NEWS

17 Oct 2023 - Glenmore Asset Management - Market Commentary

|

Market Commentary - September Glenmore Asset Management October 2023 Globally equity markets in September declined materially driven by rising bond yields. In the US, the S&P 500 fell -4.9%, whilst the Nasdaq declined -5.8%. In the UK, the FTSE 100 outperformed, rising +2.3%, due to its heavy resources and lower technology weightings. In Australia, the All-Ordinaries Accumulation Index fell -2.8%. Energy was the best performing sector (brent crude oil rose +9.8%), whilst real estate and technology were the worst performing sectors, both impacted by rising bond yields. Small caps underperformed as investor risk appetite weakened, with the ASX Small Ords Accumulation Index falling -4.0%. In bond markets, the US 10-year bond yield climbed +43bp to close at 4.54%. Its Australian counterpart saw the yield increase +46bp to 4.49%. The increase in bond yields was the main story for financial markets in the month and was driven by expectations that high inflation will be more persistent and hence require more rate hikes from central banks over the next 6-12 months. The Australian dollar was flat, closing at US$0.64. Funds operated by this manager: |

16 Oct 2023 - 10k Words | October 2023

|

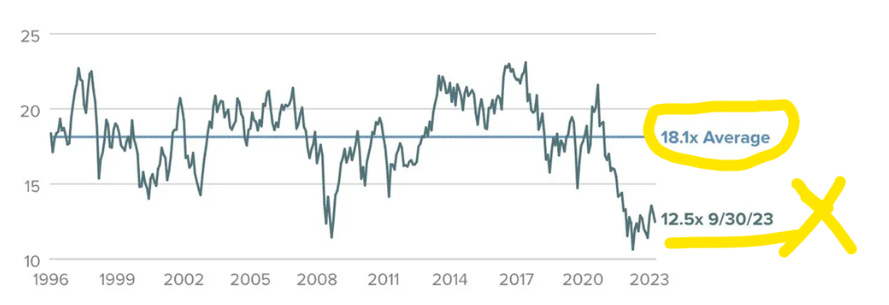

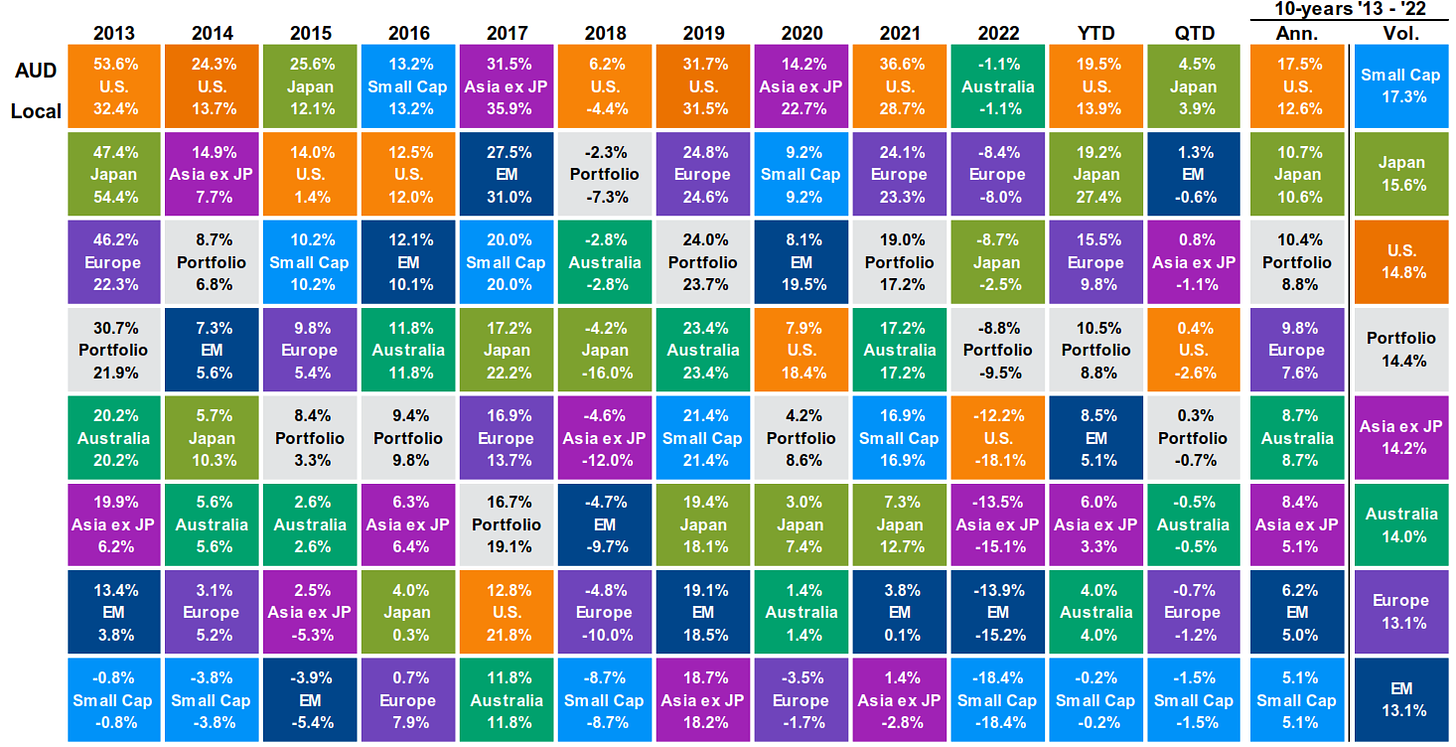

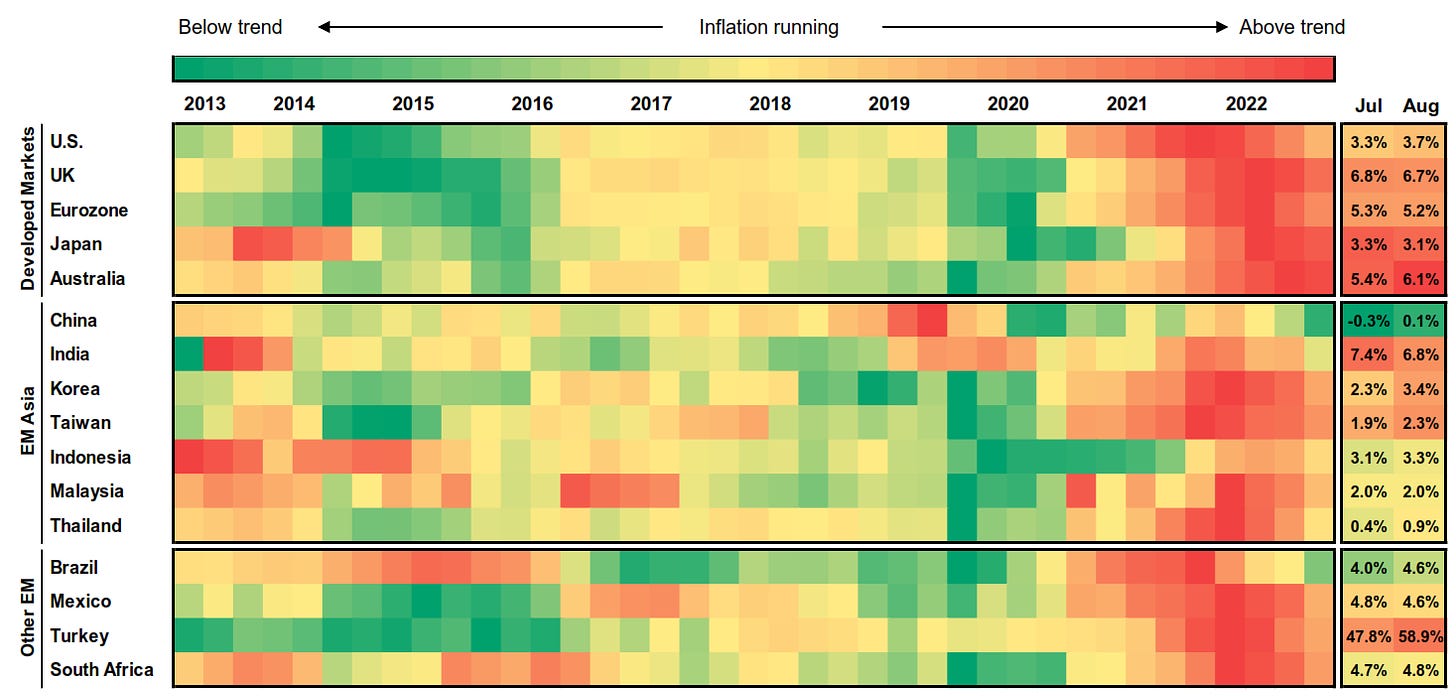

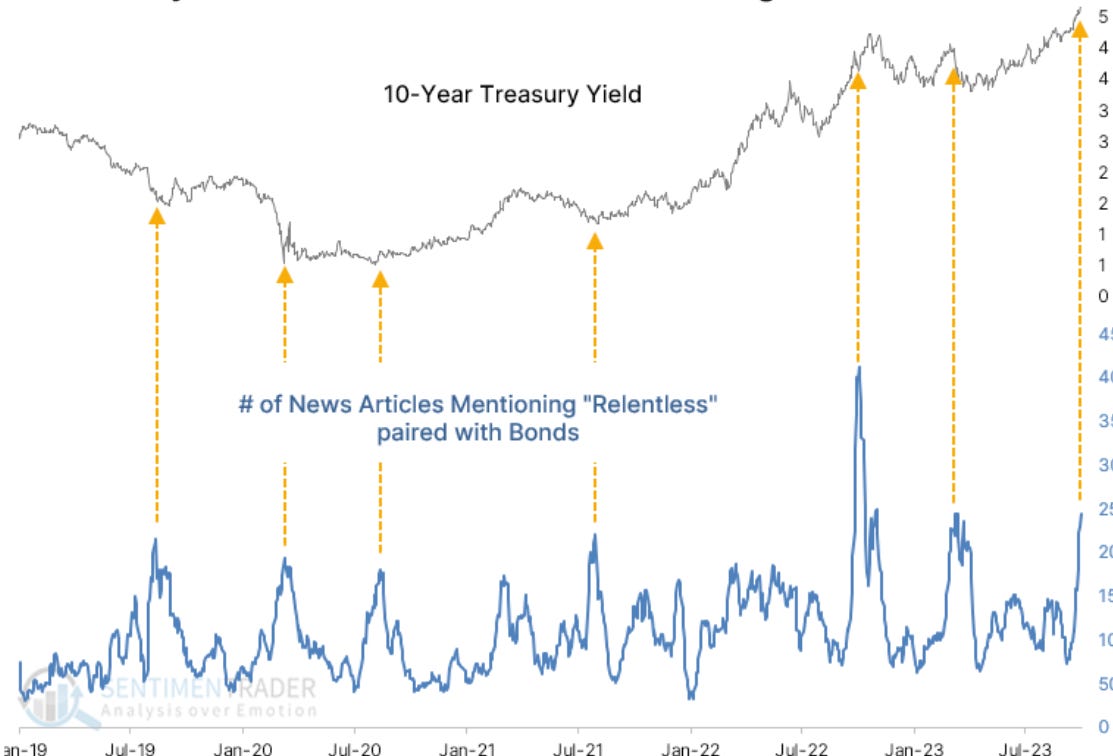

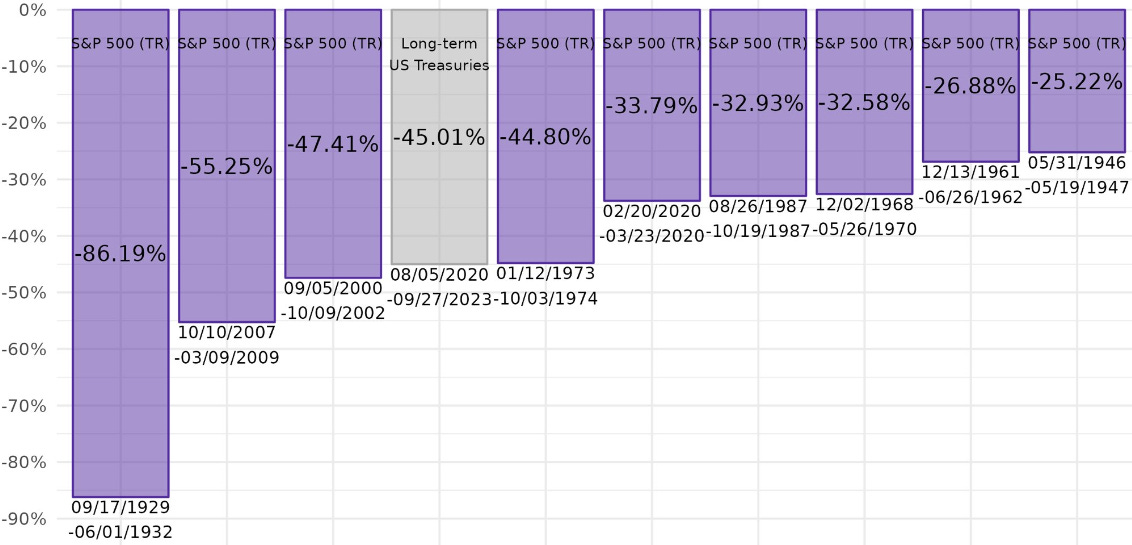

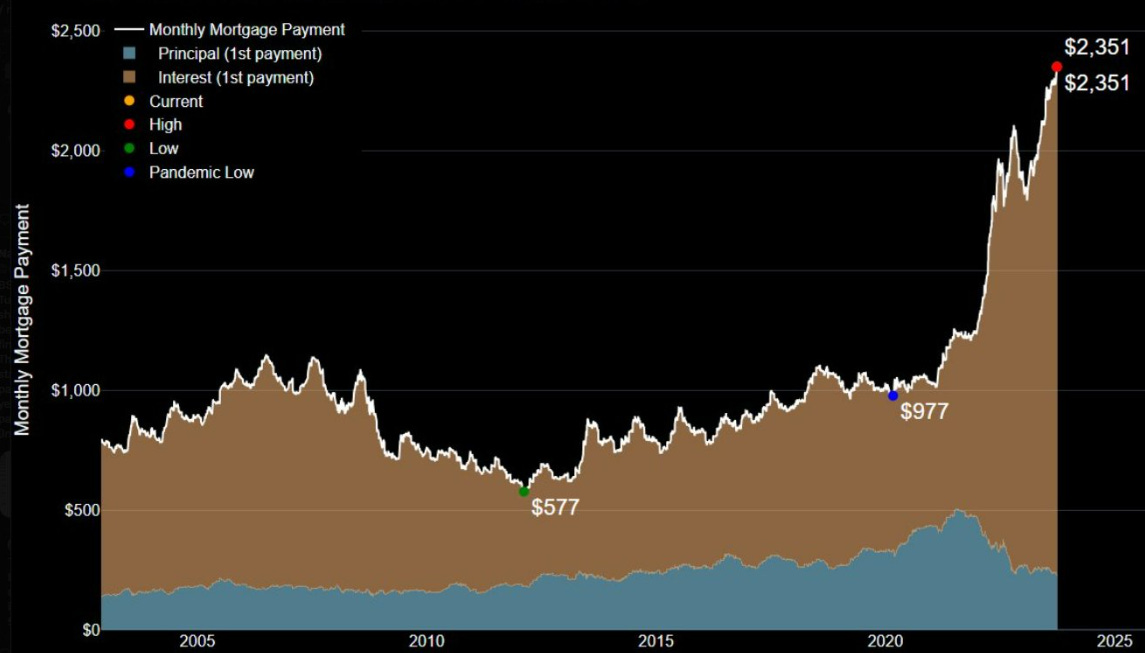

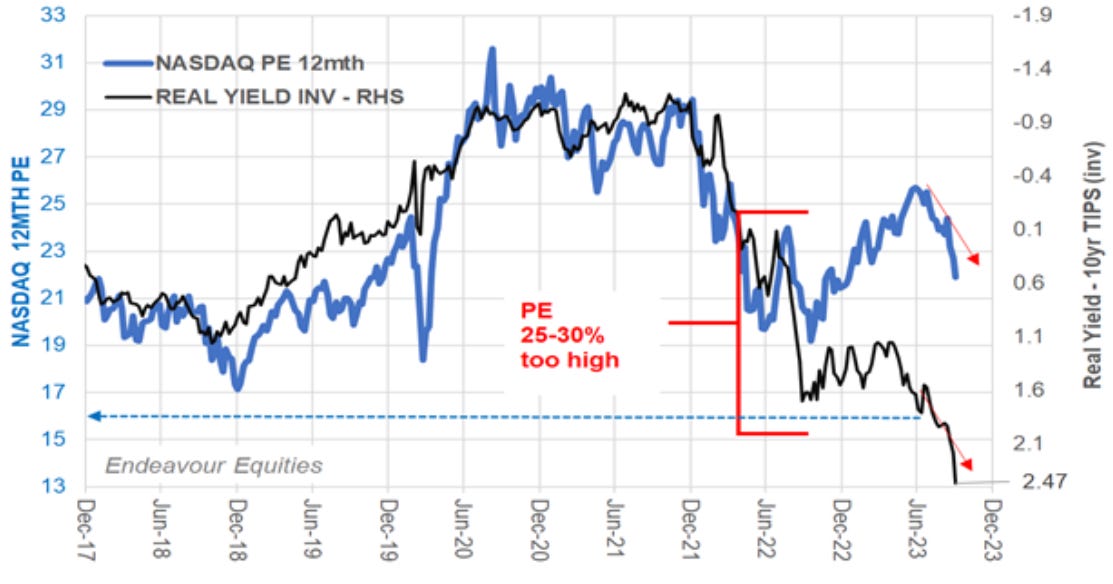

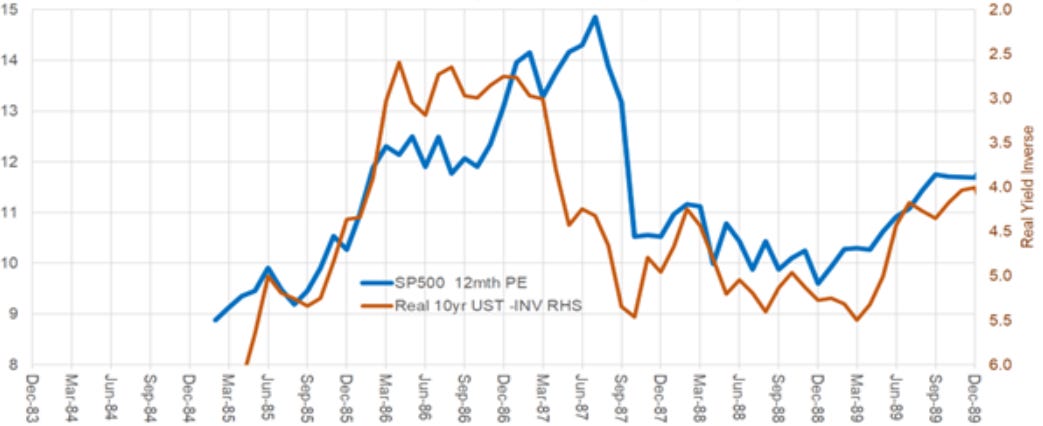

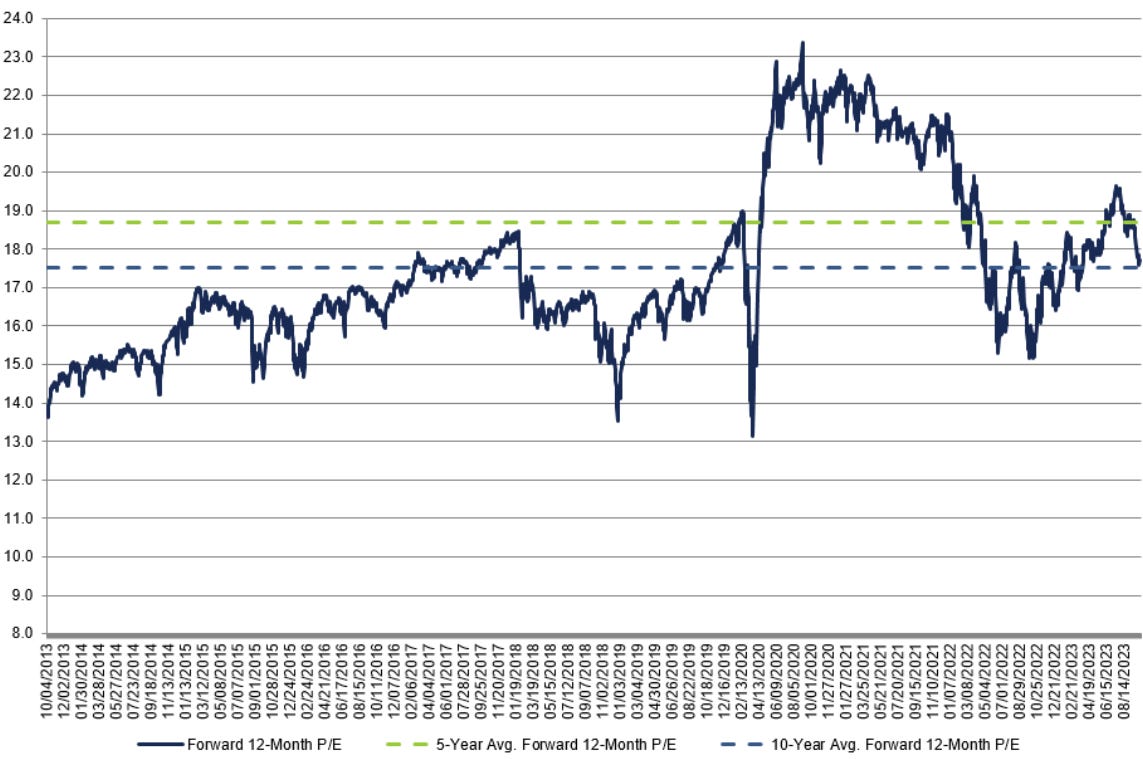

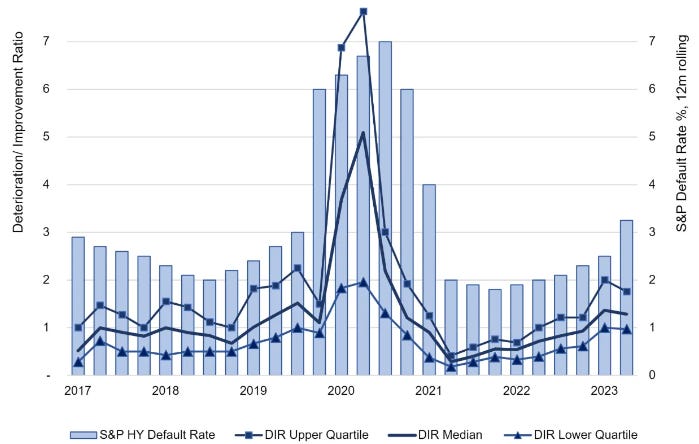

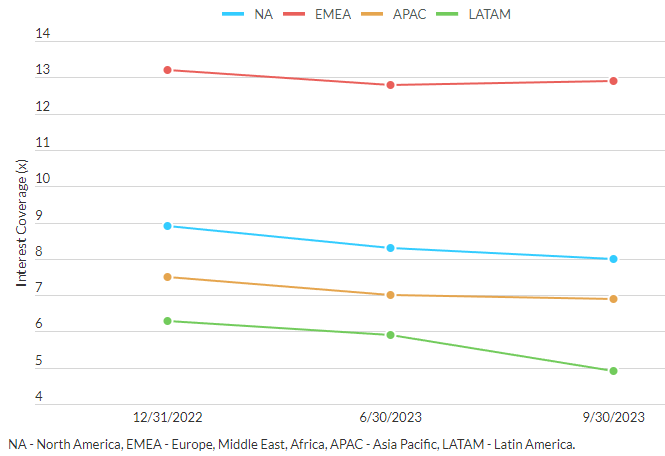

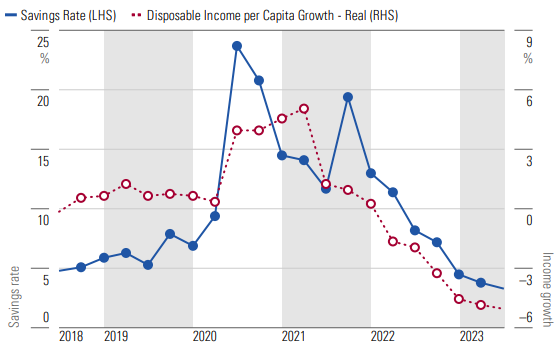

10k Words Equitable Investors October 2023 "Small caps have gone through scotched earth in the US & here," Bell Potter highlights, with JP Morgan showing small caps to be the most volatile and lowest returning asset in the past ten years. JP Morgan also shows us inflation still running above trend in developed markets, leading to a "relentless" rise in bond yields according to SentimenTrader - the flipside of which is a massive equity-like drawdown in bonds charted by @leadlagreport. Mortgage repayments, @cullenroche notes, have rocketed up. But P/E multiples haven't really responded to the shift in rates yet - Endeavour Equities charts the gap between the Nasdaq's P/E and real yields - then points out that in 1987 a P/E derating lagged higher real yields. Factset has the S&P 500's forward P/E at 17.7x, just above the 10 year average of 17.5x (calculated over a period of lower interest rates). Equitable Investors looked at Australia's 10-year government bond hitting a high not seen since 2011 as the spread between the bond yield and the ASX 200 dividend yield turned negative. We also looked at the spread between corporate "high yield" debt and the earnings yield in the US. That's as credit ratings agency Fitch sees corproate interest coverage declining "modestly" as rates stay higher for longer. Finally, Morningstar charts how Australian consumers are spending more of their income and saving less. Weighted harmonic average P/E (excluding non-earners) for the Russell 2000 Source: Bell Potter World equity market returns Source: JP Morgan Asset Management Headline consumer prices year-over-year, quarterly data Source: JP Morgan Asset Management US bond yields rise as news articles label the move "relentless" Source: SentimenTrader, Bloomberg 2020-2023 - 20+ year US treasury drawdown compared to largest stock Source: @leadlagreport Monthly mortgage payment using median existing home pirce in US with a 20% down payment & average 30Y mortgage rate Source: @cullenroche, Bloomberg Nasdaq P/E v inverse of the real yield on 10 year inflation-protected treasuries Source: @EquitOrr / Endeavour Equities In 1987 P/Es derated as a delayed reaction to higher real yields Source: @EquitOrr / Endeavour Equities S&P 500 forward 12 month P/E ratio - 10 years Source: FactSet Australian government 10-year bond yield Source: Iress, Equitable Investors Spread between S&P/ASX 200 dividend yield & 10 year bond yield Source: Iress, Equitable Investors Spread between US BBB corporate bonds and the S&P 500 earnings yield Source: GuruFocus, Equitable Investors US "high yield" corporate bond default rates rising Source: S&P Change in Fitch's forecast for 2023 inveterst coverage (EBITDA / interest) Source: Fitch Real household incomes declining and saving rates low

Source: Morningstar, ABS October Edition Funds operated by this manager: Equitable Investors Dragonfly Fund Disclaimer Nothing in this blog constitutes investment advice - or advice in any other field. Neither the information, commentary or any opinion contained in this blog constitutes a solicitation or offer by Equitable Investors Pty Ltd (Equitable Investors) or its affiliates to buy or sell any securities or other financial instruments. Nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. The content of this blog should not be relied upon in making investment decisions. Any decisions based on information contained on this blog are the sole responsibility of the visitor. In exchange for using this blog, the visitor agree to indemnify Equitable Investors and hold Equitable Investors, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to legal fees) arising from your use of this blog, from your violation of these Terms or from any decisions that the visitor makes based on such information. This blog is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. The information on this blog does not constitute a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Although this material is based upon information that Equitable Investors considers reliable and endeavours to keep current, Equitable Investors does not assure that this material is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed on this blog may change as subsequent conditions vary. Equitable Investors does not warrant, either expressly or implied, the accuracy or completeness of the information, text, graphics, links or other items contained on this blog and does not warrant that the functions contained in this blog will be uninterrupted or error-free, that defects will be corrected, or that the blog will be free of viruses or other harmful components. Equitable Investors expressly disclaims all liability for errors and omissions in the materials on this blog and for the use or interpretation by others of information contained on the blog |

12 Oct 2023 - Ferrari: The case for RACE (RACE IM)

|

Ferrari: The case for RACE (RACE IM) Alphinity Investment Management September 2023 Ferrari is one of the world's most iconic brands. It's also an amazing stock. Ferrari was founded in Italy in the 1940s and was spun off from Stellantis in 2016 under the ticker RACE IM.

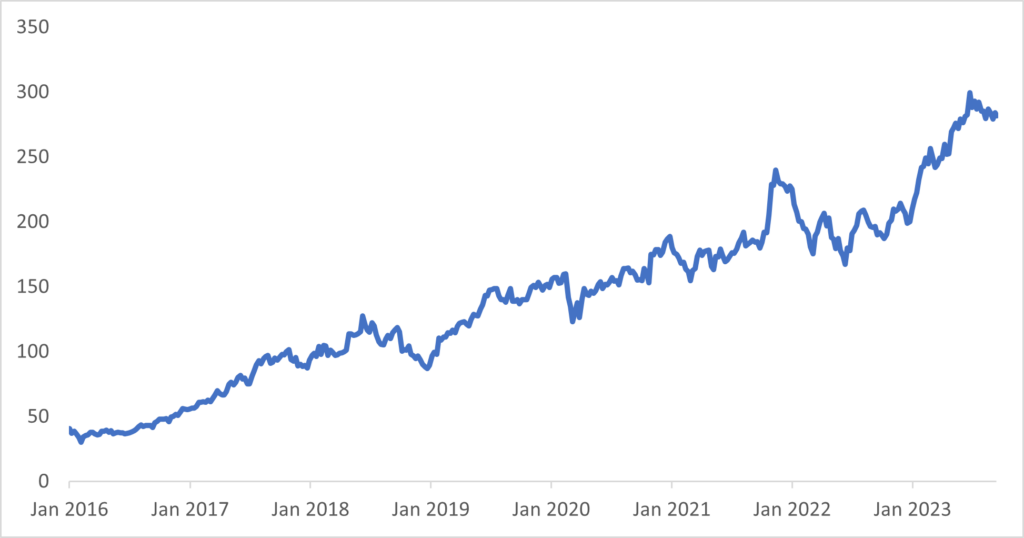

The IPO price was EUR43 and Ferrari is currently trading at ~EUR300 for a 600% return since listing. The analysis below outlines the Case for RACE and highlights 4 main reasons to why we love the stock. RACE Stock Price Since Listing in 2016

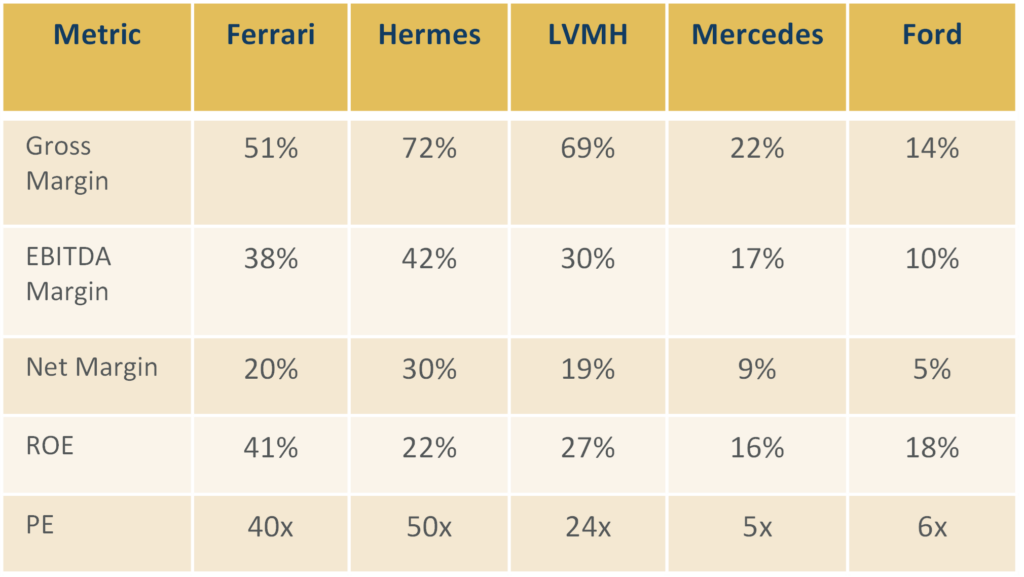

Reason #1: High margin, high return, high growth business

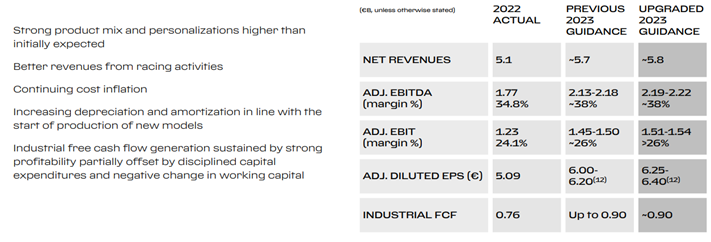

Point #2: A+ industry structure leads to earnings visibility and upgrades From this perspective, Ferrari is literally the textbook case of an A+ company. They are a heritage brand with incredibly high barriers to entry, they have few competitors, few substitutes, price insensitive customers with very little bargaining power, and a supply chain that is localised and very difficult to replicate. The net result is that Ferrari has an immense level of control over its own earnings and strong earnings visibility. Management upgraded its FY23 revenue guidance, adjusted EBIT margin guidance as well as adjusted EPS and FCF estimates at the last result. More importantly, this upgrade cycle is a consistent pattern shown by RACE management since listing.

Reason #3: Impressive Brand Recognition and Unique Positioning Among Auto Peers Ferrari is refreshingly contrarian on both these fronts. Ferrari management has made a strong commitment NOT to get into autonomous driving (AD). The whole point of buying a Ferrari is to drive it yourself! While Ferrari is a leader in hybrids with approximately 45% of deliveries already in the hybrid space, it's first fully electric car will not be presented until 2025 with the first deliveries the following year. They do not expect pure EVs to be more than 5% of total shipments by 2026. Part of this is strategic positioning that one of the great joys (so I am told) of owning a Ferrari is the vrooooom, sound it makes when you start the ICE engine. EVs don't vroom so Ferrari plans to continue to develop ICE engines into the 2030s. Reason #4: Technological leader Investment Risks Conclusion |

|

Funds operated by this manager: Alphinity Australian Share Fund, Alphinity Concentrated Australian Share Fund, Alphinity Global Equity Fund, Alphinity Sustainable Share Fund Disclaimer |

11 Oct 2023 - Who will benefit from the energy transition?

|

Who will benefit from the energy transition? Magellan Asset Management September 2023 |

|

Net Zero is not a new ambition for governments and companies, with some sectors like utilities focused on this climate risk for quite some time now. David Costello, CFA, Portfolio Manager - Energy Transition Strategy discusses the opportunities we see from the energy transition and companies that may benefit from this transition. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

10 Oct 2023 - Investing Essentials: Understanding fund fees - price versus value

|

Investing Essentials: Understanding fund fees - price versus value Bennelong Funds Management September 2023 |

|

While understanding the price of an investment is relatively straightforward, measuring value is more difficult. Everyone has a different view of what represents value. Some people are more thrifty and therefore focused on achieving a lower price point. Others are happy to pay more if they believe they'll get better quality. Value can sometimes be hard to quantify, but when it comes to investing, fees are a good place to start. It's pretty easy to work out if an investor in one fund has obtained a greater return than an investor in a similar product with a different fee. This can give a good comparison of the price paid, provided the calculation is done after the suggested investment time frame. To effectively decide whether a fund presents good value or not, you need to understand the different types of fees in a fund.Annual management fee - this should be clear-cut and is easy to compare between two funds. Management expense ratio (MER) - this represents the management fee plus other fund expenses (such as audit costs). Again, it's usually straightforward to compare the MER of two funds. Performance fee - this, however, can be more complex. Performance fees rarely encompass the same information and can be structured differently from fund to fund, making them more difficult to compare. To help understand the interplay between different types of fees, the indirect cost ratio (ICR) can be useful. This represents the overall cost of a fund at a particular point in time, including the MER and any related performance fee that has been paid during a financial year. The ICR, however, is backwards-looking. It's usually calculated after the end of the financial year, and looks solely at that past financial year. While it's a decent indicator, and certainly a good way to compare two different funds, investors should understand that it doesn't represent what they will pay for the year ahead. Investors should particularly take into account the performance of the relevant fund during that 12-month period. The ICR may look high, but were returns also strong? Don't dismiss a fund from consideration simply because of a high ICR, without also taking into account what performance has been like - that is, making a comparison on price and not a comparison on the value that has been delivered. This also relates to the 'active versus passive" management debate. Passive funds often have lower fees on face value. Then again, the levers available to an active manager give them more flexibility in adjusting their exposure to the stocks they hold to take advantage of economic themes in the current environment. For many investors, it may be the case that a combination of both approaches will serve them best, both in terms of price and value. The important thing is understanding the different fees being paid, what those fees are paying for, and why and when the merits of one approach over the other can be most beneficial. But in the end, the decision to invest in anything should be made by considering more than just the cost. |

|

For more insights visit www.bennelongfunds.com Disclaimer The content contained in this article represents the opinions of the author/s. The author/s may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the author/s to express their personal views on investing and for the entertainment of the reader. |

9 Oct 2023 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

|||||||||||||||||||

| Vanguard Active Global Growth Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| Vanguard Active Emerging Markets Equity Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|||||||||||||||||||

| Coolabah Floating-Rate High Yield Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|

|||||||||||||||||||

| Janus Henderson Global Sustainable Equity Fund | |||||||||||||||||||

|

|||||||||||||||||||

| Janus Henderson Sustainable Credit Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

| Janus Henderson Net Zero Transition Resources Fund | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

|

|||||||||||||||||||

| New Holland Capital Tactical Alpha Fund (AUD) - Class B | |||||||||||||||||||

|

|||||||||||||||||||

| View Profile | |||||||||||||||||||

|

Want to see more funds? |

|||||||||||||||||||

|

Subscribe for full access to these funds and over 700 others |

9 Oct 2023 - What are Warrants and what is a Bond/Warrant?

|

What are Warrants and what is a Bond/Warrant? PURE Asset Management September 2023 |

| Cost to acquire the warrant/option | -$0.10 |

| Cost to exercise | -$2.50 |

| Proceeds from sale of shares | +$3.00 |

| Profit | +$0.40 |

| Return on investment | 400% |

The appeal is that, compared to simply investing the shares, there is much more leverage to the rising share price. Using the same example above, but instead buying the shares, the investor would have made a 50% return.

| Cost to buy the shares | -$2.00 |

| Proceeds from sale of shares | +$3.00 |

| Profit | +$1.00 |

| Return on investment | 50% |

Therefore, although the investor is taking more risk by buying a warrant or option, because of the limited time frame until expiry, they can achieve the same profit while deploying far less capital. See below, where both scenarios yield a $5,000 profit, but the investor in the warrant/option has had to invest just 12.5% of the capital to achieve the same outcome:

| Warrant/Option | Shares | |

| Capital invested | $1,250 | $10,000 |

| Cost per security | -$0.10 | -$2.00 |

| Number of securities | 12,500 | 5,000 |

| Profit per security | +$0.40 | +$1.00 |

| Profit | $5,000 | $5,000 |

| Return on investment | 400% | 50% |

What is a Bond/Warrant?

A bond/warrant is Convertible Loan broken into its two constituent parts, being a bond (or loan to a Company), with a detached Warrant (an option to buy the shares).

Just like a convertible loan, when the warrants are exercised, the investor is effectively converting from debt into equity. This is achieved by making the cost of exercising the warrant the same as the value of the loan, so that when the Company receives the proceeds from exercise, they can be used to extinguish the loan. In turn, the investor has effectively cancelled the loan, in exchange for shares from the Company.

Just like a convertible loan, the attraction to the investor is that they prior to conversion they receive the benefits of a loan structure: interest and more protection in the capital structure, but they also have the opportunity to make an additional profit if the share price rises above the strike or conversion price.

Often a traditional convertible note does not allow the flexibility of early repayment because when the loan is repaid the investor loses the optionality of converting into shares. Convertible notes often prohibit early repayment because issuer Companies may be incentivised to repay or refinance the convertible note, just before the investor can profit from the rising share price.

Therefore, a bond/warrant structure can be attractive to the Company versus a traditional convertible loan as the Company retains the right to repay the bond whenever it chooses. Likewise, the investor is happy because if the loan is repaid early, they retain the warrant and keep the optionality to make a profit from the rising share price, but without any capital at risk i.e., they have created a free warrant.

Bond/warrants are a win-win for both the investor and the Company, but they are also a win for other shareholders. This is because the inherent attraction of the structure means the warrant strike price can justify at a material premium to the prevailing share price, therefore shareholders are less diluted, compared to raising capital via the issuance of shares. It's a win-win-win!

Funds operated by this manager:

6 Oct 2023 - Is Tesla just another car company?

|

Is Tesla just another car company? Montgomery Investment Management September 2023 In the ever-evolving landscape of the automotive industry, few companies have captured the world's attention quite like Tesla. Thirteen years ago, electric cars were synonymous with virtue signalling rather than high-performance excitement. However, Tesla disrupted this perception, transforming electric vehicles into something thrilling and aspirational. Its journey, from a modest initial public offering (IPO) in 2010 to a valuation exceeding $1 trillion in 2019, has been nothing short of remarkable. Yet, recent stagnation in Tesla's stock price has prompted a critical question: Is Tesla still the visionary pioneer it once was, or is it merely becoming "just another car company"? A background to Tesla Thirteen years ago, in 2012, hybrid electric cars were unsexy and uninspiring. Think of the Toyota Prius here in Australia, or the Chevrolet Volt and Nissan Leaf in the U.S. These were virtue-signaling vehicles designed without mass appeal in mind. Manufacturers also had a vested interest in their legacy internal combustion engine (ICE) models and weren't tooled up for mass adoption of electric vehicles (EV). Tesla changed all that, first delivering exciting luxury cars that also happened to be fast and battery-powered, before widening the appeal by launching more affordable models that were also powerful and equally good-looking. Around thirteen years ago, a small company called Tesla Motors (NASDAQ:TSLA) launched its initial public offering (IPO) on the NASDAQ stock exchange, raising a total of U.S.$226.1 million at a (split adjusted) share price of U.S.$3.40. Three years later, in 2013/14, Tesla transitioned from being essentially a start-up with highly uncertain survival prospects to being a credible auto business, redefining public expectations around electric vehicles with its introduction of the Model S, and in 2013, generating its first quarterly profit. Excitement in the stock market for Tesla, however, was arguably greater. Between 1 January 2013 and 1 January 2014, consensus full-year earnings forecasts for Tesla were revised up sharply, with 2015 net income forecasts moving from U.S.$247 million to U.S.$432 million and 2016 net income forecasts moving from U.S.$415 million to U.S.$784 million. The less-than-doubling of earnings expectations however, resulted in a 10-fold increase in the share price as the discount associated with doubts about the company's survival unwound. Tesla's profits fell well short of those forecasts, with the company reporting a net loss in 2015 of U.S.$889 million and another net loss in 2016 of U.S.$773 million. Yet the market's excitement didn't wane. The share price gains didn't continue, but the price gains didn't reverse either. Profitable hopes were simply deferred. At the start of 2015, Tesla commanded a market valuation of close to U.S.$30 billion, well short of the value ascribed to the world's largest automakers, but still around half that of Ford and General Motors. It wasn't until 2019 that the fortunes of Tesla started to take off, with its shares jumping from U.S.$12.65 in May 2019 to a split-adjusted U.S.$409.97 on November 04, 2021, and a market capitalisation of over U.S.$1 trillion. In mid-2020, Tesla achieved four consecutive quarters of positive net income for the first time in its history, and over the prior 12 months consensus net income forecasts for Tesla increased substantially. The 2021 forecast increased to U.S.$3.15 billion from U.S.$1.72 billion, and the 2022 number rose to $5.03 billion from $3.44 billion. This less-than-doubling of earnings forecasts had driven another 10x share price move. Tesla today Today, however, the share price is roughly where it was almost three years ago. If the gas has been let out (pun intended) of the share price's ascent, it begs a question: what if Tesla is just another car company? Tesla is still the market leader in battery-powered electric car sales in the U.S., with a market share of above 60 per cent, and the company's flagship Model 3 is the best-selling EV model in the U.S.. Meanwhile, Tesla's market capitalisation today of U.S.$777 billion is more than the combined market capitalisation of the next eight biggest manufacturers, including (in descending order) Toyota, Porsche, BYD, Mercedes Benz, VinFast Auto, BMW, Volkswagen, and Ferrari. Not unlike Apple, Tesla has adopted a closed-ecosystem approach to its products, owning the cars, the servicing, and the charging directly, setting it apart from other manufacturers. But does this deserve the hefty multiple placed on the company's earnings that renders it as valuable as the world's next eight biggest manufacturers? Investors can buy Toyota for $22,000 per vehicle sold in 2022, BMW for $27,825, BYD for $53,800 per vehicle sold, or they can buy Tesla for nearly U.S.$591,000 per vehicle sold. The economics between Tesla and every other car manufacturer in the world, in the long run, might be slightly different. Still, they cannot be sufficiently dissimilar to justify such a disparity in either absolute market capitalisation terms or in relative terms. Despite a share price today that is 40 per cent below its all-time high, enthusiasm for the world-changing potential of EV technology has clearly translated to an equally transformative approach to stock market valuation for Tesla. What investors are forgetting, however is that Tesla will ultimately be a car company. As competitors catch up, the competitive advantage of Tesla will erode. Meanwhile, any differences in the economics of car manufacturing between Tesla and its rivals will also diminish as more of each brand's fleet moves to electric. In time it will be harder to justify such a disparity between Telsa's market valuation and that of its competitors. Ten reasons why the differences will narrow Increased competition: As we have written about many times, an increasing number of automobile manufacturers, including traditional giants and EV startups, are producing electric vehicles that compete directly with Tesla's lineup. Brands like Ford, Rivian, Lucid, and Chevrolet have rolled out new electric models that, in some cases, outperform Tesla in terms of range, performance, and looks (the latter being subjective of course). And while the market for EVs overall is growing, Tesla's dominance in EV market share in the U.S. has already slipped from 72 per cent to 62 per cent in just the first year of rising competition and brand choice. Meanwhile analysts believe Telsa's market share could fall to as little as 18 per cent by 2026 from 78 per cent in 2018. Ageing product line: Tesla first new passenger vehicle model in three years is the just released updated Model 3. This 'stagnation' in model releases provides competitors with an opportunity to entice potential Tesla customers with newer and potentially more advanced options resulting in Tesla losing further share. Struggles in key markets: China, the world's largest auto market, has been a significant growth engine for Tesla. However, the company has experienced a softening in demand in China. Local competitors, of which BYD Co. is the largest by no means alone, are making significant strides, offering a more diversified range of models that cater to various price points. Critics in China suggest Tesla does not fully understand the preferences of Chinese consumers. Marketing and branding issues: Tesla's decision to offer discounts to boost sales is a departure from its earlier stance, indicating potential demand challenges and lower margins. Furthermore, Elon Musk's controversial takeover of Twitter Inc. has affected Tesla's brand perception, pushing some potential buyers away. Distracted Elon Musk: Many shareholders are concerned that Elon Musk, the driving force behind Tesla, has been distracted with his acquisition and management of Twitter, now called X. Such diversions annoy analysts who believe they could impact Tesla's strategic directions and operational efficiency. Share price malaise: Tesla's share price is unchanged from almost three years ago, suggesting investors are acknowledging the challenges Tesla faces and waking up to the reality of the long-term economics of manufacturing cars. Inability to meet growth targets: Despite aggressive scaling efforts, Tesla is falling short of its annual growth targets. With a 40 per cent annual growth rate in 2022 compared to 87 per cent in 2021, the company's exponential growth might be plateauing if Elon Musk's target of two million vehicles in 2023 is not met. Shifting strategies: Elon Musk's statement back in July 2021 that the "goal is not to be a car company" suggests a broader and potentially more diffuse focus and remains a reminder for analysts who focus too closely on the company's position and growth in the automobile industry. Over-reliance on existing models: Rather than diversifying its lineup, Tesla is focused on scaling up and churning out as many of its existing models as possible. This strategy is at odds with conventional (and capex intensive) wisdom that releases new models almost annually. The traditional auto industry belief is car makers need to offer a wide range of updated and more advanced models to keep buyers interested and part of their brand 'family'. Valuation metrics: At September 2023 Tesla is trading at 63.1 times trailing twelve-month (TTM) earnings. This compares to 120 times at the end of 2021. At either measure the price-earnings (PE) is a market valuation more typical of high-growth tech companies than a car manufacturer. Conclusion If Tesla does indeed become 'just a car company', the sharp drop in PE will continue and reflect a growing realisation in Tesla's growth prospects, its position in the auto industry, and its economics are less exciting than once believed. Tesla remains a global leader in the EV market with strong fundamentals, however, there are clear signs that it faces increasing challenges from competitors, potential demand issues, and market sentiment shifts. The lofty valuations and hype surrounding the company needs to be re-evaluated considering these inescapable realities. Author: Roger Montgomery Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

5 Oct 2023 - The hidden value in securitisation warehouses

|

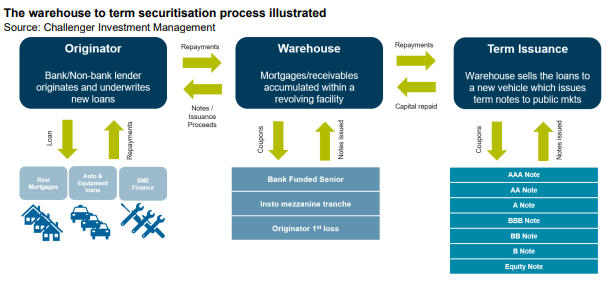

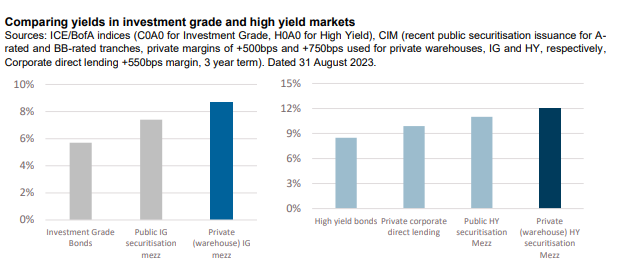

The hidden value in securitisation warehouses Challenger Investment Management September 2023 Early in my career I was introduced to the adage, "you get paid for brain damage". Despite its crudeness, the expression has proved accurate. Put another way, if you are willing to make the effort to understand and mitigate complexity, you can often get paid outsized returns for doing so. In the years following the global financial crisis, securitisation markets were viewed as overly complex. Regulatory bodies disincentivised pension funds, banks and insurers from investing in these markets outside of the most risk remote tranches. Investors that were willing to finance mezzanine tranches of securitisation issuance were rewarded handsomely for it. Fast forward to today and while markets have normalised to a degree the structural opportunity remains. However sophisticated investors have recognised that the real opportunity lies in the manufacturing of new securitisation bonds in private markets, so called warehousing or pre-securitisation finance. As a reminder a securitisation pools a group of loans/receivables into a pool which are then tranched into bonds of different risk and return profiles. A warehouse is a securitisation that allows a lender to accumulate a sufficient volume of receivables to then issue into the public market.

In the warehouse market the senior financier is typically a bank who will also act as the arranger of the public transaction. Prior to the Global Financial Crisis banks were willing to fund close to (and in some cases even more than) 100% of warehouse with the difference comfortably funded by the originator of the loans. There was no need for anyone to bridge the gap between senior bank funding and equity. The post GFC world is immeasurably different. Basel III capital standards impose extremely punitive capital treatment for banks that lend below investment grade ratings, especially where they are not in the senior tranche. For some asset types, the gap between where banks are willing to lend to and where the originator can fund can be 20-30% of the overall pool of collateral. This is the first piece of the value puzzle for securitisation warehouses. Regulations have created a structural gap in warehouse funding markets into which alternative lenders have enteredBut not just anyone can step into a warehouse. As with many private lending transactions execution risk, ongoing management and certainty of capital are critical considerations for a borrower. Alternative credit funds who are active in warehouse lending will typically have well established intercreditor relationships with multiple senior bank financiers and a long track record of efficient execution of transactions through multiple cycles. Scale also matters; an ability to grow the warehouse over time and even provide incremental capital to de-risk senior is also an important consideration for a borrower. Unlike corporate lending markets where even private transactions have some degree of standardisation, warehouses tend to be bespoke to meet the specific needs of the borrower. Having experienced counterparties who are a known quantity can reduce the cost and risk of execution. You may ask why cost and risk of execution are so important in securitisation warehouse transactions. The answer lies at the heart of the second, and in our view most important piece of the value puzzle. Securitisation warehouses are a means to an endSecuritisation originators make their returns by terming out warehouses into public markets at the lowest possible cost of funds. The warehouse allows the originator to get a sizeable enough portfolio that meets the specific needs of the public market securitisation investors, thus lowering the cost of funds. The goal of the warehouse is to get to the public markets as quickly and efficiently as possible. Experienced originators understand that the trade-off for the speed and efficiency in the warehouse is higher returns to the warehouse financiers. For the senior banks, the higher returns come through transaction fees for arranging and distributing the public securitisation. For the alternative credit funds providing the mezzanine finance, the margins in warehouses are generally around 2% per annum higher than the margins in public term transactions of the same implied credit ratings. With cash returning close to 5% across most developed markets, the all-in yield on a warehouse trade is in the low teens for a credit risk profile that often blends to around a BB credit rating. This is a considerable pickup over the high yield bond market which is only yielding around 7% in US dollar markets.

The final piece of the value puzzle relates to risk and is strongly tied to the "means to an end" argument. Because the warehouse is such an integral part of the value creation chain, borrowers have tended to go to great lengths to maintain the performance of their warehouses. This includes putting in additional equity/subordination, buying back non-performing receivables or targeting a lower risk profile with new originations. Subordination levels are also typically set based on a hypothetical 'worst case' pool based on eligibility criteria and portfolio parameters meaning that required subordination levels are higher than what they would be based on the actual pool. While we think there is a strong case for securitisation warehouses being lower risk than public market securitisations, it is important to acknowledge that they can be dangerous in the wrong hands. After all, these are mezzanine tranches where 100 cents in the dollar can be lost if there is a default. Potential investors need to be wary of this and understand the key risks which include:

The securitisation warehouse market is one of the more esoteric parts of a private lending landscape that is rapidly gaining the attention of investors across the globe. The more mainstream parts of the US and European direct lending landscape are now characterised by a group of mega funds increasingly competing with public markets (and each other) to provide multi-billion dollar leveraged buyout debt packages. The next, and in our view most attractive, opportunities in private debt lie in more niche subsectors and geographies which remain off the radar of these mega funds. Funds operated by this manager: Challenger IM Credit Income Fund, Challenger IM Multi-Sector Private Lending Fund |

4 Oct 2023 - China - the re-opening trade that never quite was

|

China - the re-opening trade that never quite was 4D Infrastructure September 2023 In this article, we explore why China's re-opening has proven to be more fizzle than fireworks.

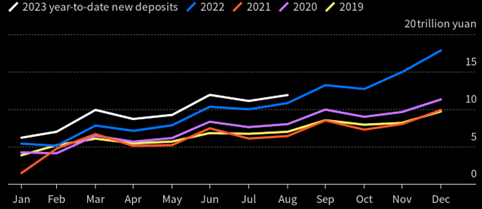

So, what went wrong? The data China's economic re-opening initially followed the expected trajectory. However, it sputtered out in the second quarter, and by July, activity numbers looked terrible. Some stabilisation has occurred in the latest August releases, but most key measures are still well below pre-COVID levels. The expectation of a pent-up consumption wave has been replaced by a more cautious household approach, marked by a higher savings rate than the four years prior. Chinese household savings

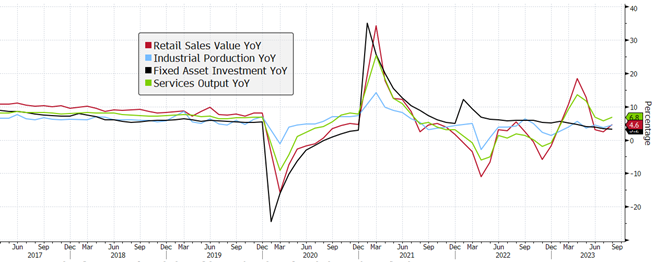

One of the main sectors that did benefit from the re-opening was restaurants (+19.4% YTD), as Chinese consumers embraced 'activities' post-extended COVID lockdowns. This was at the expense of spending on household goods (home and office appliances, and building materials). The chart below shows China's retail sales growth. Key activity data

Since re-opening, other activity, loan and survey data has also been mixed:

The slowdown in sales has put pressure on developer cashflows, with Country Garden, the largest developer outside of Tier-1 cities, under bankruptcy clouds in August. Any further signs of stress in the property market will have a detrimental effect on consumer confidence. Real estate measures (trended, mil m2, CNY bil)

Policy response and stimulus The Chinese government understands that stabilising the property market is crucial to shifting the consumer mindset towards a more spending-oriented approach, not just in the short term but as part of a long-term transition from heavy investment and export-driven growth to domestic consumption and value-added sectors. Initially, investment markets expected substantial stimulus measures when signs of weakness emerged in Q2. However, during their July politburo meeting, the People's Bank of China (PBoC) opted for more targeted fiscal stimulus across specific sectors and smaller policy measures. The government has refrained from providing cash handouts, a stance endorsed by western governments. In essence, the Chinese government is prioritising boosting consumer sentiment and spending over pursuing indiscriminate growth, especially given the significantly higher Chinese government debt compared to previous periods of stimulus, such as the Global Financial Crisis (77.7% of GDP vs. 29.3% in 2007). To date, triggers that have been pulled include:

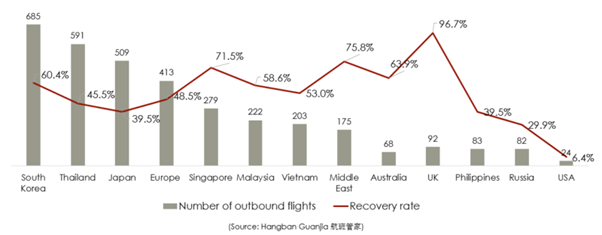

Our infrastructure exposure Within 4D's investment universe of core infrastructure, notably airports, ports, toll roads and utilities, the fundamental outlook has been mixed, with significantly overdone equity market moves. Travel demand in China has been a story of two markets. Domestically, flights are now above pre-pandemic levels, while, as at July, international travel is only at 46.9% of pre-pandemic levels. The slower-than-expected international recovery is due to the slow easing of restrictions (access to new passports and visas, group travel). Flight capacity has also been patchy regionally, and highly political, with capacity negotiated bilaterally between countries. However, we believe the demand is there. As consumer confidence increases, we expect an increase in Chinese tourists in European and Asian airports. European operator, Fraport, highlighted that there had been a steady recovery since re-opening from 18% of pre-pandemic levels in January, to 52% in June, with expectations this will continue to ramp up in the second half of the year. It has left its outlook unchanged for the financial year, anticipating Q3 will be back to 50-60% of 2019 while Q4 is expected to reach 80%, with December at 90%. Adding to the positive international momentum, in August, an additional 78 countries were added to the list where travel agents were allowed to sell group tours and package travel. Outbound flights from China (July 2023)

In the Chinese toll road sector, network traffic is now exceeding pre-COVID levels at 100- 120%. Some government policies on consumption are also benefiting the sector, such as reducing the tax on passenger vehicles and increasing subsidies for electric vehicles. Domestic car ownership maintained steady growth in the first half of 2023, reaching 328m vehicles (+5.8%). Further, the balance sheets of the listed toll road operators are in a very strong position to take in new assets should the provincial governments look to raise capital through asset sales. The port sector has seen muted volumes at both an export and import level, while yields have been solid. The volume story should not be a shock to the market - as flagged by operators - it's partly structural due to factors other than the stalled re-opening (e.g. global onshoring). The gas sector has fundamentally been slower to rebound. There has been some loss in volume growth given the slower economic activity, especially for those exposed to factories and manufacturing regions. There is also some concern over the slowing property market and a loss of new-connection revenue. However, the market has completely over discounted what we believe to be short-term shocks, and the sector is currently offering very attractive value. On our stress testing, we would have to assume zero volume growth for the next 25 years and a huge jump in the risk premia to get close to current prices. Conclusion The COVID re-opening boom and revenge-spending that was witnessed globally did not eventuate or persist as expected in China. Whilst activity data, credit growth, and consumer and business confidence has been weak, there have been signs of stabilisation in recent data points. However, one month doesn't change a picture, and market sentiment remains very poor, with foreign investor outflows still elevated. At an infrastructure sector level, domestic activity on toll roads and domestic air travel are already ahead of 2019 levels. Furthermore, the easing of travel restrictions and opening of travel capacity with key travel markets will positively impact European and Asian-based airports relying on Chinese travellers. Regardless, Chinese equities are pricing in multi-cycle low valuations, and some stocks are trading as if the re-opening never happened. We continue to be highly selective in our portfolio and continue to invest on fundamental value and assess investment opportunities that are beneficiaries to the Chinese economy, both directly and indirectly. |

|

Funds operated by this manager: 4D Global Infrastructure Fund (Unhedged), 4D Global Infrastructure Fund (AUD Hedged), 4D Emerging Markets Infrastructure Fund For more information about 4D Infrastructure, visit https://www.4dinfra.com/ The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. |