NEWS

30 May 2019 - Cyan Investment Management | Market Perspective & Fund Overview

|

Dean Fergie (Founding Director and Portfolio Manager) gives Cyan's perspective on the market's activity towards the end of 2018 and the rebound seen in the first quarter of 2019. He then discusses how the Cyan C3G Fund performed over that period. |

30 May 2019 - Performance Report: Bennelong Emerging Companies Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund may invest in securities expected to be listed on the ASX within 12 months. The Fund may also invest in securities listed, or expected to be listed, on other exchanged where such securities relate to ASX-listed securities |

| Manager Comments | The Fund's top five holding as at the end of April were Jumbo Interactive, Zip Co, Pinnacle Investment Management, Nearmap and Emerchants. Bennelong believe micro and small-cap stocks can offer more exciting growth prospects than larger companies despite presenting greater investment risks. The investment team aim to be disciplined in focusing on high quality stocks and seek to avoid the higher risk propositions such as minerals explorers, speculative stocks, fads and unproven business models. |

| More Information |

29 May 2019 - Performance Report: Touchstone Index Unaware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The portfolio is constructed using Touchstone's Quality-At-a-Reasonable-Price ('QARP') investment process. QARP is a fundamental bottom-up process, however, it also incorporates a top-down risk management framework designed to successfully manage the portfolio during varying market conditions and economic cycles. The Touchstone Fund is concentrated, typically holding between 15-20 stocks. No individual stock will ever make up more than 10% of the portfolio at any one time. The Investment Manager may temporarily exceed the exposure limits of the Fund occasionally, particularly during periods of market volatility, to allow for holdings in excess of this 10% limit where the increase in value of the underlying security is due to market movement. The Fund may also hold between 0-50% of the portfolio in cash. The Fund has a high level of associated risk, therefore, the minimum suggested investment time-frame is 5 years. |

| Manager Comments | As at the end of April, the Fund held 21 stocks with a median position size of 4.9%. The portfolio's holdings had an average forward year price/earnings of 16.0, forward year EPS growth of 6.6%, forward year tangible ROE of 27.1% and forward year dividend yield of 4.5%. The Fund's cash weighting had decreased to 3.0% from 5.0% at the end of March. The Fund primarily seeks to select stocks from the ASX300 Index, typically holding between 10-30 stocks. The Fund seeks to invest in reasonably priced, good quality companies with a significant share of expected returns coming from sustainable dividends. |

| More Information |

28 May 2019 - Performance Report: KIS Asia Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Whilst the Fund's primary strategy is focused on long/short equities, the ability to retain discretionary powers to allocate across a number of other investment strategies is reserved. These strategies may include, but not be limited to: convertible bond investments, portfolio hedging, equity related arbitrage, special situations (e.g. merger arbitrage, rights offerings, participation in international public offerings and placements, etc.). The Fund's geographic focus is Asia excluding Japan, but including Australia). The Fund may invest outside of this region to the extent that: 1. The investment decision is driven from the Asian region or; 2. The exposure is intended to mitigate risk or enhance return from factors external to the Asian region. |

| Manager Comments | Using index options and futures to keep the portfolio hedged and express a small net short bias, over the month KIS averaged -8% of AUM short which cost the Fund 58bp. There were no other losses greater than 30bp. KIS noted they remain cautious on markets and are committed to a market neutral approach, protecting investors' capital against any sudden change in sentiment. They say the rally in equity markets from the December lows feels to have been initially a reaction to looser US monetary conditions and is now a bid for equities for fear of missing out on any further rally and a lack of other investment opportunities. On the winning side the Fund made 31bp on their long position in MedAdvisor Ltd (MDR.AX). |

| More Information |

28 May 2019 - Performance Report: Bennelong Concentrated Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The overriding objective of the Concentrated Australian Equities Fund is to seek investment opportunities which are under-appreciated and have the potential to deliver positive earnings, while satisfying our stringent quality criteria. Bennelong's investment process combines bottom-up fundamental analysis together with proprietary investment tools which are used to build and maintain high quality portfolios that are risk aware. The portfolio typically consists of 20-35 high-conviction stocks from the S&P/ASX 300 Index. The Fund may invest in securities listed on other exchanges where such securities relate to ASX-listed securities. Derivative instruments are mainly used to replicate underlying positions and hedge market and company specific risks. |

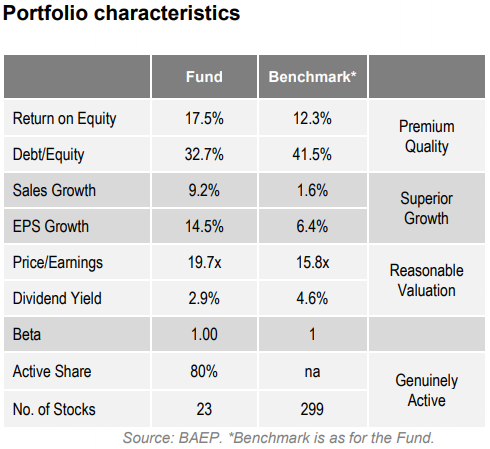

| Manager Comments | The Bennelong Concentrated Australian Equities Fund rose +3.40% in April, outperforming the ASX200 Accumulation Index by +1.03% and taking annualised performance since inception in February 2009 to +16.34% versus the Index's +10.65%. The Fund's up-capture and down-capture ratios since inception, +139% and 91% respectively, highlight the Fund's capacity to outperform over the long-term regardless of the market's direction. As at the end of April, the Fund's weightings had been increased in the Consumer Staples, Industrials, IT, Communication and Financials sectors, and decreased in the Discretionary, Health Care, Materials and REIT's sectors. The Fund's top holdings include CSL, BHP Billiton and Aristocrat Leisure. The Fund aims to invest in a concentrated portfolio of high quality companies with strong growth outlooks and underestimated earnings momentum and prospects. The data in the table below from the latest monthly report demonstrate that the Fund is in line with its investment objectives;

|

| More Information |

27 May 2019 - Performance Report: Insync Global Capital Aware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync employs four simple screens to narrow the universe of over 40,000 listed companies globally to a focus group of high quality companies that it believes have the potential to consistently grow their profits and dividends. These screens are size of the company, balance sheet performance, valuation and dividend quality. Companies that pass this due diligence process are then valued using dividend discount models, free cash flow yield and proprietary implied growth and expected return models. The end result is a high conviction portfolio of typically 15-30 stocks. The principal investments will be in shares of companies listed on international stock exchanges (including the US, Europe and Asia). The Fund may also hold cash, derivatives (for example futures, options and swaps), currency contracts, American Depository Receipts and Global Depository Receipts. The Fund may also invest in various types of international pooled investment vehicles. At times, Insync may consider holding higher levels of cash if valuations are full and it is difficult to find attractive investment opportunities. When Insync believes markets to be overvalued, it may hold part of its resources in cash, or use derivatives as a way of reducing its equity exposure. Insync may use options, futures and other derivatives to reduce risk or gain exposure to underlying physical investments. The Fund may purchase put options on market indices or specific stocks to hedge against losses caused by declines in the prices of stocks in its portfolio. |

| Manager Comments | Of the Fund's top 10 holdings, equating to about 60% of the portfolio, the strongest returns came from Walt Disney (+22.7%) and Facebook (+15), while the weakest performers were Intuit (-5%) and Amadeus IT (-1.1%). The Fund's top holdings as at the end of April included Visa, Intuit, Walt Disney, Accenture, Facebook, Tencent Holdings, Booking Holdings, Amadeus IT, Adobe and Zoetis. |

| More Information |

27 May 2019 - Bipartisanship - an Albatross for Congress

25 May 2019 - Loftus Peak | Market Update (April 2019)

|

Alex Pollak (CIO & Founder) discusses Loftus Peak's performance and portfolio composition as at April 2019. Alex points out that the net debt to equity ratio of the companies in their portfolio as group is negative, meaning they don't have debt. This, he believes, is what allows Loftus Peak's portfolio holdings to better manage exogenous shocks and thus outperform over the long-term. |

24 May 2019 - Hedge Clippings | The excitement's over, now back to work!

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

24 May 2019 - Loftus Peak | Auto Industry Disruption

|

Alex Pollak, Loftus Peak's CIO & Founder, expects electric vehicles to cause significant disruption to the auto industry. In this video, Alex details Loftus Peak's views on the disruption being caused to the industry and how they're taking advantage of it to benefit their investors. |