NEWS

30 May 2024 - Performance Report: Emit Capital Climate Finance Equity Fund

[Current Manager Report if available]

30 May 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

30 May 2024 - The Great Reversals

29 May 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

29 May 2024 - Opportunities emerging from rising demand for AI computing power

|

Opportunities emerging from rising demand for AI computing power Alphinity Investment Management May 2024 |

|

The AI boom is likely to drive a surge in energy consumption after decades of sluggish demand. Powering energy-hungry data centres has become a significant bottleneck within the AI capex cycle. We take a closer look at the implications for global energy and gas markets, but also highlight various potential beneficiaries across different industries.

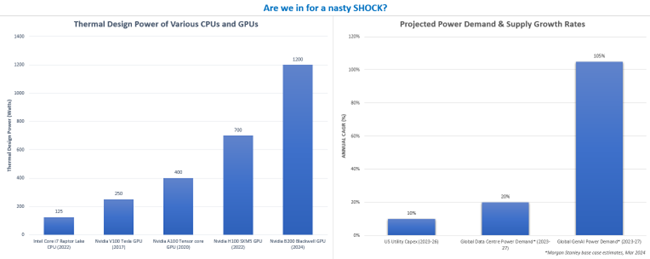

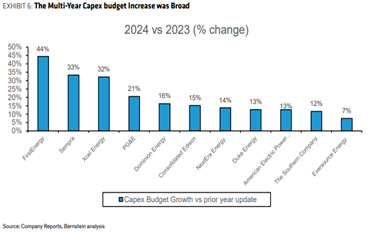

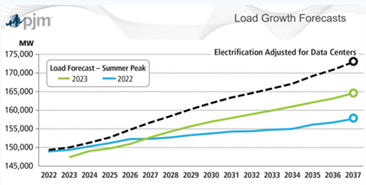

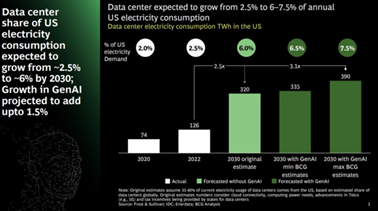

Source: Intel, Nvidia, Morgan Stanley, Company Reports, Alphinity How much energy do data centres consume today and may consume in the future?Generative AI and large language models have sparked strong rallies in some stocks, particularly those directly exposed to data centres. These centres, vital for AI processing, are reigniting electricity demand, challenging the adequacy of power supplies and infrastructure. The energy demand from data centres, already high, is predicted to grow, prompting significant investments in energy infrastructure, including natural gas and power distribution systems. Currently, data centres consume about 2.5% of global electricity, a figure Boston Consulting Group expect to rise to 4% by 2027 and as high as 7.5% by 2030, increasing the U.S. electricity demand at twice the rate of the previous decade. If correct, that will be equivalent to powering ~20% of all homes in the US. This surge underscores the urgent need for expanded power generation to prevent potential blackouts and is driving a meaningful uplift in capital expenditures by utility companies. With the U.S. leading the global data centre market, approximately 40% of global capacity, this trend is likely to be mirrored worldwide, affecting energy consumption and infrastructure development on an international scale.

Did you know?

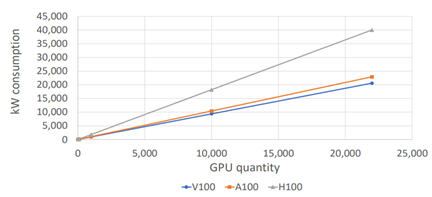

Estimating how this increased demand translates into actual electricity demandBottom-up analysis: GenAI to add 1% of incremental electricity demand growth per annumPower consumption in data centres is calculated by adding server and storage power use, multiplied by power usage effectiveness (PUE) and operating hours. By estimating GPU growth, chip utilization and power efficiency, one can project potential power needs. AI racks can need up to five times more power than traditional ones. AI data centres using GPU clusters, consume 30-100kW per rack. Taking this fact further, mature LLMs such as ChatGPT in inference mode, consume 400-1300 kWh daily, requiring significantly more power as user queries escalate post-training.

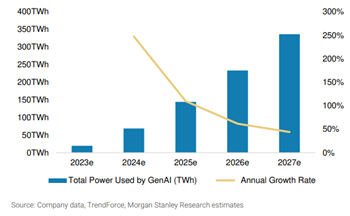

Source: Boston Consulting Group Assuming total GPU volumes rise from ~1.8m in 2023 to ~4m in 2026, custom silicon & GPU utilization rates range between 70-90% and data centre PUEs (a measure of a data centres energy efficiency) decline from 1.5 to 1.3, Morgan Stanley predicts incremental global data centre power usage will rise to 326-460 TWh by 2027, a significant increase from the current 360 TWh, with GenAI contributing about one-third of this demand. Schneider Electric estimates AI will account for a slightly lower 15-20% of the growth. This equates to a 105% compound annual growth rate for GenAI and 20% for overall data centre power, making GenAI's 2027 power demand comparable to Spain's and adding 1ppt of growth to overall electricity demand growth rates.

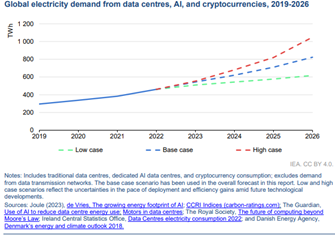

Top-down analysis: AI energy demands to double in 3yrsThe number of data centres are increasing rapidly, exemplified by Microsoft's plan to build up to one new data centre every three days, at the same time as the power intensity increases significantly. As such, BCG predicts U.S. data centre capacity will rise from 2.5% to up to 7.5% of total energy demand by 2030, increasing electricity demand by 260 TWh. McKinsey comes up with similar estimates, foreseeing power needs for U.S. data centres to double from 17GW to 35GW, equivalent to the current combined global capacity of the big 5 tech giants. Globally, institutions like the IEA foresee data centre, AI, and cryptocurrency electricity consumption doubling in the next three years to 1000 TWh, matching Japan's total power use. This surge suggests electricity demand growth could shift from stagnant for the past two decades, to 0.5-2% annually by 2030, raising questions about future supply sources. What source of energy is most likely to meet this demand?Owners of data centres, most of whom have committed to net-zero targets, face a dilemma with surging electricity needs. Renewable energy sources offer intermittent supply with 25-40% capacity factors and when paired with energy storage, higher costs. With the rapid growth in AI demand necessitating immediate and reliable power, gas generation emerges as a logical short-term solution, providing consistent electricity around the clock. Renewables will still grow in importance, especially as the cost of energy storage falls. Nuclear energy & small modular reactors are potential alternatives (see Amazon's DC acquisition), but challenged due to the long lead times to deploy and cost challenges. Recent discussions among CEOs and experts highlight the shifting demand landscape and gas's role in meeting these urgent energy needs.

This could drive an incremental 1% to 1.7% pa of unexpected demand for natural gasBernstein projects that with ~25% of the U.S. incremental demand met by gas-fired generation, an additional ~230 TWh would necessitate ~15GW new gas capacity, increasing gas demand by ~1.1 bcf/d or 1% of the total market. Under Morgan Stanley's scenario--70% renewables and 30% fossil fuels with 70% server utilization--gas demand would rise by ~13GW over 5 years. Jefferies, accounting for upcoming renewable installations and existing energy plans, forecasts an annual increase of 1.6-1.8 bcf/d in gas demand. Consequently, AI could boost U.S. gas demand by 1-1.7% annually in the late 2020s, potentially significant against an already planned 10 Bcf/d of incremental LNG exports (or ~1%). Additionally, this growth in data centre energy use could induce market volatility and regional imbalances. You are already seeing examples of crypto miners building server farms in the Permian where they can take advantage of cheap associate gas. Companies that can take advantage of the volatility through globally balanced gas portfolios and/or large trading capabilities will likely benefit. Addressing one key assumption - advancements in chip power efficiency gainsThis analysis contains multiple complex variables, such as diminishing chip power efficiency, the shifting power requirements as AI models transition from training to inference, and regulatory influences on renewable energy development and new gas infrastructure permitting. A critical factor in this context is compute intensity. Notably, while advancements in chip technology, exemplified by Nvidia's B200 Blackwell, yield substantial efficiency improvements per compute unit, the absolute power consumption continues to escalate, with the Blackwell chip (announced a fortnight ago) experiencing a 43% increase in maximum theoretical load compared to its predecessor, the H100.

Source: Schneider Electric White Paper: Challenges and Guidance for Data Centre Design ConclusionThe tech sector's rapid evolution often outpaces slower-moving industries and governments, potentially causing bottlenecks. While technological advancements may offer some relief, they may not suffice to meet the surging demand for power. Consequently, this growing need is expected to spark a renewed interest in gas-fired generation. Companies such as ConocoPhillips are well positioned to benefit from fulfilling this demand and capitalizing on the ensuing market volatility. Additionally, Alphinity has significant positions in the technology companies that are crucial to the rapid growth of AI, as well as exposure to the "picks and shovels" companies further up the value chain. These businesses are actively addressing emerging challenges, including managing heat generation, enhancing, and securing the electrical grid, and overcoming the scarcity of strategically located land. These include technology companies like Nvidia, Cadence Designs, Alphabet and Microsoft, alongside companies such as Trane Technologies, who are the leaders in data centre cooling solutions. Prologis, who are spending ~US$7-8bn over the next 5yrs to build 20 new DCs. ASML who manufacture advanced AI chip equipment, and Ferguson who supply infrastructure essentials such as pipes and fire suppression for DCs. Furthermore, our sustainable strategy owns Schneider Electric with 20% of sales to DCs and Quanta, the top U.S. grid EPC. Author: Chris Willcocks, Portfolio Manager |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Global Sustainable Equity Fund, Alphinity Sustainable Share Fund |

28 May 2024 - Performance Report: Digital Asset Fund (Digital Opportunities Class)

[Current Manager Report if available]

28 May 2024 - Trip Insights: Asia

27 May 2024 - Performance Report: ECCM Systematic Trend Fund

[Current Manager Report if available]

24 May 2024 - Hedge Clippings | 24 May 2024

|

|

|

|

Hedge Clippings | 24 May 2024

News & Insights Market Commentary | Glenmore Asset Management Investment Perspectives: 14 of the most important charts for data centre investors right now | Quay Global Investors April 2024 Performance News Argonaut Natural Resources Fund Bennelong Emerging Companies Fund Delft Partners Global High Conviction Strategy |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

24 May 2024 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]