NEWS

25 Jan 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

25 Jan 2024 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

25 Jan 2024 - Glenmore Asset Management - Market Commentary

|

Market Commentary - December Glenmore Asset Management January 2023 Globally equity markets performed strongly in December. In the US, the S&P500 rose +4.4%, the Nasdaq was up +5.5%, whilst in the UK, the FTSE100 increased +3.8%. Bond markets were a big driver in sentiment towards equities in the month, where bond yields continued to fall as inflation data softened, which in turn has implications for future monetary policy. In the US economy, many bond investors now believe we have seen the peak in interest rates, with prospects for rate cuts in 2024 now a possibility. In Australia, we believe it is more realistic to expect rates to stay at current levels until there is clear evidence that inflation is falling to targeted levels. In the US, the 10-year bond rate fell -42 basis points to close at 3.84%. For context, the bond yield has fallen ~1% from its October highs where it reached just under 5%, which is a very material decrease. In Australia, the 10-year government bond fell -45 basis points to close at 3.96%. The AUD/USD exchange rate appreciated 2 cents to close at US$0.68, as investor risk appetite increased. Funds operated by this manager: |

24 Jan 2024 - Performance Report: Bennelong Emerging Companies Fund

[Current Manager Report if available]

24 Jan 2024 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

24 Jan 2024 - How Investors Can Think About the Value of Nature

|

How Investors Can Think About the Value of Nature Redwheel December 2023 |

|

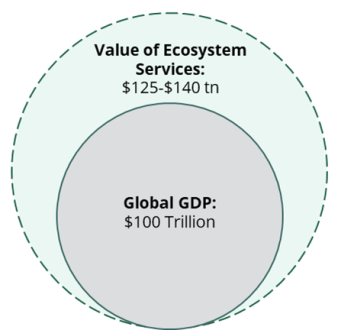

Nature matters - our individual human experience of nature is precious. Its value is immeasurable. Framing nature as the basis for Natural Ecosystem Services concentrates our focus on the more tangible contributions nature provides the economy and society. Ecosystem Services

Source: World Economic Forum, World Bank as at 2022. The information shown above is for illustrative purposes only and is not intended to be, and should not be interpreted as, recommendations or advice. These Services are commonly categorised as:

For instance, primary, secondary and working forests are a crucial source of Nature Services. Accounting for more than 30% of the planet's land[2], they offer Provisioning Services including timber, fibre, food and medicinal plants. They also provide Regulating Services including a cooling mechanism; local precipitation regulation; protection from soil erosion, landslides and floods; water filtering; and carbon sequestration. Forests offer a range of Cultural services including leisure activities, aesthetic pleasure and psychological benefits to those who enjoy them. They also remain a source of biodiversity with potentially valuable and undiscovered genetic material. Some Natural Services can be replaced with artificial processes. For instance, animal pollination services are worth more than $217 billion a year to the agricultural sector [3] and contribute to 35% of the world's crop production [4]. Many pollinators are threatened by a combination of habitat loss, pathogens and pollution, raising concerns for food security. Artificial pollination methods ranging from manual pollination to experimental micro-drone technology have some limited ability to replicate animal pollination services. In many cases it is simply not feasible to replicate Natural Ecosystem Services. Counting the cost More than half of global GDP is deemed to be highly or moderately exposed to nature [7] ; human health and wellbeing is highly dependent upon its Regulating Services which afford us access to clean air and water. Thus, the degradation of biodiversity and Ecosystem Services represent a material risk to the global economy as well as human health and wellbeing. The World Bank estimates that "business as usual" would result in the loss of $90 - $225 billion of real GDP by 2030, depending on the extent to which natural carbon capture services are lost) [8]. Change is coming Evidence of the physical risk associated with inaction is stimulating policy responses. The historic Kunming-Montreal Global Biodiversity Framework agreed in 2022 sets out twenty-three targets [9] to be achieved by 2030 in order that we remain on track for the long-term goals associated with the 2050 Vision for Biodiversity. Whilst policymakers grapple with the challenges associated with delivering these targets, other stakeholders are beginning to assess both their dependency and impact on nature. We believe, these are crucial first steps towards addressing physical risk associated with dependency and transition risk associated with impact. The Taskforce on Nature-related Financial Disclosures (TNFD) offers guidance and recommendations for the process of measurement and disclosure to enable corporates to quantify the value of nature to their business. This is a key step in the integration of nature into decision making. What we can measure; we can address

Given the critical influence of location on specific dependencies and impacts on nature by individual assets, the accuracy of this step is crucial to assessing the value or materiality of nature to it. It also allows us to understand where and how activities contribute to the degradation of nature and thus where we should focus efforts to limit further damage and address transition risk. The economic case for a nature transition is increasingly clear. As we come to terms with the significance of inaction, it appears policymakers, asset owners, investors, corporates and consumers are increasingly willing to embrace the need for change. The shift is accelerating, demand for solutions is growing and funding sources are emerging to attract investment and innovation. This represents an opportunity for the best of the solutions available now and serves as an incentive for those developing exciting solutions for the future. There is a growing body of products and services which allow the continued production of the goods and services upon which we depend but with a more limited negative impact on the natural ecosystem. We may never be able to fully quantify the value of nature, but we are becoming aware of the cost of its loss. Progress may be slower than the science demands; but it is coming. Whilst updated figures are not available, we have performed further analysis and believe that this data has not significantly changed and is reflective for 2023. Author: Amanda O'Toole, Partner and Portfolio Manager |

|

Funds operated by this manager: Redwheel China Equity Fund, Redwheel Global Emerging Markets Fund |

|

Sources: [1] Executive-Summary-and-Synthesis-Biodiversity-Finance-and-the-Economic-and-Business-Case-for-Action.pdf (oecd.org) [2] Forests, desertification and biodiversity - United Nations Sustainable Development [3] Updated-10.23.20-FINANCING-NATURE_Exec.-Summary_Final-with-endorsements_101420.pdf (paulsoninstitute.org) [4] FAO's Global Action on Pollination Services for Sustainable Agriculture | Food and Agriculture Organization of the United Nations [5] Global Assessment Report on Biodiversity and Ecosystem Services | IPBES secretariat [6] Deforestation and Forest Loss - Our World in Data [7] It's Now for Nature: Turning nature ambitions into action through the Nature Strategy Handbook - PwC UK [8] World Bank Document [9] COP15: Final text of Kunming-Montreal Global Biodiversity Framework | Convention on Biological Diversity (cbd.int) Key Information |

23 Jan 2024 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]

23 Jan 2024 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

23 Jan 2024 - Performance Report: Kardinia Long Short Fund

[Current Manager Report if available]

23 Jan 2024 - 10k Words | January 2024

|

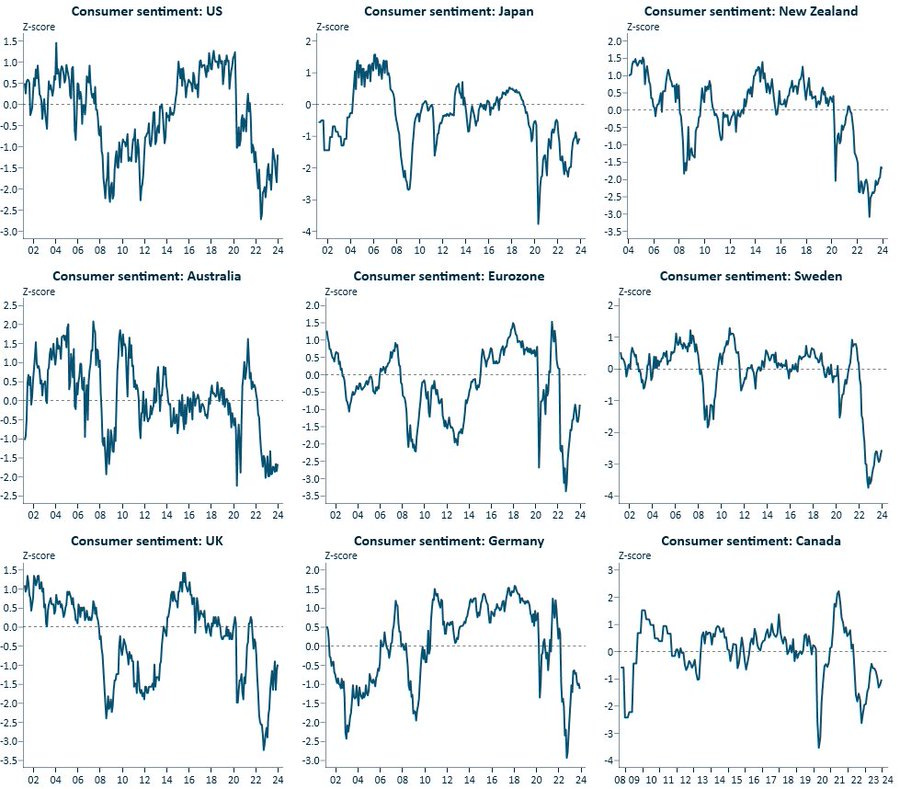

10k Words Equitable Investors January 2024 Will Australian consumers join the upswing in sentiment in 2024? What happened to the heavyweights of the S&P 500 from the 1980s? Let's take a look at what is happening with the skewed weightings and returns in that index today. Equity volatility has been low while all the action was in bonds in CY2023. Bespoke charts the history of US rates, inflation and Fed commentary as fund managers position for lower rates. Finally, Fitch paints a picture of deterioration for Greater China. Consumer sentiment has bounced materially off 2022 lows in most advanced economies... apart from Australia Source: @IFM_Economist, Industry Funds Management

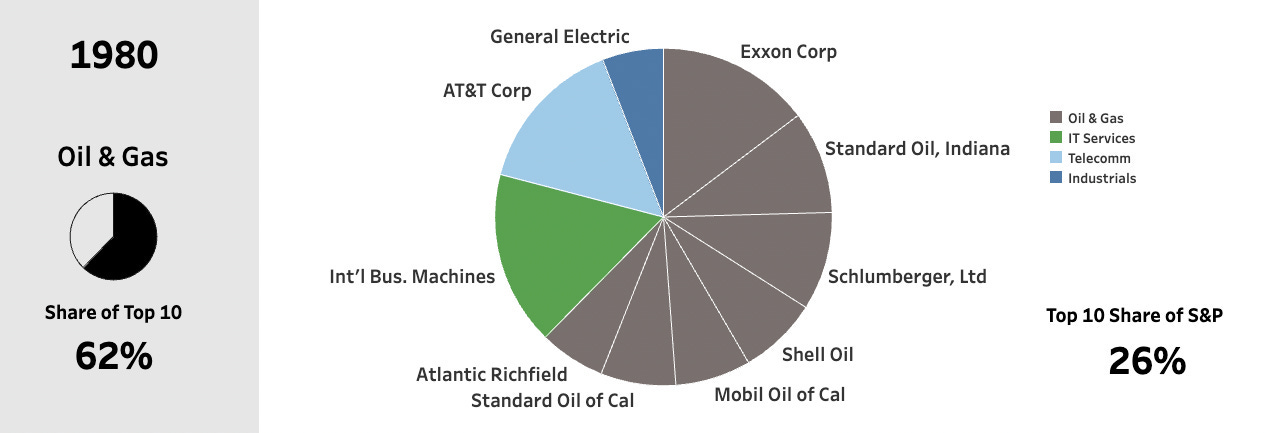

Top 10 weightings in the S&P 500 in the 1980s Source: marketsentiment.co

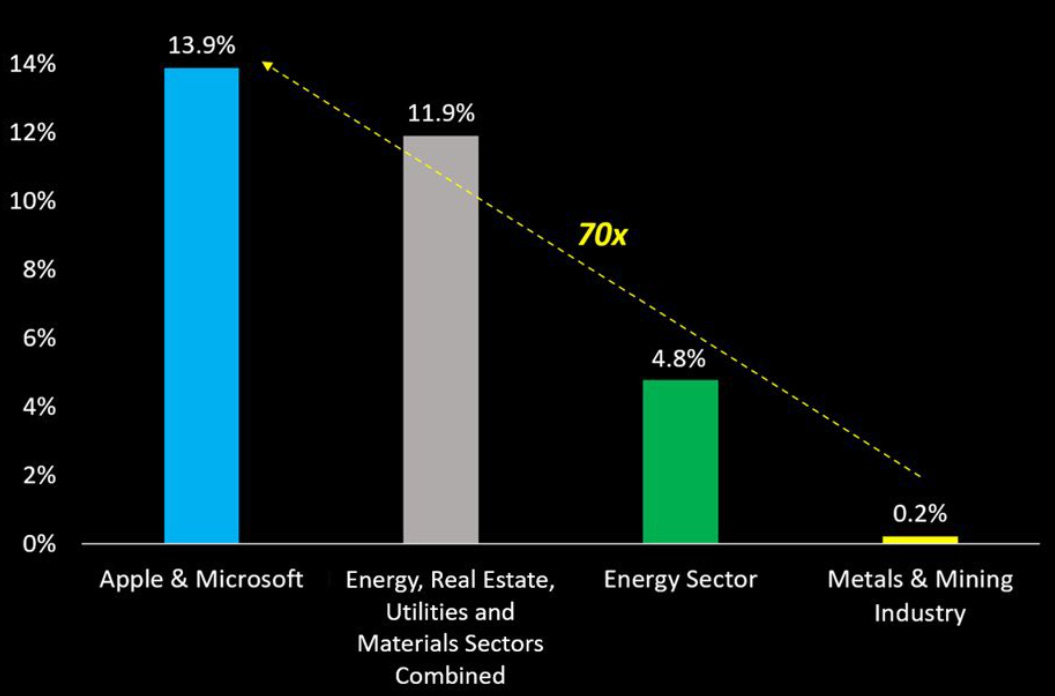

Combined weighting of Apple & Microsoft in the S&P 500 today Source: Crescat Capital, Bloomberg

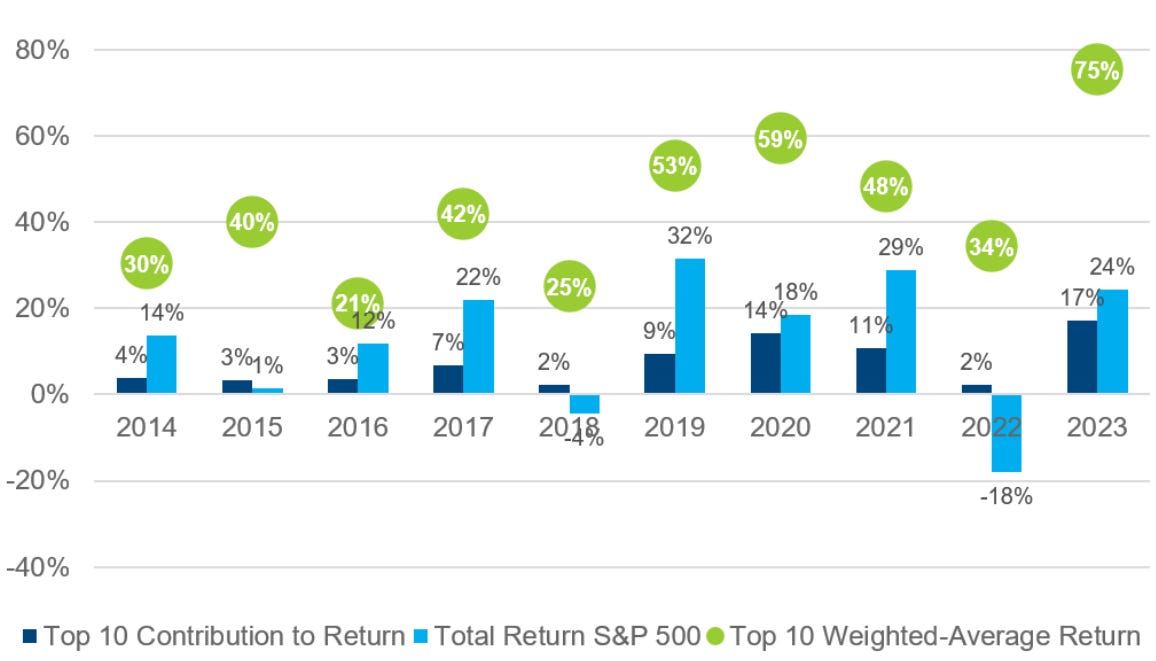

Top 10 largest weightings' contribution to S&P 500 return Source: FactSet

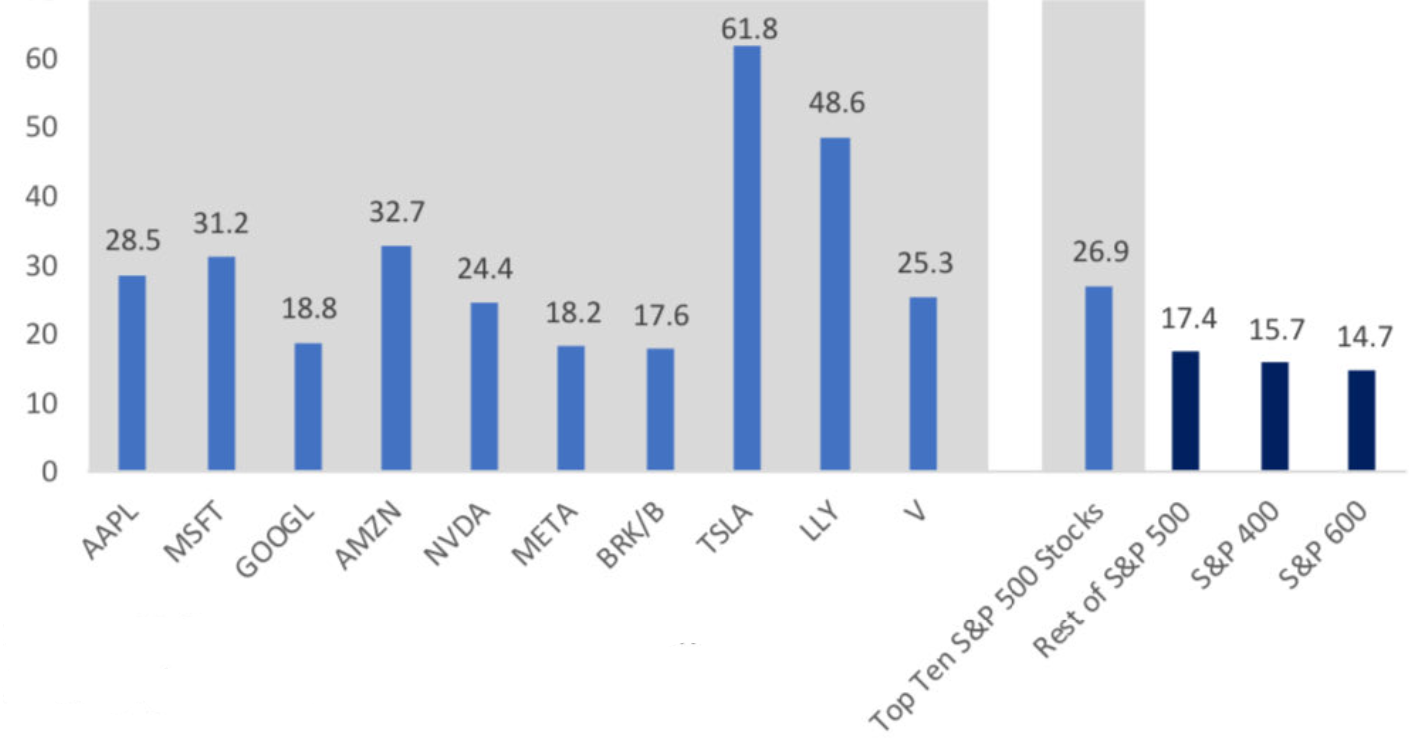

Forward P/E ratios on Top Ten, broader S&P 500 & small cap S&P 600 Source: Bespoke

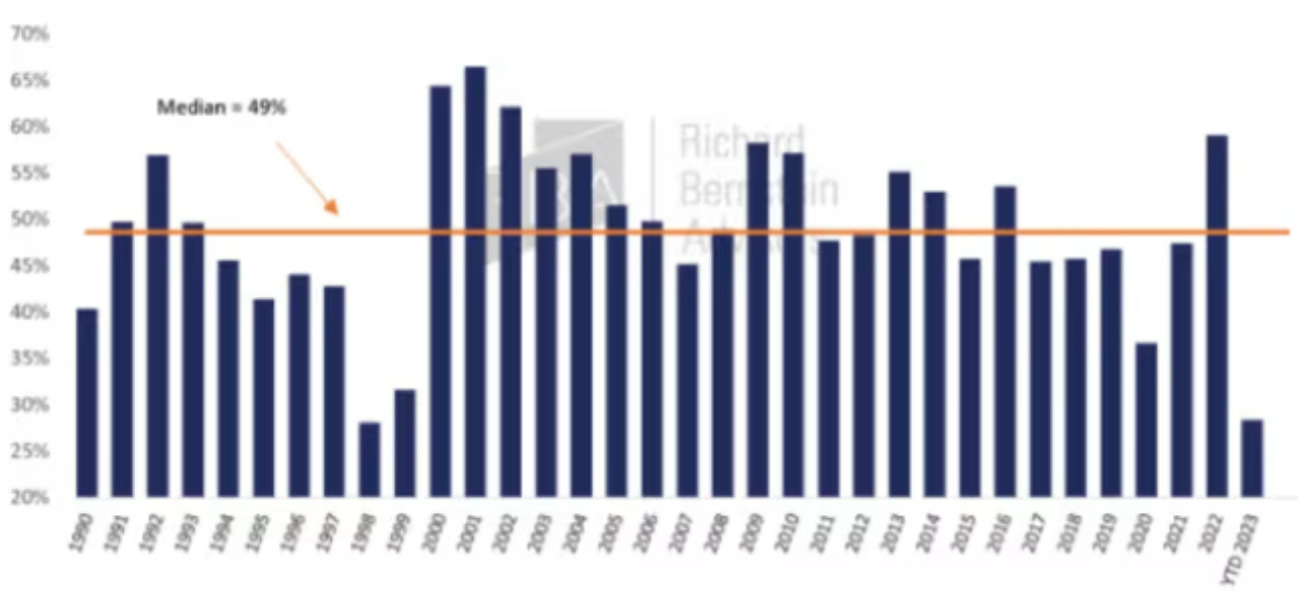

% of S&P 500 stocks that outperformed the index (through to Dec 14, 2023) Source: Richard Bernstein Advisors

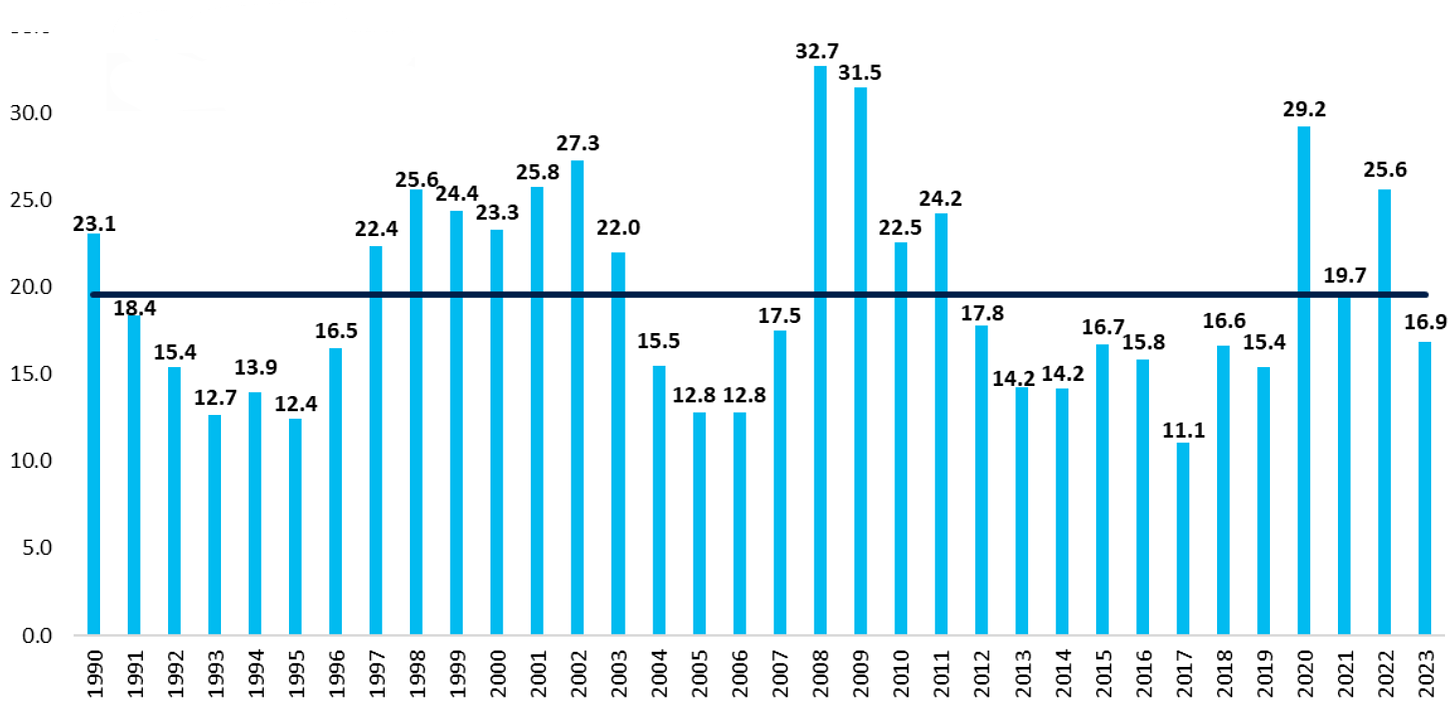

Volatility Index (VIX) yearly average 1990-2023 Source: @charliebilello, Creative Planning

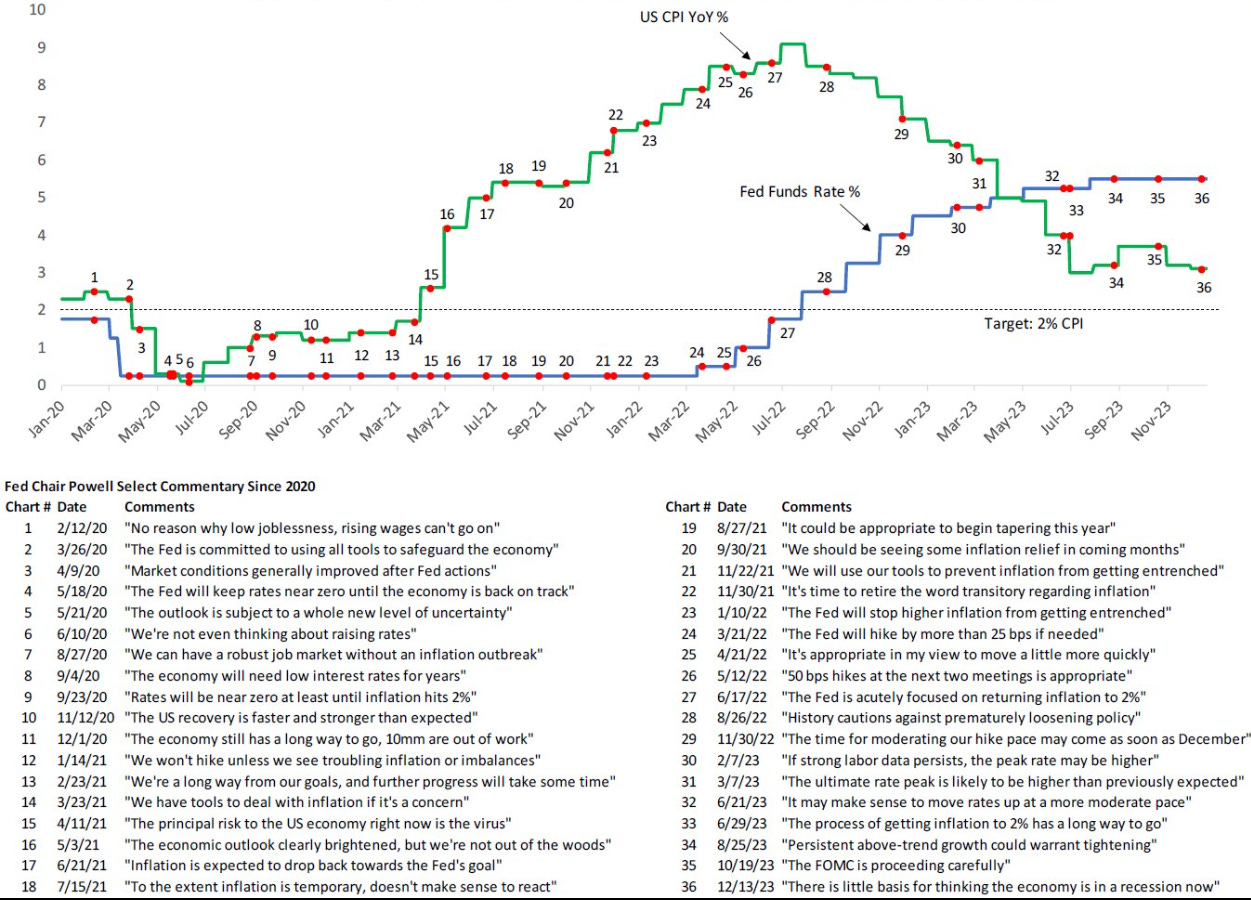

US bond market volatility v equity market volatility Source: Bloomberg Fed Funds Rate, US CPI YoY & select commentary from Powell Source: Bespoke % fund managers expecting lower long-term rates Source: Bank of America Global Fund Manager survey

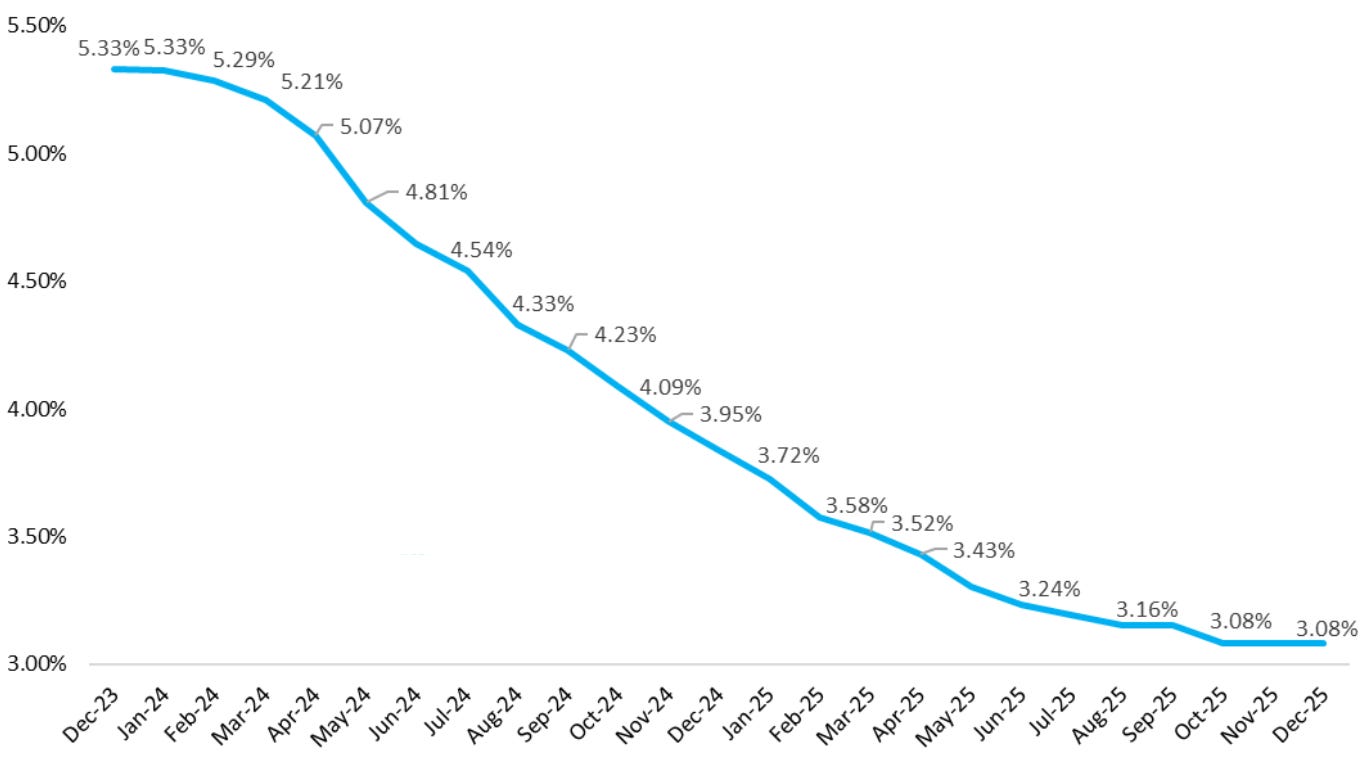

Market expectations for Fed Funds Rate Source: @charliebilello, Creative Planning

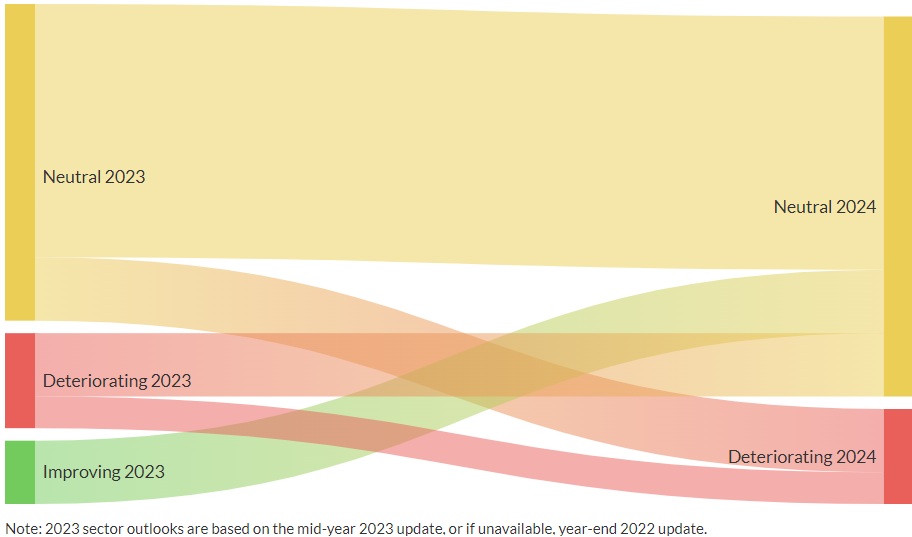

Overall trends in Greater China sector credit outlooks Source: Fitch January Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |