline inflation in the year to December 31 was revealed to have surged to 3.5 per cent, while underlying inflation was 2.6 per cent. Many now expecting the central bank to move this year. I am predicting that the fallout for equities from the rate move would result in the share market contracting up to 15 per cent this year. The S&P/ASX 200 Acc. was down over 6% in January on the mere suggestion of a new rate-rise cycle. "We think there's a real risk now that rates are going to increase by amount to 3 - 5 per cent over the next two years" The RBA might try and hold fire as long as they can, but then I think they're going to have to accelerate at a greater rate than what they would have preferred. You could easily see that 3 to 5 per cent occur over an 18-month period from July 1 this year. If you also think about the amount of debt people and institutions have taken on over the last few years, you lift that cost of debt from 2 per cent to 6 per cent or 7 per cent over the next 24 months and it can have dire consequences not only on the property market, but also on equity markets and business balance sheets. The key for investors looking to emerge unscathed is to ditch the recent investing mindset. "Investors who continue with the mindset of traditional investing over the next five years could risk giving away a significant amount of the wealth they've generated over the last five. Now more important than ever, investors need to apply a lot more active management to their portfolio, as opposed to the buy and hold index approach that worked very well over the past decade - invest for tomorrow, not yesterday" The alternative investment manager isn't suggesting investors completely back away from equities, but to reconsider how to best manage that equity allocation. To this point, the Lucerne Alternative Investment Fund (LAIF) has in recent months increased its exposure the energy sector, which has outperformed as constraints to supply chains continue. Ironically, this was a sector ignored by much of the market in recent times with the push toward clean energy. "We feel there is more upside in this sector and some market commentators believe oil could reach USD200 per barrel". Our message to investors out there is to get in front of this and start to think differently. Move away from that herd mentality, which only works well until it doesn't. LAIF, which actively manages a portfolio of alternative funds covering asset classes and themes including long-short equities, volatility, precious metals, resources, digital assets and convertibles, returned ~24 per cent last year, bettering the 22 per cent in 2020. For this year, the fund is tipping it can achieve an 8-12 per cent return, after delivering a return of ~1.5% In January. Author: Anthony Murphy, CEO |

|

Funds operated by this manager: Lucerne Alternative Investments Fund (Fee Class 1), Lucerne Alternative Investments Fund (Fee Class 2) |

8 Feb 2022 - Being Early is Not as Important as Being Right

|

Being Early is Not as Important as Being Right Longwave Capital Partners January 2022 As an investor, you are often urged to act quickly on the latest investment opportunity or regret missing out. For those interested in profiting from long term structural change it seems odd that we would need to act so quickly. Surely a profound opportunity that will change the world over many decades allows you time to sort the wheat from the chaff? If the opportunity is so fleeting delaying action misses all gains, then perhaps it wasn't the structural change it was promoted to be. At the end of 2021, it is now clear that the last 25 years was one of these generational opportunities to participate in the digitisation of, well pretty much everything. The question we ask: how early did you need to be? Well it turns out that when structural trends run for decades, investors are afforded plenty of opportunity to participate and capture these returns. The examples we use are flawed by survivor bias, but we think as time went on the likelihood that Apple, Microsoft, Amazon, Google and Facebook were likely to be structural winners became a lower risk assumption. What returns were lost by waiting until these became the more obvious winners? We start in 1995, when in August Windows95 launched and Netscape IPO'd (Yahoo followed in April 96, Amazon in Jun 97 and eBay in Sep 98). We have marked this as the beginning of the Internet era for public market investors. Let's start with Microsoft. Had you purchased Microsoft in August 1995 and held to end Dec 2021 you would have made 19% per annum over 25 years. If you had of waited until the dot com peak (Mar 2000) that would reduce to 11% p.a. Maybe you wanted to wait until the dot com settled. A purchase in Aug 2004 (when Google IPOd) returned 19% p.a. Maybe you had doubts about Steve Balmer and waited until Satya Nadella became CEO (Feb 2014) - you would have made 33% per annum in the almost 8 years since. In 1995, Apple was still in the wilderness. Steve Jobs had yet to return (1997) and the iPod was still six years away. Holding Apple from 1995 to Dec 2021 has returned 27% per annum (with a near death experience along the way). If you waited until the iPod launched, you got 38% per annum since Oct 2001. Maybe you waited until the iPhone launched (Jun 2007) to achieve 30.5% p.a. Warren Buffett ended up buying AAPL more than nine years after the launch of the iPhone (Nov 2016) yet has still realised a 46% p.a. return over the five years since. We see a similar pattern with Amazon (37% p.a. from IPO, 20% p.a. from dot com peak, 33% p.a. from when Warren Buffett bought in Dec 2018), Google (26% p.a. from IPO, 28% p.a. from May 2017 when Charlie Munger said "we blew it" for not buying Google) and Facebook. None of this was obvious or easy at the time. Looking backwards gives a false sense of inevitability to history that is anything but. The future for electric vehicles, artificial intelligence, robotics, blockchain and genomics may contain generational investment opportunities. Unfortunately, there are hundreds if not thousands of companies vying to be the few winners left standing and reward their shareholders as Apple, Microsoft, Amazon, Google and Facebook (and others) over the past 25 years have done. What is hidden from history are all the failures investors have endured along the way - either companies that failed to meet these lofty goals, or investor temperament that failed to hold onto the ultimate winners through an uncertain path. Flywheels or WaterwheelsAs small cap investors, Longwave invest in much younger industries and businesses than is typical of large caps. It is more likely that the industries and companies we invest in are younger than Australia's banking, mining, insurance, property and supermarket leaders. Just because we are not investing in 100+ year old industries doesn't however mean we spend our time funding businesses that are 10 months old. There is a lot of industry growth lifecycle between 10 months and 100 years - and the current wave of investment neophiles would have you believe any company more than a decade old is ex-growth. Our investment approach is to wait until the likelihood of success is more certain. Not guaranteed - because nothing is - just more certain than largely unproven early-stage companies. One measure of more likely success is the demonstration of a genuine and observable growth flywheel. Flywheels are sometimes over-used however we like the metaphor for the image of internally generated and sustained momentum. We seek flywheels that are self-sustaining. A profitable business with high growth opportunities reinvesting positive cash flows internally (capex, R&D, sales and marketing) to drive higher growth and higher cash flows and higher investments and higher growth etc. Many of the current crop of growth business look more like waterwheels than flywheels. Superficially the effect is similar (more investment -> more growth -> more investment) but the missing part is internal cash generation funding growth investments. Like a waterwheel, these pseudo growth businesses require external liquidity to keep turning. Maybe some of them really are self-sustaining and are using external liquidity to spin faster. Or maybe they are just not going to succeed should this external funding dry up. Every investor has their own philosophy and process and there are many methods we acknowledge we don't pursue that may work for those investors. Our process seeks high quality small companies that have been seasoned by the reality of free market competition to emerge as genuine flywheels, not waterwheels in disguise. Written By David Wanis, Founding Partner, CIO and Portfolio Manager |

|

Funds operated by this manager: |

7 Feb 2022 - Forecasting with Humility

|

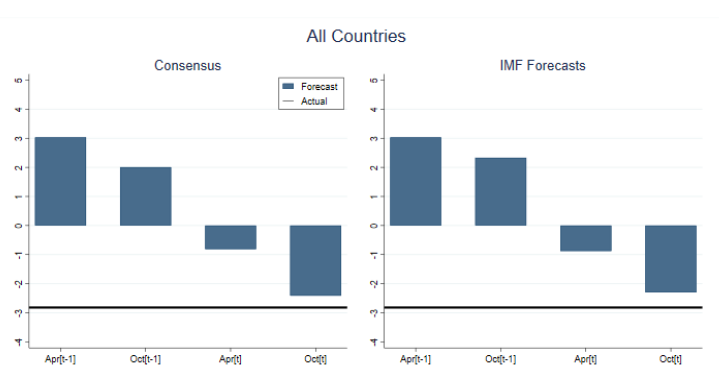

Forecasting with Humility (Adviser & Wholesale Investors Only) Merlon Capital Partners 31 December 2021 "We have two classes of forecasters: Those who don't know - and those who don't know they don't know" - John Kenneth Galbraith The problem with precisionMost forecasts begin with a starting point which is often anchored to current data. Forecasters tend to modestly extrapolate up or down from this level. This tendency to stick close to current conditions or consensus views, limits a forecaster's ability to comprehend the full range of possibilities or the impacts of more extreme circumstances. Research by the IMF explored the ability of economists to predict recessions between 1992 to 2014. It was a disaster. Economists consistently failed to predict a recession in GDP by a significant margin. Even as conditions deteriorated, economists stubbornly anchored their forecasts to the preceding non-recessionary period and adjusted their predictions downwards too little, too late. Figure 1: Evolution of Economist Forecasts in the Run-up to Recessions 1992-2014

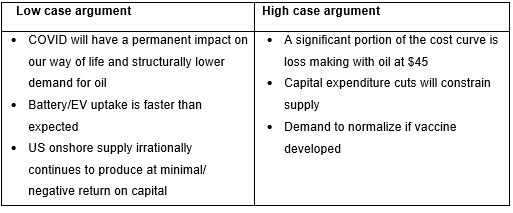

Source: "How Well do Economists Forecast Recessions?" An, Jalles, Loungani 2018Moreover, investment success is not dependent on the preciseness of predictions but instead the variance from the consensus. Equities generally price in the risks and opportunities that the market is aware of. It is often the unforeseen events which have dire consequences or large rewards. The real trick of contrarian value investing is to invest when market pessimism already prices in the most dire scenario such that it is still a reasonable investment even if this comes to pass and a fantastic one should the situation improve. A case study - Oil SearchIn May 2020, in the midst of COVID-19's first wave we initiated a position in Oil Search. This was an extremely volatile time for investors with the everchanging circumstances from the spread of COVID-19 without knowledge of a successful vaccine. The demand shock from global lockdowns, flights grounded and recessionary conditions sent some oil futures sharply into negative territory before recovering slightly to historically low levels. Volatility in oil is not uncommon. In fact, short dated oil futures historically have a standard deviation of 37%. Mixing in the unknowns of COVID, it became a very difficult proposition to forecast the oil price over the next year and beyond. By considering a range of scenarios, we instead weighed up the supporting evidence for a sensible range of outcomes.

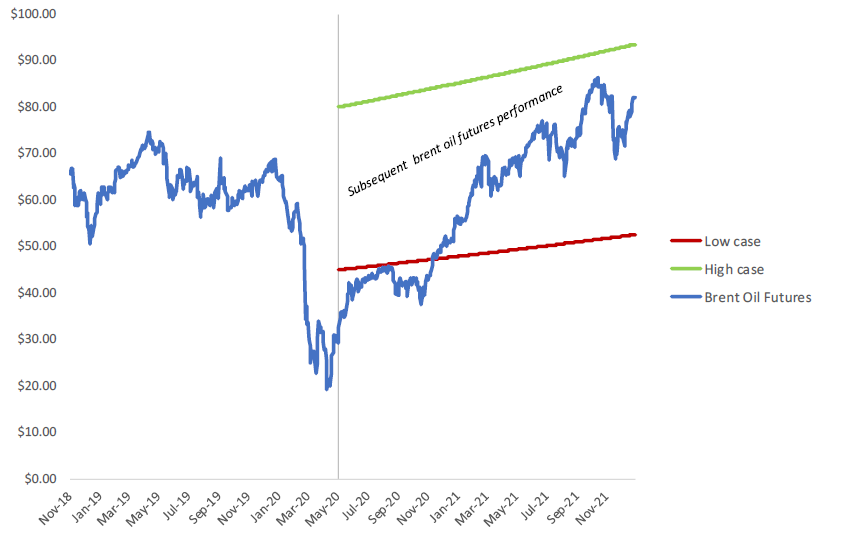

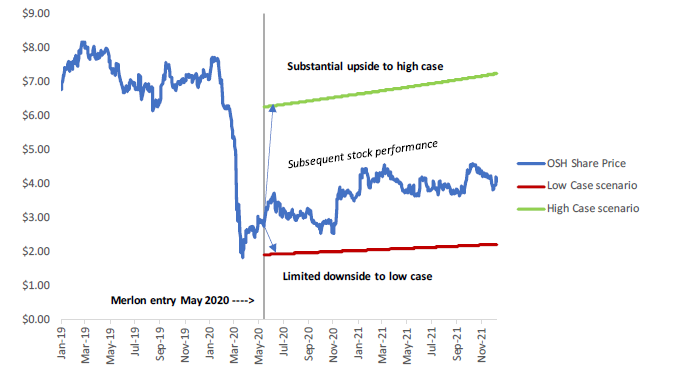

Our fundamental assessment was that supply rationalization and a return to pre-COVID demand was a more likely situation than the alternative, and hence more supportive of the high case argument. Conversely, market estimates were in the range of $40 to $65 /bbl at the time, likely a short-sighted anchoring to recent levels. The Merlon high case of $80 seemed ludicrous by most forecaster's standards. Yet, oil futures hit $80 in November of the following year. Figure 2: WTI Brent Oil Futures and Merlon High/Low range

Source: Bloomberg, Merlon Capital PartnersApplying our range of oil price assumptions yielded the valuation sensitivity of Oil Search for our high/low oil price. With substantial upside to the high case compared to a more limited low case downside, this represented a very attractive risk/reward skew. Having a range allowed us to remain acutely aware of the downside risk as the stock price changed and new information came to light. Figure 3: Oil Search Share Price and Merlon High/Low range

Source: Bloomberg, Merlon Capital PartnersBehavioural pitfallsPart of our investing philosophy is a healthy skepticism of popular opinion coupled with an awareness of our possible misjudgment and human bias. Here are two biases that we observe to be particularly pervasive in equity markets today and where we are vigilant in avoiding. 1. Recency bias. Recency bias favours recent events over historic ones. Like many living with COVID over the past two years, we commonly hear that certain trends are here to stay: Zoom business meetings, working from home, higher in-home consumption, a shift from urban centres to coastal or regional living. While we consider the possibility some of these may be permanent, we are cautious on extrapolating near-term conditions too far into the future. Notably, we saw the recency bias play out in the oil market as forecasts anchored too heavily on COVID conditions. There was little allowance in the market for oil prices to rise above $60 which led to the outsized returns when it did (and to the detriment of those who avoided oil). 2. Overconfidence and Narrow ranges. In Nicholas Taleb's book "The Black Swan" he highlights a study, where students were asked to estimate "how many Redwoods are in Redwood Park, California?" Students would respond with a range between two numbers in which they were 98% confident the answer fell into. 45% of respondents failed. They had used a range that was too narrow due to overconfidence in their ability. These students were the cream of the crop Harvard MBAs. Our human inclination is to narrow our ranges as we gain more knowledge. The more "expert" we become, the higher our tendency to overstate our abilities, and in turn our ability to forecast. And our propensity to become arrogant can blind us to risks beyond our ability to incorporate them. In December 2019, we made public a letter to the Caltex board of directors, alongside our valuation range of $20 to $40 for Caltex, in support of the Alimentation Couche-Tard proposal to acquire for Caltex for $38 including the value of franking credits. The board rejected the offer and the chairman noted our valuation range was too wide. Less than 3 months later the shares traded at $20, triggered by the pandemic, and are currently trading at $30 more than 2 years later. The Merlon ProcessWe utilise a broad scope of possibilities when evaluating companies because it is often the improbable and unpredictable that generates above market returns. It acts to limit our overconfidence in our central case and reflect on what else might go right or wrong.

To our clients and prospective clients, it can be difficult to admit that we may not know how the future might unfold. Will COVID be permanent? How will we be using the internet in the future? Will interest rates return to higher, more normal, levels? In this regard we are more aligned with John Maynard Keynes' view that "it is better to be approximately right than precisely wrong". Two years into COVID-19 the future is no less clear than when we started. This does not mean we fly blindly but rather undertake deep fundamental research to prepare for the possible outcomes. By factoring in best- and worst-case scenarios and being humbly introspective in our forecasting ability, we strive to tilt the odds in our favour. Written By Joey Mui, Analyst/Portfolio Manager |

|

Funds operated by this manager: Merlon Australian Share Income Fund, Merlon Concentrated Australian Share Fund This material has been prepared by Merlon Capital Partners Pty Ltd ABN 94 140 833 683, AFSL 343 753 (Merlon), the investment manager of the Merlon Australian Share Income Fund and the Merlon Concentrated Australian Share Fund (Funds). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed. |

4 Feb 2022 - Y2021 - The Year in Quotes

|

CY2021 - The Year in Quotes Equitable Investors 23 January 2022

It didn't start out this way intentionally but at Equitable Investors we have developed a habit of kicking off each monthly update of the Dragonfly Fund with a quote that resonated or was reflective of that point in time. We find wisdom, common sense and inspiration in many places - not just in the words of the investment greats. From Ron Barron to ron Barassi, the words we drew on for the 12 months of calendar 2021 follow.

January 2021 "Stocks that have a well-recognised brand, or a well recognised story have seen unprecedented buying relative to the rest of the market... this leaves an opportunity for investors that are willing to go the extra mile in researching stocks." ― Fabiana Fedeli, Fundamental Equities Outlook Q1 2021, Robeco February 2021 "We should be careful to get out of an experience only the wisdom that is in it and stop there lest we be like the cat that sits down on a hot stove lid. She will never sit down on a hot stove lid again and that is well but also she will never sit down on a cold one anymore" ― Mark Twain March 2021 "To make money in stocks you must have "the vision to see them, the courage to buy them and the patience to hold them. Patience is the rarest of the three." ― Thomas Phelps, 100 to 1 in the Stock Market April 2021 "The game of life is a lot like football. You have to tackle your problems, block your fears, and score your points when you get the opportunities." ― Lewis Grizzard, Don't Sit Under The Grits Tree With Anyone Else But Me May 2021 "We're guessing at our future opportunity cost... But if we knew interest rates would stay at 1%, we'd change. Our hurdles reflect our estimate of future opportunity costs." ― Charlie Munger June 2021 "There are pockets of what look like appreciable over-valuation and pockets of significant undervaluation... we can find plenty of names to fill our portfolios" ― Bill Miller, Miller Value Partners July 2021 "Those explorations required skepticism and imagination both. Imagination will often carry us to worlds that never were. But without it, we go nowhere. Skepticism enables us to distinguish fancy from fact, to test our speculations." ― Carl Sagan, Cosmos August 2021 "If the Chairman of the Federal Reserve with all the data and tools at his disposal couldn't predict what the 'market' would do, it was unlikely others could either. Which made us focus on investing in well managed, competitively advantaged, growth businesses...not the 'stock market' " ― Baron Funds founder Ron Baron September 2021 "There are two ways you can get yourself revved up - fear of failure and love of success. Personally, I like both things to be working in you, the same as you can win a game at one end of the ground and save it at the other." ― Melbourne Football Club legend Ron Barassi. October 2021 "Many people believe that investors must make the macro decision to be either bullish or bearish. Our preference is to be agnostic, objectively finding absolute bargains... we are neither bullish nor bearish. We are value-ish." ― Baupost Group founder Seth Klarman November 2021 "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves... In trying to time the market to sidestep the bears people often miss out on the chance to run with the bulls." ― former American fund manager Peter Lynch December 2021 "Most market commentary is focused on... 'expiring knowledge'. This is the headline news that fills our screens today, which in five and 10-years' time we will look back on and realise didn't actually mean anything from a long-term investment perceptive." ― Paul Black, WCM Investment Management Funds operated by this manager: |

4 Feb 2022 - Infrastructure Strategy Update

|

Infrastructure Strategy Update Magellan Asset Management January 2022 Portfolio Manager Ofer Karliner, outlines why listed infrastructure and utilities stocks rallied in the fourth quarter, the likely recovery in airport assets, why high carbon scores can be a misleading guide to ESG risks for infrastructure stocks, and why, even if interest rates rise, the infrastructure portfolios still comes with diversification, inflation protection, capital growth and yield benefits if the universe is defined correctly. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund |

4 Feb 2022 - 2022 Outlook: Finding Attractive Income and Lower Duration

|

2022 Outlook: Finding Attractive Income and Lower Duration (Adviser & Wholesale Investors Only) Ares Australia Management 21 December 2021 In the current market environment, investors are faced with the challenge of finding attractive current income solutions that offer protection from rising interest rate risk, particularly as many traditional fixed income strategies (proxy: Bloomberg Barclays Global Agg) have suffered negative monthly returns in recent months. Meanwhile, the potential for bouts of volatility is increasing amid rising inflation concerns. To solve for this conundrum, we seek to unearth investment solutions offering higher yields and diversification for Australian investors within the defensive part of their portfolios, and what we view as the more senior, high quality segments of the corporate debt and alternative credit markets; we call it the "sweet spot" of credit. This encompasses a $5.7 trillion1 opportunity set across U.S. and European loans, corporate bonds, and alternative credit markets. Importantly, we believe a dynamic, flexible approach to investing in the "sweet spot" of credit offers:

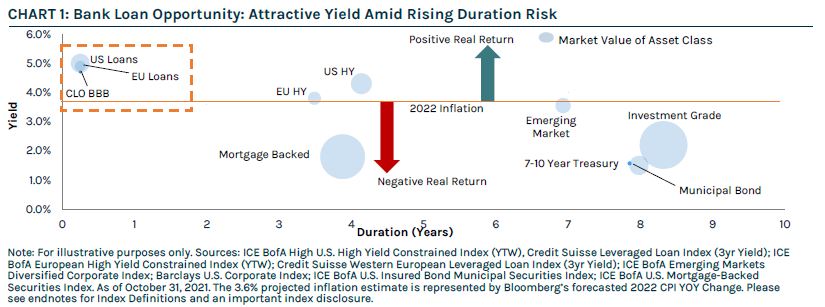

To illustrate the challengses that traditional fixed income investors are facing today, as well as the relative value opportunities available in the corporate debt and alternative credit markets, Chart 1 plots the current yield against interest rate duration for various fixed income asset classes. The size of the bubbles represents the market value of each asset class.

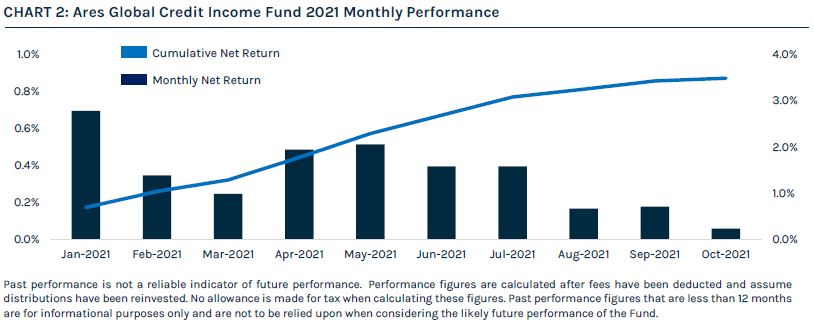

With the outlook of a low default and higher rate environment ahead, we believe certain higher beta, floating rate instruments, specifically bank loans and CLO debt securities, screen attractive from a relative value perspective as they provide high levels of current income and low duration of less than one year. In a rising rate environment, the coupon of floating rate assets adjusts to shifts in short-term interest rates, and as a result, these assets exhibit lower price volatility relative to fixed rated securities. Looking forward, while we anticipate increased price volatility and dispersion in the credit markets as interest rates and inflation remain at the forefront of policy decision making, we view bank loans and CLO debt securities as attractive allocations within fixed income as we expect retail and institutional demand to remain robust. Additionally, we believe valuations will be supported by strong fundamentals and improving credit metrics, low default expectations and robust capital markets. Across our multi-asset credit portfolios, including the Ares Global Credit Income Fund ("AGCIF"), we seek to find the most attractive relative value opportunities in the "sweet spot" of credit in order to deliver higher yields with optimal downside protection and lower volatility. Specific to AGCIF, performance has benefited from tactical asset allocation and credit selection, as illustrated by its annualized since inception net return of 9.2%.2 In addition to weathering varied market environments, we believe AGCIF is particularly well suited to serve a growing appetite for stable incoming-producing strategies among Australian investors as it targets a per annum distribution of 3%-4%. Further, the current ex-ante volatility of AGCIF averages approximately 0.5×2 the volatility of the broader bank loan and high yield bond universe, illustrating our keen focus on downside protection and volatility management. Active allocation has proven paramount in successfully navigating the volatile market environment during 2020 and remains critical to unlocking value, particularly as market conditions evolve heading into the end of 2021 and early 2022. Informed by quantitative analysis and fundamental research, our demonstrated ability to express relative value across the credit markets continues to drive strong and stable monthly performance year-to-date, as illustrated in Chart 2.

In summary, as investors seek attractive income solutions in today's market environment, many may struggle to determine how best to position their credit exposure in order to maximize yield and mitigate risk. By accessing the "sweet spot" of credit, comprised of corporate debt and alternative credit asset classes, we believe investors can overcome these challenges. At Ares, our differentiated approach to capitalizing on the best risk-adjusted return opportunities across the investable universe is rooted in the scale and integration of our Global Liquid and Alternative Credit strategies, which allows us to fully leverage extensive research capabilities, proprietary technologies and longstanding relationships. Written By Teiki Benveniste, Head of Ares Australia Management |

|

Funds operated by this manager: Ares Diversified Credit Fund, Ares Global Credit Income Fund |

3 Feb 2022 - Megatrend in focus: Silver Economy

|

Megatrend in focus: Silver Economy Insync Fund Managers September 2021 Broad trends are quite often easy to identify but what is much harder to do is identify specific industries and companies that are going to economically benefit from these trends and deliver compound annual returns for shareholders over the long term. Genomics or heart disease? A key insight from Insync's work on the ageing population is the projected rate of growth in the 70-75 age bracket. This is the fastest growing five-year age bracket for all people over the age of 55 for the next 15 years and beyond. The proportion of people of this age that develop heart related issues are astronomical.

The heart is a highly focused organ. It has just one job to do, and it does it supremely well. It beats. Slightly more than once every second; that's 100,000 times a day and as many as three and a half billion times in a lifetime. It rhythmically pulses to push blood through your body and recycle it. And these aren't gentle thrusts, they are jolts powerful enough to send blood spurting up to three meters if the aorta is severed.

In comparison to surgical procedures, TAVR has a higher survival rate (99%), lower rate of stroke, bleeding, and other complications. General anaesthesia is not necessary in the procedure and most patients leave after just an overnight stay. This provides a significant cost saving as hospital surgery, anaesthesia and costs of stay are significant burdens to healthcare systems.

Like many new and exciting technologies, it has taken time. Over 15 years in fact, for the market to start adopting TAVR to a level where the companies pioneering the technology become highly profitable and industry leaders.

Many healthcare and innovation investors have focused on genomics and gene editing. After all, it's emerging and exciting- the possibilities are immense. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund |

2 Feb 2022 - How high can government debt-to-GDP ratios soar?

|

How high can government debt-to-GDP ratios soar? Magellan Asset Management January 2022 The 'IMF crisis' is judged the worst event to have hit South Korea since the civil war of 1950-53. The rest of the world knows this financial upheaval as the 'Asia crisis' of 1997. The mismatch is because South Koreans, perhaps ungratefully, focus on the damage after the International Monetary Fund bailed out a country tormented by a currency-turned-banking crisis.[1] The then-record IMF package of US$58 billion dollars was laced with conditions. One was austerity. As government support shrank, South Korea's economy shrivelled 5.1% in 1998 while the jobless rate sprang to 7.0% from 2.1% pre-crisis (1996).[2] The contraction, however, was fleeting. South Korea's economy rebounded in 1999 (expanding 11.9%) and grew every year until the covid-19 pandemic struck in 2020. The jobless rate fell to 3.3% by 2002 and has been 3.something% ever since. Yet the crisis scarred South Koreans. Even though (at 10% of GDP in 1997) public borrowing provided no fuel for the upheaval, one legacy was a consensus that Seoul must not let gross government debt exceed 40% of output.[3] No longer. The government of President Moon Jae-in in August announced a budget for 2022 that vowed to use fiscal stimulus to counter the damage of the pandemic and, more broadly, fight poverty and inequality. Government spending is forecast to expand 8.3% in 2022. Public debt is expected to climb to 50.2% of GDP by next year and reach 59% by 2025, from 36% of output when Moon took office in 2017.[4] And why not let government borrowing rip? Does anyone care that government debt-to-GDP ratios (however imperfectly measured) are higher than seemed possible because interest rates are so low? US government debt is now at 103% of GDP.[5] Eurozone public debt is at a near-record 98.3% of output (where the record is 100.0%). France (114%), Greece (207%) Spain (123%), Italy (156%) and Portugal (135%) make a mockery of the suspended legal limit of 60%; even zero-deficit-by-law-pandemic-excepted Germany (70%) exceeds the legal ceiling.[6] While Australia's federal debt is only headed to 50% of GDP by 2025,[7] Japan's public debt stands at an astonishing 257% of GDP. Public debt in emerging markets extends to a record 64% of output. Brazil (91%), China (69%) and India (91%) exceed the average as do Latin American countries overall (73%). The IMF estimates 'general' government debt now reaches a record 99% of global output, from 83% in 2016.[8] An overarching question, especially when governments are relying on fiscal policy to fight this pandemic and linked economic crisis, is: At what level might public debt become disruptive? A debt crisis would erupt if investors assessed any country were unable to meet its debt repayments. They would baulk at buying, even holding, its bonds. Bond yields would soar, adding to the debt burden, while the country's currency would plunge, which is damaging if debts are denominated in foreign currencies. History is replete with examples of when excessive debt triggered a crisis, from an inflationary economic collapse to endless stagnation ('Japanification'). The role excessive debt played in the fall of the Ottoman and British empires shows it comes with global political implications. So, too, does China's 'debt-trap diplomacy' (that echoes US meddling in Latin America) where Beijing gains sway over emerging countries by giving them loans they can't repay. Governments have three standard ways to tackle their debt burdens. (A fourth would be asset sales, a fifth, conquest and a sixth, reparations.) The first conventional cure is to raise taxes and reduce spending. The UK in September became the first major country to raise taxes to cover covid-19 debt when it lifted payroll taxes.[9] More countries will follow. The handbrake here is that austerity is often politically fraught and can undermine economies so much it might backfire - such an outcome occurs if an economic contraction worsens debt ratios. A second, and the most appealing, option is to ensure economies flourish in a way that erodes real debt burdens over time - this is how the winners reduced their bills after World War II. The formula is to ensure nominal output (GDP unadjusted for inflation) grows at a higher rate than the average interest rate on public debt - a historic norm.[10] A variation on this recipe is that debts will be manageable if inflation-adjusted interest repayments stay below 2% of GDP for the foreseeable future.[11] Over the pandemic, these formulas were met because interest rates were around record lows partly due to central-bank asset purchases.[12] A repeat of the post-World War II drawdown - Washington's debt fell from a record 106.1% of GDP in 1946 to 23% of output in 1974[13] - will be hard because back then pent-up demand, low regulation, favourable demographics and free trade drove economies, huge multi-decade-long advantages that no longer prevail. Still, within this option, governments can choose to allow some inflation and supress interest rates. The benefit of this approach is that rising nominal GDP growth offers governments tax windfalls via higher nominal business profits and by pushing individuals into higher tax brackets. Post-war governments practised 'financial repression' to prevent market forces setting the price of money. But capital controls, fixed-exchange rates, curbed bank lending and ceilings on interest rates would entail a U-turn from the liberalised bent of the past four decades. Low rates would only encourage companies and consumers to add to their record debt loads that come primed with risks too. Permitting inflation is tricky. Officials might lose control of prices if they print too much money and 'debase the coinage' because that comes with economic and political problems.[14] Interest rates would rise if inflation were to accelerate in a durable way, which hampers economies and adds to repayment burdens. Governments would be tempted to pressure central banks not to raise rates, as US presidents Lyndon Johnson and Richard Nixon did to help pay for the Vietnam war. But that would demolish central-bank independence to fight inflation, perhaps the economic policy most responsible for recent prosperity. The other option is to default (and any 'restructuring' is technically a default). When it comes to advanced countries, Japan's debt ratio shows countries with national currencies can rely on their central banks to stave off default for a long time. But, while no defaults in such advanced countries are imminent (now that a fight over the US debt ceiling has been settled for another 12 months), their governments can't boost debt forever. Pressure will mount for authorities to control debt ratios to stop ratings downgrades, perhaps even engage in accounting tricks. Central banks could do this by cancelling the government debt they have bought under quantitative-easing programs.[15] Treasury departments could print trillion-dollar coins.[16] Eurozone governments with high debt ratios are more vulnerable to default because they lack their own currencies. Yet any default could bring down the European Monetary System. More crises around Greece, Italy and perhaps eventually France and Spain that threaten mayhem are likely, especially if bond yields rise after the European Central Bank stops its asset buying. Emerging countries, which are inherently less stable economically and politically, are most likely to default. The candidates are many - the IMF in December estimated that 60% of low-income countries are at "high risk or already in debt distress" compared with 30% in 2015.[17] Emerging countries that have borrowed in foreign currency (a diminishing percentage) and ones that have borrowed from foreigners rather than locals are the most at risk. For indebted advanced and emerging countries, a world of record government debt could soon enough be a realm of hard choices and one of sporadic crises. As the debt status quo appears unsustainable, any rise in US interest rates will signal trouble ahead. To be clear, government debt proved its worth during the pandemic and there's nothing risky with it per se especially when governments borrow in local currency from locals. Sovereign bonds are a useful financial asset that institutions hold for regulatory reasons. Debt allows governments to spread the cost of capital goods across time. A desire to sell debt forces countries to be creditworthy. Debt is a Keynesian tool for managing the economy. The flaw here, however, is that few governments post budget surpluses and debt must be repaid sometime. As Japan shows, debt-to-GDP ratios can climb far higher than thought possible without any obvious damage to an economy. It's true too that few indebted governments are struggling to sell debt at low rates. But, at some point, rising debt would trigger steeper borrowing costs and puncture the complacency that public debts are manageable because interest rates are low. History shows that public debt ushers in its nemesis; higher interest rates. That reckoning one indeterminant day likely means a harsher, poorer, perhaps crisis-prone future awaits. The likely trouble spots On November 30, Federal Reserve Chair Jerome Powell said the central bank's asset-buying program might end "a few months earlier" than its scheduled finish in mid-2022 and that it was "probably a good time to retire that word" [transitory] when describing faster inflation.[18] A report two weeks later showed US consumer prices rose 6.8% in the 12 months to November, the most since 1982. On January 5, by when the Fed had halved its pandemic asset buying to US$60 billion a month, minutes from the Fed's policy-setting meeting showed the central bank was thinking of raising the US cash rate "sooner or at a faster pace" than expected.[19] In Europe on January 7, a report showed eurozone inflation reached 5% in 2021. This fresh record high for the euro area flags the end of the European Central Bank's ultra-loose monetary policy that includes ample purchases of government debt. If the ECB trims, even slashes, its bond purchases, the eurozone's indebted countries will have lost their 'lender of last resort', a term that describes the emergency role that governments can play in countries with bespoke currencies and central banks. By acting as a buyer of its own debt in the absence of other buyers, governments can ensure they won't default on their obligations - though they generally can't avoid an economic crisis as severe as if they had reneged on their repayments. When the ECB reduces, even ends, its asset buying, global bond investors are likely to reprice eurozone sovereign debts according to a country's theoretical ability to repay. 'Lo spread' as the Italians dub the premium on Italian government debt over German bunds, to cite just one example, could well rise to troubling levels. The euro's lack of a supportive fiscal, banking and political union could inevitably lead to more debt crises and bailouts aka those of the 2010s that cast doubt on the single currency's viability. Whatever is happening in the eurozone, emerging markets are likely to more threatened by what the Fed does to global interest rates and what that might mean for the value of the US dollar. A worry is that in 2019 the IMF and World Bank assessed the world's emerging countries were already "at high risk of or already in debt distress" at the end of 2019.[20] Now average gross government debt in emerging markets is up by almost 10 percentage points since 2019 (with large variations around that average).[21] Emerging countries were vulnerable to a financial crisis pre-pandemic because many turned (once again) to borrowing after the global financial crisis. The debts of the 111 low- and middle-income countries more than doubled from US$600 billion in 2008 to US$1.3 trillion by 2018. Over the 10 years, interest plus principal repayments jumped from US$47 billion to US $117 billion.[22] Some worried that the sporadic debt holidays of 2020 - a reneging on debt repayments - could undermine trust in emerging countries and boost risk premiums on their bonds. But, even if continued, they are unlikely to be enough to prevent more developing countries defaulting - Zambia in November 2020 became the first country to default post covid-19.[23] The worry is that emerging countries are inherently riskier investments. They typically have unstable political systems and poor institutions, ones that lack capable and trustworthy bureaucracies. Governments struggle to raise adequate tax revenues, which is why they turn to borrowing. Public finances are often murky. Rule of law is sporadic. The judiciary lacks independence. The media is hobbled. Many rulers have usurped power or have gamed the democratic process to cement their rule. Their subjects identify more with tribal, religious, ethnic or cultural groups than with countries created by colonial powers that lack national unity. The poor institutions, murky politics and tribal allegiances allow corruption to thrive. Economic risks include that emerging countries often rely on a few primary exports. They are thus vulnerable to a drop in the prices of the commodities that earn their foreign exchange. Many are net food importers and their local produce is vulnerable to harsh weather (climate change). While emerging governments these days borrow more in local currency, they are still reliant to a large extent on foreign investors buying their bonds. Default risks are heightened if the investments are short term, thereby requiring constant debt renewal at inauspicious times. It's true that emerging countries, which typically posted higher growth rates than advanced ones, have taken steps to boost their financial stability that averted financial catastrophes at the start of the pandemic. They have built up foreign reserves in recent times to protect their currency regimes. Their central banks are prepared to engage in unconventional steps such as quantitative easing to protect government debt. In March and April last year, for instance, central banks of 14 emerging countries including those of India, Indonesia and Mexico announced bond-buying programs.[24] But many emerging countries have been hard hit by covid-19 in terms of deaths and lost income, especially from absent tourists. Policymakers are aware emerging countries are at risk, especially that their debts tie their fate to rich world monetary policies.[25] Yet the world lacks a global rules-based system for managing such default shocks, something the policymakers at the IMF and UN have investigated without solving.[26] If a government defaults now, only the parties involved sort out an agreement under New York or English law that may involve write-offs, loan extensions, grace periods and rate reductions, even if the negotiations are supervised by the IMF, which is conflicted if it's a creditor. Such an ad-hoc system (compared with US court-overseen corporate or municipal defaults) favours developed over emerging countries and rarely resets a country's financial position onto a sustainable path. The typical result is a country doomed to sporadic crises and economic devastation. Greece's torment of the 2010s, when it underwent three bailouts, serves as a prime example of how a country becomes an investor pariah. Argentina's nine defaults since 1827 offers another.[27] But not industrialised and OECD-belonging South Korea, even if the people there still wince at the acronym, IMF. Written By Michael Collins, Investment Specialist |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund [1] See 'The 1997-98 Korean financial crisis: causes, policy response and lessons.' Speech by Kim Kihwan, Chair of the Seoul Finance Forum, International Advisor to Goldman Sachs and Chair of the Korea National Committee for the Pacific Economic Cooperation Council, at the High-Level Seminar on Crisis Prevention in Emerging Markets organised by the IMF and the government of Singapore. 2006. imf.org/external/np/seminars/eng/2006/cpem/pdf/kihwan.pdf [2] IMF figures for Korea's economy from the World Economic Outlook Database. October 2021. The IMF's definition of gross debt consists of all liabilities that require payment or payments of interest to a creditor at some future point. [3] IMF estimates, the fairest international comparison, even if lagged, place Korean general government at just above 40% since 2015 and score it at a peak of 42% of GDP in 2019. [4] Reuters. 'South Korea drafts aggressive spending plan for 2022, taking government debt to 50% of GDP.' 31 August 2021. reuters.com/world/asia-pacific/skorea-drafts-aggressive-spending-plan-2022-taking-debt-50-gdp-2021-08-31/ [5] Congressional Budget Office. 'An update to the budget and economic outlook: 2021 to 2031.' 1 July 2021. cbo.gov/publication/57218. Within 10 years, half Washington's forecasted budget deficit is expected to go on debt repayments. See Congressional Budget Office. Presentation. 'An overview of the 2021 long-term budget outlook.' 20 May 2021. cbo.gov/publication/57189 [6] Figures as at 30 June 2021, where the eurozone debt record was set on 31 March 2021. Eurostat release. 'Government debt down to 98.3% of GDP in euro area.' 22 October 2021. ec.europa.eu/eurostat/documents/2995521/11563335/2-22102021-AP-EN.pdf/4bc91cb6-b073-d8c8-349d-18aa2bcd2b91 [7] Parliament of Australia. Budget review 2021-22. 'Commonwealth debt.' Net debt is projected to reach 41% of output by 2025. aph.gov.au/About_Parliament/Parliamentary_Departments/Parliamentary_Library/pubs/rp/BudgetReview202122/CommonwealthDebt [8] IMF 'Fiscal monitor.' October 2021. See Table 1.2 'General government debt, 2016-26.' Chapter 1. Page 9. Record for emerging markets can be confirmed from the World Economic Outlook Database. October 2021 (op cit). imf.org/en/Publications/FM/Issues/2021/10/13/fiscal-monitor-october-2021 [9] BBC. 'Boris Johnson outlines new 1.25% health and social care tax to pay for reforms.' 7 September 2021. bbc.com/news/uk-politics-58476632 [10] See Olivier Blanchard. 'Public debt and low interest rates.' Working paper 19-4. February 2019. piie.com/publications/working-papers/public-debt-and-low-interest-rates. He responds to criticism of the paper here: 'Why critics of a more relaxed attitude on public debt are wrong.' 15 July 2019. piie.com/blogs/realtime-economic-issues-watch/why-critics-more-relaxed-attitude-public-debt-are-wrong [11] See Jason Furman and Lawrence Summers. 'A reconsideration of fiscal policy in the era of low interest rates.' Discussion draft. 30 November 2020. brookings.edu/wp-content/uploads/2020/11/furman-summers-fiscal-reconsideration-discussion-draft.pdf [12] IMF. 'Fiscal monitor.' October 2021. Chapter 2. 'Strengthening the credibility of public finances.' Page 17. imf.org/en/Publications/FM/Issues/2021/10/13/fiscal-monitor-october-2021 [13] Congressional Budget Office. 'Federal debt: A primer.' See 'Data underlying figures.' 12 March 2020. [14] Higher prices impede economies through 'menu' or mark-up costs, the 'shoe leather' cost as shoppers search for lower prices, relative price distortions and tax distortions against savings income and 'bracket creep' on wages. Inflation redistributes wealth from creditors to debtors, from people of fixed incomes to those on flexible (indexed) incomes, from consumers to producers. Profiteers tend to flourish along with populists. [15] See Mark Dowding. 'BlueBay CIO: It's time to think about debt cancellation.' 4 January 2021. ft.com/content/dffca01a-173a-4d68-bc68-9af9045e712e [16] See ABC News (US). 'Is minting a $1 trillion platinum coin the answer to the debt limit crisis?' 8 October 2021. abcnews.go.com/Politics/minting-trillion-platinum-coin-answer-debt-limit-crisis/story [17] IMF Blog. 'The G20 common framework for debt treatments must be stepped up.' 2 December 2021. blogs.imf.org/2021/12/02/the-g20-common-framework-for-debt-treatments-must-be-stepped-up/ [18] Bloomberg News. 'Powell weighs earlier end to bond tapering amid hot inflation.' 30 November 2021. bloomberg.com/news/articles/2021-11-30/powell-says-appopriate-to-weigh-earlier-end-to-bond-buy-tapering?sref=ORbm2mFs [19] Federal Reserve. 'Minutes of the Federal Open Market Committee. 14 to 15 December 2021.' 5 January 2022. federalreserve.gov/monetarypolicy/fomcminutes20211215.htm [20] International Development Association, IMF. 'The evolution of public debt vulnerabilities in lower income countries.' 2 January 2020. Page 2. documents1.worldbank.org/curated/en/695971579921244762/pdf/The-Evolution-of-Public-Debt-Vulnerabilities-in-Lower-Income-Economies.pdf [21] IMFBlog. 'Emerging economies must prepare for Fed policy tightening.' 10 January 2022. blogs.imf.org/2022/01/10/emerging-economies-must-prepare-for-fed-policy-tightening/ [22] Centre for Economic Policy Research. 'Averting catastrophic debt crises in developing country extraordinary challenges calls for extraordinary measures.' CEPR Policy Insight No 104. July 2020. cepr.org/active/publications/policy_insights/viewpi.php?pino=104 [23] Geopolitical Monitor. 'Zambia becomes first post-covid debt default.' 17 November 2020. geopoliticalmonitor.com/zambia-becomes-first-post-covid-debt-default/. Most sovereign bond contracts do not include automatic force majeure protection that allows contracts to be broken due to unforeseen circumstances such as a pandemic. [24] Adam Tooze. 'Shutdown. How covid shook the world's economy.' Allen Lane. 2021. Page 164. [25] To reduce the risk, many partial solutions are offered to avoid steep defaults. US economist Joseph Stiglitz, for instance, argues for mechanisms such as 'voluntary sovereign-debt buybacks' that proved effective in Latin America in the 1990s and during the Greek crises of the 2010s. "They have the advantage of avoiding the harsh terms that typically come with debt swaps," Stiglitz argues. A buyback program under IMF oversight would aim to reduce debt burdens by securing significant discounts on the face value of sovereign bonds and by minimising exposure to risky private creditors, Stiglitz says. Such programs could advance health, climate and other goals by requiring that beneficiary governments spend the money that otherwise would have gone to debt service on creating public goods. See Centre for Economic Policy Research. Op cit. [26] See IMFBlog. 'Time is ripe for innovation in the world of sovereign debt restructuring.' 19 November 2020. blogs.imf.org/2020/11/19/time-is-ripe-for-innovation-in-the-world-of-sovereign-debt-restructuring/. See also United Nations. 'The commission of experts of the president of the UN General Assembly on reforms of the international monetary and financial system.' 2009. un.org/en/ga/president/63/pdf/calendar/20090325-economiccrisis-commission.pdf [27] Bloomberg. 'One country, nine defaults: Argentina is caught in a vicious cycle.' 11 September 2019. bloomberg.com/news/photo-essays/2019-09-11/one-country-eight-defaults-the-argentine-debacles Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |