NEWS

17 May 2024 - Hedge Clippings | 17 May 2024

|

|

|

|

Hedge Clippings | 17 May 2024 The next federal election is not due for another year, but the budget handed down on Tuesday had all the hallmarks of a government preparing for the polls without actually setting the date. Jim Chalmers won't admit it, but based on this comment from Chris Richardson during the week: "If the enemy is inflation, the IMF says you should cut spending and raise taxes. Instead, we're getting a very big tax cut and almost matching that with large increases in spending," then we're heading for trouble. If Richardson is correct, and we're certainly not going to doubt him, then Chalmers is at odds with the IMF, as well as one of Australia's top economists. Meanwhile, Treasury (presumably the advice he's relying on) is at odds with the RBA's estimate of inflation as pointed out in this piece: "Treasury has inflation heading in one direction - down - while the Reserve Bank says the opposite. They can't both be right, and what happens will play an outsized role in deciding when, or if, the central bank cuts interest rates. The government claims the budget has been designed to take three-quarters of a percentage point off inflation this year and another half a percentage point next year, while unemployment will rise slightly to 4.5 per cent next year. Time will tell if Treasury or the central bank - which has forecast inflation to be 3.8 per cent in December this year - is correct. Without a rate cut, there is close to zero chance of an early election." So Jim's budget is increasing spending via handouts across the year, topped up by Stage 3 tax cuts due in July, and wage increases already announced or in the pipeline, hoping inflation will reduce to 2.75% mid next year (around the scheduled election time) while the RBA's own forecast is for it to still be 3.2%. Given the RBA's stated driver of interest rates is taming inflation, there's a chance of a rate cut - or possibly more than one - by this time next year, but only if their forecasts are correct, and it's a big IF based on the stickiness of inflation to date. In the government's favour, this week's employment figures (along with some positive signs from the US) showed unemployment creeping up to 4.1% on a seasonally adjusted basis. The RBA's other role of maintaining full employment is secondary to inflation, but it is noteworthy that the number of unemployed people has risen 13.7% from one year ago, and Michele Bullock is on record as saying an unemployment rate of 4.5% or above would be required to have a significant effect on reducing inflation. You can't blame the Treasurer for pitching the budget and blowing the "surplus" trumpet towards the next election - whether in December or in the first half of next year, but he is ignoring the longer term deficits. He'll worry about those in due course, or leave them to his successor. News & Insights Magellan Global Quarterly Update | Magellan Asset Management April 2024 Performance News Bennelong Long Short Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

17 May 2024 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

16 May 2024 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

16 May 2024 - Quarterly consumer price index update

|

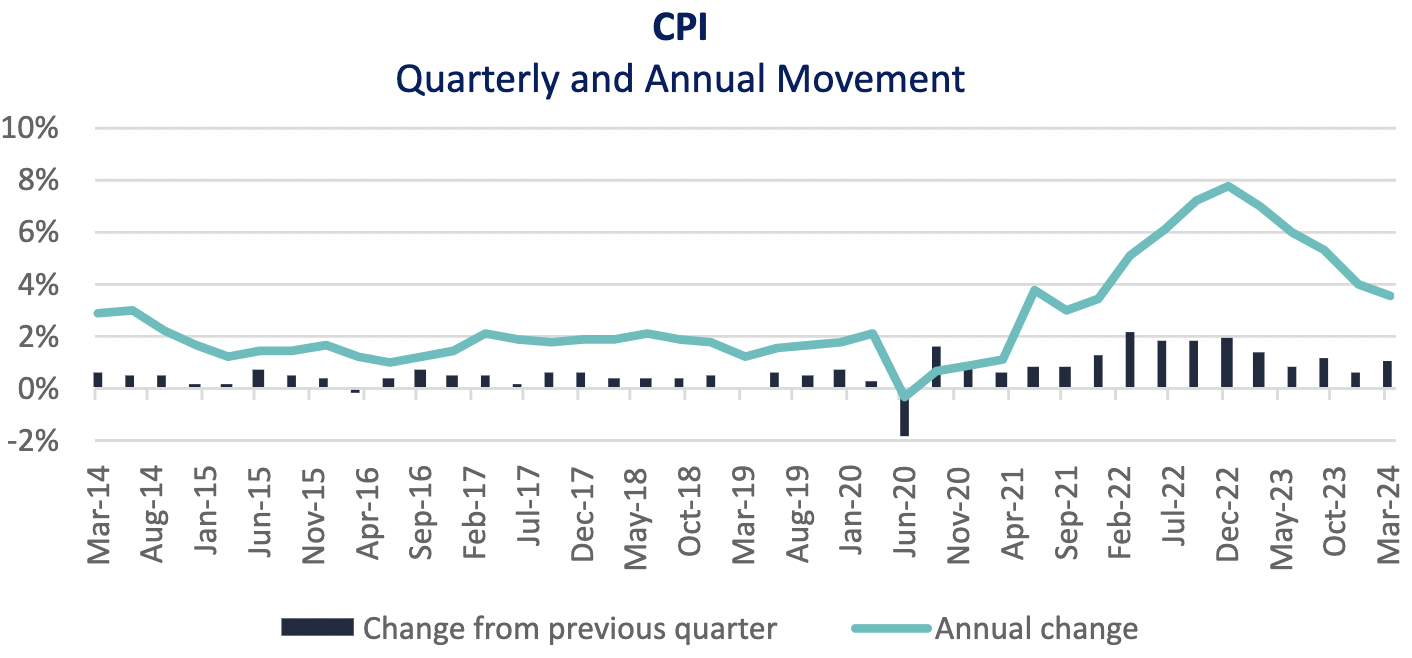

Quarterly consumer price index update Montgomery Investment Management May 2024 The long-awaited quarterly consumer price index (CPI) figure was reported this week. Over the March quarter, CPI rose by 1.0 per cent, which follows the previous 0.6 per cent December quarter increase. Over the 12 months to March 2024, CPI rose by 3.6 per cent. Whilst the annual rate of inflation is trending downwards, the quarterly figure increased by 0.4 per cent and poses ongoing challenges. Education fees rose by 5.9 per cent. This uplift was the strongest quarterly rise reported since 2012. Similarly, the U.S. faces ongoing inflationary challenges. The annual inflation rate rose by 3.5 per cent in March, a 0.4 per cent increase from the 3.2 per cent reported in February. The market anticipated 3.4 per cent. Both central banks require confidence that inflation is steadily slowing back within their respective target ranges. Widely speaking, it is evident that there is economic turbulence with ongoing geopolitical uncertainty having widespread global economic affects. Back home, other factors to consider are the strong labour market and upcoming tax cuts. The labour market remains relatively tight with the unemployment rate at 3.8 per cent in March. This coupled with the incoming stage three tax cuts, provides more turbulence and adjustment in the RBA's economic outlook and monetary policy decisions.

Author: Natalie Kolenda Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

15 May 2024 - Performance Report: Altor AltFi Income Fund

[Current Manager Report if available]

15 May 2024 - JH Explorer in Charleston: Power cabling the energy transition

|

JH Explorer in Charleston: Power cabling the energy transition Janus Henderson Investors April 2024 Ever wondered how the clean green electrons generated at offshore wind farms find their way onshore? I recently visited historic and picturesque Charleston in South Carolina to see Nexans' electricity cable-making facility. My due diligence site visits often focus on the extraction and processing of copper, but we also invest in companies using that copper to make products to enable electrification and decarbonisation. In the case of Nexans, that copper and aluminium is utilised to make high voltage cables to transmit electrons from where they are generated to where they are needed. The electric cable industry is dominated by companies such as Nexans, Prysmian and NKT. This industry is benefiting from an unprecedented wave of demand and bottlenecks in supply chains, as offshore wind farm developers and electricity grid infrastructure companies are racing to build out new capacity and strengthen grids.

The Nexans facility is truly impressive and this made me realise just how tough it is to break into the high-end cable market. It is really complicated and difficult to make these high voltage wires and even trickier to load the immensely heavy spools of cable onto specially constructed vessels and then lay them in tough offshore environments without damaging them. Nexans also allowed us into their seemingly space-age cable testing centre, where lightning strikes can be simulated, cables are tested for tiny levels of current leakage, or sufficient voltage is generated to take cables to their failure limits.

As I wandered around after my site visit, taking in the cobbled streets and exquisitely-preserved houses of the old French quarter, I discovered Charleston was called the 'Holy City' because of its tolerance of all religions. I reflected how in the late 19th century electricity had an almost divine status. It seems appropriate that the 'Holy City' is also now the place where the cables facilitating the electrification revolution are being made. Cash flow: the net balance of cash that moves in and out of a company. Positive cash flow shows more money is moving in than out, while negative cash flow means more money is moving out than into the company. Images published with permission from Nexans. IMPORTANT INFORMATION Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects. Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than, the broader market. Author: Tal Lomnitzer, CFA, Senior Investment Manager |

|

Funds operated by this manager: Janus Henderson Australian Fixed Interest Fund, Janus Henderson Australian Fixed Interest Fund - Institutional, Janus Henderson Cash Fund - Institutional, Janus Henderson Conservative Fixed Interest Fund, Janus Henderson Conservative Fixed Interest Fund - Institutional, Janus Henderson Diversified Credit Fund, Janus Henderson Global Equity Income Fund, Janus Henderson Global Multi-Strategy Fund, Janus Henderson Global Natural Resources Fund, Janus Henderson Tactical Income Fund This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. |

14 May 2024 - Performance Report: Skerryvore Global Emerging Markets All-Cap Equity Fund

[Current Manager Report if available]

14 May 2024 - Magellan Global Quarterly Update - April 2024

|

Magellan Global Quarterly Update - April 2024 Magellan Asset Management April 2024 |

|

Nikki Thomas and Arvid Streimann discuss key themes impacting the markets and providing opportunities for investors. Arvid discusses his recent trip to Washington which provided valuable insights into the future growth of AI innovation and adoption. Nikki touches on her future trip to China and how understanding the interplay between China and other economies is essential for businesses operating within China or competing against it in various sectors. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund, Magellan Core ESG Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

13 May 2024 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

13 May 2024 - Performance Report: Collins St Value Fund

[Current Manager Report if available]