NEWS

11 Oct 2022 - Decarbonise real estate or be left behind

|

Decarbonise real estate or be left behind abrdn August 2022 Market sentiment on China has become especially fragile of late amid fears over near-term growth. However, We are in one of the most significant periods of change for real estate. Seismic shifts are taking place as we respond to climate change and decarbonise assets. It is clear the changes will be dramatic and they will be apparent well before some market participants currently assume. The conflict in Ukraine and the resulting higher costs for fossil fuels have sharpened the focus on decarbonisation. At this stage, adopting an agile response and taking steps to prepare for the effects of the transition to net zero are vital. This will allow investors to mitigate the impact on valuations, returns, investment activity, and the future investibility of their assets. The momentum is buildingThere is increasing pressure on asset managers to reduce the emissions from the assets they manage. Extreme global environmental changes combined with pressure from governments, investors, regulators, occupiers and employees are forcing change. With the built environment accounting for around 40% of global carbon emissions, the commercial real estate investment sector is in the spotlight. Real estate has a large part to play in limiting global warming to the 1.5 degrees threshold. While the target of net-zero emissions for buildings is necessary, how to get there is still not clear. Government policies at a global level lag well behind what is required. As a result, the gap has been filled with a proliferation of voluntary standards, such as the Better Building Partnership, the World Resources Institute, and the World Green Building Council. While these are well-intentioned, they are often contradictory. And in the absence of a common definition of what 'net-zero carbon' means, they can cause significant confusion. A clear trend is emerging where real estate assets with a higher sustainability specification can command a premium, while those that don't are vulnerable to a 'brown' discount. More sustainable assets are commanding a premiumA clear trend is emerging where real estate assets with a higher sustainability specification can command a premium, while those that don't are vulnerable to a 'brown' discount. Ramping up sustainability performance standards is certainly increasing obsolescence (no longer fit-for-purpose) in buildings. But measuring rental premiums, lower void periods and higher valuations for more sustainable assets is likely to remain challenging, given there is limited data and evidence on which to base assumptions. Regulatory confusion isn't helpingThe current reliance on Energy Performance Certificates (EPCs) across Europe illustrates some of the issues with the existing regulatory regime. EPCs can be helpful in providing information about a property's theoretical energy use, but they tell us nothing about the actual energy used in practice. The key European Union (EU) sustainable finance regulations rely heavily on EPCs. But how these concepts are implemented by each member state renders cross-border comparison nearly impossible. At present, the same building will be efficient or inefficient (under the Sustainable Finance Disclosure Regulations), or it will be sustainable or unsustainable (under the EU taxonomy classification of sustainable activities), based purely on the country in which the building is located. Estimating the future impact of decarbonisation on assets.What is the expected cost of decarbonising real estate? No one really knows. The heterogeneity of the asset class and the uncertainty associated with the recommended path to net zero make it difficult to quantify. Numerous factors will have a sizeable impact on the cost. For example, the age of the asset, plant and machinery; the complexity of the layout; the geographic location of the asset; or the costs of construction in the country concerned. Furthermore, the decarbonisation or otherwise of the electricity grid in a particular country where there is a high level of green energy (nuclear energy, for example) will reduce the overall decarbonisation costs. The degree of global warming in the country concerned will also affect the decarbonisation start and end points. Countries that are more susceptible to global warming will have a greater need to decarbonise quickly. So how do investors begin to put a cost on decarbonisation? Estimating a decarbonisation cost for the average asset in a particular sector, within a specific country, and taking account of the sustainability of the grid, gives a benchmark starting point. Investors can then collaborate with expert consultants, such as JLL, Verco, and Evora, to analyse assets on a bottom-up basis. This provides the key data that can be used to refine the broad averages. We take a multi-pronged approachThe key challenge at the moment is finding a consistent pathway to net zero. It needs to take account of different sectors, countries, future climate change, and the sustainability of energy sources in each country. The science-based energy emissions guidance from CRREM (Carbon Risk Real Estate Monitor) is our starting point. This is then combined with the extensive bottom-up data that we have collected from external analysis of our assets. We then take a view on the most appropriate numbers based on our country or sector views. We expect our guidance to evolve as we build up a more precise database of expected and actual costs. So what does this mean?Given the undeniable impact of global warming, along with the ever-tightening and more onerous sustainability regulations, the real estate industry is under pressure to change. Investors are becoming much more aware of the need to tackle excess emissions in their assets. We are at the early stages of investors pricing in the likely costs associated with 'good' and 'bad' sustainable assets. But given the level of scrutiny in this area of real estate, the pace of change is gathering significant momentum. Some investors will be left with assets that require too much capital investment to be viable. These assets may not attract tenants or they may not generate a cashflow in the future. Indeed, they may even become obsolete, where the only course of action will be to knock them down. We are taking significant steps now, to avoid such extreme measures in the future. Author: Simon Kinnie, Head Of Real Estate Forecasting and |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund

|

10 Oct 2022 - Inflation will test Fed's patience, but RBA has cards up its sleeve

|

Inflation will test Fed's patience, but RBA has cards up its sleeve Pendal September 2022 |

|

ALONG with many other observers, we expected US inflation to moderate more than it did in August. Headline CPI came in overnight at 0.1% (8.3% annual) and underlying at 0.6% (6.3% annual). A new group of unrelated components (including vehicle repair, dental charges and tobacco) showed fresh signs of inflation, pushing the rate positive for the month. We still expect goods deflation in the months ahead. Oil prices and most other commodities are weak. But US wage growth is spreading inflation wider into services. Services inflation is now the battleground and labour supply lines are normalising far slower than goods. What little patience the US Federal Reserve may have had is running out. Fed funds now seem destined for 4% or higher. As little as six weeks ago the market was expecting terminal rates closer to 3%. RBA may be more patientAs always, Australian bonds will follow the US. But the RBA seems prepared to show a bit more patience. This is due to a number of factors — but the two main ones are wages and our floating rate mortgage market. The NAB business survey showed that rate hikes are yet to have any impact. This is not surprising as the economy is now almost fully open, many have pent-up savings to spend and fixed rates are protecting 40 per cent of mortgage holders. The RBA remain on course for 3% cash rates by year end (either 2.85% or 3.1%). It will likely rely on the fixed rate mortgage cliff and immigration to do the heavy lifting to combat inflation in 2023. Bond markets are caught in the loop of pushing rates up with the Fed but also with one eye on increasing recession risks. Flatter curves seems to be the favoured way of reconciling these two outcomes. Credit and equity markets were hit by the high inflation numbers, but for now look to be range-trading rather than breaking down. The only certainty for now is volatility is here for a while yet. Author: Tim Hext, Portfolio Manager and Head of Government Bond Strategies |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

7 Oct 2022 - Halgos and three steps for navigating the road ahead

|

Halgos and three steps for navigating the road ahead Nikko Asset Management August 2022 The experience of investing in risk assets over the last six months has been a miserable affair for most involved-particularly in some corners of the market where we have seen a collapse in share prices. We question, however, why this might be a surprise for so many investors. The evidence would suggest that many investors have become conditioned by the environment that had prevailed for over a decade, with a smooth and clear road to higher prices for equities and most financial assets. The world's key central banks have had a specific goal of lower yields on financial assets since the great experiment of quantitative easing commenced. We have been in an era that has been less about investing capital and more about deploying capital to the beneficiaries of the great inflation in financial assets. This era even had its own language: SPAC, FAANG, meme, NFT, crypto, FOMO[1], etc. We live in a world where artificial intelligence is developing rapidly and can join the dots within larger data sets much better than humans can, and we will no doubt underestimate the degree of future advances in this area. However, we have just had a good reminder of the power of human thinking, as joining the dots on the wide array of evidence from different sources has been giving us valuable insights for some time. As a team, we are always discussing and debating these observations and the insights they provide as they are instrumental in both directing our research towards the best new ideas and a correct appraisal of our current investments. The valuation of companies has been a key area of focus, particularly when the last COVID-related round on monetary creation pushed valuation disparities within the market to exceptional levels. Exactly a year ago we wrote, "These balloons…will not stay high in the sky…and the only debate will be the speed of descent". In January we wrote, "Make no mistake, there are many aspects of this that have the trappings of a bubble". This is the human algo (or "Halgo[2]" for short) in action and a good reminder to ourselves of the value of staying disciplined and bringing experience to the table. Whether the current outcome is surprising or not, all investors are now faced with a new and ongoing challenge. In our view, policymakers no longer have our back and inflation - rather than the price of risk assets - appears to be their number one priority. The road ahead is not going to be so easy. Three steps for the new road ahead It may be easy to become gloomy after the drawdown of the last few months. But we believe that there are plenty of reasons to be optimistic about the prospects for compounding your future capital from today's levels if you consider the following three steps. 1. Recognise that we have shifted to a different road type, and it is rougher and more variable As investors in individual companies, we are constantly being asked to differentiate between volatility that is just short-term angst and a signal of change. This is our suggested approach: always be open-minded to new information that could undermine a thesis. The thesis, however, is that we are seeing a regime change. More specifically, inflationary trends are now greater than they were in the past given the scale of monetary creation over the last decade. In the shorter term, there will likely be a period of easing pressures as the pending rate-induced recession commences and supply chain pressures ease somewhat. On balance, however, structural energy undersupply, labour market constraints and military expenditures will all contribute to sticky inflation at rates likely to be above the 2-3% ideal for central banks. Risk-free rates will therefore remain at higher levels. Secondly, geopolitics will likely remain problematic as the battles for technology dominance between China and the US, and the struggle for military supremacy in Ukraine are likely to be prolonged. The free flow of capital across borders should no longer be assumed, the cost of borrowing in the world's reserve currency will likely stay high and we need to be prepared for an increasing shift from certain actors, such as China, moving away from the US dollar as the currency of external trade in the years ahead. In short, we believe that growth in the broader economy will be less certain and more cyclical, and as a result, the cost of capital will not return to the low levels we saw in 2020-2021. 2. Realise that this new road may be best travelled with different vehicles Those of a certain vintage (myself included) might remember the cartoon series "Wacky Races", courtesy of Hanna-Barbera. With the adoption of a multitude of new and sometimes esoteric ETFs and other thematic vehicles in recent years, it has often felt as though we have been competing in Wacky Races! The good, albeit challenging, news for investors is that when there is a regime change, as the significant market correction seems to flag, there is a high probability that there will be new leaders in the race ahead. We have done some work on prior periods of significant market corrections and what the probabilities are, with a clear caveat that the number of reference data points is modest in total. As a reminder, the leaders over the last cycle were information technology, consumer discretionary and energy; assuming they will automatically return as market leaders is a brave call based on this work. Our personal intuition is also that new leadership is likely to emerge this time given the scale of surplus of capital that has just been allocated to the winners. 3. Improve your probabilities by sticking to a few enduring principles Gross margins are similarly being challenged by rising labour inflation (and availability), a shift to more local and higher cost supply chains, rising raw material input prices and (particularly for those sectors previously benefitting from COVID-related revenue boosts) negative operating leverage as sales decline. On average, times are getting tougher for businesses, and franchise strength is being tested more fully. Where products and business models are unique, dominant or gaining share, the scope for passing on costs to customers and sustaining volume growth is greater. Ensure capital funding is sustainable It is now patently clear to all that the cost of debt is going up notably, and as is always the case, the availability of debt could become more irregular. The degree of change in debt costs in US dollars is much greater than in other currencies, and given its reserve currency status, it raises the global cost of capital for many businesses. Self-funding growth (high free cash flow) and balance sheets with appropriate and long-duration debt, in our view, will be better placed to keep investing through the pending down cycle. Cash-burning, profitless business models likely won't pass the test. Focus on justifiable valuations We have learned, sometimes through bitter experience, that the penalty for investing at inflated prices and a lack of future cashflows can be quite onerous. Compounding capital from levels that can be politely described as "frothy" is difficult. When the music stops, falls of 80-90% are common for the frothy crowd, and more often than not they stay down as profitability remains a dream rather than reality. Where we find Future Quality winners If you are a more seasoned investor none of the above should be particularly surprising. The next key question will likely be: where are you investing your capital within global equities? Companies on a unique journey of improvement that can attain and sustain high returns on invested capital over the next five years or more have always been the best starting point, in our view. These Future Quality ideas are what excite us and have been the foundation of our alpha delivery for over a decade. For simplicity, though, there are often some common traits for these stock picks and we highlight the following: Energy transition Last quarter we highlighted in greater detail the energy transition theme. We very much retain our optimism that an enduring cycle of rising investment is now upon us as societies need to address the challenge of sustaining the still-necessary fossil fuel production, increasing supply from more trusted regimes, improving energy efficiencies, reducing emissions, and further developing alternative energy sources. The latter is key from a climate perspective, but also energy intensive in its own right, creating a circular requirement for the other drivers. In short, the addressable market will grow and surprise investors, and profitability for many suppliers of the "picks and shovels" of the energy transition is on an improving trend. This is an increasing rarity in the current environment. This quarter we have added Worley, an Australian-based provider of engineering consultancy and design services, and Linde, a leading global industrial gas provider, over the last quarter. Both are expected to be price makers in their respective markets. Enduring growth Given the backdrop of rising rates and pressures on household consumption, we are increasingly cautious about the growth outlook for many consumer-facing companies. We believe that falling propensity to consume (due to greater spending on mortgage and utility costs) and prior COVID-led pulling forward of demand will be difficult and enduring problems to overcome. Sustainable growth that is less impacted by consumer cyclicality is therefore preferred. Our long-standing overweight in the healthcare sector highlights the fact that we see the demand backdrop for better and more cost-effective solutions across ageing societies as being very much enduring in nature. In other sectors, we have also added new holdings with similar attributes, such as O'Reilly Automotive and beverage maker Diageo. The need to repair autos given the significant ageing of the fleet in the US will remain strong, and premium spirits will remain an affordable luxury with long-life inventory less impacted by the current rise in input costs. Other recent additions include leading franchises in areas such as travel, where prior consumption has been constrained significantly by COVID and as a result, we added Amadeus IT, the world's largest provider of travel booking systems, to our portfolios. The final key comment on the area of enduring growth is that we are increasingly concerned about the prospects for digital advertising. Business start-ups and the funding for newer business models have ballooned over 2020-2021, as conducive capital markets have enabled IPOs, SPACs, and a flurry of activity in private equity funding. Many of these have been technology-related firms with limited customers and cashflow, and they have been focused on finding new customers. This startup funding in 2021 is estimated at USD 650 billion in the US (Source: Crunchbase), roughly double the level of prior years. We assume that about 40% of this will end up in customer acquisition/digital marketing with the majority going to key players such as Meta and Google. This level of spending may now normalise to more sustainable levels as we see new funding dry up and many existing customers burn through cash reserves. This source of advertising spend will likely see a large drawdown, in turn prompting investors to reappraise their growth assumptions for the leading digital media players. Notable downgrades are not a key attribute for enduring growth and we have no exposure in this area. Author: Will Low, Head of Global Equities Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund, Nikko AM New Asia Fund, 1 SPAC (special purpose acquisition company), FAANG (Facebook, Amazon, Apple, Netflix and Google), 2 Halgo (Human Algorithm) Disclaimer This material has been prepared by Nikko Asset Management Europe Ltd (NAM Europe) which is authorised and regulated in the United Kingdom by the FCA. This material is issued in Australia by Yara Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252, AFSL 237563. To the extent that any statement in this material constitutes general advice under Australian law, the advice is provided by Yarra Capital Management Limited. NAM Europe does not hold an AFS Licence. Effective 12 April 2021, Yarra Capital Management Limited became part of the Yarra Capital Management Group. The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It is for the use of researchers, licensed financial advisers and their authorised representatives, and does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. Portfolio holdings may not be representative of current or future investments. The securities discussed may not represent all of the portfolio's holdings and may represent only a small percentage of the strategy's portfolio holdings. Future portfolio holdings may not be profitable. Any mention of an investment decision is intended only to illustrate our investment approach or strategy and is not indicative of the performance of our strategy as a whole. Any such illustration is not necessarily representative of other investment decisions. Portfolio holdings may change by the time you receive this. Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold, or directly invest in the company or its securities. The information set out has been prepared in good faith and while Yarra Capital Management Limited and its related bodies corporate (together, the "Yarra Capital Management Group") reasonably believe the information and opinions to be current, accurate, or reasonably held at the time of publication, to the maximum extent permitted by law, the Yarra Capital Management Group: (a) makes no warranty as to the content's accuracy or reliability; and (b) accepts no liability for any direct or indirect loss or damage arising from any errors, omissions, or information that is not up to date. Yarra Capital Management. Copyright 2022. |

6 Oct 2022 - Why on earth would Experiences thrive with all the gloom around today?

|

Why on earth would Experiences thrive with all the gloom around today? Insync Fund Managers September 2022 Put simply-Pent-up demand. Pre-Covid expenditure on experiences had been consistently growing ahead of GDP and its sub-segment, travel, was one of the fastest growing. Most megatrends within Insync's portfolio tend to have low sensitivity to economic cycles but the one sub-segment that suffered temporarily was travel. The extent of the fall in travel was unprecedented. Worldwide a staggering 1 billion fewer international arrivals in 2020 than in 2019. This compares with the 4% decline recorded during the 2009 global economic crisis (GFC).

There has been a lack of visibility on how leisure travel was going to emerge after governments implemented onerous travel restrictions. This was compounded by the shift to working from home with online meetings reducing the need for face-to-face meetings. What we do know is that humans desire to travel is hardwired into all of our DNAs. As travel restrictions have started to ease consumers appear to be making up for lost time. Airlines in the US last month reported domestic flight bookings surpassing pre-pandemic levels! US travellers spent $6.6 billion on flights in February, 6% higher than February 2019. Airlines for America, a leading US industry advocacy group noted that travellers have been eager to book tickets as COVID restrictions lifted. This provides a good indicator for the rest of the world. Our families and friends are all planning new adventures and reunions too. Interestingly, rising jet fuel prices, which have put upward pressure on ticket prices, has so far not deterred travellers who are willing to spend more. Emirates recently added a fuel surcharge and saw booking rise! A number of surveys are painting similar stories. TripAdvisor, found that 45% of Americans are planning to travel this March and April, including 68% of Gen Z travellers. This number will climb higher as the summer season rapidly approaches, as 68% of all American adults will vacation this summer (The Vacationer). No wonder hotels around the United States are nearing or have already surpassed pre-pandemic occupancy. Just try finding a decent, moderately priced hotel room in Sydney, as two of our team have recently experienced. The megatrend of Experiences is accelerating. Finding the right businesses benefitting from the trend is equally important for the consistent earnings growth we seek. It's why Cruise lines, airlines and hotels, whilst obvious picks, don't meet the quality criteria we insist upon. Recently we reinvested into Booking Holdings after the over-blown pull back in its share price and the Covid event subsiding. It generates prodigious amounts of cash because of their scale and superior margins versus its competitors. As well as delivering a commanding competitive position they also help it in protecting against inflation. Bookings recently overtook Marriott, the largest hotel group, in gross volume booked in 2012, and today stands 70% bigger. Companies with superior business models and balance sheets tend to come through a crisis strengthening their competitive position. Booking Holdings is a prime example. The structural reduction in business travel has made hotels reliant upon OTAs once again to fill-up their rooms. This has been evidenced by recent data showing strong market share gains, in excess of pre-COVID levels. Second is the shutdown of Google's "Book on Google" product, removing the biggest perennial risk to the OTA investment case. The fact that the most powerful online search engine is shutting down this service is testament to the powerful position that Booking Holdings occupy.

Long term, travel looks set to continue to grow ahead of GDP as populations age, emerging market middle classes expand, and discretionary spend shifts more from "things" to "experiences.". Booking Holdings will be a major beneficiary compounding earnings for many years with its share price likely to follow the consistent growth in earnings. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

5 Oct 2022 - Around the world in 200 Meetings, Jonas Palmqvist: Medical Technology

|

Around the world in 200 Meetings, Jonas Palmqvist: Medical Technology Alphinity Investment Management October 2022 Jonas Palmqvist shares his highlights from his recent trips to the US, the key trends and themes within the healthcare sector and the future trends to look out for in medical technology. Speakers: Jonas Palmqvist, Portfolio Manager & Elfreda Jonker, Client Portfolio Manager This information is for adviser & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

4 Oct 2022 - Which Emerging Markets look good? Hint: look for tourists

|

Which Emerging Markets look good? Hint: look for tourists Pendal September 2022 |

|

WHEN investing in Emerging Markets, consider going where the tourists go. That's the message from Paul Wimborne, who co-manages Pendal's Global Emerging Markets Opportunities Fund. For Paul and his EM team, investing starts at country-level - which means a lot of time spent sifting through national data before deciding where to invest. One of the best indicators of the health of a country is its tourism levels, he says. A strong tourism sector creates jobs, boosts local economies, adds to government revenue and foreign exchange earnings, as well as improving the cultural exchange between countries. It signals opportunities for investors in emerging markets. This is borne out by comparing the tourism sectors in Mexico, one of the better performing emerging economies, and Thailand, says Wimborne. Both countries rely on tourism and facing similar challenges - reduced capacity among airlines, airport chaos as operations ramp up again, and rising oil prices. But there is pent-up demand internally and externally, post-Covid lockdowns. The outlook for the two countries is very different. "The best tourism news is coming out of Latin America, and particularly Mexico," Wimborne says. "Passenger traffic is already back to pre-COVID levels in Mexico. That not really a surprise when you consider that tourism in Mexico depends on the United States consumer. "In the US, consumer confidence is pretty good along with employment conditions. Extrapolating the tourism sector, Mexico is the bright light within emerging markets." In contrast, many Asian economies, reliant on China, are struggling to re-emerge from the COVID pandemic. "If you take Thailand, there were just over 3 million visitors in June 2019, before the pandemic. Pre-COVD tourism contributed about ten per cent of GDP. In June this year, there were just 800,000 overseas tourists," Wimborne says. "The missing tourists are mostly from China and other Asian countries. That's because many Asian countries, including China, are trying to minimise the effects of COVID, and are following zero-COVID strategies. Outbound tourism from China is essentially zero." There are emerging economies between Mexico and Thailand whose tourism markets fall in the middle. "In Turkey, visitor numbers are just below the record level set in 2019. In Dubai, numbers are at 85 per cent of pre-COVID levels," Wimborne says. There is a geographic trend in the health of emerging economies' tourism markets. "As you move east from Latin America through the middle east, and then into Asia, tourism markets worsen. In essence, Chinese tourists are the key lagging factor in international tourism recovery. "Countries like the Philippines, Malaysia and particularly Thailand because of its reliance on tourism, are going to lag emerging markets in other regions. It's going to take longer for some countries in Asia to recover, than in other parts of the world." Author: Paul Wimborne, Senior Portfolio Manager and Co-Manager |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

30 Sep 2022 - Times like these - investing in sustainable growth companies makes sense

|

Times like these - investing in sustainable growth companies makes sense Insync Fund Managers August 2022 For the best part of 10 years, we've enjoyed the tranquil waters of low and stable inflation and even lower interest rates. That's all changing.

Many companies will struggle in this new world, however there is a small group who will thrive. And they have one thing in common: sustainable compounding earnings growth. It's never been more important for investors. We anticipate markets are already shifting focus after a recent wild swing backwards impacting all, deserved or not, to the prospect of Goldilocks economic conditions (not too hot nor too cold). The evolving economic backdrop is accelerating the business performances of the type of stocks that we hold at Insync; specific companies backed by our megatrends. Whether it's demographic shifts, digitisation or even pet humanisation; its megatrends like these providing the tailwinds for their growth, irrespective of the economy. And, it's why we remain fully invested despite market swings and the often touted fears by commentators. Investing in the highest quality stocks benefitting from megatrends delivers strong earnings growth over a full economic cycle. This is because of the duration of the megatrends being far longer than mere themes. Recent portfolio examples include Home Depot (see below) and Walt Disney (whom recently increased ticket prices by 7% with zero impact on demand). Our holdings possess high gross margins and strong pricing power, providing strength in both high and more normalised inflation environments. Our portfolio is well positioned as a result for continued delivery of the 5 year aim of both funds, as stock prices over the longer term follow consistent earnings growth. Home Depot (a supersized bunnings) benefits from the 'Household Formation' Megatrend, fuelled by the all-important 'Demographics' Super Driver. Understanding changing demographics across all ages and segments globally is very important in identifying the winning companies of the future. One example is the escalation in the 47 year old age cohort in the United States over the next 8 years (see graph below). The acceleration in the age 47 cohort coincides with the median average age of all home buyers, pushing up construction demand. Additionally a housing supply deficit in the US as high as 3.8m homes exists. On the renovation front, seniors are increasingly reluctant to move into aged care centres, and the increased 'working from home' trend further fuels demand. These are long duration strong tailwinds. Short term interest rate rises, and other macro factors are unlikely to alter this powerful megatrend. Home Depot is a big winner of all this. Think of it as a massive Bunnings network with almost 2,000 stores! They serve both trade and DIY markets, dominating the US building supply industry and run by a highly competent management team. Despite rising interest rates their recent strong results are testament to both the strength of the company and the power of the megatrend. Home Depot delivers very high returns on invested capital with an expected 10-15% p.a. compound annual earnings growth in the years ahead. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

29 Sep 2022 - Sector Spotlight: SGH

|

Sector Spotlight: SGH Airlie Funds Management July 2022 |

|

Hear from Joe Wright as he provides a backdrop on Seven Group; a diversified investment business operating mining and industrials companies including WesTrac, Coates and Boral. Speaker: Joe Wright, Equities Analyst Funds operated by this manager: Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management ('Airlie') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any third party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks.. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. |

29 Sep 2022 - Are we there yet? (Whitepaper)

28 Sep 2022 - 10k Words

|

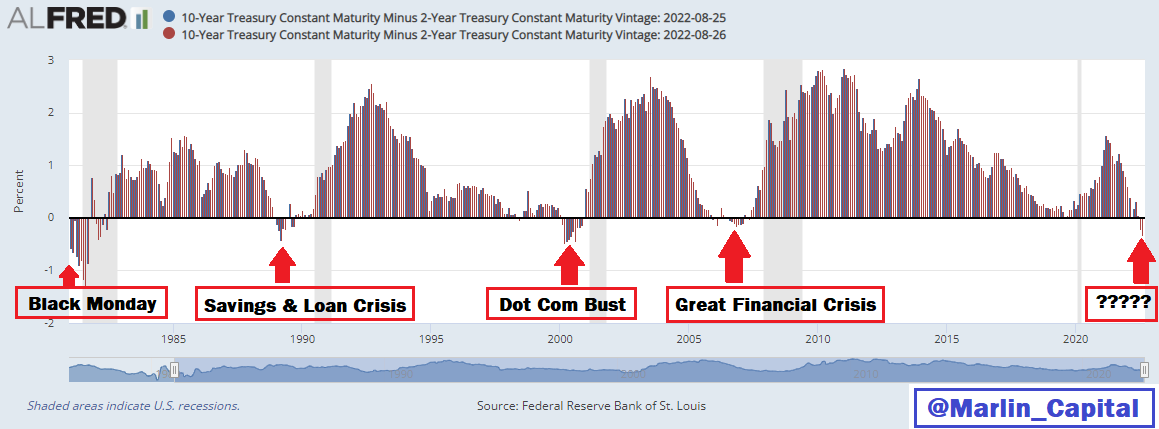

10k Words Equitable Investors September 2022 Earnings season on the ASX has come to a close with a historically low number of downgrades on the FY22 numbers, as tracked by Wilsons, but more downgrades than upgrades to EPS and dividend guidance for FY23, based on Evans & Partners' numbers. The one year return on Bloomberg's benchmark for the bond market is down 19% over the past 12 months. While the Australian yield curve is sloping upwards, the US yield curve is currently inverted. An inverted yield curve has historically led to some type of "break" in the system, @Marlin_Capital warns. But the inflation data is potentially turning - Yardeni highlights plunging US gasoline prices. Given the European situation, nuclear power and uranium are seeing a revival of sorts, at least with Japan revisiting its stance. Uranium equities have been advancing and the Washington Post ran a Blooomberg piece highlighting the unsavoury sources of current uranium supply. Taking a look at equities, Bespoke's optimistic take on the June half-year's poor showing is that such a poor first six months is typically followed by 12 months of 20%+ returns for the S&P 500. We thought it was interesting how closely the Grayscale Ethereum Trust has traded in comparison with the ARK Innovation ETF - a speculative cryptocurrency vehicle alongside a high growth tech investment vehicle. And potentially adding some colour to that is Visual Capitalist's charting of the demise of long-term investing. Aggregate ASX earnings downgrades announced over course of 12 month reporrting cycle Source: Wilsons Net guidance upgrades for FY23f for the S&P/ASX 200 Source: Evans & Partners Bloomberg Global-Aggregate Total Return Index Value Unhedged USD Source: RBA Australian and US yield curves

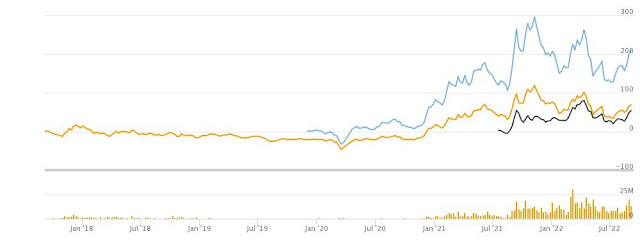

Source: worldgovernmentbonds.com An inverted yield curve has historically led to some type of "break" in the system Source: @Marlin_Capital, Federal Reserve of St Louis US gasoline priced have plummeted as consumption is reduced relative to a year earlier Source: Yardeni Research North American uranium ETFs on the rise (URA, URNM, U.U) Source: TIKR, Equitable Investors Authoritarian nations dominate the world's uranium production

S&P 500 has been up at least 22% in the year following prior 20%+ two-quarter drops Source: Bespoke Grayscale Ethereum Trust (orange) and ARK Innovation (green) moving together Source: TIKR, Equitable Investors The average holding period of shares on the NYSE has fallen to new lows Source: Visual Capitalist September Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

.png)