NEWS

2 Apr 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

||||||||||||||||||||||

| Ausbil Global Essential Infrastructure Fund (Hedged) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

|

||||||||||||||||||||||

| Barwon Global Listed Private Equity Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| BlackRock Global Impact Fund (Class D) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| BlackRock Diversified ESG Stable Fund (Class D) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| BlackRock Diversified ESG Growth Fund (Class D) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

28 Mar 2024 - Hedge Clippings | 28 March 2024

|

|

|

|

Hedge Clippings | 28 March 2024 Taylor Swift saved the day for February retail sales - or possibly just diverted the consumers' spending away from their normal patterns. Without the one-off impact of 600,000 "Swifties" (including Albo, who took time off from the affairs of State to attend at least one of the seven concerts) the month's retail sales at 0.1% would have only just made it into the positive. Add in the combined effect of concert tickets, clothing, merchandising, accessories, and dining out, and the number nudged up to 0.3%. While some of that would have diverted spending from other outlets and spending, much of the hard earned cash of the Swifties would have left with Taylor herself partly as ticket sales, and partly royalties on clothing and merchandise. News & Insights New Funds on FundMonitors.com Market Update | Australian Secure Capital Fund February 2024 Performance News Bennelong Australian Equities Fund Digital Asset Fund (Digital Opportunities Class) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

28 Mar 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

28 Mar 2024 - Planting the seed of change: real estate's role in the nature crisis

|

Planting the seed of change: real estate's role in the nature crisis abrdn March 2024 Since publishing our climate change approach for our direct real estate portfolio in 2020, we have focused on mitigating climate risks and decarbonising our real estate portfolios. But our real estate environmental, social and governance strategy also considers wider environmental and social topics, including those associated with nature and in particular biodiversity . How can real estate reduce its negative impact on nature? And how can it have a positive impact and contribute to climate solutions? A focus on natureWe are experiencing a nature and climate crisis. While the spotlight has previously been on climate change, nature is now sharing centre stage. The two issues are interdependent. Some key initiatives have caused real estate investors to sit up and pay attention to the relationship between buildings and nature.

How does real estate affect nature?Real estate contributes directly to four of the five main drivers of nature loss. Therefore, action to reduce the impact in these areas can also reduce risks for real estate assets. Five drivers of nature loss

Green infrastructure creates a positive impactReal estate provides the unique opportunity to have a positive impact at the construction phase of a building, particularly in terms of design. This may involve maintaining existing green areas or improving habitats that are in poor condition. But it can also have a positive impact in the post-construction phase, by implementing green infrastructure (see examples below). This can promote local biodiversity and contribute to climate change mitigation and adaptation. Real estate can also have a positive social impact and provide operational efficiencies. Types of green infrastructure [2]

How does nature benefit real estate investment performance?Green infrastructure can have a positive impact on people, by improving the aesthetics of a building, reducing energy costs, minimising flood remediation costs and improving local air quality. Studies show that there can be a 10% increase in willingness to pay for assets that offer green cover. Green infrastructure can increase property values by around 9.5%. And buildings in close proximity to parks or green spaces also benefit from higher values. Real estate assets with green infrastructure are more attractive to tenants, which can help to reduce void periods and increase rental values. Real estate has a key role to play in the nature crisis. It can reduce its negative impact on nature, and it can have a positive impact and contribute to climate solutions. Nature also has the potential to enhance investment returns and to make buildings more attractive to owners, tenants and communities. Author: Georgie Nelson, Head of ESG, Real Estate |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund Source: 1. United Nations Environment Programme (March 2022) Managing Transition Risk in Real Estate: Aligning to the Paris Climate Accord. |

27 Mar 2024 - Performance Report: PURE Income & Growth Fund

[Current Manager Report if available]

27 Mar 2024 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]

27 Mar 2024 - How to Handle a Correction

|

How to Handle a Correction Marcus Today March 2024 |

|

It has been one year since the bottom of the market on March 23, 2020. Since then, the ASX 200 is up 65.5%... if you bought at the absolute low and sold a year later.

For any fund manager getting abused for not achieving 54.44% in the post-pandemic recovery year, you might point out to your complaining client that the 54.44% was from the lowest low, which existed for a micro-instant on March 23rd 2020 in the most volatile week in decades. That week the market had a range of 18.9%. To have achieved 54%, you would have needed not just the the presence of mind (balls) to buy the market at that micro instant low, but you would have had to have done it amidst unprecedented volatility, and you would have had to go in 100% (no cash). And you only had an instant to do it. If you had waited a week and had caught the top in that second week, then the market has only gone up 26.7% in the last 51 weeks, not 54.44%. Half the 51.59%. Basically, if you missed the bottom of the market by a week and if you had inched in, or pyramided in, not gone all in, you would have lost even more of the gains. There is no one that went in 100% at the bottom. So just in case you get trolled about your performance, you can ask your investor if they really expected you to go all-in at exactly the right micro-instant. Truth is, the convenience of hindsight makes it very easy to complain about fund manager performance, and charts extremes are the most fabulous data points for those complaints. 15 Golden Rules From The PandemicHere are some of the lessons from the last year. Observations about sharp market corrections and their recovery.

At the end of the day, the pandemic year has been great for us as investors. It has been a year of fabulous opportunities. Hopefully you played the game. Look forward to the next great correction. Hopefully we'll all have the vigilance, experience and courage to exploit it, not run from it. Author: Marcus Padley |

|

Funds operated by this manager: |

26 Mar 2024 - Australian Secure Capital Fund - Market Update

|

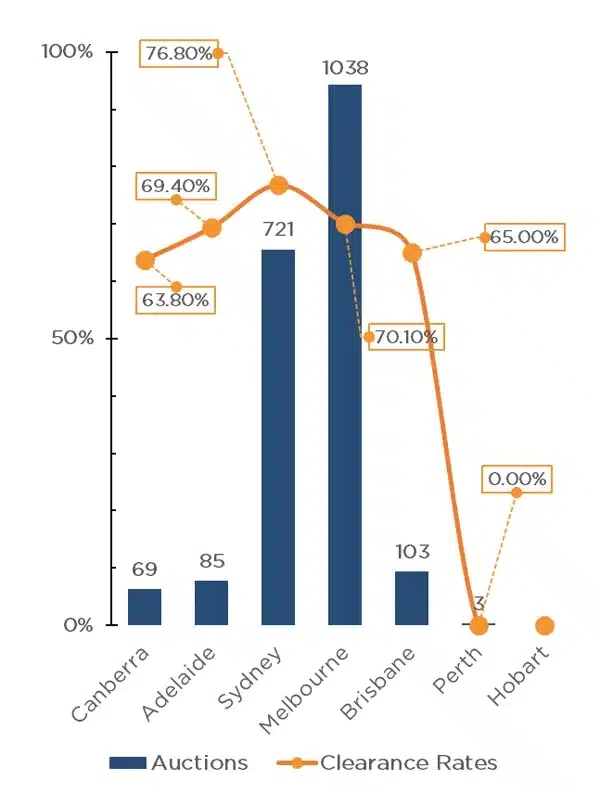

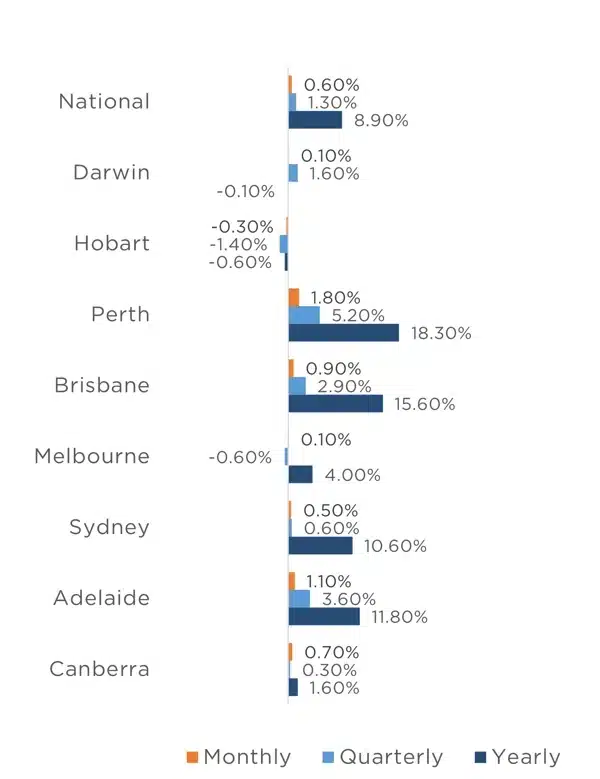

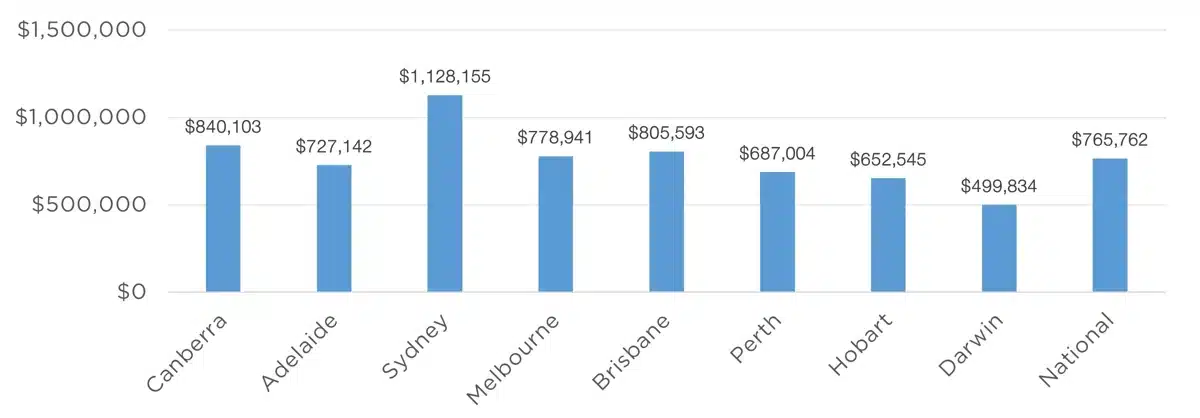

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund March 2024 The first weekend of March saw 2,019 auctions take place across the combined capital cities, down slightly on the previous year's 2,054, however clearance rates were up, 71.8% in comparison to 66.3% in 2023. Melbourne once again led the way, with 1,038 auctions taking place, followed by Sydney with 721, well above that of the other capitals, with Brisbane, Adelaide, Canberra and Perth recording 103, 85, 69 and 3 auctions respectively. The preliminary clearance rate of 71.8% for the weekend indicates that buyers and sellers are on the same page for the most part, particularly in Sydney where a clearance rate of 76.8% was achieved, well above the 68.7% of the same weekend last year. Melbourne, Adelaide, Brisbane and Canberra all managed to achieve clearance rates of above 60% for the weekend, with 70.1%, 69.4%, 65.0% and 63.8% respectively. It is interesting to note that all capital cities achieved a greater clearance rate than the same weekend in 2023, other than Adelaide, where a 72.9% clearance rate was achieved on the same weekend last year. February brought yet another strong month for property prices, with CoreLogic's Home Value Index showing a 0.6% increase across the combined capitals and combined regionals, with all capital cities experiencing growth except for Hobart, where prices fell by 0.3% for the month. Once again, Perth experienced the greatest level of growth, increasing by a mammoth 1.8% for the month, contributing to a 5.2% quarterly growth and an increase of 18.3% annually. Adelaide also experienced strong monthly growth of 1.1%, followed by Brisbane with a further 0.9% increase, bringing the median property value of Brisbane above $800,000 for the first time, with a median value of $805,593, the second highest median value nationally, behind only Sydney with $1,128,155. Canberra, Sydney and Melbourne also experienced growth for the month of 0.7%, 0.5% and 0.1% respectively, with all cities except for Hobart (-0.6%) and Darwin (-0.1%) experiencing an annual increase. Whilst there was no RBA meeting this month, economists continue to believe we are at the end of the rate hike cycle, with many expecting interest rate reductions before the end of 2024. Should interest rates ease, we expect that there will be a bump in property prices. Clearance Rates & Auctions week of 4th of March 2024

Property Values as at 1st of March 2024

Median Dwelling Values as at 1st of March 2024

Quick InsightsValues to OutperformTwo-fifths of valuers surveyed by CBRE have predicted house prices to outperform by up to 10% in Adelaide, Perth, and Sydney. Valuers were also relatively bullish on the apartment sector with 44 per cent predicting prices to increase over the next 12 months. The survey also highlighted a high level of demand from upgraders and downsizers, buyer segments who were less sensitive to interest rate movements. Source: Australian Financial Review Build-to-Rent Builds SteamSalta Properties, is now surging into the build-to-rent sector, with ambitions to create a $3 billion platform and with its first project in inner-city Melbourne close to completion. "We could see that we were heading into a fairly significant housing shortage in Melbourne, and more broadly across Australia," said Sam Tarascio, manager of the firm. The first block is a 94-unit project in trendy Fitzroy North at 249 Queens Parade. To be known as Fitzroy & Co, the building has topped out and is on track to welcome first residents from July into their one, two and three-bedroom apartments. Those tenants can expect a range of resident services, access to shared spaces and a variety of amenities. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

26 Mar 2024 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]

25 Mar 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]