NEWS

12 Apr 2024 - Hedge Clippings | 12 April 2024

|

|

|

|

Hedge Clippings | 12 April 2024 It was only a couple of months ago that the "market" (i.e. bond traders and economists) was firmly of the opinion that the US Federal Reserve would cut interest rates up to six times this year - starting about now. Fast forward to "now" - actually last Wednesday - and the market views that the cuts, or possibly cut, (singular) won't arrive until much later in the year, possibly not until November. Some - including former US Treasury Secretary Lawrence Summers - warned that the next move might even be up, not down. The cause of this market re-think were the US CPI numbers for the 12 months to March which rose by 3.5% over the past 12 months, up from 3.2% in February, having previously peaked at 9.1% post COVID back in 2022. Excluding volatile items such as food and energy it left core inflation unchanged at 3.8%, but for a market that was hoping for, (but not expecting) a reduction, this was not the news they were looking for. Aside from higher food and fuel prices, the strength of the US economy, and the jobs market in particular, is not helping the Fed's task of cutting rates following their next meeting on the 1st of May. Over 300,000 jobs were added last month in the US, the largest gain in almost a year, against expectations of just 200,000 resulting in a jobless rate of 3.8%. In turn, this cast doubts on the argument that continued high US interest rates of 5.25% to 5.5% would damage the economy. Simply put, it seems that while the Fed is concerned about inflation above 2%, the average consumer is not - or is at least dealing with it, particularly if they have a job, which most do. Much the same logic applies in Australia, albeit the numbers are a little different. December quarter CPI was 4.1%, and on a monthly basis in the 12 months to February it had dropped to 3.4%, although excluding volatile items such as fuel, fruit and vegetables etc., it was higher at 3.9%. Unemployment is low at 3.8%, or seasonally adjusted 3.7%. The RBA's cash rate is at 4.35%, and with some inflationary pressures coming through from recent wage decisions, higher oil prices, and July's Stage lll tax cuts, prospects for a rate cut aren't looking too good. However, looking at the latest Housing Finance figures for February, this doesn't seem to be holding most borrowers back. Year on year, total housing finance rose 13.3%, with investors leading the charge up 21.5%, versus owner occupiers at 9.1%. However, all this is likely to do is confirm, or continue, the chronic housing shortage in Australia, as evidenced by the Building Activity statistics released this week. On an annual trend basis to December the number of total dwellings commenced fell by -15%, and the number completed fell by -2.4%. Meanwhile net overseas migration rose by 518,000 in 2023. As such, that level of increase will keep the economy growing (as it has done for decades), make the RBA's inflation target of 2.5% harder to achieve, and underpin, if not continue, to increase property prices. As in the US, while sections of the media and social services point to high inflation, maybe the average consumer is learning to live with it, and just get on with life. In turn that can lead to entrenched inflation, above the RBA's target, hard to achieve - a situation they're keen to avoid. News & Insights New Funds on FundMonitors.com Fund Monitors | Portfolios March 2024 Performance News Bennelong Australian Equities Fund Delft Partners Global High Conviction Strategy Bennelong Concentrated Australian Equities Fund 4D Global Infrastructure Fund (Unhedged) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

12 Apr 2024 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

12 Apr 2024 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

12 Apr 2024 - Why reframing fixed income is key to portfolio stability

|

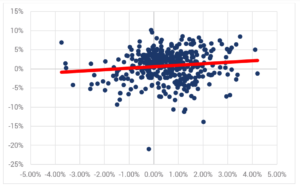

Why reframing fixed income is key to portfolio stability Yarra Capital Management March 2024 Conventional portfolio construction theory positions equities as the primary driver of returns, while fixed income typically takes a back seat as a low-return and low-risk asset class. However, this perspective often overlooks a crucial aspect of fixed income: its role in dampening portfolio volatility. Protecting portfolios through the stormContrary to the notion that fixed income should exhibit a negative correlation to equities, suggesting that when one goes up, the other goes down, in our view, it's more accurate to view fixed income as a stabilising force within a portfolio. Instead of focusing solely on returns, investors should also consider the invaluable function of fixed income can have in reducing overall portfolio volatility and improving risk-adjusted returns. Historically, equities have exhibited higher volatility, compared to bonds, reflecting the relatively stable income streams of bonds and their fixed coupon payments. While bonds can still experience price fluctuations, especially in response to changes in interest rates or credit risk, these movements are generally less pronounced compared to equities. Even small bond allocations in a portfolio can help dampen portfolio volatility for a small reduction in overall return and improving risk adjusted returns (Sharpe ratio). Chart 1: Historical risk adjusted return comparison of bonds and equities

|

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

11 Apr 2024 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

11 Apr 2024 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

11 Apr 2024 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

10 Apr 2024 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

10 Apr 2024 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

9 Apr 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]