NEWS

25 Oct 2023 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

25 Oct 2023 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

25 Oct 2023 - The Fall and Rise of Uranium

|

The Fall and Rise of Uranium Eiger Capital October 2023 The nuclear industry is undergoing something of a renaissance. For anyone with an interest in the industry, even a passing one, it's been a painfully long wait, but the uranium worm certainly seems to have turned. Over the past 12-18 months, we have added positions in Boss Energy (BOE.ASX) and Paladin Energy (PDN.ASX), two uranium miners. At the time of writing, the uranium spot price had topped US$70/lb, a 13-year, pre-Fukushima high and contracted volumes are on the up. In that time there has been more than one surge in the commodities sector, but uranium has missed out every time. So how did we get here?

Langer Heinrich Stage 3 construction circa 2011 (about a month prior to Fukushima) - uranium was looking up The FallNot much moves quickly in the nuclear industry. The last time we experienced this level of positivity, one of our team was on site at Paladin's Langer Heinrich (LH) uranium mine in Namibia. That was in early 2011 during the Stage 3 expansion (see above). The mood then had turned bullish even though the uranium price had peaked three years earlier at over US$130/lb . Uranium price, US$/lb (Source: Cameco) Most commodities overshoot and that was certainly the case with uranium in 2007 as phenomenal Chinese growth erased a decades long malaise in uranium. However, over the next three years, the price did not dip below US$40/lb and exceeded US$70/lb around the time of that LH site visit - about where we find ourselves now. Prices were high, the mine was expanding, and uranium was being hailed as a natural alternative to coal for reliable baseload, driven by a "green energy" tailwind. What could go wrong? An earthquake. And an unusually big and complex one at that. It struck the east coast of Japan in March 2011, just a handful of months after that LH site visit. At magnitude 9, the so-called Great East Japan Earthquake was the largest in Japan's history and the fourth largest recorded since the advent of modern seismology, 110 years earlier. In other words, this was a very rare event. The earthquake and resulting tsunami disabled the cooling systems of the coastal Fukushima Daiichi Nuclear Power Plant, resulting in core meltdown in three reactors. While the Daiichi plant, which first began operating in 1971, was able to withstand the ground movement produced by the quake, it was not designed to cope with the 15m tsunami that followed. Unfortunately, the engineers had used a 1960 Chilean earthquake and its resultant 3m tsunami to design some of the safety systems at Daiichi. The plant's 10m elevation should have allowed plenty of room for a "regular" tsunami but proved to be inadequate on this occasion as no-one anticipated the magnitude of this event. In short, Japan's nuclear industry, which accounted for ~30% of the country's electricity generation, shutdown in a nationwide safety review, whilst a pall was cast over the global industry that would last a decade. A long, dark winterFukushima's impact on the global nuclear industry cannot be underestimated. For example, following the accident, Germany immediately shutdown eight of its 17 reactors and committed to close the remainder of its fleet, the last of which occurred in April 2023. Prior to the disaster, nuclear energy accounted for one-quarter of Germany's electricity production.

Reactor numbers are still low (Source: IAEA - PRIS) Overall, global electricity production from nuclear dropped 11%. Justifiably, fear of further accidents at older reactors and the increased cost of upgrading/replacing to newer, safer designs, impeded growth of the industry. Furthermore, sentiment was greatly impacted by the potential of renewables - would nuclear even be needed as baseload if windmills and solar panels could deliver zero-carbon power? On the supply demand side, Kazakhstan, the world's biggest producer of uranium, was ramping up production at the time of Fukushima, and continued to do so beyond the shutdown of the Japanese industry. To compound the problem, Canada's Cameco commenced full-scale commercial production at the underground Cigar Lake in May 2015. The eventual commissioning was complex and protracted. Development had started a decade earlier, but a series of water inflows flooded the mine (it's not called Cigar Lake for nothing). At the bottom in October 2016, the spot price of uranium dipped to US$18/lb and it would be another four to five years before market would stir.

Nuclear capacity under construction (Source: IAEA - PRIS) The SpringWe can probably trace the start of the current "boom" to mid-2021 when Canada's Sprott Asset Management founded its Sprott Physical Uranium Trust (SPUT), a physically backed financial product. Its purchases helped soak up excess market supply within a gently improving backdrop for nuclear energy. This enthusiasm was shortly followed up at the COP26 meeting in Glasgow, Scotland, later that same year, where nuclear energy again featured as a low-carbon alternative to coal baseload power but arguably with more urgency. It is increasingly apparent that net-zero by 2050 solely from renewables is extremely challenging and nuclear power represents one low-carbon way to fill the gap. In terms of power generation, nuclear energy offers several advantages over traditional baseload. Nuclear utilities are very long-life assets, land use is 30-100x less than other low CO2 options, CO2 emissions/kWh are lower than all other power sources except for wind, and life extensions of nuclear power plants represents the lowest cost low-CO2 energy. Other factors have combined to add upward pressure to the uranium price. For example, in the US, the Inflation Reduction Act (Aug 22) provides tax credits and development incentives for existing reactors and uranium resources, while the DoE commenced purchases for its Federal Strategic Uranium Reserve (Sept 22). Elsewhere, nuclear energy has been included in the green energy taxonomies of the EU, UK and South Korea. In geopolitical terms, there is clear uranium (and gas) supply risk around Russia following the invasion of Ukraine and the coup in Niger, the world's sixth largest supplier, has caused consumers like France some concern.

Nuclear capacity under construction (Source: IAEA - PRIS) From a capital point of view, we are seeing increased investment in nuclear power from Asia in particular (see above). On the supply side, uranium exploration and development has plummeted and remains at multi-year lows. While the uranium market is a closed and esoteric one that can be difficult to decipher, there is incremental benefit in the short-term from this supply-demand dynamic.

Global uranium exploration and development expenditure (Source: NEA/IAEA)

Note: Values at 7% discount rate. Box plots indicate maximum, median and minimum values. The boxes indicate the central 50% of values. i.e. the second and the third quartile. Source: IEA Where to from here?While the outlook for the uranium market is better than it has been for more than a decade, challenges remain. Nuclear energy is still a divisive issue due to ever-lingering safety concerns, and it could be argued that countries like Australia may never see its use. Other factors that impede acceptance include the upfront cost of construction, strict regulation and the time to build a new plant, where the median time is currently around 80-90 months. On the flip side, nuclear facilities are amongst the most rigorously engineered structures on Earth and provide very long life, consistent output. While upfront capex is very high, the levelized cost over the life of a nuclear asset is extremely competitive especially if life extensions to existing plants is considered. Moreover, new technologies, such as Small Modular Reactors (SMR) offer potential advantages in cost and safety. Finally, recent geopolitical developments such as the Russia/Ukraine conflict highlight the need for secure, reliable sources of power. In a world focused on low carbon electricity, it is not surprising that many nations are considering a nuclear future. Author: David Haddad, Principal and Portfolio Manager Funds operated by this manager: |

24 Oct 2023 - Australian Secure Capital Fund - Market Update

|

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund October 2023

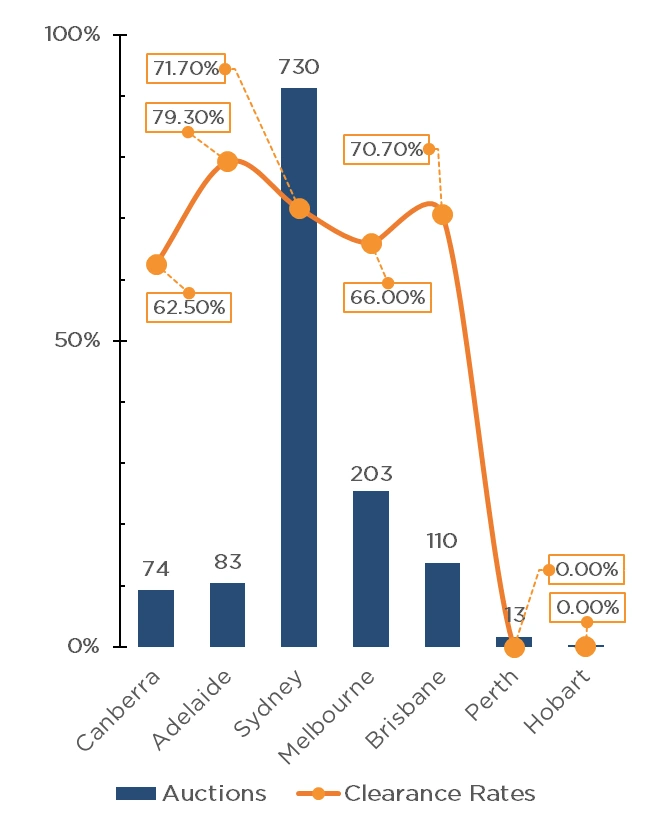

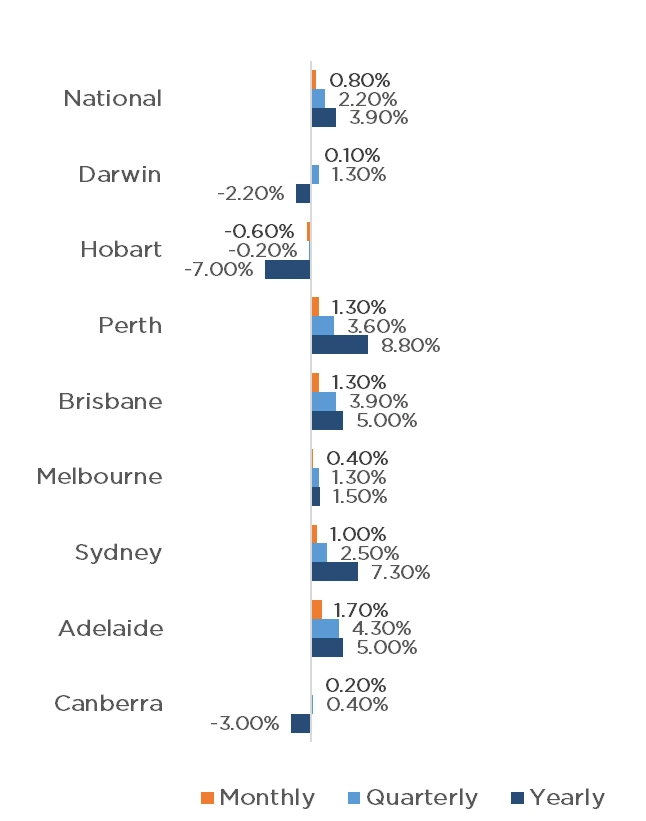

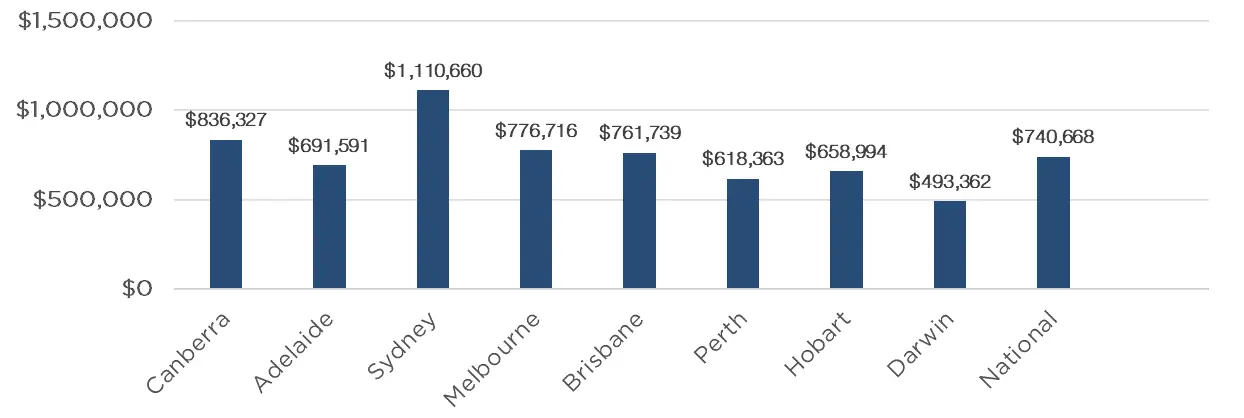

The first weekend of October saw the number of auctions decline significantly on the previous week (1215, down from 2,648), as is common on long weekends, caused by the AFL Public Holiday and the King's Birthday. Sydney recorded the most auctions of the capital cities, with 730 taking place, followed by Melbourne and Brisbane with 203 and 110 respectively. Adelaide and Canberra just missed out on triple digit figures, with 83 and 74 respectively, whilst just 13 and 2 auctions occurred in Perth and Tasmania respectively. Whilst the number of auctions declined for the week, clearance rates remained strong at 70.3% across the combined capitals (up from 59.7% last year). This was driven by Adelaide, Sydney and Brisbane all recording above 70% clearance rates with 79.3%, 71.7% and 70.7% respectively. Melbourne and Canberra also had moderate clearance rates of 66.0% and 62.5% respectively. The property market continued to grow yet again with a 0.8% rise for the month of September, taking quarterly growth to 2.2%. Adelaide experienced the largest monthly growth of 1.7%, followed by Brisbane and Perth with 1.3% each. Sydney, Melbourne, Canberra and Darwin all experienced growth with 1%, 0.3%, 0.2% and 0.1% respectively, whilst Hobart was the only capital city to fall in September with -0.6%. Quarterly data is similar, again with Adelaide leading the way (4.3%), closely followed by Brisbane (3.9%), Perth (3.6%) and Sydney (2.5%). Melbourne and Darwin both increased 1.3% for the quarter, with Canberra at 0.4%. Again, Hobart is the only capital to not experience growth, falling by 0.2% for the quarter. Whilst many economists predicted a softening in property prices in the later stages of 2023, dwelling values have remained strong. As we head into the spring and summer selling season, we may see supply increase slightly but the market remains extremely tight. Clearance Rates & Auctions Week of the 3rd of October 2023

Property Values as of 2nd of October 2023

Median Dwelling Values as of 2nd of October 2023

|

23 Oct 2023 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

23 Oct 2023 - Investment Perspectives: The housing fate from interest rates

20 Oct 2023 - Hedge Clippings | 20 October 2023

|

|

|

|

Hedge Clippings | 20 October 2023 Last week Hedge Clippings noted that "Central Bank Speak" involves the specialised art of covering all bases and potential outcomes, whilst not actually confirming what you're really thinking, or going to do. The exception of course is when they actually raise or cut rates, in which case they refer you back to their previous comments, and basically say "I told you so", or "don't say we didn't warn you." So while US markets are tossing up between rates staying as they are, or possibly rising one more time, Jerome Powell's overnight comment that "a range of uncertainties, both old and new complicate our task of balancing the risk of tightening monetary policy too much, against the risk of tightening too little" didn't actually say anything we didn't know, except they haven't made their mind up yet. To be fair to Powell, and the RBA's Michele Bullock if it comes to that, the US economy is evenly poised, balanced between trying to re-bottle inflation to get it back to the 2% target, maintaining sufficient growth and employment, and without risking "unnecessary harm to the economy" as he puts it. Powell's problem is that achieving both is a very difficult balancing act. The market is currently betting on the Fed holding the line at their upcoming meeting at the end of this month, but has no such certainty looking forward to December. Back home, the ABS released their Australian labour force figures, and on the surface, little had changed. Unemployment decreased fractionally on seasonally adjusted terms to 3.6%, with total employment edging up by just 6,600 but with full-time jobs decreasing by 39,900 offset by part-time jobs increasing by 46,500. The RBA wouldn't have been too pleased with those numbers in their efforts to return the cash rate to their preferred 2-3% target band, having previously indicated that unemployment around 4.5% is necessary to cool the economy, and thereby tame inflation. Next week's September CPI figure, due on Wednesday, followed by PPI results on Friday, will give a clearer picture of the outlook. Meanwhile, the minutes of the RBA's September meeting revealed the board didn't consider a rate cut as an option - it was either leave rates as they are, or increase them by 0.25%. That's likely to be the case again at their next meeting due on Cup Day. At this stage, we'd still favour an extension of the "pause" but wouldn't want to bet the house on it. As the previous governor was keen to say, "it's a very narrow path." News & Insights 10k Words | October 2023 | Equitable Investors Market Commentary | Glenmore Asset Management September 2023 Performance News Delft Partners Global High Conviction Strategy Quay Global Real Estate Fund (Unhedged) Digital Asset Fund (Digital Opportunities Class) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

20 Oct 2023 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

20 Oct 2023 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

19 Oct 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]