NEWS

13 Oct 2023 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

12 Oct 2023 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

12 Oct 2023 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

12 Oct 2023 - Ferrari: The case for RACE (RACE IM)

|

Ferrari: The case for RACE (RACE IM) Alphinity Investment Management September 2023 Ferrari is one of the world's most iconic brands. It's also an amazing stock. Ferrari was founded in Italy in the 1940s and was spun off from Stellantis in 2016 under the ticker RACE IM.

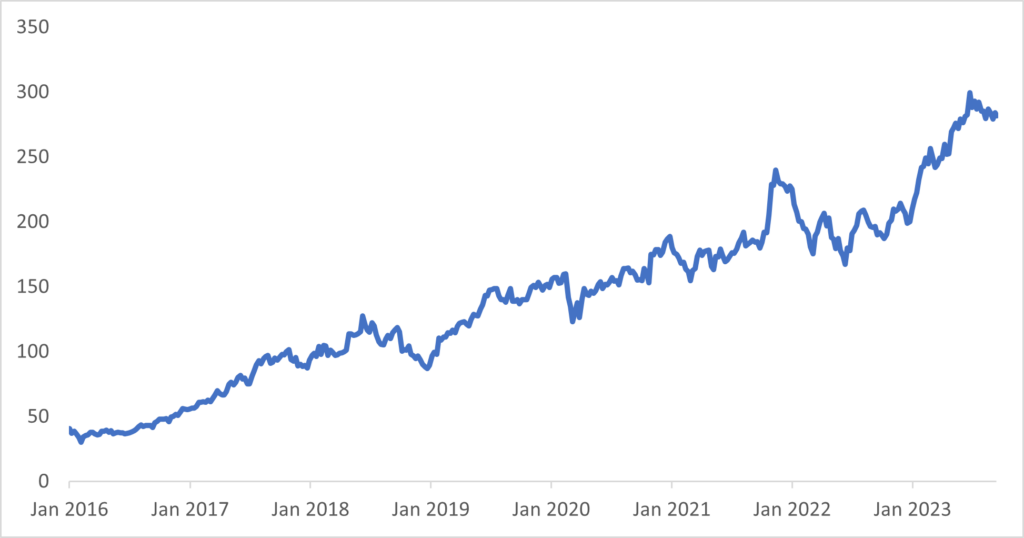

The IPO price was EUR43 and Ferrari is currently trading at ~EUR300 for a 600% return since listing. The analysis below outlines the Case for RACE and highlights 4 main reasons to why we love the stock. RACE Stock Price Since Listing in 2016

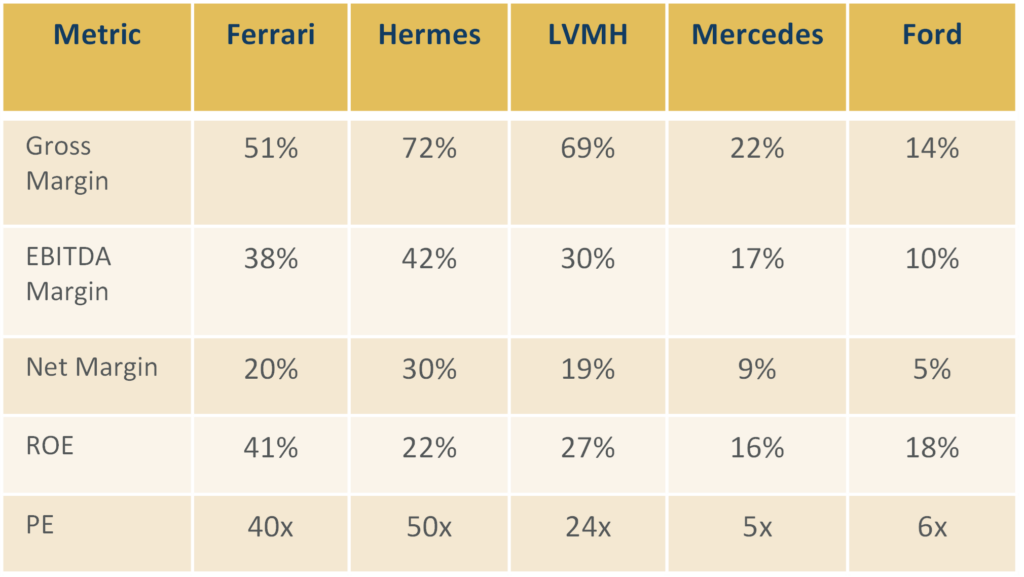

Reason #1: High margin, high return, high growth business

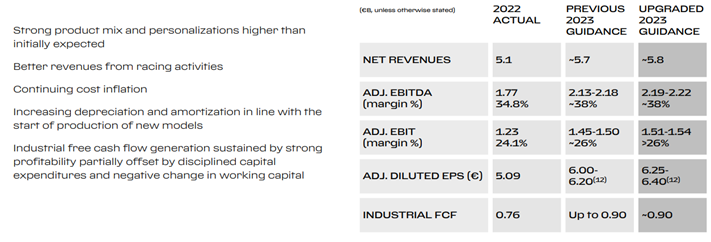

Point #2: A+ industry structure leads to earnings visibility and upgrades From this perspective, Ferrari is literally the textbook case of an A+ company. They are a heritage brand with incredibly high barriers to entry, they have few competitors, few substitutes, price insensitive customers with very little bargaining power, and a supply chain that is localised and very difficult to replicate. The net result is that Ferrari has an immense level of control over its own earnings and strong earnings visibility. Management upgraded its FY23 revenue guidance, adjusted EBIT margin guidance as well as adjusted EPS and FCF estimates at the last result. More importantly, this upgrade cycle is a consistent pattern shown by RACE management since listing.

Reason #3: Impressive Brand Recognition and Unique Positioning Among Auto Peers Ferrari is refreshingly contrarian on both these fronts. Ferrari management has made a strong commitment NOT to get into autonomous driving (AD). The whole point of buying a Ferrari is to drive it yourself! While Ferrari is a leader in hybrids with approximately 45% of deliveries already in the hybrid space, it's first fully electric car will not be presented until 2025 with the first deliveries the following year. They do not expect pure EVs to be more than 5% of total shipments by 2026. Part of this is strategic positioning that one of the great joys (so I am told) of owning a Ferrari is the vrooooom, sound it makes when you start the ICE engine. EVs don't vroom so Ferrari plans to continue to develop ICE engines into the 2030s. Reason #4: Technological leader Investment Risks Conclusion |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

11 Oct 2023 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

11 Oct 2023 - Performance Report: Collins St Value Fund

[Current Manager Report if available]

11 Oct 2023 - Who will benefit from the energy transition?

|

Who will benefit from the energy transition? Magellan Asset Management September 2023 |

|

Net Zero is not a new ambition for governments and companies, with some sectors like utilities focused on this climate risk for quite some time now. David Costello, CFA, Portfolio Manager - Energy Transition Strategy discusses the opportunities we see from the energy transition and companies that may benefit from this transition. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

10 Oct 2023 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

10 Oct 2023 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

10 Oct 2023 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]