NEWS

26 Jul 2018 - Performance Report: Quay Global Real Estate Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | June was a relatively active month for the Fund. The Fund's student accommodation investee, Education Realty Trust (EDR), received an all cash take-over offer from entities associated with Greystar Real Estate Partners which Quay noted they are in no rush to accept. Separately, Quay's decision to hold Hispania Activos despite an April bid from entities associated with Blackstone has reaped additional rewards; in June the initial cash offer of 17.45 euros/share was revised to 18.25 euros/share with approval from the Board. Throughout the month the management team toured the US, Canada and UK, meeting with existing and prospective investees and their competitors, and looking for new investment ideas. Quay mentioned that they added a new investee during the month in the UK student accommodation space. Overall, Quay noted the outlook was positive, albeit with growth at more modest levels consistent with later cycle positioning. The exception was the industrial sector, where Quay believe the consensus outlook has become almost euphoric. They noted that this makes them cautious and is reflected by the under representation of the sector in the current portfolio. |

| More Information |

25 Jul 2018 - Can't Trump this: How commercial property fares in a China/US trade war

24 Jul 2018 - Pengana Emerging Companies Fund pays 15% distribution to investors

24 Jul 2018 - Bennelong Twenty20 Australian Equities Fund June 2018

BENNELONG TWENTY20 AUSTRALIAN EQUITIES FUND

Attached is our most recently updated Fund Review on the Bennelong Twenty20 Australian Equities Fund.

- The Bennelong Twenty20 Australian Equities Fund invests in ASX listed stocks, combining an indexed position in the Top 20 stocks with an actively managed portfolio of stocks outside the Top 20. Construction of the ex-top 20 portfolio is fundamental, bottom-up, core investment style, biased to quality stocks, with a structured risk management approach.

- Mark East, the Fund's Chief Investment Officer, and Keith Kwang, Director of Quantitative Research have over 50 years combined market experience. Bennelong Funds Management (BFM) provides the investment manager, Bennelong Australian Equity Partners (BAEP) with infrastructure, operational, compliance and distribution services.

For further details on the Fund, please do not hesitate to contact us.

23 Jul 2018 - Pengana Emerging Companies Fund pays 15% distribution to investors

23 Jul 2018 - Performance Report: NWQ Fiduciary Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund aims to produce returns, after management fees and expenses of between 8% to 11% p.a. over rolling five-year periods. Furthermore, the Fund aims to achieve these returns with volatility that is a fraction of the Australian equity market, in order to smooth returns for investors. |

| Manager Comments | NWQ noted there was a small reversal in a number of themes in June that the Fund's Alpha managers had profited from in recent months due to investor portfolio repositioning ahead of the financial year end. NWQ expect the effect of this to be transitory and their outlook for their Alpha managers remains positive given the heightened level of volatility and stock-level dispersion seen in recent months. |

| More Information |

20 Jul 2018 - Hedge Clippings, 20 July 2018

It seems fund rankings are in the news in the past couple of days, whether it be super funds, or managed funds available outside super.

Taking super funds first, there seem to be two schools of thought, each not surprisingly probably dependent where the self-interest of the thinker lies.

Super Ratings tables clearly show that industry super funds have outperformed the bank and for-profit sector funds, and while they will understandably promote their performance and claim that it is due to lower fees, they will also rightly claim that asset allocation plays a significant part in their success.

On the other hand Colonial has argued that it is not a simple comparison and the options available, along with the demographics of the fund members, are significant. What is relevant is that the massive number of options and alternatives available make it incredibly difficult not only to compare funds and the returns, but also for the investor to choose the appropriate option.

Whatever the arguments the logic and argument from the Productivity Commission that across the board fees be reduced to match those available in comparable products and jurisdictions overseas, but that there should be a simple default option of the top 10 performing funds.

The complexity of the current array of choices simply makes it impossible for the average person to make an informed choice.

Moving on to managed funds outside superannuation, the tables in today's Financial Review, supplied by Mercer, make interesting reading and will equally no doubt be promoted by each of the relevant funds.

What is interesting is that when Australian Fund Monitors analyses results to the end of June (bearing in mind not all funds have reported as yet) for the past one, three and five years, there are some significantly interesting trends:

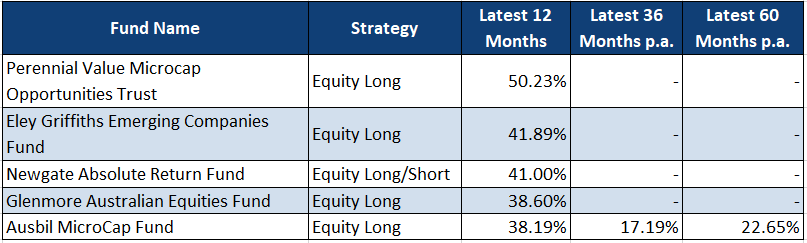

- Firstly when it comes to 12 month performance Australian equity funds (whether long only or long short), four out of the top five were early stage managers who do not yet have a three or five year track record.

- The emerging or micro-cap sector dominates, having been particularly strong over the past 12 to 24 months, particularly with the Banks and Telstra taking a battering.

- All are concentrated - it is simply impossible to provide these kind of returns when the ASX accumulation index returned 13% without significant stock picking skills (as opposed to Super, where asset allocation is a primary driver of performance).

Finally, in a rising market, with the exception of Newgate and Smallco, Long Only funds dominated.

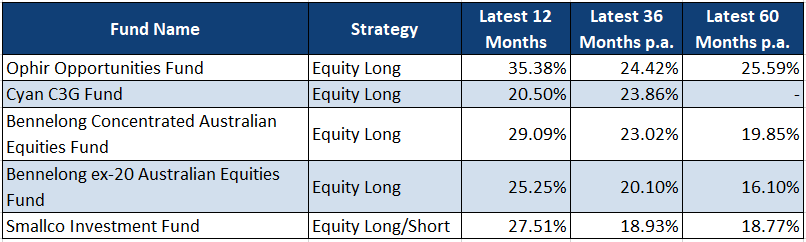

Taking the top five performing funds over three years, the table looks like this:

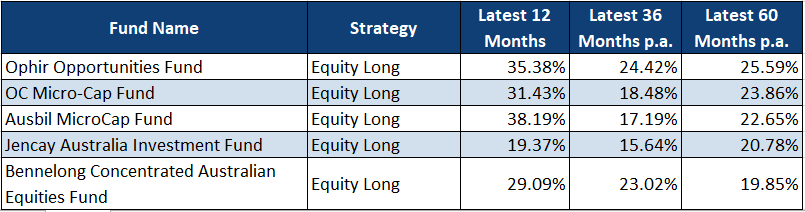

Then taking the best performers over five years, the results are as follows:

Before we receive a raft of complaints from those managers with better returns in a specific year than those listed, we applied a consistency filter, which with the exception of the earlier stage funds in the one and three year tables, took out any fund with a performance of less than 15% over either one, three or five years. Equally, the above tables only include equity based funds with a geographic mandate of Australia and New Zealand, so Asian and Global funds were excluded.

Methodology is always important when ranking and filtering funds, and purely selecting the top performing funds based on returns is always risky, simply because looking at returns, without looking at risk factors such as volatility , Sharpe ratios, draw downs and up and down capture ratios, doesn't tell the whole picture.

And of course the overall disclaimer that "past performance is no guarantee of future returns" applies - although we consider it to be highly relevant.

20 Jul 2018 - Fund Review: Bennelong Kardinia Absolute Return Fund June 2018

BENNELONG KARDINIA ABSOLUTE RETURN FUND

Attached is our most recently updated Fund Review. You are also able to view the Fund's Profile.

- The Fund is long biased, research driven, active equity long/short strategy investing in listed ASX companies with over ten-year track record.

- The Fund has significantly outperformed the ASX200 Accumulation Index since its inception in May 2006 and also has significantly lower risk KPIs. The Fund has an annualised return of 10.52% p.a. with a volatility of 6.90%, compared to the ASX200 Accumulation's return of 5.93% p.a. with a volatility of 13.41%.

- The Fund also has a strong focus on capital protection in negative markets. Portfolio Managers Mark Burgess and Kristiaan Rehder have significant market experience, while Bennelong Funds Management provide infrastructure, operational, compliance and distribution capabilities.

For further details on the Fund, please do not hesitate to contact us.

19 Jul 2018 - Fund Review: Bennelong Long Short Equity Fund June 2018

BENNELONG LONG SHORT EQUITY FUND

Attached is our most recently updated Fund Review on the Bennelong Long Short Equity Fund.

- The Fund is a research driven, market and sector neutral, "pairs" trading strategy investing primarily in large-caps from the ASX/S&P100 Index, with over 15-years' track record and an annualised returns of over 16%.

- The consistent returns across the investment history indicate the Fund's ability to provide positive returns in volatile and negative markets and significantly outperform the broader market. The Fund's Sharpe Ratio and Sortino Ratio are 1.02 and 1.69 respectively.

For further details on the Fund, please do not hesitate to contact us.