NEWS

Unless that is, you have been invested in the US Magnificent Seven. It has been a year of extraordinary moves in things we never saw coming.

1 Feb 2024 - A Fairytale of New York (NYSE and the Nasdaq)

|

A Fairytale of New York (NYSE and the Nasdaq) Marcus Today December 2023 |

2023 has been a year that most Australian investors would like to forget.

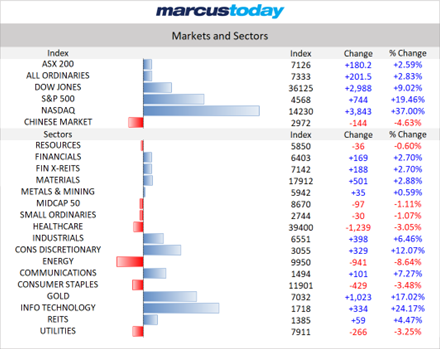

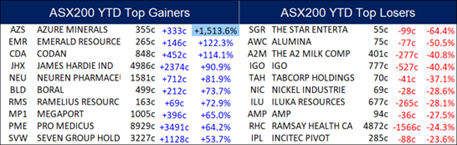

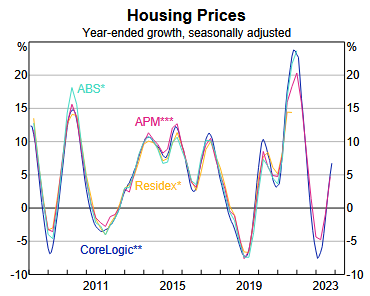

Source: Marcus Today . Source: Marcus Today. Unless that is, you have been invested in the US Magnificent Seven. It has been a year of extraordinary moves in things we never saw coming. Bitcoin is the best performing 'asset' - and I use that term loosely. US Bond markets have staged an extraordinary rally in the last month or so, as yields spiked and then collapsed. Iron ore has defied gravity and hit $200 in AUD terms, almost back to the halcyon days during CV-19, or the big gains we saw before the GFC - and all this without the bazooka stimulus we have come to expect from the Chinese. In fact, Chinese property seems to have gotten worse over the year. Here, the retailers have had a great year despite all the rate rises. Where was that mortgage cliff that traumatised markets? It's coming apparently. Many have suffered, but we now have a pause in the inflation offensive. Rates are normalising. The last decade was abnormal! What happened to house prices? They just kept going higher.

Source: ABS, APM, CoreLogic, Residex. Trophy homes changed hands at record prices. Young people have given up on the Great Australian Dream. The Bank of Mum and Dad took a pounding this year - if you could find them on their holiday in Europe that is. This time last year, lithium was riding high at extraordinary levels, and now we have gone from rooster to feather duster. Much like another white powder craze in milk powder! White line fever. Remember that? A2 Milk (ASX: A2M) hit 20 bucks - madness. Plenty of that around. Gone now though. Some brokers were sounding the warning bell on lithium prices and were 'pooh-poohed' for their view. As General Melchett once said in Blackadder, you should never pooh-pooh a pooh-pooh. Wise words darling, eh? At one stage this year, we had billionaires fighting to keep lithium assets Australian-owned. Hats off to you Gina. You succeeded. Unfortunately, it was at a cost. Quite a big cost. For everyone. In hindsight, it looks like two bald men fighting over a comb. Origin Energy (ASX: ORG) saw off the 'Brookfield Mounties' after a rear-guard defence from Australian Super, though several other icons fell - Newcrest is no longer and OZ Minerals (ASX: OZL) fell to BHP (ASX: BHP). Is the ASX shrinking to greatness? Then there are the gold miners. Who would have 'thunk' that gold would hit an all-time high whilst rates were going higher? Gold pays no dividends and actually costs money to store. It has always puzzled me why we spend so much time and money digging it up, making it into a nice bar shape, and then burying it again in an underground vault. The sector is up 17%. Still, many things in life puzzle me. I struggled with The Book of Mormon! Was that just me? This year we had the rise of AI and the machine. I thought Nvidia was a skin care product until this year! Even AI didn't see that one coming. We also had a year where GLP-1 drugs offered a 'miracle cure' for obesity, and killed CSL (ASX: CSL) and Resmed (ASX: RMD) in the process. More iconic falls. The consensus last year was that the US economy would experience a recession. The question was whether we were going to get a soft landing or a hard landing. Well, no recession. The experts got that wrong too. In fact, there is not much the experts got right. Oil was supposed to hit $100 due to Ukraine, and then Gaza. Nope. Oil is struggling, even if the Saudis are cutting production. What to expect in 2024.Firstly, experts have no monopoly on making daft predictions. Just because they are on TV or interviewed in the media, I think 2023 shows how wrong they can be. There is one certainty in 2024 that even the experts will get right. The US Presidential Election. Everything to play for, and everything to lose. Are we really headed back to the chaos of the Trump era? It seems a distinct possibility. We are not talking about it yet - but we will. The US Election cycle kicks off early in 2024. The experts are still forecasting a recession and a landing of some sorts in 2024. Hard or soft. Similar arguments triggered a war in Lilliput. Which end of the egg to crack? The markets are now pricing in quite savage rate cuts in the US in 2024. The reason is the US economy is crashing. Is it? I am not sure the Fed will be that aggressive. The economy is slowing, but crashing in an election year seems unlikely. Powell will want to keep his job and the Fed independent. Trump is an agent of change. There are two themes that I think will manifest in 2024. Both out of favour. Both troubled, and both seeing serious negativity. The first one is lithium. At some stage, and we are not there yet, the price will have fallen so much that all that supply coming on stream will struggle to get funding. Plenty of it will be uneconomic. All those gold miners who switched to lithium may have to switch back to gold! Remember the dot-com boom? The miners became web-masters and then had to switch back! When was the last time that we saw a high-profile off-take agreement? Yep, I can't remember one. My 'go-to' would be Pilbara Minerals (ASX: PLS). It still has 20% shorted. A market cap of around $10bn with a cash stash and no problems with the US, as far as Chinese ownership is concerned. Remember when Liontown (ASX: LTR) was valued at nearly $7bn for a project still under construction? We are not at peak bearishness in the sector as yet, but at some stage in 2024, there will be a huge bounce. The other one which has been taken out the back is the oil and gas sector. BHP is looking pretty smart with its jettison of the oil and gas assets to Woodside (ASX: WDS). If you had said there would be a war in the Middle East and interest rates would be at 4.35%, there would not be many experts who would have predicted consumer discretionary stocks would be out partying, and oil and gas stocks suffering from a serious hangover. Yet here we are. I think the sell-down in oil has been overdone. WDS is the premier way to go with this, and I still like Karoon (ASX: KAR), which has de-risked from a one-trick pony with the recent Gulf of Mexico acquisition. Both a big and a smaller one are buys for a better 2024. Finally, I was asked to pick a stock for an Advent Calendar segment recently. I had two that I liked: Treasury Wine (ASX: TWE) for a reopening of China year, and Zip (ASX: ZIP). I know. Crazy, but the US consumer is still spending, just finding different ways to pay. I think we are all guilty of that. Regulation is coming here, and that will provide some certainty. The key is the US, the growth of BNPL, and the pesky ZIP balance sheet. Could 2024 be the year we are talking BNPL again? Maybe, but then again, I have been wrong many times before. Why should this year be any different? The good news is that next year, ChatGPT will be writing a similar article, and I will be redundant. You can blame it then. Author: Henry Jennings, Senior Market Analyst, and Media Commentator |

|

Funds operated by this manager: |

31 Jan 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

31 Jan 2024 - Global Matters: 2024 outlook

30 Jan 2024 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

30 Jan 2024 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

30 Jan 2024 - Airlie Quarterly Update - January 2024

|

Airlie Quarterly Update - January 2024 Airlie Funds Management January 2024 |

|

Emma Fisher provides her perspective on how the Australian equity market played out in 2023 and the outlook for the year ahead. Emma also discusses movements within the portfolio and the approach to position sizing. Funds operated by this manager: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

29 Jan 2024 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]

29 Jan 2024 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

29 Jan 2024 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

25 Jan 2024 - Hedge Clippings | 25 January 2024

|

|

|

|

Hedge Clippings | 25 January 2024 Among the various dates and events either celebrated or lamented around this time of the year there is one that may not make the headlines given tomorrow's anniversary of the landing of Captain Arthur Philip taking first place. Today, the 25th of January, is the fourth anniversary of the first reported case of COVID-19 in Australia. Co-incidentally this week Scott Morrison also announced his retirement from federal politics. Whatever else one thought about him, his initial handling of the pandemic was swift and decisive (some will argue possibly divisive as well!). He won't go down in history as one of our more successful Prime Ministers, but Australia's record of 920 deaths per million of population position it at 108 in world rankings for COVID deaths, and 39th in cases per million which allows for debate from both sides of the "who liked Scomo" debating team. Interestingly, when researching the above statistics, China was way down the bottom of the list at number 221 out of 229 countries, with just 4 deaths per million from COVID, which seems about as reliable and credible as their economic reporting. China is facing multiple headwinds: Inflation is -0.3% YoY and PPI is -2.7% indicating low consumer demand. The property market is "soft" at best - some would call it a disaster, - and the collapse of the Zhongzhi Enterprise Group, a wealth manager which was regarded as one of China's largest shadow banks, owing RMB 220-260 billion (USD 36bn) and stating that it is "severely insolvent" won't help consumer confidence. On the trade front, China's trade with the US fell 11.6% in 2023, while trade with Russia increased by 26%. Meanwhile, it has yet to be seen what effect the shipping problems in the Gulf of Aden, and the longer voyage around the Cape of Good Hope will have on China's trade with Europe. Having driven global growth for the past two decades or more, and exported deflation over the same period, China's change of fortunes have yet to play out on the world's economies. Turning to US politics, it seems a re-run of the 2020 Trump-Biden election battle is now almost a certainty, provided each reach Tuesday November 5th (Melbourne Cup) deadline unscathed - Trump from the various legal challenges he's facing, and Biden from his advancing age. As we noted last week, in a country with a population of over 330 million, it's amazing neither party can come up with an alternative. One interesting view we heard this week is that each candidate provides the best reason to vote for the other: Trump has a strong following among his supporters, but is polarising to say the least. Not only will his presence entice many democrats to actually vote, but there's a risk that some disaffected republicans will also turn out to vote - but against him. That could also cut both ways - there has to be genuine concern about Biden's age and abilities given the prospect of an 86 year old being in the White House at the end of his second term. Meanwhile, enjoy Australia's national holiday - whatever you want to call it, and however you want to spend it. News & Insights 10k Words | January 2024 | Equitable Investors Market Commentary | Glenmore Asset Management December 2023 Performance News Digital Asset Fund (Digital Opportunities Class) 4D Global Infrastructure Fund (Unhedged) Bennelong Emerging Companies Fund Skerryvore Global Emerging Markets All-Cap Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |