NEWS

1 Aug 2024 - China Autos: Finding the fast lane

|

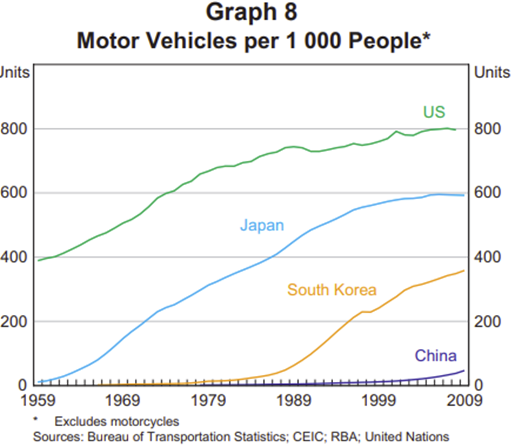

China Autos: Finding the fast lane Ox Capital (Fidante Partners) July 2024 BYD starting in pole position!The rise of the Chinese auto industry is nothing short of remarkable. Thirty years ago, China did not have an auto industry of any scale. China produced only 5,000 passenger cars in 1985! One of the earliest joint ventures (JV) between a foreign car maker and a Chinese company was the Volkswagen JV in Shanghai. Its signature car was the Santana which quickly became a best seller given its superior technology and reliability to competitive offerings at the time.  Fast forward to 2000, China had fewer than 20 million cars on the road, a very low rate of car ownership given its billion plus population. This started to change post the joining of the WTO. With the economy taking off, many other foreign car companies joined in the fray forming JVs in China. These plants were run by foreign management, and were generally highly profitable, as demand was strong, car prices were high and labour costs were low. The blossoming of the domestic auto industry enabled the development of the automotive supply chain. As the Chinese car market grew in scale, manufacturing of key components, for example engines and gear boxes, moved to China  Foreign joint venture partners were typically state-owned companies, with standout successes including Shanghai Auto and Guangzhou Auto. Both companies were able to develop their own car brands, effectively competing in the market. For instance, Shanghai Auto acquired the MG brand and has successfully exported it to other countries. The more enterprising, privately-owned auto manufacturing upstarts have proven to be tougher competitors. After a decade of intense competition, hundreds of private automakers have been whittled down to a handful of survivors. These operators have gained scale and technological knowhow, are extremely cost-conscious and innovative. Notably, the fast iterative product cycles meant the improvement in quality was rapid. Geely Auto (in Chinese Geely means prosperity) quickly accumulated technological knowhow. This was achieved through mergers and acquisition, rigorous investment in research, and sheer hard work. For example, they acquired several companies that have fallen into difficult times - including Volvo, Lotus, London Electric Vehicle Company (London cabs), Renault drivetrain JV amongst others. Now they have developed brands of their own, such as Lynk&Co, Polestar, Zeekr, the Smart Car JV with Mercedes. The Polstar 5, needs no introduction, is in fact ultimately owned by Geely.  One of the highly automated auto plants in China

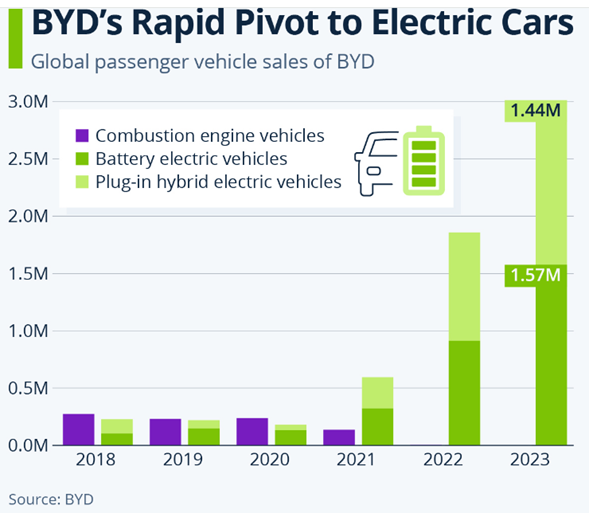

Apart from Geely, another surprising success story is BYD. What's remarkable is that BYD started out as a manufacturer of lithium batteries for PCs and smartphones. The company then chose to transition into electric vehicle production and has now become the largest EV maker in both China and the world!  BYD is early in its growth trajectoryFirstly, BYD spends around USD8 billion a year on research and development. Its product quality and technological leadership is unparalleled. BYD's latest plug-in hybrids have superb fuel efficiency of around 2.9L per 100km. Fully charged and a full tank of fuel, these BYDs can travel in excess of 2000km according to online bloggers! Second, BYD is only getting started in its ambition to conquer the auto market in China and abroad. Despite its success, BYD has only a 10% market share in China's passenger car market. With cost and quality leadership, its domestic Chinese sales is likely to be resilient in coming years. Further, export momentum is strong, with BYD only exporting around 300,000 cars a year, growing at 150% year over year in the month of June. To achieve long term success in global markets, BYD is not standing still, and it is building manufacturing plants in Hungary to supply Europe, along with Thailand and Mexico for ASEAN and Latin America, respectively. Third, prices of BYDs sold outside of China are typically at significant premium to the domestic market. While this higher price tag may partially be a result of transportation cost and tariffs in some cases, profitability per car is likely to be significantly superior in the export market. This is an interesting insight that will drive growth in profitability for BYD going forward. An older BYD rendition.  Twenty years after its first car, BYD is now gaining significant tractions in the global market through a few of its model. For example, BYD Seal 06, the current best-selling sedan, is growing rapidly overseas. Starting price tag in China USD25,000!  Funds operated by this manager: Ox Capital Dynamic Emerging Markets Fund Important Information: This material has been prepared by Ox Capital Management Pty Ltd (Ox Cap) (ABN 60 648 887 914) Ox Cap is the holder of an Australian financial services license AFSL 533828 and is regulated under the laws of Australia. This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws. This document has been prepared without taking into account any person's objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriaten |

31 Jul 2024 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

31 Jul 2024 - Policy choices & Australia's growth conundrum

30 Jul 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

30 Jul 2024 - Trip Insights: The US

29 Jul 2024 - Performance Report: ECCM Systematic Trend Fund

[Current Manager Report if available]

26 Jul 2024 - Hedge Clippings | 26 July 2024

|

|

|

|

Hedge Clippings | 26 July 2024 The US economy picked up in the second quarter, rising 2.4% - buoyed by consumer spending on services, which in turn were supported by wage increases - up from 1.5% in January to March. Overall, 2nd Qtr GDP rose 2.8%, but with inflation subsiding it's looking as though the Fed could start cutting interest rates when they next meet. Given that FOMC meeting doesn't occur until September 25th, there's plenty of water to flow under the bridge by then, but virtually all (as in 82 out of 100) of the economists surveyed by Reuters in the States are predicting that outcome, and most are then expecting another cut before the end of the year. If that's the outcome - (and surely 82% of economists couldn't be wrong?) - then the FED would appear to have achieved the soft landing they've been aiming for. Closer to home, the outlook is not so clear, but at least we'll have an answer - like it or not - sooner when the RBA meets in early August. Between then and now we'll have CPI inflation figures for both the month of June, and the June quarter, both due next Wednesday, along with Retail Trade. Following that, and with plenty of time for the RBA to chew over them, will be June's Labour Force figures on Thursday, and both PPI and Household Spending on Friday. While locally economists aren't all in agreement on the need for a rate rise, there aren't any we've heard calling for a cut - unless you include the Treasurer Jim Chalmers, who one might suggest has his own agenda and motivation for doing so. As a result we expect that the RBA will still be trading that well worn, but increasingly narrow path, not helped of course by the government's support of above inflation wage rises, and their recent tax cuts. The Last Word This week's Hedge Clippings includes a new video segment, "The Last Word" which we'll be recording and distributing each Friday in conjunction with Finance News Network. We'll take an overall view of markets and global economic issues over the last week, along with politics, with a dash of customary cynicism as appropriate - or in some cases, probably inappropriate, as we try to end the week with literally, the last word. News & Insights Investment Perspectives: Why are we listening to central banks? | Quay Global Investors Attention shifting from inflation to the growth outlook | Magellan Asset Management June 2024 Performance News Bennelong Concentrated Australian Equities Fund Digital Income Fund (Digital Income Class) |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

26 Jul 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

26 Jul 2024 - Global Investment Committee's outlook: still growing but proceed with caution

|

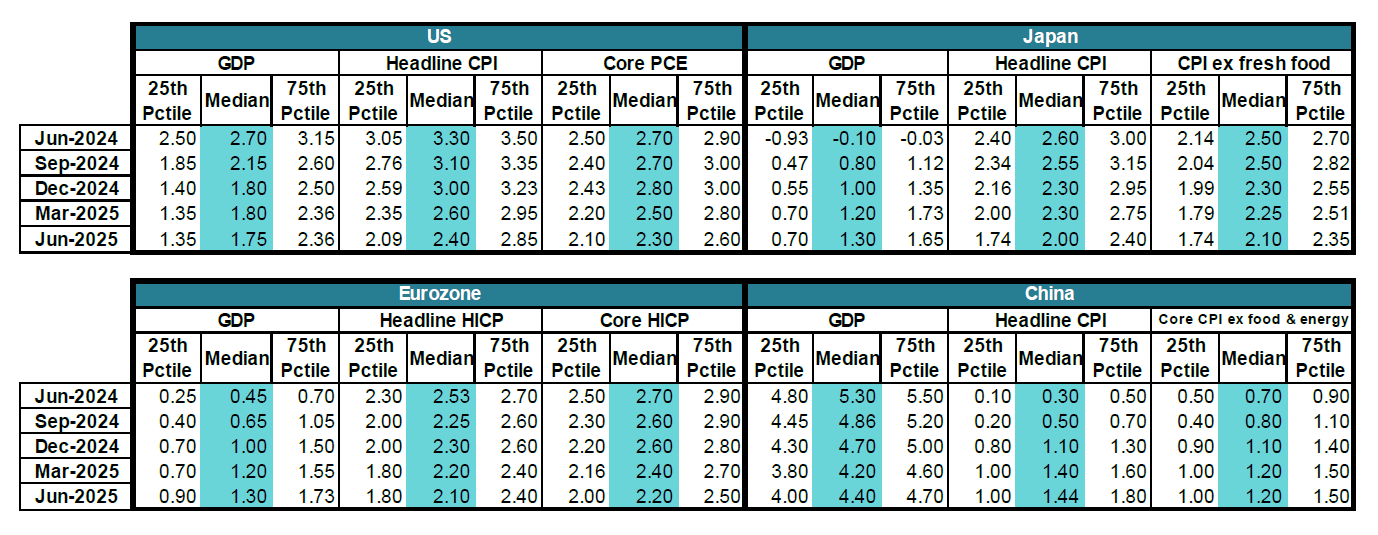

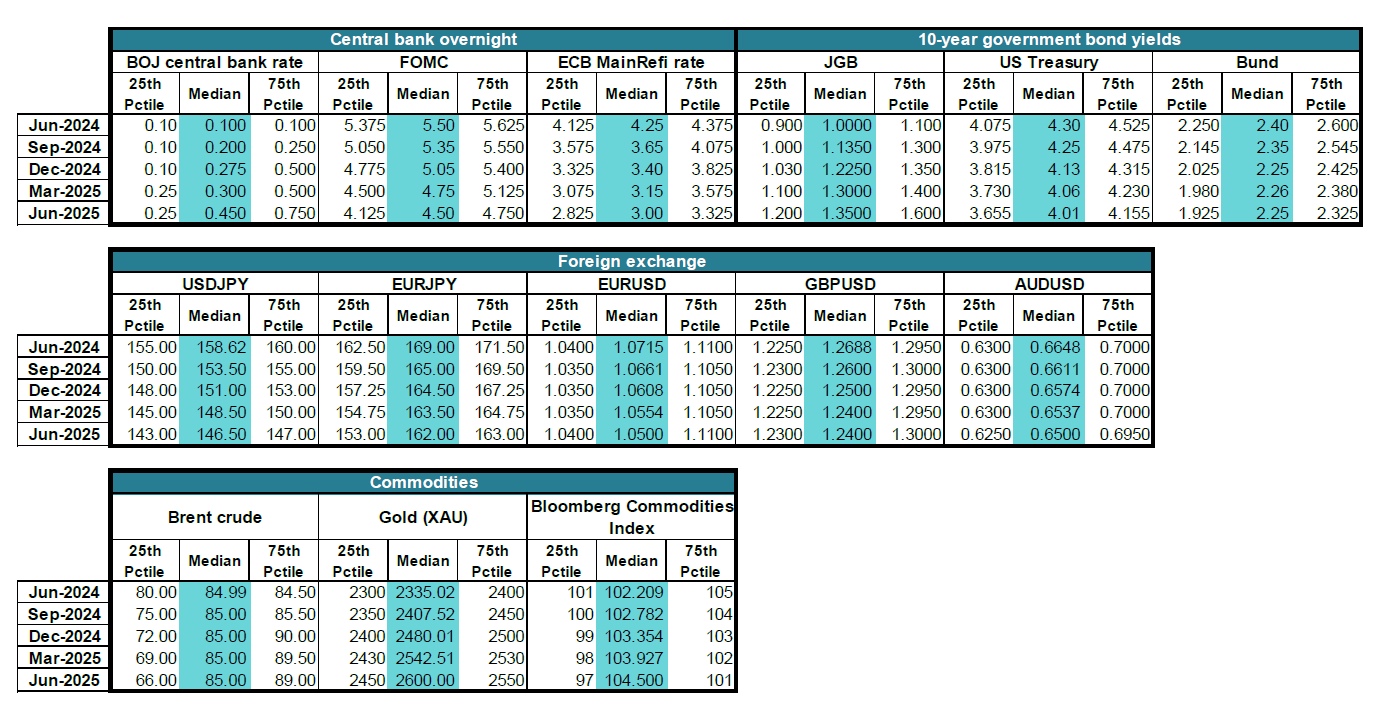

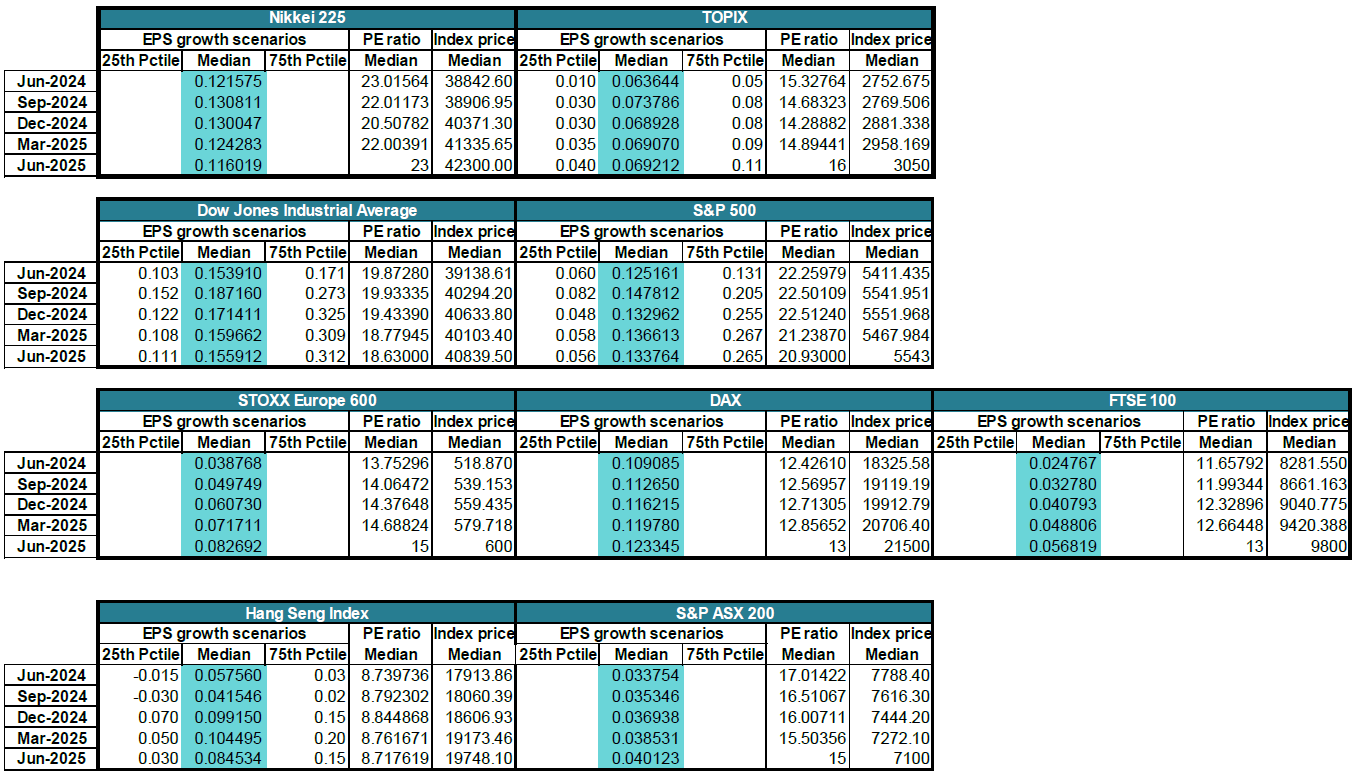

Global Investment Committee's outlook: still growing but proceed with caution Nikko Asset Management July 2024 Q2 2024 in review: re-rating of central bank policy, concentration of riskAs the GIC convened on 27 June, markets had largely converged toward our Q1 views on both equity markets (stronger for longer) and Fed policy (foreseen delivering one rather than three rate cuts in 2024). Similarly, as we foresaw in April, the BOJ kept policy accommodative after ending negative interest rates in March, supporting growth. Meanwhile, contrary to our expectations in Q1, both inflation and growth in Europe slowed to such an extent that the ECB was able to commence its rate cut cycle in advance of the Fed (who remains on hold at the time of writing). The pick-up in European growth, however, remains anaemic; meanwhile, the ECB appears to be evaluating the impact of its initial rate cut and confirming that inflation is moderating as expected. Currently, the US is experiencing a two-speed economy, where corporate earnings, as well as expectations for future earnings, remain robust; meanwhile, household sentiment--particularly concerning the future--has worsened significantly. Although layoffs have not yet picked up momentum, hiring--and therefore labour mobility--has chilled somewhat and unemployment--while still low--has headed steadily higher. The household indicators contrast with signals of buoyancy emerging on the manufacturing side (e.g., bottoming out in PMIs and decreases in inventories of shipments). US inflation, meanwhile, continues to moderate, though not quickly enough for the Fed to signal an imminent rate cut. The BOJ, having recently exited unconventional easing measures including negative interest rates, yield curve control and ETF purchases, signalled that it will remain accommodative for quite some time as it watches for signs of Japan's reflationary "virtuous circle" gaining traction. Japanese corporate profits and investment continue to show positive signals. Capex is supported by ongoing chronic labour supply shortages (evident in the June quarter Tankan) and investment in software and R&D. Although the historic spring "Shunto" rounds of wage hikes point toward imminent positive real wage growth (especially as inflation moderates), data and household behaviour have yet to reflect expectations of permanent real income expansion. The yen has weakened to multi-decade lows versus the dollar, and this has been a tailwind for earnings among large corporates with overseas revenues. In China, although domestic property woes continue, external demand and the bottoming of the global manufacturing cycle have helped to provide some supportive counter currents to lacklustre domestic demand. Nevertheless, trade tensions continue to escalate--particularly in areas of strategic investment for China such as solar energy and EVs. The government continues to ensure that its commitment to support domestic demand fiscally is balanced with its desire to stave off perceptions of moral hazard. Markets have tentatively rewarded the pledge by the National People's Congress to match its 2023 commitment to boost growth to 5% year-on-year (YoY); however, deflationary pressures continue to present headwinds. Amid this backdrop, alongside ongoing accommodative financial and monetary conditions, the GIC anticipates that economic growth will likely to be in line with consensus estimates for ongoing above-potential growth in most large economies. Although the GIC foresees prices as likely to remain on a gradual disinflationary trend in the US and Europe, we see upside risks to this outlook, particularly in 2025. Consensus forecasts: slower but above-potential growth contrasts with gravity-defying US earnings growth forecastsAccording to consensus forecasts, US GDP growth is expected to slow from above 2% to the higher 1% range, but remain above potential (around 1.5%, according to Bloomberg) across the 1-year forecast horizon. Growth is expected by consensus to be underpinned by consumption and private investment. The rate of inflation is expected to gradually ease from above 3% to the mid-2% range (headline) and end June 2025 modestly above 2%. In line with the Fed's Summary of Economic Projections, markets are pricing in at least one rate cut by the Fed before the end of 2024, with the expectation of an additional cut in the remainder of the year or in early 2025. The consensus has priced in over 100 basis points of rate cuts by the end of Q2 2025. Meanwhile, consensus estimates are for 10-year Treasury yields to decline alongside Fed rate cuts to near 4%, keeping the US yield curve inverted over the coming year. Corporate earnings growth forecasts are much more aggressive than macroeconomic forecasts, with consensus seeing double-digit growth in US equities, with earnings growth of companies listed on the Dow expected to remain above 20% over the next year; however, price to earnings ratios are seen moderating toward 20 toward Q2 2025. The dollar is forecast by consensus to give back some of its recent gains across the board, with USDJPY anticipated to decline toward 145. The dollar is also seen weakening against other currencies; as of 27 June, EURUSD is expected to rebound above 1.10, GBPUSD to 1.29 and AUDUSD to 0.69 by Q2 2025. Consensus forecasts predict an improvement in Japan GDP growth from temporarily negative YoY levels in early 2024, surpassing potential growth (estimated by the BOJ as just above 0.6%). Inflation is anticipated by consensus to moderate gradually toward the BOJ's 2% target, with ex-fresh food inflation expected to reach 2.1% YoY by Q2 2025. Meanwhile, the BOJ is expected to continue withdrawing stimulus, with the uncollateralised call rate foreseen around 0.4% as of Q2 2025, while 10-year yields are expected to end the period above 1.2%. Although the market has been slow to react to the gradual narrowing of the US-Japan interest rate differential, consensus forecasts predict the yen to regain ground against both the dollar and euro, with USDJPY foreseen retreating to 145 and EURJPY to 161.5. Japanese corporate earnings are forecast by consensus to remain in buoyant double-digits over the latter half of 2024, moderating in early 2025, and possibly reversing before Q2 2025. Consensus forecasters anticipate a pick-up in Eurozone GDP from anaemic levels to above potential (estimated around 0.6% by Bloomberg), posting 1.5% YoY growth by Q2 2025. Eurozone inflation is anticipated to moderate to just above the ECB's 2% target by the end of Q2 2025, with core inflation foreseen slightly higher in the mid 2% range. Numerous ECB rate cuts are foreseen by the market consensus, with forecasters viewing rates as likely to end Q2 2025 around 2.9%, similarly to what is priced into Overnight Index Swaps. 10-year bund yields are foreseen to dip to 2.25% by Q2 2025, keeping the curve inverted over the year horizon. Corporate earnings are anticipated to turn from negative to positive toward the year's end and into 2025 in the Eurozone and the UK. As with valuations in the US, Eurozone and UK P/Es are foreseen by consensus to moderate gradually, as earnings outpace price appreciation. Consensus forecasts foresee China GDP growth temporarily breaking above 5% in mid-2024, but then languishing below this level for the rest of the forecast horizon. Industrial production is seen as a near-term supportive factor of fixed asset investment, while retail sales are expected to recover toward the end of 2024. Both headline and core inflation are expected to show signals of gradual reflation recovering the 1% handle by the end of Q2 2025. Consensus forecasters foresee that commodities have already peaked. Although some forecasters do expect upside risk to oil prices, many see oil prices heading back toward USD 80/barrel (Brent crude) and gold ending Q2 2025 back near the USD 2,200/ounce level. GIC outlook vs. consensus: in line on median GDP, inflation but earnings may be more subdued vs. consensusA note on changes to the Global Investment Committee Process: In June 2024, we made changes to the Global Investment Committee, as to align our quarterly Outlook more closely with the views underlying our portfolio investments. In lieu of forecasts, we have chosen to provide guidance ranges for indicators and indices that we feel most closely relate to the asset classes we manage. In place of forecasts the Global Investment Committee now provide aggregate guidance at the median for our central outlook, and at the 25th and 75th percentiles. The asset classes represented in our Outlook can change over time, depending on what is most representative of our active investment views. In the event full ranges are not available, this may be interpreted as to mean that the asset class is not a central focal point for our highest conviction investment views. The GIC's guidance ranges may be found in Appendix 1 of this document. Growth and inflation: in lineAs its central scenario, the GIC foresees mild upside risk to GDP growth trajectories in all regions but Europe. The GIC expects US GDP to moderate from above 2% in mid-2024 to 1.75% by the end of the outlook period. Although there are risks to both sides, the GIC anticipates these risks to be biased more toward the upside than downside, foreseeing a 25% chance of growth remaining above 2%. As our central scenario, the GIC's guidance for both US headline and core CPI differs little from consensus, expecting headline prices to disinflate to 2.4% by Q2 2025 and core to 2.3% over the same period. Nonetheless, several of our members do foresee lower probability tail risks to the inflationary upside, which we will discuss in the Risks to our Outlook section. Meanwhile, our outlook for Japanese growth, which is also in line with consensus, forecasts above-potential growth as our central scenario. Nonetheless, we do not agree with consensus estimates for growth to show a YoY surge in Q1 2025, with the potential for the lagged impact of tightening to date to prevent Japan from fully capitalizing on the YoY basis effects of soft Q1 2024 growth. We foresee upside and downside risks mostly balanced over the rest of 2024, with downside risks likely to increase in 2025, due to the potential delayed impact of rate hikes as well as softer growth abroad. Although our central inflation outlook is also in line with consensus, on aggregate, we see a bias toward upside (cost-push) risks to headline inflation, while we see downside risks to core inflation. That said, some GIC members foresee a 25% probability of inflation potentially retreating temporarily below 1% YoY in 2025, while others see the probability of core inflation remaining "stuck" at the mid-2% levels. Downside risks to growth may also emerge depending on the degree and the speed of any rebound by the yen; a rapid bounce may prove a near-term hurdle for corporate earnings. Large firms with overseas revenues have been able to capitalise on yen weakness to date, which has afforded them an additional buffer to absorb price rises from suppliers and raise wages. On aggregate, our members remained less positive than consensus on European GDP growth; although ECB easing might allow for upside risks to our central outlook for anaemic growth in the front end of our outlook period (the rest of 2024), on aggregate, the GIC is of the view that the risks may be biased toward the downside in the latter half of the outlook period (ending Q2 2025); although a rebound in manufacturing has helped European growth pick up somewhat, the exposure not only to geopolitical risks (such as the war in Ukraine and Red Sea shipping disruptions) but also the ongoing sluggishness of consumption and domestic investment in the Eurozone are leaving our members less than enthused about Eurozone growth prospects. On the whole, the GIC foresees Eurozone inflation as likely to moderate toward the ECB's 2% target by the end of Q2 2025, with risks balanced at the near end of the outlook period and biased toward the upside going into 2025. The GIC anticipates China GDP growth to remain close to consensus, with a downside trajectory from above 5% to the mid 4% handle by the end of the outlook period. However, we foresee uncertainty over how quickly China may reflate, with downside risks to the central outlook outweighing upside risks within 2024, while 2025 may, thanks to favourable basis effects, bring China inflation back above 1% again by the end of our outlook period. Interest rates: uncertainty seen increasing toward 2025Given that BOJ policy is still extremely accommodative (with interest rates near zero), uncertainty is likely to rise as the central bank progresses further into its rate hike regime. Our central scenario is somewhat more hawkish than consensus; the GIC foresees the BOJ as likely to hike once before September-end and again before the end of March 2025, with some probability that this rate hike may come before December 2024. Our median scenario foresees a third hike before the end of Q2 2025, converging on an overnight rate modestly above the 0.4% currently priced in by consensus. However, we foresee greater uncertainty both to the upside and the downside (consistent with the discussions described in the "growth and inflation" section above) going into 2025. Meanwhile, we expect 10-year JGB yields to rise at a faster pace than foreseen by consensus, with our central scenario for 10-year yields at the end of Q2 2025 converging at 1.35% (versus consensus of 1.23% at time of writing), with bonds likely to come under pressure from the BOJ potentially commencing its quantitative tightening regime in July. The GIC's central FOMC outlook is very close to consensus. The GIC foresees interest rates just above 5% at 2024 end and likely to fall to 4.5% by the end of the outlook period. We foresee risks both to the upside and downside, and we estimate a 25% chance of rates falling to 4.13% or lower or staying at 4.75% or higher by the end of our outlook period. Many of our members also foresee tail risks as biased to the upside, which will be discussed in the Risks to the Outlook section below. Meanwhile, the GIC expects the US Treasury curve inversion to persist, with our central scenario seeing the 10-year Treasury yield end Q2 2025 just above 4%. Nonetheless, our members' views for the latter half of the outlook period were more dispersed, and several perceived tail risks to the upside on US rates and inflation. The GIC foresees a similar ECB rate cut path to the consensus forecast (ending Q2 2025 at 3%). However, we perceive some upside risk, estimating a 25% chance that interest rates end the year at 3.3% or higher, thanks to more stubborn inflation, in line with the bias to the upside in inflationary risks toward the end of our outlook horizon (Q2 2025). The GIC sees bund yields declining mildly to around 2.25% toward the end of Q2 2025, though on aggregate it foresees greater downside than upside risk for bunds, concentrated in the latter half of the outlook period (mostly due to soft growth). Foreign exchange: dollar firmness to persist, yen to make a muted comebackThe GIC's clearest counter-consensus view may be its outlook for the dollar to show stubborn strength against many of the major currencies. Although directionally, consensus forecasts are for the dollar to lose ground across the board, the GIC looks for EURUSD, GBPUSD and AUDUSD to fail to rally over the coming year, with the central scenario for all three currency pairs to weaken. This contrasts with consensus forecast for strengthening in all three pairs. Given the extreme valuation in USDJPY, however, (with the pair above 161, far from purchasing power parity that should have the yen just under 100 to the dollar), the GIC anticipates potential for some correction in USDJPY, although not quite as much as consensus forecasts. Views over the yen's direction were disperse among our members, with some foreseeing additional yen weakness from current levels, and signalling potential risks to markets and growth in the event the currency strengthens again more rapidly than expected. On aggregate, although our median outlook forecasts USDJPY at 146.5 at year-end, we foresee yen weakness turning around more slowly than forecast by consensus. Although we see risks to both sides, we estimate a 25% chance that consensus views will come to fruition, with the dollar giving up ground not only versus the yen but against a wide variety of currencies. Commodities: not done with the rallyAnother area where the GIC's view diverges from the consensus is the outlook for commodities. The GIC expects commodities to retain broad support, whereas the consensus expects a peak to have already been reached. We foresee gold as likely to continue capitalising on recent gains and end Q2 2025 at USD 2,600/ounce, and we see Brent crude as likely to hit a floor at USD 85/barrel. The GIC also sees the Bloomberg commodities index as likely to continue picking up toward 105, estimating a 25% chance that commodities show the type of retreat that markets are pricing in. Earnings growth to remain solid, but it will not defy gravityOverall, we anticipate earnings growth to remain fairly steady over the year to Q2 2025. However, we do not foresee US earnings growth remaining above 20%, even among large caps, particularly in light of the foreseen slowing growth trajectory. We predict a more conservative double-digit growth trajectory for the Dow (with a median estimate of 15.6% EPS growth as of Q2 2025), while the S&P is also likely to demonstrate solid growth. We foresee valuation (P/E ratios) as likely to post a down trend, with earnings growth outpacing price rises, with S&P PER likely to be below 19x by the end Q2 2025. We do foresee Japanese companies as likely to present healthy single-digit earnings growth across the TOPIX, which represents the majority of our Japan equity investments. We do expect large caps to continue to show faster earnings growth than the broader index (as they have so far this cycle). That said, we foresee some potential for sector rotation, with a slowdown occurring in large cap earnings (toward the lower double-digits). The broader index could also post resilient earnings, particularly as domestic demand starts to improve in Japan. We see a 25% chance of the TOPIX showing double-digit growth by Q2 2025. We foresee TOPIX PER potentially going on a mild uptrend as valuation re-rating continues, anticipating convergence to around 16x by the end Q2 2025. However, some downside risks persist in the form of the impact of the BOJ's rate hikes. Lagged cost-push inflation, in part driven by the yen's weakness, is another downside risk; a weaker yen is helpful for large firms with overseas revenues, but less so for smaller, domestically-oriented firms which are sensitive to import price rises. One GIC member was encouraged that buybacks are picking up (and with them, hopes of higher return on equity), although clear evidence of investments into restructuring and increasing productivity is sought as a key stock selection criterion. Meanwhile, too rapid a USDJPY reversal may prove disruptive for the large, listed firms who have been able to capitalise on the yen's weakness to date, and this may prove a headwind for overall Japanese earnings in the absence of countervailing factors such as a pick-up in domestic demand. We foresee earnings growth among companies listed on the Hang Seng as likely to show modest improvement over the course of the coming year. That said, the GIC does see some downside risks (linked to uncertainty over China's near-term ability to beat deflation) in the more immediate quarters of our outlook horizon; we estimate a 25% possibility that earnings may show single-digit negative growth in latter 2024, yet we foresee recovery thereafter as our main scenario. That said, some downside risks remain (such as trade conflict and increasing tariffs) that could still undermine growth going into 2025. Although European stocks were mentioned as being potentially under-valued, alongside UK and Australian equities, these assets remain generally out of favour among the majority of GIC members, primarily due to the outlook for slow earnings growth in these regions. These asset classes do merit monitoring, however, particularly given their low valuations. One GIC member pointed out that European P/E ratios remain low compared to recent historical valuations. Risks to our outlook: elections, inflation, AI re-rating, systemic riskAlthough the GIC's central outlook remains mostly in line with consensus, we perceive downside tail risks to growth as likely greater than upside tail risks in the year to Q2 2025, with some tail risks showing potential to rise beyond low-probability events. Meanwhile, we see low-probability risks to inflation as balanced to the upside.

Investment strategy conclusion: aggregate growth still has legs, but proceed with cautionThe overall economic outlook does not look poor on an aggregate perspective. The GIC believes that there is likely a case for continued positive earnings growth going into 2025. Nonetheless, consensus earnings growth forecasts do not look entirely consistent with the consensus GDP growth outlook, which, while above potential growth, is still forecast to slow. Although rate cuts from the Fed (alongside further rate cuts from the ECB) are anticipated, valuations are such that one rate cut within 2024 is not, in our view, likely to result in further price growth. Earnings may remain healthy for some time, particularly if ongoing investment in technology continues alongside anticipation of future productivity growth. However, caution is warranted as lower-probability risks to growth have the potential to escalate from tail risks to higher-probability downside scenarios. These include additional fiscal expansion or trade barriers in the US. The BOJ, meanwhile, is the outlier as it is hiking rates while other central banks are doing the opposite; although we expect firm growth and accommodative conditions continuing to support earnings for TOPIX constituents, the outlook is not without its risks of fluctuations in the interim. One of our key non-consensus views is that the dollar will continue to strengthen against currencies other than the yen, which might take more time to recoup its losses than what the consensus forecasts anticipate. However, the yen reversal may present a hurdle to the global earnings of large-cap stocks; in this case we would remain reliant on a pick-up in domestic demand to support smaller cap, domestic names, and thus keep TOPIX earnings positive. Alongside our higher-than-expected commodity outlook, the conditions may be such that the US may export any upside risks to inflation to other markets more easily. Although our central scenario is for continued above-potential growth, we remain vigilant about risks related to inflation, re-rating of AI investments and systemic financial risk. Appendix 1: GIC Outlook guidance rangesGlobal macro indicators

Central bank rates, forex, fixed income and commodities

Equities

Funds operated by this manager: Nikko AM ARK Global Disruptive Innovation Fund, Nikko AM Global Share Fund Important disclaimer information |

25 Jul 2024 - Performance Report: Equitable Investors Dragonfly Fund

[Current Manager Report if available]