NEWS

18 Apr 2018 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The Fund's positive return came from the short portfolio's contribution. However, the long portfolio also outperformed the market with several positions closing higher. Bennelong noted performance broadly reflected trends set by reporting season. In terms of pairs, positive contributors included long Macquarie / short Bendigo and long ALS limited / short Aurizon. On the negative side, long Crown / short SkyCity was the Fund's weakest pair, however, Bennelong noted that the overall contribution from the Fund's negative pairs was minimal. |

| More Information |

17 Apr 2018 - Performance Report: NWQ Fiduciary Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund aims to produce returns, after management fees and expenses of between 8% to 11% p.a. over rolling five-year periods. Furthermore, the Fund aims to achieve these returns with volatility that is a fraction of the Australian equity market, in order to smooth returns for investors. |

| Manager Comments | NWQ noted that, against the challenging market backdrop, it was pleasing to see the Beta managers hedge out a portion of the market risk. In addition, as is to be expected when volatility increases, the opportunity set for the Alpha managers widened and, as a result, these managers made a meaningful positive contribution to overall Fund performance in March. |

| More Information |

16 Apr 2018 - Performance Report: Cyan C3G Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Cyan C3G Fund is based on the investment philosophy which can be defined as a comprehensive, clear and considered process focused on delivering growth. These are identified through stringent filter criteria and a rigorous research process. The Manager uses a proprietary stock filter in order to eliminate a large proportion of investments due to both internal characteristics (such as gearing levels or cash flow) and external characteristics (such as exposure to commodity prices or customer concentration). Typically, the Fund looks for businesses that are one or more of: a) under researched, b) fundamentally undervalued, c) have a catalyst for re-rating. The Manager seeks to achieve this investment outcome by actively managing a portfolio of Australian listed securities. When the opportunity to invest in suitable securities cannot be found, the manager may reduce the level of equities exposure and accumulate a defensive cash position. Whilst it is the company's intention, there is no guarantee that any distributions or returns will be declared, or that if declared, the amount of any returns will remain constant or increase over time. The Fund does not invest in derivatives and does not use debt to leverage the Fund's performance. However, companies in which the Fund invests may be leveraged. |

| Manager Comments | Cyan noted the Fund's defensive cash position alleviated some of the market weakness. One clear positive was the Fund's biggest holding, equipment financier Axsess Today (+8%). Negative contributors included AMA Group, Afterpay Touch, Motorcycle Holdings, Experience Co and Moelis, however, Cyan noted the most material negative contributor was BlueSky Alternatives (BLA) which they discuss in depth in their latest report. Cyan first invested in BLA in October 2014 at $2.80 and built upon this position over time, however, after the release of Glaucus' negative report on the business at the end of March, Cyan decided sell their position completely. The Fund is currently defensively positioned, with a substantial cash holding complemented by 20 positions. Cyan look forward to deploying further cash as opportunities are identified but remain acutely aware of inconsistent sentiment and patches of extreme volatility that the market is currently experiencing, particularly at the smaller end. |

| More Information |

13 Apr 2018 - Hedge Clippings

Macro risk and volatility remain front and centre

Macro issues seem to be centred on geopolitical risk, particularly where The Donald is involved. Mind you, his "my button is bigger than yours" policy approach seems to be moving things along on the Korean Peninsula more than those of his predecessor, so while his style may be more "hardball" than "diplomatic", it might just also turn out to be more effective.

Syria, and in particular with Russia and Iran's involvement, may be a harder nut to crack. From a market perspective investors are possibly becoming acclimatised to Trump's Twitter Diplomacy, which in itself may be a risk when, or if, the rhetoric results in an actual physical or military confrontation.

Meanwhile turning to the markets, in spite of the increased volatility of the past two months, the upcoming US earnings season is likely to see continuing growth in positive numbers. As the US economy picks up, and while wages/inflation remain reasonably benign, interest rates rises will remain firmly on the agenda as the market's number one economic risk.

What has recently changed in the US is the market's perception and realisation, particularly over the issue of privacy and personal data for tech stocks and the FANGS, which have had such a stellar run for the past few years. Suddenly people are realising that if you're not paying for a service or product, you are the service or product.

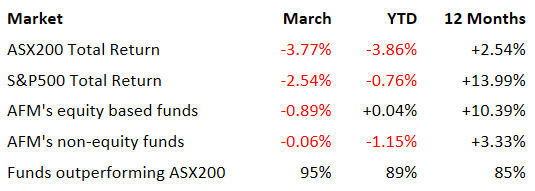

Meanwhile taking a look at the local market and funds' performance YTD and over the past 12 months, where apart from January in the US, there is a sea of red:

Hedge and absolute return funds risky? Hardly! Although choppy markets certainly make things more difficult in a general sense, equity based funds' average outperformance of almost 8% over 12 months, with 85% of all funds' returns beating the market, would seem to answer their critics.

Next week sees a recommencement of the Hayne Royal Commission, with the spotlight turning to the Financial Services sector and wealth advice (or more correctly in some cases, lack of it). Whilst unlikely to be quite as explosive as envelopes stuffed with cash passing across the desks of suburban bank managers' desks, it will still cause plenty of embarrassment to those in the spotlight, and others in the advice industry.

Expect particular attention not only on fees being charged with no advice given, but also over promotion of in house products on dealer groups' approved product lists (APL's), and vertical integration of the industry overall.

13 Apr 2018 - Fund Review: ARCO Absolute Trust March 2018

ARCO ABSOLUTE TRUST (formerly Optimal Australia Absolute Trust)

AFM have released the most recently updated Fund Review on the ARCO Absolute Trust.

We would like to highlight the following aspects of the Fund;

-

ARCO Investment Management is a specialist Australian equity investment manager and the Fund has a long/short equity strategy typically with a low but variable net market exposure comprising 40 to 65 stocks broadly selected from within the ASX200.

-

The investment team comprising George Colman, Peter Whiting, and Stephen Nicholls bring 100 years combined experience in equity markets.

-

The Fund has an annualised return since inception of +8.43%. The Fund's approach to risk is shown by the Sharpe ratio of 1.41 (Index 0.27), Sortino ratio of 2.95 (Index 0.28), both of which are well above the ASX 200 Accumulation Index and has recorded over 79% positive months.

For further details on the Fund, please do not hesitate to contact us.

12 Apr 2018 - Fund Review: Bennelong Long Short Equity Fund March 2018

BENNELONG LONG SHORT EQUITY FUND

Attached is our most recently updated Fund Review on the Bennelong Long Short Equity Fund.

- The Fund is a research driven, market and sector neutral, "pairs" trading strategy investing primarily in large-caps from the ASX/S&P100 Index, with over 15-years' track record and an annualised returns of over 16%.

- The consistent returns across the investment history indicate the Fund's ability to provide positive returns in volatile and negative markets and significantly outperform the broader market. The Fund's Sharpe Ratio and Sortino Ratio are 1.00 and 1.64 respectively.

For further details on the Fund, please do not hesitate to contact us.

11 Apr 2018 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

| Manager Comments | Positive contributors in March included Dacian Gold, Global Geoscience and the Fund's shorts in Invocare, Mineral Resources, Aurizon and Telstra. These were offset by declines in several holdings, driven by the market sell-off, including Orocobre, Cimic, Wattle Heath, Metals X, Echo and Paragon's Cobalt holdings. Paragon ended the month with 30 long and 26 short positions. Paragon's view is that the mood across global markets remains in fear territory, with March exhibiting high levels of volatility once again. In order to best navigate this period of volatility, Paragon increased the Fund's hedges through March and further reduced their net exposure. They also noted that, while ongoing volatility presents certain challenges, they continue to embrace the opportunities that come with it, identifying new stocks for the Fund. |

| More Information |

10 Apr 2018 - Performance Report: MHOR Australian Small Cap Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | MHOR looks for investment that exhibit the following set of characteristics: -Opportunity - to take advantage of growth and positive alignment with industry themes and trends. -Quality business - competitively advantaged product or service offering. -Financial flexibility - appropriately resourced to capture its opportunity. -Management - with the vision and capability to bring it all together. -Fundamentally undervalued. MHOR also considers labour standards, environmental, social and ethical considerations when making investment decisions but only to the extent that these factors impact the assessment of risk or return. The minimum suggested investment timeframe is 3-5 years. |

| Manager Comments | Positive contributors included SPZ, NWH & IMD. Notable detractors were TBH & DUB. The Fund exited the month with 32 stocks and 10% cash. MHOR noted the portfolio performed in line with the market during the downdraft. They went into results season with a target list of potential actionable ideas and, from this list and others, deployed 10% of the fund's cash throughout the season. This allowed MHOR to gain conviction on some stocks and top up holdings, as well as rotate into new ideas and away from stocks where MHOR's assessment had changed. Cyclical stocks caught MHOR's attention the most, they noted. The Mining Services Sector remains foremost in their thinking with much repaired balance sheets, improved operational visibility, reasonable valuation and consensus expectation framework as well as a more limited competitor set than the prior resources peak. This sector remains MHOR's largest overweight. With respect to valuation and expectation, MHOR found Media and Retail to be interesting ahead of results. |

| More Information |

9 Apr 2018 - Fund Review: Insync Global Titans Fund February 2018

INSYNC GLOBAL TITANS FUND

Attached is our most recently updated Fund Review on the Insync Global Titans Fund.

We would like to highlight the following:

- The Global Titans Fund invests in a concentrated portfolio of 15-30 stocks, targeting exceptional, large cap global companies with a strong focus on dividend growth and downside protection.

- Portfolio selection is driven by a core strategy of investing in companies with sustainable growth in dividends, high returns on capital, positive free cash flows and strong balance sheets.

- Emphasis on limiting downside risk is through extensive company research, the ability to hold cash and long protective index put options.

For further details on the Fund, please do not hesitate to contact us.

6 Apr 2018 - Hedge Clippings, 6 April, 2018

Bill Gates reportedly once gave this advice to an audience of school leavers he was asked to address. It might be equally apt for Robert Shand, the CEO of Blue Sky Alternative Investments, under extreme pressure this week from an activist short selling attack by US hedge fund Glaucus, who claim that Blue Sky's share price is (was is probably more correct now) significantly overpriced. Readers would understand that Hedge Clippings has no issue with short selling in itself, but can sympathise with Blue Sky, whom we have always found to be smart and professional, under attack from a concerted campaign online and in the media designed solely to drive the price down for a profit, rather than letting natural market price discovery take its course.

There's no doubt that Glaucus has involved itself in a case of market manipulation, as Shand claimed in his teleconference on Tuesday morning. There's also no doubt that some elements of the Glaucus report were based on assumptions and speculation, which Blue Sky has claimed are not based on fact, but opinion. The issue with activist short selling, and then heavy publication of the logic or otherwise behind it, is that it doesn't have to be based on fact, or accurate. Once the fear factor is in shareholders minds the buying will dry up, even if they don't hit the panic button and sell. That's how the activist model works.

Shand is facing a number of difficulties in responding, and is learning the hard way that running a fast-moving asset management company investing in alternative and unlisted assets as a public company has its own set of issues. Many, or most of the asset they have developed and manage are closed-ended funds investing in unlisted assets, so pricing is always going to be a question. The timing of exiting, or realising the full value of these mainly private equity, private real estate or infrastructure assets is critical. Most importantly the issue of market transparency doesn't necessarily sit comfortably with unlisted assets housed in wholesale funds.

As such Blue Sky are caught between a rock and a hard place, but like it or not Shand and his board have only two options - either open up the books to prove Glaucus is wrong, or secondly, putting their heads down and focus on delivering the performance of the various underlying assets in due course. The second option in itself will not be easy as "in due course" could be a number of years in the case of some of the underlying investments. Meanwhile, market perception will make it difficult to source new deal flow, and the negative publicity will also make it difficult to attract investors to those funds, while at the same time trying to keep the market happy.

Difficult does not mean impossible. Macquarie Bank came under a similar style attack a few years ago when a US based short seller accused it of being a Ponzi scheme. History shows that Macquarie's share price suffered (and no doubt the short seller profited) but over time the performance was such to re-build the bank's reputation - and share price. There have of course been other cases...