NEWS

4 Nov 2019 - Performance Report: Insync Global Capital Aware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync employs four simple screens to narrow the universe of over 40,000 listed companies globally to a focus group of high quality companies that it believes have the potential to consistently grow their profits and dividends. These screens are size of the company, balance sheet performance, valuation and dividend quality. Companies that pass this due diligence process are then valued using dividend discount models, free cash flow yield and proprietary implied growth and expected return models. The end result is a high conviction portfolio of typically 15-30 stocks. The principal investments will be in shares of companies listed on international stock exchanges (including the US, Europe and Asia). The Fund may also hold cash, derivatives (for example futures, options and swaps), currency contracts, American Depository Receipts and Global Depository Receipts. The Fund may also invest in various types of international pooled investment vehicles. At times, Insync may consider holding higher levels of cash if valuations are full and it is difficult to find attractive investment opportunities. When Insync believes markets to be overvalued, it may hold part of its resources in cash, or use derivatives as a way of reducing its equity exposure. Insync may use options, futures and other derivatives to reduce risk or gain exposure to underlying physical investments. The Fund may purchase put options on market indices or specific stocks to hedge against losses caused by declines in the prices of stocks in its portfolio. |

| Manager Comments | The Fund returned -2.21% in September after the cost of fees and downside protection. Positive contributors included Apple, London Stock Exchange, Adidas and Bristol-Myer Squibb. Detractors included S&P Global, The Walt Disney Co, Visa and Intuit. The Fund continues to have no currency hedging in place as Insync consider the main risks to the Australian dollar to be on the downside. Insync believe current market conditions continue to reflect the trend in place since the GFC of low growth and low inflation. They noted that, if this trend continues over the medium to long-term, they expect their portfolio of high ROIC stocks benefitting from global megatrends should outperform as these companies are less dependent on the global economy to generate consistent profitable growth. |

| More Information |

1 Nov 2019 - Hedge Clippings | 01 November 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

1 Nov 2019 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The majority of the Fund's pairs contributed positively during the month (17 of 29). The one negative pair of note was long Challenger (CGF) / short AMP & IOOF (IFL), with IFL experiencing a rally after news that the Federal Court ruled in favour of IFL in a case brought by APRA. On the positive side, the Fund had a solid contribution from a telco pair and two energy pairs. In their latest report, Bennelong highlight a chart which caught their attention in September which shows continued increase in debt levels of US corporates. Measured as a share of GDP, this now sits above prior peak levels. They noted they wonder what the end game is for cheap debt, and how much further indebtedness can rise before risk appetite changes. |

| More Information |

1 Nov 2019 - Performance Report: NWQ Fiduciary Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund aims to produce returns, after management fees and expenses of between 8% to 11% p.a. over rolling five-year periods. Furthermore, the Fund aims to achieve these returns with volatility that is a fraction of the Australian equity market, in order to smooth returns for investors. |

| Manager Comments | NWQ's view is that global markets continue to be caught between the conflicting currents of a global economic slowdown and heightened geopolitical risk on the one hand and central bank policies designed to stimulate growth on the other. They noted the relative calm in equity markets during the month presented the Fund's managers with fewer opportunities than in recent months which was reflected in the Fund's flat performance in September. NWQ are satisfied with the Fund's return of +4.17% over the quarter. |

| More Information |

31 Oct 2019 - Invest in Your World

30 Oct 2019 - Positive developments likely from the Retirement Income Review

29 Oct 2019 - Performance Report: Touchstone Index Unaware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The portfolio is constructed using Touchstone's Quality-At-a-Reasonable-Price ('QARP') investment process. QARP is a fundamental bottom-up process, however, it also incorporates a top-down risk management framework designed to successfully manage the portfolio during varying market conditions and economic cycles. The Touchstone Fund is concentrated, typically holding between 15-20 stocks. No individual stock will ever make up more than 10% of the portfolio at any one time. The Investment Manager may temporarily exceed the exposure limits of the Fund occasionally, particularly during periods of market volatility, to allow for holdings in excess of this 10% limit where the increase in value of the underlying security is due to market movement. The Fund may also hold between 0-50% of the portfolio in cash. The Fund has a high level of associated risk, therefore, the minimum suggested investment time-frame is 5 years. |

| Manager Comments | As at the end of September, the Fund held 21 stocks with a median position size of 4.6%. The portfolio's holdings had an average forward year price/earnings of 16.6, forward year EPS growth of 4.3%, forward year tangible ROE of 21.6% and forward year dividend yield of 4.2%. The Fund's cash weighting was increased to 5.3% from 5.1% as at the end of August. The Fund primarily seeks to select stocks from the ASX300 Index, typically holding between 10-30 stocks. The Fund seeks to invest in reasonably priced, good quality companies with a significant share of expected returns coming from sustainable dividends. |

| More Information |

25 Oct 2019 - Hedge Clippings | 25 October 2019

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

25 Oct 2019 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

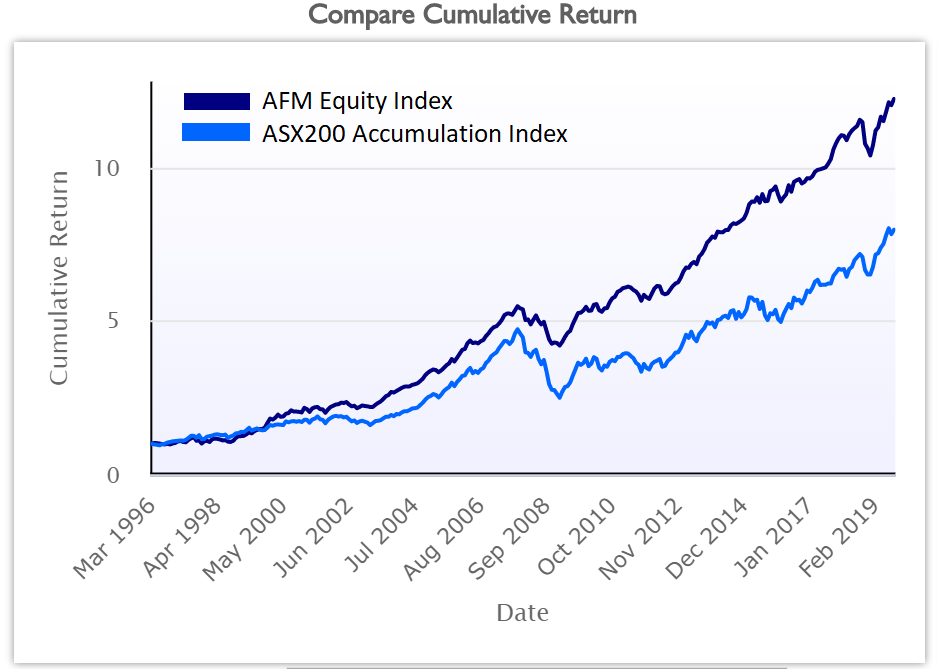

| Manager Comments | The Paragon Australian Long Short Fund has returned +10.48% p.a. since inception in March 2013. By contrast, the ASX200 Accumulation Index has returned +8.88% p.a. over the same period. The Fund has a down-capture ratio of performance of 40%, indicating that, on average, the Fund has significantly outperformed in falling markets since inception. The Fund returned -3.1% in September. Positive contributors included Atrum, Jumbo and Nickel Mines. These were offset by declines in iSignthis, Agrimin and the Fund's gold holdings. Paragon noted in the previous bull cycle of 2009 - 2011, gold had ten corrections greater than 5% amid its 167% gain. Their view is that volatility in gold bull cycles is a given and historically being patiently invested has paid very well. During the month Paragon visited Atrum's Elan project in Canada and Adriatic released initial metallurgical resutls, both surprising to the upside and discussed in more depth in the Fund's September report. Paragon noted that whilst they're pleased with Atrum's stock price doubling since initiating their position in February, they believe there remains considerable upside ahead. |

| More Information |

25 Oct 2019 - Fund Review: Bennelong Long Short Equity Fund September 2019

BENNELONG LONG SHORT EQUITY FUND

Attached is our most recently updated Fund Review on the Bennelong Long Short Equity Fund.

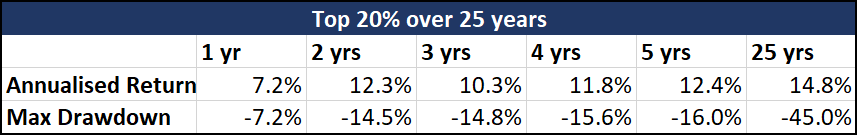

- The Fund is a research driven, market and sector neutral, "pairs" trading strategy investing primarily in large-caps from the ASX/S&P100 Index, with over 16-years' track record and an annualised returns of 14.90%.

- The consistent returns across the investment history highlight the Fund's ability to provide positive returns in volatile and negative markets and significantly outperform the broader market. The Fund's Sharpe Ratio and Sortino Ratio are 0.89 and 1.45 respectively.

For further details on the Fund, please do not hesitate to contact us.