NEWS

16 Feb 2024 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

16 Feb 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

16 Feb 2024 - Murray Ackman: Ignore the billionaires - diversity, equity and inclusion are good for investors

|

Murray Ackman: Ignore the billionaires - diversity, equity and inclusion are good for investors Pendal February 2024 |

|

AMERICAN billionaires seem to be picking fights with big brands and civil rights groups over whether corporate diversity, equity and inclusion (DEI) policies are discriminatory. Or even whether they cause aircraft malfunctions. If you've been following the "woke backlash", you'd be familiar with recent flash points such as the campaign against Harvard's first Black female president Claudine Gay. Tesla's Elon Musk, hedge fund manager Bill Ackman and Lululemon founder Chip Wilson have all been engaging in civil discourse on social media recently, expressing anti-DEI views. Musk went as far as suggesting that Boeing, fresh from having a fuselage panel fall off mid-flight last month, was prioritising diversity over safety. That drew a swift rebuke from civil rights groups. "DEI must DIE," Musk said recently on his X social network. "The point was to end discrimination, not replace it with different discrimination." This week the Tesla CEO erased mention of DEI in the electric vehicle maker's corporate filings. Do DEI critics have a point? And what does that mean for investors and companies? What are the concerns about DEI?Musk's criticism of Boeing centred around the impact and unintended consequences of connecting executive pay to diversity targets and ESG metrics. At the start of 2022 Boeing altered its bonus scheme, rewarding executives who hit certain climate and DEI targets. Boeing is certainly not alone here. In 2011, just 1 per cent of listed companies had such a policy. By 2021 it was 38 per cent, and the trend continues. Supporters argue this is positive for companies and shareholders. The idea is that such policies safeguard future economic results from risks while aligning the managerial objectives with shareholder interests. Sharemarket analysts look for such policies as a sign that a business cares about a particular issue. Who's right?Does linking executive pay to diversity improve a business? Or are such corporate DEI policies a sign of excess? There are plenty of studies - including from Pereptual's Regnan sustainable investing business - suggesting DEI can drive business outperformance. A 2021 study from sustainable investing leader Regnan found that DEI - and especially equity and inclusion - can drive business outperformance. Yet Regnan also found many businesses think about diversity and inclusion in a flawed way. For example, DEI policies often focus on the needs of minority groups, while majorities are not always adequately considered. For investors and companies alike, we believe organisational settings should allow all talent to flourish - including 'majority talent' as well as talent that is traditionally under-represented. These are essential pre-requisites for an equitable and inclusive workplace. Businesses benefit from fair employment practices, supportive cultures and open decision-making. What it means for investorsWhile there is now a lot of ESG measurement going on inside companies, it's fair to say there could be a deeper discussion about how inclusive culture can be good for a business. But is Elon Musk right to say there is undue focus placed on DEI? The billionaire's complaints could make sense in the context of a boot-strapped start-up operating from the proverbial garage. But it feels provocative coming from the CEO of a business with one of the highest market caps in history. Based on our experience at Pendal, businesses clearly demonstrate what they care about by what they report. And that is useful for investors. Investors should expect to see comprehensive DE&I plans from companies. And take caution with companies that ignore these responsibilities. And they should look beyond the reported diversity numbers to understand if a business has the right structure to allow for diversity and growth. While it's entertaining to see billionaires argue among themselves, investors must understand how a company thinks about diversity and inclusion if they want to understand whether it is managing risks. Author: Murray Ackman |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

15 Feb 2024 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

15 Feb 2024 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

15 Feb 2024 - A few charts from our Micro Caps CY2024 Overview

|

A few charts from our Micro Caps CY2024 Overview Equitable Investors February 2024 CY2023 Review

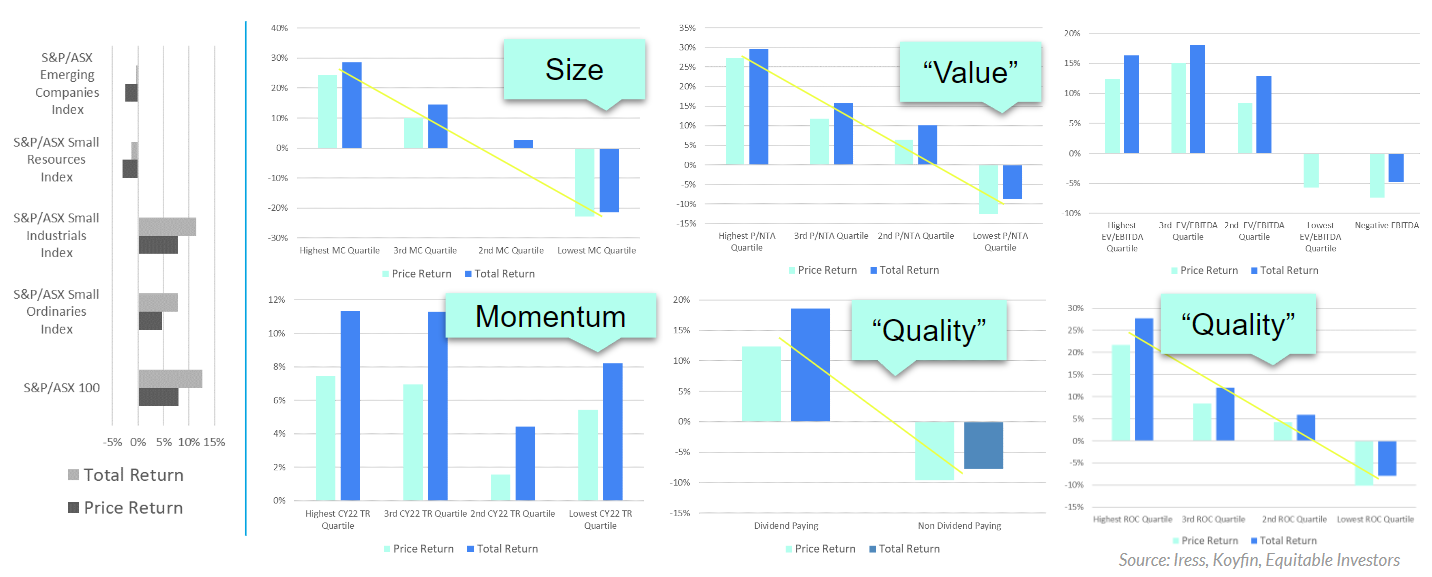

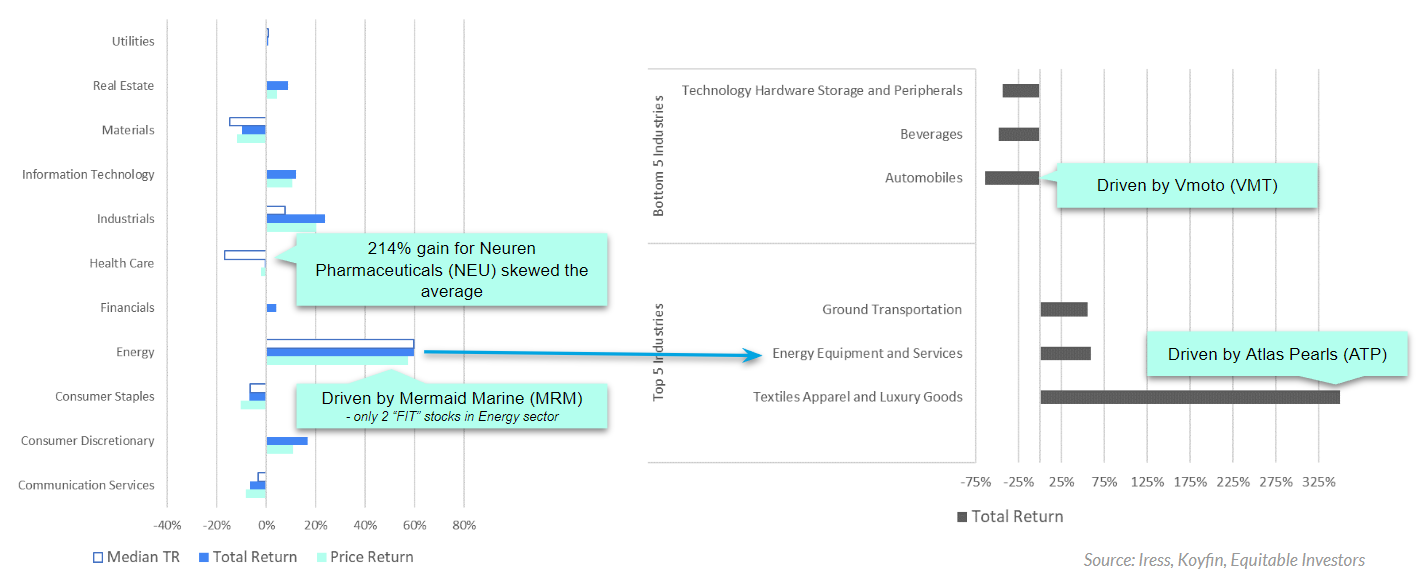

Stocks on higher multiples did better than those in "value" territory as investors chased "quality" (if you define that as top quartile return on capital or companies paying dividends) but the most clear cut divide in ASX listings in CY2023 was simply size as investors shunned the perceived heightened risk of micro caps. Below we analyse CY2023 performance of our ASX "FIT" (Financials, Industrials & Technology) micro-to-mid cap universe, alongside the S&P/ASX benchmarks. All FIT returns presented are averages of the stocks that meet the relevant criteria. CY2023 Sector & Industry Review

The Materials sector, covering chemicals, packaging and paper, was the most beaten-down in CY2023 with an average decline of 10% and a median decline of 15%. Health was an interesting space, where the average return was -1% but the median was -17% as the median biotech, pharmaceutical and health care stock fell by more than 20% BUT one stock surged 214%. Interesting to note that Consumer Discretionary stocks strongly outperformed Consumer Staples.

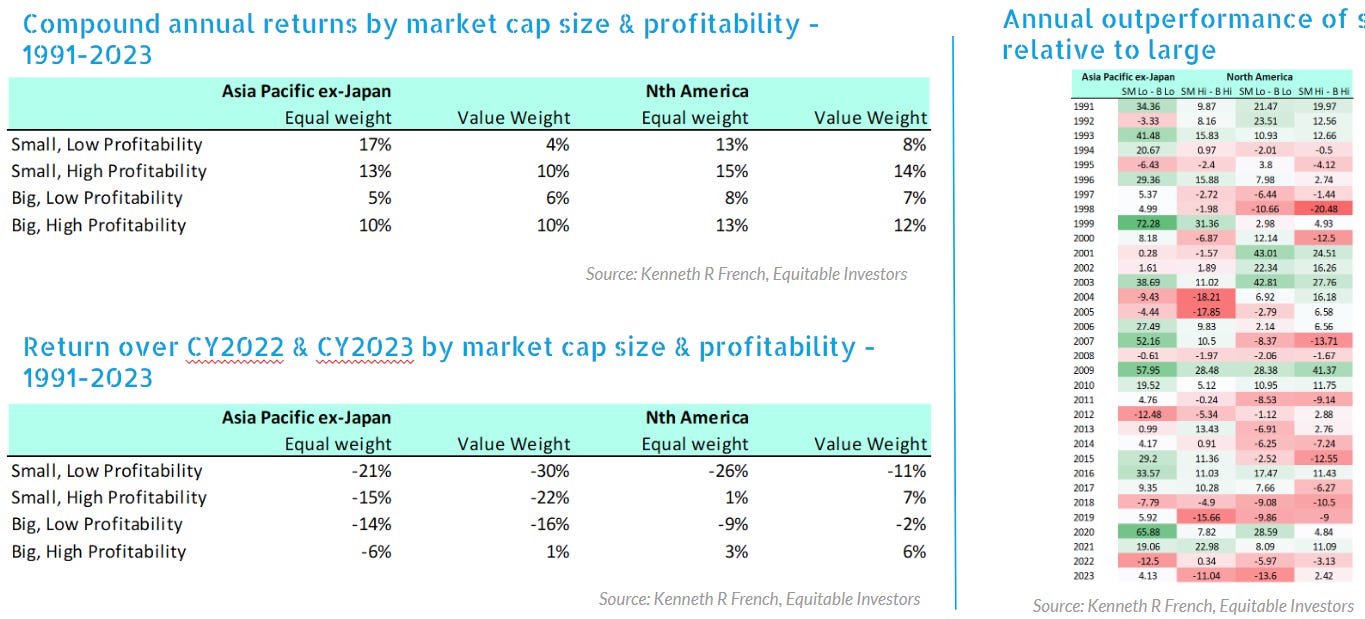

Returns by Size - Broader International Perspective

On an equal-weighted basis, the smallest 10% of stocks by market cap have outperformed the larger 90% in North America and in Asia Pacific ex-Japan (Australia, Hong Kong, NZ & Singapore) over the past 30+ years. But returns over CY2022 and 2023 have favoured the largest and most profitable businesses.

We began tracking the dispersion of trailing (historical) EV/EBITDA multiples when we launched the weekly "Small Talk" publication in 2020. There has been a tangible shift downwards in multiples, with 51% of companies on 10x or less in 2022 and 2023, compared to just 39% at the end of 2020. Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

14 Feb 2024 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

14 Feb 2024 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

13 Feb 2024 - Performance Report: Collins St Value Fund

[Current Manager Report if available]

13 Feb 2024 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]