NEWS

16 Nov 2022 - Energy system stability: risks, opportunities & the decarbonised future

|

Energy system stability: risks, opportunities & the decarbonised future (Adviser & Wholesale Investors Only) Merlon Capital Partners October 2022 Introduction Being able to turn on a light is dependent on the stability of each link in what is a long, complex energy supply chain. An issue affecting any of these links can have an outsized impact on the energy system. And as we have witnessed in 2022, the impact that the manifestation of these risks has resulted in high energy prices, and in turn, global inflation. In this paper, we discuss:

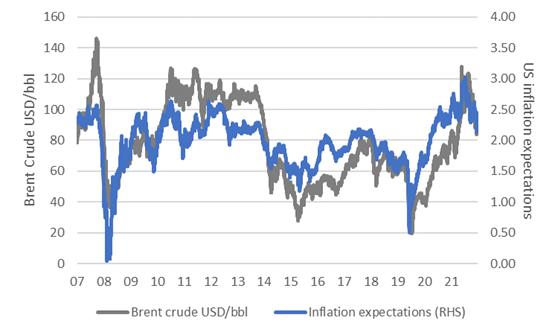

1. System risks: origins If efforts are not made to ensure the integrity of every link of a supply chain, it will be vulnerable to a complex range of risks. In the period post the onset of COVID in 2020, we have seen three examples of the manifestation of these risks in energy markets, all of which have contributed to the significant return of inflation (see Chart 1):

Chart 1: oil prices vs inflation expectations

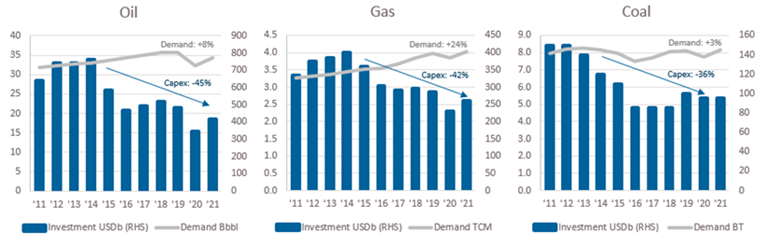

Sources: Bloomberg. Federal Reserve of St. Louis. Calculations: Merlon Capital. Risk 1: constrained capital flows Despite our longer-term objectives of decarbonisation, roughly two-thirds of electricity is still generated through the burning of oil, gas and coal. As such, generating electricity is heavily reliant on the secure supply of these fuels. Yet with capital for carbon-intensive fuel investment increasingly difficult to obtain due to the pivot towards renewables investment, capital expenditure across these fuels has declined by more than 40% on average over the past decade. This compares to an average demand growth across these fuels of more than 10%. Chart 2: underinvestment in carbon-intensive fuels

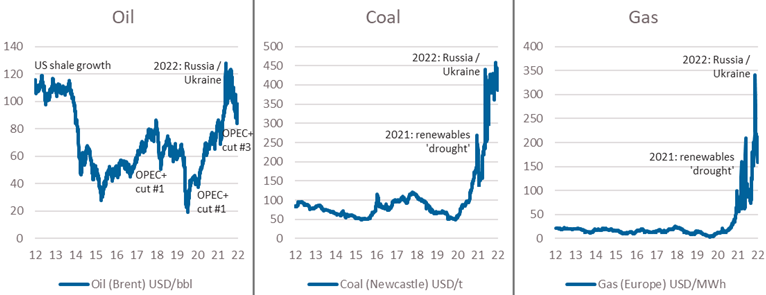

Source: International Energy Agency. Calculations: Merlon Capital. This persistent underinvestment has seen an increasingly vulnerable supply chain across all traditional fuels, which, given renewables variability (see below), the COVID-stimulus-driven demand recovery, and Russia's military activities, have all combined to increase demands on this weakened supply chain, which can only be resolved through higher prices as per the charts below, or ultimately demand destruction. Chart 3: pricing of carbon intensive fuels

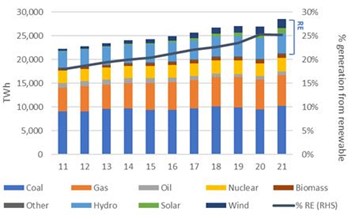

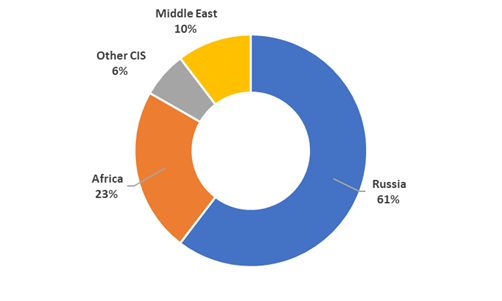

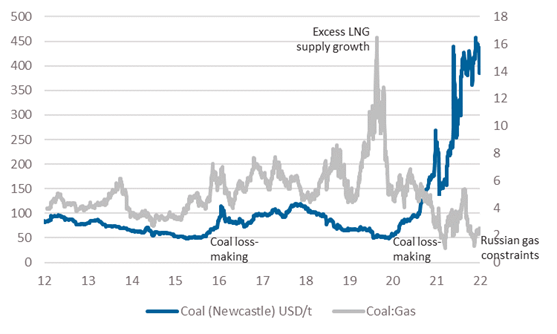

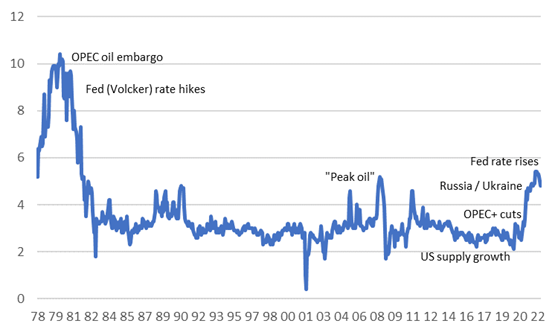

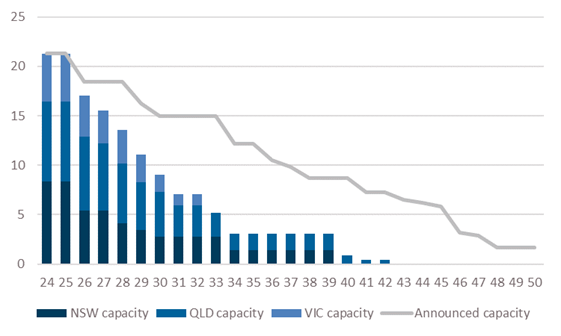

Source: Bloomberg. Calculations: Merlon Capital. Considering each of these commodities in more detail uncovers some interesting nuances. In the cased of oil, given Russia's importance to the global oil supply (~10%), it appears surprising that although oil has rallied, it has significantly underperformed gas and coal since the beginning of the year. This has been a function of the 3-5% of additional supply which was still to come from OPEC as it entered 2022. While the cartel has not met this supply normalisation, it has still represented an overhang on market pricing, despite the recent announced cuts. It has also been muted by Russia's ability - to date - to redirect oil to other destinations such as China, India, and Turkey. In addition, supply was boosted by US President Biden's direction to sell roughly 1mbpd from the US Strategic Petroleum Reserves. These have all combined to result in adequately supplied oil markets. In the case of gas, on the other hand, supply has been tight since 2021, when northern hemisphere renewable energy experienced prolonged underperformance, and demand for gas rose to backstop electricity grids. Exacerbating this market dynamic was Russia's invasion of Ukraine in early 2022. Russia is a large supplier of gas into Europe at roughly 50% of gas imported. In response to Western sanctions on Russian oil, Russia has responded by significantly constraining the supply of Russian gas flows into Europe. As a result, gas prices have risen to unprecedented levels. And coal? Coal and gas are close substitutes in electricity generation, with coal prices influenced heavily by the availability and price of gas. The gas flow disruptions from Russia into Europe noted previously are resulting in previously idled coal-plants restarted, and the demand for coal rising. Yet sanctions have also been applied to Russian coal, meaning the greater demand for coal has been met by lower supply. The key nuance to consider is that Russian coal, and European demand for it, are related to specifically to high calorific value (CV) coal (6,000 kcal). High CV coal is only a small part of the global coal market. There is no significant shortage of the more abundant low energy coals from Indonesia. Thus, the high coal prices we are seeing relate primarily to high CV Australian coal as the only other supplier of this product in scale, thereby benefiting Australian producers of this product, and impacting other consumers, most notably Japan, South Korea and Taiwan. Risk 2: unbacked intermittent renewables growth Globally, renewable energy represents one-quarter of total electricity generated, having grown 79% over the past decade. In the reverse effect of what we noted in the section above, these high levels of investment resulting in high levels of supply saw a market balanced through declining electricity prices. Chart 4: electricity generation by source (global)

Source: BP Statistical Yearbook. Calculations: Merlon Capital. Yet underneath this politically and environmentally favourable trend was a latent and growing risk: if a system becomes more reliant on a more variable source of supply, and the ability to backstop the system through similarly growing 'firming' capacity (whether carbon intensive or otherwise) is not evident, the system as a whole will have been weakened. In fact, not only was new firming capacity not sufficiently developed, existing baseload capacity was in fact removed. And in the early 2021 period, we saw this risk manifest, as wind and solar 'droughts' in the northern hemisphere resulted in a system short of energy, and a market forced to pay up for coal and gas fuels to firm up the supply of electricity (https://www.merloncapital.com.au/whos-got-the-energy/), in the absence of batteries, pumped hydro, hydrogen, and other zero-carbon firming capacity. In the case of Australia - energy self-sufficient, and far from the weather patterns of the northern hemisphere - we have witnessed the relatively easy phase of the transition phase. We have a system that had excess baseload capacity, which despite closures of some coal fired capacity, has been sufficient to backstop the intermittency of our renewables growth. From here on, however, as coal fired generation capacity retirements accelerate (see Chart 8, below), and with renewables penetration already at around 25%, the absence of firming capacity to backstop the continued growth exposes Australia to similar risks to those seen in the northern hemisphere in 2021. Risk 3: reliability of key suppliers Risks to supply can also manifest in the level of exposure to a single supplier and their reliability. Given its wealth of natural resources, in particular energy, and its proximity to Europe it is no surprise that Russia is the dominant supplier to the region. This supplier concentration is most evident in the case of Germany, relying on Russia for more than half of its coal and gas supplies. This relationship began in a small scale in the 1950s, before gathering pace from the 1970s onwards, cemented further through the development of large-scale oil and gas pipelines to service the region. Chart 5: European gas supply by source

Source: BP Statistical Yearbook. Calculations: Merlon Capital. From Germany's perspective, the availability of large volumes of cheap and reliable supplies was essential to the development of a globally competitive industrial powerhouse. In short, German industrial economics won over the geopolitical considerations associated with such a large supplier. For a number of decades, this risk lay dormant. In 2014, however, with Russia's annexation of Crimea, these risks began to reveal themselves. Despite this, Germany's energy procurement policy remained unchanged. And yet this lack of responsiveness to Germany's implicit funding of Russia's military adventures is not new. Russia's invasion of Afghanistan in 1979 was followed in 1980 by an agreement to construct a dedicated 4,500km pipeline from Western Siberia to Germany, doubling Germany's imports of Russian gas. In this way, Germany has both funded Russian military, and exposed itself to the whims of an increasingly belligerent Russia. Germany is now left with the unenviable task of rapidly building out alternative gas supply arrangements to replace a supply chain which took decades to develop, and which was relatively cheap due to pipeline infrastructure. This supply chain replacement will be costly at many levels:

2. Investing in the context of risk We have been following Risk 1 (constrained capital flows) for some time (see https://www.merloncapital.com.au/oil-pricing-in-a-more-realistic-recovery/). In identifying this risk, coupled with declining energy prices, we grew increasingly confident that there was the likelihood of a tightening pricing environment (see chart 2). At the risk of repeating ourselves, we expected energy markets to tighten because any demand or supply shock to an underinvested (read, 'undermaintained') system would be magnified. And the nature and timing of the shock itself does not necessarily need to be forecast explicitly due to the inherent randomness of economies, geopolitics and increasingly, the environment. With supply unresponsive, in the short-term at least, the only shock absorber to restore balance is price. In essence underinvestment creates the opportunity for higher future returns. At Merlon, we constantly look for these situations, where conditions of growing risk can be accompanied by potential opportunities, some of which may more than compensate for these risks - that is, an increasingly favourable risk / return trade off. We often find that the positive trade-off is most pronounced where the media and industry participants have become overly negative. Although conditions may be negative, and a litany of reasons why 'the end is nigh', it rarely turns out as bad. In fact, if conditions improve to only being less bad, the degree of negativity embedded in equity prices can result in appealing returns. In the case of commodities, what we specifically look for are the combination of defined conditions. While seemingly counterintuitive, these conditions include:

The combination of these two conditions is particularly powerful, as underinvestment, often triggered by low prices and a loss-making industry, in turn leads to reduced risk of further price falls and eventually price recovery as supply tightens from both underinvestment and the exit of loss-making participants. While not a certainty, the odds at this point of a cycle are most heavily in an investor's favour relative to any other point of the cycle. We want to invest when the risk / return skew is most heavily in our favour, noting that 100% certainty is not a possibility in markets. Possible scenarios for energy prices: Where in 2019/20 excess LNG supply growth saw gas prices collapse, pushing coal prices down also, albeit less that gas, driving an historically high coal-to-gas ratio. Today we see the inverse of this situation, with gas supply constrained by Russia, driving the gas and coal prices higher, albeit with coal prices less so, driving the historically low coal to gas price ratio. Chart 6: coal pricing dynamics

Source: Bloomberg. Calculations: Merlon Capital. From here, we are monitoring the trade-off between downside risks from demand destruction (likely), gas supply returns (possible), and increased coal supply (unlikely), relative to the upside risk from a continuation of underinvestment (likely) whereby carbon-intensive commodities become increasingly scarce in the process of decarbonisation. Inflation? It is interesting to note that as fears of recession have grown, and oil prices have declined, inflation expectations have shown signs of a turning point. Little wonder then, Biden's negative response to the most recent OPEC+ 2mbpd production target cut. We would note, however that this 'cut' is unlikely to alter the current market balance given underperformance of OPEC members relative to their targets, coupled with the likelihood that demand is possibly worse than those outside the market realise - OPEC sees daily customer demand nominations which are not visible to the broader investment community. Chart 7: University of Michigan Inflation Expectations survey

Source: Surveys of Consumers, University of Michigan, University of Michigan: Inflation Expectation©[1] 3. Future risks Australia's global position in the decarbonised future stands in stark contrast to Australia's privileged position in an industrialised, carbon-intensive global economy. While the changing relevance globally is clear, the changing nature (read, 'growing') of our risks should be considered. In many ways, the path forward for Australia (and globally) appears clear: invest heavily in renewable energy generation, alongside the development of firming capacity (batteries, pumped hydro, hydrogen, and gas), in order to meet our net zero 2050 targets (albeit with the largest emitters in China, and third largest in India pushing, their own net zero target dates to 2060 and 2070 respectively). Yet again, underneath this accepted path lie significant risks, all of which we noted above, and reiterate below in the context of our future path towards a decarbonised economy: Risk 1: constrained capital flows In some ways, this risk looks unlikely to change as we decarbonise. In the face of our coal fleet retirement, and the increasing likelihood of this path accelerating (Chart 8, below), the incentive to invest capital to maintain coal mines and coal fired power stations is diminishing further. The risk here, then is seemingly clear: system reliability underpinning 75% of our electricity is declining. The number of coal-fired generations outages seen over the past 12 months is indicative of this trend. Chart 8: AEMO forecast coal capacity (step-change scenario) vs announced capacity (GW)

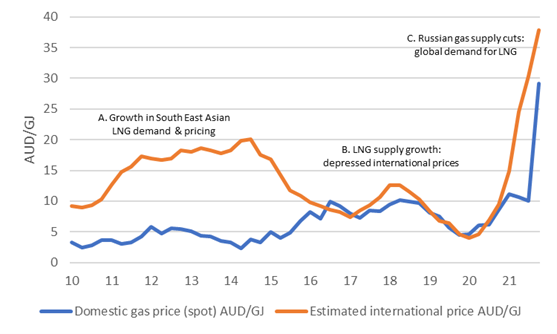

Source: AEMO. As governments become more nervous (state and federal) in the face of an accelerating retirement path, and rapid, but not rapid enough build out of renewable generation to backfill the departing coal-fired generation, we are potentially moving into the phase of knee-jerk reactions in order to regain a sense of control. As we have seen in the Federal government's increasingly over-budget, over-time Snowy Hydro 2.0, NSW's 2021-announced 'Electricity Infrastructure Roadmap' and the recently announced Victorian government's decision to re-establish the State Electrical Commission, government at all levels is growing in size in Australia's future electricity generation. While this gives a sense of greater certainty, the budgetary over-runs in Snowy Hydro 2.0, coupled with the reduction in private investment that has occurred since intervention gathered pace under the previous federal government, ultimately crowds out investment, introduces the tax payer to cost over-runs, and risks reduced accountability as the political cycle continues. Risk 2: unbacked intermittent renewables growth: Outside of these risks, which have been acknowledged at the highest level of government, we have an additional supply risk, in the form of managing what is an intermittent source of energy. Our acceleration in the removal of coal-fired generation - again, as we have seen in the case of Europe - means these risks are increasing. To date, the growth of intermittent renewable capacity has been largely backstopped by an oversupply of baseload and peaking generation. Looking ahead, however, as the retirement of coal fired capacity continues (Chart 8), renewable generation growth will form an increasingly large percentage of our energy mix, necessitating a solution to intermittency outside of baseload plants, or else face a 2021-like situation seen in the northern hemisphere. Risk 3.0: reliability of key suppliers: In a manner similar to that of Germany today and its supply of gas energy today, Australia's future renewable energy supply chain has already become highly reliant on a politically questionable supplier. China is currently the manufacturer of 80% of the world's panel supply (IEA, July 2022). This is level is similar in the case of lithium-ion batteries and other renewable generation and storage components and processed raw materials such as lithium. Our exposure to this supplier will only grow as our coal retirement path rolls on (Chart 8, below), our generation fleet becomes more renewable, and our car fleet becomes increasingly electric, and our housing stock replaces its gas supply with electricity, demanding significantly greater imports of photo-voltaic panels, electrolysers, wind turbines, lithium and other 'critical minerals' from China. Furthermore, we will be competing with the rest of the world to secure this supply, delivering even greater geopolitical leverage to China. And, in turn, like Russia's invasion of Ukraine, Australia's (and the world's) growing reliance on China for renewable energy generation and storage inputs may facilitate an escalation of tensions between China and Taiwan. In such a situation, and should Australia object in any way, it is not hard to see risks to this supply. We have already seen how China is readily willing to 'punish' Australia should it wish, as we have seen in 2021 with their banning of Australian coal. Energy has always been a geopolitical issue, and likely to increasingly be the case. And as such, we may witness more supply shocks contributing to energy disruption as well as inflation going forward. Risk 3.1: reliability of key suppliers In the industrialised, carbon-intensive economic era post the 1850s, Australia has been 'energy-advantaged' with large volumes of cheap domestic gas supplies. In a similar way to Germany's key supplier of cheap energy being Russia, we have been our own key supplier, and hence the reliability of this supply is still a critical question. The chart below shows that before the commencement of large-scale LNG exports from Australia's east coast in 2015, Australia enjoyed significant energy competitiveness. From this point onwards, however, we can see how Australian spot gas prices have converged on international prices. It is important to note that despite this spot price convergence, contract prices (which affect the large-scale domestic electricity and industrial user base) have yet to fully converge. This is due to the lagged effects of long-term contracts rolling, as well as being a market that has been, until very recently, well-supplied with gas. Chart 9: Australian domestic spot gas price vs international netback equivalent AUD/GJ

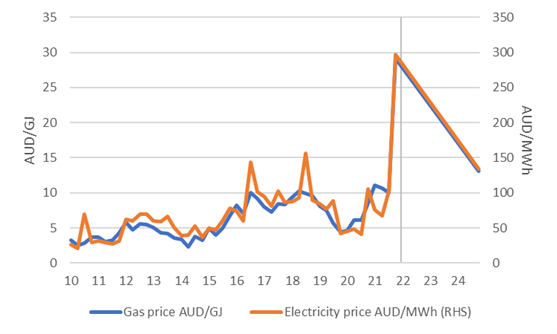

Source: St Louis Federal Reserve. Australian Energy Regulator. Calculations: Merlon Capital. As noted originally, the cost to Germany of what was a reliable source of cheap gas, becoming an unreliable supplier, has been the need to construct a second gas supply infrastructure, including large scale LNG import terminals. According to the ACCC, Australia could also be facing a shortage of domestic gas from 2023, albeit not to the same scale as Germany currency faces. Yet given the lack of investment in new capacity to service the lower priced (historically) domestic market, coupled with growing ESG-driven restrictions, Australia is now faced, like Germany, with the need to invest in a gas import infrastructure, beginning with import terminals in Geelong and potentially Port Kembla also. With this new infrastructure comes the new direct link via imports to international market pricing (in addition to links via export hubs). Where to for Australian electricity prices Given the key role of gas in electricity price formation (see chart below), we are now able to model what could happen to our electricity price forecasts when we are increasingly exposed to a regional (rather than domestic) gas pricing regime. Using a relatively neutral international LNG price forecast of USD9.50/mmbtu (based on Brent oil futures of USD74/bbl), converting this into a domestic 'netback' gas price of AUD13/GJ, and then using the historical relationship between gas and electricity prices, we forecast a possible wholesale electricity price of AUD130/MWh. In short this implies a 'normal' future electricity pricing environment 60% higher than the average over the period since 2010. It is important to note that this forecast is not based on today's elevated spot international gas prices, but a return to a pre-COVID, pre-Russia / Ukraine 'normal' oil-linked contract environment (if such an environment is possible). Not only is this inflationary, but it also may signal the end of Australia's era of energy advantage. Chart 10: domestic gas prices vs electricity prices

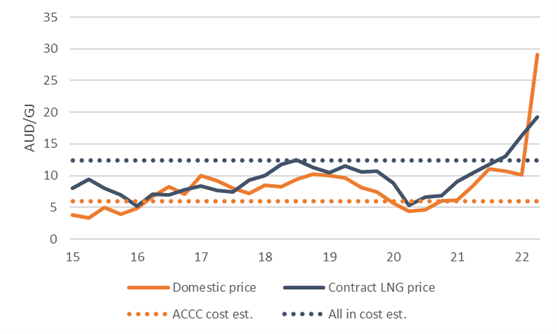

Source: Australian Energy Regulator. Calculations & forecasts: Merlon Capital. Who to blame? Although the export of large volumes of what is effectively 'unconventional' (read, costlier) gas via the Curtis Island LNG hub implies that we are exporting gas from a nation that is set to be short gas, this gas is only flowing due to investments that were only worth making due to their ability to sell it at higher international prices (see point A. in Chart 9 above). Selling into the domestic market at the prevailing pricing regime would have rendered the investment loss- making, hence a disincentive from making this investment. Chart 11 (below) shows the true, all-in cost that needs to be covered 'through the cycle' for the project to have been worth making. The widely publicised ACCC operating cost line is not wrong, yet it ignores other costs including the cost of the project's original construction, the cost of financing this project, and the additional 'return' required to compensate for the risk of the investment. Chart 11: gas price vs true project economics

Source: Company Reporting (sample QLD LNG producer). ACCC. Calculations: Merlon Capital. In other words, this gas would not have reached the ground had it not been for a higher priced export opportunity, rendering these projects economic. Its existence now does not imply it necessarily should be made 'available' to any party, given the need for it to generate a return on the investment required to bring it to the ground. As such, forcing the re-routing of contracted export volumes into the domestic market at economically loss-making prices poses a sovereign risk for future large-scale investment in Australia. And this debate, necessarily suffers as a result of its politicisation. And the cost of this debate includes reduced focus on avoiding the future energy supply crunch, a reduced incentive for domestic and international parties to invest large scale sums of capital into new energy projects, and poor decisions made by governments reluctant to rely on markets and feel it necessary to more directly control investment (as noted above), in a style more reminiscent to centrally planned economies, and all the associated inefficiency that this involves. So, does linking domestic gas prices to international markets mean future investment in large scale gas capacity is now incentivised? While potentially making new investment attractive, our original point on constrained capital flows is considered likely to prevent such capital flowing into new domestic east coal gas investment at a scale likely to resolve the anticipated shortage. However, one positive in terms of actual availability of gas is Viva Energy's Geelong terminal project, which, if it proceeds, is expected to source gas from Woodside's west coast supplies, including its recently sanctioned Scarborough project. While possibly priced at internationally referenced markets, it will at least mean we may be able to backstop our decarbonising electricity system, a positive in an increasingly complex and costly energy transition. Conclusions & portfolio considerations Having previously identified and invested in the opportunities made available through prolonged underinvestment in traditional energy fuels and invested on the basis of the estimated risk / return trade-offs, we have been steadily reducing exposures as companies in this space have outperformed. These positions have included Ampol, Viva Energy, Woodside, Santos, New Hope, and Whitehaven. We continue to look for new opportunities through this lens, regardless of their sector, and demonstrate patience in waiting for such opportunities to become truly compelling. Conversely, we look for situations where capital flows are relatively unconstrained and seek to avoid these given the likelihood of excess supply and low future returns. Australia's increasingly constrained energy future, as we have shown, contains many risks. Yet we do expect to see opportunities for a sensible government, industry and financial level debate in order to manage these risks as early as possible. And from an investment perspective, as we have shown, with risk can come opportunity. Author: Ben Goodwin, Analyst/Portfolio Manager |

|

Funds operated by this manager: Merlon Australian Share Income Fund, Merlon Concentrated Australian Share Fund [1] Surveys of Consumers, University of Michigan, University of Michigan: Inflation Expectation© [MICH], retrieved from FRED, Federal Reserve Bank of St. Louis https://fred.stlouisfed.org/series/MICH/, (Accessed on 12/10/22) This material has been prepared by Merlon Capital Partners Pty Ltd ABN 94 140 833 683, AFSL 343 753 (Merlon), the investment manager of the Merlon Australian Share Income Fund and the Merlon Concentrated Australian Share Fund (Funds). It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Past performance is not a reliable indicator of future performance. Neither any particular rate of return nor capital invested are guaranteed. |

15 Nov 2022 - Magellan Global Strategy Update

|

Magellan Global Strategy Update Magellan Asset Management October 2022 |

|

Nikki Thomas, CFA, Portfolio Manager, discusses the market's reaction to the volatile macro environment, how Magellan's Global Portfolios are positioned and which quality companies are well placed to deliver growth in the years ahead. Speaker: Nikki Thomas, CFA, Portfolio Manager |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

14 Nov 2022 - Drawdowns and small stocks for God-like performance

|

Drawdowns and small stocks for God-like performance Equitable Investors October 2022 "If God is omnipotent, could he create a long-term active investment strategy fund that was so good that he could never get fired?," US-based quantitative investor and author Wesley Gray asked several years ago. Gray's data indicated that God would likely get fired - if God focused on picking investments that would deliver top decile (top 10%) returns over five years. After picking the stocks with perfect foresight and heading out fishing for five years, Gray found God's celestial clients would have endured drawdowns of as much as 76% in the interim. How many clients would have had the stomach to endure that? We semi-regularly take a look back at what the return distribution for ASX industrials has been like over a five year period. It is an exercise that provides data points and context when considering risk and return. We ran the numbers for the five years through to the end of August 2021, and found that:

Source: Equitable Investors, Sentieo Some of the names in the top decile are well known "growth" stocks like Hub24 (ASX: HUB) and Pro Medicus (ASX: PME). But there are plenty of names you may not have heard of - like IT recruitment and labour player HiTech Group (ASX: HIT) and medical diagnostic developer Proteomics (ASX: PIQ). For context, the annualised total returns for both the S&P/ASX 100 and the S&P/ASX Small Ordinaries benchmarks were both around 11% - substantially higher than the median stock in this review. The median stock would underperform indices over five years, if not for any other reason than simply because those indices would be rebalanced through the period in favour of the stocks that are performing. Consistent experienceThe distribution of returns in this period of review was similar to when we ran the same analysis back in May 2018, although in the latest numbers there is a slightly larger portion of stocks that have had negative outcomes (40% now versus 36% then). These figures are also consistent with a US analysis of the total lifetime returns for individual stocks between 1993 and 2006, where Blackstar Funds found 39% of all stocks had a negative return and around 20% were "significant" winners returning 300% or more. Source: Blackstar Funds InsightsKey insights we take out of the data presented here are that:

Author: Martin Pretty Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

11 Nov 2022 - Federal Budget October 2022-23 (For Adviser Only)

10 Nov 2022 - Inflation - higher for longer?

|

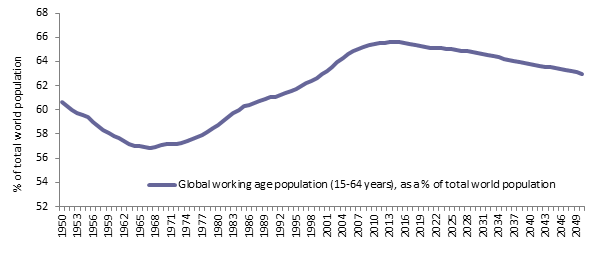

Inflation - higher for longer? abrdn October 2022 Inflation continues to be the dominant economic theme across the globe for governments, central banks and societies at large. The notion of this being a "transitory" phenomenon has been replaced by a realisation that it is much more persistent and far reaching than previously acknowledged. In turn, this has elicited aggressive tightening of monetary policy by central banks in an attempt to tame price pressures. Markets expect policymakers will be broadly successful in achieving this objective. Helpful in this respect are signs that a number of pandemic-related issues, such as supply-chain blockages and labour shortages, are beginning to ease. However, there are a variety of longer term, structural issues at play that should not be ignored as they have the potential to keep inflation elevated for a protracted period. This could further complicate the policy outlook, especially as the economic cycle looks increasingly mature. It's important to remember that the majority of these drivers were evident before policymakers rolled out Covid-induced stimulus packages. They may not be quashed by simply tightening financial conditions alone. It's therefore possible that inflation could become more ingrained globally, and while headline inflation rates may decline from their near-term highs, levels may stay elevated for longer. DeglobalisationA key facet of the mid-1980's 'Great Moderation' in inflation was increasing trade connectivity between countries and growing global interdependence. Ostensibly, developed economies benefited enormously from a liberation of the supply side. Technological advances, political reforms and economic stability allowed companies and governments to more cheaply access key inputs such as labour, raw materials and manufactured goods. In recent years, however, there's been a growing movement away from globalisation. Alarmed by China's increasing global clout, and spurred further by protectionist sentiments, the Trump administration began placing punitive tariffs on Chinese imports in 2018. President Biden has kept many of these tariffs in place. Similarly, political events such as the UK's decision to leave the EU and the embargos on Russian trade and investment are further evidence of the reversal of globalisation. At a corporate level, many firms have been moving towards shorter, more secure supply lines rather than simply the cheapest option. The pandemic exacerbated this trend. We're therefore seeing a reversal of the globalisation trend of recent decades that helped to keep input prices in check. Demographic driversInterlinked with the deglobalisation theme is the evolution of demographic factors, particularly when viewed through the prism of global supply of labour. In the late 1970s, we witnessed the beginning of an upward trend in the global working age population (those aged 15-64). This was led by the baby-boomers and medical advances. It also reflected the liberalisation of global labour markets and access to previously untapped sources of workers. The expanding supply of global labour contributed meaningfully to downward pressure on wages. However, as the chart below shows, this trend has started, and should continue to, reverse. This will potentially lead to a larger proportion of individuals who have little or no productive output but who still consume. In short, we have a situation of reduced labour supply that isn't matched by a material let up in demand. Global working age population (15-64 years), as a % of total world populationSource: UNCTAD e-handbook of Statistics 2021 Exacerbating this demographic trend has been a fall in labour participation rates in a number of developed market economies. There are various theories to explain this phenomenon. For example, large numbers of people unable to work due to 'long Covid,' early retirements and life preference changes. What matters from an inflation perspective is that reduced working age numbers, coupled with reduced participation rates, mean tighter labour markets and increased upward pressure on wages. Greenflation?An increasingly debated potential driver of structurally higher inflation is 'greenflation'. The movement towards a less carbon-intensive economy has been supported by tighter environmental regulations, as well as changing investor and corporate preferences. The result has been much reduced investment in traditional energy infrastructure in areas such as oil and gas. This is felt most acutely when exogenous strains are placed on fragile supply structures, as evidenced by the recent Ukraine conflict. More broadly, it seems unlikely that the transition towards a greener economy will be smooth. Many projects, by their very nature and scale, could take decades if not generations to execute. The implication for energy markets is that they are likely to remain volatile, with potentially increased upside risks to the inflation outlook. Putting everything togetherAlthough there will be regional and country variations, headline inflation in most developed markets appears likely to peak in late 2022 or early 2023. This will give some comfort to central bankers and government officials as it reduces the likelihood of a repeat of the early 1980s where more extreme policy measures were required to tackle excessive inflation. Still, we think inflation will remain a recurring and persistent theme, which will be a significant departure from the trend of the past four decades. With structural patterns apparently shifting, it is crucial that investors consider this evolution when constructing portfolios and recognise the value of real returns alongside nominal equivalents. Author: Adam Skerry, Head of Inflation Rate Management |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund

|

9 Nov 2022 - 4D inflation podcast (part 1): Paul Volcker, central banks, and the UK

|

4D inflation podcast (part 1): Paul Volcker, central banks, and the UK 4D Infrastructure October 2022 In part 1, Greg Goodsell (4D's Global Equity Strategist) speaks with Dave Whitby (Bennelong Account Director) about how most developed economies are dealing with inflation - and how the UK differs.

Speakers: Greg Goodsell, 4D's Global Equity Strategist and Dave Whitby, Bennelong Account Director |

|

Funds operated by this manager: 4D Global Infrastructure Fund, 4D Emerging Markets Infrastructure FundThe content contained in this audio represents the opinions of the speakers. The speakers may hold either long or short positions in securities of various companies discussed in the audio. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the speakers to express their personal views on investing and for the entertainment of the listener. |

8 Nov 2022 - How green hydrogen will impact natural gas investors

|

How green hydrogen will impact natural gas investors Pendal October 2022 |

|

REPLACING natural gas with "green hydrogen" is often touted as a way to solve "stranded asset" risk for fossil fuel assets such as gas pipelines. The International Energy Agency believes hydrogen has the "potential to play a key role in a clean, secure and affordable energy future". As part of a renewable energy transition, some natural gas pipeline and storage infrastructure could be repurposed for hydrogen. The clean fuel could even be blended into natural gas. But is it really a solution for investors worried about holding "stranded" fossil fuel assets that no longer have an economic use due to redundant technology or high costs? There is no clear-cut answer right now - and advances are required to make hydrogen technology economical, says Murray Ackman, a credit ESG analyst in Pendal's Income and Fixed Interest team. Stranded asset risk"Stranded asset risk is very tangible for fixed income investors when you're looking at a seven- or 10-year bond," says Ackman. "You have to take a view on what may or may not happen during that time frame. "Credit ratings, access to financing, cost of funding, demand for the products, regulation - those are the kind of ESG risks that we're looking at." Some risks are clear cut: "Coal is something that needs to be phased out very quickly, so if you're coal or coal-adjacent like a train company that hauls coal from the mines, there is a clear stranded-asset risk in the short term. "The cost of funding might become higher and there could be a chance of default or ratings downgrades." But the risks to natural gas assets - and the potential for hydrogen to be a solution - are more difficult to pin down. A natural gas replacementPart of the problem is conflating potential industrial and domestic uses for hydrogen. "There are some very clear uses for hydrogen as a replacement for natural gas in industrial processes like producing fertiliser, powering heavy vehicles and aircraft or making steel," says Ackman. "And there's this moon shot that it will be a one-for-one replacement for natural gas," says Ackman. In that scenario, parts of the natural gas pipeline and storage infrastructure can be repurposed for hydrogen, protecting their value well into the future and saving them from becoming stranded assets. "This is what industry is betting big on. It's tricky because the economics don't stack up yet - but then that was true for solar panels for a long time too." For households, the benefits of hydrogen are less clear cut. Hydrogen can be blended into the natural gas but above about 10 or 20 per cent it can damage some existing pipes. "And if you go any higher 20 per cent, you need to change household appliances anyway - if you're changing your stove to something that can accept hydrogen, why not just change to electricity?" The weighing of these different views is an important part of the investment process, says Ackman. "It's very much a question mark whether it is the solution. In our investable universe, we've got some gas distribution networks. "The question is 'why are you talking about how good hydrogen is?' "Is it because you really believe it? Or is it because it's an existential threat and without it you have a potentially stranded asset in the future?" Author: Murray Ackman, Credit ESG analyst |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

7 Nov 2022 - Collins St Convertible Notes Webinar Recording - New Investment Opportunity & Fund Update

|

Collins St Convertible Notes Webinar Recording - New Investment Opportunity & Fund Update Collins St Asset Management Oct 2022 |

|

|

The Co-Founders of Collins St Asset Management, Michael Goldberg and Vasilios Piperoglou, alongside Head of Distribution & Investor Relations, Rob Hay, hosted an interactive webinar where they announced - Announce the details of the October and November capital raisings and the way in which both existing and prospective clients can invest into the Fund. - Provide an update on the performance and positioning of the Fund, including some topical issues around increasing interest rates and the negotiation of conversion prices given recent market volatility. Speakers: Michael Goldberg, Co-Founder, Vasilios Piperoglou, Co-Founder, and Rob Hay, Distribution & Investor Relations

|

4 Nov 2022 - Global equities: Three different scenarios and their probabilities

|

Global equities: Three different scenarios and their probabilities Pendal October 2022 |

|

THE December quarter may see a rally, but equities will be range bound for the next few years, with rotations between value and growth stocks, argues Pendal global equities fund manager Chris Lees. "Our base-case scenario is that this interest rate shock-crisis 'valuation' bear market is morphing into a recessionary 'profits' bear market, with the S&P 500 already down 25% year-to-date. "But we don't expect widespread financial contagion, where markets would fall by more than 50% like in 2008. "Our current scenario analysis is 50% bullish and 50% bearish," says Lees, who co-manages Pendal Global Select Fund with long-time colleague Nudgem Richyal. "Short-term reasons to be bearish include a recession potentially becoming a financial crisis or contagion. "Medium-term reasons to be bullish include the US Federal Reserve regaining credibility with inflation and interest rates stabilising next year," Lees says. Lees breaks down the probability of three scenarios as follows:

What does it mean for investing?In recent months the fund has sold economically cyclical stocks with earnings risk due to recession, and purchased more economically resilient companies, including some in the emerging markets of Brazil and Indonesia. "Not many people know that the Brazilian and Indonesian equity markets have outperformed the USA stock market this year - even in US dollars - which is another example of just how different this bear market is from previous bear markets when they fell much harder," Lees says. The fund is also considering, or as Lees puts it "tiptoeing" around, neighbourhoods where they see positive relative fundamentals and valuations, with stabilising relative share prices. "Some quality growth stocks are already down 50 per cent year to date and are beginning to stabilise," Lees says. "And some emerging markets, notably Brazil and Indonesia." He also says its worth looking for opportunities to arise from the eventual turn in the US dollar, which in his words is "inevitable but not necessarily imminent".

Author: Chris Lees and Nudgem Richyal - co-manages Pendal Global Select Fund |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

3 Nov 2022 - Magellan Infrastructure Strategy Update

|

Magellan Infrastructure Strategy Update Magellan Asset Management October 2022 |

|

Gerald Stack and Ofer Karliner, CFA, discuss the recent reporting season, the European energy crisis and provide an outlook for companies in Magellan's Infrastructure Strategy. Speaker: Gerald Stack Deputy CIO, Head of Infrastructure and Portfolio Manager |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should read and consider any relevant offer documentation applicable to any investment product or service and consider obtaining professional investment advice tailored to your specific circumstances before making any investment decision. A copy of the relevant PDS relating to a Magellan financial product or service may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any strategy, the amount or timing of any return from it, that asset allocations will be met, that it will be able to be implemented and its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |