NEWS

25 Feb 2022 - Big opportunities for small cap investors in IPOs and secondary placements

|

Big opportunities for small cap investors in IPOs and secondary placements Firetrail Investments January 2022

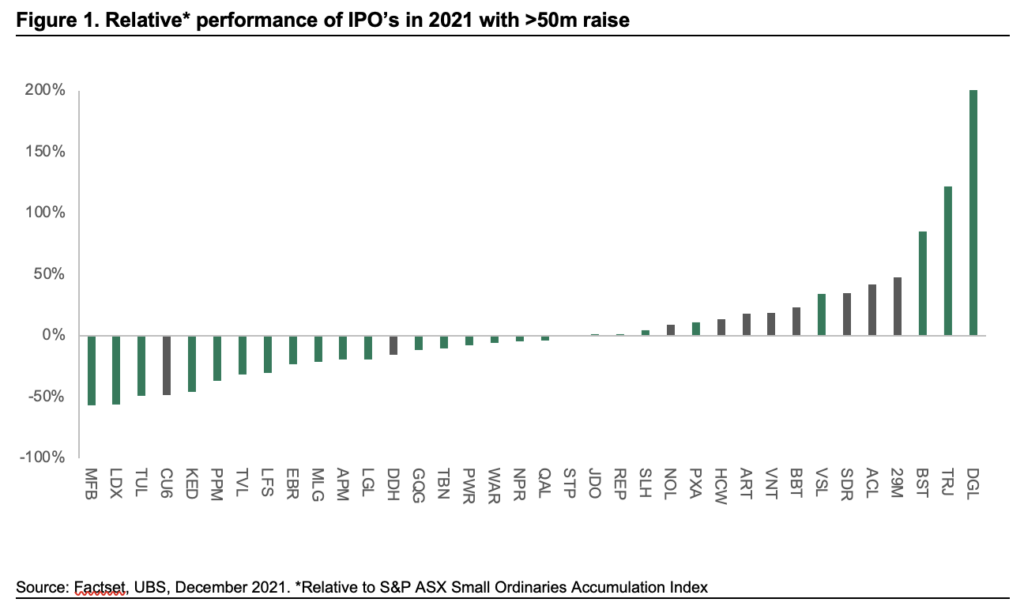

2021 was an exciting year for initial public offerings (IPOs) and placements. 55 companies with an offer price greater than A$20 million made their debut on the ASX during the year. Up a staggering 62% from the year before! Secondary placements experienced a more modest increase, up 6% from 2020. Most equity capital market (ECM) activity took place in the small cap end of the market. Providing a material opportunity for institutional small cap managers like Firetrail to add value for their investors. In this article, we analyse the success of small cap IPOs and placements in 2021, provide key takeaways for investors, and what to expect in capital markets in 2022. We conclude that corporate activity will remain elevated in small companies throughout 2022. Creating meaningful opportunities for investment managers willing to do the work to identify the best opportunities. IPOs and placements outperformed in 2021It wasn't just the sheer number of IPOs and placements that broke records in 2021. Together, new ASX-listings raised a total of A$12 billion! Among them were a record number of billion-dollar floats, such as APM, SiteMinder and PEXA. On the first day of trading, these IPO companies outperformed the market by an average of 20%. However, we did see this outperformance moderate by the end of the year. We saw the inverse occur in the market for secondary offerings. Average day one performance hovered around 10.1%. While calendar year performance rose to 15.4%! The total amount raised by secondary offers was A$37.7 billion. But that doesn't seem like an accurate reflection of performance from a market perspective. Careful stock selection is criticalIf we adjust for the size of the raise, the story changes. We see big declines for first day and calendar year performance for both IPOs and secondary placements. Suggesting that the relative performance is skewed by a handful of big winners. In the IPO space, performance was dominated by a few key players. DGL, a chemical manufacturing and storage group, and Trajan, an analytical science and devices company, experienced greater than 100% returns in the calendar year. To account for this asymmetry, we took the median performance for the calendar year. The median return for IPO stocks was just -4%. Providing a more accurate reflection of capital market performance. Clearly, an ability to pick winners is key to harnessing value from corporate activity. The chart below compares the relative performance of IPOs that raised more than $50 million. While average performance was strong, there were more losers than winners. Through deep fundamental analysis, Firetrail were able to pick the winners this year. The median return from our IPO participation was 18% for the 2021 calendar year (shaded in grey in Figure 1).

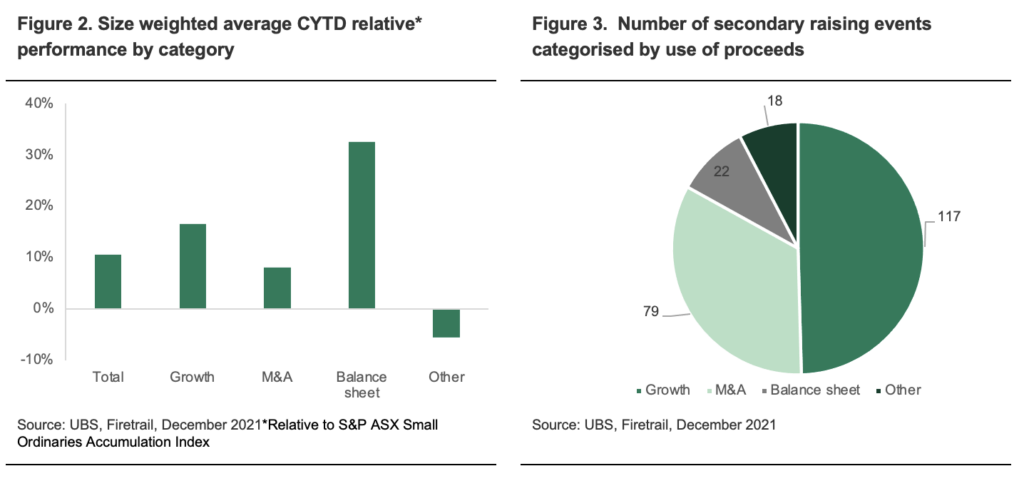

The best returning secondary issuances were in companies in need of balance sheet repair. The average placement in this category delivered 33% excess. In many instances we observed that the 'raise' was already priced in by the market. Hence recapitalisation was the catalyst to refocus the market on business fundamentals. The market also rewarded companies raising capital to grow organically far more than M&A. Raisings for growth dominated the market (Figure 3). In contrast, there were few M&A bargains in 2021 due to intense competition for assets. Many companies were willing to pay listed multiples for strategic acquisitions.

Opportunities will remain elevated in small caps in 2022ECM events are a consistent source of opportunity and strong returns for small cap investors. Access to these opportunities is key, and the Firetrail team have a strong track record of leveraging our corporate relationships and fundamental expertise to access attractive corporate opportunities for our investors. Since the inception of the Firetrail Team's Small Companies strategy in 1998, previously the Macquarie Australian Small Companies Fund, these events have contributed an average 20% of the total excess returns, or ~3% p.a. Looking ahead to 2022, low interest rates and high valuations will continue to encourage companies to raise capital. We expect ECM activity to remain elevated and to continue delivering material opportunities for small cap investors like Firetrail. Conclusion2021 was a year of frantic ECM activity and we see no sign of this abating as we move through 2022. As small cap investors, we are excited by the opportunity and potential returns offered by IPOs and secondary placements in the coming year. Our experience shows that meaningful returns are out there if managers are willing to do the work to find them! Funds operated by this manager: Firetrail Absolute Return Fund, Firetrail Australian High Conviction Fund Disclaimer This article is prepared by Firetrail Investments Pty Limited ('Firetrail') ABN 98 622 377 913 AFSL 516821 as the investment manager of the Firetrail Australian Small Companies Fund ARSN 638 792 113 ('the Fund'). This communication is for general information only. It is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. It has been prepared without taking account of any person's objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so. Past performance is for illustrative purposes only and is not indicative of future performance. Pinnacle Fund Services Limited ABN 29 082 494 362 AFSL 238371 ('PFSL') is the product issuer of the Fund. PFSL is a wholly-owned subsidiary of the Pinnacle Investment Management Group Limited ('Pinnacle') ABN 22 100 325 184. The Product Disclosure Statement ('PDS') and the Target Market Determination ('TMD') of the Fund is available at www.firetrail.com. Any potential investor should consider the PDS before deciding whether to acquire, or continue to hold units in, the Fund. Whilst Firetrail, PFSL and Pinnacle believe the information contained in this communication is reliable, no warranty is given as to its accuracy, reliability or completeness and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the relevant laws, Firetrail, PFSL and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. This disclaimer extends to any entity that may distribute this communication. The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of Firetrail and its investment activities; its use is restricted accordingly. All such information should be maintained in a strictly confidential manner. Any opinions and forecasts reflect the judgment and assumptions of Firetrail and its representatives on the basis of information available as at the date of publication and may later change without notice. Any projections contained in this presentation are estimates only and may not be realised in the future. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Firetrail. Pinnacle and its associates may have interests in financial products and may receive fees from companies referred to during this communication. This may contain the trade names or trademarks of various third parties, and if so, any such use is solely for illustrative purposes only. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with, endorsement by, or association of any kind between them and Firetrail.

|

24 Feb 2022 - Investment Perspectives: House prices - what's in store for 2022 and beyond

|

Investment Perspectives: House prices - what's in store for 2022 and beyond Quay Global Investors February 2022 |

|

According to CoreLogic, Australian house prices increased +22.1%[1] in 2021, led by Australia's largest city of Sydney (+25.3%). It is likely that there have been a few culprits for this stellar performance, including record low interest rates, healthy household balance sheets, and perhaps a new desire to re-invest in the home as some workers contemplate an extended 'work from home' environment. To be fair, the uplift in residential prices is not a local event. The value of homes has soared across the world, including New Zealand (+27.6%), the United States (+19.1% to October), the UK (+10.0%) and even places like Turkey (+40.0% to October). And for those who believe interest rates drive property prices, the average key interest rate in Turkey during 2021 was 18% (up from 11% in 2020).[2] As we head into 2022, there is an expectation that interest rates are likely to rise around the world in response to recent inflation data. That may be true. However, we do not believe this will be enough to stop the gains - in fact, rising rates may indeed add to further gains (as per Turkey). The biggest risk for investing in residential property is, as always, excess supply. The housing cycle So, is the surge in residential property prices causing a supply response? In Australia, the answer is an emphatic yes.

The surge in new housing starts since COVID is similar, albeit sharper, to the 2015-2018 cycle which ultimately saw prices correct in 2019. We have yet to see any heat come out of the Australian market - completions have yet to increase as they lag starts by around a year. Inevitably, completions will surge this year to match the starts, which may be somewhat ominous for the Aussie housing market. Quantifying the oversupply (if any) We can get a general sense of any imbalances using historical trend data. For example, Australian household starts ran at a consistent 40,000 per quarter between 2000-12, which appears to reflect a balanced housing market (no acceleration or deceleration in supply). Post 2012, supply accelerated as immigration increased. Adjusting for the increase in annual immigration from 1.4% per annum (2000-2011) to 1.7% per annum (2011-2019), steady-state supply can be estimated at ~50,000 per quarter, being household starts of 40,000 increased pro-rata with a higher immigration rate. Using this assumption and based on housing starts data, we can estimate the cumulative supply shortfall since 2010.

Generally, the Australian housing market has defied most gloomy predictions. Indeed, there was almost a small cottage industry dedicated to predicting the imminent collapse of Australian house prices in the post-financial crisis world. However, the chart above demonstrates that there has never been a situation where there has been excess supply of housing in Australia. Accelerating housing starts (as prices rise above replacement cost) were quickly absorbed by new households. For Australia, population growth has generally provided Aussie housing the ultimate 'get out of jail free card' just as the market begins to cool. We made a similar observation in our June 2019 article What now for residential property?, where we reversed our earlier bearish 2017 call. However, with COVID, population growth effectively halted right at the time supply was accelerating. For example, if we were to reduce our household growth assumption to 20,000 per quarter (60% reduction), the residential market would quickly become oversupplied (once current projects complete later in 2022).

We don't believe it is time to call for a market correction just yet, but based on the above chart it seems unlikely recent national residential price growth will be repeated in 2022. What about the US?

Does the US face the same supply headwinds as Australia? To answer, we have applied the same methodology as the Australian analysis above. Specifically:

o 1.2m single family homes per annum (consistent with pre-GFC bubble average) o 0.3m apartments per annum (consistent with pre-GFC bubble average), and

The following charts reflect the result for each sector.

Source: St Louis Fred, Quay Global Investors For single family, there was a significant increase in excess supply leading to the financial crisis, which offers no surprise since prices boomed and were well above replacement cost. However, the single-family sector was crushed post crisis in terms of price (and ultimately resources), resulting in a significant deficiency in supply - even after allowing for the pandemic-induced collapse in immigration. Conversely, US apartments never felt the effects of excess supply in the lead-up to the financial crisis. Also, unlike single family homes, apartment supply recovered more quickly in response to the demographic demands of millennials leaving home in the first half of the 2010s. However, with the decline in immigration there appears to be a growing risk that apartments are moving into excess supply for the first time in decades. Concluding thoughts But by digging into the data, it is clear not all markets face the same risk. The cumulative undersupply in US single family housing is still significant and may take many years to rectify - especially now the sector has a demographic tailwind with the millennials, the largest US demographic cohort, seeking a more stable accommodation to marry and raise a family in a home. The outlook for US apartments and Australian residential is less sanguine. For the first time in decades, there is a real risk these markets are facing a headwind of persistent oversupply, exacerbated by pandemic-induced immigration declines. A word of warning: this analysis is not meant to be all encompassing and each market has its own subtleties and nuances. To be clear, we are not necessarily predicting a 'crash', or even a correction in these markets. The investment market is littered with the dead bodies of housing perma-bears. But it seems clear from the data that right now that one of the best risk return profiles is in US single family housing - which is where the fund maintains a significant investment position. We are more than happy to remain long. |

|

Funds operated by this manager: [1] www.abc.net.au/news/2022-01-04/australia-house-prices-corelogic-data-december-2021/100737080

|

23 Feb 2022 - Intercontinental Exchange

|

Intercontinental Exchange Magellan Asset Management January 2022  In 1997, Jeff Sprecher of the US, who had spent years developing power plants, decided to provide transparent pricing to the US power market. Well before electronic trading of financial securities became the norm, Sprecher paid US$1 for a tech start-up so he could build a web-based trading platform. For three years, Sprecher and his team met oil, natural-gas and power companies to learn what people sought in a trading platform. Some of the innovations that resulted included pre-trade credit limits, counterparty credit filters and electronic trade confirmations - novelties taken for granted now. By 2000, the trading platform was set for launch. Sprecher renamed the shell company Intercontinental Exchange to highlight the trading platform's ability to cross oceans, let alone borders. In 2001, the International Petroleum Exchange of London wanted to evolve from floor to electronic trading. At the time, the exchange was a regional one that offered oil futures contracts and had less than 25% share of the global oil futures market. Intercontinental Exchange, which promotes itself as ICE, saw an opportunity to branch into energy futures and clearing and purchased the exchange. Thanks to the ability of ICE's platform to increase price transparency, handle high volumes efficiently and lower transaction costs, the volume of oil futures traded on what is now called ICE Futures Europe swelled. A regional exchange grew into a global one. From 2007, the year ICE listed (with the ticker ICE), the company went on a buying spree of exchanges. The company snared the New York Board of Trade, which barters commodities such as cocoa, coffee and cotton, ChemConnect, which trades chemicals, and the Winnipeg Commodity Exchange, now ICE Futures Canada that mainly trades canola. A sign of ICE's ambitions was the company's failed bid that year for the commodities-based Chicago Board of Trade. Undaunted, the ICE takeover quest continued such that ICE, which earned US$6.6 billion in revenue in fiscal 2020, owns an exchange arm that boasts 12 global exchanges and six clearing houses that service the energy, agricultural and financial sectors. The haul includes the purchase in 2013 of the New York Stock Exchange, the world's biggest by volume. Among feats, ICE hosts nearly 66% of the world's traded oil futures contracts and is the world's leading clearer in energy and credit defaults. On top of that, ICE's exchange arm manages key global benchmark contracts. This list includes Brent oil, Euribor, natural gas, sterling short and long rates and sugar barometers of performance. In recent years, ICE has branched out such that the exchange business, which brought in 55% of ICE revenue in fiscal 2020, is one of three divisions. The second arm, responsible for 27% of revenue in fiscal 2020, is the fixed income and data services business that sells data and technology to help investors make and execute decisions. ICE assess prices for roughly three million fixed-income securities spanning about 150 countries in 73 currencies, as well as providing advanced analytics and indexes for fixed-income markets. ICE's other business is mortgage technology, which pulled in the remaining 18% of revenue in fiscal 2020. This arm has digitalised the mortgage process to reduce costs and increase efficiencies. The ICE mortgage business is the largest to automate the entire process, is the industry's leading platform with more than 3,000 customers, partners and investors, and the industry's only loan registry. This platform offers significant growth potential as more US mortgage originators are expected to turn to ICE's digitised offering. ICE is a promising investment in three ways. The first is that the exchanges and other businesses possess sustainable competitive advantages that form a daunting 'moat' for the parent company - where moat is a colloquial way to say a company is protected from competition. Most of ICE's earnings are derived from trading and clearing fees from the exchange businesses and linked data. These businesses are moated because they enjoy economies of scale, network effects and industry structure that intimidate would-be competitors. Another moat for ICE is that when it comes to derivatives and listing, there are limited substitutes. The holder of benchmark contracts is favoured in negotiations, even if others are seeking to undercut on price. A second advantage ICE enjoys is that the company is vertically integrated - it controls the execution and clearing of contracts. This enables the company to exert pricing power, attract volumes, and improve counterparty and systemic risk management. The other advantage that makes ICE an attractive investment is the company is well managed. While ICE has a history of disrupting others, the Sprecher-led team has prevented ICE being disrupted. Management has steered the business towards attractive industry structures (derivatives exchanges), unique data sources and value-add analytics. As important, the team has largely directed ICE away from equities exchanges, where regulation and technology have upended the pricing power and volumes over the past 15 years. All up, ICE is well placed to provide compounded returns for its investors for the foreseeable future. ICE, as do all businesses, faces risks. One is that the company's revenue is tied to trading volumes over which it has little influence. The fact that trading volumes often increase in turbulent and falling markets means that ICE is well placed to weather a market slump that falls short of a prolonged 'bear market' where trading was light. ICE's other risk is that its business is exposed to adverse changes to regulations. Moves by regulators to separate execution and clearing, and actions that might reduce trading volumes, would disrupt ICE's revenue. ICE is protected to some extent in this regard because regulators are aware that such moves against exchanges, especially ones that feature large derivatives trading, would boost trading costs, hamper innovation and, possibly, increase systemic risks. ICE, thus, is well placed in a world where Sprecher's vision has helped electronic trading become the norm. Sources: Company filings and website. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

22 Feb 2022 - 10k Words - February Edition

|

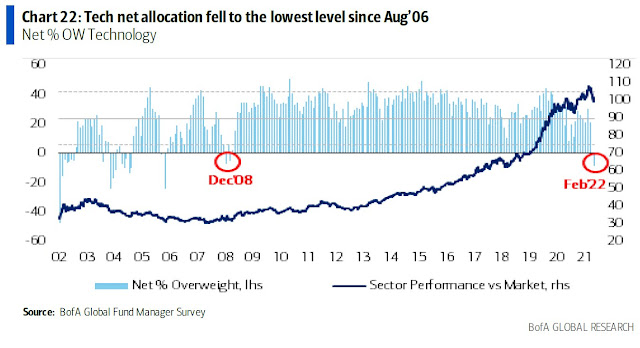

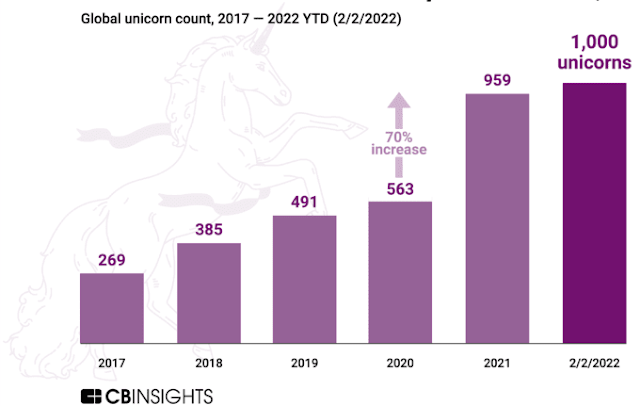

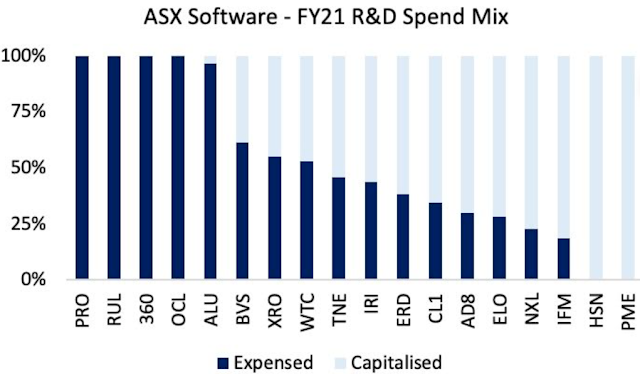

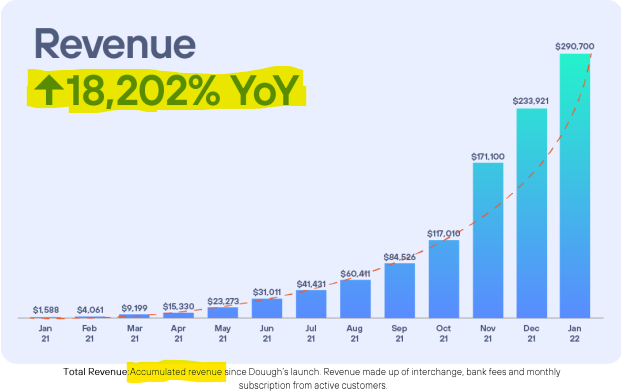

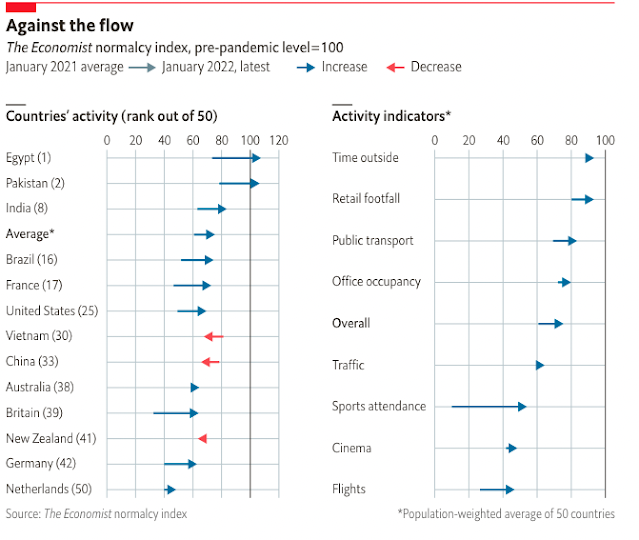

10k Words - February Edition Equitable Investors February 2022 Apparently, Confucius did not say "One Picture is Worth Ten Thousand Words" after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy. You may have noticed that the tech sector has been under pressure lately. Bank of America's monthly fund manager survey shows allocations to the sector are at the lowest point since 2006 - yet in the unlisted world CB Insights has tallied up a surge in "unicorns" to 1,000! Totus Capital made a great point on the significant dispersion between different tech companies' accounting treatment of R&D spend. And ASX-listed fintech Douugh's "accumulated revenue" chart, as highlighted by @lukewinchester9, was definitely an innovative approach to presenting financials. On the COVID-19 front, Bloomberg shows global air traffic is still less than half pre-pandemic levels, while The Economist shows most countries trending back towards "normalcy" - with China a notable exception. Tech net allocation at lowest level since 2006 Source: Bank of America (via @daniburgz) Now there are 1,000 unicorns Source: CB Insights Huge differences in how ASX software companies account for R&D spend Source: Totus, livewiremarkets Accumulated revenue chart by ASX-listed Douugh (DOU) Source: Douugh Limited, @lukewinchester9 Global air traffic less than half pre-COVID level Source: Bloomberg The Economist's "Normalcy Index" Source: The Economist Funds operated by this manager: Equitable Investors Dragonfly Fund

Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog

|

22 Feb 2022 - Manager Insights | Magellan Asset Management

|

|

|

|

Damen Purcell, COO of FundMonitors.com, speaks with Chris Wheldon, Portfolio Manager at Magellan Asset Management. The Magellan High Conviction Fund has a track record of 8 years and 8 months. The fund has provided positive monthly returns 88% of the time in rising markets, and 22% of the time when the market was negative, contributing to an up capture ratio since inception of 83% and a down capture ratio of 88%.

|

22 Feb 2022 - Would you like chips with that?

|

Would you like chips with that? Loftus Peak January 2022 It was all about "chips" - semiconductors - in 2021and likely also in 2022. We (internally) break down our portfolio into three categories - those that produce the tools that enable disruption ("tools"), those enabled by these tools ("enablers") and a group of more downstream beneficiaries ("beneficiaries"). It's not the only way the portfolio is split, but it is a useful way to understand how value in disruption can be tracked. This understanding resulted in a significant weighting toward the "tools" companies during the year, including semiconductor designers, makers and suppliers such as Qualcomm, Nvidia, AMD, Marvell, Taiwan Semiconductor Manufacturing Company (TSMC), Samsung and ASML.These companies are the equivalent of pick and shovel makers in a goldrush. They may not perform as strongly as the best miners, but they do produce a steadily-growing and valuable cashflow stream. And they are not as subject to failure if a particular "mine" (social media platform maybe, or app) doesn't work. It's an area in which most investors do not participate. However, it is correct to say that the new disruptive business models which have created so much value for shareholders would simply not have emerged but for the increasing sophistication and sheer grunt of the chips on which they run. Earlier this week, for example, the agricultural machinery company John Deere debuted a new autonomous tractor with attached tillage equipment at the CES trade show in Las Vegas. Deere's director of emerging technologies stated the tractor can run fully driverless at all times while tilling, saving significant time and labour. The company has stated it intends to expand the technology to include planting and weed control.

The John Deere autonomous tractor. The scope of this is enormous. The feed from cameras, radar and possibly lidar (light detection and ranging) must be fused into a single moving picture - although it is not a picture, since every element of it must be 'interpreted' (and so involves graphics processing units, or GPU's, tied in to the central processing units, or CPU's). All of this intelligence is then used to drive the actuators which steer, till and spray across the mapped field. This is automation writ large. The essential tools for these use cases are GPU's by the likes of companies Nvidia and AMD (which together generated +4.1 percentage points of return for Loftus Peak investors in 2021). Companies such as these have created interlocking value loops with each other. A Google-map search for directions may take place on a Samsung phone, using a Qualcomm processor, to then be stored in a Microsoft Cloud. Semiconductor companies are powering disruption across all industriesNeed to create recommendation engines for everything from movies to restaurants to clothing, or crank up machine learning systems to remove spam from millions of inboxes? Find the quickest way home? Play a game in smooth 4K? Conjure the metaverse itself?

Business case for the metaverse? Designing cars, with a team working from offices all over the world. Ford already does it. Electric cars? These cannot run without power semiconductors from ON Semiconductor and Infineon. Ditto the home solar roof panels which require inverters and rectifiers to turn the DC current to AC, on which almost all appliances run. Even excluding battery electric vehicles, the silicon content of cars is set to triple in the next three years as drivers demand better safety features such as lane departure and school zone warnings, not to mention ever more sophisticated in-car displays and entertainment/navigation systems.

The silicon content in cars is set to triple in the coming years. Indeed, the reason that used car prices have skyrocketed is because new cars are not available pending the required chips to finish them. Semiconductors are now critical in areas as diverse as shipping logistics, vaccine development and power grid management. The Loftus Peak portfolio does not include semiconductor companies because it is a technology investor, trying to pick winners from a commoditised group of companies making low value-add components for computers. They are there because of their critical role in powering the cutting edge of disruptive businesses in all parts of the economy. Where next for semiconductors?The revenue limitations for semiconductor companies are not related to demand, but supply. Because of supply chain mayhem caused by COVID-19 coupled with an endless thirst for compute cycles required by advanced applications, there is simply not enough capacity in the world's major chipmakers to satisfy the demand. It's the reason that TSMC has allocated US$100b over the next three years to additional manufacturing capacity, more than double the normal sum. Virtually the entire company's production in 2022 is already sold, and the situation seems likely to continue into 2023. The Economist magazine recently referred to data as the new oil - true enough - and it is the semiconductors that are producing, storing and generating value from it. There is no sensible reason for any fully engaged market participant to miss this trend. Investors should look to their own portfolios to ensure adequate, well-priced exposure. Funds operated by this manager: |

21 Feb 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

||||||||||||||||||||||||||||

| CAI Global Market Neutral Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Investors Mutual Concentrated Australian Share Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Investors Mutual Future Leaders Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Investors Mutual Private Portfolio Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Investors Mutual Small Cap Fund |

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| Polen Capital Global Small and Mid Cap Fund | ||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||||||||

|

Subscribe for full access to these funds and over 650 others |

||||||||||||||||||||||||||||

21 Feb 2022 - Managers Insights | Equitable Investors

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Martin Pretty, Director at Equitable Investors. The Equitable Investors Dragonfly Fundd has been operating since September 2017. Over the past 12 months the fund has returned +17.36%, outperforming the index by +7.92%, which returned +9.44%.

|

21 Feb 2022 - A company entering 2022 in high spirits

|

A company entering 2022 in high spirits Claremont Global December 2021 As the pandemic kept people at home, we saw a dramatic rise in at-home consumption of spirits and a shift in preferences towards more premium products. We believe both trends driven by the pandemic are sustainable trends. Diageo is currently one of the 14 stocks in the Claremont Global portfolio. In this article we discuss how Diageo's leading market position and unique portfolio of brands ― combined with strong category drivers ― has set the company up for long term success. Diageo (DGE: LSE)Diageo is the world's largest producer of international spirits with a portfolio of over 200 brands sold in more than 180 countries. The company owns a nearly a quarter of the top 100 western-style spirits with key brands including Johnnie Walker, Smirnoff, Capitan Morgan, Baileys, Don Julio and Guinness. Diageo is also the only western company with exposure to Baijiu, the world's largest spirit category, with a majority stake in Shui Jing Fang in China. Diageo - key brands

Source: Company website Superior execution shines in a crisisThe pandemic saw hospitality businesses (or on-trade) close across the world, which represents around one third of Diageo's overall business. However, Diageo's management was quick to adapt to changes in demand, occasions and channels. They activated in-store marketing, focused innovation towards convenience and invested in their online capability. These series of actions paid off, driving a rapid recovery in sales and saw Diageo hold or grow off-trade share in over 85% of net sales in measured markets in FY21. A portfolio that can stay ahead of the curveThe key to Diageo's success is having a well-diversified portfolio that can meet changes in consumer tastes. However, the company has also been able to acquire and build brands to shape their offer towards higher growth opportunities. Diageo's portfolio is strongly placed as they hold a leading position in four out of the five fastest growing spirits categories (see chart below). Diageo is number one in Scotch (1.7x the scale of the nearest competitor), Gin (2x the scale of the nearest peer) and Canadian Whiskey and top five in Tequila (fastest-growing portfolio). Diageo's success in Tequila (see chart below) is a good example of their ability to identify early stage shifts in consumer preferences. Diageo acquired the remainder of their stake in Don Julio in 2014 and acquired Casamigos in 2017. Since acquiring Don Julio, they have increased sales seven-fold and Casamigos eleven-fold. Don Julio 1942 (the aged version) is now the single-biggest luxury spirit brands in the US. Diageo anticipates that 50 per cent of their incremental growth from FY23-26 will be driven by Tequila, which will make the agave spirit their second largest behind Scotch by FY26. Global growth of retail sales value (RSV) by category 2020-25 compound annual growth rate (CAGR)

Source: Diageo CMD presentation Nov 2021, IWSR estimates Diageo - Tequila organic sales growth

Source: Claremont Global, company data. Past performance is not a reliable indicator of future performance. Penetration - spirits continue to be the winning categoryThe spirits category has been winning market share from beer and wine over the last decade and now accounts for 39 per cent of the total global alcoholic beverage market (Total Beverage Alcohol or TBA), which is up from 30 per cent in 2010. While this has accelerated during the pandemic, industry sources expect the consumer shift towards spirits to continue growing at 6 per cent per annum over 2020-25, which is around 3x faster than wine and around 2x faster than beer (source: Diageo, IWSR). Each year more than 50 million consumers reach drinking age which supports growth and Diageo additionally recruits over 40 million new consumers each year. Diageo is the largest international spirits producer, 1.5x the size of its nearest competitor and is well placed to benefit from the attractive category growth. However, there is plenty of room to grow as Diageo has only 4 per cent share of TBA and the company recently set the ambitious target to increase their TBA share by 50 per cent by 2030. Spirits share of TBA

Source: Diageo CMD presentation Nov 2021, IWSR estimates. Global growth of RSV by category (2020-25 CAGR)

Source: Diageo CMD presentation Nov 2021, IWSR estimates. Premiumisation - looking higher and higher up the shelfPremiumisation has been a key growth driver for Diageo as people are drinking less but opting for better quality alcohol ― whether it is moving from illicit alcohol to branded or from black to blue label. Across the industry super premium and premium price tiers have grown by 13 per cent and 9 per cent respectively over the last 10 years, well above budget friendly alternatives (source: Diageo/IWSR). While this trend has also been boosted by lockdowns, at home consumption has remained resilient as hospitality venues reopen and we also expect consumers to drink higher quality beverages while they are out. This plays into Diageo's key strength, as it generates over half of its business from the faster growing premium and super premium price tiers (see chart below). Diageo's super premium+ price tier grew 35 per cent in FY21 (see chart below). We believe the acceleration in premiumisation is sustainable as household balance sheets remain robust and consumers continue to look for affordable luxuries. In the US, the average household spends only $17 per month on spirits, which offers plenty of room for upside. Global growth of RSV by price tier (2020-25 CAGR)

Source: Diageo CMD presentation Nov 2021, IWSR estimates. Diageo total value growth by price tier

Source: Claremont Global, company data. Past performance is not a reliable indicator of future performance Why Diageo continues to be a global leaderWe are attracted to Diageo's global leading position and diversification across regions and spirits. We see Diageo as a quasi-staple, offering solid top line organic growth of 5-7 per cent (a target they recently upgraded), with an attractive and expanding operating margin of close to 30 per cent. The company has also delivered 20 years of dividend increases. Diageo's performance through the pandemic provided clear evidence in the strength of the management team and benefits from reinvestment in recent years, that has made Diageo a more agile company. Diageo is also an industry leader in environmental, social and governance (ESG) and as part of their 2030 goals have made sizeable commitments around positive drinking, inclusion and diversity and sustainability (including net zero carbon emissions across direct operations). Author: Chris Hernandez, Investment Analyst Funds operated by this manager: |

18 Feb 2022 - Carbon, Slavery and Poker

|

Carbon, Slavery and Poker Longwave Capital Partners January 2022 Efficiently adapting an integrated ESG investment process to new information inputs is essential for investors. Richer information helps us identify hidden risks in company operations and focus our engagement on weak actors. In 2021, we enhanced our in-house ESG scorecards with carbon emissions and modern slavery information and learnt a few things along the way. AGM voting season prompted us to wonder if some companies deserve a meme song: If you don't spill me baby I'll do anything I want. One of the persistent aspects of investing over the long term is that information inputs morph in response to corporate trends and regulatory reporting requirements. Investment processes need to adapt to this new information when it's relevant to investment decisions. With this in mind, Longwave was founded with the intention of always keeping an eye on the horizon and adapting to new information inputs. Our core investment philosophy never changes (that Quality small cap companies outperform over the long term). But we recognise that if we can systematically capture new information early, it may enrich or enhance our decision making on the fundamental side of our investment process. This need to adapt to new information is most obvious at the nexus of an integrated ESG approach. At the beginning of 2021 we observed the following changes in the ESG information landscape: carbon emissions data had significantly improved for small caps; companies have started to report their Modern Slavery approach and Sustainable Development Goals have started to turn up in company annual report commentary. At Longwave, our fundamental stock valuations are directly impacted by ESG scores. As more information becomes available, our research management tooling has enabled us to bring in new data and adapt our scorecards as the information landscape morphs. With this in mind, we set out at the beginning of 2021 to enhance our ESG scorecards with information on Carbon Emissions, Modern Slavery statements and SGD's. We love learning new things about companies and this ESG enhancement is no exception. In this report we share what we set out to do and what we learned and a few thoughts about how we think the information needs of ESG focused investors are likely to change in the next couple of years. Carbon We've believed for many years that the early 2020's would eventually be the turning point in the markets' focus and understanding of the gargantuan global task that climate change transition represents. One of our ESG goals for 2021 was to be able to measure Scope 1 and 2 emissions reliably and accurately across our portfolio. Up until this year, accurate GHG emissions data for small-cap companies has been hard to come by and very few companies have been reporting emissions. Our analytical needs are multiple and sit at both the portfolio and company level. We need to be able to:

This year a dataset with reported and relatively high confidence estimates became available for the small-cap universe. We incorporated it into our research management platform and using that as a base, have cross-checked it against reported information and started a conversation with some of the larger companies in the small-cap universe who appear to be outliers. As always with data projects, we learnt a few things during the process:

We are now able to see (at the click of a button) the Weighed Average Carbon intensity of our portfolio vs the index both at the aggregate, sector and company level. We were pleased to see that the portfolio carbon intensity is lower than the index without having expressly controlled for emissions.

We are also able to track changes in intensity through time. Finally, we used this as an opportunity to think about how the data might be used to reward companies that are making a genuine difference to climate change transition. If we think from first principals about what has to change between 2020 and 2050, companies with emissions intensive operations will need to invest in their asset bases (probably out-of-cycle) to lower their emissions intensity. The role financial markets play in that equation is to both provide the capital necessary for the transition and to reward the improvers with a lower cost of capital. Alongside a transition of the existing asset base, financial markets have a role to play in funding new technology solutions in a range of energy market and industrial equipment verticals. When we look at the Australian small cap universe, the companies with the lowest emissions intensity tend to be in that position naturally (due to business model or industry). As a result, they are unlikely to ever have a significant role to play in moving the economy further towards net-zero. Holding a portfolio of these carbon-light businesses might feel good, but in practical terms, your incremental capital investment (reinvested profit sitting inside each company you own) isn't actually being spent on the effort to transition to net-zero. On the other hand, some of the more emissions intensive businesses (such as Viva Energy) have a significant role to play in transitioning their asset base to net-zero and in the absence of government policy can choose to invest or not invest. We think companies who have higher emissions intensity but show big improvements year on year because they're investing incremental capital to facilitate transition should be rewarded for their efforts. And we think investors who truly want to ensure their money is contributing to transition in the most impactful way should be thinking about how their captive incremental dollar of capital spend is being put to work. Over 2022 and beyond we will use our new dataset to explore these ideas further. Modern Slavery In 2018 the Australian Government passed the Modern Slavery act. Any business with revenues over $100m is required to prepare a modern slavery report that outlines risk of exposure to modern slavery in the operations and supply chains of the company. These reports are supplied to the Australian Government and are generally made public on company websites. Our objective in incorporating Modern Slavery into our Social scorecard in 2021 was to analyse the statements produced by our portfolio holding companies and understand how each company identifies and manages the risks. Modern Slavery is what we think of as a slow-burn hidden reputational risk. A public exposure of particularly bad corporate actors has the potential to lead to large customer boycotts, fines or the need to re-point a global supply chain to higher cost suppliers. A better understanding of just how focused a company might be on these hidden risks can help us avoid or weight the portfolio away from companies with higher exposure. We are now able to see at the portfolio level, what percentage of our portfolio isn't reporting on modern slavery. We will use this to guide some of our ESG engagement in 2022.

We are also able to see the categorisation of our portfolio (and each company) into high, low and unknown risk. Again, this will help us form targeted engagement in 2022.

This process was rich with learning outcomes:

We will use these learnings to further enhance our qualitative data capture on modern slavery over 2022. Proxy Voting Observations And finally to Poker. We are often blown away by the greed which can be on show in the annual ritual of renumeration reports and votes. Philosophically, we believe that its fine for management to be paid for performance, but our active voting policy clearly spells out that we need to see appropriate and transparent hurdles. What's unique about Australia is that shareholders have the 2-strikes and a board spill tool at their disposal (if greed morphs into avarice). Nine companies in our systematic portfolio this year had board-spill motions put to shareholders. But within that 9, three stood out and prompted a discussion of what we term board-spill poker. Board-spill poker is when a board decide (after a first strike), to make either minor or no changes to the renumeration structure and put it back to shareholders. We can only assume they are intending to call the bluff of the shareholder base (most likely under pressure from founder managers). The remuneration report votes are advisory only, so if shareholders are unwilling to use the consequence option as it was intended, it's a toothless tool. In the absence of material personal consequences for being 'bad actors', the renumeration practices can continue unabated. By way of example, a well known retail company received a 41% AGAINST vote to its renumeration report (second strike), but a full 95% of investors voted AGAINST the board-spill motion. We are happy to say that Longwave was in the 5% of investors who decided that a consequence tool needs to be used. We will be interested to see the 2023 cycle of renumeration reports from these companies, but we wouldn't be surprised if there is no material change to their renumeration practices. Some of the significant vote issues we dealt with over the primary AGM season included 3 board spills, 2 shareholder resolutions and a range of renumeration structures that didn't meet our standards. A healthcare company we own continued to increase the CEO's base salary above inflation, despite having awarded an extremely large LTI package in 2019, followed by a 75% base salary increase in FY20 and large one-off retention bonuses. We had voted for the CEO LTI package two years ago, however we believe base salary increases continued to be excessive. We felt if didn't vote for a spill motion, the directors were unlikely to listen to a significant shareholder issue. A resources company we own put the same renumeration framework to shareholders 2 years in a row after a 93% vote against the Rem report in 2020. The board spill was an easy decision to make; there had been no change to the company's remuneration framework compared to the prior years and it really did solidify our concerns about board independence. We subsequently voted for board candidates (a mix of independent and major shareholder aligned) who we think will better align the renumeration structures to the economic interests of shareholders. Another resources company we own had a shareholder resolution put up that would have required the company to disclose, in subsequent annual reporting, a plan that demonstrates how the company's capital expenditure and operations for its coal assets will be managed in a manner consistent with a scenario in which global energy emissions reach net zero by 2050. We voted FOR this resolution as we believe that improved understanding of financial scenarios for capital allocation and cash flows back to shareholders under a net zero by 2050 scenario would be useful. It prompted us to think about a world in which coal asset-owners publicly publish their responsible shutdown plans matched to transition and how that might impact pricing of the equity. Unfortunately, the resolution was defeated. Finally, a founder-led telecommunications business we own sought to issue options to non-executive and executive directors because of the dilution they had suffered after successive capital-raises to fund the company's acquisitive growth strategy. The board of this company is non-independent. Executives and NED's are adequately cash compensated, and Executives also have in place adequate STI and LTI structures. We voted against this options issuance as we didn't believe the options were appropriate for directors. Options create alignment differences with shareholders which may compromise independence. Additionally, the reason proposed was to counter equity dilution from new acquisitions directors suffer - however all shareholders suffer similar dilution with no options granted, and it is the value accretion from the transaction which is required to add value over and above this dilution. Looking into 2022, as we increase our standards and engagement on environmental and social issues we may use director voting as a way of communicating a lack of action by boards on these matters. Written By Melinda White, Equity Portfolio Manager |

|

Funds operated by this manager: |