NEWS

27 Jun 2024 - Transition trilemma: a reckoning for decarbonisation?

|

Transition trilemma: a reckoning for decarbonisation? abrdn June 2024 The transition in 2024 - reality bitesDecarbonisation, supply resilience, affordability: is it possible to solve all three? The old adage of the transition trilemma (balancing all three components of energy policy) has come starkly into focus again over the last 12 months. To some, the energy transition seemed unstoppable. But throw in some post-pandemic supply chain issues, stubborn inflation, cost-of-living pressures, a hefty dose of geopolitics, and the juggernaut is starting to stutter. It's going to be a bumpy ride and investors need to understand the implications. Decarbonisation in EuropeThe pace of decarbonisation in the European energy system has been impressive over the last decade. Around 70 gigawatts of renewable generation capacity was added in 2023 - a 17% increase on 2022 - and the bloc is well on the way to exceeding its target of 42.5% of energy consumption from renewables by 2030. The UK has also made substantial progress in some areas, such as reducing the emissions intensity of electricity by 64% since 2015. But since Russia's invasion of Ukraine there's been a noticeable rebalancing of attention towards energy security and affordability. This has become more pronounced over the last 12 months. Energy security and affordabilityIn the UK, the wind industry's cost problems were brought into sharp focus in 2023, when there were no bids for the fifth round of offshore auctions. In the transport sector, cost pressures also led to a slowing of electric-vehicle uptake across Europe, and policies to ban the sale of conventional passenger vehicles have been pushed out. The focus of policymakers, so far, has been firmly on decarbonising electricity generation, while other parts of the jigsaw have been neglected. This remains the case in the 'space and time' elements of the transition: getting renewable energy to where it is needed at the right time. This mismatch creates delays and adds costs for developers. The lack of storage, meanwhile, has led to periods of negative electricity prices and unused renewable energy. In order to retain system resilience, governments are forced to rely on gas-fired (or in some cases coal-fired) generation to do the hard work for longer. Facing the realityAll of these factors add up to a slower decarbonisation pathway. The UK's independent Climate Change Committee has major concerns about the country's progress against targets. Some analysts now consider it highly likely that the 2050 net-zero objective will be missed. In Scotland, the recent scrapping of the country's 2030 climate target was the catalyst for the collapse of the coalition government's power-sharing agreement. Similar patterns are playing out across the globe. Despite impressive progress, the energy transition is now facing some cold, hard economic and political realities. It's clear that the transition can't and won't happen without balancing energy security and the consumer's pocket. Case study - biomethane in ItalyFor infrastructure investors, we are used to navigating this complex situation to find opportunities to deliver long-term value for our clients. Our most recent investment in Italy provides an excellent example of combining the decarbonisation imperative with energy security and locking-in price certainty for the taxpayer. The country is looking to produce 30% of its energy needs from renewables by 2030 and, in line with overall EU ambitions, to fully decarbonise by 2050. With the support of the EU, the Italian government has decided to move away from using biogas for electricity generation. Instead, it's upgrading to biomethane to directly displace fossil gas in the grid. There's now a €4.5 billion incentive programme in place for biomethane in Italy. This is part of the EU's wider strategy to increase domestic production to 35 billion cubic metres by 2030. The strategy can support new biomethane plants, or the upgrading of existing biogas plants to produce biomethane, to reduce greenhouse gas emissions by at least 80% compared with conventional fossil gas. Importantly, the shift to incentivising more green molecules also reduces the country's reliance on imported fossil fuels. We established a partnership with Blu-H Energy, which has unrivalled knowledge of the market. It is helping us identify small-scale opportunities and build our platform. But not all sites are equal. There are several crucial criteria we consider when selecting appropriate sites. First and foremost is the control of feedstock. It's not like installing solar panels in a field and waiting for the sun to shine. These plants need large quantities of inputs like manure and other agricultural waste. Securing this at the right price and quality is a key determinant of success. We like rolling up our sleeves and getting involved in this type of investment. Taking our time, getting to know a sector, and building the right relationships on the ground is how we create the opportunities and risk-adjusted returns for our clients. Final thoughts...The energy transition is at a crucial point. There's a recognition that it won't happen at any cost and a rebalancing towards resilience and affordability is underway. This creates complexity for investors. But as exemplified by the case of our biomethane investment in Italy, sometimes it's possible to tackle all three of the trilemma's imperatives at once. Author: Ruairi Revell, Head of Sustainability, Infrastructure |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund |

26 Jun 2024 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]

26 Jun 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

26 Jun 2024 - Performance Report: ECCM Systematic Trend Fund

[Current Manager Report if available]

26 Jun 2024 - 10k Words | June 2024

|

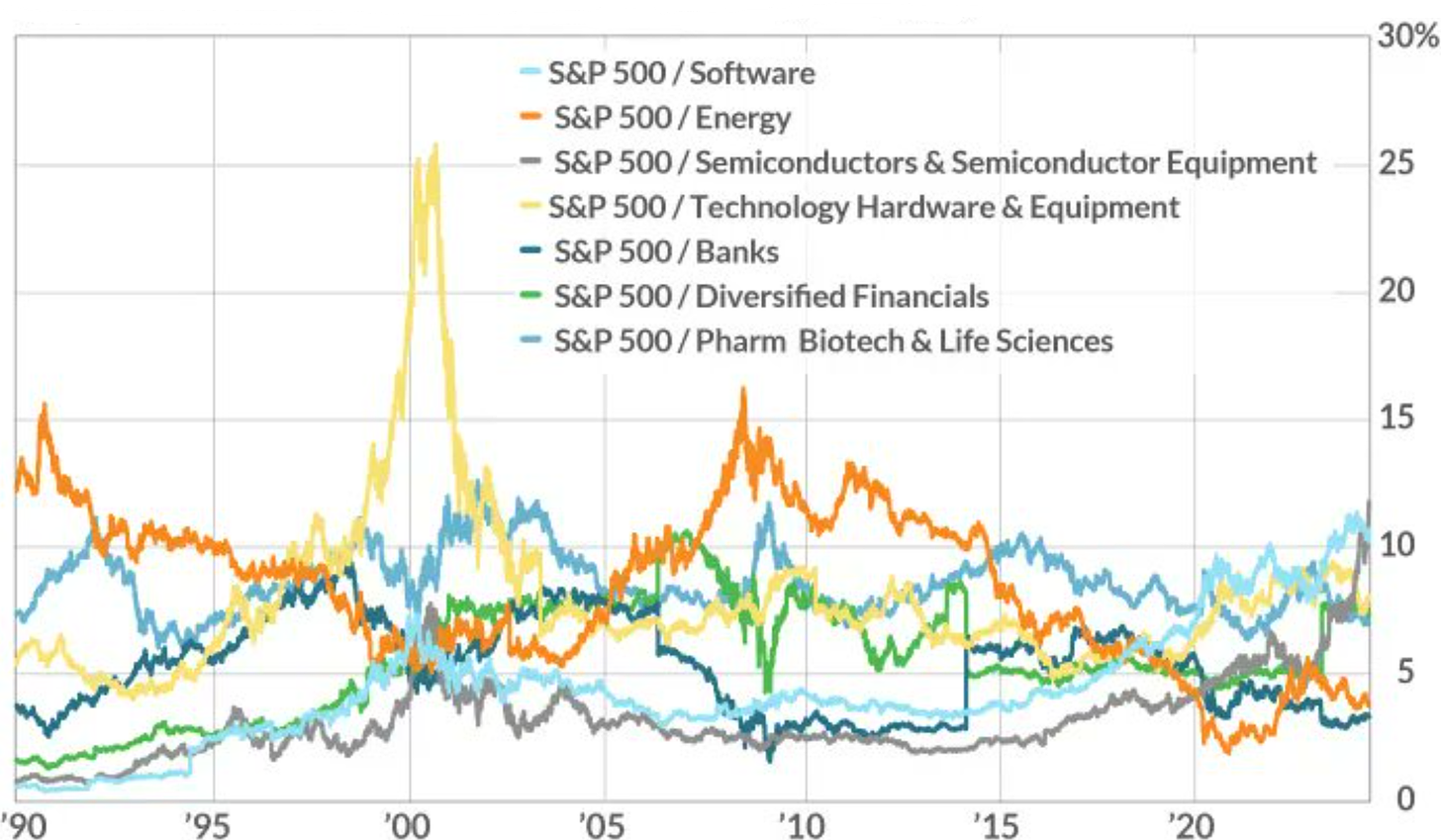

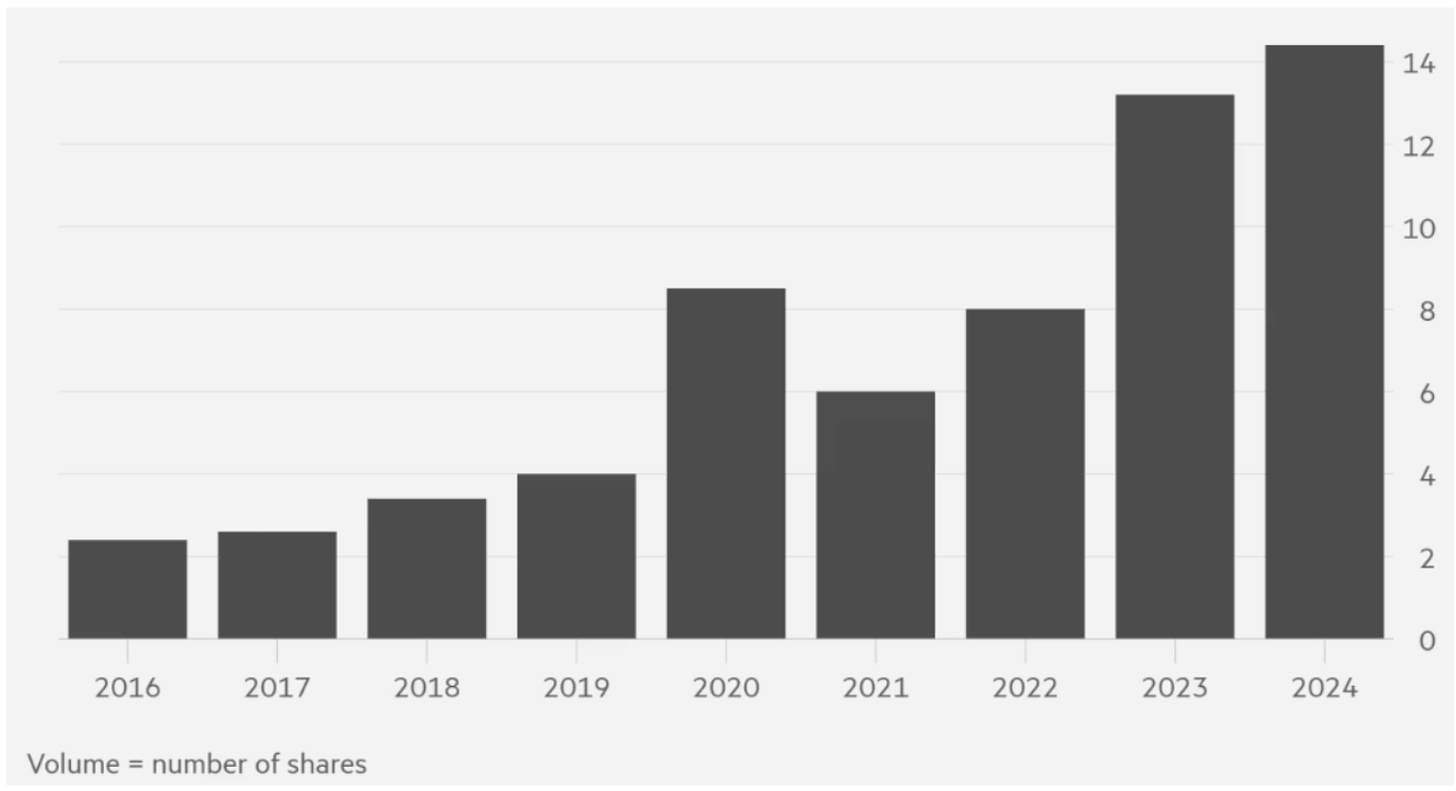

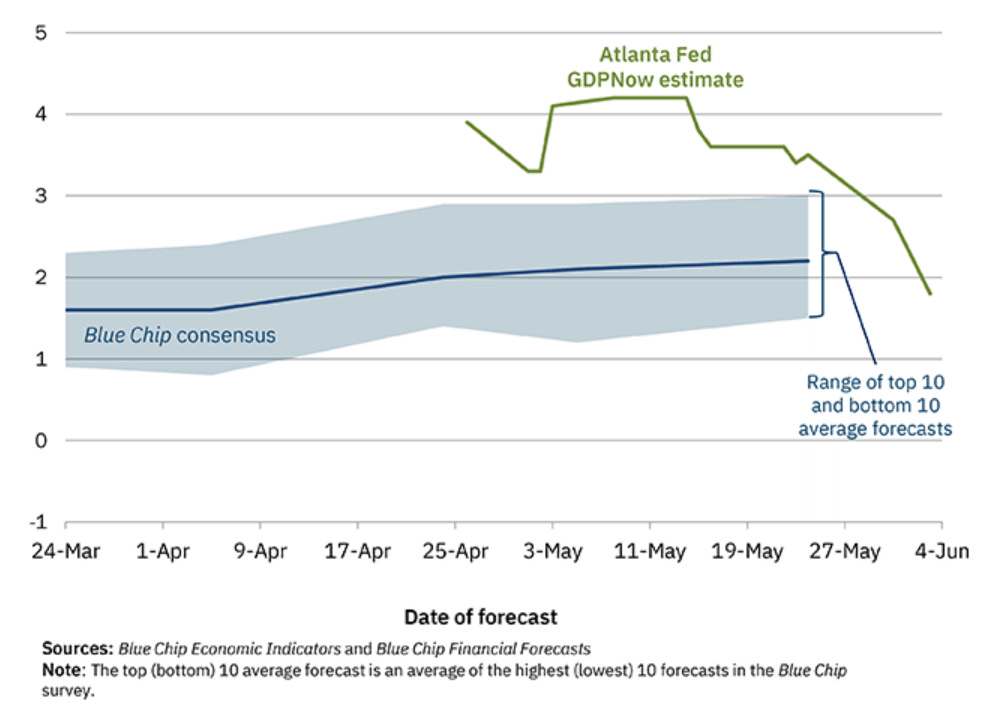

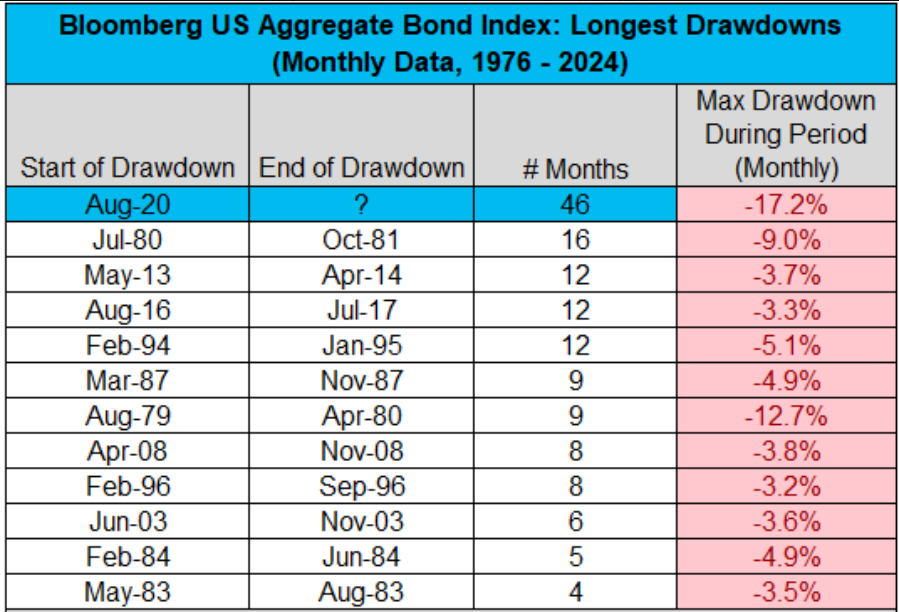

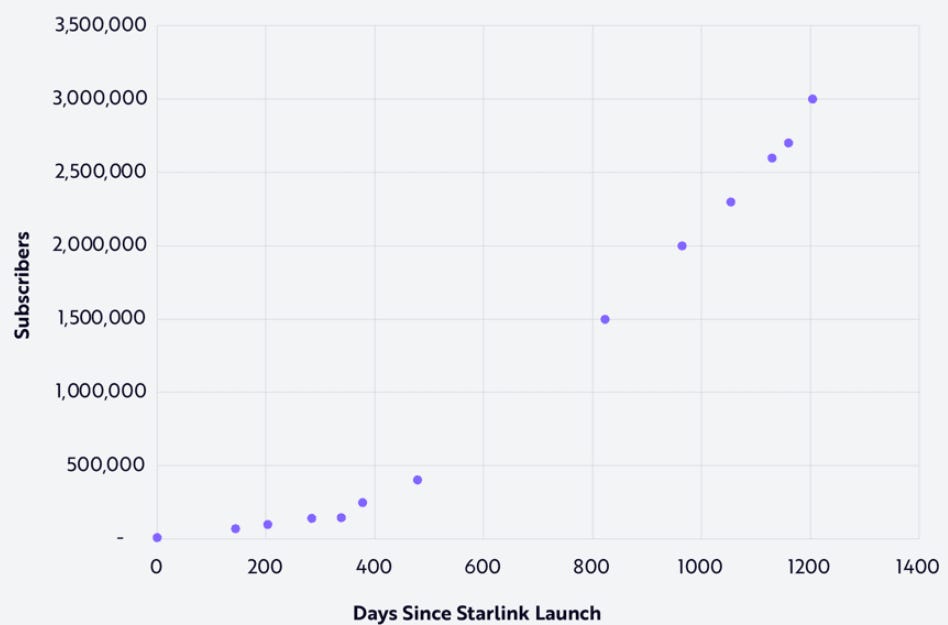

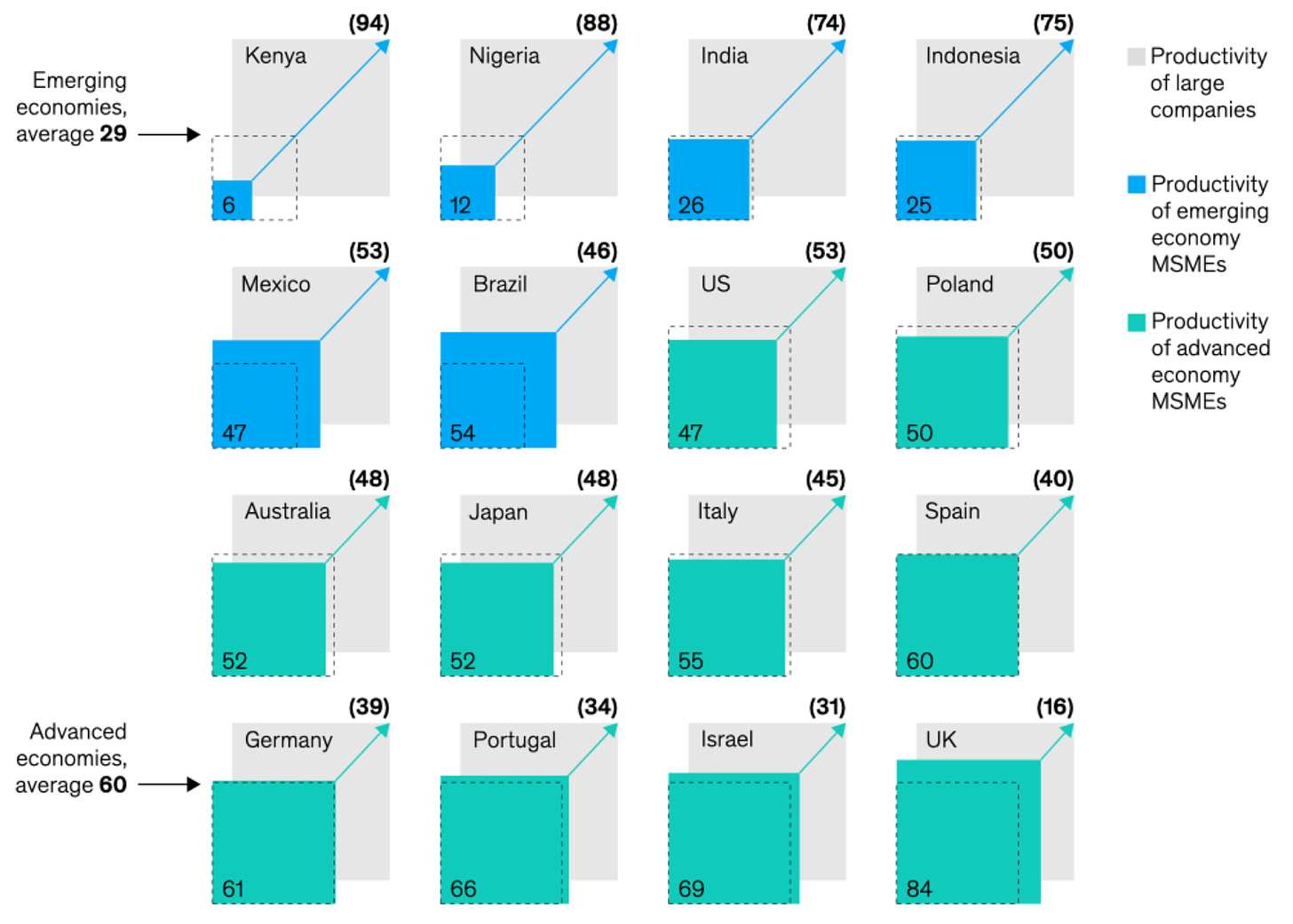

10k Words Equitable Investors June 2024 We have semiconductors snatching the sector title in equities as penny stock activity also rise in the US (not so much in Australia; and no mention of GameStop here, sorry). B2B SaaS growth moderates - as have tech EV/Revenue multiples - and strategists are now looking at strong US corporate earnings growth - will it drive capex or will it fall short itself as demand cools? The Atlanta Fed's GDP indicator has certainly dropped in recent days. Over in the US bond market, we are witnessing possibly the longest ever drawdown. Meanwhile, the Federal Reserve last held rates steady for over a year in the lead-up to the global financial crisis. Finally, we take a look at Starlink satellite customer numbers scaling up and the varying productivity chasm between small and large enterprises across nations. Semiconductors emerge with the heaviest weighting in the S&P 500 Source: FactSet (via @jessefelder) Share of US equities volume accounted for by "penny" stocks (trading at <$US1 a share) Source: Financial Times

Estimate of ex-S&P/ASX 300 volume relative to total ASX volume Source: Equitable Investors, Iress Net new sales for all "B2B" SaaS companies on ProfitWell Metrics since Jan 1, 2022 (seven-day growth rates, seasonally adjusted) Source: ProfitWell

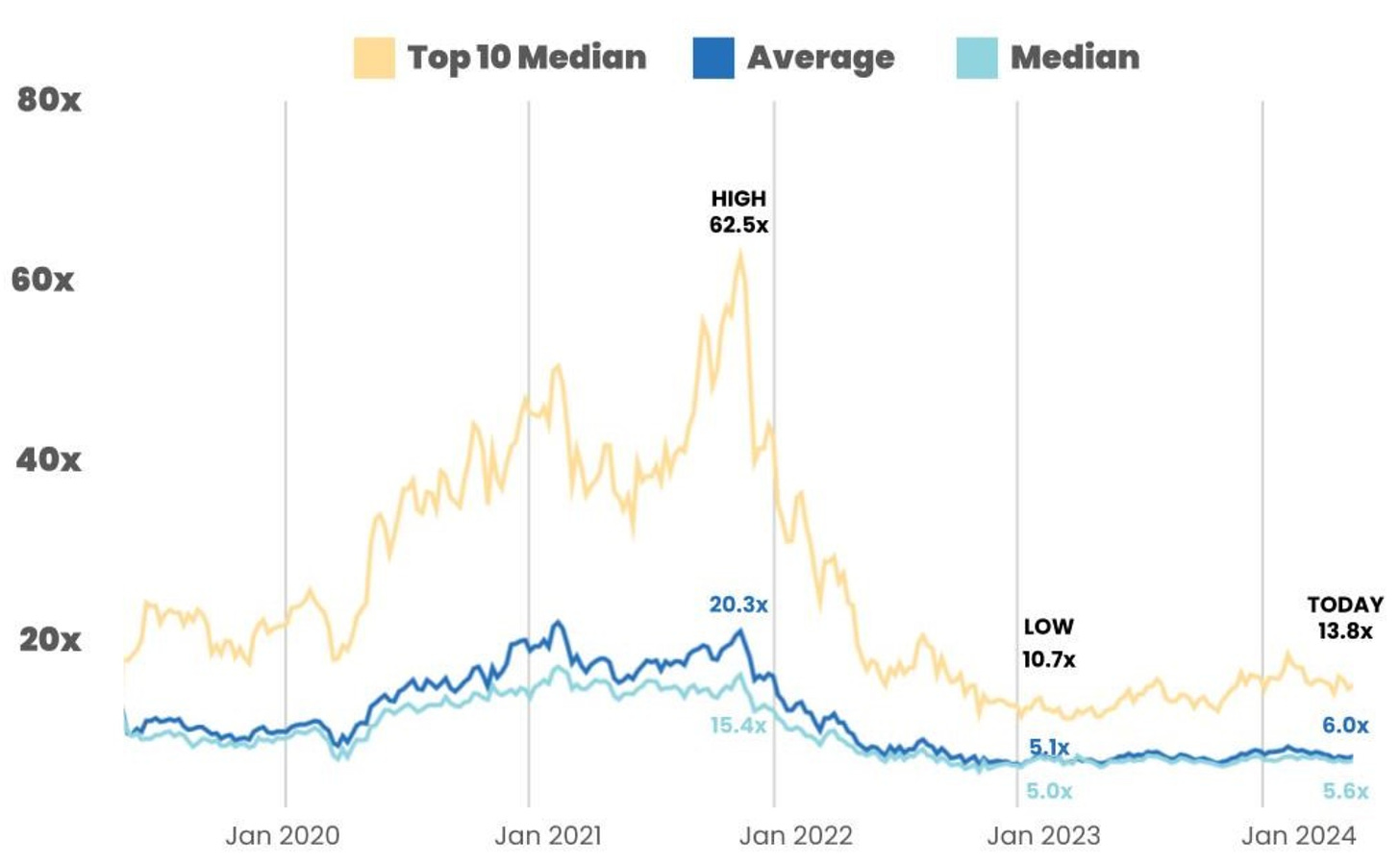

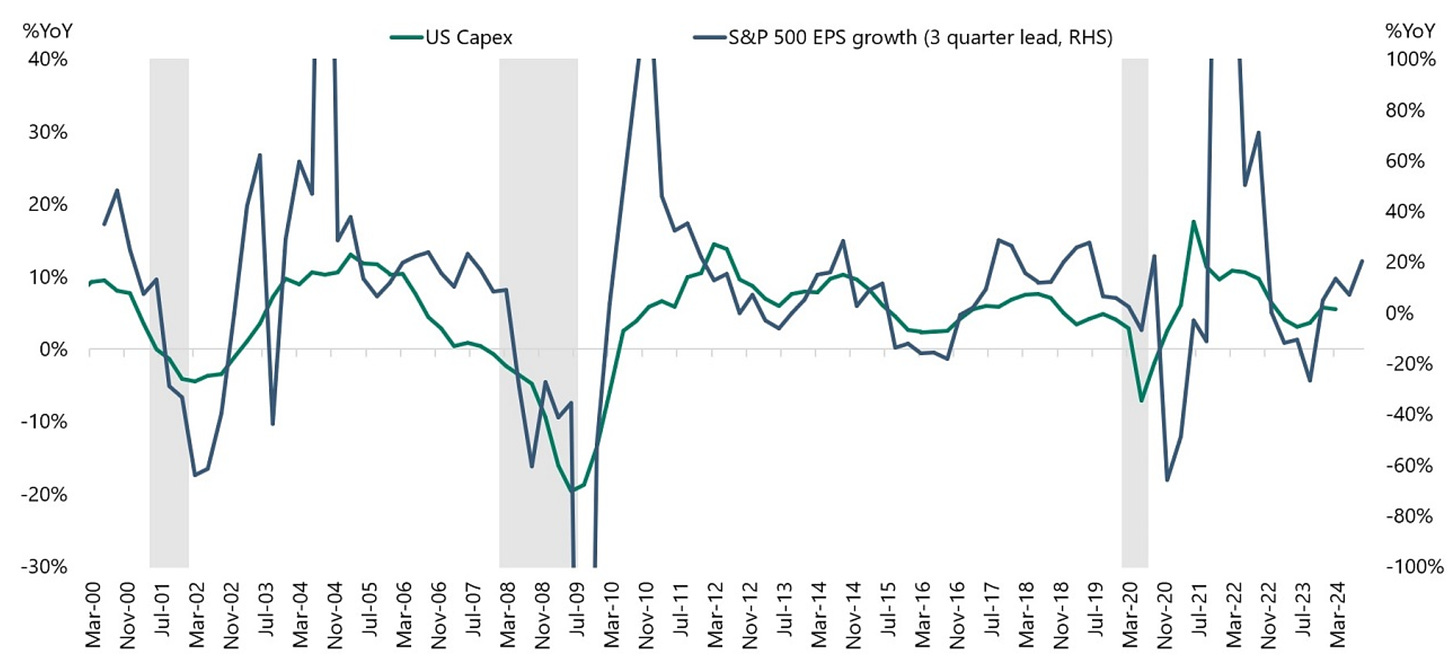

Technology sector EV/NTM (next 12 months) revenue multiples Source: Mostly metrics Strong S&P 500 earnings growth as lead indicator for capex spending Source: Apollo Chief Economist (BEA, S&P. Haver Analytics)

Evolution of Atlanta FedNow GDPNow real GDP estimate for 2024 Q2 Source: Atlanta Fed US Bond Market in a drawdown for 46 months Source: Creative Planning, @CharlieBilello One precedent for the Federal Reserve undertaking a long hold Source: Bloomberg Source: ARK Productivity of "Micro-, small, and medium-size" enterprises relative to larger firms by country Source: McKinsey June 2024 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

25 Jun 2024 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

25 Jun 2024 - Performance Report: Digital Income Fund (Digital Income Class)

[Current Manager Report if available]

25 Jun 2024 - Australian Secure Capital Fund - Market Update

|

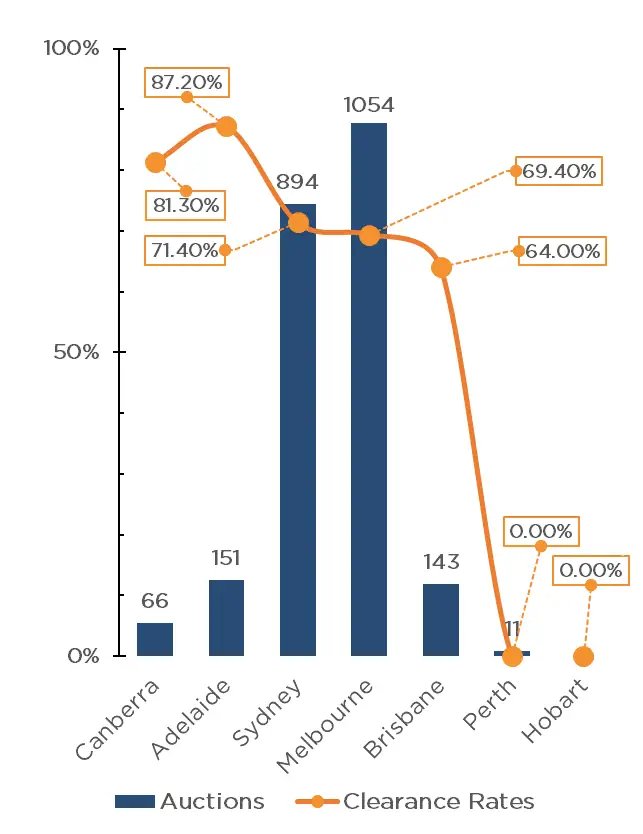

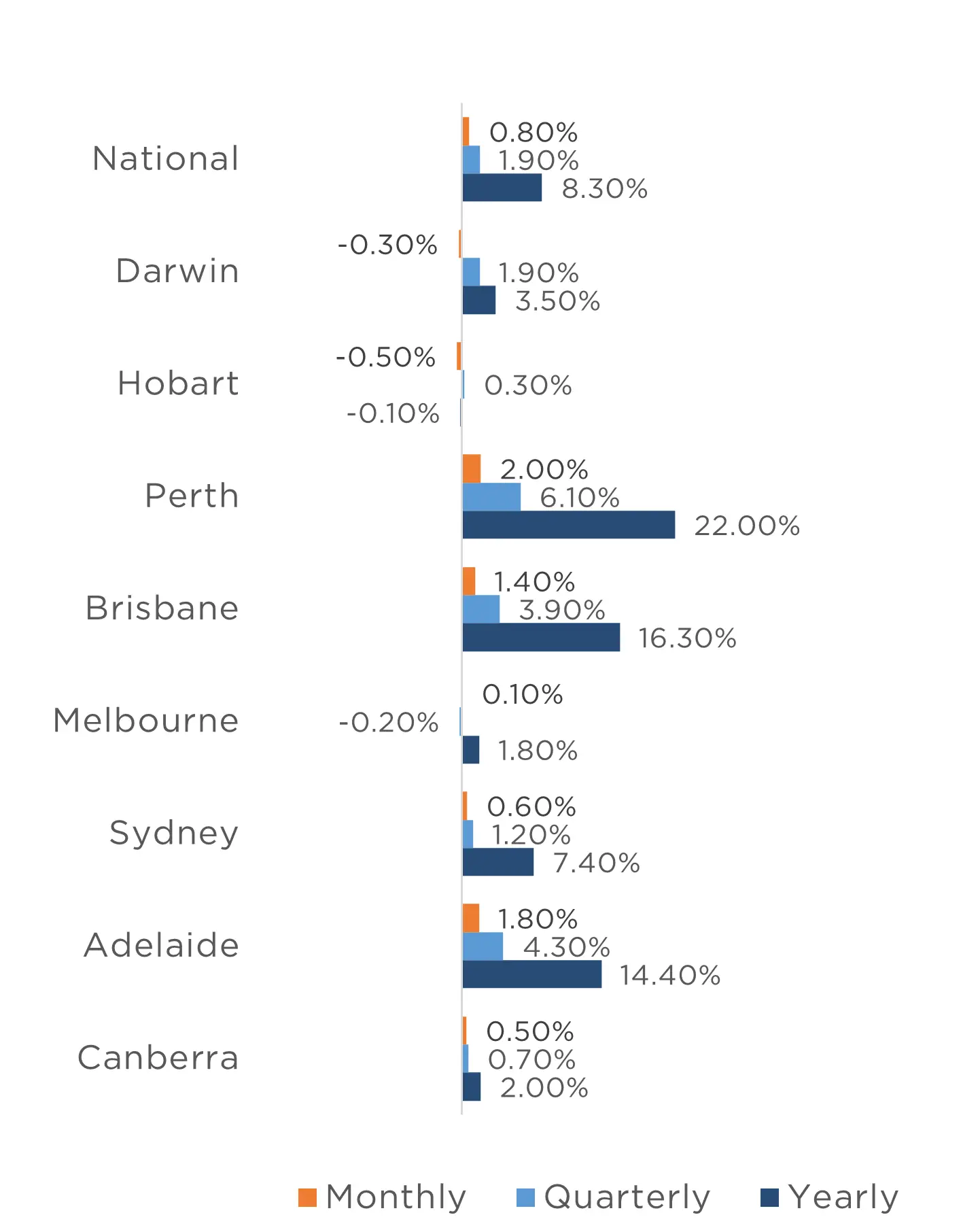

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund June 2024 For the 16th consecutive month, property prices across the capital cities have risen, with CoreLogic's Home Value Index reporting a 0.8% increase for the month of May, the largest monthly gain since October 2023. The regions also continue to experience growth, with a combined 0.6% increase. Perth continues to be the highest performing market, increasing by a whopping 2% for the month, with Adelaide and Brisbane also recording strong growth of 1.8% and 1.4% respectively. Sydney, Canberra and Melbourne also experienced growth for the month, increasing by 0.6%, 0.5% and 0.1% respectively, whilst only Hobart and Darwin recorded a reduction in dwelling values, of 0.5% and 0.3% respectively. The RBA is scheduled to next meet on the 18th of June. Whilst we believe a further increase to interest rates is unlikely, the undersupply of new housing and low tenancy vacancy rates should, in our view, ensure property prices remain strong regardless of the RBA decision. Clearance Rates & Auctions week of 2nd of June 2024

Property Values as at 1st of June 2024

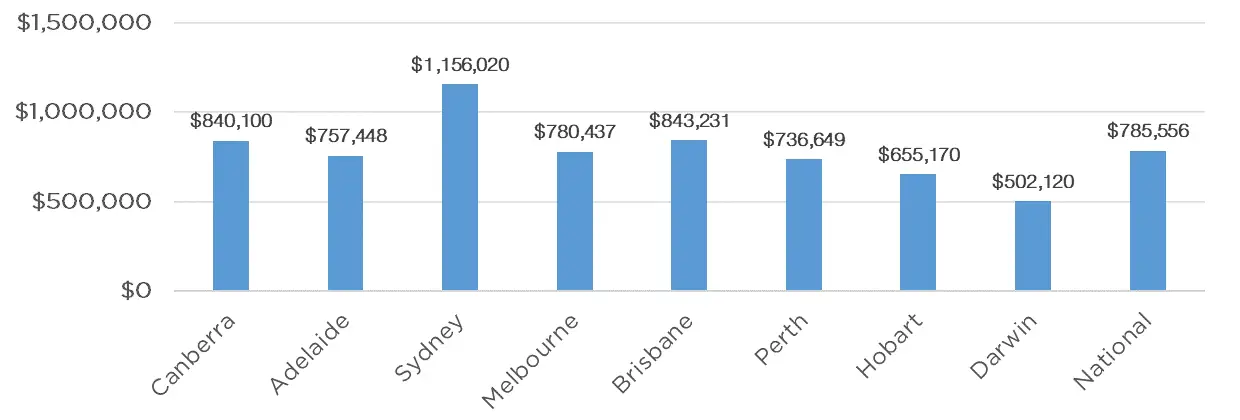

Median Dwelling Values as at 1st of June 2024

Quick InsightsInvestor's RushLoans in the investment property market spiked in April, new home loan commitments to investors jumped 5.60% from March, the fastest rate of gain since November 2021. Commonwealth Bank senior economist Belinda Allen said, "There's no end to price impacts from the lack of supply and strong demand. It's economics 101″. Source: Australian Financial Review Australian Apartments Up AgainThere has been a 26% national increase in apartment selling prices, primarily benefiting higher-end developments, this surge alone is driving the rise in new home completions to 28,000 this calendar year. This figure marks the highest in four years, compared to the previous total of 32,000. However, Urbis director Mark Dawson emphasized that without a corresponding decrease in borrowing or materials costs to make lower-priced unit projects financially feasible, the current spike in completions might taper off in the future. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

24 Jun 2024 - Performance Report: Bennelong Twenty20 Australian Equities Fund

[Current Manager Report if available]

24 Jun 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Maple-Brown Abbott Australian Small Companies Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Acorn Capital NextGen Resources Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Acorn Capital Micro Opportunities Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Impax Sustainable Leaders Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| Invesco Global Real Estate Fund - Class A | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 800 others |