NEWS

16 Jul 2024 - Why Anchoring is Sabotaging Your Stock Market Success

|

Why Anchoring is Sabotaging Your Stock Market Success Marcus Today July 2024 |

|

A landscape image representing the stock market and stock market analysis. The background features a digital chart with rising and falling stock prices, candlestick graphs, and financial data overlays. On the side of the image, a large anchor is more apparent and appears submerged into the stock market scene, symbolizing stability amidst the market fluctuations. The overall color scheme includes shades of blue, green, and red to reflect the dynamic nature of the stock market. No ocean or people are present in the image. Understanding Anchoring and Its Impact on Stock Market Investments What is Anchoring in Financial Markets? We all have a lot of trouble buying stocks that have gone up a lot and selling stocks that have gone down a lot. If that's you then I regret to inform you that you are being affected by a well-established financial concept that only affects soft brained investors. It is called "Anchoring". Anchoring, also known as a 'focusing bias', is the use of a reference point against which to judge value. You hear the issue every day in a broking office, it's when someone says "I can't buy that because the share price is up XYZ%" or "You can't sell that the price is down XYZ%". An even more soft brained development on the theme is when you find yourself saying "It's down XYZ% so it's cheap" or "It's up XYZ% so it's expensive". But making money in shares is all about where the share price is going. In that equation, where the share price has been is pretty much irrelevant and the fact that we don't buy or sell a stock because it is up X percent or down X percent, because of where the share price 'was', is unscientific. What you paid for a stock, what price it was in the past, in fact, any reference to the share price history, ignores the only relevant consideration which is what the share price is going to do tomorrow. BHP five years ago was priced on a different set of facts to BHP now, so what relevance is that old high or old low. It's irrelevant. Despite that it is common practice to reference how much a stock has moved from the lowest low or highest high and it is commonplace to take those past prices (laughably - the extreme highs or lows) as an anchor point from which to judge the current price as being expensive or cheap based on how far it is up or down since then. But past prices are simply a statement of where a price was. The more important consideration is what the company is worth now coupled with an understanding that the market's appreciation of what the company was worth at some point in the past has almost certainly changed. As soon as the value of a company changes, which arguably it does every day, you have to move your thinking along. If your decision making starts with a reference point from the past (It's up XYZ% from the low") you have proven yourself a bit amateur. To make a stock judgement past prices are the most unscientific of starting points. Another amateur manifestation of anchoring is buying stocks because they have fallen a lot. This is technically wrong to do (you should sell stocks going down not buy them). Buying bombed-out stocks (catching the knife) because they have fallen a lot, ignores the fact that the market's assessment of the company's value has changed, a lot, for the worse, so the 'attraction' of a big fall is irrelevant. The other very widespread use of anchoring is when traders use their purchase price as a reference point. "I'll sell it if it goes up 10%" or "I'll sell if it goes below my purchase price". All very nice but not rational, although, in its defence, anything, even unscientific anchoring, is better than nothing when it comes to having some trading discipline. An extension of anchoring is 'lazy jargon'. Saying that a stock is "cheap" or "undervalued" because it has fallen a lot. Or "expensive" or overvalued" if it's gone up a lot. A stock can only be valued with reference to what it is worth, not with reference to what the share price used to be. The best way to avoid anchoring is to forget the past price as a reference point and simply assess 'cheap or expensive' on some other criteria. PE history perhaps, or price relative to an intrinsic value calculation would be more useful. Meanwhile you can amuse yourself by listening out for anyone, you perhaps, making comments or decisions on the basis that a stock is up X% or down X% because your sole focus should be whether a stock is going up or not. The fact that it's gone up or not, that, is irrelevant. Anchoring - Another reason humans aren't wired to trade successfully. Author: Marcus Padley |

|

Funds operated by this manager: |

15 Jul 2024 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

15 Jul 2024 - 10k Words | July 2024

|

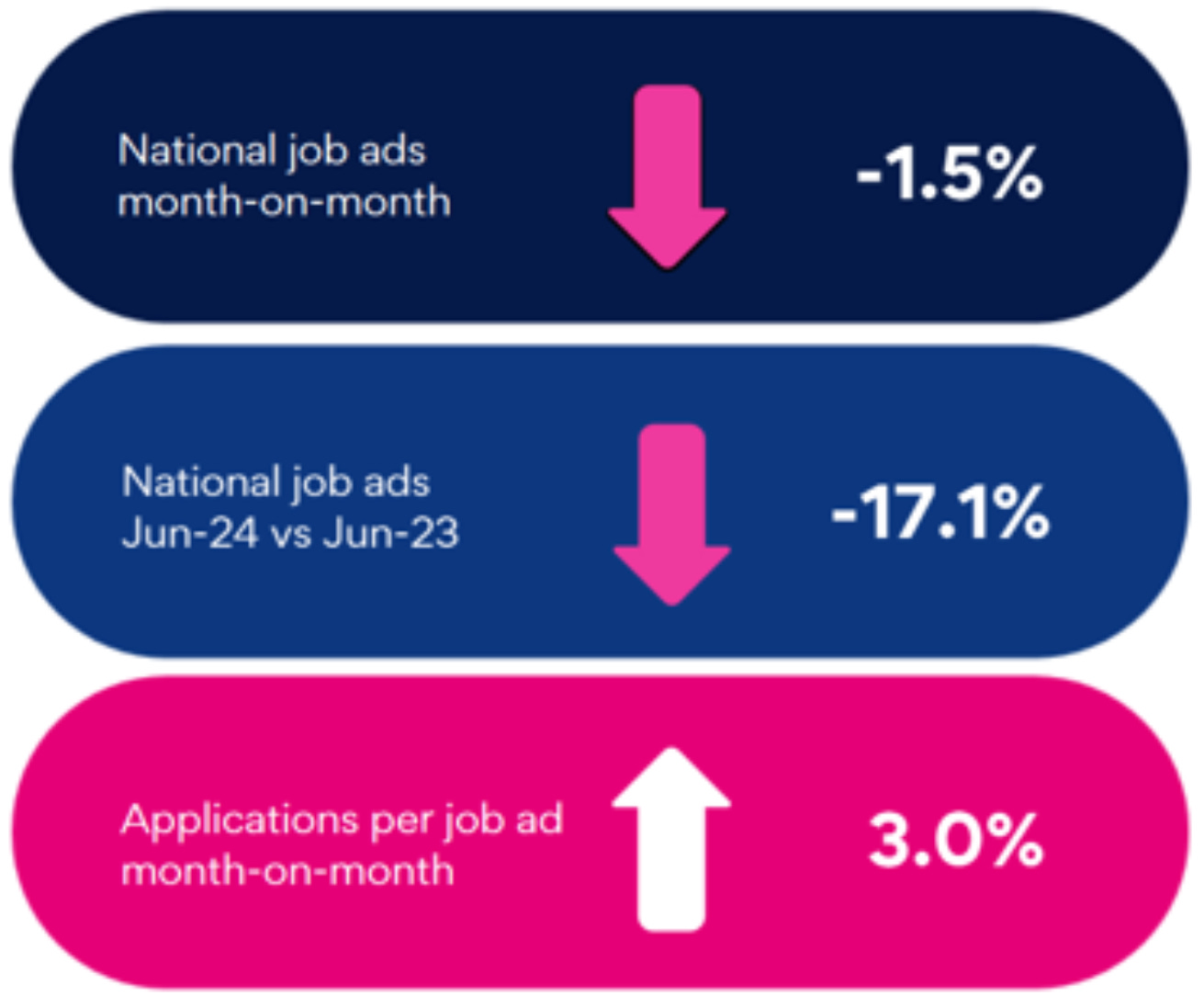

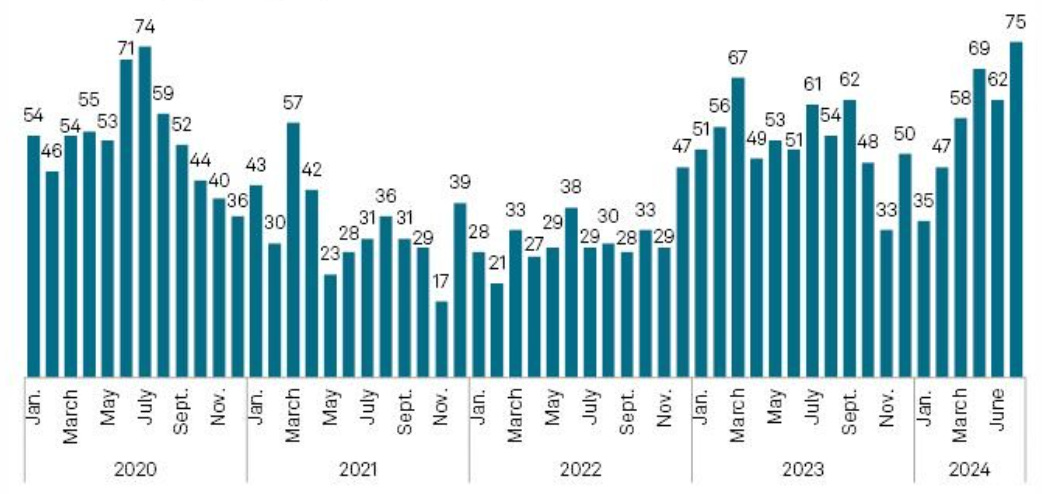

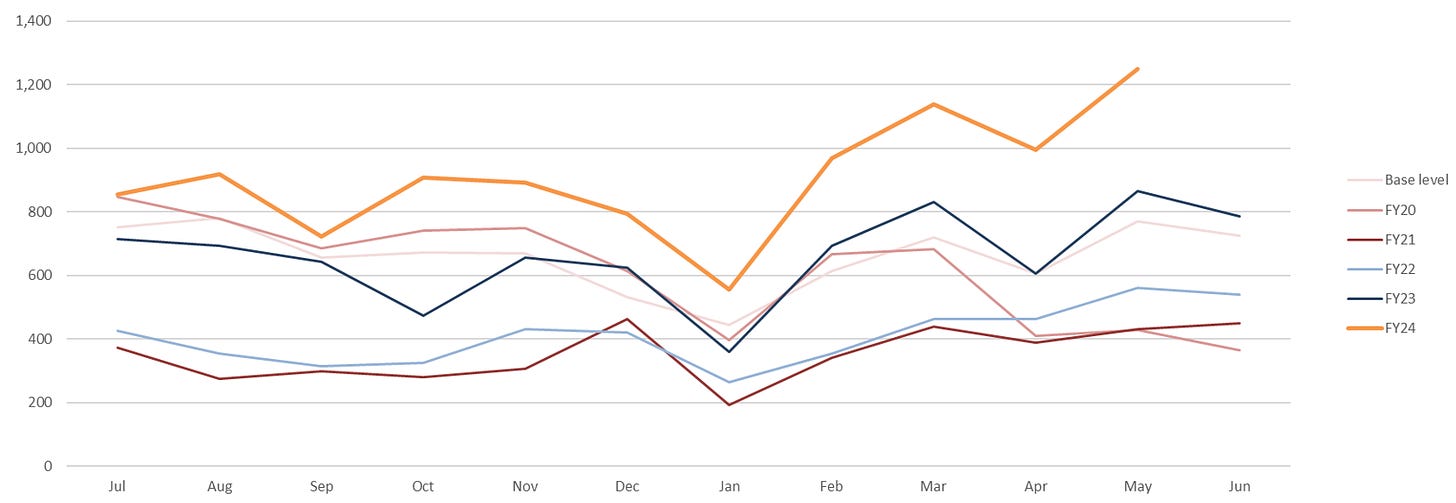

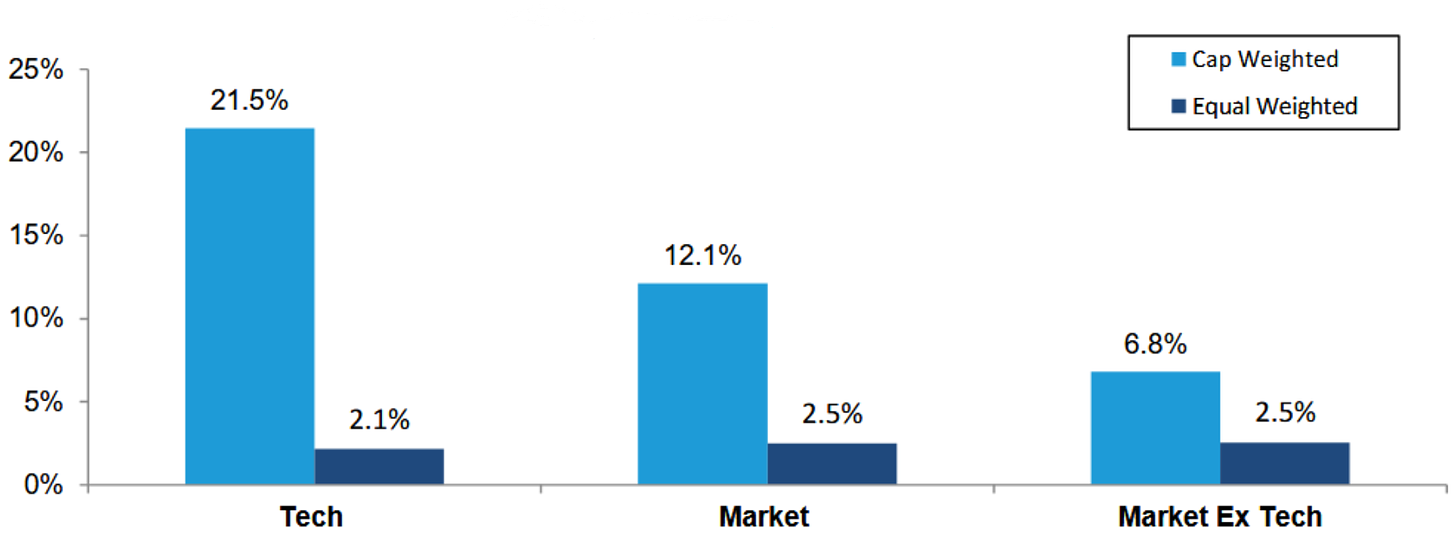

10k Words Equitable Investors July 2024 Seek's national job ads count is down 17% over 12 months; corporate bamkruptcy/administration filings at multi-year highs; equal-weighted tech stocks are lagging cap-weighted tech performance by even more than the broader US market; AI valuations holding up VC space too; sustained net short positon on S&P 500; ASX nano/micro caps and the seasonal performance driven by tax loss selling in June, with a rebound in July; and finally the volume of downgrades coming into ASX reporting season is in-line with prior years. Seek's June 2024 Australian job ads

Source: Seek US bankruptcies by month

Source: S&P Australian external administration appointments by year

Source: ASIC 2024 YTD absolute performance - tech v. rest of the market

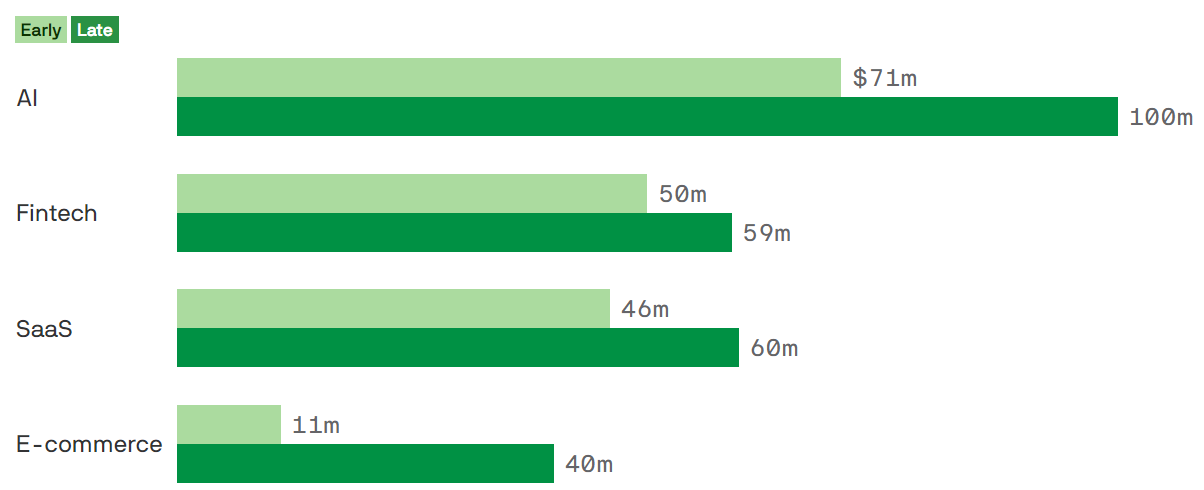

Source: Bernstein via @modestproposal1 2024 VC-backed tech valuations of select verticals, by stage

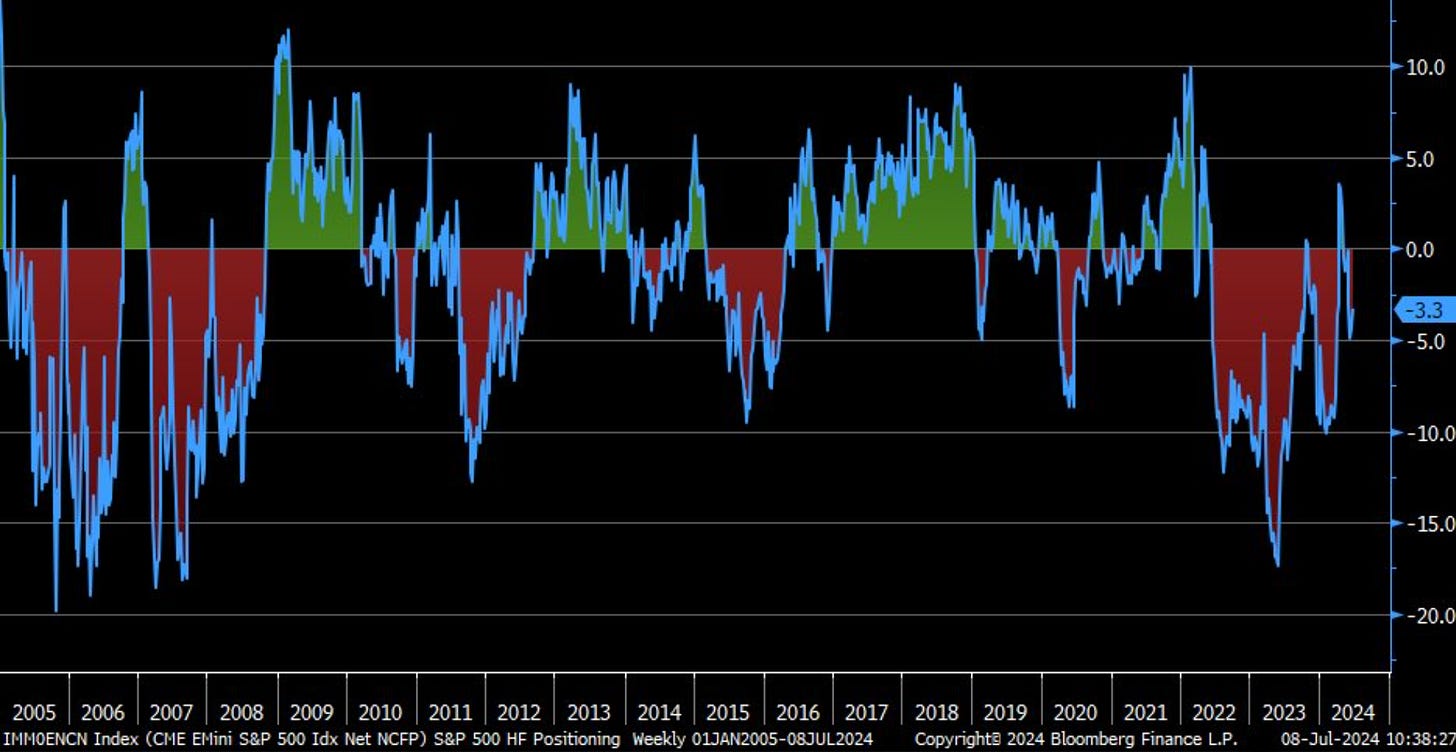

Source: Axios E-Mini S&P 500 net non-commercial futures positions % of open interest

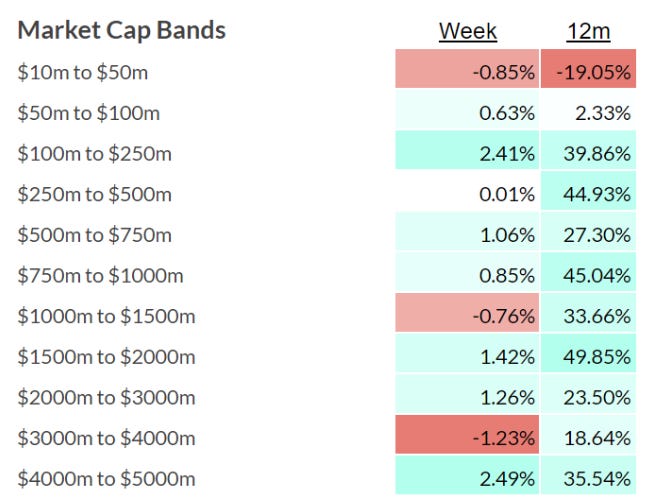

Source: @LizAnnSonders, Bloomberg ASX ex-resoures by market cap band over 12 months of CY2024

Source: Equitable Investors

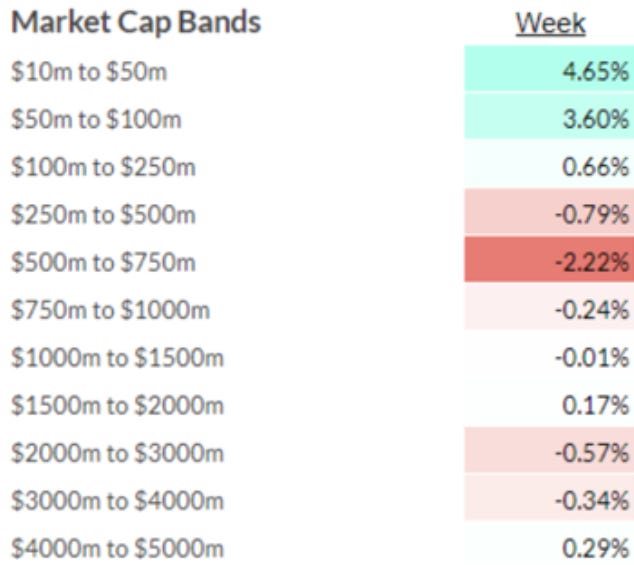

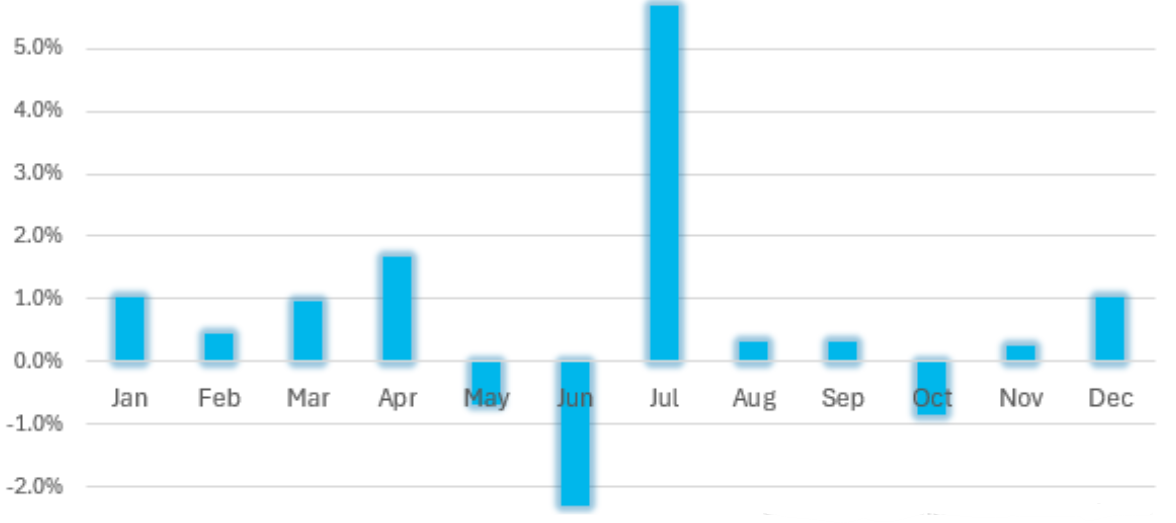

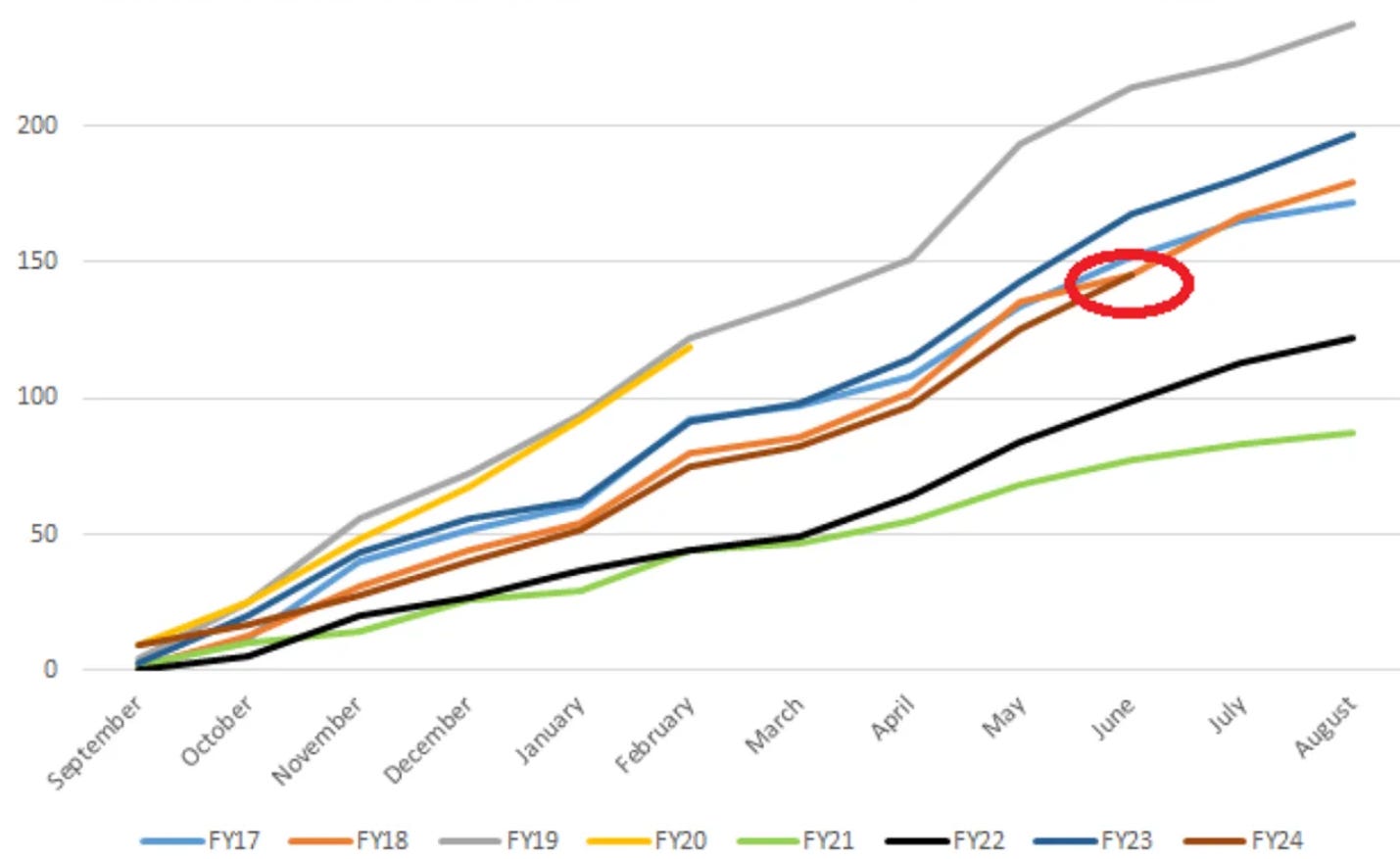

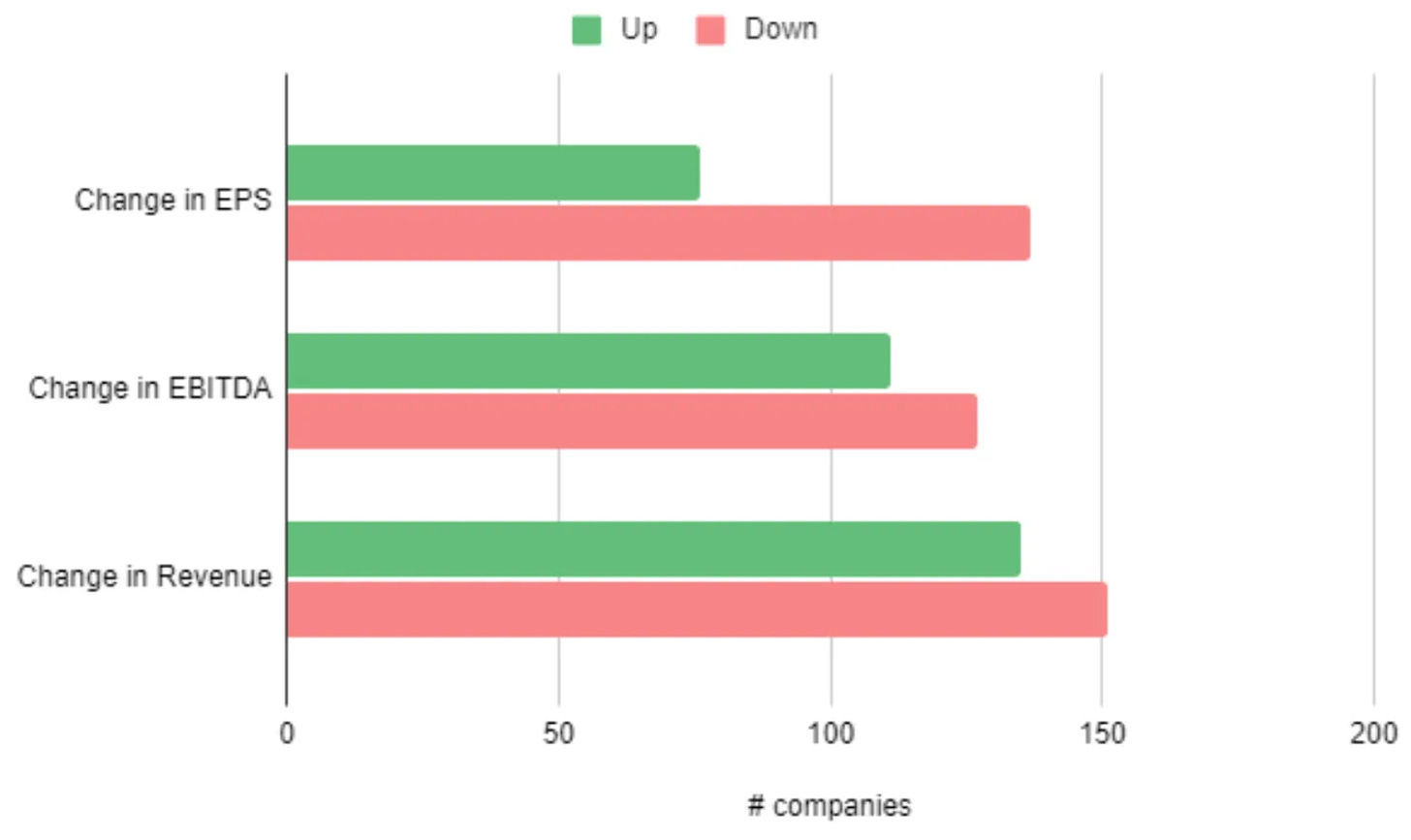

ASX ex-resoures by market cap band - first week of FY2025 Source: Equitable Investors Average monthly return of S&P/ASX Emerging Companies Index (since March 2016, excluding COVID-impacted CY2020)

Source: Equitable Investors Number of ASX downgrades - comparison with past financial years (FY20 cut short by COVID) "FIT" universe (ASX micro-to-mid, ex resources) - changes to consensus estimates over past 12 months Source: Equitable Investors July 2024 Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Past performance is not a reliable indicator of future performance. Fund returns are quoted net of all fees, expenses and accrued performance fees. Delivery of this report to a recipient should not be relied on as a representation that there has been no change since the preparation date in the affairs or financial condition of the Fund or the Trustee; or that the information contained in this report remains accurate or complete at any time after the preparation date. Equitable Investors Pty Ltd (EI) does not guarantee or make any representation or warranty as to the accuracy or completeness of the information in this report. To the extent permitted by law, EI disclaims all liability that may otherwise arise due to any information in this report being inaccurate or information being omitted. This report does not take into account the particular investment objectives, financial situation and needs of potential investors. Before making a decision to invest in the Fund the recipient should obtain professional advice. This report does not purport to contain all the information that the recipient may require to evaluate a possible investment in the Fund. The recipient should conduct their own independent analysis of the Fund and refer to the current Information Memorandum, which is available from EI. |

12 Jul 2024 - Hedge Clippings |12 July 2024

|

|

|

|

Hedge Clippings | 12 July 2024 If there was one topic aside from inflation and interest rates that was set to dominate the news in 2024, it was going to be elections - or more importantly their outcome. 64 countries, plus the European Union, have held, or are due to hold elections this year, representing 49% of the world's population. You would expect therefore to say "Democracy Rules" - except it doesn't always apply. The potential for change in Russia (even though elections were held) was limited to say the least, as it was in Bangladesh, or Pakistan, where the most popular politician, Imran Khan, was in jail. Last week's UK election is another case in point: Democracy, of a sort, took place with an overwhelming vote of no confidence in the ruling Conservative government, although only 59% of the population thought it was worth the effort to vote on the day. Presumably a fair proportion of the 41% who didn't vote were still following the UK's WWll era slogan "Keep Calm and Carry On". Meanwhile, a fair proportion of the 61% who did vote will have to do the same for the next 4 years. However, the result was lopsided. While the winning Labour Party control 412 or 63% out of the total of 650 House of Commons seats, they received only 34% of the overall vote. Much of the skew can be blamed on the UK's system of first past the post voting - although if blame is to really be apportioned, Rishi Sunak and his 4 predecessors in 10 Downing Street should really shoulder it. This system saw 12.2% of the vote cast for the Liberal Democrats, who won 72 seats, while arch-spoiler Nigel Farage's Reform UK party out-polled the Lib Dems with 14.5% of the vote, but only won a paltry 5 seats for their efforts. As above, Democracy of a sort, but we have to admit better than that available - or not, depending on your view - in Putin's Russia, or for that matter Xi's China, where he was unanimously elected by almost 3,000 delegates of the National People's Congress last year. Australia's political system may not be perfect, but proportional representation, thanks to our preferential system, sure beats the heck out of the UK, let alone China and Russia! Which leads us to the looming election in the US, where earlier today Joe Biden was mumbling and bumbling his way through an hour-long news conference following the end of the NATO Summit commemorating its 75 years' existence (six years short of Joe's own age). In between slips of the tongue (mixing Putin with Zelensky, and for a moment naming Trump as his Vice President) Biden sounded more like he was at an election rally than a summary of the NATO deliberations. Meanwhile Trump, thanks to the US Supreme Court's ruling on presidential immunity, was busy filing an appeal against his conviction on criminal charges stemming from hush money paid to a porn star. Unless Biden has a change of heart, which it seems he's unwilling to do, one of them will end up as President of the free world come November. Whichever side of politics you're on in Australia, thank your lucky stars you're here! News & Insights Down-trading Megatrend | Insync Fund Managers Why invest in global equities | Magellan Asset Management June 2024 Performance News Bennelong Australian Equities Fund Glenmore Australian Equities Fund Bennelong Long Short Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

12 Jul 2024 - Performance Report: Cyan C3G Fund

[Current Manager Report if available]

12 Jul 2024 - Performance Report: Argonaut Natural Resources Fund

[Current Manager Report if available]

12 Jul 2024 - Performance Report: Bennelong Long Short Equity Fund

[Current Manager Report if available]

12 Jul 2024 - Fast food profits

|

Fast food profits Montgomery Investment Management June 2024 I have previously written here that one of the most repeatable ways to make money on the Australian Stock Exchange (ASX) is to buy into a retail store rollout story early. Catching the steepest part of the 'S' curve when revenue and profit growth are accelerating while head office becomes simultaneously more efficient usually produces good results thanks to the accompanying rise in the share price. And when like-for-like sales of existing stores are still growing and the number of new stores being added is high in proportion to the number of existing stores, jumping aboard early provides an even more beneficial tailwind. Store growth ambitions are often disclosed in a company's initial public offering (IPO) prospectus and within twelve months, investors usually have a good idea about management's ability to deliver on the stated plans, as well as customers' love for the concept. Recent retail success stories Some recent and not-so-recent examples include Lovisa (ASX:LOV), which sold its product through 60 stores in 2012. When it was listed in 2014, it had grown to 220 stores. Eight years after listing, Lovisa distributes its jewellery through 449 stores. And since it listed, the share price is 976 per cent higher. JB Hi-Fi (ASX:JBH) listed in October 2003, with just 25 stores, issuing shares at $1.55. Today, with 316 stores (including acquisitions of Clive Anthonys and The Good Guys) the shares trade at $58.46, a return of 3671 per cent, or 19.1 per cent per annum over 20 years, excluding dividends. The furniture retailer Nick Scali (ASX:NCK) was listed in May 2004. At the time of its 2004 full-year results, it reported sales of $43.4 million and earnings of $6.7 million from just 10 stores. The IPO price was $1. With 85 stores today, and more than 90 Plush stores, the share price is up 1378 per cent at $13.78, or 14 per cent per year over 20 years. Guzman y gomez IPO Recently, the healthy, fast, Mexican-inspired food chain Guzman y Gomez launched its prospectus for an already fully subscribed IPO to list shares on the ASX on 25 June. With its first store opening in 2006, and 185 stores in Australia currently, Guzman y Gomez's management has already proven to be one of Australia's fastest-growing quick service restaurant (QSR) teams. Guzman y Gomez plans to have over a thousand domestic stores in the next twenty years. This compares with McDonalds (NYSE:MCD) Australia, which opened its first store in 1971, reached 869 stores in 2011 and now has 1043 stores. Elsewhere, Subway, which launched in 1988, has 1227 stores across Australia today, while Domino's (ASX:DMP), which set up shop in 1983, now has 736 stores. And like Lovisa, JB Hi-Fi and Nick Scali before it, Guzman y Gomez lists 'new store openings' as its top source of future growth, stating, "new restaurant openings in Australia are expected to be the primary contributor to Guzman y Gomez's network sales growth over the long term. Guzman y Gomez believes there is an opportunity to grow its network to more than 1,000 restaurants in Australia over the next 20-plus years. The company believes that it has substantially built the team, restaurant pipeline, and infrastructure to be able to open 30 new restaurants per annum over the near-term [it opened 26 in CY23], increasing to 40 restaurants per annum within five years." As an aside, there are also 16 stores in Singapore, five in Japan and four in the U.S. Not only are store openings going to continue, they are expected to accelerate. That's the first source of growth. Importantly, individual store economics are extremely attractive, with Guzman y Gomez expecting to achieve a return on investment (ROI) in line with existing stores of approximately 50-55 per cent on new corporate restaurants and its franchisees to achieve an ROI of approximately 30 per cent on new franchise restaurants, with the difference being due to the royalty paid by franchisees. Not only is the number of these highly profitable stores expected to grow significantly and accelerate, but restaurant margins are also expected to improve. Guzman y Gomez restaurant margins improve with volume, and volume rises as Guzman y Gomez stores mature. In 2023, corporate restaurant margins were 14.4 per cent. In 2024, that margin is expected to rise to 17.1 per cent and 17.8 per cent in 2025. At the same time, the Franchise royalty rate is expected to rise from an average 7.6 per cent in FY23 to 8.3 per cent in 2025. And as the store count grows, the general and admin related costs should come down. Indeed, the company is aiming for a reduction in G&A-to-network-sales from the expected 6.8 per cent of sales in FY25. Accelerating store openings, continuing like-for-like sales growth, expansion in restaurant margins and franchise royalty rates should all add up to strong earnings growth, something investors are desperately seeking in an environment marred by slowing economic growth and heightened interest rates. What remains for investors to consider is the price they might be paying for all this growth. Cornerstone investors, which include Aware Super and Copper Investors, are acquiring their shares at $22 each following a 250-for-one share split. That price represents a very high price-earnings (P/E), so one might wonder what the cornerstone investors see that's worth paying up for, especially given at that multiple there will be any number of investors who turn their back on the opportunity. So is Guzman y Gomez the ultimate investor Mexican standoff? Valuation considerations Most investors value QSR businesses on an earnings before interest, tax, depreciation and amortisation (EBITDA) multiple basis, and the number on the prospectus is about 38 times, which, again, is very high. Importantly, it's worth understanding that 38 times includes the losses the company is currently incurring in the U.S. strip out those losses and the multiple applicable to the Australian business is about 32 times. It's also worth acknowledging a change in the terms between the company and its franchisees. When Guzman y Gomez first launched, the standard franchise contract included an eight per cent of sales royalty. Given Guzman y Gomez franchisees earn abnormally high returns on investment, Guzman y Gomez changed that franchise royalty to eight per cent of sales up to three million dollars per store and 15 per cent above that. All new franchise arrangements are struck on the new terms and old franchise arrangements, when they come up for renewal, will move to the new platform. Assuming Guzman y Gomez didn't open another restaurant ever again and existing stores traded without any further improvement, the shift to the new contract terms would see the EBITDA multiple falls from 32 to approximately 28 times. Meanwhile, if the company also opens its targeted 30 stores next year, never opens another store again after 2025, and these stores trade in line with existing stores, the EBITDA multiple falls to 23 times. It is clear from the prospectus, the company plans to open many more stores in coming years. International comparisons Despite Guzman y Gomez's prospectus appearing to play down its international growth opportunities, it may nevertheless be worth comparing the adjusted EBITDA multiple to global peers. A relevant comparison would be Cava (NYSE:CAVA), which IPO'd in the U.S. in June 2023, also at U.S.$22 per share, funnily enough. Upon listing, Cava shares surged 89 per cent to U.S.$42 amid that clearly welcomed long-term sustainable growth stories, especially category-defining brands. Cava has about 200 stores and trades at 82 times EBITDA. Meanwhile, Chipotle (NYSE:CMG), which is obviously the behemoth in the space, and arguably mature, with 6,000 stores, trades at 34 times. With an already proven store concept, a significant store rollout opportunity ahead, and a proven management team to execute that store rollout, some investors are clearly arguing the multiple is reasonable. And with existing shareholders (including your author) escrowed until August 2025, the supply of shares may be tight. Investing in the rapid rollout of a successful store concept has been one of the easiest and most repeatable ways to make money in the Australian stock market. The listing of Guzman y Gomez in June this year will help determine if that strategy remains relevant. Author: Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

11 Jul 2024 - Performance Report: Glenmore Australian Equities Fund

[Current Manager Report if available]

11 Jul 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]