NEWS

26 May 2023 - The Rate Debate - Ep38 - Mixed signals from RBA creating market confusion

|

The Rate Debate - Ep38 Mixed signals from RBA creating market confusion Yarra Capital Management April 2023 Hitting the economy with surprise after surprise, the RBA takes another fresh assault to tackle inflation head-on by taking the cash rate to 3.85%. Continued mixed signals from Australia's central bank are causing havoc within the domestic economy. With the RBA not ruling out further rate hikes, Darren and Chris look into the impact on markets and discuss their thoughts on the future of the RBA in episode 38 of The Rate Debate. |

|

Funds operated by this manager: Yarra Australian Equities Fund, Yarra Emerging Leaders Fund, Yarra Enhanced Income Fund, Yarra Income Plus Fund |

25 May 2023 - Changing of the Guard: Re-shoring to Drive a Manufacturing Resurgence

|

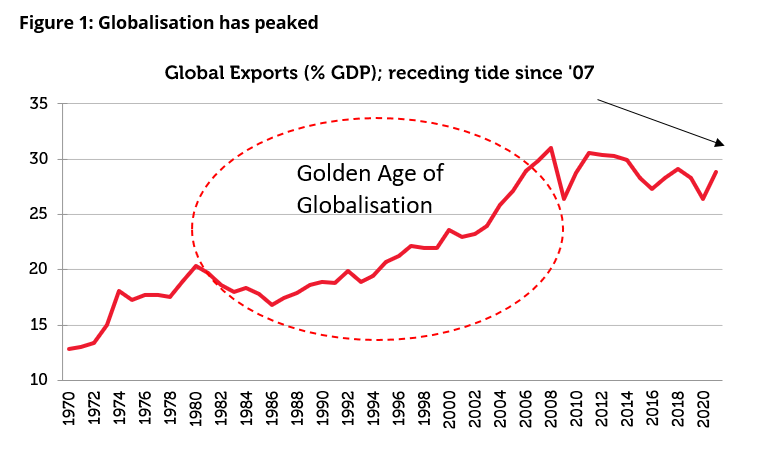

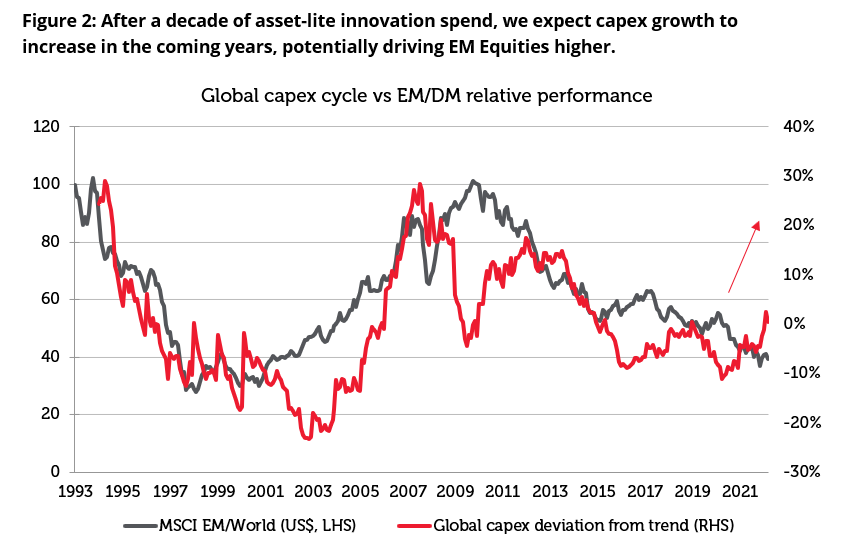

Changing of the Guard: Re-shoring to Drive a Manufacturing Resurgence Redwheel (Channel Capital) May 2023 Over the past decade we have seen more investment in asset-light innovation and technology than in any previous business cycle. The world is now awash with food delivery apps and online gaming and video streaming services. This investment has generally been driven by low inflation and a low cost of capital. However, we believe that the world is now entering a new asset-heavy economic cycle characterised by higher inflation, positive real interest rates and increased tangible capex as the world's priorities shift towards more spending on defence, renewable energy and localised manufacturing supply chains. As the macro environment is changing, we believe that the geopolitical environment is also evolving in a way that is very different to the one that shaped the secular bull market in trade of the 1990s and 2000s. In 1986, the pivotal Uruguay Round of the General Agreement on Tariffs and Trade (GATT) marked the start of a new era of globalisation. World trade expanded rapidly following the collapse of the Berlin Wall in 1989 and the signing of the North American Free Trade Agreement (NAFTA) in 1994. India joined the World Trade Organisation (WTO) in 1995 and China finally gained entry in 2001. Between 1995 and 2010, the pace of world trade grew at twice the rate of world GDP.[1] The outsourcing of manufacturing to cheap labour regions of the world along with the lower cost of importing capital goods back to the West dramatically boosted world trade. This benefitted countries such as Germany and the US.

Source: World Bank as at 06/03/2023. The information shown above is for illustrative purposes. Past performance is not a guide to future results. The peak of globalisation coincided with the financial crisis in 2008. Since then, world trade has slowed and trade as a share of GDP has moderated. We expect that this slower trend will continue after the Covid pandemic and the conflict in Ukraine revealed the fragility and over reliance on crucial supply chains in certain countries. The focus on de-carbonisation and increased geopolitical considerations are likely to result in a move towards greater regionalisation and onshoring which should drive capex growth. We believe that one of the more important aspects of de-globalisation relates to the security vulnerabilities created by potential economic dependence on strategic rivals such as Germany's reliance on Russia for the majority of its oil supply. As a result, supply chain security is being prioritised over the cost of production. With globalisation leading to deeper global trading relationships, we believe that unwinding these connections will create long-lasting effects on the global economy and financial markets. This will negatively impact developed markets as a more localised production base will likely raise the costs for most corporates in the developed world. On the other hand, Emerging markets (EM) should see a net benefit on the back of Foreign Direct Investment (FDI) inflows into various regions and increasing capex.

Source: Redwheel, CLSA, Datastream - Refinitiv as at 16 March 2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes.

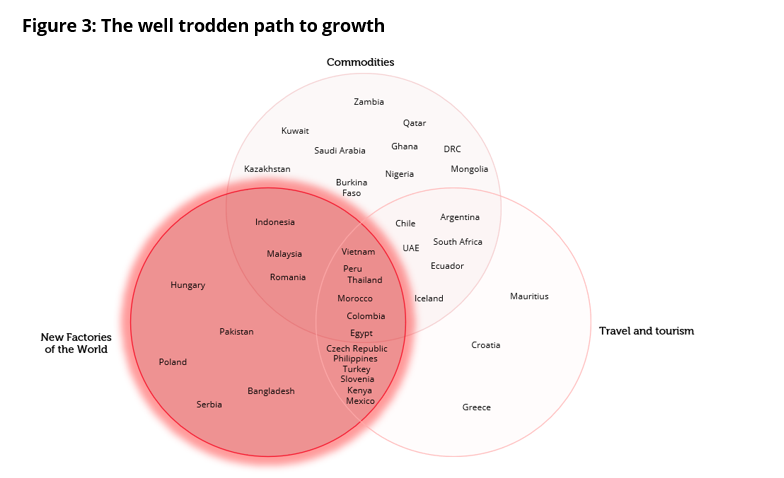

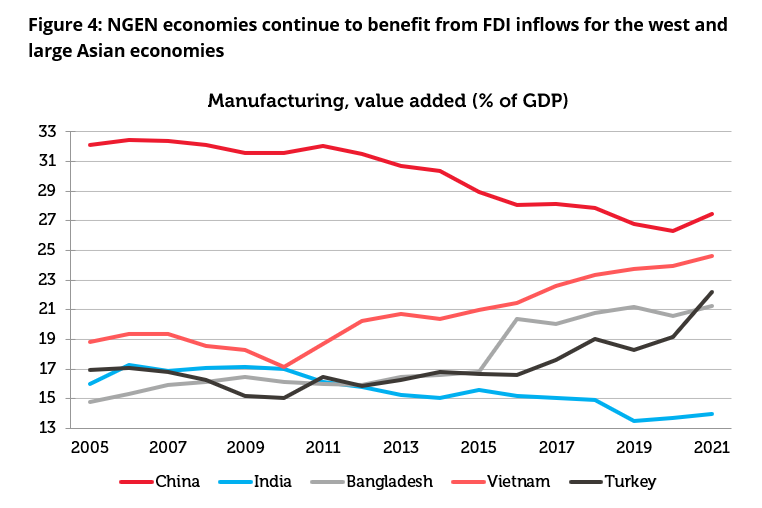

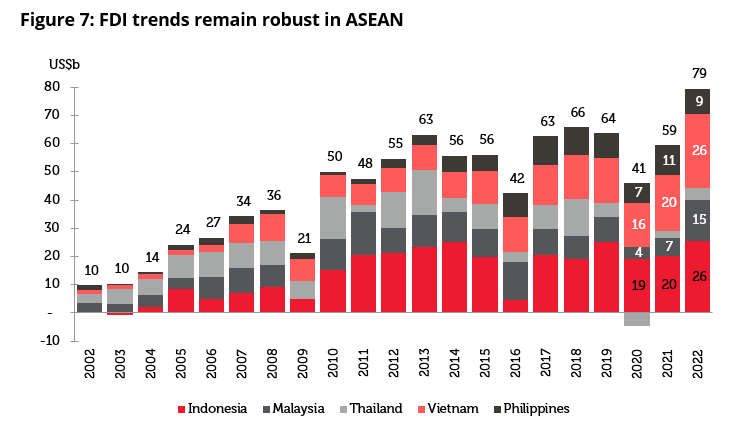

Source: Redwheel as at 28/02/2023. The information shown above is for illustrative purposes. The Beneficiaries: Next Generation Emerging (NGEN) MarketsOne of the most powerful ways that a country can develop its internal resources and realise its true longterm potential is by establishing an urbanised working population. This requires investment in manufacturing capabilities so that the workforce can shift from agrarian roots to a developed, salaried existence. Urbanisation drives consumption as local economies grow and consumers look to increase spending in property and durable goods, such as cars and appliances. China represents one of the most striking examples of this transformation. Its manufacturing capacity grew exponentially over the last twenty five years and created enough jobs to lift 750 million people out of poverty and into urban life.[2] Over the same time, its share of global manufacturing has risen from approx. 4% in 2000 to nearly 29% today.[3] As the US and Western Europe reduce their dependency on China, we expect this relocation of supply chains to benefit Latin America, Eastern Europe and the ASEAN region in the same way. The US has shifted its stance towards China and introduced policies that encourage re-shoring as illustrated by the Inflation Reduction Act and the CHIPS Act. Given the size of the Chinese export pie — almost ~US$600 billion p.a. is from the US alone — the emergence of new ecosystems represents a very significant opportunity for Next Generation Emerging Markets.[4] The US, Europe and Japan have remained important FDI sources for Next Generation Emerging Markets (NGEN), contributing significantly to the upswing since 2021. However, FDI from China, Taiwan and Korea has risen strongly with this bloc's contribution to ASEAN inflows rising the most over the past decade as North Asian markets move up the value chain.

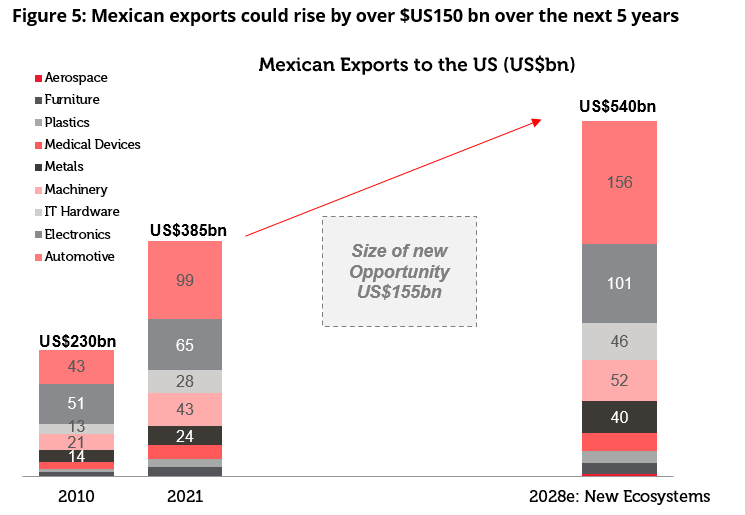

Source: World Bank as at 01/03/2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. MexicoGains from nearshoring could be transformational for Mexico's economy. Mexico's manufacturing exports (currently ~40% of GDP) could enter a new era of expansion on the back of accelerated growth in existing manufacturing clusters and the rise of new ecosystems.[5] We estimate that Mexican exports could rise by US$155bn (or more than 10% of GDP) over the next 5 years. This includes gains in well-established sectors, those associated with intra-United States, Mexico and Canada trends (US$38bn) and those specifically related to firming IT hardware and new clusters such as batteries, as well as electric vehicles and parts (US$22bn). Mexico is already taking export and manufacturing share from Asian economies to support the US and Canada, and as a result, macro and regional evidence show that we are well into the expansion of current ecosystems. There are a several key signposts ahead including progress on United States Mexico Canada Agreement (USMCA) disputes, the outcome of Mexico's 2024 presidential elections, the transition to Electric Vehicles (EVs) and the impact of the Inflation Reduction Act on the US auto industry. A great example of this ecosystem expansion is Tesla's recent announcement to build their new factory in Nuevo León which is one of the northern states of Mexico. The five billion dollar investment will aim to create 6,000 jobs and is the largest single investment in Mexico.[6] Beyond the numbers, this highlights Mexico's strategic role as the US diversifies away from China and moves away from fossil fuels. There are many direct and indirect beneficiaries from these types of inbound investments, ranging from banks such as Banorte to the industrial parks sector led by the Fibras and Vesta. Supply/demand dynamics in the Mexican industrial space are already tight due to the nearshoring structural shift that is driving a manufacturing boom. Looking forward, we estimate the $155 billion of incremental exports (over a 5Y period) would require at least 13 million square meters (sqm) of incremental industrial space — of which only 2 million sqm is under construction. Hence, Mexico is short at least ~11 million sqm of required Gross Leasable Area (GLA). More broadly, higher construction and manufacturing activity are all positive demand drivers for construction related companies in Mexico like cement stocks.

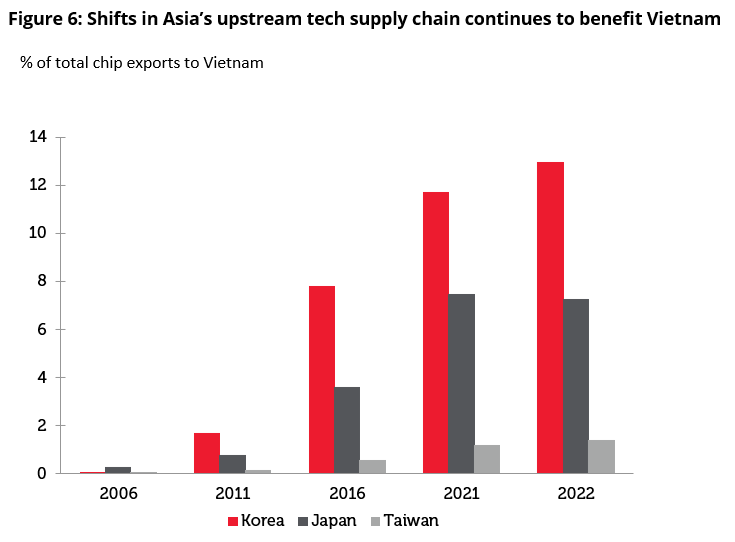

Source: US Census Bureau, Redwheel as at 28/02/2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. VietnamVietnam is now an established example of supply chain relocation. As a result of the sustained industrial development in Vietnam over the past decade, Vietnam's manufacturing output share of GDP has risen from 17% in 2010 to 24% in 2022.[7] Even though Vietnam's inbound FDI growth has slowed recently the absolute figure is still substantial and has increased as a share of the global aggregate, rising from 0.1% in 2000 to 1.6% in 2020. FDI disbursement in Vietnam also strengthened in 2022.[8] Of all the ASEAN nations Vietnam's ties to North Asia have deepened the most during the period. By 2018, China and Korea's value-added contributions to Vietnam's exports of manufactured goods were 30.7% and 11.7%, respectively.[9] There seems to be room for capacity growth in Vietnam as its manufacturing output share is still below that of Thailand's. Moreover, we think Vietnam should continue to gain in areas such as downstream lower-end manufacturing from China given the combination of China's industrial upgrading and declining working-age population as well as Vietnam's comparative advantages in these sectors. Longer term, Vietnam's strong pursuit of free trade agreements bode well for its ability to move up the value chain. In addition, Vietnam is supported by a relatively large workforce that is young and educated. Shifts in Asia's upstream tech supply chain also indicate some of Vietnam's increased electronic trade flows. As seen on the chart below Vietnam's share of chip exports from Korea, Taiwan and Japan continues to grow.

Source: Credit Suisse as at 28/02/2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. Over the last decade, Samsung has moved a large portion of its electronics manufacturing from South Korea and China to Vietnam. The company has invested almost $20bn in Vietnam and currently operates six factories along with a research and development centre based in the country. Today, Vietnam accounts for nearly half of Samsung's mobile phone production globally and in turn Samsung accounts for nearly one fifth of all Vietnam's exports.[10] Another example is Apple Macbooks moving production from China to Vietnam with the assistance of its top supplier, Foxconn. The company is moving forward with its plan to eventually end its reliance on China to manufacture many of its products including iPhones, AirPods, HomePods and MacBooks. Production of MacBooks in Vietnam is said to begin as early as May 2023. Once the assembly lines start operations in Vietnam Apple will have a second manufacturing base for its flagship products. A key beneficiary of this shift to Vietnam is Hoa Phat Group due to the increased demand for infrastructure needed to build out the manufacturing hubs. Hoa Phat Group is the largest steel manufacturer in Vietnam with a market share of around 32.5%.[11] We believe that the improvement in cash flow will reflect in the company's financials in 2023 and 2024. MalaysiaSince 2019, Malaysia has experienced the fastest rise in annual FDI inflows as a percentage of GDP in the ASEAN region.[12] The country's manufacturing output has increased more than that of neighbouring nations during the same period and has pushed up the trade surplus. Additionally, the increase in FDI likely reflects an expansion of distribution facilities and Malaysia's increasing role as a trans-shipment hub. Malaysia's position in the middle of semiconductor supply chains and a comparatively high export overlap with China versus the rest of ASEAN should allow it to gain from regional integration. Additionally, its geographical advantage and increased capacity in global distribution and processing activities lend structural support to boost its manufacturing activity. We believe that the recent pick-up in FDI can be sustained especially if the new coalition government can provide a more stable political environment than the period following the 2018 election and perceived reputational risks relating to forced labour issues improve. Going forward, Vietnam and Malaysia look well placed to remain the main ASEAN beneficiaries of supply chain shifts. Idiosyncratic improvement of IndonesiaIndonesia continues to make inroads in raw material processing. Recent gains reflect the offshoring of basic materials production from China, which could persist as it seeks to achieve carbon neutrality by 2060. Speaking of this trend, FDI inflows from China have jumped since 2016 and now represent the largest source of FDI for Indonesia after Singapore.[13] Indonesia will likely see continued FDI inflows as part of its venture into the supply chain for decarbonization metals and electric vehicle batteries. We are also optimistic with regarding the outlook for investment into the basic material industries more broadly, given the energy cost and drastic cost escalation of manufacturing in Europe. Additionally, the government have placed certain restrictions on some of Indonesia's mining exports, amid increased investment to expand capacity and move further downstream, also point to greater metals value added. Indonesia holds the world's largest nickel reserves and significant production of this metal and other metals, such as copper, is set to come on stream over the next three to five years. Hence, there is good scope for Indonesia to have an increased role in EV supply chains through providing key battery inputs and potentially production assembly.

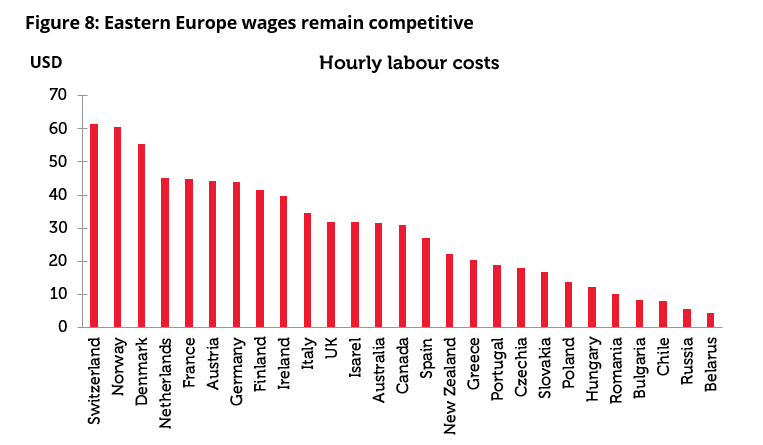

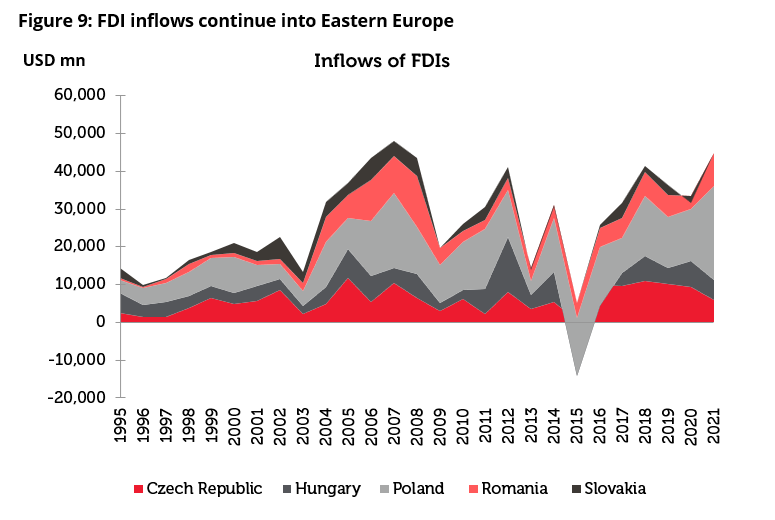

Source: Governments, World Bank, Macquarie Research 28/02/2023. Past performance is not a guide to future results. The information shown above is for illustrative purposes. Eastern Europe and North AfricaThe diversification of supply chains should also benefit countries in Eastern Europe and North Africa. Despite relatively higher labour costs compared to LATAM and ASEAN peers, its geographical proximity to Western Europe, higher quality of production and the shortened delivery times can compensate for the labour-cost gap among these countries. Despite increases in labour costs, labour costs in Central and Eastern Europe (CEE) countries remain around one third of those in Germany.[14]

Source: Citi, International Labour Organisation as at 31/12/2022. The information shown above is for illustrative purposes. *Hourly labour costs in US dollars converted using 2017 purchasing power parities (PPP $) and exchange rates (US $), latest year In May 2020, the Polish Institute of Economy published a report indicating that the CEE countries could gain up to $22 billion annually following relocation of production from China. The CEE countries that are set to gain the most relatively from this trend are Slovakia, Poland, Czech Republic and Hungary. The chart below shows a substantial rise in FDI inflows in the CEE region over recent years. Poland stands out as the largest nominal recipient of FDI inflows (though mostly because of the size of its economy). CEE economies are certainly punching above their weight in terms of being an attractive FDI destination. For example, UNCTAD data allows us to estimate that the CEE region accounted for 6% of the value of all announced FDI projects globally in 2021, which is significantly more than the region's share of global GDP (1.6%) or total population (~1.1%).

Source: UNCTAD, FDI/MNE database (www.unctad.org/fdistatistics). Past performance is not a guide to future results. The information shown above is for illustrative purposes. An example of the on-going shift of manufacturing into the CEE region is found in automobile production. Romania, the Czech Republic and Morocco now produce more passenger vehicles than more developed economies, such as Italy. Companies such as Peugeot, Renault and Jaguar Land Rover have all shifted production to lower cost locations, and we expect this trend to continue. We see the banking sector as the biggest beneficiary in Eastern Europe. There is currently low leverage in the economy meaning that the banks have the capacity to outgrow GDP growth.[15] ConclusionThe development of a manufacturing economy and an urbanised workforce is a well-trodden path. We have seen it before, and we expect that we will see it again. The Asian "Tiger" economies of Hong Kong, Singapore, South Korea and Thailand enjoyed rapid growth as they developed manufacturing industries and grew employment in the 1980s and 1990s. In the early 2000s, China then took over the helm as the world's low-cost manufacturer and underwent a similar industrial transformation, growing its manufacturing capacity exponentially. With the world now looking to diversify its supply chains and to reduce its reliance on China, we believe it will be the next generation emerging market economies which will emerge as the greatest beneficiaries of this new shift in global manufacturing supply chains. Vietnam is currently among the front-runners of this new wave but other Asian economies such as Malaysia and Indonesia look well-positioned to attract continued inward investment as they develop strong manufacturing bases and expand employment opportunities. Elsewhere in the world, Mexico, the Czech Republic, Morocco and Hungary look similarly well placed to benefit from reshoring over the coming years. Over the last thirty years in emerging markets we have seen the positive effect which higher employment has on a country's economic development from Korea to China. We now look forward to the Next Generation of Emerging Markets to continue along this well-trodden path to prosperity and economic growth. |

|

Funds operated by this manager: CC Redwheel Global Emerging Markets Fund, CC Redwheel China Equity Fund Sources: [1] World Bank and Bloomberg, as at 30 April 2023 [2] World Bank & IMF, as at 30 April 2023 [3] Bloomberg, as at 30 April 2023 [4] Morgan Stanley, US Census Bureau, 30 April 2023 [5] Tellimer and WorldBank, 30 April 2023 [6] Tesla, 30 April 2023 [7] World Bank, 31 January 2023 [8] World Bank, 31 January 2023 [9] World Bank, April 2023 [10] Samsung Company Reports, 30 April 2023 [11] Hoa Phat Group Company Reports, 30 April 2023 [12] World Bank & IMF, 31 Jan 2023 [13] Credit Suisse, April 2023 [14] Governments, World Bank, Macquarie Research, April 2023 [15] Peugeot, Renault, JLR, Company Reports, April 2023 Key information: No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Past performance is not a guide to future results. The prices of investments and income from them may fall as well as rise and an investor's investment is subject to potential loss, in whole or in part. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so. The statements and opinions expressed in this article are those of the author as of the date of publication, and do not necessarily represent the view of Redwheel. This article does not constitute investment advice and the information shown is for illustrative purposes only. |

24 May 2023 - Momentum is Building in Aged Care

|

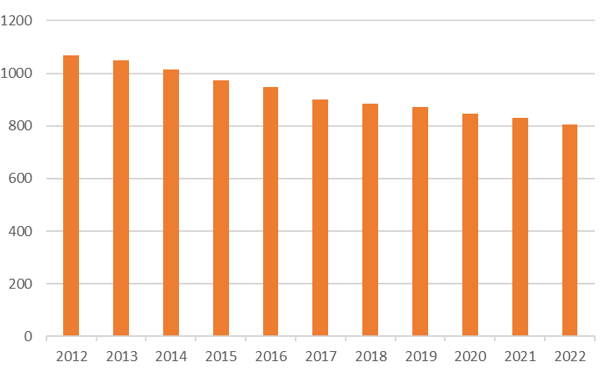

Momentum is Building in Aged Care Novaport Capital May 2023 With established investments in both of Australia's listed residential aged care providers, Estia Health and Regis Healthcare, our positive outlook for the sector is informed by three factors. Firstly, advanced age is associated with complex and ongoing care needs which Residential Aged Care is uniquely positioned to provide. Secondly, Aged Care operators with established processes to consistently deliver care (meeting ever more demanding standards) have a clear opportunity to consolidate what is currently a fragmented sector. Finally, the demographic tailwind provided by a growing and ageing population supports demand growth for the foreseeable future. Aged Care Industry Consolidation - Number of Providers

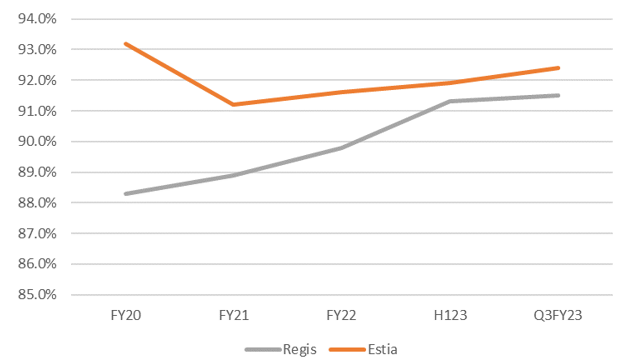

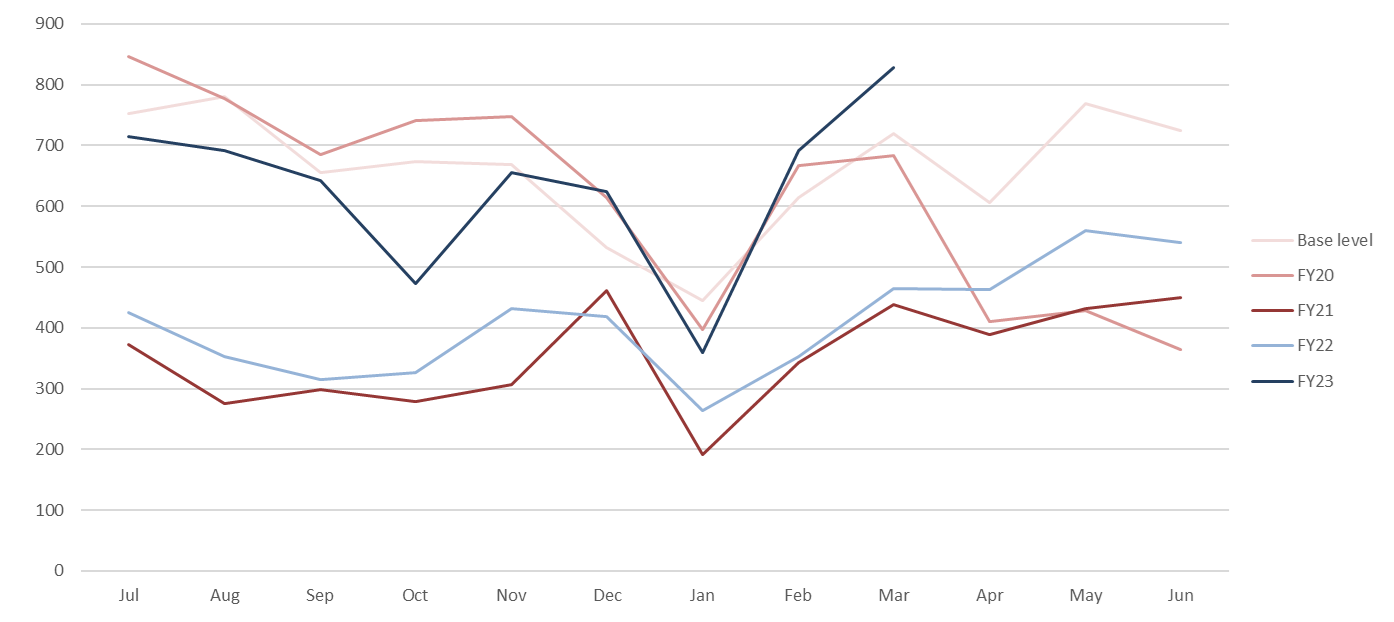

Source: Regis Healthcare In recent years the sector had to navigate challenges including a squeeze in funding, the Royal Commission and COVID-19; however recent operational updates from the listed providers as well as an announcement from the Federal Government, highlights how positive momentum is building in the sector. Funding ClarityOn 4th May 23, the Australian Government outlined how it will fund a 15% Aged Care workforce pay increase proposed by the Fair Work Commission. It is offering a meaningful increase in the AN ACC daily funding rate (rising to over $240 per resident) as well as a 'hotelling supplement' of $10.80 (per resident per day) to cover increased wages for aligned staff such as chefs. The funding increase is expected to pass through to workers in the form of higher wages, yet it reflects a positive outcome for the sector overall. It resolves a major uncertainty has dogged the sector since the Fair Work Commission first proposed wage increases for Aged Care employees. It also indicates the current government's commitment to sustainably reform the sector. Providing financial incentives for workers to commit to a career in Aged Care should support improved quality of care and customer satisfaction. In the past, low wages have repelled workers from Aged Care and operators became increasingly reliant on temporary employment agencies to fill rosters. The margins charged by these agencies are high, therefore the financial burden of using agency staff has been punitive for operators. Stabilising the workforce represents a meaningful opportunity for Aged Care operators to improve their financial performance. Operating Metrics ImprovingRecent updates from both the listed Aged Care operators shows they have made good progress on driving operational improvement. Occupancy is trending higher following several years disrupted by the Royal Commission and then Covid-19. Higher occupancy drives both revenue and margin.

Source: Regis Healthcare Ltd, Estia Health Ltd The sector has is also making progress adapting to the AN ACC funding reforms. Following substantial changes to the funding model, Aged Care operators can now refine their operations to ensure they are adequately funded to provide better quality care to residents. Resolving the uncertainty about the funding structure has enabled operators to develop platforms and models to deliver sustainable care. Author: Sinclair Currie, Principal and Co-Portfolio Manager Funds operated by this manager: NovaPort Microcap Fund, NovaPort Wholesale Smaller Companies Fund This material has been prepared by NovaPort Capital Pty Limited (ABN 88 140 833 656 AFSL 385 329) (NovaPort), the investment manager of the NovaPort Smaller Companies Fund and the NovaPort Microcap Fund (Funds). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Fund's Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Funds. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. NovaPort and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, NovaPort and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group. |

23 May 2023 - Australian Secure Capital Fund - Market Update April

|

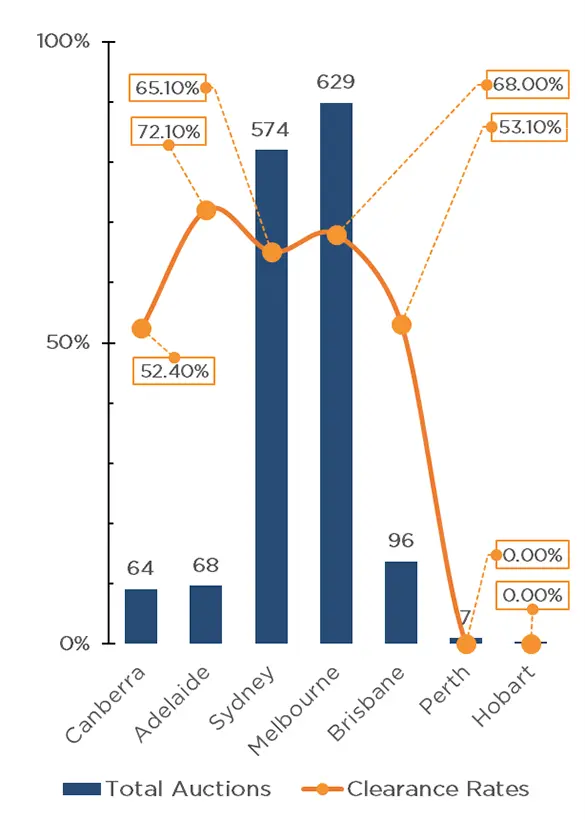

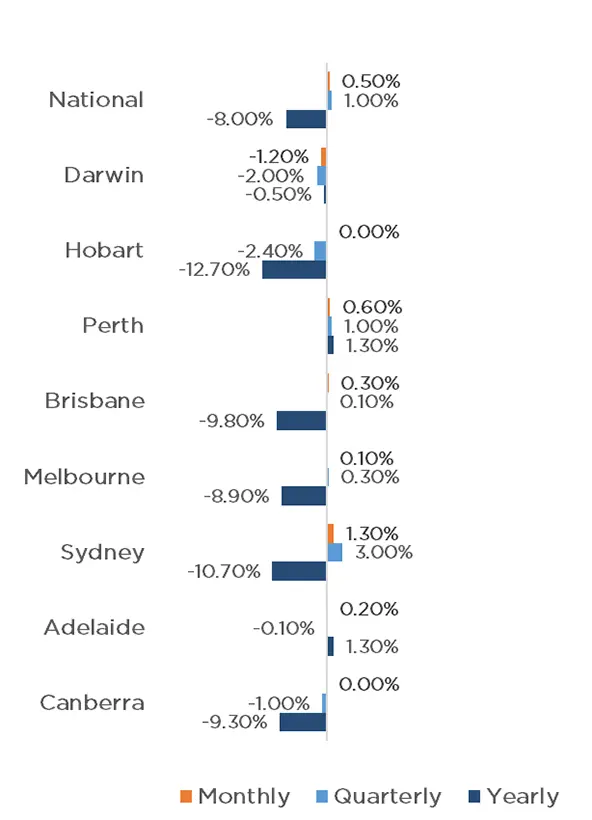

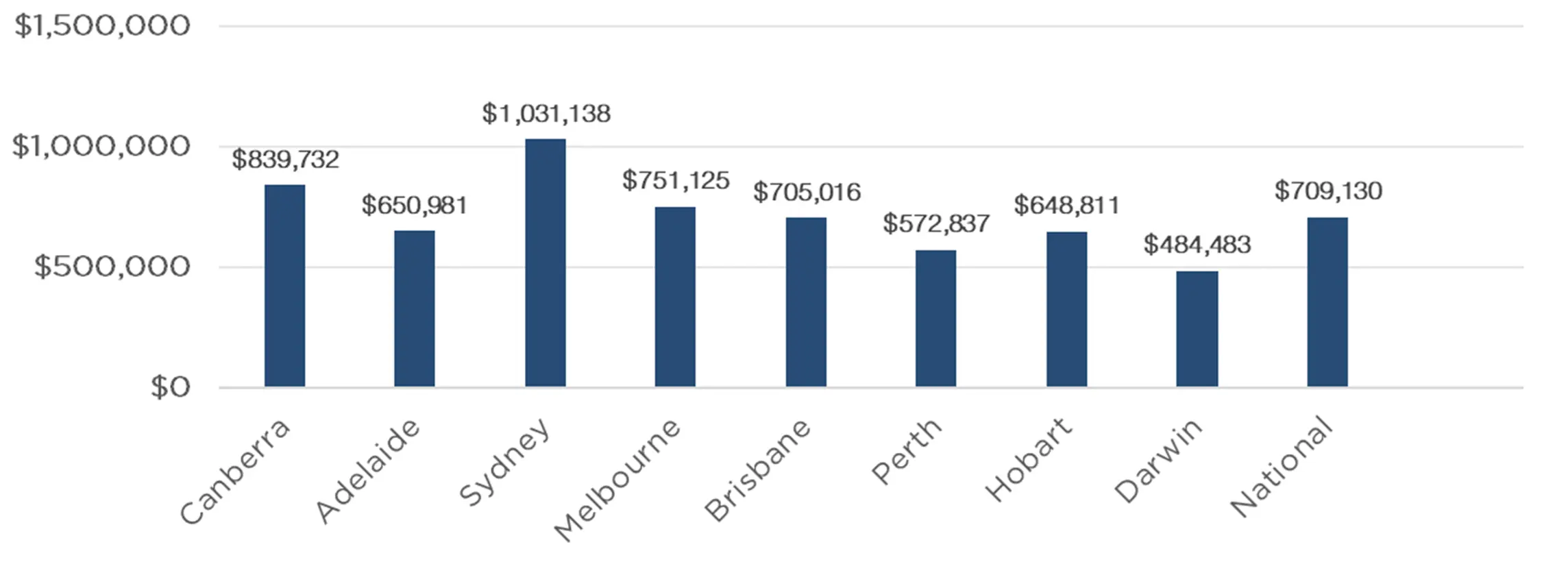

Australian Secure Capital Fund - Market Update April Australian Secure Capital Fund May 2023 Australian housing values appear to have stabilised, with a second consecutive monthly increase as CoreLogic's national Home Value Index rose by half a per cent. The capital cities performed strongly, with Sydney leading the way with a 1.30% increase for the month, followed by Perth (0.60%), Brisbane (0.30%), Adelaide (0.20%) and Melbourne (0.10%). Canberra and Tasmania remained stable, whilst only Darwin recorded a decrease in values, with a 1.20% reduction. Similarly, the regions have also performed quite well, with South Australia seeing a 0.90% increase, followed by Queensland (0.80%) and Western Australia and Tasmania, both increasing by 0.10%. Only regional Victoria and New South Wales experienced a reduction in values, of 0.40% and 0.30%, respectively. Auction activity remained low in April, with volumes down by approximately 25% when compared to last year. Persistently low levels of residential property coming to market remains a key factor in supporting housing values. The rolling four week trend during April was around 14% below the previous five year average in new listings for April. Whilst numbers were down, clearance rates remained robust. With the decision of the RBA to once again increase the cash rate by a further 0.25% following last month's pause, the outlook for the property market remains stable but with future growth potentially constrained. Whilst we are yet to see the full impact that the rate rise cycle has had on household cashflows, foreign buyers are returning and the labor market remains tight which should keep prices stable. Clearance Rates & Auctions 17th - 23rd of February 2023 |

22 May 2023 - 4D podcast: The golden opportunities for infrastructure in a challenging environment

|

4D podcast: The golden opportunities for infrastructure in a challenging environment 4D Infrastructure May 2023 Bennelong Account Director, Jodie Saw, speaks with Chief Investment Officer and Portfolio Manager, Sarah Shaw, about how infrastructure has been performing, 4D's portfolio, and the opportunities for infrastructure growth despite a tumultuous few years. "There is a place for infrastructure in all portfolios and in all markets. It offers defensiveness with growth, and sector and regional diversity, which means infrastructure can be fundamentally positioned for all points of an economic cycle. And we think allocations to the asset class should be more representative of this opportunity set."

|

|

Funds operated by this manager: 4D Global Infrastructure Fund (Unhedged), 4D Global Infrastructure Fund (AUD Hedged), 4D Emerging Markets Infrastructure Fund For more information about 4D Infrastructure, visit https://www.4dinfra.com/ The content contained in this audio represents the opinions of the speakers. The speakers may hold either long or short positions in securities of various companies discussed in the audio. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the speakers to express their personal views on investing and for the entertainment of the listener. |

19 May 2023 - The blue sky for rare earths now a bit cloudier

|

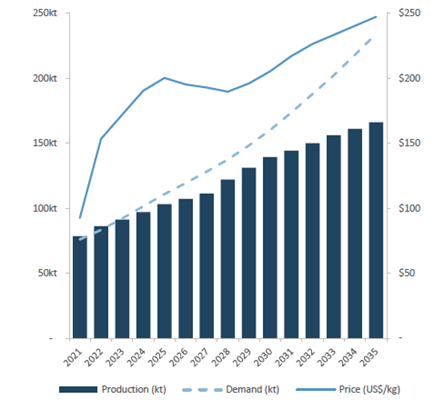

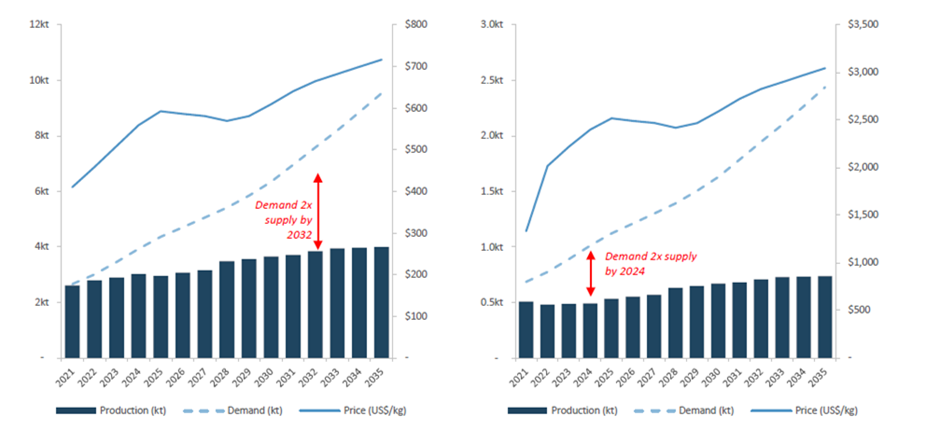

The blue sky for rare earths now a bit cloudier Tyndall Asset Management May 2022 Tesla claims it will eliminate the use of Rare Earths in its Electric Vehicles. Portfolio Manager Jason Kim investigates how realistic this claim is, drawing on insights from Adamas Intelligence, a leading research consultancy on critical minerals, and industry consultant Yoo Cheol Kim (YC Kim). During Tesla's 2023 Investor Day in March, the global electric vehicle behemoth claimed that their next generation electric vehicles (EVs) will no longer contain rare earths. Rare earths are used in some permanent magnets that are a critical component of motors in electric vehicles. These magnets contain rare earths called NdFeB magnets (Nd - the rare earth elements Neodymium and Praseodymium, in conjunction with some Terbium and Dysprosium, Fe - Iron - and B - Boron). Tesla CEO, Elon Musk, is known for making hyperbolic statements and although his statement contained no details on how this would be achieved, the impact on rare earths stocks was immediate and dramatic. Lynas, a large producer of rare earths listed on the ASX, saw its share price decline by almost 7% on the day, with further declines over the subsequent three weeks - a cumulative 23% decline during March alone (although part of this decline may also reflect the coincident announcement of an increased Chinese production quota of rare earths). Similar declines were seen elsewhere, including in China, the dominant producer and processor of rare earths, with key stocks in China falling anywhere from 4% to the daily limit of 10% on the day after Tesla's statement. Ferrite Magnets - the only feasible option currentlyTesla had previously used AC induction motors (with no rare earths) in their earlier models but replaced them with permanent DC magnet motors which contained rare earths (NdFeB magnets). Tesla's decision to switch away from AC induction motors was driven by a range of factors, including problems with unbalanced voltage supply, rotor locking, and interference with the complex network of sensors found in modern vehicles. In light of these challenges, a number of experts in the field of EVs and rare earths predict that Tesla will not return to using AC induction motors. According to Adamas Intelligence, the only current feasible alternative to rare earth-containing magnets is ferrite magnets. Moreover, ferrite magnets are currently being used by Proterial (formerly Hitachi Metals) in its latest EV motor design and have previously been used in vehicles such as GM's 2016 Chevy Volt. Germany's BMW has been active in steering away from rare earth magnets, with the company prompted to reduce its rare earths consumption to limit over-reliance on Chinese-based supply chains given growing geopolitical tensions. However, while ferrite powered motors can match the performance of NeFeB powered motors to some extent, this performance comes with a significant weight and efficiency penalty that has made the switch unattractive to date. This means that the manufacturer must accept a reduced driving range or an additional cost for a larger battery to maintain the driving range. There is also the issue of a material reduction in torque with the ferrite powered motors. Given the bigger batteries, as well as more copper required, some experts believe there is no material cost advantage to using ferrite powered motors to NdFeB powered motors. Why is Tesla looking to stop using Rare Earth (NdFeB) powered motors?Tesla's move reflects concerns that there is insufficient supply of rare earths to meet the projected demand for EVs over the coming years. Rare earths industry consultant, YC Kim, subscribes to this view. He has stated that the global EV market is projected to grow from 8.2 million units in 2022 to 39.2 million units by 2030, a nearly 5-fold increase in eight years. While these numbers are forecasts and subject to significant uncertainty, there is little doubt that the switch away from internal combustion engine (ICE) vehicles is accelerating. The result will be an increase in demand for EVs such that production volumes will be multiple times higher by the end of the decade. In 2022, Adamas Intelligence data indicates that passenger EV motors were responsible for 12% of global NdFeB magnet consumption.¹ According to YC Kim, if global EVs production grows to 39.2 million units by 2030, then EVs will account for roughly 50% of the NdFeB magnet consumption in 2030. This would see total demand for NdPr (Neodymium and Praseodymium) growing to almost four times its current size by 2030.² Where will all these Rare Earths come from?This fourfold increase in demand for rare earth minerals appears difficult to satisfy based on current supply forecasts. Indeed, the supply-demand forecasts of both Adamas Intelligence and YC Kim indicate a substantial shortfall in the supply of these rare earth elements (refer Figures 1 and 2). Figure 1: NdPr demand-supply balance (LHS) vs price (RHS) Source: Adamas Intelligence, and Australian Rare Earths Ltd. Figure 2: Dysprosium and Terbium demand-supply balance (LHS) vs price (RHS)

Source: Adamas Intelligence, and Australian Rare Earths Ltd. This supply shortfall will be very positive for pricing, as higher prices will be necessary to incentivise new supply to come to market. If Tesla wants to meet its target, it is clear that based on current supply forecasts, there simply won't be enough rare earths to produce their targeted number of EVs using NdFeB powered motors. YC Kim's discussions with major auto manufacturers suggest the first preference is to use NdFeB powered motors. He is of the view that while ferrite powered motors will work, given the significant trade-offs, they will only be suitable for lower priced mass market cars. It is simply a matter of rationing the limited supply of rare earths. YC Kim is also concerned that the growing demand for EVs within China could result in the cessation of rare earth exports as soon as 2025. Further, China has issues with its own supplies currently and has stepped out to neighbouring countries such as Myanmar (via China-controlled entities) to produce rare earths. This looming supply shortfall and potential cessation of Chinese supply has not gone unnoticed by Western governments, as detailed by Stefan Hansen in his note The Value in Securing Critical Mineral Supplies. ConclusionDespite Tesla's ambitious claim that it will cease using rare earths, it appears the demand for rare earths will continue to grow and that supply growth still remains an issue. This will most likely result in the various industries increasingly using lower quality alternatives purely out of necessity and not out of choice. There are some possible advancements that may result in true alternatives to rare earths in motors, such as manganese bismuth magnets. However, they are all still in their development infancy, and their commercialisation, if they prove to work, is still several years away. Iluka Resources, which is predominantly a mineral sands miner with a very large presence in titanium dioxide and zircon markets, has been a beneficiary of government support aimed at increasing the supply of critical minerals including rare earths. This support will assist in the acceleration of Iluka's emerging, but potentially very large, rare earths mining and processing business. As we transition towards a net-zero world while being in a period of heightened geo-political tensions, Tyndall AM believes that Iluka Resources offers a unique and undervalued opportunity. The market has not fully understood the potential upside from their rare earths opportunity, and the significance of the government support that this project has received. Author: Jason Kim, Portfolio Manager Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund

References

Important information: This material was prepared and is issued by Yarra Capital Management Limited (formerly Nikko AM Limited) ABN 99 003 376 252 AFSL No: 237563 (YCML). The information contained in this material is of a general nature only and does not constitute personal advice, nor does it constitute an offer of any financial product. It does not take into account the objectives, financial situation or needs of any individual. For this reason, you should, before acting on this material, consider the appropriateness of the material, having regard to your objectives, financial situation, and needs. The information in this material has been prepared from what is considered to be reliable information, but the accuracy and integrity of the information is not guaranteed. Figures, charts, opinions and other data, including statistics, in this material are current as at the date of publication, unless stated otherwise. The graphs and figures contained in this material include either past or backdated data, and make no promise of future investment returns. Past performance is not an indicator of future performance. Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided. |

18 May 2023 - Learning the lessons of history

|

Learning the lessons of history JCB Jamieson Coote Bonds May 2023 Investors have been faced with more historic events in the past three years than most people see in two decades. Charlie Jamieson and Mark Burgess share their views on what's ahead and how lessons from the GFC have prepared investors.KEY TAKEAWAYS:

Investors have been through a range of extreme events in the past three years. Those trials have included zero interest rates followed by the fastest rate hiking cycle in history, oil prices turning negative, two of the largest banking collapses in US history, several crypto crashes and - most obviously - a global pandemic. Now, three years on from the start of the pandemic, Jamieson Coote Bonds (JCB) Chief Investment Officer, Charlie Jamieson and Mark Burgess, Chair of the Advisory Board, have shared their views on the path ahead for markets. SKILL TO DRIVE FUND MANAGER RETURNSIn the years following the global financial crisis (GFC), falling cash rates drove better returns from bonds, according to Mr Burgess. When central banks cut their cash rates following the GFC (and abruptly 'raced to zero' during the early stages of the pandemic), it helped fund managers deliver generally better results, he said. Typically, banks lower their borrowing costs as the cash rate trends downward. As a result, falling rates reduce the cost of capital for businesses and increase the expected return on investments*. Lower borrowing costs also encourage businesses to invest more in new capital assets. But that situation has changed with significant lifts to cash rates worldwide in the past 12 months. Mr Burgess said fund performance will come to lean more heavily on the skill of fund managers. Their ability to pick assets, the strategies they employ and the timing of their implementation will be vital to their success. "So the choice of manager matters," Mr Burgess reiterated. "Skill will be the biggest proportion of return, rather than falling rates which has been the biggest proportion of returns in my career. And if you have invested with a fund manager who's not that skilled, you're about to find out about it." NO 'V-SHAPED' RECOVERYMr Burgess explained that while there's little doubt the global economy is in the throes of a bear market, there's some debate over whether this is a normal cyclical bear market, or a structural one. If it's a structural bear market, the correction will be "far deeper and longer" than if it were simply cyclical. Mr Burgess, however, is not in the structural camp. "For that correction to happen, the structure of the system has to break," he said. Mr Burgess went on to explain that while the environment remains fragile, lessons from 2008, interventions by authorities in any failing institutions and better capitalised core banking systems, should allow for less cyclical damage than markets such as 2008 or 1970s which saw severe structural corrections. He noted however that the environment remains challenging, which will limit the ease of an immediate recovery. "It's no longer about creating credit; it's about how we structure debt and refinance. With high levels of debt refinancing is the key and the recovery there will be challenging." Although assessing the current bear market as cyclical, JCB does not expect to see a 'V-shaped' recovery in which asset prices enjoy a sharp rise back to previous highs after a similarly sharp decline. "Barring a catastrophic and systemic shock we're not going to be cutting rates," Mr Jamieson said. "That's why it's such a different go-forward, because all of the things that got carried to that very high place pre-COVID are unlikely to get carried in that same way. "So, as we've had these adjustments through the bond market, through some credit markets and the like, we're not going to get that V-shaped recovery." PLENTY OF CASH ON THE SIDELINESMr Burgess said one of the big surprises is how much money is currently "sitting underneath the market". This, he said, is likely driven by the lessons learned in 2008 during the GFC. "One of the advantages of having had a global financial crisis in '08 is that when you get a financial crisis, you actually get some future benefit, and that future benefit is that you know how to handle a financial crisis," he said. "The way people are preparing for it is that a lot of high-net-worth investors have a lot of cash ready to buy distressed assets." Most institutional investors have already pre-allocated cash to purchase distressed or oversold assets, he said. However, in some cases Mr Burgess said the volume of cash sitting in some areas such as private equity and institutional and high net worth holding is notable. Other areas however will see cash constraints - such as speculative technology. COMMERCIAL REAL ESTATE SECTOR SET TO DIPProperty markets have received significant attention as rising interest rates place the sector under mounting pressure. In the residential space the effects of these rate changes are already being felt, Mr Jamieson noted. "Anecdotally, from talking to my friends, we're all in our 40s - we've got our own families, we've got a high cost base at this point in our family lives - everybody knows it's going to be hard," he said. "I don't feel like anyone's really well set up for it yet. They just think that they'll make the adjustment if and when it comes." In the commercial property sector, however, some interesting themes are starting to take root. Mr Burgess noted that between higher interest rates and the 'work-from-home' revolution that started in COVID-19 lockdowns, office spaces may not be generating the same returns. The outlook for the sector remains negative, he added, and some investors are now looking at strategies to profit off this weakness. He cited Blackstone's newly launched US$30.4 billion distressed property fund as a prime example of this approach. Mr Burgess cautioned that while he expects prices for commercial property in Australia to continue falling, he doesn't think the downturn will be as pronounced as in past cycles. "There's not so much distress out there that people are going to have to give buildings away this time around." BONDS STAGE A RETURNThroughout the past cycle, Mr Burgess said, markets were plagued by "too much capital" chasing select stocks - with buy-now-pay-later businesses, speculative technology areas and video streaming giant Netflix both prime examples. This excess capital pushed distorted valuations and ultimately hurt returns. Mr Burgess said much of this excess capital has already "been washed out" of the market but cautioned "there's other areas that have yet to play out". With this in mind, Mr Burgess predicted a return to "good old-fashioned investing" where investors are wary of too much capital flowing into companies they're looking at. At the same time, Mr Burgess said investors are starting to look to government bonds as another option for their portfolios. "What I hear as a bond manager is that people are buying government bonds through gritted teeth, but bonds have gone back into some sort of normalised range," he said. "Now institutions are gradually allocating to bonds because they're starting to think it actually makes sense. The sharp rise in interest rates have made bonds quickly attractive again". The key to navigating the next 12 months, he said, would be to consider the current market with fresh thinking, weigh up which direction capital is flowing (and how much of it is moving), and using 'age-old' investing techniques to generate returns. True investment skill will finally be back in fashion he noted. * Reserve Bank of Australia, 'The Transmission of Monetary Policy: How does it work?', September 2017, accessed 20 April 2023.Author: Charlie Jamieson and Mark Burgess Funds operated by this manager: CC Jamieson Coote Bonds Active Bond Fund (Class A), CC Jamieson Coote Bonds Dynamic Alpha Fund, CC Jamieson Coote Bonds Global Bond Fund (Class A - Hedged) References

|

17 May 2023 - Cashflow matching

|

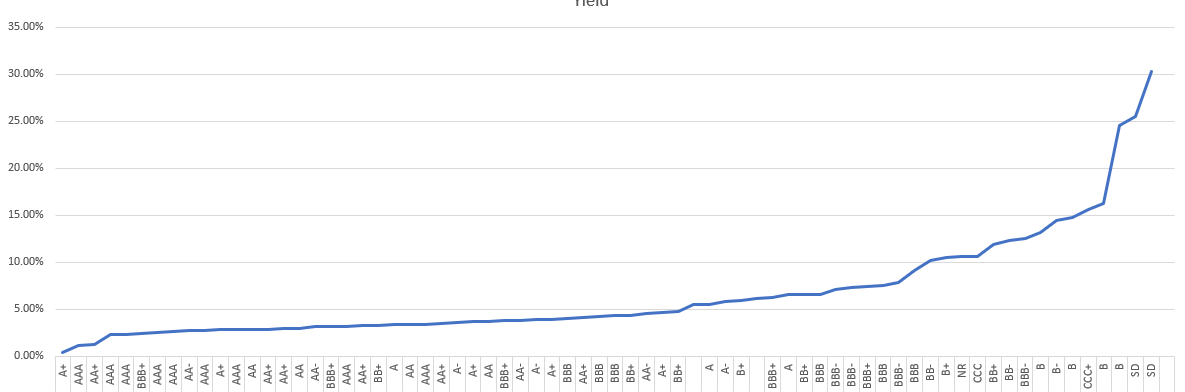

Cashflow matching abrdn May 2023 In UK, the bulk purchase annuity (BPA) market has seen around £150bn of value transferred from pension schemes to insurers over the last five years. 1 Projections for the next decade suggest further transfers of over £500bn, fuelled in part by higher interest rates improving schemes' funding ratios. Although the backdrop may seem irrelevant in APAC, the capability to efficiently construct cashflow-matching portfolios is of increasing importance to both insurers and pension schemes in the region. In this article, we take a look at how novel portfolio construction techniques offered by asset managers can allow insurers and pension schemes to accurately match their liability cashflows whilst also ensuring their risk appetite and specific fund tolerances are fully considered. HolisticWith a holistic cashflow match framework, it is possible to optimally construct portfolios which offer desirable levels of yield, whilst reflecting all possible specific client specifications and restrictions. This includes clients who want their matching portfolio to meet the requirements for Matching Adjustment (MA) compliance under Singapore RBC 2 currently and the upcoming Hong Kong RBC. An investment manager can also offer pre-trade modelling and optimisation capability As well as portfolio construction, efficient ongoing portfolio management ensures assets also continue to be rebalanced and optimised throughout mandate life cycle. Later in this article we will examine the range of assets and different client specifications that can be embedded into a flexible portfolio construction and management framework. But first, what about risk appetites and tolerances? FlexibleA cashflow matching framework is centred around maximising the correspondence between the asset cashflows and the client's liability cash flow. The latter can be on best estimate basis, or based on guaranteed cash flow, depending on the nature of the mandate requirements. The asset cashflows may also include haircuts reflecting the imperfect FX hedge, necessary for example in matching adjustment mandates. It is through the additional constraints, however, that the portfolio can be tailored to meet client and regulatory requirements. For example, asset managers' tools can include:

Such a framework is flexible enough to meet any requirements or risk appetites. It's also important that asset managers work collaboratively to ensure clients' views and demands are fully reflected in the portfolio construction and on-going fund management tools. The full client life-cycle and all asset classesCashflow-matching managers are able to incorporate the full client life-cycle and a wide range of asset classes ensuring they are particularly well-placed to work with insurers and pension schemes. But what should these clients look out for in terms of manager skills, tools, capabilities and scale? The best teams benefit from a suite of proprietary, on-desk cashflow matching tools and use these to manage sizable matching portfolios in accordance with regulations in different jurisdictions . These tools aid portfolio managers and clients throughout the full lifecycle of such funds: *Initiation of mandates and fund restructuring e.g., a fund uprisking from government bond to credit or switching from credit to higher-rated supranational bonds whilst maintaining the match *Pre-trade modelling to ensure proposed new purchases and switches are suitable from a cashflow matching or on-going matching adjustment compliance point of view. *Portfolio rebalancing/liquidity management to meet cash requirements in and out of the fund. With a fast growing MA market and a limited supply of eligible public securities in local currency, it's a key requirement for MA portfolios to widen the scope of asset classes in order to continue to offer attractive solutions within a competitive market place. As such, in addition to local currency investment grade fixed income securities, best-in-class cashflow matching solutions can include overseas debt, e.g., USD corporate bonds, paired together with cross-currency swaps or repackaged up as a special purpose vehicle. It's a key requirement for Muli-Asset portfolios to widen the scope of asset classes The capability to model private placements, commercial real estate loans, and infrastructure bonds is also crucial. Naturally embedding such securities allows for efficient management of public credit alongside non-public debt within cashflow matched & matching adjustment mandates. Quantitative portfolio designIn short, proprietary quantitative portfolio design can be applied on a wide and diverse investment universe. This design may be tailored to meet clients' needs and constraints. Such a flexible and transparent process also allows for informed discussion between key stakeholders, enabling comparison of the relative merits of a spectrum of matching portfolios with different 'risk-return' profiles. To illustrate this point, we showcase such an 'efficient frontier' of matching adjustment compliant portfolios for a stylised liability profile and a public credit universe in Chart 1 and Chart 2 below. Chart 1 Matching Adjustment 'efficient frontier' constructed from the public credit universe. Typical portfolio issuer/sector /rating constraints. Liabilities c. 12y duration. Close of Business (CoB) 30-Dec-2022. A "Best cashflow match" portfolio with no yield constraint (meets various portfolio limits & MA CF-Match Tests). B Better yielding MA Compliant Portfolio (still meeting all limits & CF-M tests) C Pushing yield at the expense of cashflow match (portfolio only just matching adjustment compliant). Source: abrdn. For illustrative purposes only. Chart 2 Cashflow match plots for the three highlighted portfolios along the MA 'efficient frontier'. Stylised liabilities of c. £1bn PV (present value) and 12-year duration. All portfolios meet the required'Tests'. CoB 30-Dec-2022. Source: abrdn. For illustrative purposes only. The above portfolios also embed insurers' typical issuer, rating and sector limits and demonstrate the benefits of an optimisation exercise, potentially resulting in a 30bps gain in spread whilst retaining an acceptable quality of cashflow matching. A huge opportunity for insurers and pension schemesWith Hong Kong insurers embracing the upcoming Hong Kong RBC and Singapore insurers moving from RBC adoption to RBC optimisation, we are witnessing a trend in APAC similar to what has been ongoing among their European peers. Asset managers with proprietary techniques and insurance asset management capabilities could be well placed to support this journeys that lie ahead. Author: Mark Cathcart, Investment Director, Liability Aware |

|

Funds operated by this manager: Aberdeen Standard Actively Hedged International Equities Fund, Aberdeen Standard Asian Opportunities Fund, Aberdeen Standard Australian Small Companies Fund, Aberdeen Standard Emerging Opportunities Fund, Aberdeen Standard Ex-20 Australian Equities Fund (Class A), Aberdeen Standard Focused Sustainable Australian Equity Fund, Aberdeen Standard Fully Hedged International Equities Fund, Aberdeen Standard Global Absolute Return Strategies Fund, Aberdeen Standard Global Corporate Bond Fund, Aberdeen Standard International Equity Fund, Aberdeen Standard Multi Asset Real Return Fund, Aberdeen Standard Multi-Asset Income Fund 1 Source: Professional Pensions, October 2022 |

16 May 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|

|||||||||||||||||||

| Ellerston Overlay Australian Share Fund | |||||||||||||||||||

|

|||||||||||||||||||

|

|

|||||||||||||||||||

|

|||||||||||||||||||

| Tribeca Vanda Asia Credit Fund - Founders Class | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Avari Capital Partners - Private Loan Income Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Victor Smorgon Partners Global Multi-Strategy Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |

16 May 2023 - 10k Words | May Edition

|

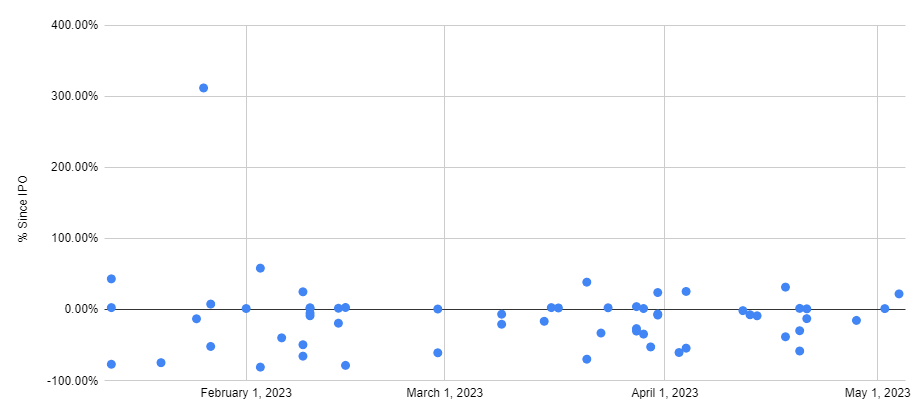

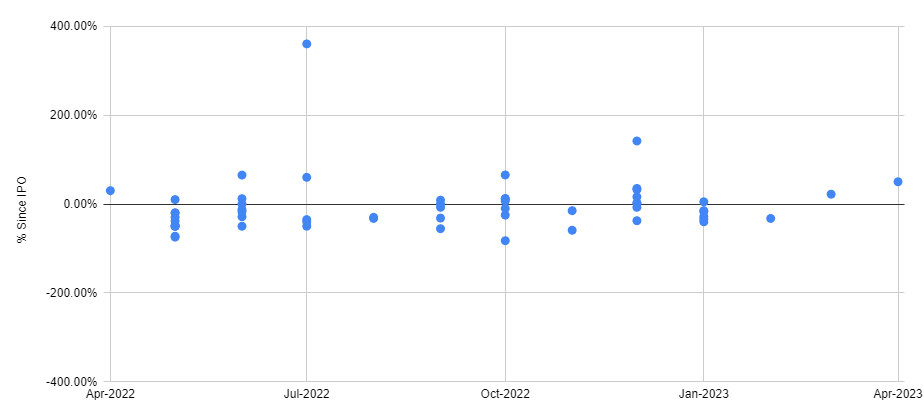

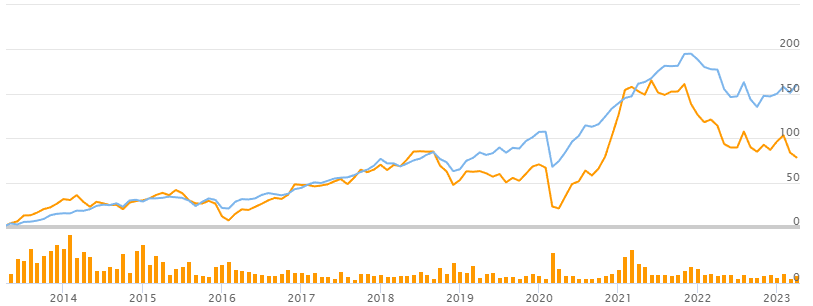

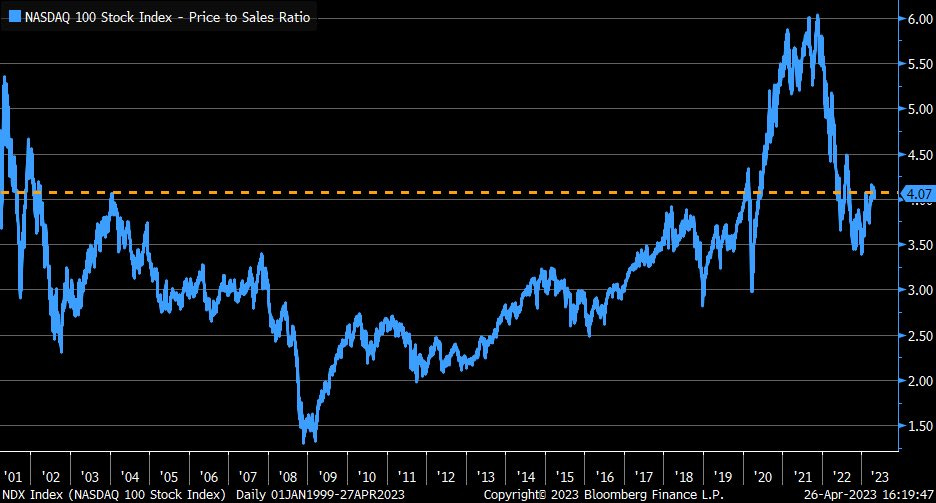

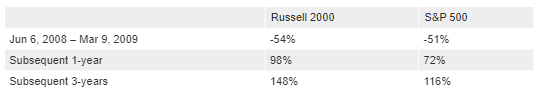

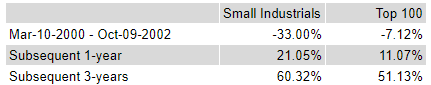

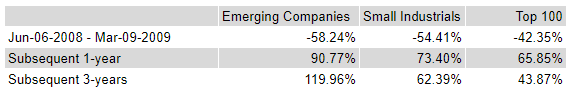

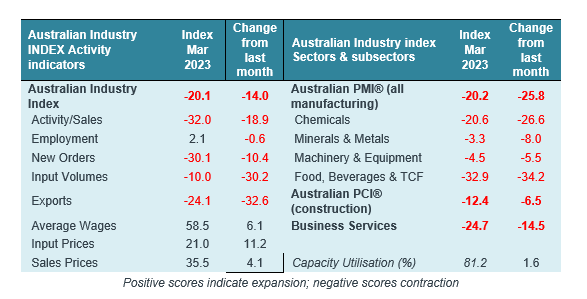

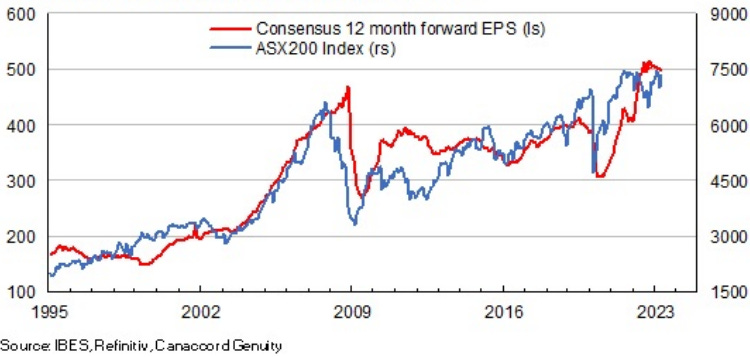

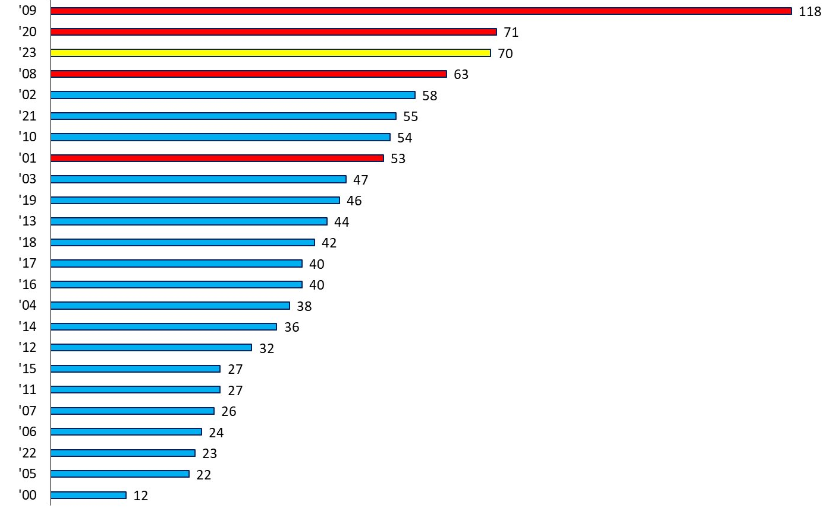

10k Words Equitable Investors May 2023 Miserable IPO returns have been the story even though Kenvue got away with a 22% stag on day one of its US listing last week; a gap has opened between small and large stocks with the "jaws" notable in both price movements and valaution comparisons; in that context it is interesting to see how smaller stocks have outperformed historically coming out of market drawdowns; in Australia the industry survey looks negative but S&P/ASX EPS revisions haven't really been notable; insolvency is on the rise as is US consumer credit card debt; and finally for whoever is advising the state fo Victoria, credit ratings do matter. Distribution of returns from US IPOs by issue date (2023 to date) Source: Equitable Investors, StockAnalysis Distribution of returns from ASX IPOs by issue date Source: Equitable Investors ASX small caps (SSO - orange) v large caps (STW - blue) Source: Equitable Investors, TIKR US micro caps (IWC - orange) v large caps (IVV - blue) Source: Equitable Investors, TIKR Past 20 Years World Small Cap P/E Ratios Source: Pzena Nasdaq 100 Price/Sales Ratio Source: Charles Schwab & Co. US small caps v large caps during & after the "dot-com bubble" Source: abrdn US small caps v large caps during & after the GFC Source: abrdn S&P/ASX small v large during & after the "dot-com bubble" Source: Equitable Investors, Iress S&P/ASX small v large during & after the GFC Source: Equitable Investors, Iress AIG Industry Index Source: IFM, AIG Consensus EPS expectations for S&P/ASX 200 Source: Cannacord Large bankruptcies ($US50m+ liabilities) - Jan-Apr count for 2023 Source: Bloomberg, @jsblokland Australian companies entering external administration for the first time (FY23 = black line) Source: ABS US Consumer Loans (Credit Cards & Other Revolving Plans, All Commercial Banks) Source: @glightfinancial, FRED Government Bond Yields and their S&P credit ratings Source: Equitable Investors, worldgovernmentbonds.com May Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |