NEWS

22 Mar 2022 - Supply chains, logistics and inflation

|

Supply chains, logistics and inflation Forager Funds Management 07 March 2021 In this video, Steve Johnson and Chloe Stokes discuss a topic that's been top of mind for many investors: cost inflation and what it might mean for the future. The impacts have been pretty widespread so far, Steve says. For example, supply shortages have resulted in product mark-ups from the likes of Installed Building Products (NYSE:IBP), while online beauty retailer Adore Beauty's (ASX:ABY) customer acquisition costs have increased significantly as competition for its customers increases, and fast-fashion retailer Boohoo's (LON:BOO) margins have taken a hit due to significant increases in freight costs. |

|

Funds operated by this manager: Forager Australian Shares Fund (ASX: FOR), Forager International Shares Fund |

22 Mar 2022 - War. What is it good for?

|

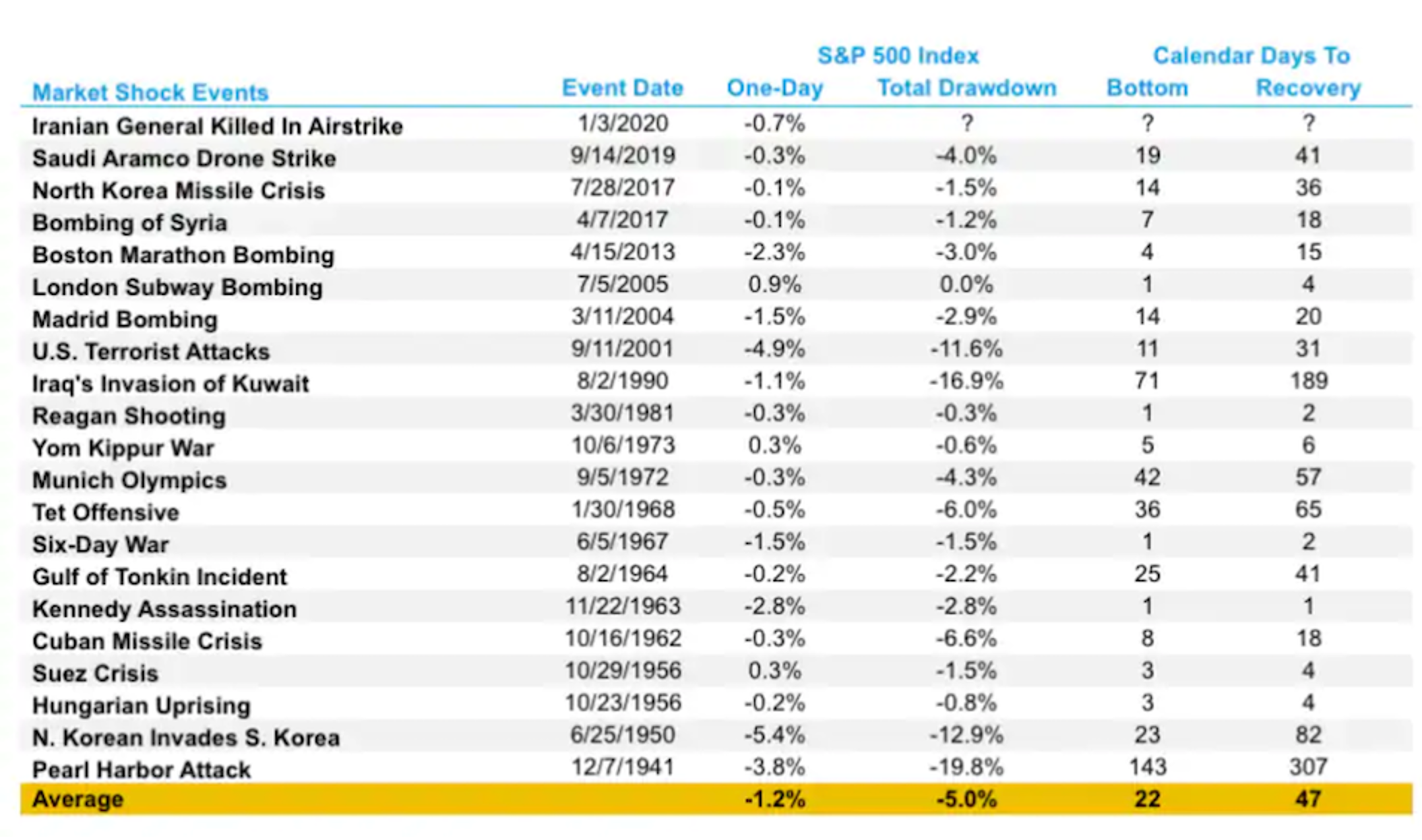

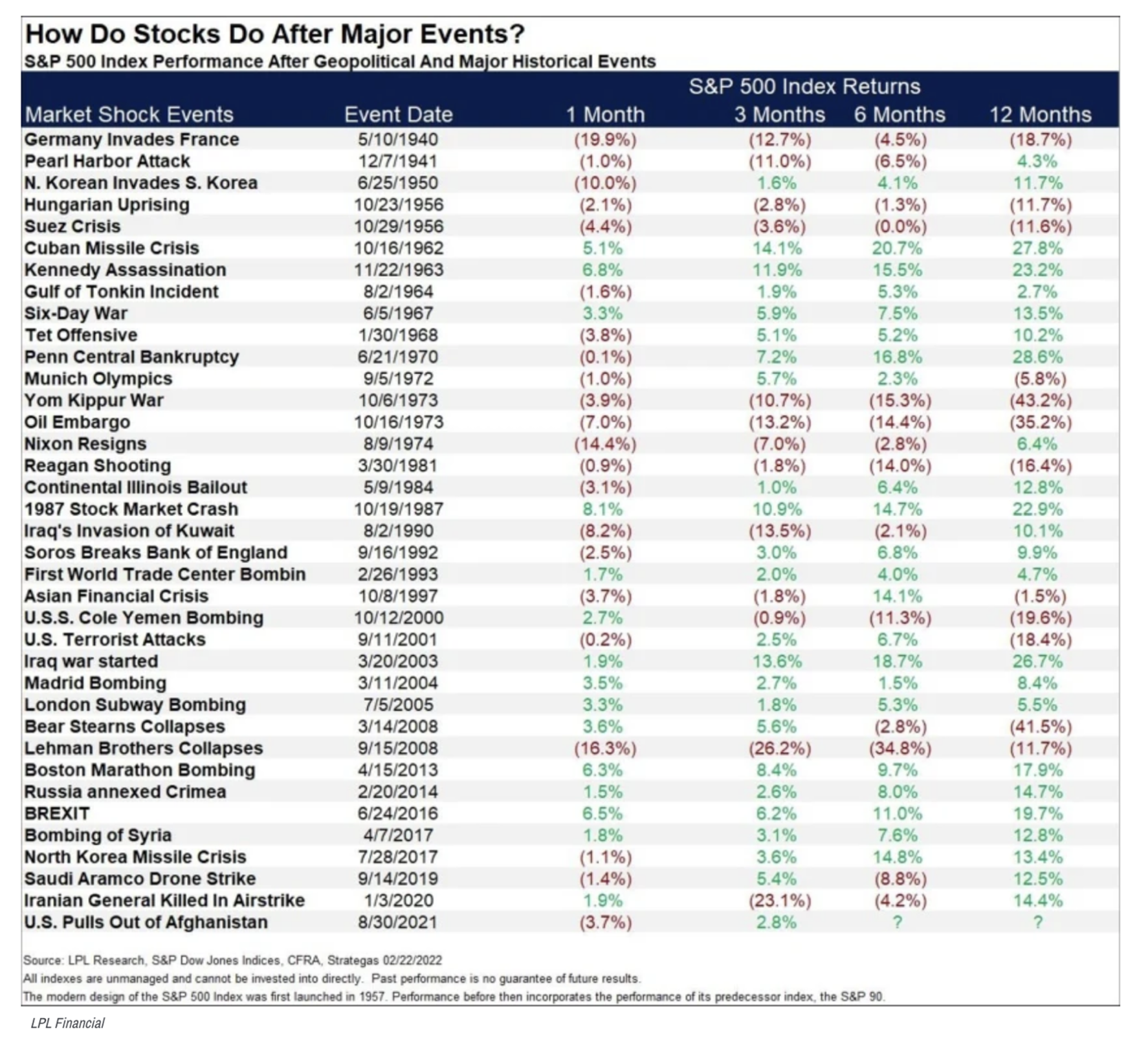

War. What is it good for? Montgomery Investment Management March 2022 Edwin Starr's classic 1969 anti-war song, War, asks: "War: What is it good for?" and responds emphatically "absolutely nothing." It's hard to argue with the sentiment. But it turns out Starr was not completely correct. You see, despite the terrifying carnage and destruction, war can often be a fruitful time to invest. Let me be clear: I detest armed conflict. War should be avoided at all times and not prompted by immature despots, seeking acclaim they can only take to their grave. With Russia and the Ukraine on the brink of war, and with markets predictably reacting negatively, I thought it is worth revisiting the enquiries I made the last time an armed conflict threatened to destabilise the world and markets. History suggests past conflicts have not inflicted permanent pain on investors. It has indeed been wise, historically, to invest at the depths of the conflict when fear was at its extreme. Research by LPL Financial, conducted in 2020, of market reactions to past geopolitical crises confirms stock market investors have mostly shrugged off geopolitical conflicts as some sectors and companies have continued to generate profits. Of course, that latter observation doesn't let investors off the hook because stocks can, and frequently do, move independently of the performance of the underlying business. Table 1, from 2020 by LPL Financial reveals however investors would be wise not to sell into the fear and weakness but instead, remember that there have been dozens, if not hundreds, of conflicts in the past and the stock market has survived. This of course is not to diminish the very real suffering at the hands of tyrants and dictators, which democratic allies should pull all stops to prevent. Table 1. A summary of geopolitical events and stock market reactions

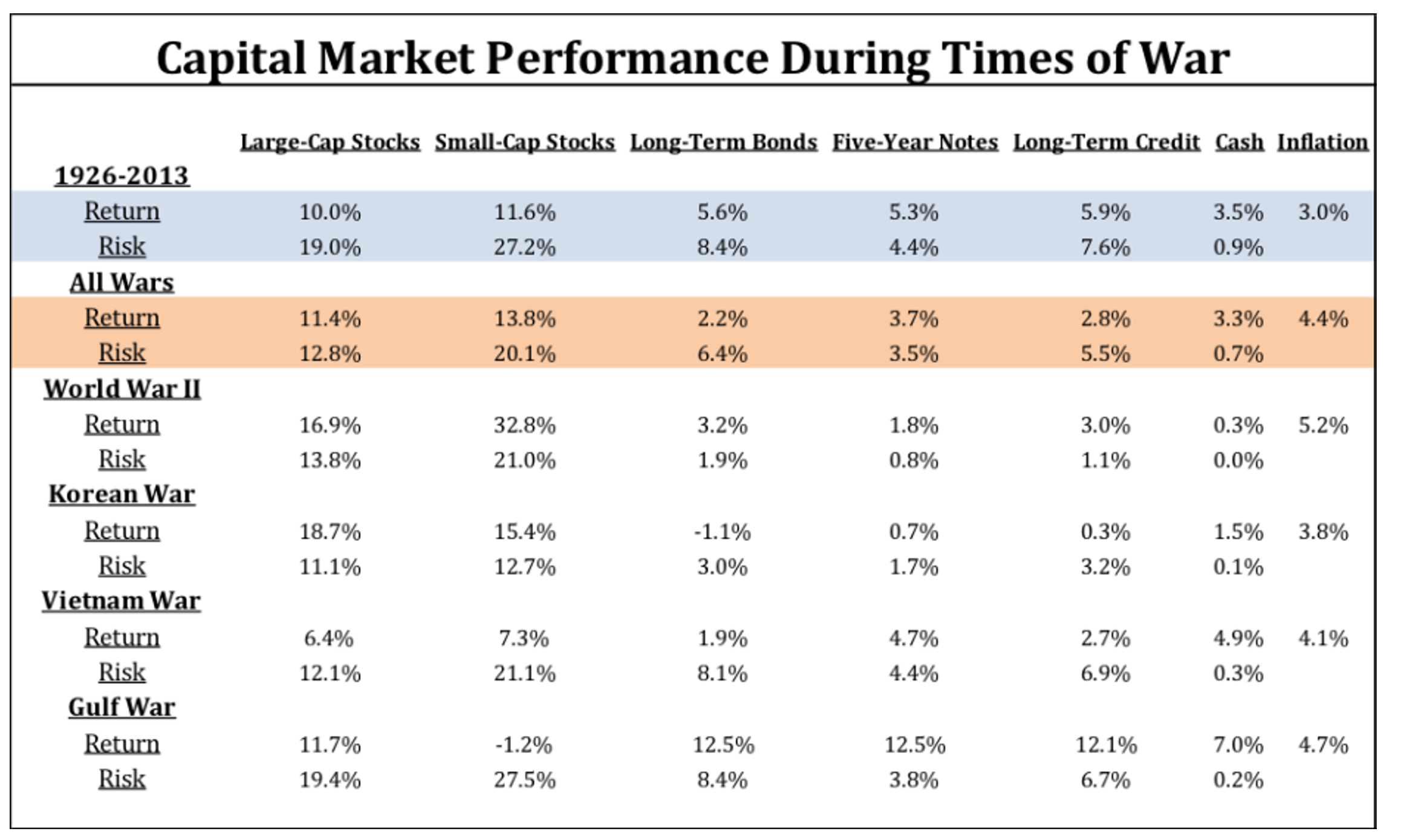

Source: LPL Research, S&P Dow Jones Index, CFRA. 1/6/20 Let's put the current invasion of Eastern Ukraine by Russia into some perspective. Following the outbreak of World War I in 1914, the Dow Jones declined almost a third within six months. Business ground to a halt and liquidity in the stock market vaporised as foreign investors sold US stocks to raise money for the war effort. The NYSE (New York Stock Exchange) closed on July 31, 1914. The world's financial markets closed their doors by August 1. The NYSE was closed for four months. It was the longest suspension of trading, and circuit breaker, in history. Almost immediately, however, a substitute trading forum called the New Street market emerged and trading began offering economically meaningful liquidity but impaired price transparency. Closing the stock exchange for a third of a year would be unthinkable today. It was unthinkable then. To wit: "If at any time up to July, 1914, any Wall Street man had asserted that the stock exchange could be kept closed continually for four and one-half months he would have been laughed to scorn."[1] It must have seemed grim for stock market investors, especially for anyone with capital tied up and locked down. After the stock market reopened in 1915, however, the Dow Jones rose more than 88 per cent. 1915 recorded the highest annual return on record for the Dow Jones Industrial Average. From the start of World War I in 1914, until its end in 1918, the Dow Jones rose 43 per cent or about 8.7 per cent annually. The Second World War must have seemed primed to be a whole lot worse. From the start of WWII in September 1939, when Hitler invaded Poland, until it ended in late 1945, the Dow Jones rose 50 per cent - equivalent to a compounded seven per cent per annum. In other words, the two most damaging conflicts in history saw the stock market rise meaningfully. On 7 December 1941, when the Imperial Japanese Navy Air Service attacked the U.S. naval base at Pearl Harbor, Honolulu, by surprise, stocks opened the following Monday down 2.9 per cent, but it took just a month to regain those losses. And then, when the allied forces invaded France on D-Day on June 6, 1944, the Dow Jones barely reacted and rose more than five per cent over the subsequent month. Caveat(s) According to research conducted in 2015, into U.S. military conflicts after World War II by the Swiss Finance Institute, stock prices tend to decline in the pre-war phase and recover when war commences. But when war is a complete surprise, stocks decline. Another study, published in 2013 by Mark Armbruster, of Armbruster Capital Management, examined the period from 1926 through July 2013 and found that stock market volatility was actually lower during periods of war. "We looked at returns and volatility leading up to and during World War II, the Korean War, the Vietnam War, and the Gulf War. We opted to exclude the Iraq War from this group, as the Iraq War included a major economic boom, and subsequent bust, that had very little do with the nation's involvement in a war. "As the table below [Table 2.] shows, war does not necessarily imply lackluster returns for Domestic stocks. Quite the contrary, stocks have outperformed their long-term averages during wars. On the other hand, bonds, usually a safe harbor during tumultuous times, have performed below their historic averages during periods of war." Table 2. Capital market performance at times of war

Source: Mark Armbruster/CFA Institute In recent years, the 9/11 attacks and the Global Financial Crisis in particular, have trained investors to expect central banks to rescue them through the repression of financial market volatility. Moreover, the belief and hope the initial conflict doesn't escalate, drawing in the rest of the world, has also been supported by real world experience. Investors have thus been conditioned to eschew an overreaction. It is probably the fear of an all-inclusive war that inspires investor reaction to even the most minor of conflicts involving powerful nations but investors do well more often than not, when they remain invested, take advantage of weak prices and correctly bet that sober hearts and minds will prevail. Most of the time it is economic and idiosyncratic fundamental factors that impact security prices. Very rarely, a solitary exogenous event is influential enough to override the usual factors and impact market returns materially. Based on research of history and the above data, however, war and geopolitical conflicts shouldn't be counted in that category. Author: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund [1] Noble (1915, p. 87). |

21 Mar 2022 - Manager Insights | DS Capital

|

|

||

|

Chris Gosselin, CEO of Australian Fund Monitors, speaks with Rodney Brott, CEO & Executive Director of DS Capital. The DS Capital Growth Fund has a track record of 9 years and 2 months and has outperformed the ASX 200 Total Return Index since inception in January 2013, providing investors with an annualised return of 14.56% compared with the index's return of 9.07% over the same period.

|

21 Mar 2022 - Learning from historians as well as from history

|

Learning from historians as well as from history Equitable Investors 11 March 2022 Responding to cannon fire in the bay, the citizens of Melbourne armed themselves and gathered in Port Melbourne in September 1854, believing a Russian attack that media commentators had warned of was upon them. Twenty eight years later, Melbourne's Age newspaper warned that "it would be comparatively easy for Russia to bring down an overwhelming force from the neighborhood of the Amoor without awakening the suspicions of the British naval officers at China or Japan." The city's populace was then stirred by a series of articles claiming to have proof of a planned invasion - allegedly deciphered copies of telegrams between the Russian Minister of Marine and a Russian Admiral. But the cannon fire in 1854 was actually from a friendly ship, the Great Britain, that was celebrating its release from quarantine. And the telegrams of 1882 and stories of imminent invasion that surrounded them were a hoax. No invasion obviously ever eventuated. The Ballarat Courier described it as a "stupid and offensive affair". Melbournians (or a portion of them) had taken what they read in the newspapers at face value. They may have considered newspapers to be a trustworthy source. Gold had been discovered and wealth created that others might be envious of. There was a feeling of isolation given the distance from Great Britain. Russian ships had visited Victoria as they followed the winds on a "great circle" route to get from Europe to the northeastern region of their vast country. Information fragmentsThe tragic war that is being waged in Ukraine is generating volumes of information and disinformation around the clock. It is far easier now in the social media era than it was in the 1850s for investors to be exposed to incomplete fragments of the truth or deliberately misleading information that causes their imagination ro run away and make decisions hastily. This Ukraine war triggered panic when Russia attacked a Ukrainian nuclear power plant, Zaporizhzhia, which is understood to be the largest nuclear power plant in Europe. Images of heavy fire led to fears there would be a melt-down on a scale greater than Chernobyl. Not to underplay the potential risks of what is going on in Ukraine, the reality was in this case that it was a training building at the power plant that caught fire, not the nuclear reactors. And the experts tell us, with reference here to Bloomberg's reporting, that the reactors are "housed inside containment buildings that will protect them from plane crashes, tornadoes, bomb attacks, and explosions caused by the escape of flammable fission by-products". Learning from Historians as well as from History Students of history (the tales of Melbourne's Russian fears are sourced from this investor's long forgotten Honours Thesis in History) need to know how to research and dig for relevant information. But that is only half the battle. Historians must also be able to critically assess information. Who or what is the source? What was the intended audience? What motives and bias come into play? These skills are equally valuable to investors awash in live feeds from around the world - especially when a social media algorithm may be pushing one particular blinkered view or perspective on them. Author: Martin Pretty, Director Funds operated by this manager: |

18 Mar 2022 - What to expect from markets during the Russia and Ukraine war

|

What to expect from markets during the Russia and Ukraine war Montgomery Investment Management March 2022 Roger reveals the past market performance following major geopolitical or historical events since World War II. A discussion on the economic implications invariably begins with energy markets. Booming logistics has created an energy crisis driving oil, from negative prices just under two years ago, to nearly a hundred dollars a barrel today. Commodities prices have also soared with Ukraine one of the world's larger exporters of iron ore. Transcript Roger Montgomery: A week or so ago we wrote about historical precedents with respect to the equity market returns amid war. The summary; equities tend to decline in the prelude to war and rise when the first shots are fired. When we have seen divergence from that historical pattern it is because there was no prelude. Between 1914 and 1918, the period that defines WWI and between 1939 and 1945 - defining WWII - the Dow Jones rose 8.7 per cent and 7 per cent per annum respectively. During the two periods that arguably define the worst military conflicts in modern history the markets rose. Most-conflicts-since-then have been relatively short-lived. Have a look at this table courtesy of LPL Financial. It reveals past market performance following major geopolitical or historical events since WWII. The bottom line is, in the absence of a recession, the market appears to eventually shrug off conflict. None of this is to diminish the very real horror of the humanitarian crisis unfolding in the Ukraine, the mounting loss of life and thousands of families and individuals displaced as they leave their homes and relationships for safety across the border. For each conflict or crisis, investor uncertainty stems from the presence of elements that make it more unique (and worse) than those that preceded it. With respect to Russia's unprovoked invasion of the Ukraine, we have, according to various press reports, an unhinged kleptocrat, with a finger on a phalanx of nuclear weapons. Maybe this time is indeed different. And let's not forget investors were already nervous about inflation and rising interest rate before Putin's aggression. Indeed, the prevailing inflationary climate may have had something to do with his timing. Booming logistics has created an energy crisis driving oil, from negative prices just under two years ago, to nearly a hundred dollars a barrel today. Commodities prices have also soared. US inflation hit a four-decade high and perhaps, Putin seized the opportunity thinking the west might be loath to impose sanctions that drive prices higher. But the Ukraine is one of the world's larger exporters of iron ore and some 600 million people in Europe and elsewhere are fed by the country's agriculture sector. Conceivably, Putin underestimated the West's determination to secure this important source of food and mineral commodities. But more important than letting commodity supply fall under Putin's control, maybe it is the West's determination to defend democracy that Putin has underestimated. Keep in mind, the stock market can remain elevated for some time - even as a train wreck is obviously approaching. Eventually however it succumbs to a wave of panicked selling - much as a deer or rabbit transfixed by headlights succumbs to the vehicle careening towards it. Investors need to watch for the point at which the Allied's words, sanctions and the supply of arms to Ukrainian civilians is inadequate to defend democracy and the Ukraine. Putin's persistence - and it is clear his pride won't tolerate anything less - and the failure of diplomacy, would be negative for risk assets. A consequent delaying, by central banks, however, of both quantitative tapering and interest rate increases is a positive. If diplomacy does succeed, the focus will return to inflation, interest rates and the risk of a wage price spiral. In either case the possibility of a pronounced correction is one investors should be ready to take advantage of. If I was to make one prediction it is that in a several years' time, we will have seen a correction but we will also have seen peak inflation and the effect of automation on productivity and wages, which will be incredibly positive for high quality businesses, those with pricing power and those growing into their-potential-to-be-a-multiple-of-their-current-size. Speaker: Roger Montgomery, Chairman and Chief Investment Officer Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

18 Mar 2022 - Why epoch-defining AI is today's most important investment theme

|

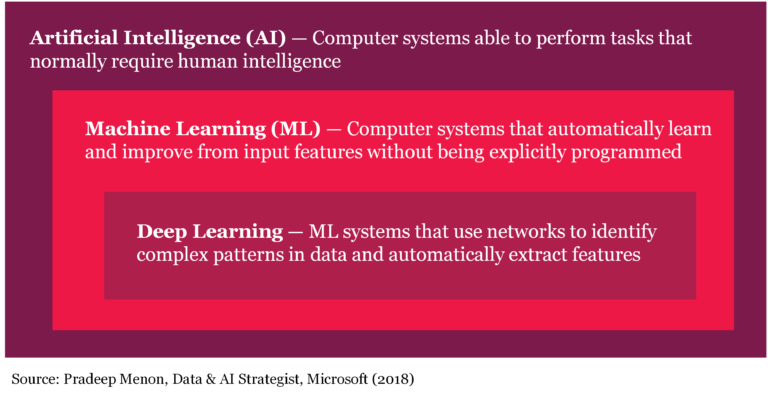

Why epoch-defining AI is today's most important investment theme (and the safest way to profit) Summary of Whitepaper Montaka Global Investments March 2022 Most investors are aware that artificial intelligence, or AI, is an important transformation. But many still underestimate the sheer world and life-changing power of this revolution and its investment potential. AI will recast and refashion every aspect of life: how we consume, how we work, how we monitor industrial machines, how we deliver healthcare, how wars are won, and how we solve climate change. Not only is software eating the world, but it is becoming a lot smarter at an accelerating rate and will continue to do so. Why? Because of AI - and more specifically, machine learning (ML), the most common and practically applicable subset of AI today.

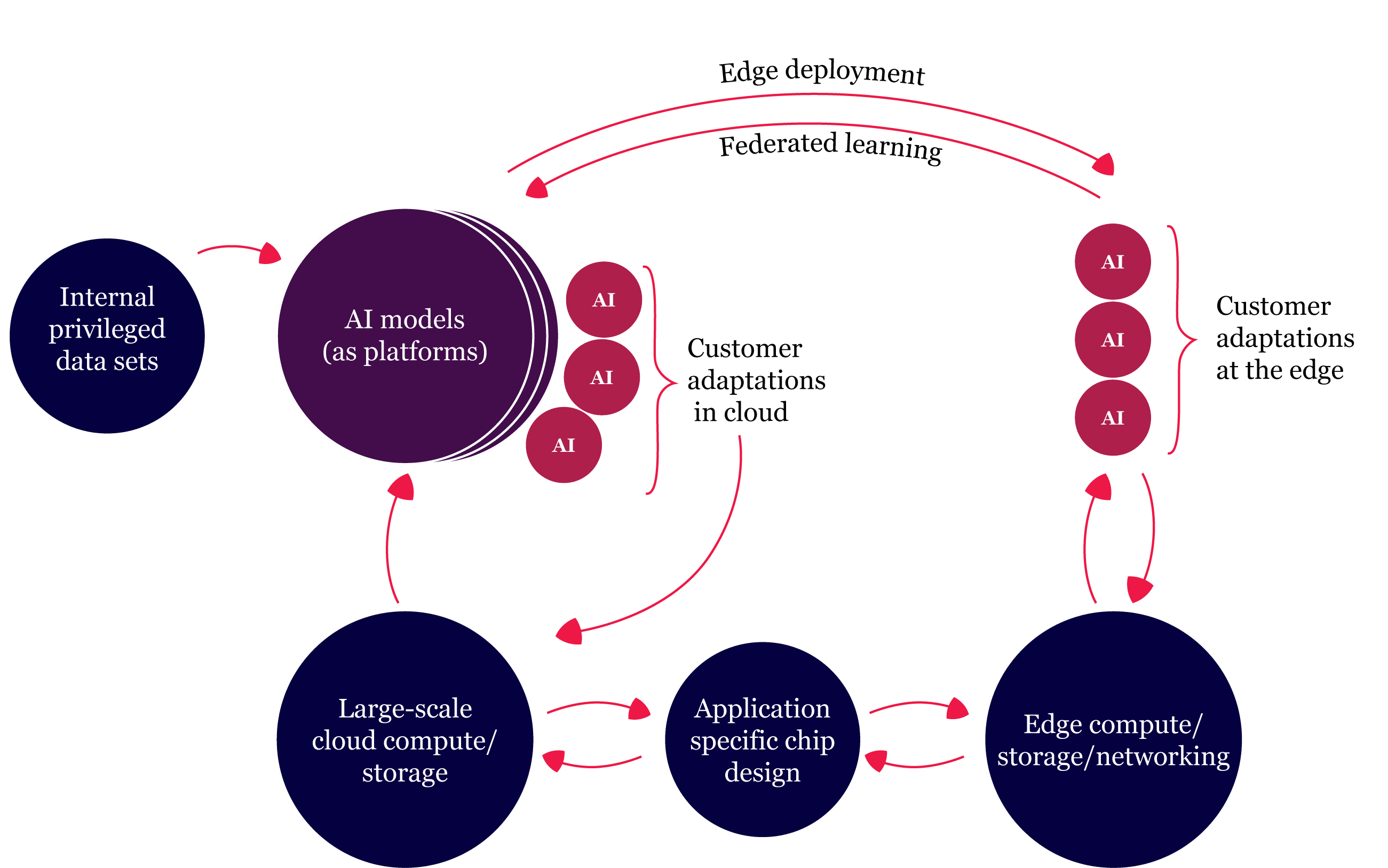

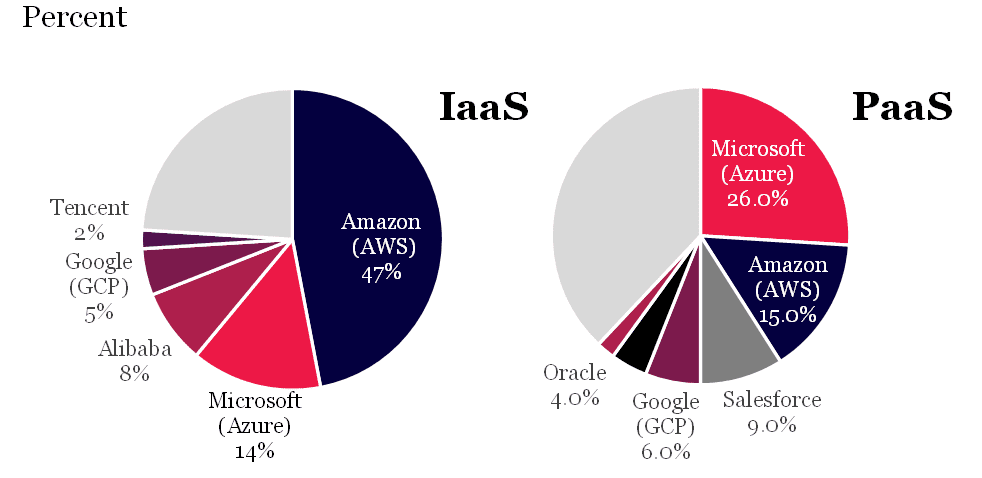

There are myriad ways investors can profit from this AI transformation, but Montaka believes the world's leading cloud computing providers, or 'hyperscalers', particularly Amazon, Microsoft and Alphabet (owner of Google) are one of the safest and surest ways to win. Many investors perceive these mega-tech businesses as 'well-understood', 'mature' and sometimes even 'boring'. We disagree. We believe AI will spark a new phase of hypergrowth for these companies that will take investors by surprise and trigger a big re-rating of their shares. The hyperscalers are uniquely positioned to create an 'AI fly-wheel'

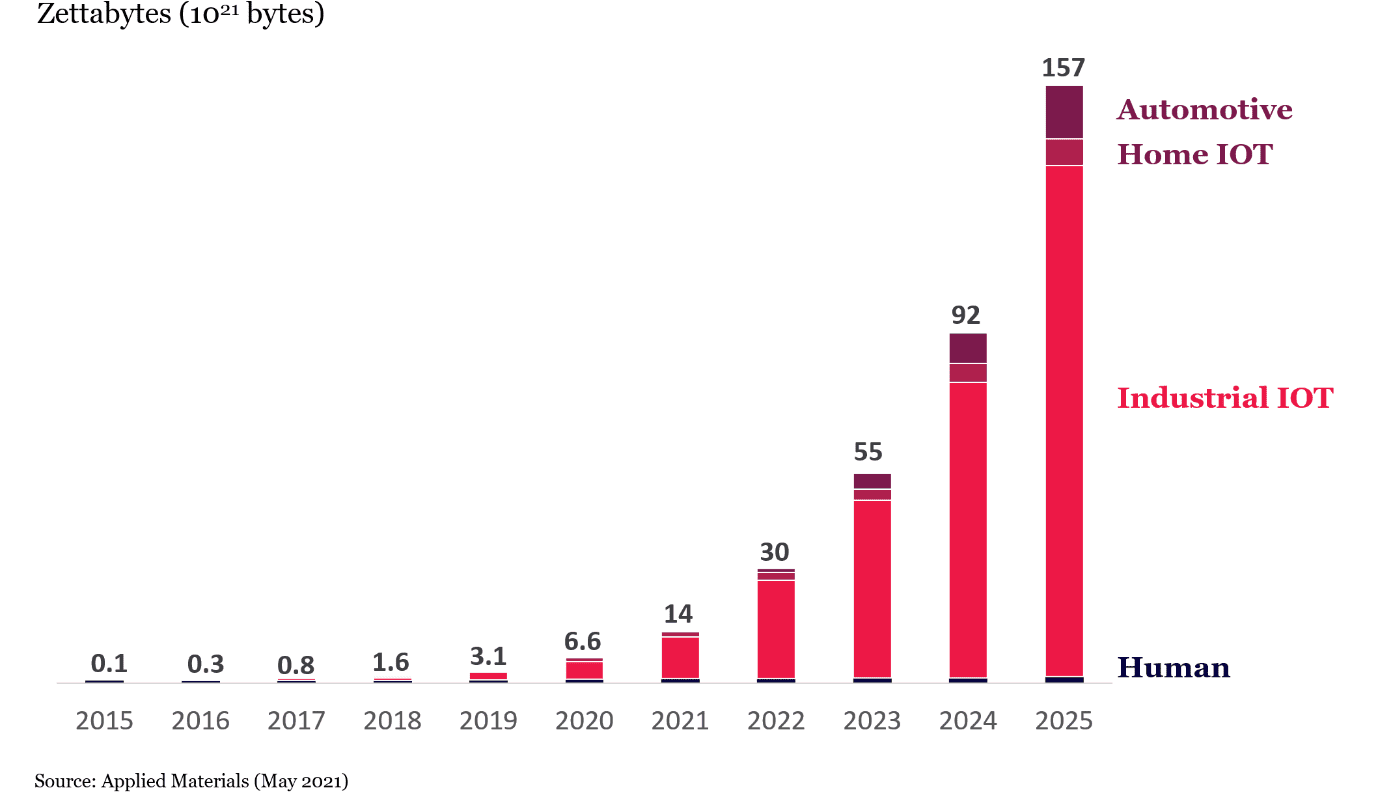

The world's hyperscalers are investing heavily in low code/no code interfaces (including, for example, drag and drop interfaces and natural-language-to-code translators) to democratise the development of AI-based enterprise applications so they are used by more and more employees of the cloud providers' customers. The second driver of massive demand for compute and storage services delivered by hyperscalers is that AI is increasingly being incorporated into every software application in every device. This includes IoT for which we are about to see an explosion in smart devices, deployed at the 'edge', built to be used across all aspects of life. Data Generation - By category

3. ML drives surging demand for compute and storage The effect of incorporating ML into applications is a significant increase in compute and storage intensity, which will benefit hyperscalers. The more successful an AI application is at continually extracting additional relevant data to virtuously improve the accuracy of the embedded ML models, the vastly more compute and storage that is required. 4. Hyperscalers set to dominate 'ASICs' - the new wave of chips powering AI Another reason that hyperscalers are positioned to win from AI is that they are at the cutting edge of developing new chips - Application Specific Integrated Circuits (ASICs) - that will dominate in coming years. Successful innovation on chip energy efficiency is an imperative for the long-term proliferation of AI. Given the enormous economic incentives at play, there is a high probability the hyperscalers will lead this innovation. Not only will this have a positive direct impact on the world's physical environment, but the enabling of increasingly powerful AI will likely, itself, resolve many of the challenges the world needs to overcome to mitigate climate change risks. 6. Hyperscalers will benefit from growing barriers-to-entry that makes them long-term winners from AI Today's hyperscalers have a significant lead over competitors and it is highly likely this lead will only extend over time. The 'barriers to entry' in the space are already very high - and rapidly growing higher, all but eliminating the realistic prospects of a major new competitor materialising.

Montaka believes AI will drive much, much more demand for compute and storage - both in the cloud and at the edge - than many are expecting today. Furthermore, this growth is largely assured, the long-term winners are already known today with a high degree of certainty, and we believe the current stock prices of these businesses are failing to adequately reflect what Montaka's sees on the horizon. It appears highly plausible that hyperscaler revenue expectations are far too low in the context of the scale of the AI-based opportunity that lies ahead. If so, then Amazon, Microsoft and Alphabet - as well as Alibaba and Tencent - will likely surprise investors substantially to the upside over the coming years. Investors should also remember that the enormous R&D being incurred by the hyperscalers, while expensed fully each period to satisfy accounting rules, represents an economic investment in future earnings power. Through this lens, hyperscaler earnings power today is 'artificially' understated - and valuation multiples, therefore, overstated. Funds operated by this manager: Montaka Global Fund, Montaka Global Long Only Fund DISCLAIMER |

17 Mar 2022 - Australian Equities - At The Crossroads?

|

Australian Equities - At The Crossroads? Airlie Funds Management 08 March 2022 |

|

After varying lengths of ever-lower interest rates, RBA asset-buying and benign inflation - all three are reversing course, resulting in increasingly volatile equity markets in 2022. Airlie Portfolio Manager, Matt Williams and Equities Analyst, Will Granger explore what this means for Australian equities. The pair analyse the latest February earnings season and provide insight into the Airlie Australian Share Fund (AASF) portfolio. Timestamps: Funds operated by this manager: Airlie Australian Share Fund |

17 Mar 2022 - Geopolitical volatility and stagflation fears

16 Mar 2022 - 3 stocks to benefit from energy increases

|

3 stocks to benefit from energy increases Datt Capital 03 March 2022 Russia's invasion of Ukraine and the subsequent sanctions against it enforced by the Western world have enormously affected energy and broader commodity markets. The important Asian LNG benchmark, the JKM index, is currently trading ~US$35/MMBtu; significantly higher than in recent months. Whitehaven Coal (ASX:WHC) Written By Emanuel Datt Funds operated by this manager: |

|

Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds no exposure to the stock discussed |

15 Mar 2022 - Investing in infrastructure: what's changed and where are the opportunities?

|

Investing in infrastructure: what's changed and where are the opportunities? Magellan Asset Management February 2022 The last two years has seen international travel upended, domestic transport challenged, 'essential services' redefined and a growing interest in the role infrastructure can play in decarbonisation. With this backdrop, does the case for investing in global listed infrastructure still stack up? |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund |