NEWS

18 Mar 2024 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]

18 Mar 2024 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

18 Mar 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| JPMorgan Global Macro Sustainable Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| JPMorgan Global Strategic Bond Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| JPMorgan Income Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| JPMorgan Sustainable Infrastructure Fund - Class A Units | ||||||||||||||||||||||

|

||||||||||||||||||||||

| JPMorgan Global Bond Active ETF (Managed Fund) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

15 Mar 2024 - Hedge Clippings | 15 March 2024

|

|

|

|

Hedge Clippings | 15 March 2024 You can take your pick when it comes to forecasts for inflation in both the US and Australia. The general consensus being that while declining from the levels of 12 months ago, the rate of decline is slowing. The same goes for Europe - according to forecasts from the Federal Planning Bureau in Belgium, (surely the World's centre of bureaucracy and bureaucrats) the average CPI in 2024 should be 3.0%, dropping to 1.8% in 2025, compared to 4.06% in 2023, and 9.59% in 2022. While European inflation has been more severe than either the US or Australia, we live in a global world and the overall trend is likely to be much the same. News & Insights New Funds on FundMonitors.com Wrestling the gorilla | Insync Fund Managers Market Commentary - February | Glenmore Asset Management February 2024 Performance News Bennelong Emerging Companies Fund Glenmore Australian Equities Fund Delft Partners Global High Conviction Strategy Bennelong Twenty20 Australian Equities Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

15 Mar 2024 - Performance Report: Kardinia Long Short Fund

[Current Manager Report if available]

15 Mar 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

15 Mar 2024 - Tim Hext: What we learned from the latest GDP data

|

Tim Hext: What we learned from the latest GDP data Pendal March 2024 |

|

The December-quarter GDP numbers just stopped short of the "no-growth" scenario we were slowly sliding towards last year. Pendal's head of government bond strategies explains Tim Hext what it means for markets

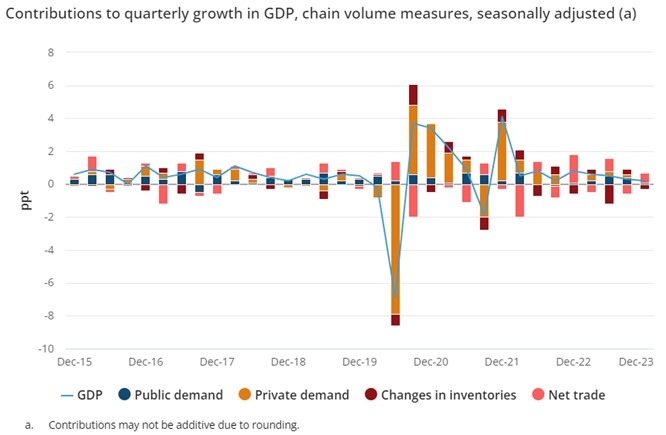

THE December-quarter GDP numbers just stopped short of the "no-growth" scenario we were slowly sliding towards last year. Q4 GDP came in on forecast at just 0.2%, as you can see in the ABS graph below. After 2.3% growth in 2022, 2023 finishes with GDP at 1.6%.

Source: ABS, 2024 In per capita terms, we went backwards for the third quarter in a row (-0.3% for the quarter) and are down 2.4% over 2023. The weakness is largely from consumer spending, which is going almost nowhere - this was up 0.1% for the quarter and 0.1% for the year. Remember, this was a year where almost 600,000 people entered the country so, on average, we are all spending less than in 2022. Interestingly, we are earning more, but it is all being swallowed up by inflation, interest rates and tax creep. In fact, compensation of employees was up 8.1% in 2023, but taxes paid 11.5%. The Stage 3 tax cuts (beginning July) will only partly remedy this. If you feel like money is going out just as fast as it comes in, you have good reason. The GDP you hear reported is a volume measure (called chain volume) of output for the economy. Most of us think in nominal terms. On a nominal basis things look better - with GDP at 1.4% for Q4 and 4.4% for 2023. Higher prices and improving terms of trade has helped cushion the blow in the real economy. Government and business investment propping up the economy So, if consumer spending - which makes up 50% of the economy - is flatlining, then where is the modest growth coming from? Government spending and investment continues to be strong. Government spending was up 0.6% for the quarter and 2.7% for the year, while government investment was slightly down for the quarter but up a massive 13.6% in 2023. Private investment was up as well, but modest overall. Data centres and warehouses are driving solid growth. Concerningly though, dwelling investment was down 3.8% for the quarter and down 3.1% on the year. Hopes of a building boom to help the housing shortage fly in the face of higher interest rates. Rents go up, so inflation goes up, so interest rates go up, so housing investment falls - if you follow the logic of rate hikes to tackle rental inflation, you are smarter than me. Hours worked still falling The GDP numbers also include data on hours worked. This fell for the second quarter in a row and is now down 1% from mid-year. The RBA will take some comfort that firms are responding to slower conditions by reducing hours of existing employees and not hiring new ones, rather through layoffs - at least for now. So, what does this mean for markets? First of all, the rate hikes have worked. While the fixed rate cliff has been more of a speed bump, the RBA will be pleased that higher rates are reducing demand in the economy. Lower immigration in the year ahead will also help. At the same time, the supply side of the economy is another year away from the pandemic and has now largely normalised. This will give the RBA further comfort that its path back to inflation below 3% is realistic and achievable. This, in turn, opens the door to rate cuts later in the year. We still think three cuts - in September, November and December - are realistic. By then, the US Federal Reserve should be well into rate cuts, and inflation - while sticky around 3% - would be considered under control. In turn, GDP would be allowed to push back up towards 2% or above without threatening the inflation outlook - and this would be a good outcome for all and meet the objectives of the RBA. Author: Tim Hext |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

14 Mar 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

14 Mar 2024 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

14 Mar 2024 - Glenmore Asset Management - Market Commentary

|

Market Commentary - February Glenmore Asset Management March 2024 Globally equity markets performed strongly in February. In the US, the S&P 500 was up +5.2%, the Nasdaq increased +6.1%, whilst in the UK, the FTSE 100 was flat. The driver of the US markets was continued strong performance of the technology sector, as well as a decline in inflation (+3.1% rolling 12 months), which bodes well for future monetary policy. The ASX All Ordinaries rose +1.2%, with technology and consumer discretionary sectors being the top performers. Gold was the worst performer, impacted by rising bond yields and a poor reporting season, where cost increases were a factor. Rising costs against a backdrop of weaker commodity prices were a headwind for the resources sector, though we would note investor sentiment is already quite bearish. Regarding the ASX reporting season, we viewed it as better than had been expected. Of note, a reasonably large number of small/mid caps stocks beat analyst expectations, both on profit margins and revenue growth. The overall theme was that despite the large number of interest rate hikes in the last 18 months, the Australian economy and consumer spending has been resilient. Whilst unemployment has risen in recent months (currently 4.1%), it is still very low by historical standards. In terms of monetary policy in Australia, the RBA remains "on pause" whilst it monitors inflation data. We do not assume any interest rate cuts for the next 6-9 months but believe we have seen the worst of the interest rate rises. In bond markets, the US 10-year bond rate increased +26 basis points (bp) to close at 4.28%, whilst its Australian counterpart rose +12 bp to finish at 4.14%. The Australian dollar was flat, ending at US$0.65. Funds operated by this manager: |