NEWS

19 Jul 2022 - 'Small Talk' - cold, hard data on FY22

|

'Small Talk' - cold, hard data on FY22 Equitable Investors July 2022 We thought we would review the cold, hard data on the financial year 2022 that came to an end on June 30. The data tables paint a clear picture: companies priced on high multiples coming into the year faced a sobering reassessment of their valuations, as did unprofitable businesses; the only safe haven was the energy/commodities complex; small stocks were shunned by nervous investors, and the tech sector was particularly under pressure. The difference between high EV/EBITDA and low EV/EBITDA stocks in our "FIT" universe was the most stark - an 18% differential in price returns (where we split stocks into three baskets - low, middle and high). Five of the worst six performed stocks were in the Buy Now Pay Later (BNPL) space, led by merger partners Sezzle (SZL) and Zip Co (Z1P) in first and third. The best returns came from an eclectic mix: heart device company Anteris (AVR) and heavy equipment maintenance business Mader Group (MAD). Some of the less obvious takeaways from our "FIT" universe were that: it was not the case that the "dogs" of the prior year were the place to be - the "middle-of-the-road" stocks from FY21 held up best in FY22; and companies with market caps between $750m and $2 billion suffered notably worse declines than those capped under $100m. The wash-up from FY22 is that we are now seeing more attractive valuations AND the recapitalisation opportunities we have been highlighting are beginning to flow. For bottom-up investors like Equitable Investors, we believe the opportunity set will be as rich as it has been in many years and we are keen to engage with investors who want to be part of this "recap" opportunity through Dragonfly Fund.

Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions.Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components.Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

18 Jul 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

||||||||||||||||||

| Ausbil Active Sustainable Equity Fund | ||||||||||||||||||

|

||||||||||||||||||

|

Ausbil Active Dividend Income Fund |

||||||||||||||||||

|

||||||||||||||||||

|

Ausbil Australian Concentrated Equity Fund |

||||||||||||||||||

|

||||||||||||||||||

|

Ausbil Australian SmallCap Fund |

||||||||||||||||||

|

||||||||||||||||||

| View Profile | ||||||||||||||||||

|

Ausbil Global Essential Infrastructure Fund (Unhedged) |

||||||||||||||||||

|

||||||||||||||||||

| View Profile | ||||||||||||||||||

|

Ausbil Global Resources Fund |

||||||||||||||||||

|

||||||||||||||||||

| View Profile | ||||||||||||||||||

|

Ausbil Long Short Focus Fund |

||||||||||||||||||

|

||||||||||||||||||

| View Profile | ||||||||||||||||||

|

MacKay Shields Multi-Sector Bond Fund |

||||||||||||||||||

|

||||||||||||||||||

| View Profile | ||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||

|

Subscribe for full access to these funds and over 650 others |

18 Jul 2022 - Manager Insights | Cyan Investment Management

|

|

||

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Dean Fergie, Director & Portfolio Manager at Cyan Investment Management. The Cyan C3G Fund has a track record of 7 years and 11 months and has outperformed the ASX Small Ordinaries Total Return Index since inception in August 2014, providing investors with an annualised return of 10.52% compared with the index's return of 5.26% over the same period.

|

18 Jul 2022 - Compelling Opportunity for Investors: Improving Convexity, Yet Benign Default Risk

|

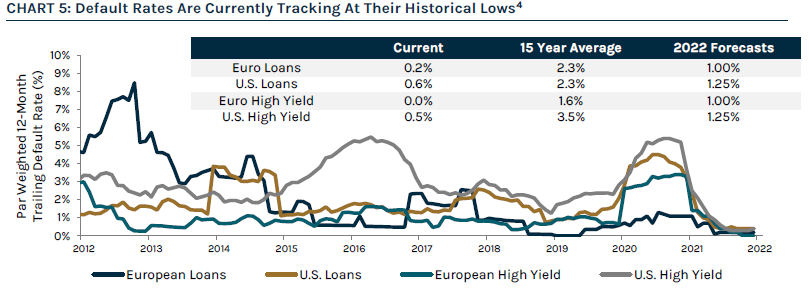

Compelling Opportunity for Investors: Improving Convexity, Yet Benign Default Risk (Adviser & Wholesale Investors Only) Ares Australia Management 28 June 2022 What is Convexity & Why Is It Important? When credit instruments sell off, market participants will often talk about convexity being back. So, what is it?

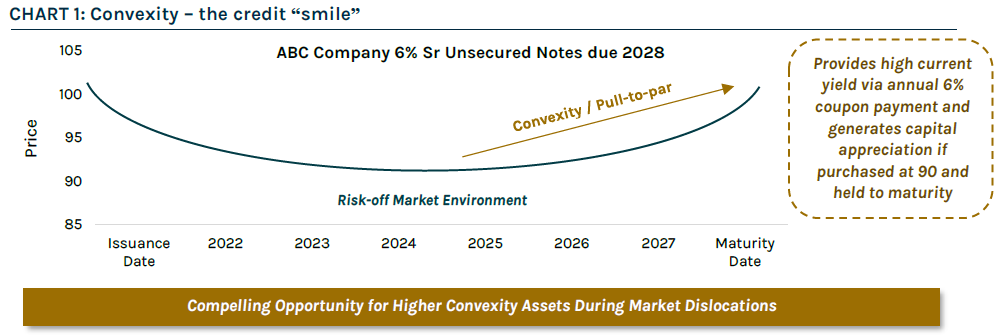

During a risk-off environment, the price of a credit instrument typically drops below its nominal value (also referred to as "face" or "par" value) due to perceived increased default risk. As illustrated by the example in Chart 1 below, there is a compelling investment opportunity when a bond trades at a discount to its nominal value - assuming the bond does not default, a bond's price will benefit from a natural "pull" to the nominal value as it approaches maturity. This movement is referred to as "pull-to-par". Typically, bonds and loans that trade at a discount have positive convexity, offering investors enhanced yield and capital appreciation potential without taking excess risk.

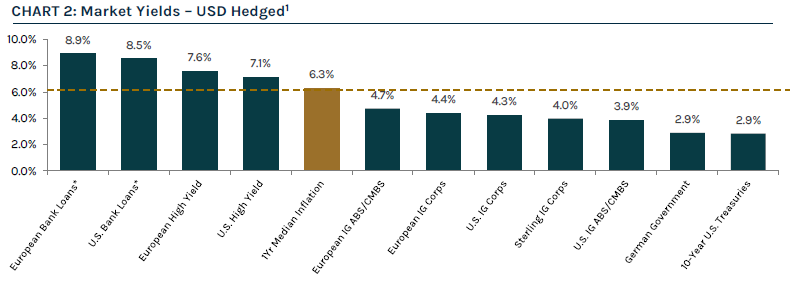

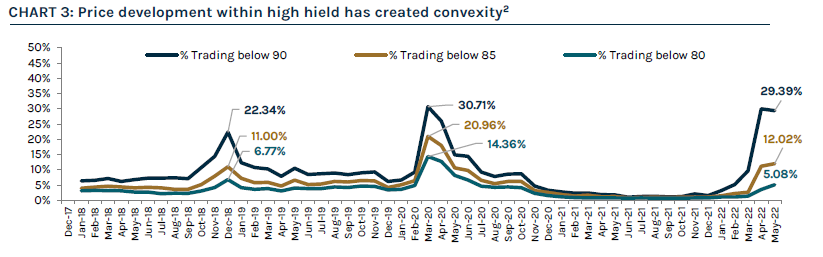

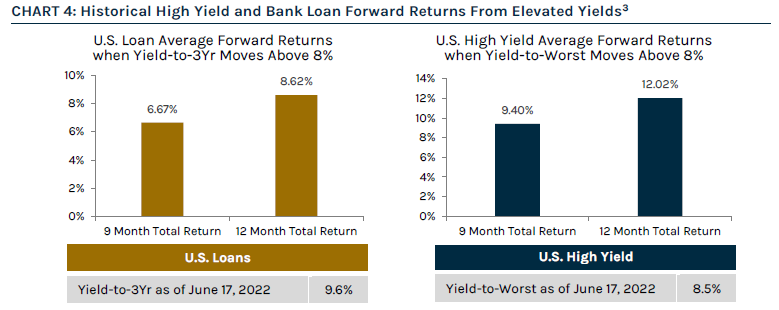

Market Opportunity - Convexity & Higher Yields Calendar year 2022 has presented significant turmoil for global financial markets amid a risk-off environment and sustained macro uncertainty. Global inflationary pressures continue to persist, including the ongoing war in Ukraine, slowing growth, higher energy prices and supply-chain disruptions. Central banks face substantial challenges as they look to combat elevated inflation with interest rate hikes, but without triggering a recession. Against the backdrop of wider spreads and the sell-off in rates over the past few months, fixed income yields have reset to higher levels, presenting an attractive opportunity for yield-focused investors. Global leveraged credit assets are providing a meaningful pickup in real yields when compared to traditional fixed income markets, as illustrated in Chart 2. Higher yields and a decline in asset prices have introduced greater upside convexity in leveraged credit This combination of higher yields and cheaper prices in an environment where bouts of volatility have become shorter and more frequent, is presenting alpha generating opportunities for active managers. History suggests investing in periods of dislocation, when yields reach current levels, provides attractive forward returns in the high yield bond and bank loan markets.

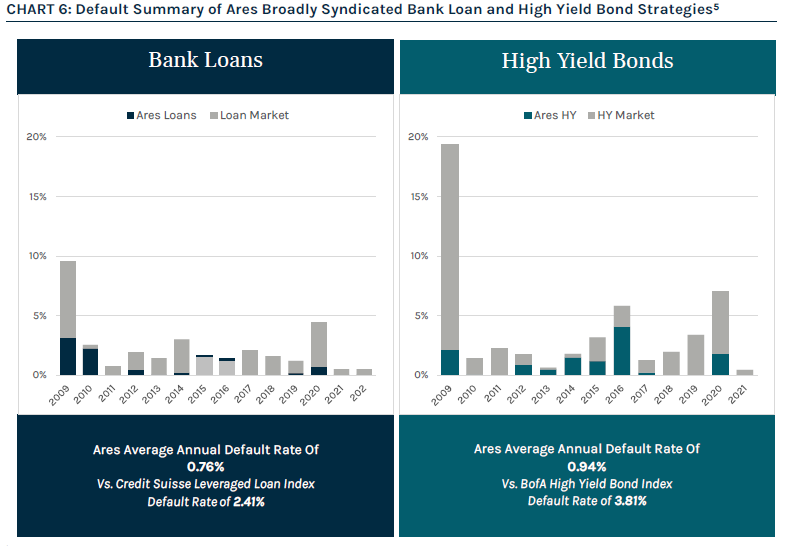

Market Outlook Looking forward, we expect volatility to persist with the potential for asset coverage leakage and an uneven recovery across markets. We believe credit spreads are currently at levels that represent attractive entry points, but tail risks have increased, and we anticipate elevated credit dispersion as well as rising idiosyncratic credit events driven by a host of conflicting themes. We believe Ares is well positioned to provide superior credit selection and vigilant risk management in today's volatile market due to our disciplined investment process that focuses on capital preservation, predicated on bottom-up fundamental research with the goal of minimizing default risk by identifying and avoiding marginal quality credit. This core tenet of Ares' investment philosophy has resulted in significantly lower defaults in its bank loan and high yield bond strategies, particularly in periods of dislocation. In summary, as investors are faced with rising rates and elevated inflation, many may struggle to determine how best to position their credit exposure in an effort to maximize yield and mitigate risk. At Ares, our differentiated approach to capitalizing on the best risk-adjusted return opportunities across the investable universe is rooted in the scale and integration of our Global Liquid and Alternative Credit strategies, which allows us to fully leverage extensive research and origination capabilities, proprietary technologies and longstanding relationships. Written By Teiki Benveniste, Head of Ares Australia Management |

|

Funds operated by this manager: Ares Diversified Credit Fund, Ares Global Credit Income Fund |

15 Jul 2022 - Mind the gap - Hedging tails to provide liquidity in times of stress

|

Mind the gap - Hedging tails to provide liquidity in times of stress (Adviser & wholesale investors only) CIP Asset Management July 2022 Including tail hedging in a portfolio can have the following benefits:

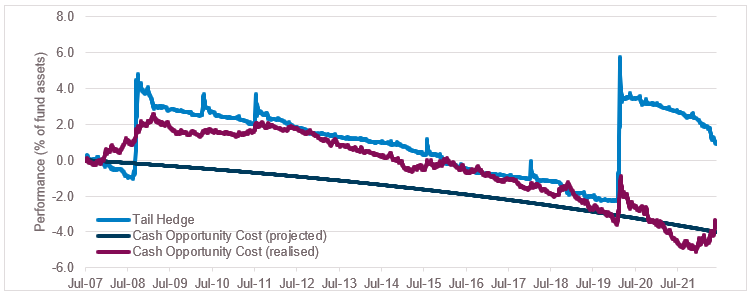

Point 3 may be of particular interest to Australian super funds where, for example, FX hedges can incur large mark-to-market losses during times of market stress. For example, the latest Quarterly Superannuation Statistics published by APRA (March 2022) show the industry currently has $322bn of FX hedges. During the financial crisis AUD dropped 37.6%, which would have led to FX hedge losses of -$121bn based on current exposures at a time the overall portfolio was down -26% (-$577bn in today's terms), and a COVID scenario would result in FX losses of around -$58bn at a time overall assets were down -$466bn. Investors use a variety of approaches to try and mitigate losses in their portfolios, including diversification, market timing, and explicit hedging. While we agree all three approaches have a place in managing portfolios, hedging is by far the most reliable way to mitigate losses during times of market stress. It (almost) goes without saying that even investors who successfully add long-term alpha for their clients via market timing cannot always predict market drawdowns, and one only needs to look at recent market moves to see the pitfalls of relying too heavily on diversification (eg simultaneous sell-off in equities and fixed income with ACWI -18.9% and Global Agg -14.5% YTD on a total return basis). Because it is reliable, hedging can be an important tool in building resilient long-term portfolios. However, that reliability comes at a cost, and because true market stress events are few and far between, we often find that the costs of hedging are more visible to investors than the benefits. Since most investors are not particularly concerned by small drawdowns, the cost of hedging can be reduced by focusing only on larger, less-frequent drawdowns. Specifically, tail hedging allows investors to hedge against only the most extreme outcomes that can inflict long-lasting damage on even the most diversified portfolios. It's worth reiterating that because tail hedging, by design, is only expected to 'work' in the most extreme circumstances, investors can expect to see (modest) losses in tail hedges far more frequently than they will see gains. However, it is the timing and magnitude of the gains that is important. A robust tail hedging program will provide investors with large gains when other parts of the portfolio are experiencing very large drawdowns. And that knowledge may also allow investors to adopt a barbell approach and take higher risk, and earn higher returns, elsewhere in the portfolio. One final point: to be reliable, a tail hedge needs to be "always on" since the whole point of hedging is that we can't always predict a drawdown. In this regard, systematic option strategies can be particularly useful. In addition to the FX exposures outlined previously, an additional liquidity drain may come in the form of capital calls on private equity commitments. The super industry currently has approximately $106bn exposure to private equity. Some basic assumptions (1) lead to a rough estimate of $11bn liquidity required in a crisis year. Further liquidity needs might reasonably be expected to arise from such things as capital raising (eg rights issues) from portfolio companies, investment opportunities in real estate, infrastructure etc arising from market and/or funding stress. The main point is that super funds can expect to have high liquidity obligations that are required (or desired) to be met during times of market turmoil, on our calculations as much as 6% of fund assets, and possibly much more. A super fund could budget for this by setting aside some amount to be held in low risk, highly liquid instruments such as cash, ready to be deployed in times of stress. However, such an approach has an opportunity cost because the return on cash is much lower than the return on the rest of the portfolio. Using the past 15y years as a rough guide, a cash investment would have returned 2.6%p.a. vs approximately 5%p.a. for a typical balanced super portfolio. The last 10y would have been an even larger difference (1.5% vs 8%). The chart below shows the performance of a systematic tail hedge strategy(2) (light blue line) compared to the realised opportunity cost of holding an additional 6% of fund assets in cash (purple line) and the projected constant opportunity cost of holding cash (dark blue line).

Figure 1: Tail hedge strategy vs opportunity cost of holding cash. The chart shows the long-term performance impact of running a tail hedge strategy can be substantially less than holding additional cash in the portfolio. The mark-to-market of the tail hedging program would need to be met over time, but the chart shows that the realised negative performance during "normal" periods is no more than the drag on performance from holding excess cash, and during stress periods the tail hedging realises large gains which can be used to meet any liquidity requirements. For the specific objective of providing liquidity during a crisis, we find an effective tail hedging program to be a more efficient approach despite the perceived "cost" of hedging. 1 10y fund life, 5y investment phase with capital called evenly, investment realisations of zero in a market crisis. 2 The example strategy is a SPX 3m 1×4 20d/5d put spread rolled monthly. |

|

Funds operated by this manager: |

14 Jul 2022 - Be an investor not a speculator

|

Be an investor not a speculator Claremont Global June 2022 The current market sell-off has many market participants running for cover and waiting till the "uncertainty clears." Issues concerning the market are well-known - central bank tightening, high inflation, the Ukraine conflict, supply chain shortages and increasing concerns of a recession in 2023. And in current markets, I am reminded of the timeless words of Benjamin Graham (the father of security analysis and Warren Buffet's mentor) who made the clear distinction between investment and speculation. In his seminal work "The Intelligent Investor" on the very first page he makes the following observation:

Defining an adequate returnWhen reading this quote the key word is adequate. Note that Graham makes no mention of market timing or predicting a bottom - a practice much loved by sell-side strategists. So what is considered an adequate return? Over the 100 years to December the S&P 500 has given an annual return of 8% p.a. Equity returns are simply a function of:

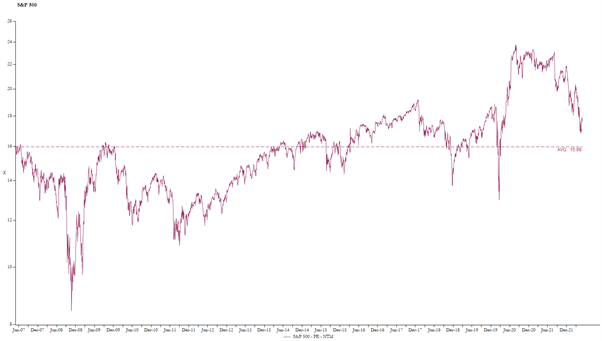

The S&P 500 path to adequateLet's break down these constituents: Earnings growth: looking at 2007 as our starting base (i.e. peak of that cycle) and using consensus earnings in FY22 - earnings per share (EPS) growth was on average close to 6 per cent per annum over the 15-year period. We think this number is a reasonable proxy of our long-term estimate for future earnings growth. Dividends: the current dividend yield is 1.6 per cent. PE expansion/compression: this is the hardest to forecast and requires an accurate forecast of future investor psychology and interest rates. Over the last 15 years the market multiple has averaged 16 times and the current multiple is 17.4x. Assuming a reversion to 16x over 10 years would detract 0.8% p.a. from an investor's return.

Source: FactSet If we add these three constituents together it leads to a return of 6.8% per cent - somewhat short of the long-term equity return of 8 per cent. And while this may not be quite "adequate", it is still a reasonable return compared to what's currently on offer in a savings account - although hopefully news here is improving and central bankers will offer some comfort to hard-pressed pensioners! This assumes one invests in the market through an index fund, where for the purposes of this article I have ignored passive fees. And as an active manager trying to beat the market - we have always targeted a long-term return of 8-12 per cent per annum. This is why last year we were cautioning clients that we expected future returns to be at the bottom end of our targeted range, given the elevated valuation of the market. However, the recent market sell-off has us feeling far more constructive and on the front foot with clients. Let's now look at this by breaking down into the same three constituents. The Claremont path to adequateEarnings growth: we believe our companies could deliver earnings growth over the long term in the low double digits. Dividends: the current yield on the fund roughly equates to our active manager fees. PE expansion/compression: our fund holdings now trade 1 per cent below their 10-year average and 13 per cent below the five-year average. We would argue that it is not unreasonable to expect PE multiples to have a neutral impact on future returns over the long-term. So, if we put this all together - we are much more confident of hitting the right side of that 8-12 per cent per annum equation than we were a few months ago. We know we have little ability to call the bottom, however at current prices we believe we have a reasonable probability of achieving an adequate return. The art of patienceTo conclude with Ben Graham and one of my favourite quotes on market fluctuations in Chapter 8 of the Intelligent Investor:

The sell-off this year has already seen us add two companies to the portfolio - companies we have been following for years while we waited patiently for an entry point. And now with 13 names in the portfolio and a cap of 15 - we have room for two more. Whilst no one likes a falling share market, it opens up a wider opportunity set for us and the ability to acquire truly great businesses at prices that ensure a fair risk-adjusted return. We intend to do just that. Author: Bob Desmond, CFA, Head of Claremont Global & Portfolio Manager Funds operated by this manager: |

13 Jul 2022 - Meta & the battle for digital advertising supremacy

|

Meta & the battle for digital advertising supremacy Antipodes Partners Limited June 2022 Antipodes has owned Meta (previously Facebook) since the end of 2018 and despite the recent volatility in which many sold out of the company, it remains one of our top 20 holdings. We think that even though competition for eyeballs is increasing, and will continue to increase, the digital advertising pie is growing, and Meta can continue to dominate advertising revenue over our investment horizon. Further we believe there are opportunities to increase the monetisation rate of core Facebook and Instagram. In this new podcast episode, Alison Savas is joined by Ben Legg, one of the world's leading authorities on the digital advertising industry. Ben is a former Google COO, and now helps global brands advertise on social networks. Some key points covered include:

|

|

Funds operated by this manager: Antipodes Asia Fund, Antipodes Global Fund, Antipodes Global Fund - Long Only (Class I) |

13 Jul 2022 - Super-sized rate hikes, super-sized credit risk, super-size problems. Follow the dominoes.

|

Super-sized rate hikes, super-sized credit risk, super-size problems. Follow the dominoes. Jamieson Coote Bonds June 2022

The change of policy in 2022 has set off a series of dominoes for asset markets. Government Bonds were first to fall in quarter one, with other assets also following aggressively into quarter two. Listed assets are marked to market instantly (which can often be unpleasant) whilst illiquid or private markets can hold previous asset valuation marks as there is no observable price where price discovery could occur. It is worth considering what those realisable values might be if higher quality or liquid public assets are already -10, -20, -30%? Is a credit crisis about to erupt?The dominoes of change are quickly bringing attention to credit default as it stands to reason that refinancing outstanding lowly rated corporate debt will become increasingly problematic. The Australian Government was borrowing 10-year money at 1.05% in August last year, these rates have now moved to over 4.05% today. If the Government has to pay over 4% when it used to pay a bit above 1%, then spare a thought for corporate borrowers who might have borrowed at super low rates and are now asked to refinance at Government Yield of 4% plus some large credit spread component. How long will the markets have confidence in these lowly rated corporates to refinance at such punitive interest rate levels? The danger here is that they cannot ROLL those existing borrowings forward. That means there is no further credit extended and they need to REPAY the initial borrowing amount as well. That is exactly how a credit crisis erupts.

This is the policy pivot we have written about for some time and has marked a turning point in asset performance. But how does a Central Bank do that here with inflation globally between 5 and 8 %? Central Bankers are now rapidly raising rates as fighting inflation has taken absolute priority over saving corporate zombies from bankruptcy, generating material stress in the credit complex as many investors flee the asset class. Credit risk has been spectacularly dormant as the broad decline in long term Government Bond yields since the 1980's, plus support from Central Banks, has fostered a "begin" environment for the assets class, slingshot by the massive support of flows and investor sponsorship in the ''search for yield'', under the financial repression of low interest rates. That sponsorship and flow looks likely to have ended with rates markets having a stunning sell off this year, leading most asset markets to weak performance. Many public credit assets have also underperformed - primarily from their inherent fixed income duration, rather than the material recalibration of credit (spread) risk.

The US Fed moved to 1.75% this week and suggested its next move is either 0.50% or 0.75% hike to 2.25 or 2.50% in July to continue the fight against inflation by killing demand in the economy. The forces corporate credit markets are now facingSo, the next complex issue facing markets will likely revolve around credit default and the stunning rebirth of credit risk in the corporate credit fixed income space. Credit is a high specialised market which is little understood by most investors. Credit quality, as measured by ratings agencies, ranges from the highly converted (but low yielding) AAA rated issuers, all the way through to lower CCC rated issuers classified as having substantial risk of default (known in markets as 'junk'). Due to the inherent credit risk in these lower rated securities, yields are far higher to entice investors to take on the risk of default.

Any such support for the market looks very difficult to achieve this time as Central Bankers are now rapidly raising rates to fight inflation. Would you lend money to a buy now pay later platform or a growth company with no sustainable earnings to meet debt repayments in the current environment? Thankfully for Australian investors we have very few names like this, but our corporate credit does move its sympathy with global markets which are full of such names. Rate hikes strike in an uncertain worldWith materially higher rates now priced by Government Bond markets, the economy is expected to slow rapidly as rate hikes bite, hitting the public, lowering confidence and curtailing discretionary spending. Liquidity and asset quality will become important considerations for portfolios looking to benefit from steep discounts in many quality assets. We do not expect that rates will fall back to anything like the emergency levels we have seen post pandemic, so it feels like the re-birth of credit and default risk could be with us for some time yet as we move to a structurally higher rate environment than in recent years. It is important to acknowledge that the playbook in the last few episodes of a corporate credit seizure (Central Bank rate cuts and Quantitative Easing) will not work under a higher inflation and unstable geopolitical environment. That pivot of policy simply isn't available if inflation remains above Central Bank mandate levels as we would expect for the balance of 2022 due to the global energy shock. |

|

Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged), CC Jamieson Coote Bonds Global Bond Fund (Class B - Unhedged) |

12 Jul 2022 - Australian Secure Capital Fund - Market Update

|

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund June 2022 Aggregated property values across the country on a monthly basis have slowed marginally, (-0.80%). The highest performer this month was Adelaide (+1.30%), followed closely by Perth (+0.40%). Australia's property price increases experienced over the last 18 months are now well and truly past their peak rate of growth. Interestingly however unit prices are holding their value better than houses across capital cities with regional property still remaining in positive growth. The market is quickly becoming a buyers market with aggregate home sales nationally through the June quarter now 15.9% lower than a year ago. However, with housing conditions cooling, the flow of new listings to the market is slowing which along with a strong labour market should help support prices Rental markets around the country also remain extremely tight with rents and residential property yields now rising at a faster rate than housing values also providing a buffer for property investors. Ultimately however it will be interest rates which will have the largest impact on the path of housing markets.

The weighted average clearance rate across the country is lower than last year at 59.8% compared to 2021's 75.4% clearance rate (-15.60%) Other cities across the board also achieved rates marginally lower than last year, with the exception of Brisbane. Brisbane increased by +5.90% compared to the previous year, with Canberra being dropping in comparison (-29.70%) Source: CoreLogic Source: CoreLogic Quick Insights Lowered Rates & Politicised Policy A new study by the Melbourne Institute has revealed that government support programs contributed very little to the health of the housing market during the pandemic. Instead, it was the RBAs low cash rate that boosted the purchases. Buyers took advantage of relatively low servicing costs and interest rates. Housing programs typically assisted only the few who applied early. The War Room Tony Lombardo, CEO of Lendlease; Janice Lee, PwC Australia Partner; Susan Lloyd-Hurwitz, CEO of Mirvac; and Tarun Gupta, CEO of Stockland, some of the nation's most senior property leaders came together earlier this month to discuss the ongoing housing crisis. The conclusion drawn in the Channel Nine boardroom was that government policies stimulating demand can only do so much. Ultimately, it is the lack of investment in property infrastructure and overly tight zoning policies that continue to stoke unaffordability. Sydney's Stamp Duties The NSW Coalition Government announced this month its new revisions to the stamp duty. The system would allow home buyers to opt-out of paying stamp duty in favour of a $400 and 0.3% annual land tax. Some were quick to note how this might increase housing prices as the money usually spent on stamp duty would instead go into an auction bid. However, as lenders take the cost of annual tax into their loan serviceability criteria, the impact of this legislation may become negligible. Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

12 Jul 2022 - Earnings risk is being contemplated by markets

|

Earnings risk is being contemplated by markets QVG Capital Management June 2022 Inflation driving higher rates and earnings risk (given recession fears), combined with tax-loss selling and flows out of equities, to deliver a horror month for the Small Ords. The benchmark fell -13.1% for June delivered the second worst monthly return since the GFC. The Aussie 10-year bond rate started the month at 3.34% and finished it at 3.66% but not before touching a high of 4.25% intra-month. The US 10-year Treasury Bond interest rate showed a similar pattern, starting the month with a 2.83% yield and finishing it at 3.06% via a 3.48% high. The moves lower in global and domestic equities are starting to price these higher rates. The new fear gripping markets is earnings risk. Depending on who you read, the average US recession sees -13% to -17% earnings cuts (the GFC was a lot worse). It is this earnings risk that is now being contemplated by markets. We have managed money in rising and falling rate environments and know which we prefer! In the past, rising rate environments have been gradual enough so that the earnings growth of our portfolio has compensated for multiple compression from higher rates. The unique feature of this market is not the magnitude but the speed of the move in rates which has led to the fastest compression of valuations ever as shown here: Valuations have never before compressed so quickly Year-on-year change in trailing Price/Earnings multiple of the S&P 500

The chart above shows we have been sailing into the wind, but it won't always be this way. Given the next leg of this bear market is likely to be a focus on earnings not multiples, we have been positioning the portfolio towards companies we believe have greater earnings certainty. This ought to mitigate the impact on the portfolio of a recessionary or slowing growth environment should it occur. Funds operated by this manager: |