NEWS

29 Feb 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

29 Feb 2024 - Just Eat the Marshmallow: Why Wait When Value Is Already on the Table?

|

Just Eat the Marshmallow: Why Wait When Value Is Already on the Table? Redwheel January 2024 |

|

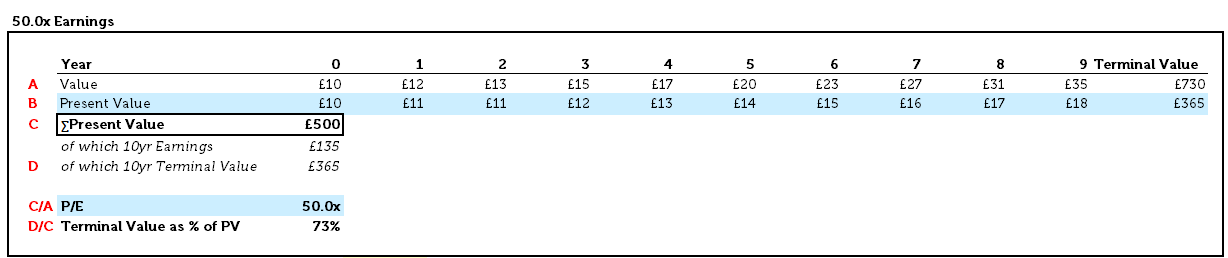

Ah, January. Just the word sends shivers of excitement down the spines of gym proprietors across the world, salivating at the prospect of new year's resolutioners confidently paying for a full year's membership, only to slink away sometime in March. Yes, it is the season for attempting to better oneself, and crucial to that effort is self-control and discipline: being able to say no to that sweet treat, and dragging yourself out of bed for that early morning run. Self-control's influence on success has been a topic of extensive study, one of the most famous involving four-year-olds, and marshmallows. In the experiment [1], Walter Mischel, a psychology professor at Stanford University, placed a single marshmallow on a table in front of several hundred children (one at a time, mind you). He would then leave the room for a few minutes, and if, by the time he came back, the child had resisted the urge to eat the marshmallow, they would earn a second marshmallow. Fun as though this experiment must have been - at least for the children - the most interesting results came years later, when the researchers followed up with the now-grown subjects of their study. There was a strong correlation between the length of time that a child was able to resist eating the marshmallow - taken as a proxy for self-control - and their academic test results, weight, life satisfaction, mental health, and earnings. The longer the wait, the better the outcome. While some dispute the efficacy of this study, the general principle of self-control as a route to success in life is hardly controversial. When it comes to investing, however, we would caution against the alluring promise of additional sweets and advise instead: just eat the marshmallow. And here is where the key difference between the experimental bonus marshmallow and corporate earnings comes in: waiting for the extra marshmallow may be a good use of self-control when it is promised by a psychologist in a white coat, because you know that it is coming; the same, alas, is not necessarily true with companies. Why wait and rely on hopes that high future growth materialises when you can invest in companies already trading at more reasonable valuations? As value investors, we look to buy companies at a significant discount to intrinsic value, or the true worth of a business, based on a conservative assessment of its earnings power over time, and the money that will need to be reinvested to sustain that earnings power. A key part of that process is in trying to figure out what the business can earn realistically, and not getting too absorbed in expectations for sky-high earnings growth. Helpfully, earnings tend to be tied to a number of things, including the assets that the business can utilise and, importantly, what the business has previously demonstrated that it can earn. After all, paying a reasonable price for established earnings doesn't require great feats of corporate athleticism to turn into a good result for investors. By contrast, when you pay a large price relative to the historic earnings power, you are baking in assumptions of good-to-exceptional growth; figuring out ahead of time which companies are going to deliver that growth, and which will disappoint, is an almost impossible task. Paying for that growth upfront leaves no room for error: you likely won't beat the market by being right most of the time if you are betting on the outcomes as certain. Consider a company priced at 50x its most recent earnings [2]. To justify that price, we need to distil into a single value all the future earnings of the business: the way that this is done is typically by taking a nearer-term picture of income, say, over the next ten years, and then adding on a "terminal value", the net worth of the business after that forecast - a sum intended to reflect long-run value. These figures are then expressed as a present value - namely, what the sum of the cashflows is worth today - and that present value is the price at which investors buy and sell companies in the market. To justify a price of 50x current earnings, investors would have to assume that earnings per share grow at 15% each year for the next ten years - a herculean feat - and assume a longer-term growth rate of about 3.0%. Even then, with such staggering success, the price can still only be justified by utilising a required rate of return of 8.0%, which some may see as insufficiently low for the associated risk [3]. Finally, even after generating such incredible earnings growth for ten years, paying 50x today's earnings means that today's present value is still mostly made up of the "terminal value", which represents a whopping 73% of the current asking price:

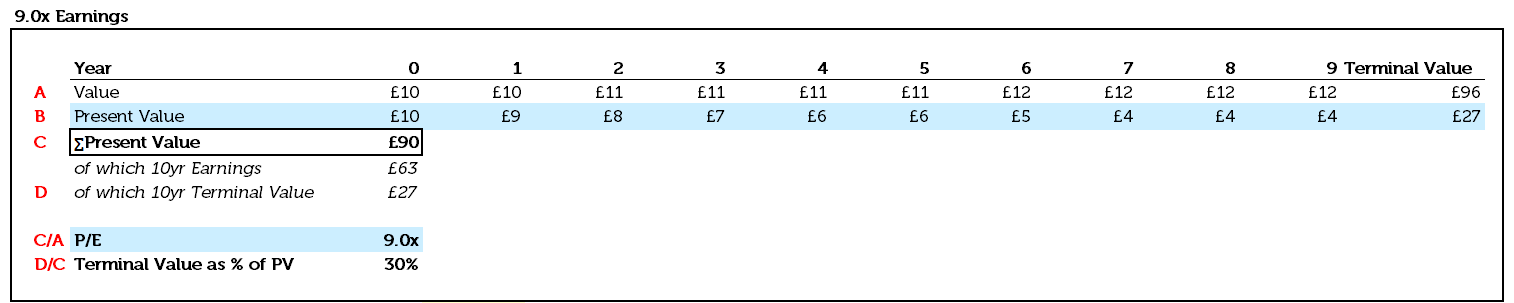

Source: Redwheel. The information shown above is for illustrative purposes. To pay such a price, therefore, investors need to feel certain of the future, certain that by ignoring more reasonably priced companies today - the lonely single marshmallow presented at the start of our experiment - they are going to be rewarded with phenomenal growth for a very long time into the future, and earn themselves an extra marshmallow. Assuming such extreme growth for such a long time makes value investors like us nervous. If we don't make any heroic assumptions [4], and pay a much lower price relative to current earnings, the reliance of our current business value on the outcome of the long-term future falls fast, with the "terminal value" comprising only 30% of today's price, if we pay only 9x current earnings. That means that if both our theoretical companies announced that they were going to cease to exist in ten years, our investment would retain 70% of its value, compared with the higher-priced company, which would be worth only 27% of the price paid.

Source: Redwheel. The information shown above is for illustrative purposes. We make this point to underscore the importance of thinking carefully about the expectations - explicit or implicit - that are built into market prices for businesses, and the chances of those expectations paying off. Unlike in a lab, in the real economy it is, in our opinion, foolish to assume that more marshmallows will always be forthcoming, and we believe investors should think carefully before turning one down today. So next time you hear analysts confidently predicting that Company X or Y is going to make $25 per share of earnings in 10 years' time, and $250 in 20 years' time - ask them to take out their wallets and bet on it. We, on the other hand, would gladly tell you that we cannot precisely predict what earnings will be in 10- or 20-years' time, and we don't need to - because we haven't paid much for them in advance, preferring to base our view of sustainable earnings power on the demonstrated historical earnings capabilities of an enterprise. While many are trying to predict the future, we are simply trying to put the present in the context of the past. In the investment world, we find simply eating the marshmallow in front of us requires the most self-control - and can often make the most sense. Author: Shaul Rosten |

|

Funds operated by this manager: Redwheel China Equity Fund, Redwheel Global Emerging Markets Fund |

|

Sources: [1] Mischel W, Ebbesen EB, Zeiss AR. Cognitive and attentional mechanisms in delay of gratification. J Pers Soc Psychol. 1972 Feb;21(2):204-18. doi: 10.1037/h0032198. PMID: 5010404. (https://pubmed.ncbi.nlm.nih.gov/5010404/) [2]We can think of a few culprits, who shall remain nameless; one rhymes with Badobe [3] I would be one of those people [4] In this case, 2.5% annualised per share earnings growth, a 2.0% perpetual growth rate, and a 15.0% discount rate Key Information |

28 Feb 2024 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

28 Feb 2024 - Global Matters: Gridlock - the vital role of Australia's transmission infrastructure

27 Feb 2024 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

27 Feb 2024 - Australian Secure Capital Fund - Market Update

|

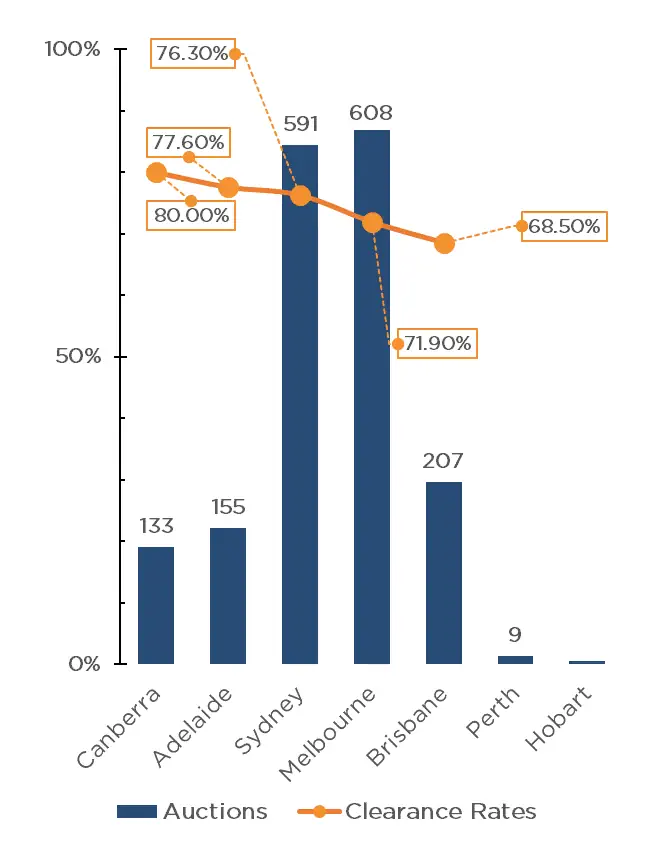

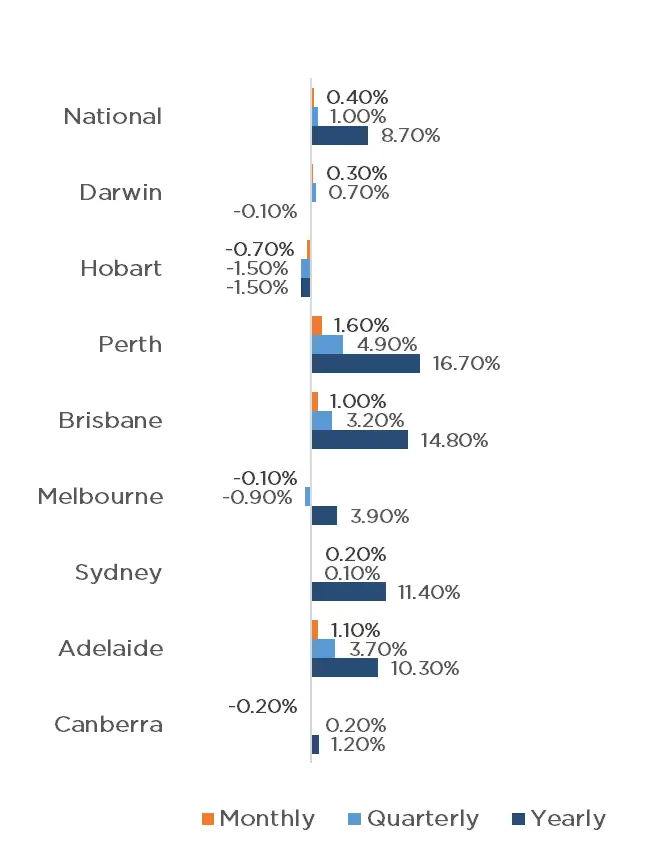

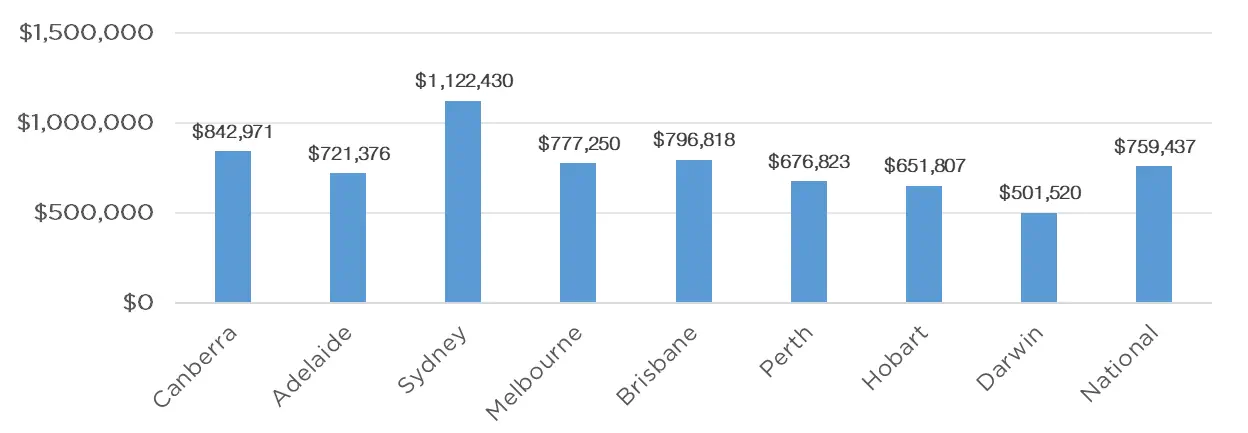

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund February 2024 The first RBA meeting of the year has taken place, with the cash rate remaining on hold at 4.35%. Recent inflation data has given economists confidence that we have reached the end of the rate hike cycle. The first weekend of February brought the start of the 2024 auction season, with a mammoth 1,671 auctions being held across the combined capitals. This is the second largest opening weekend since 2008, with only the corresponding weekend in 2022 holding more auctions, with 1,779 taking place. This result was up 26.4% on 2023 data, and was more than double than double the number of auctions held over the year so far (803). Melbourne recorded the most auctions for the weekend, with 603 taking place, followed closely by Sydney with 562. Brisbane, Adelaide and Canberra also recorded triple digit auction numbers with 203, 159 and 132 auctions taking place respectively, whilst Perth and Tasmania held just 9 and 3 auctions respectively. Preliminary clearance rates have also begun the season strongly, with a clearance rate of 73.9% across the combined capital cities, well above the 61.9% of 2023. Canberra led the way with 80.0%, followed by Adelaide, Sydney and Melbourne with 77.6%, 76.3% and 71.9% respectively. Brisbane being the only capital below 70% with a 68.5% result. The property market continues to show growth, albeit signs of cooling do exist, with a 0.4% increase across both the combined capitals and regionals. Perth continues to experience the highest rate of growth, increasing by 1.6% for January, followed by Adelaide and Brisbane with 1.1% and 1% respectively. Darwin and Sydney also experienced growth of 0.3% and 0.2% respectively, whilst prices in Melbourne, Canberra and Hobart have fallen by 0.1%, 0.2% and 0.7% respectively. The annual change remains significant with a 10% increase across the combined capitals, and 4.9% increase for regional centers, contributing to a national increase of 8.70%. This has been driven by four of the capitals experiencing double figure growth with 16.70% for Perth, 14.80% for Brisbane, 11.40% for Sydney and 10.30% for Adelaide. Melbourne and Canberra also recorded growth for the year with 3.90% and 1.20% whilst only Darwin and Hobart saw prices fall for the year with 0.1% and 0.4% respectively. This has led to Brisbane now holding the second highest median value in the country, overtaking Melbourne with a median value of $796,818 compared to Melbourne's $777,250. Whilst the property market has begun to show signs of easing, given that economists predict we are at the end of the rate hike cycle, we anticipate that property prices will still experience growth throughout 2024, as interest rates begin to subside, and the lack of housing supply continues. Clearance Rates & Auctions week of 4th of February 2024

Property Values as at 1st of February 2024

Median Dwelling Values as at 1st of February 2024

Quick InsightsWill Values Fall? Unlikely.With home values in capitals such as Sydney still 2.4% lower than their peaks, many investors such as Sydney-based investor Nicholas Marangos-Gilks are more motivated than ever to increase demand in the market. Buyers are not waiting for the rate cut to occur. Tim Lawless, CoreLogic research director, has commented, "We are still seeing housing values below their record highs in Sydney, Melbourne, Hobart, Darwin and the ACT. In these cities we could see motivation from buyers looking to get into the market while values are still below their peaks." Source: Australian Financial Review Looser Planning, not Restrictive TaxesEliminating negative gearing and ditching capital gains tax discounts will not solve the worsening housing affordability crisis, but boosting supply by easing planning rules will, a new report says. Centre for Independent Studies chief economist and former Reserve Bank official Peter Tulip said restrictive planning rules have added more than 40% to house prices in Sydney and Melbourne, while property taxes boosted values by 4% at most. "There are arguments from the tax policy perspective that negative gearing and the capital gains discount should be considered, but it's not relevant to the question of housing affordibility," he said. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

26 Feb 2024 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

26 Feb 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|||||||||||||||||||||

| Aura Core Income Fund | |||||||||||||||||||||

|

|||||||||||||||||||||

| View Profile | |||||||||||||||||||||

|

|

|||||||||||||||||||||

| JPMorgan Equity Premium Income Active ETF (Managed Fund) | |||||||||||||||||||||

|

|||||||||||||||||||||

| View Profile | |||||||||||||||||||||

| JPMorgan Equity Premium Income Active ETF (Managed Fund) (Hedged) | |||||||||||||||||||||

|

|||||||||||||||||||||

| JPMorgan US 100Q Equity Premium Income Active ETF (Managed Fund) | |||||||||||||||||||||

|

|||||||||||||||||||||

| JPMorgan US 100Q Equity Premium Income Active ETF (Managed Fund) (Hedged) | |||||||||||||||||||||

|

|||||||||||||||||||||

| View Profile | |||||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

24 Feb 2024 - Hedge Clippings | 23 February 2024

|

|

|

|

Hedge Clippings | 23 February 2024 This week for a change, Hedge Clippings is going to ignore the Reserve Bank, inflation, interest rates, and even politics, as Barnaby's retired to the bush, and Donald Trump has seemingly even gone quiet as he considers his next legal option. Instead, we're reverting to our bread and butter, the performance of markets and managed funds. It's been just over 3 months since the extraordinary rally in equities kicked off last November. At the end of October last year, the ASX200 Absolute Return Index (ARI) was negative (just) YTD since January 2023, and up only 2.95% over 12 months. By the end of December, the index was up 12.4%. Things did slow down somewhat in January, with a return of 1.19%, by which time the 12 month rolling return had fallen to 7.08% thanks to its performance in January 2023 "falling off" the 12 month's numbers. In the small cap sector, the numbers were even more extreme as risk appetite among investors, plus limited liquidity in most stocks in the sector took a toll. At the end of October '23, the ASX Small Ordinaries ARI was down 6.05% YTD, and -5.11% over 12 months. By the end of December, it had risen over 14% to finish the year up 7.82%, before dipping to a 12 month number of +2.09% by the end of January. Small caps of course are notoriously volatile: In September 2022 the index was down 22% over 12 months, but a year earlier, September 2021, the index was up 30.4%, having risen no less than 52% in the 12 months to March '21 in an amazing rebound from the initial depths of COVID in March 2020 of -21% over 12 months. Experienced investors and advisors will correctly point out that when investing in the market, and managed funds in particular, it's the long (term) game that counts. Most offer documents (and ASIC) suggest a 5-7 year term to ride out the swings and roundabouts. Taking that approach, and the long term suggests an 8-9% annualised return (including dividends) from the Australian equity market and 10-12% from global equities based on the MSCI All Countries World Index. Over the same 5-7 year period, managed funds in AFM's Equity Peer Groups - both Large and Small/Mid Cap - have on average largely provided the same returns after fees as the index: The issue of course is volatility, or standard deviation of returns, but as shown below, so is the concept of average. Many will correctly point to the fact that individual stocks and fund's performance varies dramatically and with careful selection, performance can far exceed the above (although passive investing in an index ETF doesn't provide this, but that's a discussion for another day). Of course equities aren't the only game in town, particularly in volatile markets. Over the past 2-3 years, Private & Hybrid Credit funds have proven that they can return the same as equities (8-10% plus) with a fraction (or none) of the volatility, plus a regular income stream paid monthly or quarterly. We're currently preparing our Fixed Income Private Credit Sector Review to shine a light on this emerging, and increasingly popular sector which features a surprisingly diverse range of strategies and underlying assets. News & Insights New Funds on FundMonitors.com Market Commentary - January | Glenmore Asset Management Stock Story: Charter Hall | Airlie Funds Management January 2024 Performance News Glenmore Australian Equities Fund Insync Global Capital Aware Fund Bennelong Emerging Companies Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

23 Feb 2024 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]