NEWS

18 Dec 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - November Glenmore Asset Management December 2023 Globally equity markets recovered strongly in November. In the US, the S&P 500 rose +8.9%, the Nasdaq increased 10.7%, whilst in the UK, the FTSE 100 was more muted, rising +1.8%. The key driver of the rally was data points showing cooling inflation, which in turn saw bond yields fall materially. The US 10-year bond rate declined -58 basis points to close at 4.26%. Its Australian counterpart fell +52bp to close at 4.41%. The weaker inflation data provided hope that the restrictive interest rate hikes of the last 18 months may be nearing an end. In Australia, the All-Ordinaries Accumulation Index rose +5.2% in November. Top performing sectors were healthcare and real estate (a clear beneficiary of lower bond rates), whilst energy was the worst performing sector, driven by a fall in oil and gas prices. Positively for the fund, small cap stocks outperformed large caps as investor risk appetite improved with falling bond rates. Given the material underperformance of small cap stocks vs large caps in the last 18 months, we believe the next few years should be positive for the fund given its skew to small caps, where we are seeing quality companies across numerous sectors priced very attractively. Funds operated by this manager: |

15 Dec 2023 - Hedge Clippings | 15 December 2023

|

|

|

|

Hedge Clippings | 15 December 2023 No wonder there's a property crisis - and it's not just because in the 12 months to 30 June Australia recorded a net annual gain of 518,000 people, with migrant arrivals up 73% year on year to 737,000. Temporary visa holders numbered 554,000, while departures decreased marginally by 2% to 219,000. To what extent this represents a catch-up post COVID remains to be seen, but with a population of just 26 million this represents a huge influx - and a massive supply/demand imbalance when it comes to housing and infrastructure. Australia's economy has always benefited from migration, and with 910,000 jobs created over the last two years, and historically low unemployment, there's nothing to fear from the numbers. Australia needs migrants to fill job vacancies, and to maintain the record of growth. As the federal government announced this week, going forward the "mix" of migrants is to change, although we're not confident that when they announce the details they'll get the balance right. Being politicians, there's always the risk they'll make decisions based on the next election, rather than what's best for the long term economic and social benefit of the country as a whole. Even though unemployment inched up by 0.1% in November to 3.9%, with 19,000 joining their ranks, employment increased by 61,000 people, resulting in the employment to population ratio reaching a record high of 64.6%, and the participation rate also at an all time high of 67.2%. But back to property... All too often Hedge Clippings' focus is on interest rates and inflation. However, in spite of the Doomsday merchants and some so-called property experts predicting a 20% to 30% fall in property prices and widespread mortgagee sales as the RBA jacked up interest rates, this hasn't occurred. Prices have remained strong. One reason - and possibly the major one - for the property crisis in Australia is simply the imbalance between supply and demand - economics 101. According to Brook Monahan of Mosaic Property Group, who operates a highly successful building/development business in SE Queensland, Australia wide in the year to March 2023, homes were needed for an additional 226,000 households. Only 170,000 were completed. Next year is worse, with a forecast of just 153,000 new homes completed. As a nation, Australia has never completed more than 191,000 new homes, and the ten year average is 173,000. The target requirement is 240,000. In other words, we're simply going backwards, and cost pressures and lack of effective decision making by governments of all persuasions is not going to help. As Monahan continues, until there is action on a policy front (because winding back migration is not the solution), the current housing shortage will continue to drive rents higher still, and worsen housing affordability. Forecast reductions in interest rates towards the end of 2024 on the back of falling inflation won't help, although it will help those with existing mortgages. And so as we end 2023 and look both backwards and forward, we'd have to say it's been a challenging year, and next year is likely to be the same. Meanwhile, Hedge Clippings will be taking a short, but (we think) well earned break, so this will be the last edition before we return in the New Year. Until then, we'd like to thank you for your time and attention over the past year, and wish you and your family a Happy Christmas, and a safe, healthy and prosperous New Year. News & Insights New Funds on FundMonitors.com The real risk of wildfires to US infrastructure investors | 4D Infrastructure Investing Essentials: Diversification - The shield against investment volatility | Bennelong Funds Management November 2023 Performance News Glenmore Australian Equities Fund Bennelong Emerging Companies Fund Skerryvore Global Emerging Markets All-Cap Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

15 Dec 2023 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

15 Dec 2023 - Performance Report: Collins St Value Fund

[Current Manager Report if available]

15 Dec 2023 - China Property: Has the "Grey Rhino" been tamed?

|

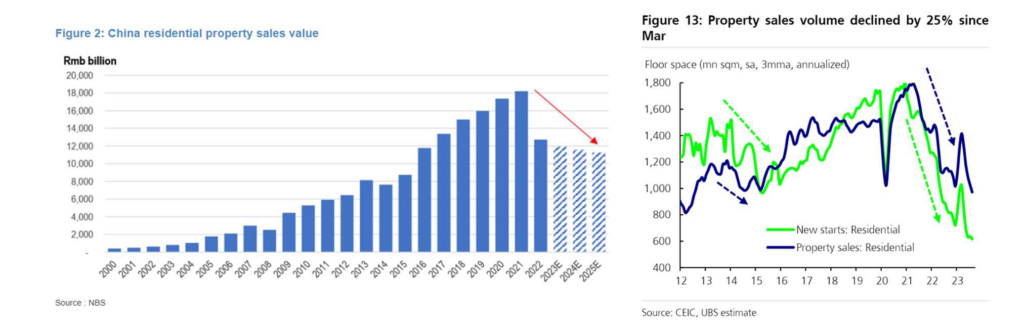

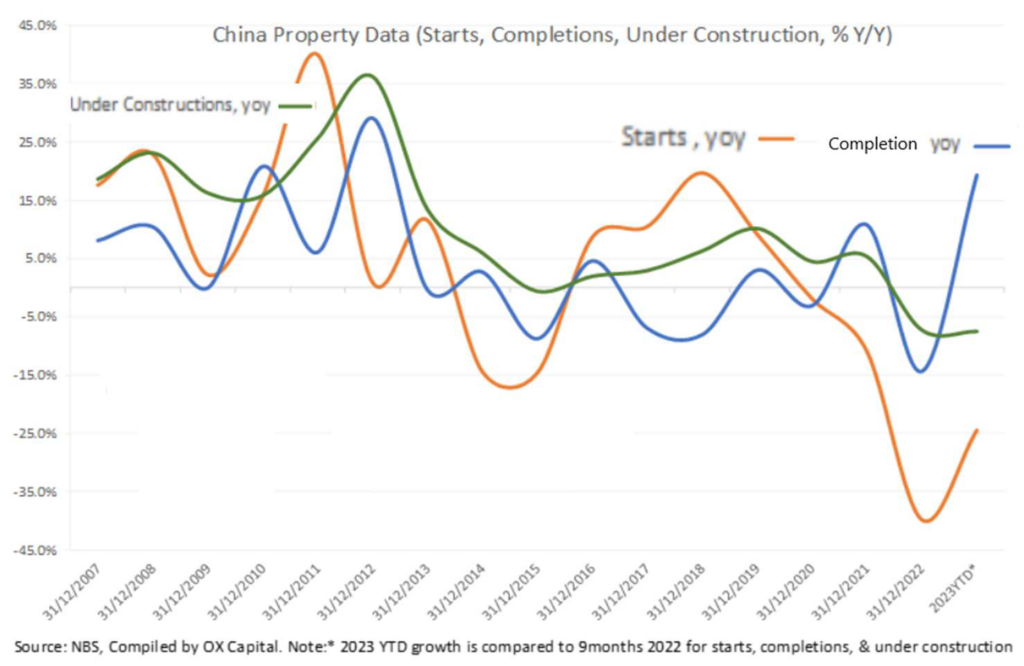

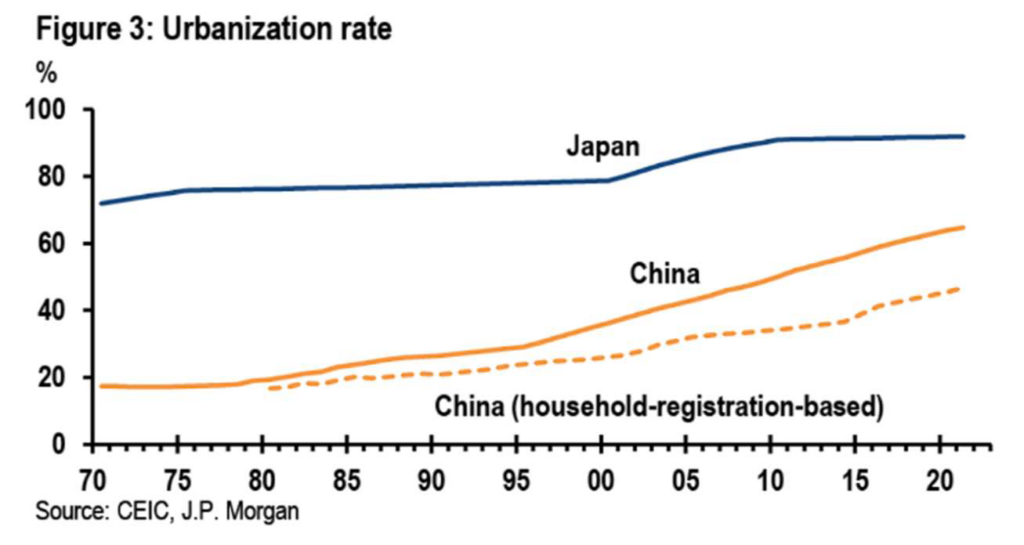

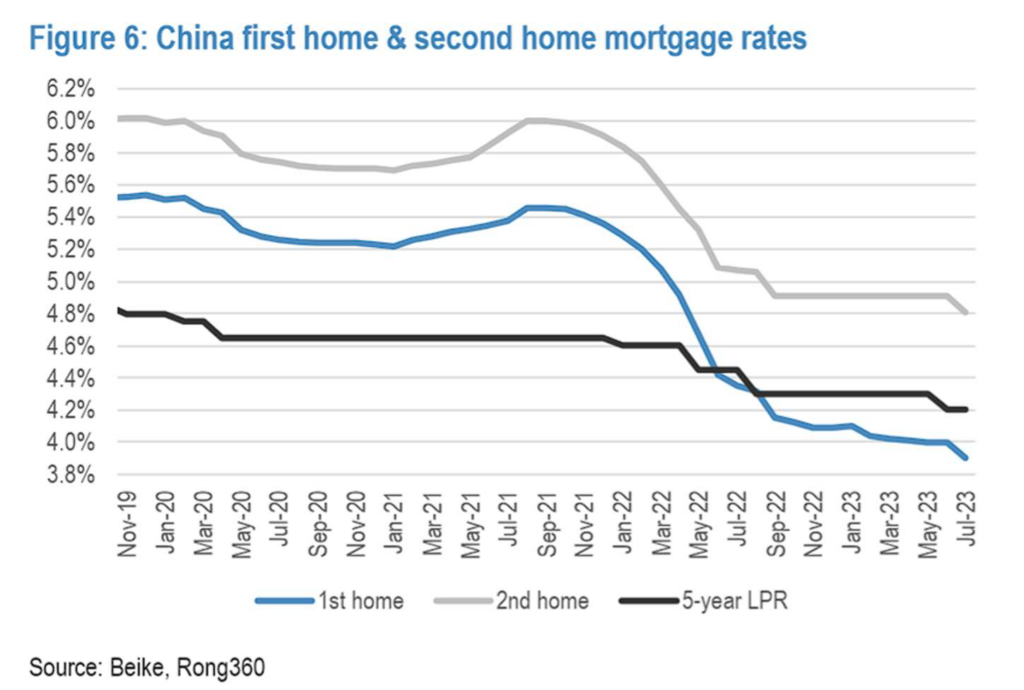

China Property: Has the "Grey Rhino" been tamed? Ox Capital (Fidante Partners) December 2022 Stabilization of property market in sight = Time to buy quality growth stocks in China. Relative to most governments in the world, the Chinese authorities proactively controlled and deflated the property 2) Housing starts have declined over 60% from peaks to 2023 YTD. Urbanization rate in China is only ~60%,

3. Stimulating growth: The Chinese authorities have started to stimulate the economy, showing an intention to boost growth, increase consumer sentiment and investor confidence. We believe further reforms are likely to mitigate risks to the broader economic recovery. Notably, our base case for China is that of continual policy easing and continued government stimulus, an environment ripe for improving economic activity. Funds operated by this manager: |

14 Dec 2023 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

14 Dec 2023 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

14 Dec 2023 - Why government bonds remain a natural choice

|

Why government bonds remain a natural choice JCB Jamieson Coote Bonds November 2023 As we approach the eagerly anticipated end of the rate hiking cycle, investors are considering how to position portfolios for what comes next, while trying to navigate the current higher rate, higher inflation environment. Perhaps now, more than in any other cycle, the role of bonds in portfolios is being questioned after negative annual returns were experienced in 2022. In this article, we discuss why 2022 was such a difficult year for investors across the board, why higher rates aren't necessarily a bad thing for active bond investors and why the valuable role bonds play in a diversified investment portfolio hasn't changed. 2022 - AN EXCEPTION RATHER THAN THE RULEWhen it comes to making the case for bonds, perhaps the biggest objection comes from those who saw 2022 as a serious flaw in the argument. Bonds traditionally play the role of what many refer to as 'portfolio insurance' - offsetting equities' losses during market upheaval - but in 2022 they failed to perform this function. SO, WHAT HAPPENED?Bond returns have two main enemies, inflation, which erodes their value, and rising interest rates, which reduces the value of existing bonds because higher rates of income are available elsewhere. In 2022, we had both inflation and higher rates in tandem, as central banks aggressively hiked rates in a bid to bring inflation back to tolerable levels. As active bond investors, we've managed portfolios through a number of crises, and to put 2022 in context, this was one of the biggest bond market sell-off events since the great depression. We see this as an exception to the rule, rather than a 'new normal'. While financial market downturns typically see equity markets sell off and bond markets surge, rapid rate rises and inflation result in both asset classes suffering. The history books are punctuated by market crises, and while history doesn't repeat, looking to a previous episode of severe negative returns in 1994, interestingly this was followed by a period of outperformance in 1995. 2023 hasn't been a turnaround year like 1995 was, but we remain of the view that 'boring bonds' can quickly turn around in a correction event and that timing the market is impossible. The old adage of 'time in the market, not timing the market' holds true in bonds also. Chart 1: Australian Government Bond Market and Equity Market Annual Returns since 1993

Source: Bloomberg AusBond Treasury 0+ Yr Index vs S&P ASX 200 Accumulation Index. As at 27 November 2023. HIGHER RATES AREN'T ALL BADIncreasing interest rates in the context of an actively managed bond portfolio invested over the medium to long term is not necessarily bad. Higher rates restore their value and defensive properties relative to equities and active management enables bonds to be traded on the secondary market, before they mature, meaning that the negative effects of rising rates can be managed. In the post GFC period of ultra-low interest rates and bond yields, the ability of bonds to deliver meaningful returns and their defensive characteristics were much more limited than they are today in a higher interest rate regime. In essence, the cushions have now been re-inflated and bonds are now in better shape than they have been for years. If anything, the case for holding bonds has strengthened, particularly if rates have risen too high, too quickly and an economic downturn looks imminent. A TRIED AND TRUSTED DIVERSIFIER

Regardless of the path ahead for cash rates, bonds remain a vital diversifier. Whichever way an investor constructs a portfolio, a diversified range of return sources across asset classes can help mitigate risk. The top left quadrant of the chart above illustrates events where bonds have provided positive returns, during crises where equity markets were strongly negative. This shows the value of diversification and the traditional portfolio defence role of government bonds in action. CONCLUSIONLooking ahead, we believe the delayed impact of the rapid rise in interest rates on the economy could result in an economic downturn, with central banks cutting interest rates well into 2024 to stimulate economies. In that scenario, allocations to government bonds are typically sort after, driving bond prices and returns higher. About once every decade bond investors are rewarded for their patience and time in the market and we believe that the cyclical nature of the economy, and our analysis suggests that this time is coming.

Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) |

13 Dec 2023 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

13 Dec 2023 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]