Governments that perform poorly in managing climate change transition may encounter difficulty finding investors to buy their sovereign debt, that is the finding of a research paper by global bond managers Ardea Investment Management and Fortlake Asset Management, along with academic researchers at the University of Technology, Sydney.

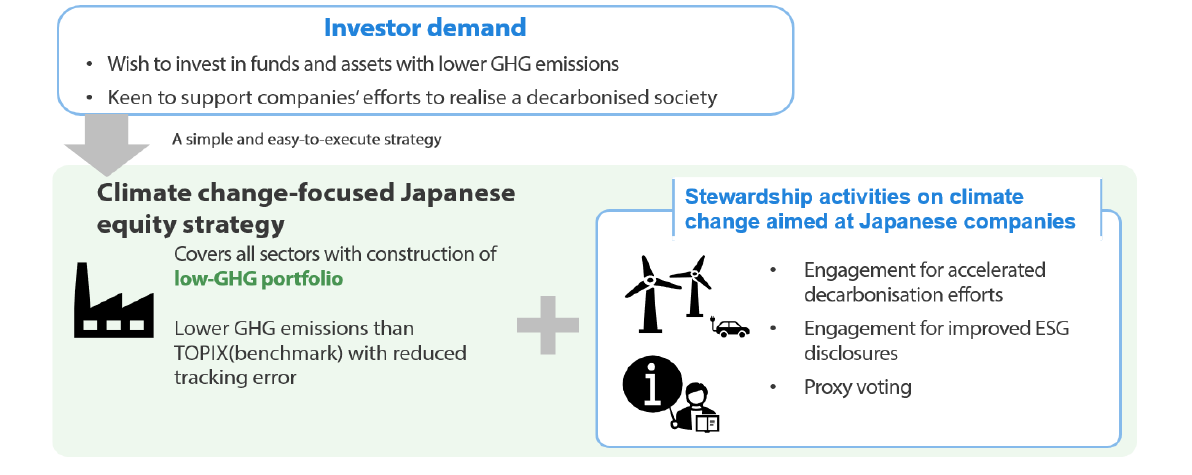

While the integration of climate change considerations in equity investing is today quite mature, the sovereign debt market has lagged considerably. However, the authors predict the reduction in carbon emissions and increased take up of renewable energy will become ever more important risk indicators for government bond investors.

The paper, Climate Transition Risk in Sovereign Bond Markets, shows carbon dioxide emissions, natural resources rents, and renewable energy adoption statistically impact sovereign bond yields and spread. It aims to give fixed income investors and policymakers a way to assess country transition risk that is aligned directly with the United Nations Sustainable Development Goals.

Commenting on the paper, Dr Laura Ryan, Head of Research at Ardea Investment Management, said, "Given the threat climate change poses to the global economy and the rapid rise of transition risk, we advocate that climate transition risk factors are determinants in sovereign bond markets.

"Carbon dioxide emissions and natural resources rents not only negatively affect the environment and inhibit progression toward climate goals but also increase a country's cost to borrow in debt markets.

"Importantly, the adoption of renewable energy was found to be an economically and statistically significant mitigation strategy, as the supply and consumption of clean fuel sources could drive economic growth, counteracting any short-term financial losses from the non-renewable energy sector," Dr Ryan said.

Developed versus Developing Markets

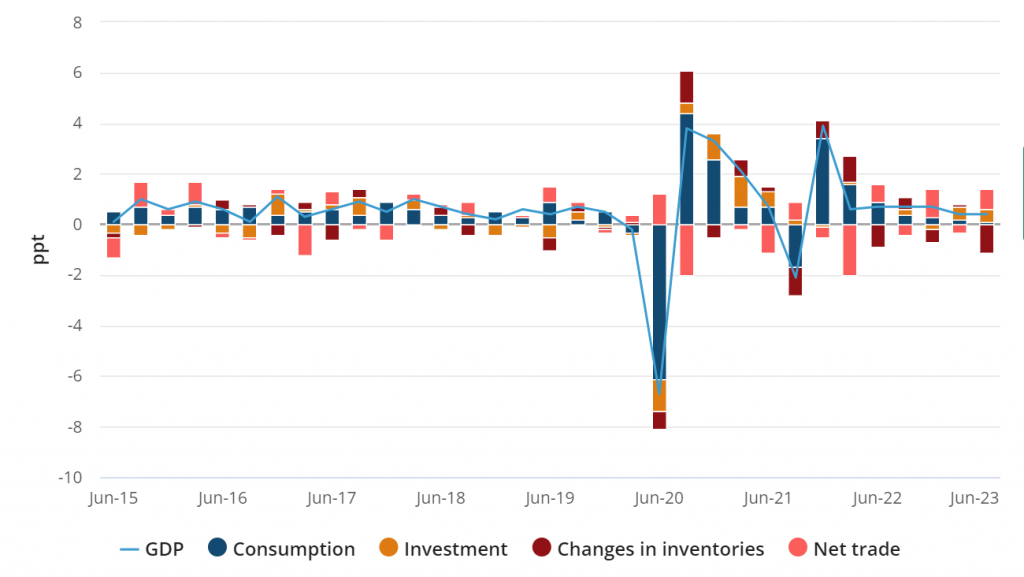

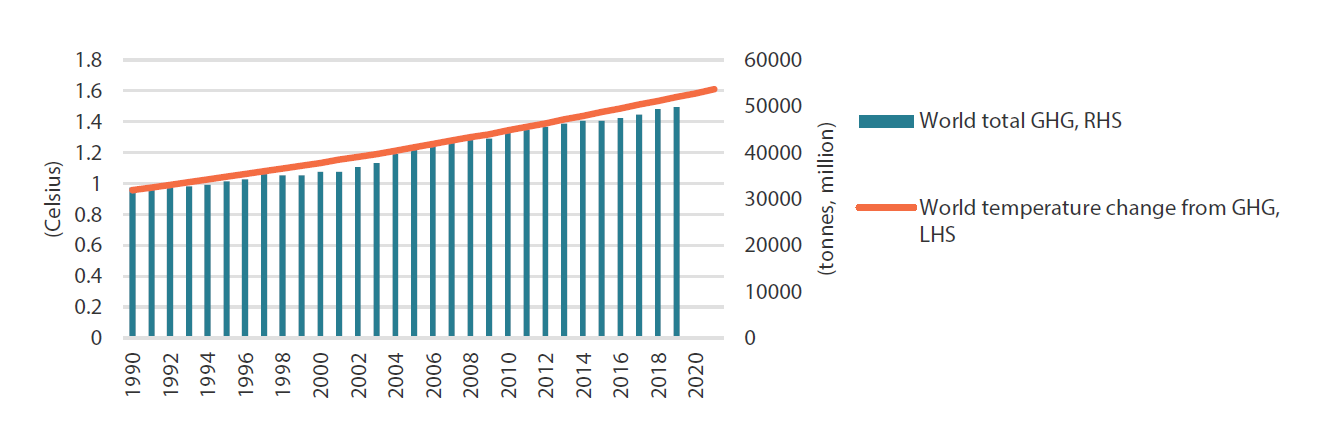

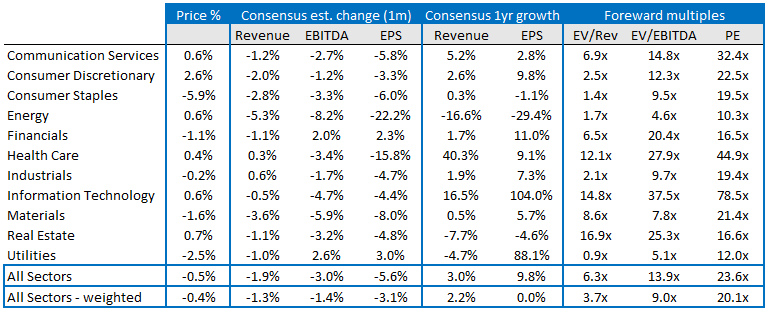

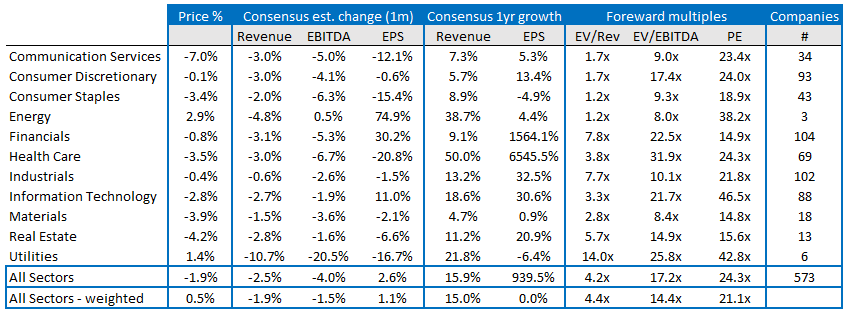

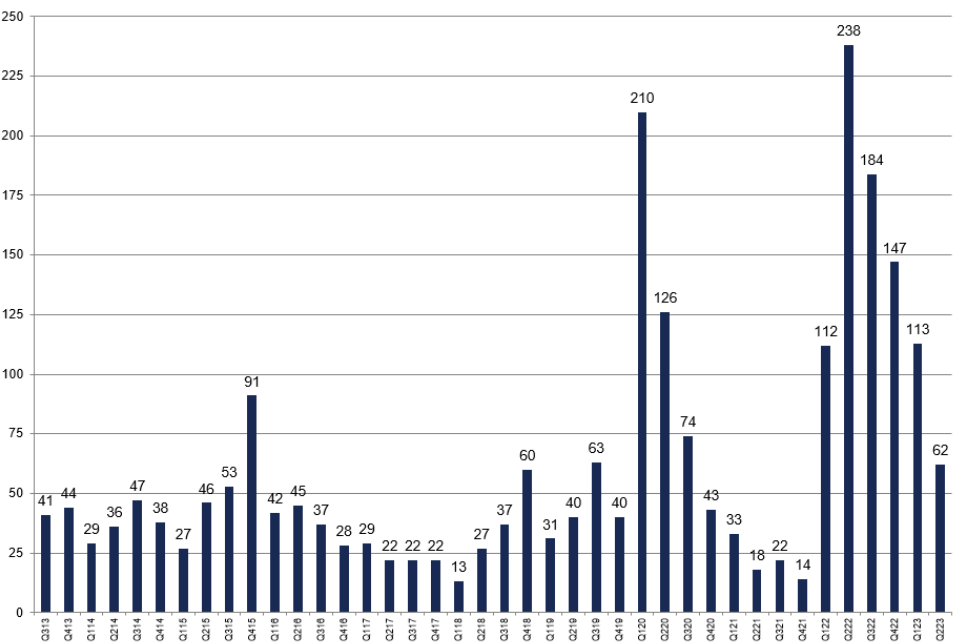

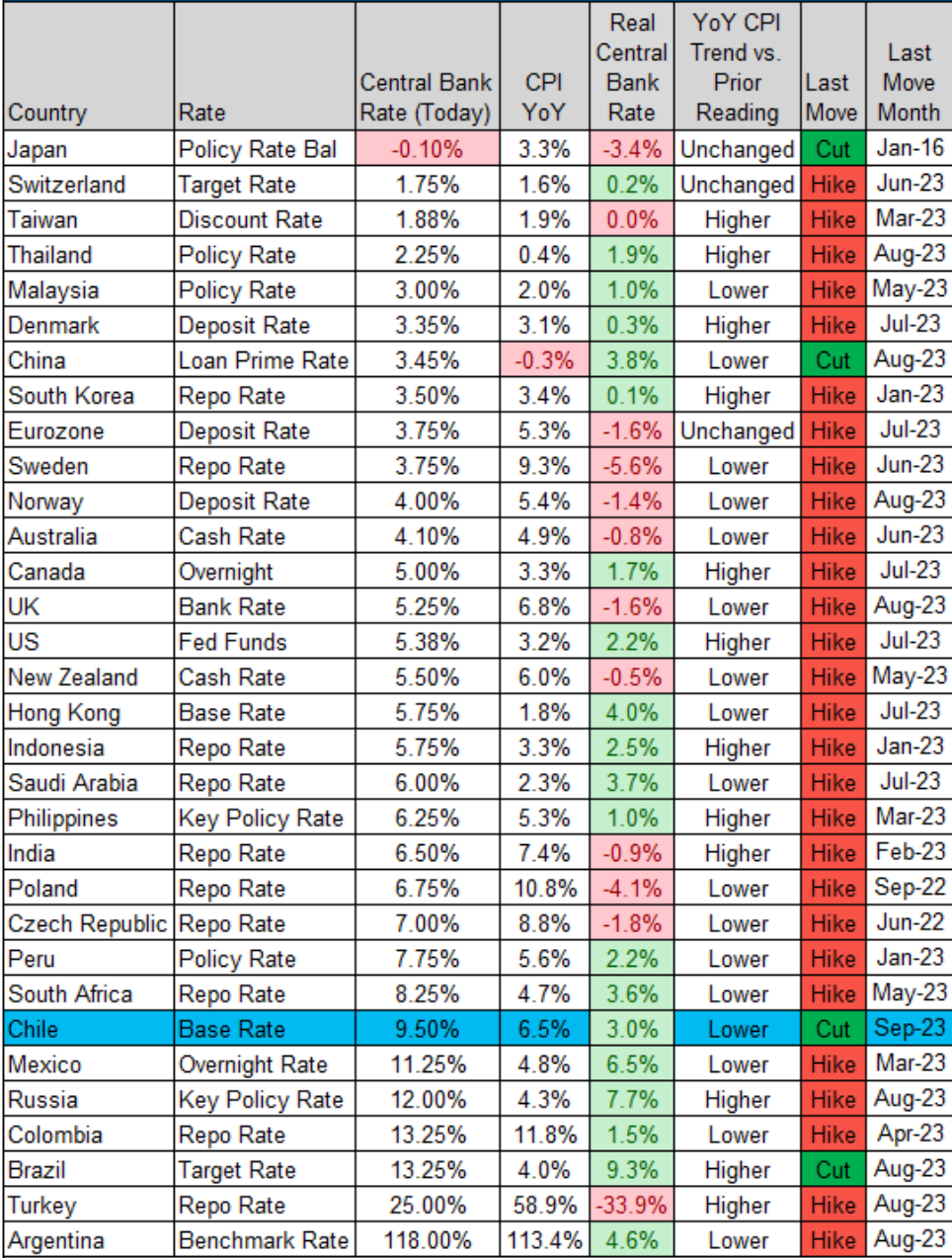

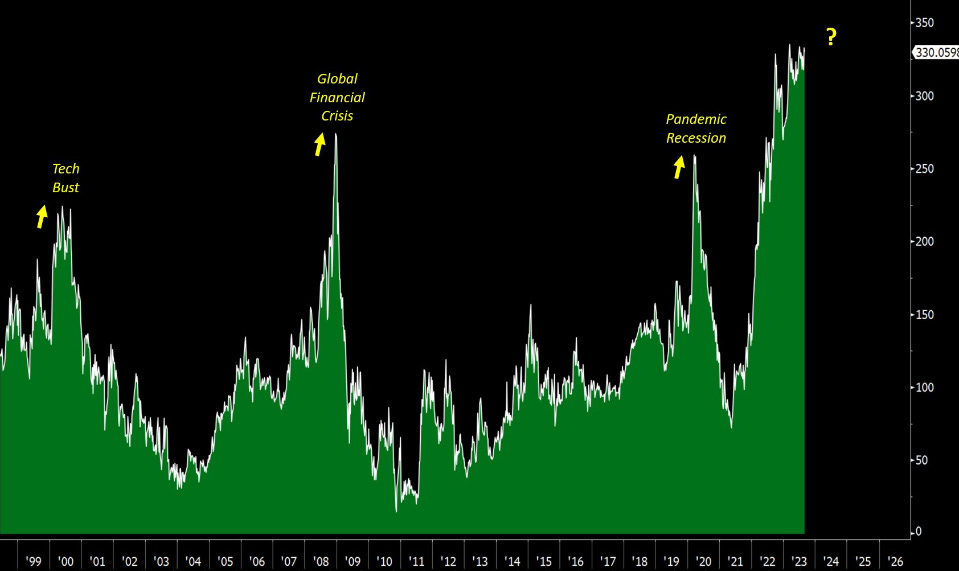

Assessing the transition risk factors, macroeconomic fundamentals and sovereign yield spreads across 39 countries between 1999 to 2021, the research found a strong positive association between carbon dioxide emissions and sovereign yields and spreads across advanced and developing countries.

In developed markets, natural resources rents have a strong positive association, while renewable energy has a negative association with yields and spreads.

Cheaper financing may counteract any short-term losses that industries may face from reevaluating assets. Further, the savings made on funding could be invested into renewable technologies and transitioned away from sectors in decline, such as the fossil fuel industry.

Fortlake Asset Management's Deputy Chief Investment Officer, Kylie-Anne Richards, added, "This research shows that prioritising renewable energy supply and consumption, while forgoing the short-term opportunity cost of decreased revenue from natural resources, would benefit from lowering the cost of borrowing in the sovereign debt market."

In contrast, in developing markets, while yields tend to rise when carbon emissions increase, they are expected to fall when earnings from natural resources rise, and perversely, yields rise when renewable energy consumption increases. This suggests that investors in developing country debt prioritise the pursuit of economic growth and profits from natural resources over climate transition goals.

"Developing economies are less likely to have the resources needed to facilitate a transition from fossil fuel reliance to renewables, and thus they seem not to prioritise climate change targets," Dr Richards said.

"While investors seem to focus instead on short-term factors, such as a developing country's ability to repay debt and the fact that the profits from high natural resources rents may be higher than the uncertain payoff of transition."

A warning for policymakers

While estimates vary in terms of reducing net carbon emissions to zero, it is projected that to achieve the goals set out by the Paris Agreement by 2050, spending of $50 trillion will be required. This expenditure will be largely financed by governments, with a sizable proportion of this spending allocated to renewable technology.

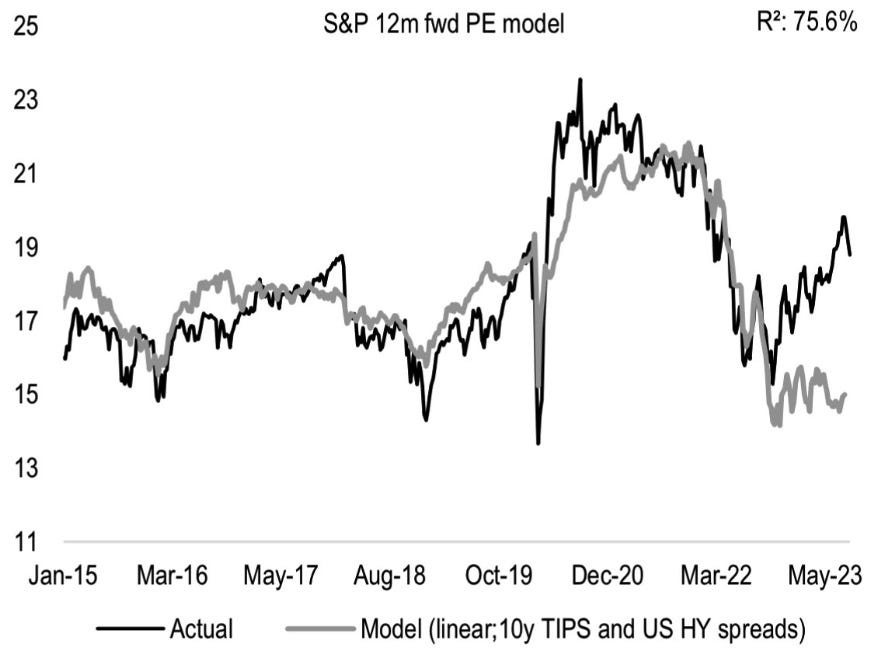

The evidence presented in this paper has clear implications for policymakers given sovereign bond markets are the benchmark from which every other asset class is priced.

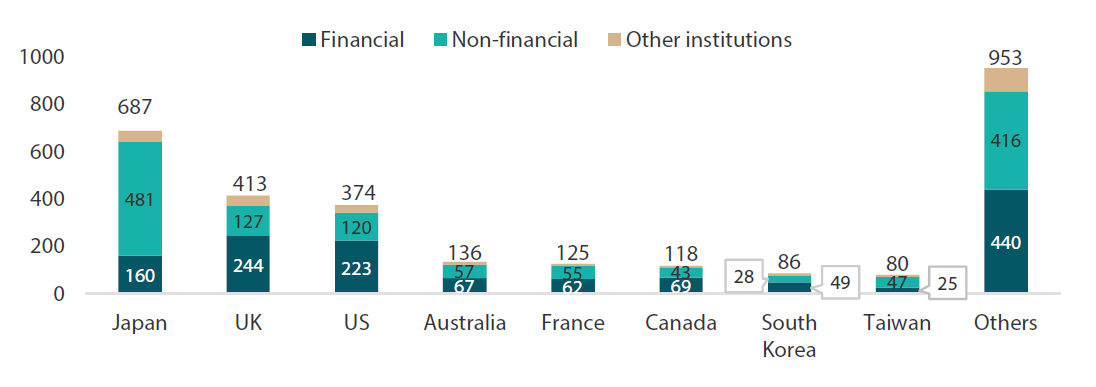

"The sovereign debt market is one of the largest asset classes globally and has significant exposure to the full gambit of climate risks. However, unlike equities and even corporate debt markets, the integration of climate change considerations into the investment process has lagged significantly," Dr Richards said.

The paper provides a clear argument to request greater government transparency on specific climate risks, strategies and policies that are inherently linked to the bonds they issue.

For example, Dr Ryan and Dr Richards believe the Australian government should be more open about the direct link between our borrowing costs and climate change.

"It is undeniable that governments are exposed to transition risk. Whether it is considered through the channel of directly or indirectly influencing yields via macroeconomic variables such as GDP, investors are already starting to penalise advanced countries with poor prospects of transitioning away from fossil fuels," Dr Ryan said.