NEWS

20 Nov 2023 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

20 Nov 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|||||||||||||||||||

| EQT Cash Management Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| EQT Mortgage Income Fund (Wholesale) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| EQT Mortgage Income Fund (Retail) | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|

|||||||||||||||||||

| Euree A-REIT Securities Fund | |||||||||||||||||||

|

|||||||||||||||||||

| Euree Multi Asset Balanced Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| Euree Multi Asset Growth Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 750 others |

17 Nov 2023 - Hedge Clippings | 17 November 2023

|

|

|

|

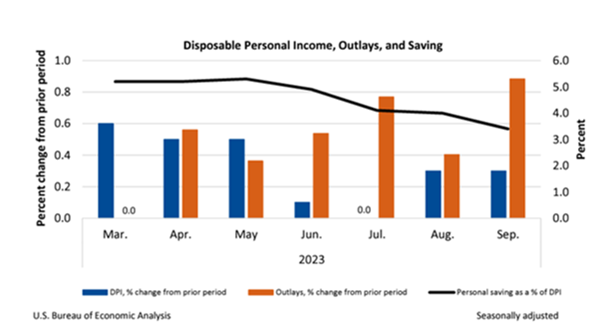

Hedge Clippings | 17 November 2023 No sooner had the RBA hiked interest rates for the 13th time (unlucky for some) to 4.35% in the face of falling - but persistently higher than they'd like - inflation, than the US posts some encouraging news for their October inflation figure of 0.0% month on month, taking the 12 month number to 3.2%, down from 3.7% the previous month, both numbers being 0.1% below expectations. Core CPI increased 0.2% month on month, and 4.2% over 12 months, again below the market's expectations. Much of the drop was the result of falls in energy prices, with notoriously volatile fuel prices falling, in spite of increased global tensions. In any event, expectations of a rate hike in the US evaporated, hitting the US$, and boosting the little Au$$ie battler. That's all well and good for the US, and will of course give the RBA some encouragement that the worst is over, at least globally. However, the RBA board wouldn't have been as happy with the inflationary outlook based on the release of Australian wage data, which grew 1.3% over the September quarter, the largest increase in the 26 year history of the ABS Wage Price Index, which was also higher than the local inflation rate of 1.2% over the same period. In other words, wages grew faster than inflation at a time when the RBA is trying to dampen demand, not fuel it. Then along come employment figures for October at 3.7%, flat on trend terms, and up slightly seasonally adjusted. Prior to being appointed to the top job at the RBA Michele Bullock indicated an unemployment rate of 4.5% would be required to tame the inflation dragon, but maybe as that didn't appear to be eventuating she felt the need to cause pain elsewhere? Either way, and as we've noted before ad nauseam, both unemployment and interest rates only affect a proportion of the population, and in the case of interest rates, unevenly at that. Added to which is the lagging effect of higher mortgage rates, and the fact that higher interest rates benefit a different group of consumers, generally those less impacted by inflation to boot! We're in agreement with the RBA that inflation is far too persistent, and not only for the sake of the economy, and the welfare of those most affected, and least able to bear the cost. On a purely selfish level, in addition to seeing increases of 20 to 25% in the price of our daily caffeine fix, we're sick of writing about it every Friday! In times gone by there were political characters who were easy targets for Hedge Clippings' brand of cheap humour, or local or global political issues to have a crack at. The world is sadly in far too serious a place for that kind of stuff, and opinions on both sides are too entrenched, and intolerant, to venture onto that stage, or soap-box. Where's Scomo, Boris, or even The Donald when you're looking for a little light-hearted fun and cynicism to end the week? The answer of course is that Donald hasn't really gone, he's just gearing up for another tilt at the White House, which isn't looking as far fetched as it might have been four or five years ago! News & Insights New Funds on FundMonitors.com Market Commentary | Glenmore Asset Management Investing in communication towers | Magellan Asset Management Events & Webinars October 2023 Performance News Bennelong Australian Equities Fund Skerryvore Global Emerging Markets All-Cap Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

17 Nov 2023 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

17 Nov 2023 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

17 Nov 2023 - Good things come to those that wait

|

Good things come to those that wait Devon Fund Management October 2023 After a challenging few months, stock markets have started November brightly. With inflation getting under control, many central banks cooling their jets, and bond yields easing, are equity markets in for a strong end to 2023? If October was meant to be the "Bear Killer" month, it certainly didn't pan out that way. The month started brightly enough with the end of the debt ceiling standoff in the US, but the Israel/Hamas conflict came from left field and added another dimension to go with existing market uncertainties. Bond yields rose, with the US 10-year hitting the highest level in 16 years, despite many central banks pushing pause. The European Central Bank joined other majors in going on hold after 10 consecutive increases. Inflation prints meanwhile continued to be generally lower than expected, while economic data was broadly positive, as was the earnings season in the US and Europe. Nonetheless, markets continued to soften in October. The Dow Jones and the S&P500 declined 1.4% and 2.7% respectively during the month, marking the first three-month losing streak for both indices since March 2020. Europe and Asia were similarly weak. The falls in New Zealand and Australia were more pronounced. The NZX50 fell 4.8% to hit a 16-month low, while the ASX200 dropped 3.8%, back to the levels of a year ago. November has started off much brighter. As is (usually) the case with October, historically speaking, November is also seen as a strong month for markets, with seasonal tailwinds often featuring in a year-end rally. Whether this transpires may depend on what the bond market does, and on any messaging that rates may not be higher for longer. There are some hopeful signs at the start of this month, with the Federal Reserve leaving rates at a 22-year high for the second straight meeting, but with the language at Jerome Powell's post-meeting conference being interpreted by many that the central bank is "done" with rate hikes. While the year has not panned out particularly well for the NZ share market to date, there are also some positive tailwinds in the air. The switch to a right-leaning government appears to have already boosted business sentiment, while a lower-than-expected inflation print and tick-up in the unemployment rate could well mean that a rate hike is off the table when the RBNZ meets later this month. Across the Tasman it is a slightly different story with the CPI and retail sales both coming in hot at the last prints. While developments in the Middle East were a new factor for investors to consider in October, it was the rise in bond yields that provided the main headwind. Oil prices initially surged to US$95 following the incursion by Hamas, but have since settled back to where they were in September. Safe havens such as gold and cryptos rallied on rising geopolitical tension, but the oil market is not suggesting the conflict will broaden within the region. The view that rate hikes were near an end was not disrupted during the month, but the length of time they would remain elevated was. The "higher for longer" narrative provided a complication to investors buoyed by falling rates of inflation and many central banks hitting the pause button. The Fed though has perhaps provided some cause for comfort over the past week in holding the Fed Funds Rate in a target range between 5.25-5.5%. While there was no commitment to officials being "done" with further rate hikes, there were some subtle changes to the language used in the accompanying statement, while Jerome Powell suggested at the press conference that monetary policy was "sufficiently restrictive." Bond yields dropped away in the aftermath. Officials upgraded their assessment of the economy while noting that inflation (while elevated) was still falling. The Core Personal Consumption Expenditures price index, the Fed's favoured inflation gauge, increased 3.7%, the first sub-4% reading in nearly two years. Recent quarterly GDP numbers were robust, and the Fed changed its description of the economy from "solid" to "strong." All heading in the right direction. The Fed remains in data-dependent mode but also noted the dual-sided risks to the economy, with previous rate hikes likely to have a dampening impact.

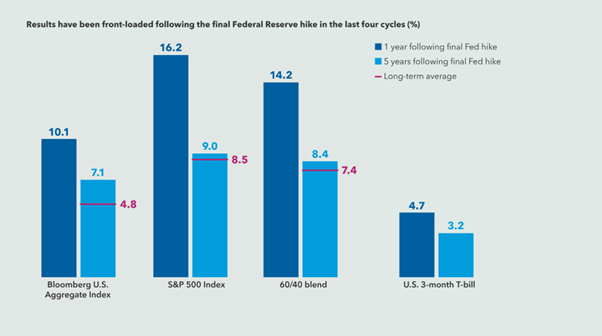

September and October proved challenging months for markets as bond yields climbed, but sentiment has turned sharply with November underway. Yields have backed away from recent highs, with the US 10-year back at 4.67% in early November after hitting 5% last month. Data released recently has given further credence to the narrative that inflation is easing, and the labour market is slowing (the cost of labour declined in the third quarter and October job additions have come in below expectations), boosting the scenario that the Fed is done with rate hikes. This would be a highly significant milestone, given the strong performance of markets in the year following the final Fed hike over the past four cycles.

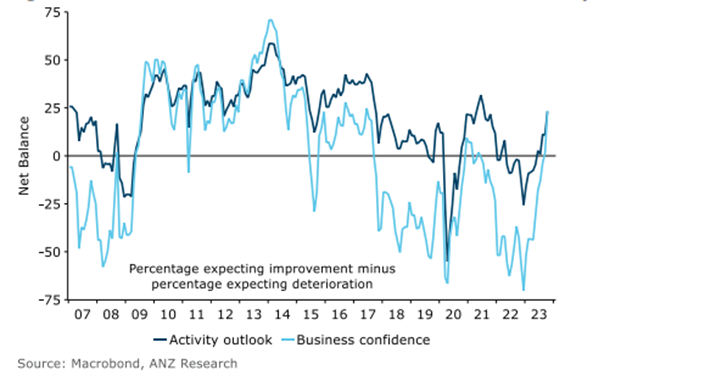

The 10-year Treasury yield hit the highest level since 2007 during the month and one area which was impacted significantly was high PE growth stocks. The tech-laden Nasdaq fell nearly 3% and had its third consecutive negative month. Super-cap tech stocks particularly the "Magnificent 7" (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) have had a big say in proceedings this year, given they account for around 30% of the S&P500. It has been a mixed bag in terms of reporting, with strong results but differing outlooks amongst the constituents that have reported to date. Alphabet, Meta and Tesla were somewhat downbeat, while Amazon and Microsoft were in the more positive camp. In recent days Apple has beat on earnings, but given a weak outlook. Nvidia reports later this month. Share price performances from the mega-cap group have been contrasting. Tesla fell 20% in October, while Nvidia and Alphabet have also underperformed the benchmark. AI has been one driver behind the blue sky that has been priced into some of the 'M7' names, meaning there is a lot to live up to in terms of valuation, and leaving these names prone to any 'imperfect' news. There have been reports that Nvidia may have to cancel billions of dollars in orders from China due to tighter US controls. Alphabet's CEO has meanwhile been in court, conceding that agreements making Google's search engine the default on smartphones and browsers can be "very valuable." Google is involved in the most significant monopoly trial in 25 years. The big super-tech names have a lot to live up to, and time will tell if any become "Maleficent" from a share price perspective. Two of the M7 however put in strong gains in October - Amazon and Microsoft. Strong results from both were matched by upbeat outlooks. Microsoft, the top holding in the Devon Global Sustainability Fund, rose around 7%. The company's Azure cloud segment is performing robustly and anticipation is building around the growth potential of Microsoft 365 Co-pilot. With the earnings season roughly three quarters through, nearly 80% of S&P500 companies that have reported to date have beaten earnings, above the 5-year average, although only around 60% have done so on revenues. This in part reflects a slowing economy, but also that margins have been resilient amidst cost-cutting. The overall share price reaction though has been heavily weighted towards what management teams have said about the outlook. Older economy stocks have mostly been positive from a reporting perspective. Results from the banks were well received, although there have been disappointments. Some companies are also handling an inflationary environment (and other challenges) better than others. Sales at McDonald's, Coca-Cola and Starbucks have been relatively inelastic as the companies have been putting up prices. The spotlight on obesity (with new wonder drugs) has also yet to have an impact where you expect it might. Consumers in the world's largest economy may be trading down but are still spending on necessities. This was also evident in knockout results from streamers Netflix and Spotify. There hasn't been too much in the way of corporate results in New Zealand, but there was an election result. There has already been some feel-good news from the business sector, with the ANZ Business Outlook showing that business confidence jumped 21 points to +23 in October. The reading is the highest level since mid-2017 when National was the government. While inflation expectations didn't fall, reported wage increases versus a year earlier dropped to 4.9% - that's the lowest read since March 2022. NZ First is now playing a role in the government, but it appears the election result is rubbing off on business optimism. The question now is will there be follow through?

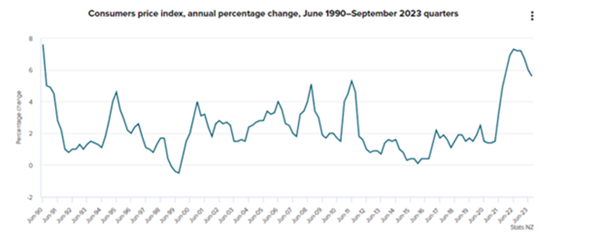

There was some good news on inflation during the month, which came in lower than expected in the September quarter. Annual CPI came in at 5.6% in the 12 months to the end of September, which was down from 6% in the three months to June. Consensus expectations were around 5.9%-6.0%, while the RBNZ forecast in the August MPS was 6%. In the quarter the CPI rose 1.8% which is below the RBNZ's forecast for 2.1%. Inflation is cooling with non-tradeable (domestically driven) inflation also coming down.

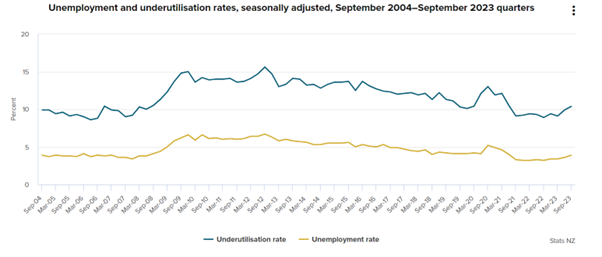

Inflation is at the lowest level in two years, which has reduced the prospect of another rate rise by the RBNZ (the next meeting is at the end of this month), as has a slight easing of pressures in the employment market. New Zealand's unemployment rate lifted to 3.9% in the year ending September, from 3.6% previously. This is materially higher than the 3.2% low in September 2022. The underutilisation rate lifted to 10.4%, up 0.5% from the previous quarter, and from 8.9% the previous year. Underutilisation is a broader measure of spare labour market capacity than unemployment alone. The employment market has been too tight, but things appear to be turning, and arguably heading back towards the "maximum sustainable level" targeted by the RBNZ.

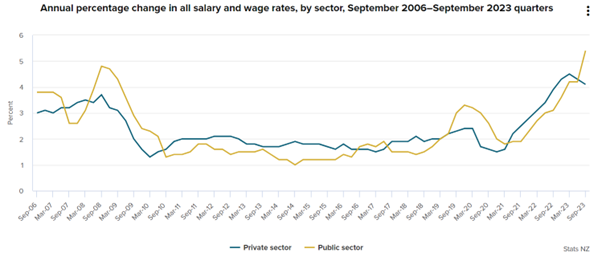

Meanwhile, wage growth is easing, at least in the private sector. The Labour Cost Index was 4.3% in the year to September 2023, unchanged from the previous quarter. Salary and wage rates for the public sector increased 5.4% annually, the highest rate since the series began in the December 1992 quarter. This has been influenced by collective agreements for teachers, nurses, and the NZ Defence Force over the past year. These settlements won't though be an ongoing feature.

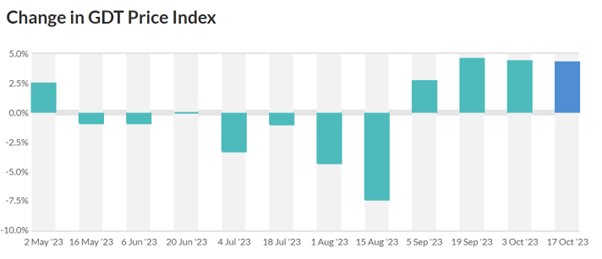

Confirmation that the RBNZ (along with many other major central banks) is also "done" with further rate hikes would be well received across the corporate sector, and the market generally. We are starting to see signs of this being acknowledged with markets rising in the early days of November. China, NZ's biggest customer meanwhile remains an unknown, but a key area of the economy - the dairy sector - is already seeing tailwinds. Milk prices have risen at the last four auctions. This could have positive trickle-down impacts on the NZ economy.

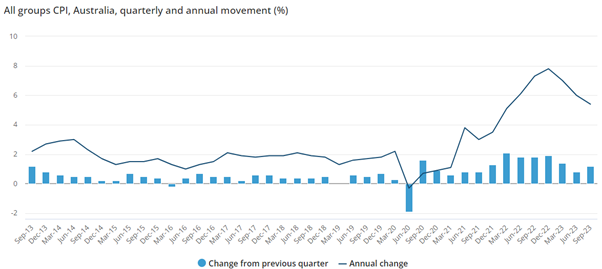

Source: Global Dairy Trade It is a slightly different story in Australia. The RBA noted at its last meeting that keeping rates on hold was a close call. Since then, two key pieces of data have boosted the case for a rate hike on Melbourne Cup day. Third-quarter inflation was stronger than expected with the CPI rising 5.4% year on year, above expectations for around 5.3%, but down from 6% in the second quarter. Core annualised inflation was up 5.2% against a forecast of 5%. This is while new Governor Michele Bullock has reiterated that officials have a "low tolerance" for a slower return of inflation to the RBA's target range.

Source: ABS The Aussie retail sales print for September was also hotter-than-expected. Retail turnover rose 0.9% month on month, around triple consensus forecasts. August and July numbers were revised upwards. Department stores and household goods were key drivers, which flies in the face of downbeat consumer confidence. We have also seen similar upbeat comments at AGM updates from several big Aussie retail names. Perhaps a resurgence in the housing market has helped liven spirits. CoreLogic data showed Aussie house prices increased further in October, underpinned by strong demand from migrants and foreign investors, amid a tight rental market. Sydney house prices are up 9.1% on a year ago, while those in Perth have jumped 11%. The broader fortunes of Australia, like NZ, remain closely tied to those of China. A rise in iron ore prices (which were already elevated from a historical perspective) in recent weeks suggests that the outlook has improved here. Once again the past month delivered a major surprise for investors to contend with. The promise of the final two months of the year being much better is however gaining credence. The soft-landing scenario remains alive and well, particularly with many central banks coming to the end of their rate-tightening programs. After a tough 2022, history is on the side of 2023 finishing positively. Uncertainty though still abounds in a number of areas, making for a productive environment for astute, active investors.

Funds operated by this manager: Devon Trans-Tasman Fund, Devon Alpha Fund, Devon Australian Fund, Devon Diversified Income Fund, Devon Dividend Yield Fund, Devon Sustainability Fund |

16 Nov 2023 - Performance Report: Collins St Value Fund

[Current Manager Report if available]

16 Nov 2023 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

16 Nov 2023 - China and India's contrasting inflation front

|

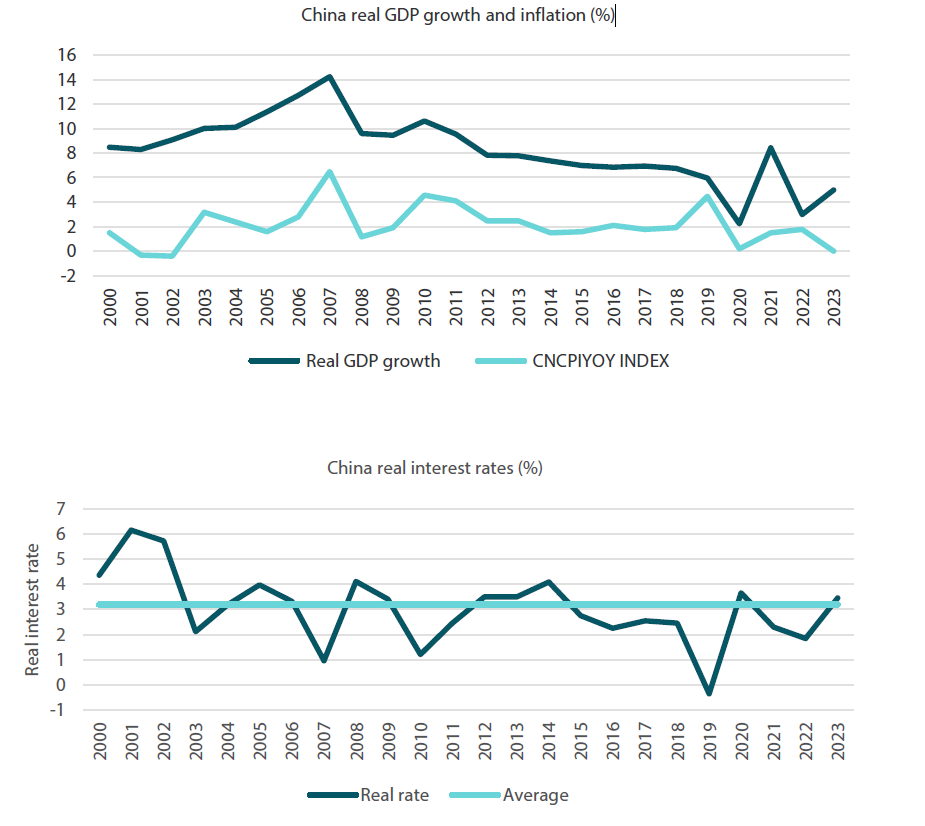

China and India's contrasting inflation front Nikko Asset Management October 2023 The implications of inflation Inflation--the increase in the general price level of goods and services in an economy over a timeframe--has become one of the most closely watched economic gauges in recent years as consumer prices hit record highs. Besides bearing significant influence on standards of living, economic growth and the direction of interest rates, inflation also has significant implications on the top-down development of countries as well as the bottom-up fundamentals of companies. On a top-down basis, inflation signals the strengths and weaknesses in the overall economy and drives the policies and responses of governments and central banks, either being supportive or restrictive. From a bottom-up perspective, inflation signals whether certain industries have the pricing power to pass on the changes in costs and to generate sustainable returns from future investments. In other words, inflation encapsulates changes in both the overall economy and the operating metrics of a company. Moreover, inflation can have political implications, particularly in the developing world, as it is often a key issue in elections and can impact the popularity of elected politicians. That is why investors in the emerging markets often pay close attention to the general development of consumer prices, plus the outlook of inflation. Indeed, how a government navigates inflation often affects future investment returns. In this article, we compare and contrast two of emerging Asia's largest economies, China and India, through the lens of inflation. Today, China and India face opposite inflationary pressures, which could alter the outlook for these two large emerging economies. Inflation in China is close to zero, while that of India is above 6% (as of August 2023). Year-to-date (YTD), as at end-September 2023, the renminbi has depreciated more than 5% against the US dollar (USD), whereas the India rupee is flat versus the greenback. Equity markets also seem to be rewarding one and punishing the other; Indian equities (as measured by the MSCI India Index) were up 8.0%, in USD terms, on a YTD basis (as at end-September 2023), while China stocks (as measured by the MSCI China Index) were down 7.3% YTD. China faces deflationary pressures Let us begin with a close look at China. Concerns that China could be facing a deflationary spiral arose when the country reported that consumer inflation dropped by 0.3% YoY in July, the first decrease since February 2021. Since then, consumer prices in the world's second largest economy have moved higher, rising by 0.1% YoY in August, allaying fears a persistent deflationary trend in the nation. Headwinds from falling property prices and the decline in construction activity due to its ailing real estate sector are likely to cause more lingering deflationary pressures, in our view. Very low inflation or deflation can directly impact consumer behaviour. First, it can lead to a decrease in consumer spending as consumers may delay purchases in anticipation of lower prices in the future. This can lead to decreased economic growth and job creation. Second, low inflation can compound the debt burden. As the real value of debt increases due to the lack of inflation, this could lead to increased financial stress for households and businesses. At the same time, low inflation can discourage investments as investors may seek higher returns in other countries with higher inflation rates. And if subdued inflation persists for an extended period, it can lead to a deflationary spiral where prices continue to fall, potentially leading to a long-term economic stagnation. The big picture is that Chinese economic growth has been on a declining trajectory since the 2008 Global Financial Crisis (GFC). Having said that, if China were to achieve its government's targeted GDP growth of 5% for 2023, that would still be a decent result for a maturing economy (see Chart 1 for China's real GDP growth, inflation and real interest rates). Chart 1: China's real GDP, inflation and real interest rates

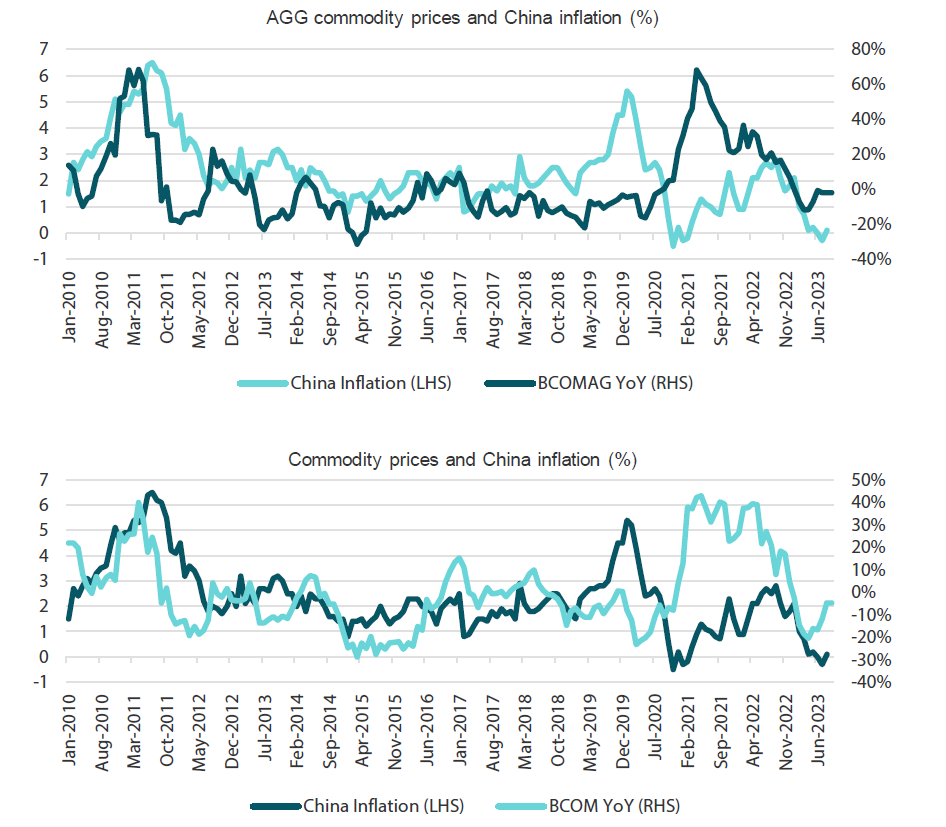

Source: Bloomberg, August 2023 More broadly, China currently faces several structural issues. It has negative population growth, a heavy debt burden in certain areas (namely property), an oversupply of goods, weak export markets and tight monetary policy. China's monetary policy has historically been on the tighter side, averaging 3% in real interest rates. Despite its recently flagging economy, China's current real interest rates still stand at 3%. There have been times when real rates in the country were lower, such as during the GFC and around the period of global economic weakness of 2015. This time around, the People's Bank of China (PBOC) is using alternative measures, like cutting mortgage rates incrementally and reducing banks' reserve requirements to boost overall liquidity. In our view, the Chinese government and the PBOC need to do more to stimulate the economy. Monetary policy loosening at a drip-feed speed is not creating a positive environment for the Chinese markets. Indeed, consumer and investor confidence in China is fading. Portfolio flows are negative and foreign investors are net sellers of Chinese equities. Nonetheless, it is not all bad for the world's second largest economy on the inflation front. One of the positives is that China is still seeing some inflation on the services side, which accounts for 40% of the inflation basket. Services-related inflation is rising at 1.3% on average, compared to overall consumer inflation at 0.1% YoY (as at August 2023). Historically, China's services-related inflation had hovered between 2-3%. During the COVID-19 lockdowns, it fell below zero. A rise in services consumer price index (CPI) is good for the overall inflation picture in China, which is growing more slowly in recent years and whose growth is largely due to government spending. All in all, China needs inflation to move higher. Higher commodity and agriculture prices could lead spur Chinese inflation Going a step deeper into the drivers of inflation in China will show that agriculture prices (namely those of soybean and pork) and commodity prices (including hydrocarbons, which are the main components of oil and natural gas) are closely related to the direction of inflation in the country (see Chart 2). As such, rising commodity prices and higher agricultural prices could pose an upside risk to inflation in China. A surge in China's inflation in 2019, for instance, was partially attributed to the outbreak of swine flu in 2018, which caused an increase in pork prices amid a drop in supply. Chart 2: China's inflation and commodity prices move in tandem

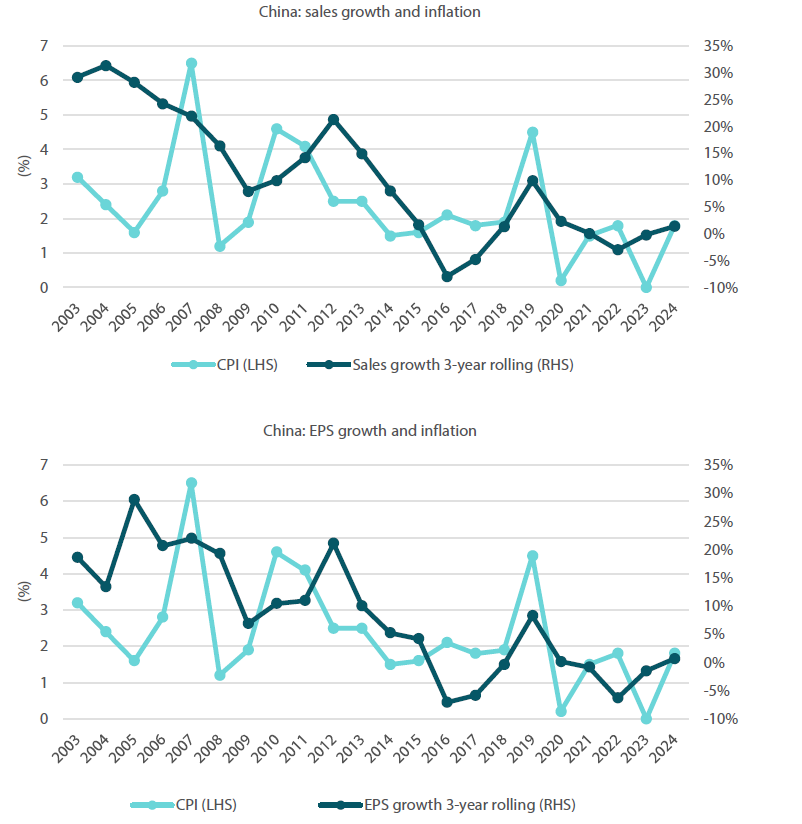

Source: Bloomberg, August 2023 COVID-19 further distorted the time series of inflation in China. Since the country's re-opening earlier in 2023 (and the absence of disease or other disruptions to supply), agriculture consumer prices look to have bottomed. Agriculture inflation in China is trending around 2% and could lift overall Chinese CPI. The same is true of rising commodity prices. Oil prices have recently risen above USD 90 per barrel. China imports around 59% of its oil needs, making it the largest oil importer globally, and higher oil prices will support inflation in the country. There is, however, a risk of stagflation if rising commodity-driven inflation is accompanied by low growth. Indeed, without productivity gains or other spending increases, inflation without growth for China may be problematic for the world's second largest economy. Chinese inflation and its impact on equity markets The Chinese equity market, as measured by the MSCI China Index, is trading close to the lowest price earnings (PE) multiples in 20 years, with very low growth priced in by the market. During the 2010-2015 period, equity valuations in China fell with declining inflation. Over that period, the market return in China averaged 1.5% on an annualised basis. Without dividends, it was negative. Today, China is once again experiencing a period of low and declining inflation, which coincides with the downturn of its equity market. However, if Chinese inflation starts to rise due to higher agriculture and commodity prices and looser monetary policy, we do expect a better showing for China stocks. This is because corporate sales and earnings per share (EPS) growth rates tend to have a positive correlation with inflation (see Chart 3). Chart 3: China's corporate sales and EPS growth are positively correlated with inflation

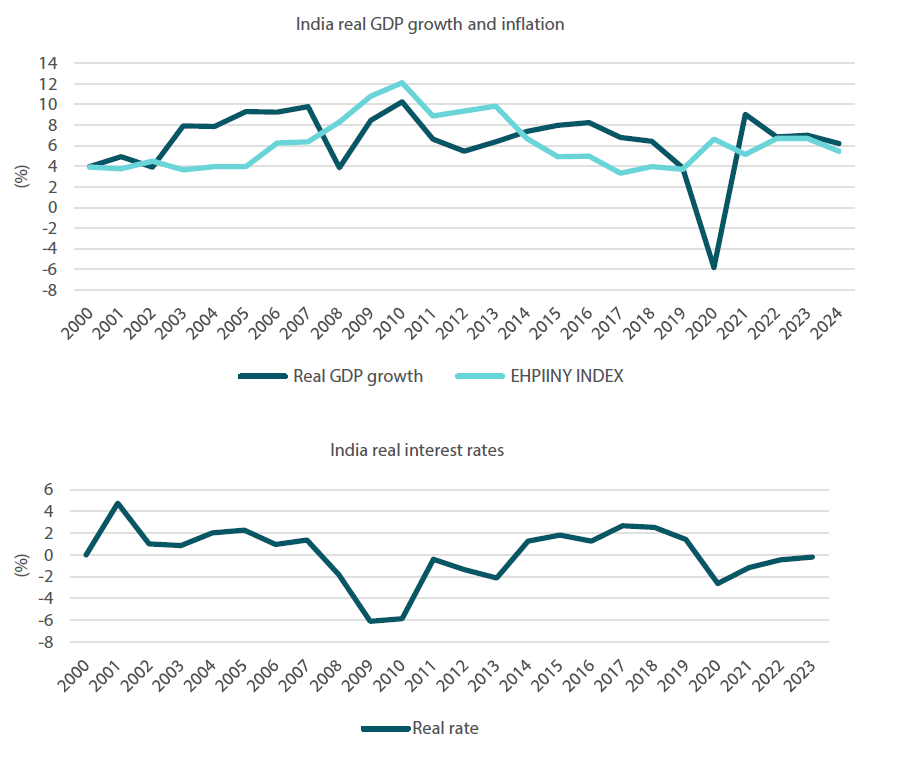

Source: Bloomberg, August 2023 Earnings growth in China has been decelerating since 2005 and hit bottom in 2016, when China implemented a massive monetary stimulus that lifted global equity markets and Chinese earnings. The effects of that stimulus have worn off, and the Chinese equity markets are now back to the lows of 2016. Chinese earnings growth is in a difficult position; it needs a forthcoming and large stimulus, which, in turn, will help lift inflation in the country. After China's last set of quarterly results, earnings revisions for 2023 and 2024 were negative; growth expectations, though positive, are also falling. We have looked at the annualised three-year sales growth of corporate China, working under the assumption that it takes time for inflationary pressures to work through a company's operations. Our expectations are for Chinese inflation to rise to 2% in 2024 and sales growth to follow suit. If that materialises, it would be a good result for Chinese earnings growth. All things considered, the Chinese equity market needs a source of higher profitability, and rising inflation, amongst other factors, could be key to invigorate profit levels. India at a sweet spot Viewed through the lens of Inflation, India is at the opposite end of where China is. India's Inflation, while above the Reserve Bank of India (RBI)'s target of 4%, isn't looking too elevated, as compared to its historical averages. Inflation in India has slightly eased to 6.83% YoY in August (from 7.44% in July) and is currently in line with the country's average annual inflation rate, which over the past few decades has been around 6-7%. As we see it, the Indian central bank remains accommodative, keeping real rates close to zero. The country's political climate is pro-business. The government of Indian Prime Minister Narendra Modi is in its third year of running large budget deficits, and with the coming general elections in 2024, the administration is unlikely to tighten its budget strings in the foreseeable future. At the same time, high oil prices have yet to hit the Indian economy, which is still relying on cheap Russian oil. India's annual GDP growth has hovered steadily in recent years, generally between 6% and 10%, while inflation has moved around the same levels as GDP growth (see Chart 4). India is in a sweet spot at the moment as inflation is trending lower, yet it is at a faster rate than GDP growth. Chart 4: India's real GDP, inflation and real interest rates

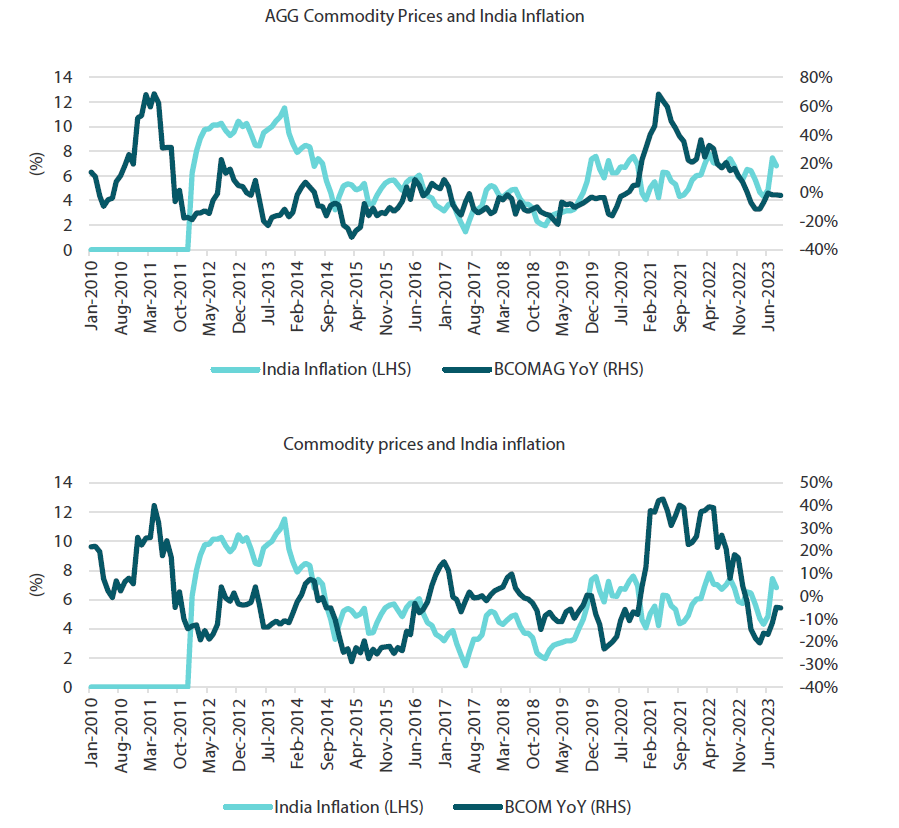

Source: Bloomberg, August 2023 The RBI tends to keep a closer eye on real GDP growth than inflation. In times of rising real GDP growth, the central bank has tightened monetary policy and loosened policy during periods of declining GDP growth. Expectations are for the RBI to continue to be accommodative, given that there are elections in 2024. Future agriculture prices key to India's inflation India's inflation basket is heavily weighted towards food, which makes up almost 37% of the CPI basket, while fuel comprises 5-6% of the total. Agriculture prices, on a YoY basis, have flattened, giving respite to inflationary pressures in India (see Chart 5). If there are any shocks to the global food supply, from either an escalation of the Ukraine-Russia war or from weather-related events, that could be a potential risk to inflation in India. Overall commodities, though rising largely because of higher oil prices, do not have that much of an impact on inflation in India. Chart 5: India's intertwined Inflation and commodity prices

Source: Bloomberg, August 2023 The Indian equity market and its link with inflation In India, the earnings yield, which is the inverse of the PE multiple, tends to move in tandem with inflation. During the commodities super cycle at the turn of the century, the Indian stock market did very well as inflation trended higher and valuations rose. Today, the environment looks similar. Inflation is high, growth expectations are rising and the market is starting to perform well. India's earnings growth, which is reaching historic highs, could mean persistently higher inflation. However, stand-alone valuations in the country are not excessive and rising rates haven't dampened investor sentiment. Relative to cash, equity valuations look fair, our view. Likewise, sales and earnings growth in India, historically, have had a fairly good relationship with inflation. In the post pandemic period, we have seen a divergence, however. Inflation has flattened and is expected to decline over 2024, while both sales and earnings are expected to continue to rise. Still, we reckon that if the country's sales and earnings were to remain strong in 2024, that would be supportive of higher rather than lower inflation. All in all, the Indian equity market looks well-placed with inflation under control, supportive monetary and fiscal policies. And with investors looking for alternatives to China, the uptrend in the India equity market could last for a while. Overall, the Indian equity market is pricing in a longer growth cycle; earnings growth expectations remain high, while strong macro tailwinds should continue to support the corporate sales and earnings rebound. Key takeout

Author: Mohammed Zaidi, Investment Director Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

15 Nov 2023 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]