NEWS

23 Apr 2024 - US wildfire risk rears its head again

|

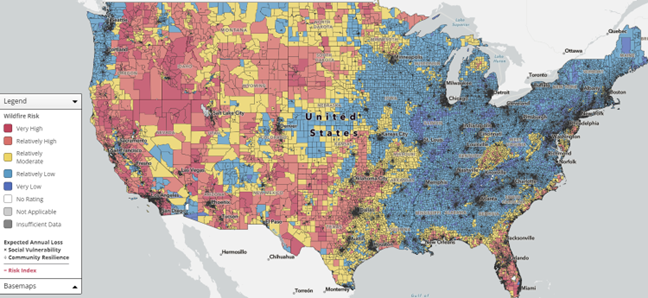

US wildfire risk rears its head again 4D Infrastructure April 2024 In his annual letter to investors, released on 24 February 2024, Warren Buffett drew the public's attention to the increasing wildfire risk that electric utility investors in parts of the US are exposed to. He confirmed this risk had negative ramifications on essential investment required to support utilities and communities alike. This messaging was further reinforced by the experience of Xcel Energy, who in early March confirmed that its assets in Texas were likely responsible for the ignition of the Smokehouse Creek wildfire. Strong words from Buffet on an increasingly concerning utility riskBuffett drew broader investor attention to an issue which is already well understood by US utility investors, attributing the poor performance of Berkshire Hathaway Energy (BHE) to increased wildfire risk - to "the regulatory climate in a few [US] states has raised the spectre of zero profitability or even bankruptcy (an actual outcome at California's largest utility and a current threat in Hawaii)". This was in reference to BHE's utility company, PacifiCorp (referenced in the previous article listed above), which BHE believes is facing at least $8 billion in legal liability claims associated with fires it allegedly ignited in October 2020[1]. The scale of such potential liabilities obviously raises the question of the financial viability of PacifiCorp. To this Buffett stated, "At Berkshire, we have made a best estimate for the amount of losses that have occurred. These costs arose from forest fires, whose frequency and intensity have increased - and will likely continue to increase - if convective storms become more frequent". Importantly, with regard to BHE's appetite in bailing out the company from financial distress Buffett stated, "Berkshire can sustain financial surprises but we will not knowingly throw good money after bad"[2]. This should be a major concern for legislators and regulators in exposed states, as an electric utility in financial distress (potentially bankruptcy proceedings) will struggle to attract investment capital and service its customers. This is particularly important in the current environment, with massive capital investment required to support the energy transition and power demands of AI and data centres. Indeed, Buffet recognises the investment proposition on which utilities were historically based could be in question, "Now, the fixed-but-satisfactory return pact has been broken in a few states, and investors are becoming apprehensive that such ruptures may spread". Xcel Energy the latest utility at riskShortly after the release of Buffett's investor letter, Xcel Energy confirmed that its assets are likely to have ignited the Smokehouse Creek wildfire in Texas. A lawsuit against the company has claimed that one of the company's utility poles near Stinnett, Texas, had been blown over by strong winds sparking the initial blaze. The fire based in the largely rural Texas panhandle and parts of Oklahoma burnt around 1.2 million acres, destroyed 400-500 structures, and is associated with two casualties. Despite it being too early to understand the potential legal liabilities facing the company, Xcel Energy's share price fell 17% (representing a c.US$6 billion devaluation in market capitalisation) in the week after media reports implicated the company in the fire. This again reinforced the risk facing electric utility investors from the unintended ignition of wildfires. The states, and therefore companies, physically exposedOne major problem in identifying wildfire risk is that the geographies exposed to wildfires are increasing over time as a result of global warming - which we touch on in our article, Extreme weather risks and their impact on investors. Despite the increasing occurrence, the states that are currently most exposed to wildfires are depicted by UBS below, utilising data provided by FEMA on the National Risk Index. The map shows that the highest risk areas are in the western, central and southern parts of the US.

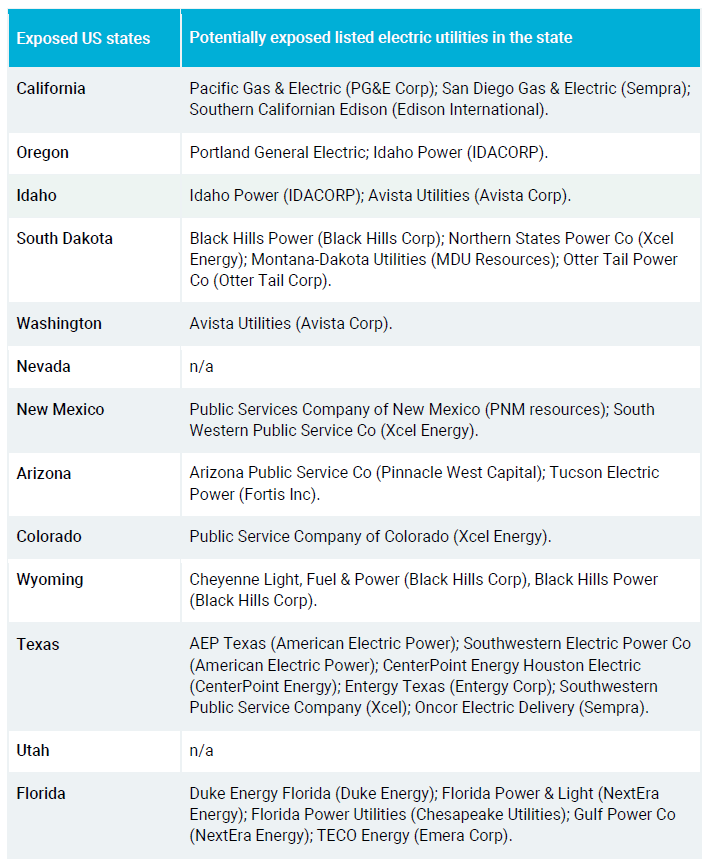

Source: California Board of Forestry and Fire Protection (CAL Fire) The map helps identify states that are most exposed to wildfires, and the utilities which have significant operations in those states (listed in the table below). This provides a first pass as to utilities in 4D's investment universe which have/could have risk from wildfires.

This a high-level geographic assessment only and captures many of the US utility operators. A deeper dive would see some with little real wildfire exposure at present as they operate in more urbanised areas with little vegetation to support the damaging fires - for example CenterPoint Energy Houston Electric (in the Texas section of the table above) have confirmed that their operations in downtown Houston is highly unlikely to be impacted. Other considerations to wildfire liability exposureOther major considerations as to electric utilities' exposure to wildfire liabilities include: 1) how prepared electric utility companies are to mitigate physical wildfire risks; 2) what litigious environments exist in various states; and 3) are companies able to manage wildfire liabilities of various scale if incurred? These are the areas that 4D undertakes significant due diligence in when considering a company for investment. When researching a potential investment in a US electric utility that is in (or could develop into) a high wildfire risk geography, we spend significant time understanding the company's wildfire mitigation preparedness. This incorporates getting a thorough understanding of wildfire mitigation plans in its totality, which incorporates vegetation management processes, situational awareness (video monitoring of the network, lineman visual inspections, and drone surveillance), investment in hardening the network from fire ignition, and established public safety power shutdown (PSPS) procedures as a last resort. Significant investment in the insulation of overhead wires, replacement of weak/old power poles and undergrounding of wires in particularly high-risk regions all 'harden' the grid from wildfires. The particular litigious framework established in individual states identified in the table above vary considerably. Some key factors, which will influence the level of legal liability risk, include:

The question of a company's ability to manage wildfire liabilities will be dependent upon its balance sheet capacity and liquidity, which are obviously influenced by its size. Smaller electric utilities, including smaller municipal owned utilities, will be less able to manage large legal liabilities and are more likely to be forced into financial distress and/or bankruptcy. Could this be a driver of M&A consolidation in some states? A financially distressed company is unlikely to have the capacity and/or willingness to continue to invest much-needed capital in the networks (replacement, growth and hardening) which could hinder economic and social development in the exposed region. We expect there will be growing questions around insurance for these events - what can be insured, what premiums will do as this risk intensifies, and when does insurance pay out? It could get harder for utilities to protect themselves from this risk. 4D's approachWildfire risk is becoming a bigger concern for market investors and is probably something that is still being understood. At 4D, we don't recommend avoiding these companies from investment altogether. We do, however, recommend thorough due diligence of the risk to a company before taking a position. As always, we balance quality, risk and return in making investment decisions. In some cases, that risk will be too great - as Buffett outlines, there is the potential for the adoption of risk that outweighs the potential regulatory return of a utility, which can end up in the loss of all equity value (as experienced by PG&E Corp). However, in others we see the moderated risk more than compensated by valuations, with network hardening against fires also a strong driver of earnings growth. The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. [1] Warren Buffett's western utility facing untold billions in wildfire damages after the latest bombshell jury verdict came down - The Associated Press; 7/3/2024 [2] Charlie Munger - The Architect of Berkshire Hathway; Warren Buffett; 24/2/2024 Funds operated by this manager: 4D Emerging Markets Infrastructure Fund, 4D Global Infrastructure Fund (AUD Hedged), 4D Global Infrastructure Fund (Unhedged) |

22 Apr 2024 - Performance Report: Kardinia Long Short Fund

[Current Manager Report if available]

22 Apr 2024 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

22 Apr 2024 - Manager Insights | 4D Infrastructure

|

|

|

|

Chris Gosselin, CEO of FundMonitors.com, speaks with Sarah Shaw, Global Portfolio Manager and CEO/CIO at 4D Infrastructure. The 4D Global Infrastructure Fund (Unhedged) has a track record of 8 years and 1 month and has outperformed the S&P Global Infrastructure TR (AUD) benchmark since inception in March 2016, providing investors with an annualised return of 9.22% compared with the benchmark's return of 8.49% over the same period.

|

22 Apr 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Asymmetric Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Federation Alternative Investments II (Wholesale) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Federation Alternative Investments II (Retail) | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Nanuk New World Fund (Currency Hedged) | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Pengana High Conviction Property Securities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |

19 Apr 2024 - Hedge Clippings | 19 April 2024

|

|

|

|

Hedge Clippings | 19 April 2024 US Fed Chair Jerome Powell has been walking back - or talking back - expectations for an imminent rate cut in the US for some time now. At the end of last year, market expectations were for the Fed to cut up to six times this year. Following the Fed's March meeting Powell told a Senate committee hearing that they (cuts) were "not far" which resulted in the market expectations being reduced to three. At the beginning of this month, Powell was saying cuts were still likely, but only "at some point". This week he's saying rates can stay at current level "for as long as needed" if higher inflation persists. And it seems it is. Based on the latest US figures, the economy is running well, and as a result annual inflation to March came in at 3.5%, up from 3.2% a month earlier. There's even talk that the next move from the Fed may be up, which would require a major change of view from Powell from just three months ago. Our view has long been that following the spike in inflation post Covid, and then the seemingly quick reversal, the final one to two percent reduction to a hard target of 2% was always going to be difficult, unless of course there was a recession or hard landing. Currently, that hard landing scenario seems unlikely both in the US and locally. Even though March unemployment rose slightly in Australia to 3.8%, it is still a long way from the level Michele Bullock indicated it would need to be to cause an issue. Still at home, Australia's CPI numbers are due next Wednesday and will be crucial to the RBA's thinking. February's seasonally adjusted CPI number year-on-year was 3.7%, up from 3.5% in December, and just as it is in the US, that's heading in the wrong direction. There's a real risk that consumers get used to inflation between 3-4%, possibly just thankful it's half the level it was a year ago. With wage rises well above that in many sectors, along with government largess and generosity, and Stage lll tax cuts just around the corner, the RBA's fear of entrenched inflation of 3-4% is all too real. News & Insights New Funds on FundMonitors.com Manager Insights | 4D Infrastructure Market Commentary | Glenmore Asset Management Investment Perspectives: Aussie interest rates are heading for zero (again) | Quay Global Investors March 2024 Performance News Bennelong Long Short Equity Fund Skerryvore Global Emerging Markets All-Cap Equity Fund Argonaut Natural Resources Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

19 Apr 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

19 Apr 2024 - Why 2024 will be a 'show me' year

|

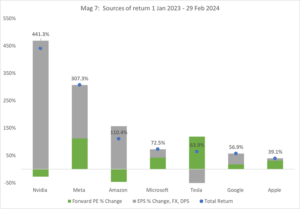

Why 2024 will be a 'show me' year Alphinity Investment Management March 2024 2023 global equity returns were dominated by an alphabet soup of megatrends. From (Chat)GPT shining the spotlight on the lifechanging potential of Generative Artificial Intelligence (GEN AI), to a broader adoption of Glucagon-Like Peptide -1 (GLP-1) diabetes drugs for weight loss and other obesity-related diseases. These megatrends resulted in extraordinary share price movements across multiple sectors as investors crowded into the themes and quickly decided who the winners and losers may be. As we head into the third month of 2024, we continue to see these megatrends dominate equity market returns. In contrast to 2023, there is a clear bifurcation between megatrend beneficiaries that can deliver revenue and earnings growth and those that can't. This is not only evident within the Magnificent 7 ("Mag 7"), but also across other so-called GEN AI and GLP-1 winners and losers. Alphinity continues to have selective exposure across both megatrends. Within GEN AI, we have exposure to early AI winners, such as Nvidia and Microsoft. In addition, we continue to invest in opportunities across the broader AI ecosystem. SK Hynix, ASML, Cadence and Accenture are examples of technology enablers and facilitators where AI is augmenting company performance. Importantly, we continue to look further afield across sectors to companies not only enabling AI but those that will also reap its benefits. We also have a nuanced exposure to the GLP-1 megatrend where the initial market clamour to define "winners" and "losers" delivered some interesting opportunities. While market leader and key GLP-1 winner, Novo Nordisk, has seen strong share price gains, assisted robotic surgery company Intuitive Surgical was initially dropped into the loser bucket on account of minor exposure to gastric banding. The market has since recalibrated ISRG expectations, and the shares have more than recovered the initial knee jerk reaction. A further broadening out of these megatrends should continue to create exciting new "show me" opportunities in 2024 and beyond. GEN AI - Show me the earningsGEN AI truly entered our lives in 2023. OpenAI's humanlike generative AI Chatbot, ChatGPT kicked off a wave of excitement across consumers and companies. What ensued was a whirlwind of AI investments and developments across multiple industries as companies explored different ways of delivering AI building blocks or integrating these technologies into their businesses. During 2023, many companies in the AI ecosystem got swept up in the euphoria. From the enablers and infrastructure providers on the front end (such as semiconductor makers and data centres) to those that design software and provide related services (including end-user applications and cloud computing), amongst others. None more so than the Mag 7. While 2023 saw the rising AI tide lift most Mag 7 boats, year-to-date there has been a large divergence in performance amongst the group, defined by those that can deliver earnings growth to justify high multiples and those who can't. AI posterchild, Nvidia, has added another c60% YTD, to be up more than 440% since the start of 2023. Importantly, during this time the Nvidia forward PE multiple has come down, from 44x to 32x. The stock has got cheaper as earnings have outstripped the remarkable share price growth. Other major enablers such as Amazon and Microsoft have continued to rally supported by strong results from increased AI demand also. Meanwhile Tesla and Apple have been dethroned by GLP-1 winner Eli Lilly and AI winner ASML, who now occupy their top 7 spots in YTD contributors. Both Tesla and Apple are facing a range of challenges, but also recently disappointed investors with the lack of progress with their AI related plans. Bifurcation within the Mag 7 driven by strong earnings power or the lack thereof: Nvidia derated despite 441% return over the 14 months

Source: Bloomberg, 29 February 2024 While industry data suggest a rapid adoption of AI across industries, the enablers continue to lead the charge year-to-date. Recent 4Q23 result releases and capex intentions underscore the longevity of investment intentions across enablers and adopters. AI mentions were at all-time highs as AI diffusion becomes more commonplace and remains a top CIO priority. While AI is emerging as one of the largest innovation cycles in decades, we are only in the early innings of its diffusion. It will take time for AI to impact revenues and margins more meaningfully and more broadly.

ConclusionIn times when the stock market is infused with captivating megatrends, such as GEN AI and GLP-1, there is a tendency for investor expectations to overshoot. Resulting in share prices of perceived beneficiaries running on speculation and the fear-of-missing-out rather than fundamentals. The intense market concentration and diverging price movements of the last 14 months is a good case in point. Looking ahead, we expect to see a continuous evolvement and adoption of both GEN AI and GLP-1. Assessing long term winners and losers along the way will be crucial and fluid. At Alphinity, we will continue to deploy our agile, tested investment process to find "show me" megatrend earnings leaders in 2024 and beyond. |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

18 Apr 2024 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

18 Apr 2024 - An upgrade to the financial system's plumbing

|

An upgrade to the financial system's plumbing Pendal April 2024 |

|

THE plumbing of Australia's financial system is a bit like the plumbing in your house - of little interest until something goes wrong. For those few who do take an interest in the RBA and our financial system's plumbing, the Assistant Governor Chris Kent gave a speech on Tuesday last week: "The Future of Monetary Policy Implementation". By the end of this year, he explained, Australia will have a new system called "Ample Reserves". In short, the central bank will set a price for "Open Market Operations" (repos) and offer unlimited quantity - instead of setting the quantity and letting the market determine the price, as was the previous system. Banks have been flush (so to speak) with liquidity since early 2020, courtesy of RBA quantitative easing and the term funding facility over the pandemic. These are now slowly rolling off, reducing excess reserves in the system. The RBA is worried that the pre-pandemic "corridor and low reserve" system may not work so well. That system relied on the RBA accurately forecasting government inflows and outflows into the system (think taxes and welfare payments) and offsetting them by adding or draining the cash back into the system through repos and reverse repos. You lend them securities and they give you cash that you then pay interest on or vice versa. The corridor meant banks could always borrow or lend unlimited funds with the RBA at 0.25% above or below target cash, but hardly ever did. With Ample Reserves, banks can go to the RBA and offer unlimited securities to repo in return for cash (OMOs) at a pre-set margin to the official cash rate. The price and frequency of these operations are yet to be determined but look like at least weekly and something like the target cash rate plus five basis points (currently 4.40%). The RBA will release more details later in the year after market consultations. So, what does this mean for investors?The good news for leveraged portfolios is that there is now an "ample" supply of central bank liquidity at a reasonable price. For investors, the good news is that overnight cash should eventually drift back towards target cash levels rather than sit at the ES level. This would mean closer to 4.35% than 4.25% at current cash targets. The bad news for investors, however, is that bank bills are less likely to drift too far above cash again. Also, for relative value funds, government bond baskets (where bonds trade to futures) are less likely to get too cheap again. Overall, it is a new era for the RBA. It is not only temporarily moving out of the asbestos-ridden 65 Martin Place while expensive and long overdue renovations are undertaken, but it now has a new way of ensuring system liquidity is always rock solid. Author: Tim Hext, Pendal portfolio manager and head of government bond strategies |

|

Funds operated by this manager: Pendal Focus Australian Share Fund, Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Regnan Global Equity Impact Solutions Fund - Class R, Regnan Credit Impact Trust Fund |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |