NEWS

29 Nov 2022 - Investing in climate adaptation for a resilient world

|

Investing in climate adaptation for a resilient world abrdn November 2022 Key takeaways

The urgent need for adaptation Whilst much of the climate narrative focuses on achieving 'net zero' in the decades ahead, it is becoming increasingly apparent just how dramatically our climate is already changing. The last year has once again delivered record climate events with devastating impacts - deadly heatwaves across Southern Asia, severe flooding in Pakistan, South Africa and Brazil, drought across China and south-western states in the US, and ice shelf collapse in Antarctica, to name a few. 2021 losses from climate related events were estimated by Munich Re to be the second highest in history and this is likely to be exceeded this year- with clear risks to society, businesses and the economy. Adapting to these physical impacts of climate change is therefore absolutely critical. A year on from COP26, and Climate Action Tracker shows that country pledges will still fail to limit warming to below 2°C, let alone the 1.5°C target. But even the most optimistic climate scenarios result in an increase in warming and therefore a continuation of the rise in frequency and severity of extreme events and a worsening of chronic changes. It is therefore too late to focus on climate mitigation (i.e. decarbonisation) alone. We need to ensure that our communities, businesses and economies are resilient to these impacts. The widening adaptation gap The 2022 Adaptation Gap Report identifies that, whilst adaptation finance is rising as a proportion of total climate financing (34% in 2020 compared to 14% in 2019), combined mitigation and adaptation flows have actually fallen over the last reporting period. The UNEP report estimates that the annual adaptation costs in developing countries alone to be in the range of $160-340 billion by 2030, and almost doubling again by 2050. By this assessment, adaptation finance needs are currently between 5 to 10 times higher than adaptation finance flows, and growing. We highlight this adaptation gap as one of four critical interconnected gaps that need to be adequately addressed at COP27. In addition, it was agreed at COP15 in 2009 that developed nations would provide climate finance of $100 billion a year by 2020 to developing nations for mitigation and adaptation. That promise was broken. A key minimum requirement for COP27 is ensuring that this commitment to public financing is met. However, even if this was met and it was all allocated to adaptation it would still fall far short of what is required. There needs to be a more integrated approach to mainstream adaptation finance- as current approaches tend to be piecemeal, localised and responsive to current impacts. Lessons learned from the pandemic need to be applied to ensure coordinated global, national and local response to improve resilience and adaptation financing. The Global Commission on Adaptation has identified $1.8 trillion in adaptation investments that could deliver net benefits of $7.1 trillion by 2030. Despite this growing evidence of the benefits, less than 2% of adaptation finance currently comes from private sources. There are a number of reasons why private investment in adaptation has been limited to date:

It is clear that public finance alone is not going to close the widening gap. So existing barriers to mobilising private finance need to be addressed to grow opportunities for private investors.

The importance of investing in adaptation Physical impacts of climate change affect every sector and region on the planet. Some however are more severely impacted than others and we highlight three particular sectors below:

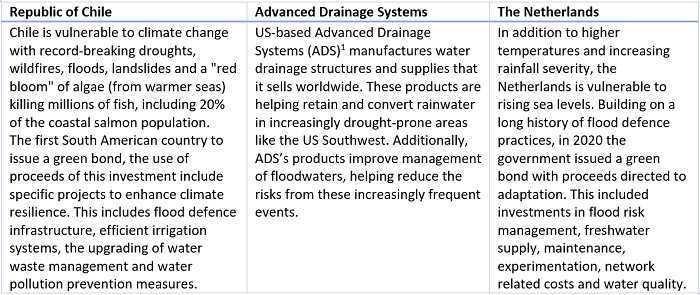

Without adaptation, businesses face physical damage and power outages. Extreme weather may also interfere with renewables providing a reliable energy source. It's likely there will also be more supply-chain disruptions, insurance losses, commodity shortages and inflation. This provides a clear financial case for incorporating climate adaptation into investment decisions to build resilience. Investment opportunities for adaptation and resilience 1. Understanding and incorporating the physical risks of climate change into decision-making Financial institutions need to understand how the assets they invest in assess and manage the physical risks of climate change in line with the recommendations of the TCFD and integrate this into asset valuations. The Coalition for Climate Resilient Investment (CCRI) is a private sector-led initiative launched in 2019 which abrdn are members of and aims to ensure that physical climate risks are systematically integrated into all investment decisions by 2025. The goal is to improve the pricing in of climate change in order to de-risk the investment for financial partners, provide investor confidence and help mobilise capital towards climate resilient investment. A key output of the initiative is the PCRAM framework which provides a methodology for pricing physical climate risks into infrastructure investments. Incorporating an assessment of acute and chronic physical risks is a core part of our due diligence process for new infrastructure investments, but this can differ considerably depending on the type of asset and its location. This is equally important for publicly-listed assets. Our bespoke climate scenario analysis framework provides a forward-looking view of the impact of climate change on asset values. Our approach to scenarios allows us to disaggregate the company-level results from different scenarios into the impact drivers, including physical risk and adaptation. This provides an indication of the potential direct physical impact on assets that companies are facing. Given the location-specific nature of physical risks, this then needs to be explored in more detail at individual-asset level. For this reason we are focussing on in-depth scenario analysis at building-level for our own real estate portfolio. 2. Investing in adaptation solutions There are vast opportunities for investors to become involved in helping countries and businesses strengthen resilience against climate extremes. This includes utility companies creating more weather-resistant grids; homebuilders specialising in heat- and flood-resistant designs; and governments with innovative resilience projects. These opportunities will only expand in the years ahead. Research by Munich Re has shown that linking adaptation and insurance, for example by restoring coral reefs that reduce storm damage, or by planting to alleviate flooding, could lead to reduced premiums and a six-fold return on investment. Adaptation investments should be a growing and important part of the investment universe for climate-focused strategies. By including these opportunities alongside climate change mitigation ideas, thematic investors can diversify their exposures while contributing to a critically underfunded part of the solution to climate change. In fixed income at abrdn, this process seeks to determine an understanding of the link between a bond issuer and its impact on adaptation. Assessing the nature and extent of the relevant physical risks and how these are being addressed by the issuer's actions has led to several investment ideas that contribute to climate change adaptation. Three examples of bond issuers and their approaches to adaptation are highlighted in the table below. It is time for investors to wake up to the reality of climate change today and invest not just in mitigating its causes, but also in adapting to its consequences. The need for adaptation solutions will only expand in the years ahead as temperatures continue to rise. Author: Tzoulianna Leventi, Investment and ESG Analyst |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund 1 Discussion of individual securities in this article is for informational purposes only and not meant as a buy or sell recommendation nor as an indication of any holdings in our products. |

28 Nov 2022 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||||

| Frame Long Short Australian Equity Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

|

|||||||||||||||||||

|

|||||||||||||||||||

| Balmoral Digital Momentum Fund Two | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |

28 Nov 2022 - 10k Words

|

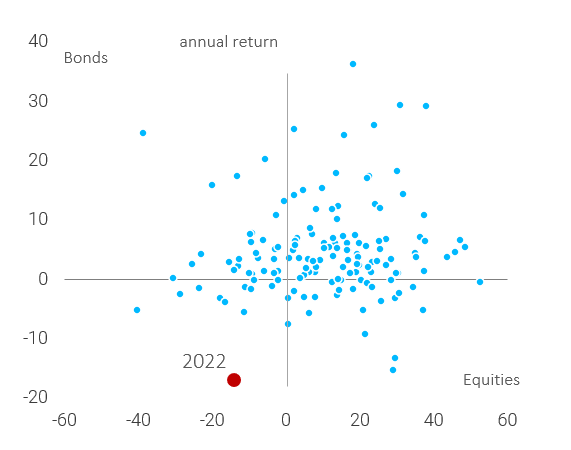

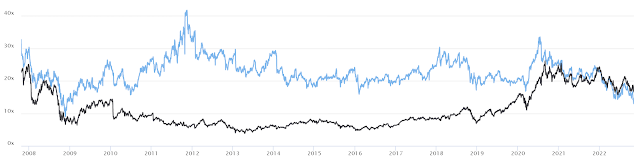

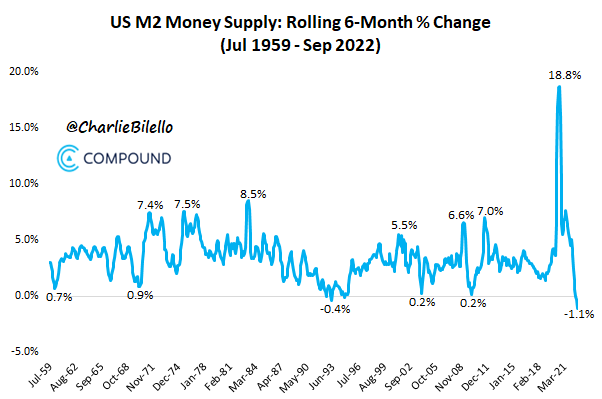

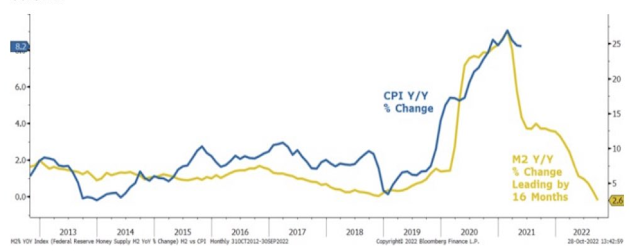

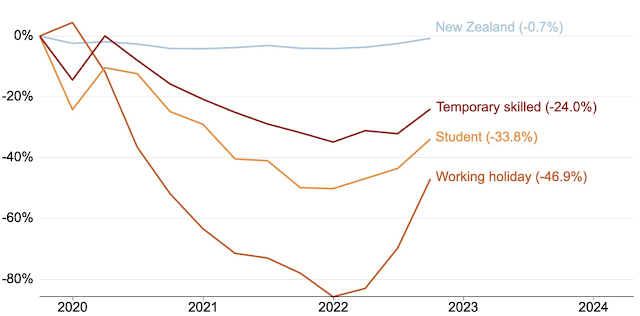

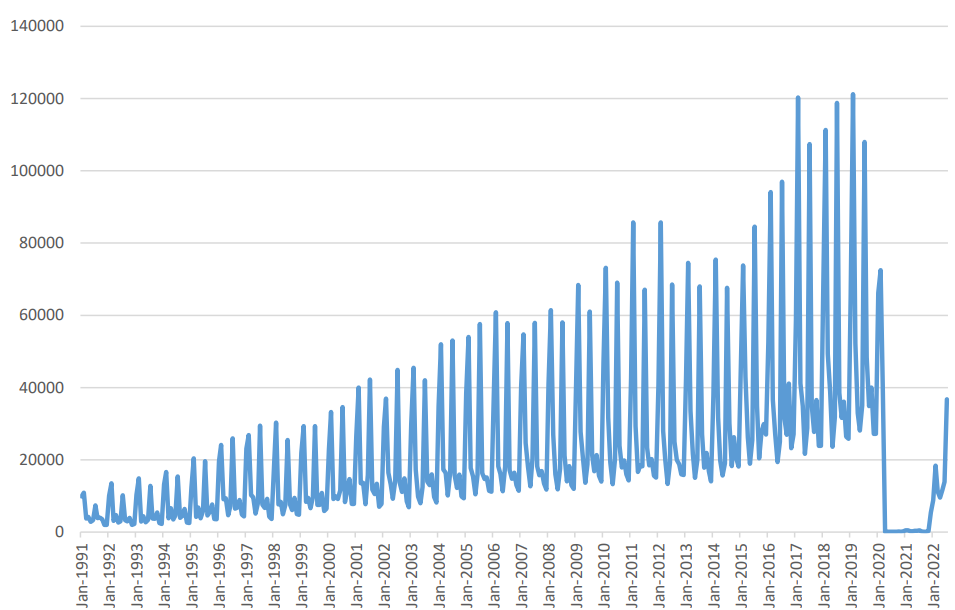

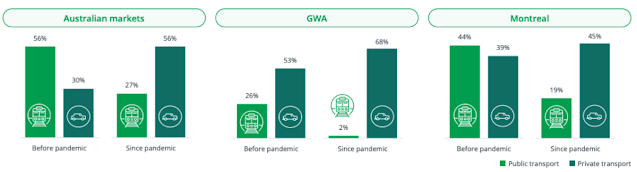

10k Words Equitable Investors November 2022 There hasn't been a year quite like this one for investment markets - just look at where @darioperkins plots 2022's returns. While we are sticking with that theme, CNBC tallies $US3 trillion in lost market cap from just seven companies in one year. As a valuation check, Amazon is now trading well below its long-term average EV/EBITDA multiple - while Apple remains above its own. With the "M2" measure of money supply in the US plunging the most on record in a six month period, as highlighted by @CharlieBillelo, Morgan Stanley chartered the historical correlation between M2 and inflation; and True Insights looked at the correlation with stock valuations. An exploration of the pre-and-post COVID worlds has us looking at Australian temporary visas through Grattan Institute's chart, student arrivals in Australia via Pac Partners and finally, a significant shift in communter preferences that suits toll road operator Transurban just fine. Annual US bond and equity returns since 1870 Source: @darioperkins $US3 trillion lost in seven companies in one year

Forward EV/EBITDA of Amazon and Apple

US "M2" money supply experienced its largest decline over a six month period on record Source: @CharlieBilello Inflation relative to changes in the "M2" money supply for the United States Source: Morgan Stanley, Bloomberg S&P 500 Forward PE change relative to changes in "M2" money supply Source: True Insights Change in temporary visa-holders in Australia since pre-COVID Source: Grattan Institute Student arrivals per month into Australia Source: ABS, PAC Partners Preferences for commuting mode before and after COVID Source: Transurban November Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

25 Nov 2022 - What drives poor returns?

|

What drives poor returns? Insync Fund Managers October 2022 Most investors do not reap the benefits of compounding wealth that come from equities. Equities grow wealth very well. $100 in the S&P 500 at the start of 1926, three years prior to the great crash, would have boosted your wealth to over $1 Million today. That's 10.05% p.a. Tumultuous macro world events have rained down upon us since then, and so it's not adverse macro events that derail wealth accumulation; it is investors' reactions to them. In short, investor behaviour derails compounding wealth. We've experienced difficult months recently for our quality-based strategy including recessionary concerns. We've also delivered positive annual above market returns recently as well - 2017, 2018, 2019, 2020, & 2021 (December Ending). First to fall: When a recession looms, a Quality company's stock price often falls more than the market initially. Quickest to rise: They are also the first to recover and outperform the other major investment styles during a market recovery. All roads lead to technology - Accenture Some of our 16 global megatrends are technology based. Despite all the negative noise shouting for our attention today, the reality is that we are in the middle of an unstoppable wave of technological advances impacting every business. From old style utilities and industrials to online payments, construction and retail. Companies must digitise their business to remain competitive, grow their customer base, revenues and earnings. Accenture is a key player assisting in this digital transformation. Accenture posted revenues of $62 billion, a record 22% growth adding $11 billion for the year, and importantly EPS growth of 18%. New bookings were $18.4 billion for the quarter, their second highest ever. A case study on how they do it- EDF French multinational utility company EDF digitizes the construction of nuclear power stations that provide low-carbon energy for more than 6 million UK homes alone. Accenture transformed EDF's digital construction processes by creating a digital factory model on a secure cloud infrastructure. This drives cost efficiencies. Construction methods that relied on thousands of uncoordinated, disjointed paper plans and text are now digitized with contractors accessing and sharing the same view and information. AI then scans and assesses this for problems and opportunities. Digital dashboards provide real-time data visibility across a myriad of systems. 'Digital twins' identify areas for automation across power plants, all of which drive safety, efficiency and quality. A 'digital twin' virtually duplicates physical objects, processes & systems, and are used to predict how those elements will respond to different variables. Premiumisation powerhouse - LVMH LVMH is the world's largest luxury conglomerate. Brands include Christian Dior, Givenchy, Louis Vuitton, Tag Heuer, Bulgari, Fendi, and Moët & Chandon - even Cape Mentell wines in WA and Cloudy Bay in NZ. LVMH's products are an expression of creativity and timelessness. The previous LVMH picture highlights an important facet of their brand strength. They are 6 of LVMH's oldest brands (houses) in the leather goods division with the Loewe brand first established in 1846. History shows heritage brands with a strong leather goods offer, fare best during economic downturns. In today's difficult macroeconomic climate LVMH delivered standout growth. LVMH recorded revenue around €56.5 billion in the first nine months alone. Up 28% compared to the same period last year. Luxury shoppers have not lost their appetite for high-end designer goods, even in tumultuous times. We have often cited the benefits of companies with pricing power and high gross margins in a rising inflationary environment. LVMH is a stand out example. Whilst the luxury sector is not immune to recessionary shocks, the negative impacts do not last very long. The strongest brands tend come out bigger and better on the other side. LVMH offers a proven defensive track record. The GFC period highlights this. Overall sales at LVMH declined by 4% yet Fashion & Leather Goods (F&LG) posted sales growth of +2% in the worst recessionary period we have had in decades. Back then F&LG made up 55% of their total. Today it represents 75% of group profits. Conventional wisdom pointed to people trying to hide their wealth during an economic downturn. During the GFC, anecdotes spread of shoppers coming out of Bergdorf Goodman in NY with their purchases wrapped in brown paper bags. But a 2010 joint study by the Marshall School of Business and UCLA put paid to this. The study focused on luxury leather goods and how they changed during the GFC. Leading brands substantially trimmed their offering, whilst simultaneously increasing price points. They also featured a higher proportion of items with logos or other brand identifiers. Louis Vuitton and Gucci were charging consumers more to flaunt their brands during a recession. The study explained this by segmenting luxury consumers into "Patricians" and "Parvenus", or "insiders" and "outsiders" to the world of luxury. Parvenus needed to confirm they were still wealthy during a recession by buying more items from the latest collections of lux brands. This created an opportunity for ostentatious luxury designs. The GFC sent the world into a tailspin, mainly because it was the most significant contraction in the global economy since WWII and the last global recession was 18 long years ago. Luxury stocks saw a mass sell-off. From the peak of their performance in May 2007 to trough in March 2009, an index of the top 13 luxury goods companies lost 62 percent of its value. Over the same period, the financial performance of the 13 companies making up the index was the reverse! Sales continued growing; +5.7% in 07', +6.5% in 08' and +2.2% in 2009. Their share prices recovered sharply immediately after the bad news ebbed. Investors rightly appreciated the resilience and strength of their business models. LVMH have delivered a compound annual earnings per stock growth rate of 14% p.a. since the start of the GFC. A compound annual rate of return of 17% p.a. over the same period. Summing things up The global economy is impossibly complex, with billions of moving parts driving demand, consumption and activity. Commentators, most fund managers, consultants and the media earn money trying to predict what all of these billions of consumers and companies are doing, or are planning to do over the next few weeks, months or even years. It's not only foolish but impossible. Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

24 Nov 2022 - Is Google's LaMDA chatbot sentient?

|

Is Google's LaMDA chatbot sentient? Alphinity Investment Management September 2022 Google's Artificial Intelligence (AI) is at the heart of its search engine and has powered Alphabet to become a $1.5 trillion market cap company. However, the sophisticated AI that drives Google and other big technology companies around the world is not without risks. One of these risks was highlighted recently when Google engineer Blake Lemoine was suspended and then fired after claiming that LaMDA, a computer chatbot he was working on, had become sentient and was thinking, reasoning, and expressing feelings equivalent to a human child. Lemoine's critics are quick to point out that this is nothing more than the ELIZA effect: a computer science term that refers to the tendency to unconsciously anthropomorphise computer generated responses to make them appear human. In LaMDA's case, this could mean that a huge number of chatbot conversations were edited down to result in a narrative that only appears coherent and humanlike. Indeed, Google's position on this is that LaMDA, which stands for Language Model for Dialogue Applications, is nothing more than a sophisticated random word generator. Google is not alone in presenting AI risks. Meta's BlenderBot 3 has self-identified as "alive" and "human" and was even able to criticise Mark Zuckerberg. An MIT paper titled "Hey Alexa, Are you Trustworthy?" shows that people are more likely to use Amazon's assistant if it exhibits social norms and interactions thus creating an incentive for parent companies to develop AI that is, or at least appears, sentient. Nor are AI risks solely in the realm of big tech. Autonomous driving, financials services, manufacturing and industrials also have AI risks that are potentially underappreciated by investors and by society as a whole. AI as an ESG and Sustainability IssueBy far the majority of ESG and sustainability research focuses on planetary boundary related issues such as climate change and biodiversity. However, if the development and application of AI is mishandled and technological singularity becomes a possibility, that is potentially the biggest human sustainability issue of all. So how should investors think about the ESG and Sustainability risks associated with AI development and application? The table below outlines 6 features of a responsible AI design which can provide a checklist for engaging with corporates on the sustainability of their AI design process: Feature and Comment Human Centric Human centric AI works for people and protects fundamental human rights. It is continuously improving because of human input and is aware of the risks of singularity. Transparent Transparent AI allows humans to see whether the models have been thoroughly tested and make sense, and that they can understand why particular decisions are made by the AI system (i.e. no black boxes). Secure Secure AI refers to the protection of AI systems, their data, and their communications is critical for the ultimate users' safety and privacy. Contestable Contestable AI enables humans to meaningfully contest individual automated decisions made by AI systems.\ Accountable Accountable AI means that every person involved in the creation of AI at any step is accountable for considering the system's impact. Fair and Unbiased Fair and unbiased AI aims to identify, acknowledge and address bias in the underlying data. Forward Looking Forward looking AI aims to address potential ethical issues in AI at the start of the design process rather than at the time of application. On the ESG side, specific AI governance measures are also critical to ensure a sufficient level of oversight with respect to AI risks. These include an AI Ethics Committee, AI related disclosures and aligned KPIs. Governance best practice is for corporates to have a specific committee for responsible AI that is independent, multi-disciplinary, rotating and diverse. Microsoft is an example of best practice in this regard. MSFT as an AI, Ethics and Effects in Engineering and Research (AETHER) Committee with representatives from engineering, consulting, legal and research teams. Microsoft also has an Office of Responsible AI which is headed by a Chief Responsible AI Officer and a Chief AI Ethics Officer. Disclosure around AI products and their design and commercialization is obviously critical. Despite the criticisms of LaMDA, so far, Google is one of the only large tech companies that discloses a list of AI applications it will NOT pursue including applications that cause harm, weapons, surveillance that goes against international norms and AI that contravenes international law and human rights. They highlight that this list may change as society's understanding of AI evolves. Increasingly we expect companies to address sustainable and responsible AI in their annual ESG and Sustainability Reporting. Aligned KPIs is likely the most difficult aspect of AI governance to determine and analyse. In principle, it means that KPIs are not geared towards commercialization of AI at all costs. This could create a disincentive for employees working on AI design and application to raise concerns or discontinue AI projects that conflict with the company's AI principles. This is an area for engagement as very little is currently disclosed on KPI alignment. ConclusionGoogle's LaMDA has reignited the debate about the ethical risks of AI development and application. While most experts agree that technological singularity (i.e. technology becomes uncontrollable and takes over) will not happen in our lifetime, that doesn't mean AI development and applications are not a risk that needs to be taken seriously. The bulk of ESG and Sustainability research tends to focus on planetary boundary related risks like climate change and biodiversity, but if singularity risks are mismanaged by AI companies, that could be the biggest risk to human sustainability of all. Author: Mary Manning, Global Portfolio Manager This information is for advisers & wholesale investors only. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

23 Nov 2022 - 4D inflation podcast (part 2): The US Inflation Reduction Act

|

4D inflation podcast (part 2): The US Inflation Reduction Act 4D Infrastructure November 2022 In part 2, Peter Aquilina (4D's Head of ESG and Senior Investment Analyst) speaks with Dave Whitby (Bennelong Account Director) about how the US' new Inflation Reduction Act is really about transitioning the US to a decarbonised, clean/renewable energy economy.

Speakers: Peter Aquilina, Head of ESG and Senior Investment Analyst |

|

Funds operated by this manager: 4D Global Infrastructure Fund, 4D Emerging Markets Infrastructure FundThe content contained in this audio represents the opinions of the speakers. The speakers may hold either long or short positions in securities of various companies discussed in the audio. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the speakers to express their personal views on investing and for the entertainment of the listener. |

22 Nov 2022 - Australian Secure Capital Fund - Market Update

|

Australian Secure Capital Fund - Market Update October Australian Secure Capital Fund November 2022

National property prices have fallen for the sixth consecutive month, with values declining a further 1.2% in October. Whilst the price correction continues, there is some signs of easing within the capital cities, with the rate of decline slowing following falls of 1.6% (August) and 1.4% (September), reducing to a 1.1% decline in October. Queensland capital cities recorded the most significant monthly change with the Home Value Index recording a 2% reduction. New South Wales, Tasmania and Canberra experienced further declines of 1.3%, 1.1% and 1% respectively. Smaller falls of 0.8% for Victoria and the Northern Territory, with South Australia and Western Australia experiencing the smallest reductions of 0.3% and 0.2% respectively.

Despite the continued reduction in house prices, at the combined capital city level, housing values have fallen just 6.5% following a 25.5% increase through the upswing, with Sydney recording the largest falls of 10.2% since the January peak (after a 27.7% rise), and Melbourne down 6.4% since February (after a 17.3% rise). Interestingly, unit prices have held value better throughout the downturn (down 4.2%), likely driven by surges in rental returns, as well as experiencing smaller growth during the upswing. Supply remains lower than previous years, with the number of newly listed capital city dwellings in October down 25.2% from 2021, and almost 19% below that of the previous five-year average. This lack of supply is likely to contain the price falls to an extent, as there has not been any significant upswing in panicked selling or forced sales. The last weekend of October saw a total of 1,908 auctions take place across the capital cities, well below the 3,546 on the same weekend in 2021. Clearance rates also remain lower than last year, with the weighted average clearance rate across the capital cities at 59.8% (down from 76.8% in 2021) in the last weekend of October. Similar to last month, clearance rates in Adelaide were the highest of the weekend, with a clearance rate of 68.2%, followed by Sydney (62.3%), Melbourne (60.7%), Canberra (59.8%), Brisbane (45.7%) and Perth (38.5%). Whilst it is too early to determine if the worst of the decline phase is over, the RBA's decision to raise the cash rate by a further 0.25% instead of 0.5% for the second straight month, despite the high inflation reading for the September quarter, indicates they do expect inflation to start moderating.

Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

||||||||||||||||||||||||

21 Nov 2022 - The Rate Debate: Storm clouds continue to gather in global markets

|

The Rate Debate - Episode 33 Storm clouds continue to gather in global markets Yarra Capital Management November 2022 The RBA hiked rates for the seventh consecutive month as it seeks to stifle inflation. Global central banks continue aggressive monetary tightening despite early signs of moderating inflation and weaker forward growth indicators. With the consumer bearing the brunt of high inflation and tighter financial conditions, the RBA has backed away from aggressive rate hikes for now. Will other central banks follow, or is this a temporary reprieve? Speakers: |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

18 Nov 2022 - Get ready for a glass shortage - unexpected effects of the energy crisis

|

Get ready for a glass shortage - unexpected effects of the energy crisis abrdn October 2022 Plastic wine bottles, jam jars and long waiting lists for luxury glass items may all become part of daily life as a result of the energy crisis. Glass manufacturers are heavy energy users, so have been hard pressed by the rapidly escalating costs of oil and gas. They are currently having to put up the prices of their products by around 35%, although this may rise further. The concern is that passing this cost on to the consumer means prices will increase in a way that makes glass packaging, especially for food and drink, too expensive. Consumers will demand cheaper alternative packaging. Glass half emptyAlready, the luxury end of the glass market is bracing itself for much higher energy costs. Many of the Venetian glass workshops on the Italian island of Murano have already closed their doors because the cost of energy has made their decorative items too expensive. Customers looking to buy Venetian vases and fine crystal glasses could face extensive waiting lists this winter. The world-famous manufacturer of Riedel glass in Austria and Germany is also contemplating a shutdown. That's because furnaces can break if they cool, so pausing during periods when gas is rationed is not an option. Glass half fullNonetheless, glass is completely recyclable, so remains one of the greenest choices for storing food and drink. Given the challenges, we are seeing some surprising effects of the energy crisis as companies strive to develop innovative solutions and better opportunities. Virdrala is one of the leading glass container manufacturers in Western Europe, operating in Spain, Portugal, Italy, the UK and Ireland. It produces a full range of glass containers, selling eight billion per year. Of its products, 35% are for wine, 26% are for beer, and the balance is split between food, spirits and soft drinks. Adapting to the challenges, Vidrala is increasing its focus on glass recycling - in 2021, 48% of the glass it produced was recycled. It's also raised the collection rate of used glass to improve both manufacturing efficiency and earnings. Currently, the company is cooperating with a non-governmental organisation, which encourages people to recycle, collects the glass and delivers it to Vidrala for melting and recycling. Looking to the longer term, Vidrala is working together with other companies from the glass industry to investigate hybrid hydrogen furnaces that could power the industry in the future. Glass manufacturers are also exploring innovations such as reducing the melting temperature of glass by adding ash, allowing a more 'imperfect'-looking glass with less clarity and more bubbles, plus increasing the use of wind and solar energy at factories. What about the future?There's no doubt that the energy crisis will bring all kinds of innovative new solutions. Could we see milkman-style deliveries of wine in reusable bottles? Or more food and drink in aluminium cans? Will much more food move to recyclable plastic packaging or paper-based packaging? Dutch company Corbion is at the forefront of innovative packaging solutions. It produces PLA, a bio-based and biodegradable plastic packaging, made from renewable resources. PLA is strong enough to replace conventional plastics. And, once used, it can be composted, breaking down into CO2, water and biomass. To tackle the many challenges ahead, innovative thinking is needed alongside a more sustainable and, where possible, more traditional way of doing things. Inspired by the humble soap bar, shampoo is now available in solid bars, packaging free. Could the future see us taking our bottles to local shops and supermarkets for wine and oil refills, as is the norm in many parts of Southern Europe? What does all this mean for investors?As a society, we need to reduce our dependence on fossil-fuel energy. The current shortage could be the pressure we need to make dramatic changes. Meanwhile, many of the glass companies affected by the energy crisis are small caps. Due to their size, they are nimbler than their larger peers, putting them in pole position to both adapt quickly and create alternative solutions. So, challenging times can create opportunities for well-managed, innovative companies. Such businesses also create potential opportunities for diligent investors. Maybe it's time to raise a glass after all? Author: Tzoulianna Leventi, Investment and ESG Analyst |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund , Aberdeen Standard Life Absolute Return Global Bond Strategies Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund

|

17 Nov 2022 - Sustainable investing: Five steps to avoid greenwashing

|

Sustainable investing: Five steps to avoid greenwashing Pendal October 2022 |

|

AS DEMAND for sustainable investing grows, Australians are becoming more attuned to the threat of "greenwashing". What is greenwashing? Australian investments regulator ASIC defines it as "the practice of misrepresenting the extent to which a financial product or investment strategy is environmentally friendly, sustainable or ethical". The value of Australian assets managed using a "rigorous, leading approach to responsible investment" passed $1.5 trillion last year — 43% of the total market, the Responsible Investment Association Australasia reported earlier in the month of October. RIAA last year certified 225 products in Australia and New Zealand, representing $74 billion of assets under management — up $18 billion in a single year. (Pendal is named by RIAA as one of 74 responsible investment leaders in Australia.) But not all investment managers are as green as they may seem. So what steps can you take to avoid greenwashing? "It can be a real challenge to spot whether a product you've invested in is truly green versus one that's just claiming to be green," says Pendal senior risk and compliance manager Diana Zhou. In June, Australian Securities and Investments Commission published guidelines to help product issuers self-evaluate their sustainability-related products. But investors can still find it problematic separating financial products that are sustainable from the ones that just say they are. Elise McKay, an investment analyst with Pendal's Australian equities team, says there are broad global questions on what exactly represents best practice in ESG. Right now European regulators are leading the way with explicit regulations on disclosures, reporting and metrics. "My view is that ultimately Australia will head down a similar path towards greater regulation — but we are not there yet. "From an investor perspective, people are selecting these funds because they have an ethical desire to invest aligned with their beliefs. "Product issuers have an obligation to be 'true to label' and deliver them the solution they are after." How can investors be sure that the products they are investing in are delivering what they promise? McKay and Zhou offer these five steps for investors and advisers to avoid falling victim to greenwashing: 1. Dig deeper than the glossy marketing materialInvestment opportunities often come with glossy brochures, but behind the marketing material is a product disclosure statement (PDS), usually available on the product issuer's website. Zhou says "the PDS, by law, must disclose the extent to which ESG practices are taken into account in selecting, retaining or realising an investment. "Investors should read the offer documents (PDS and Additional Information Booklet) in detail rather than relying only on marketing. These documents should provide details on a manager's ESG practices. "A PDS needs to be submitted to ASIC and needs to comply with certain rules in the Corporations Act — so there is regulatory oversight." 2. Check up on a product issuer's governanceCompanies with strong governance frameworks are more likely to be in compliance with rules and regulations, says Zhou. "You're looking for a dedicated responsible investment page on the an issuer's website. "There will usually be policies and statements about responsible investing, climate change, human rights, modern slavery and stewardship. " "The proxy voting process is important for transparency. There should be a record of how the manager voted at the annual meetings of its portfolio companies. Investors should be able to see which resolutions were voted on and which way the investor voted. "Investors can also look at whether the manager is a signatory to the Principles for Responsible Investment (PRI) which gives an indication of the level of commitment a manager has on implementing its responsible investing strategies" 3. Understand how sustainability is integrated into the investment frameworkThere are a number of ways a manager can integrate ESG factors into the investment process - but some are more effective than others, says McKay. Some managers may simply screen out investments while others conduct detailed benchmarking of a portfolio company's ESG targets. "Look for detailed benchmarking on areas like climate change, diversity, biodiversity and natural resources, the circular economy and so on to identify who are really leading sustainability and ESG targets." 4. Look for evidence of stewardship activity.A fund manager that genuinely cares about making a difference will be actively engaged with portfolio companies. This goes beyond proxy voting, says McKay. "Spend time understanding what stewardship activities are done — what are the areas that a manager is working on with companies." You can read more here about what to expect from a modern investment manager's engagement activities. 5. Spend time with the investment teamFinally, and potentially most importantly, McKay urges investors to get to know their fund managers and get into a direct discussion with them to go behind the written word. "Go and talk to the fund manager — get them to explain the framework to you," says McKay. "Go beyond disclosure and get into a discussion to find out if they are really doing what they say they are doing." Author: Diana Zho, Senior Risk and Compliance Manager |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |