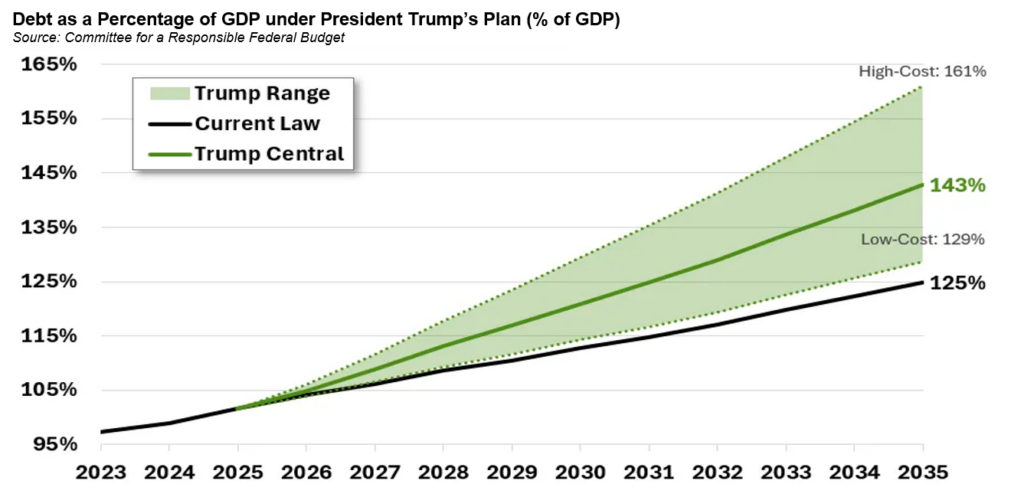

With Trump trades flooding the equity market in the run up to the US elections; a sell-off in the treasury markets since then; and Bitcoin hitting an all-time high this month, it is fair to say, that for some investors at least, the last few months have been a bare-knuckle roller-coaster ride.

In a quest to retain balance in portfolios, where can investors go to both avoid mercurial shocks and achieve returns? Traditionally, fixed income has been the yin to equity's yang. But is this still the way to restore balance to the books? The answer depends on the 'how' of fixed income.

Right now, the pursuit of higher yields is driving demand for investment grade corporate bonds, which are less liquid than their government bond cousins. However, fixed income investing is teetering ever closer towards untested territories with the inexorable rise of private credit.

This unrated end of the credit spectrum, which is even less liquid than investment grade corporate bonds, has been gathering momentum over the last 15 years, and according to Morgan Stanley's[1] estimates, could reach $2.8 trillion by 2028. Add in music royalties, auto loans, residential mortgages, franchise finance and infrastructure debt, and by a private global markets firm's estimate, the total addressable private debt market may be as much as $40 trillion[2].

The recent avalanche of assets cascading into private credit has come from insurers[3], who traditionally keep high allocations to fixed income. To satiate their need for returns, insurers are raiding other parts of their portfolio, such as private equity, to fund this credit buying spree.

This may explain why we are seeing so many private equity behemoths diving into this corner of fixed income; an access point to the recurring fees from managing insurance capital; a market that itself is expected to reach almost $10 trillion by 2028[4].

Blackstone[5], for example, has integrated its corporate credit, asset-based finance, and insurance groups into a single new unit. Meanwhile, Brookfield and KKR & Co. have taken majority stakes in, or bought outright, insurance companies, prompting Moody's to issue a warning on what it calls a balance-sheet heavy approach earlier this year[6].

Private credit, originally a peripheral player in the non-league of asset classes, was the domain of smaller companies and sub-prime borrowers. But now these large alternative asset managers control this income stream, the tables have turned.

Offering fixed income-like lower volatility and equity-like higher returns with a deal flow that is uncorrelated to private equity activity, private credit is being hailed as the diversifier for turbulent times ahead.

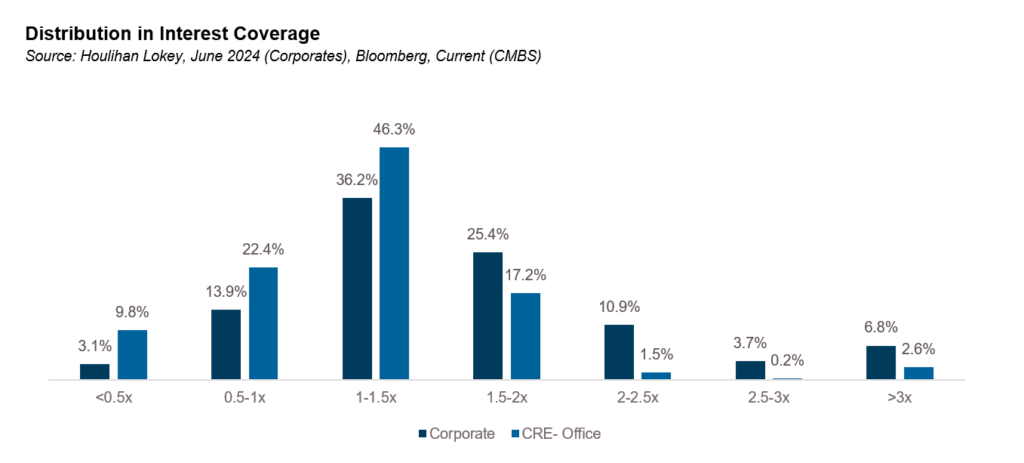

But is it really? Its systemic credentials have not yet been tested, during a prolonged economic downturn, for example. Moreover, as it is still under the radar of financial regulators, private credit still has more leeway than banks, the traditional lenders whose antics were nipped in the bud after the Global Financial Crisis.

The issues with private credit include the potential lack of transparency; less oversight and accountability; a dearth of credit ratings; liquidity and conduct risk; and potential for elevated losses in a recessionary environment. And, from a geographic perspective, according to Pitchbook's 2023 Global Private Debt Report[7], of the current $1.6 trillion global private debt market, the lion's share, around $1.1 trillion, is in the US.

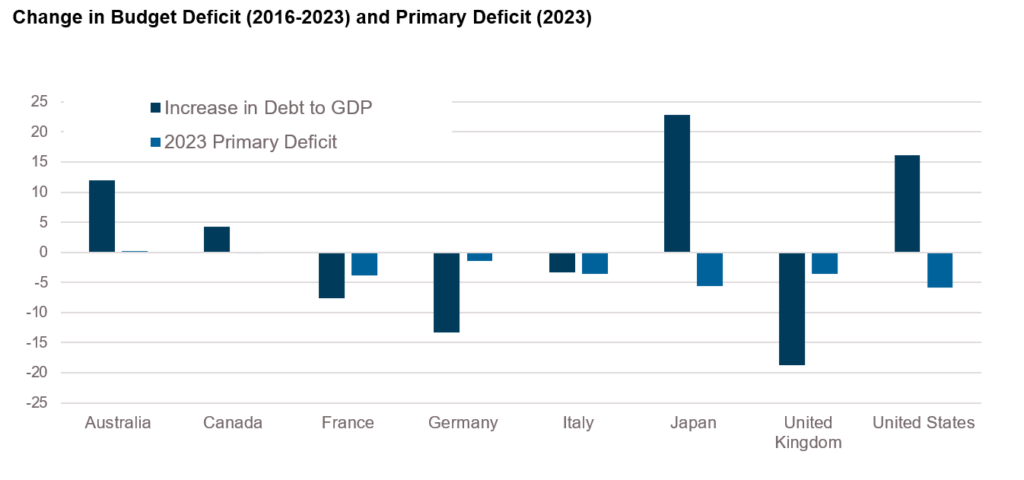

As the world waits for Trump and his largely politically untested team to take office in January, and the spectre of war still looms on the horizon, no-one can bet with certainty on interest rate direction and whether or not fiscal further tightening is on the cards.

If rates do rise, then loans with floating rates will adjust and deliver higher returns, so no problem. Fiscal tightening, however, will see private credit spreads contract and the liquidity premium in investment grade segments of private credit markets may decrease.

All of these are worries that keep investors awake at night. So where can investors find Zen in an increasingly turbulent world? Is there an investment that is agnostic to the whims of politics; the increasing probability of more war; and the prevailing macro-economic environment and guarantees portfolio peace of mind during market turbulence?

No. But without ignoring interest rate and global macro risks, investors can change the way they view the interaction between asset classes, and in turn, protect the downside and still harvest the returns. To harness the power of fixed income to restore and retain balance in a multi-asset portfolio, investors need to understand one key concept: bonds do not need to be negatively correlated to equities to reduce portfolio risk.

What really matters more than the bond/equity correlation is the relative volatility between the two asset classes. From this perspective, bonds provide the necessary diversification if bond volatility is lower than equity volatility, even if the correlation is positive.

Obviously, analysis shows that, while better outcomes can be achieved under negative correlation, this is secondary to the impact of relative volatility. Negative bond correlation is therefore not necessary to deliver better diversification to an equity heavy portfolio, making bond volatility a more influential factor on returns than correlation.

Taking this a step further, when building up a defensive portfolio to guard against expectations of volatility, the often-overlooked government bond is actually typically less volatile than its corporate bond cousin, which can have a linkage to the general performance of the underlying company's stock.

So rather than focusing on yield harvesting or interest rate and credit spread predictions, the key to restoring balance in a multi-asset portfolio is to mine for relative value in inefficient and inconsistent pricing between securities, such as high-quality government and semi government bonds, which have similar risk characteristics and are duration-neutral, credit-free, and shake less when volatility, likely around election time, comes calling.

Source: Westpac Economics

Source: Westpac Economics