NEWS

13 Mar 2018 - Performance Report: Cyan C3G Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Cyan C3G Fund is based on the investment philosophy which can be defined as a comprehensive, clear and considered process focused on delivering growth. These are identified through stringent filter criteria and a rigorous research process. The Manager uses a proprietary stock filter in order to eliminate a large proportion of investments due to both internal characteristics (such as gearing levels or cash flow) and external characteristics (such as exposure to commodity prices or customer concentration). Typically, the Fund looks for businesses that are one or more of: a) under researched, b) fundamentally undervalued, c) have a catalyst for re-rating. The Manager seeks to achieve this investment outcome by actively managing a portfolio of Australian listed securities. When the opportunity to invest in suitable securities cannot be found, the manager may reduce the level of equities exposure and accumulate a defensive cash position. Whilst it is the company's intention, there is no guarantee that any distributions or returns will be declared, or that if declared, the amount of any returns will remain constant or increase over time. The Fund does not invest in derivatives and does not use debt to leverage the Fund's performance. However, companies in which the Fund invests may be leveraged. |

| Manager Comments | Positive contributors in February included Spirit Telecom (+27%), Axsess Today (+20%) and Readcload (+90%). Negative contributors included Motorcycle Holdings (-12%), Experience Co (-5%), Kelly Partners (-9%). To date, Cyan has taken a placement in BlueSky (BLA) and subscribed for some shares in a new IPO. During the market weakness there were a number of Fund holdings that Cyan added to, including AMA Group (AMA) and Moelis (MOE) which, Cyan noted, have been rewarded. The Fund currently has just over 20 positions and in excess of 45% of the Fund's total capital invested in cash. Even with this controlled portfolio, Cyan are confident they can provide solid returns to their clients. Cyan continue to adhere to their long-held investment philosophies, ride out the current volatility and make opportunistic investments they deem appropriate within the Fun's risk parameters. |

| More Information |

12 Mar 2018 - Fund Review: ARCO Absolute Trust February 2018

ARCO ABSOLUTE TRUST (formerly Optimal Australia Absolute Trust)

AFM have released the most recently updated Fund Review on the ARCO Absolute Trust.

We would like to highlight the following aspects of the Fund;

-

ARCO Investment Management is a specialist Australian equity investment manager and the Fund has a long/short equity strategy typically with a low but variable net market exposure comprising 40 to 65 stocks broadly selected from within the ASX200.

-

The investment team comprising George Colman, Peter Whiting, and Stephen Nicholls bring 100 years combined experience in equity markets.

-

The Fund has an annualised return since inception of +8.35%. The Fund's approach to risk is shown by the Sharpe ratio of 1.38 (Index 0.30), Sortino ratio of 2.89 (Index 0.33), both of which are well above the ASX 200 Accumulation Index and has recorded over 78% positive months.

For further details on the Fund, please do not hesitate to contact us.

9 Mar 2018 - Hedge Clippings 09 March, 2018

Trump's Tariffs obscures bond and equity market risks - for now.

Trump's trade restriction deal is still a work in progress, but in typical Donald style it's all part of a bigger negotiation play, and possibly directed as much at the rust belt which helped him into the White House in the first place than foreign nations dumping steel on the US market.

We're not sure his change in US tariff policy (now clearly aimed at China and Asian imports, although that's gone unsaid) will necessarily turn around that section of the US economy, which is also facing other significant structural and long term issues. However, whilst not agreeing with his economic logic, one has to give Donald the politician points for keeping to his electoral promises.

We also noted that when it comes to trade and tariffs, he's now saying the Mexican's are his good friends, along with Canada. How much steel and aluminium (or even aluminum) is required to build the WALL?

Meanwhile the bond/equity market two step has receded from the front pages* of all but the financial press, but it is still there. As per this report from HSBC's Steven Major this morning:

"Our view is that the correction in risky asset markets (equities) should be taken as a warning of what could follow," Major wrote in the report. "Historical correlations between asset classes are unlikely to be stable as the global economy adjusts for the normalisation of unconventional monetary policy."

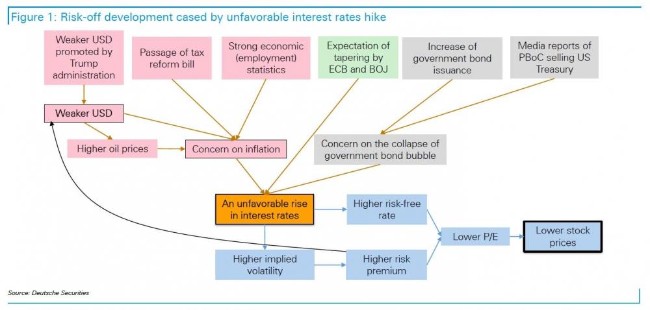

We've written about this for a while, but this chart from Deutsche puts it all in simple terms. As they say, a picture paints a thousand words...

This chart was produced before Trump's announcement on tariffs, but the key boxes are "An unfavourable rise in interest rates" and "Lower stock prices". Don't ignore the message!

In breaking news it has been announced that Donald Trump and North Korea's Kim Jong Un will meet in May - refer above to Trump's negotiating style rather than political skills. There will be plenty of claims to bringing this historic meeting about, firstly from Trump himself by ramping up both rhetoric and sanctions, but also China for the pressure they've brought to bear behind the scenes. If nothing else it will put two of the most distinctive global haircuts into the same space at the same time.

*So too, thankfully, has Barnaby's maybe baby and the PM's "bonk ban". The wider world must be wondering what life down under is all about.

9 Mar 2018 - Fund Review: Bennelong Long Short Equity Fund February 2018

BENNELONG LONG SHORT EQUITY FUND

Attached is our most recently updated Fund Review on the Bennelong Long Short Equity Fund.

- The Fund is a research driven, market and sector neutral, "pairs" trading strategy investing primarily in large large-caps from the ASX/S&P100 Index, with over fourteen-year track record and annualised returns of 16.38% p.a.

- The consistent returns across the investment history indicate the Fund's ability to provide positive returns in volatile and negative markets and significantly outperform the broader market. The Fund's Sharpe Ratio and Sortino Ratio are 1.00 and 1.65 respectively.

For further details on the Fund, please do not hesitate to contact us.

8 Mar 2018 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The long portfolio performed slightly better than the market with a return close to zero, while the short portfolio was the drag on returns underperforming the market slightly. The portfolio experienced a favourable hit rate of company results in February reporting season across both the long and short portfolio, which was not reflected in the return. Return from the Fund's most profitable pair, long Aristocrate / short Tabcorp, was due to a weak result from Tabcorp. The Fund's weakest pair was long Carsales / short Computershare with both stocks down; Carsales due to profit taking after a strong run and Computershare due to a stronger result and associated earnings upgrades. |

| More Information |

7 Mar 2018 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

| Manager Comments | Positive contributions in the month were from Global Geoscience and the Fund's shorts in Invocare, IPH, Ramsay Health (all downgrading), IOOF, Telstra and the Fund's bond proxies. These were offset by declines in Orocobre, CleanTeq, Challenger, Janus Henderson, Agrimin and Echo. The Fund ended the month with 32 long positions and 19 short positions. In their latest report, Paragon briefly discuss the rapid sell-off of bonds at the start of 2018 which triggered higher volatility and a roughly 12% correction in US stock markets - the first >10% correction in two years. Paragon believe the current correction is well and truly overdue, and that rising bond rates and their rate of change will continue to drive increased volatility over 2018. Paragon also noted that, in light of the fact that several of the Fund's key high-conviction long positions carry higher volatility in periods of market stress, Paragon has a flexible mandate and is active with exposure, having the ability to hedge and shift to a higher cash position (currently 35%) when appropriate. |

| More Information |

7 Mar 2018 - KIS Capital Research - Human Longevity

We see human longevity as a huge new investment theme. Whilst its impact on the healthcare system alone will be enormous, we expect its ripples to extend further, washing into the broader economy.

6 Mar 2018 - Performance Report: Qato Capital Market Neutral Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund seeks to preserve capital and maximise absolute returns through active and constant risk management, targeting monthly a net market exposure of 0% to hedge broader market risks by generally holding up to 50 S&P/ASX-100 positions (up to 25 long positions & 25 short positions). Historically, the strategy has been uncorrelated to traditional asset classes with a negative beta to equity markets. Qato Capital's process is entirely systematic - stock selection and risk management are all employed in a rules based approach. Positions in Qato's long-portfolio and short-portfolio are rotated monthly dependent upon their Q-Score ranking. The strategy employs no financial leverage/gearing to purchase securities, no derivatives and no financial products to imitate leverage. |

| Manager Comments | South32 was the strongest performer for the month, contributing +0.83% due to the Fund holding an overweight position of +4.6%. Flight Centre also contributed positively (+0.40%) after rallying +15.35%. The Fund's underweight position in the Financials sector, which pulled back -0.79%, also had a positive impact on relative performance, with the Fund holding short positions in ANZ (-0.56%) and Westpac (-1.26%). A strong rally in the healthcare sector (+3.16) negatively impacted performance of the short book which held positions in Sonic Healthcare (+4.3%), CSL (+3.6%) and Cochlear (+1.4%), although the impact was lessened by short positions in Ramsay Healthcare (-2.5) and Healthscope (-8.1%) which contributed positively. |

| More Information |

6 Mar 2018 - Performance Report: Pengana PanAgora Absolute Return Global Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | PanAgora believes the best way to find opportunities in the global markets is to combine fundamental analysis with robust quantitative techniques in order to filter the investment universe and select the investments. The Fund invests primarily in listed equity securities from a global universe of developed markets and a select group of emerging market countries. The Fund's objective is to seek absolute returns by identifying and exploiting multiple inefficiencies that may exist in global equity markets. These inefficiencies are primarily exploited through the use of a long/short equity strategy which aims to construct a portfolio that is generally neutral to market movements. As such the performance of the investment strategy is largely independent of the market's performance. The Fund seeks to achieve its objective by using a diversified set of strategies that have low correlation to one another. In addition, because many of these strategies are designed to generate profit under different market conditions, their combination is expected to result in more stable returns over time than any individual strategy in and of itself. |

| Manager Comments | Performance in January was driven by the long-term portfolio which contributed +1.10%, with strong performance coming from the U.S. large capitalisation and Emerging Markets stocks. Intermediate-term strategies detracted -0.04% due to U.S. merger arbitrage and share class arbitrage related trades, and short-term strategies detracted -0.02% as earnings related trades disappointed. |

| More Information |

5 Mar 2018 - Performance Report: Bennelong Concentrated Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The overriding objective of the Concentrated Australian Equities Fund is to seek investment opportunities which are under-appreciated and have the potential to deliver positive earnings, while satisfying our stringent quality criteria. Bennelong's investment process combines bottom-up fundamental analysis together with proprietary investment tools which are used to build and maintain high quality portfolios that are risk aware. The portfolio typically consists of 20-35 high-conviction stocks from the S&P/ASX 300 Index. The Fund may invest in securities listed on other exchanges where such securities relate to ASX-listed securities. Derivative instruments are mainly used to replicate underlying positions and hedge market and company specific risks. |

| Manager Comments | At the end of January, the Fund's weighting in the Materials sector increased to 14.7% from 7.1% as at the end of December. Weightings were decreased in the Discretionary, Health Care, Consumer Staples, Industrials and Financials sectors. |

| More Information |