NEWS

20 Jun 2019 - Loftus Peak | Investment Horizon

|

The Loftus Peak Global Disruption Fund has returned +19.76% p.a. since inception in Nov 2016, outperforming the ASX200 by +6.07% on an annualised basis. Alex Pollak (CIO & Founder) says this is due to their focus on ensuring that they're buying things that are happening now, but which aren't obvious, and which will generate return 1 - 2 years out. Examples include the data centre space, machine learning, retail and banking. Loftus Peak do hold companies such as Apple and Google, however it's their investments in the less obvious companies which Alex believes has allowed them to outperform over the long-term. |

19 Jun 2019 - Performance Report: Bennelong Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Bennelong Australian Equities Fund seeks quality investment opportunities which are under-appreciated and have the potential to deliver positive earnings. The investment process combines bottom-up fundamental analysis with proprietary investment tools that are used to build and maintain high quality portfolios that are risk aware. The investment team manages an extensive company/industry contact program which helps identify and verify various investment opportunities. The companies within the portfolio are primarily selected from, but not limited to, the S&P/ASX 300 Index. The Fund may invest in securities listed on other exchanges where such securities relate to the ASX-listed securities. The Fund typically holds between 25-60 stocks with a maximum net targeted position of an individual stock of 6%. |

| Manager Comments | The Fund returned -1.45% in May, taking the YTD return to +13.08%. The largest detractor was Reliance Worldwide after the company downgraded its earnings guidance. Bennelong noted that, as Reliance had a large weighting in the portfolio, the share price decline had a material impact on performance. Other detractors included Corporate Travel Management and Costa Group. The main positive contributor to performance was Aristocrat Leisure. Bennelong's view is that while valuation metrics such as price-to-earnings ratios appear relatively attractive for the ASX, the main risk they see is that of earnings risk; i.e. the risk that companies disappoint investors by delivering earnings below expectations. They note that share prices have often fallen disproportionately in response to earnings downgrades, such as those seen with Reliance Worldwide and Costa Group. Their conclusion is that investors remain very risk-averse, short-term focused and skittish. |

| More Information |

19 Jun 2019 - Cyan Investment Management | Current and Prospective Investments

|

In this video Dean Fergie (Founding Director and Portfolio Manager) gives his thoughts on some of Cyan's holdings, including Motorcycle Holdings, Experience Co, Afterpay, Splitit and Atomos. Cyan continue to have a positive outlook on each of these companies. |

18 Jun 2019 - Bennelong Twenty20 Australian Equities Fund May 2019

BENNELONG TWENTY20 AUSTRALIAN EQUITIES FUND

Attached is our most recently updated Fund Review on the Bennelong Twenty20 Australian Equities Fund.

- The Bennelong Twenty20 Australian Equities Fund invests in ASX listed stocks, combining an indexed position in the Top 20 stocks with an actively managed portfolio of stocks outside the Top 20. Construction of the ex-top 20 portfolio is fundamental, bottom-up, core investment style, biased to quality stocks, with a structured risk management approach.

- Mark East, the Fund's Chief Investment Officer, and Keith Kwang, Director of Quantitative Research have over 50 years combined market experience. Bennelong Funds Management (BFM) provides the investment manager, Bennelong Australian Equity Partners (BAEP) with infrastructure, operational, compliance and distribution services.

For further details on the Fund, please do not hesitate to contact us.

17 Jun 2019 - Performance Report: Cyan C3G Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Cyan C3G Fund is based on the investment philosophy which can be defined as a comprehensive, clear and considered process focused on delivering growth. These are identified through stringent filter criteria and a rigorous research process. The Manager uses a proprietary stock filter in order to eliminate a large proportion of investments due to both internal characteristics (such as gearing levels or cash flow) and external characteristics (such as exposure to commodity prices or customer concentration). Typically, the Fund looks for businesses that are one or more of: a) under researched, b) fundamentally undervalued, c) have a catalyst for re-rating. The Manager seeks to achieve this investment outcome by actively managing a portfolio of Australian listed securities. When the opportunity to invest in suitable securities cannot be found, the manager may reduce the level of equities exposure and accumulate a defensive cash position. Whilst it is the company's intention, there is no guarantee that any distributions or returns will be declared, or that if declared, the amount of any returns will remain constant or increase over time. The Fund does not invest in derivatives and does not use debt to leverage the Fund's performance. However, companies in which the Fund invests may be leveraged. |

| Manager Comments | Top contributors included Alcidion, Isentia, AMA Group and ReadCloud. Detractors included Kelly Partners, Experience Co and Afterpay, although smaller weightings in these companies curtailed any material negative Fund performance. The Fund has subscribed to a number of smaller placements but has also taken stock in a handful of new IPO's due to list in the next month or two. Some of these include Victory Offices who operate 19 flexible workspace locations, and Quickfee who offer premium funding and payment solutions to the accounting and legal industries in both Australia and the US. Cyan emphasise that, whilst month-to-month volatility can be expected, they have a firm view of long-term opportunity and remain confident in the outlook for the Fund. |

| More Information |

14 Jun 2019 - Hedge Clippings | 14 June 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

14 Jun 2019 - Performance Report: DS Capital Growth Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The investment team looks for industrial businesses that are simple to understand; they generally avoid large caps, pure mining, biotech and start-ups. They also look for: - Access to management; - Businesses with a competitive edge; - Profitable companies with good margins, organic growth prospects, strong market position and a track record of healthy dividend growth; - Sectors with structural advantage and barriers to entry; - 15% p.a. pre-tax compound return on each holding; and - A history of stable and predictable cash flows that DS Capital can understand and value. |

| Manager Comments | The Fund performed strongly in May with solid gains across the portfolio. Top performers included Lifestyle Communities, AMA Group and Interxion (US listed). There were no major changes to the portfolio. DS Capital noted the election result was embraced by the stock market with the policy agenda of the winners appearing favourable for economic growth. In the meantime, they expect low interest rates to have a favourable impact on stock market valuations. They add that although rates will ultimately normalise they don't believe this is likely in the near term. DS Capital feel the portfolio is well positioned as they work toward reporting season. |

| More Information |

14 Jun 2019 - Fund Review: Bennelong Kardinia Absolute Return Fund May 2019

BENNELONG KARDINIA ABSOLUTE RETURN FUND

Attached is our most recently updated Fund Review. You are also able to view the Fund's Profile.

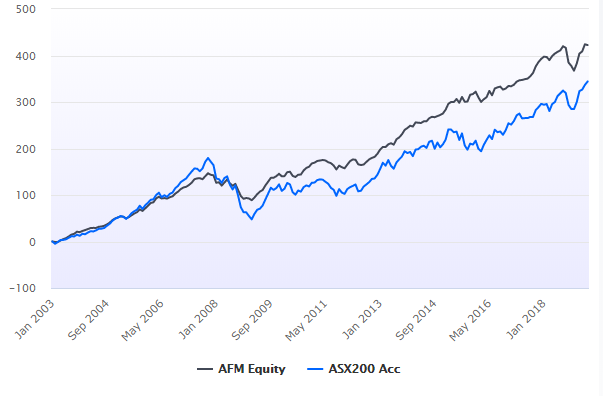

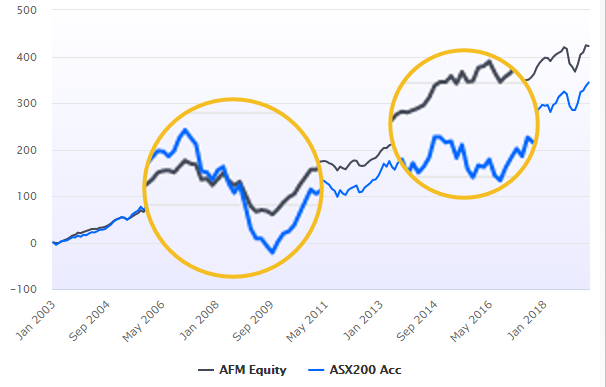

- The Fund is long biased, research driven, active equity long/short strategy investing in listed ASX companies with over ten-year track record.

- The Fund has significantly outperformed the ASX200 Accumulation Index since its inception in May 2006 and also has significantly lower risk KPIs. The Fund has an annualised return of 9.12% p.a. with a volatility of 7.06%, compared to the ASX200 Accumulation's return of 6.09% p.a. with a volatility of 13.23%.

- The Fund also has a strong focus on capital protection in negative markets. Portfolio Managers Mark Burgess and Kristiaan Rehder have significant market experience, while Bennelong Funds Management provide infrastructure, operational, compliance and distribution capabilities.

For further details on the Fund, please do not hesitate to contact us.

13 Jun 2019 - Loftus Peak | Valuing Stocks

|

When valuing the stocks Loftus Peak invest in, Alex Pollak's (CIO & Founder) view is that PE multiples are useless given that they are only single-period measures. Loftus Peak prefer to look further into the future by considering what will happen to revenue growth within a 5 year period. |

12 Jun 2019 - Performance Report: NWQ Global Markets Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | This is achieved through active allocations to a select number of liquid alternative managers that employ a variety of strategies. The Fund places emphasis on managers who demonstrate a rigorous and repeatable investment process that has delivered a strong track record. |

| Manager Comments | US and European equity markets suffered their largest monthly decline for the year in May while safe haven assets such as US Treasuries, the US Dollar and Japanese Yen strengthened. This market backdrop, they noted, was more favourable for the Fund's discretionary managers (+2.38%) as compared with the systematic managers (-3.99%). The Fund's currency exposures were the largest positive contributor during the month. However, these gains were more than offset by losses in the Fund's equity exposures. The Fund's fixed income positions combined to produce a modest loss while there was a small gain from the Fund's commodities positions. |

| More Information |