NEWS

6 Sep 2024 - Hedge Clippings | 06 September 2024

|

|

|

|

Hedge Clippings | 06 September 2024 In last week's Hedge Clippings we "expected that the phone lines would be running hot between Jim Chalmers and the RBA to encourage a rate fall" following the July CPI figure. While we're pretty sure the phone lines did in fact run hot, what we didn't expect from the Treasurer was a broadside delivered via multiple media appearances, including his now infamous claim that the RBA was smashing the economy with high interest rates. The government is obviously keen not to be seen as responsible for any household financial pain, but such a direct and openly critical comment - although he subsequently denied that it was meant as criticism - made the issue very public, which it was no doubt intended to do. As we've previously commented, the government and the RBA are each pulling on the opposite ends of the same rope. The RBA is trying to curb inflation by keeping rates elevated and reducing demand, while the government is trying to offset the effects of inflation by increased spending, supporting above CPI wage increases, and handouts, subsidies, and tax cuts for all. Having dispensed with the former governor, Philip Lowe, and replaced him with his deputy, Chalmers finds there's been no change in policy, or message - only the messenger. Meanwhile the message was reinforced again on Thursday by Michele Bullock with a speech given at the annual Anika Foundation lunch entitled "The Cost of High Inflation" which not only suggested there would be no easing before Christmas, but that it would be 2026 before the bank's inflation target was met. She was careful to emphasise that conditions, or the numbers, may change between now and then, in which case the RBA would adjust policy settings accordingly. While that might suggest an earlier timeline for easing if conditions allow, it could also mean the opposite. Meanwhile, we expect Jim Chalmers to continue with his line that the government is doing all that it can to help stretched household budgets - which it is - but it is certainly not helping the RBA fight the costs of high inflation. Of course he also has one eye (or maybe both) on the upcoming election. Rather than continue the public spat he started, it seems Dr. Chalmers called for some back-up in the form of ex (Labor of course) treasurer Wayne Swan, who maintained the pugilistic tone by accusing the RBA of "punching itself in the face" and so continuing the issue. Chalmers and Swan may be trying to shift the blame for household mortgage pain, but borrowers don't seem to be pulling their collective heads in based on housing finance statistics released today by the RBA. Investors led the charge, with new investor loans up by 35% over July, 2023, new owner occupied loans increased by 21%, and owner occupied first home buyer loans were up 19.7%. As the ABS noted, these numbers were only partially driven by higher property prices. So in between accusations of "smashing the economy", and "punching itself in the face", the RBA is steadfast in its fight against inflation, the government is pouring more fuel into the economy, while the property market - or at least the financiers of it and real estate agents - aren't taking any notice. Finally on the political front, Bill "Wee Willy" Shorten announced his exit this week, having tried, but never made it to the lodge, in large part due to his policy to cancel franking credits in the lead up to the 2019 election, when he and shadow treasurer Bowen "misread" the level of investor anxiety about the move. Yet another case of politicians being totally out of touch with both the electorate, and common sense. Even so, maybe Shorten can see the writing on the wall for the next election? News & Insights New Funds on FundMonitors.com What not being born and not dying is doing to investments | Insync Fund Managers Stock Story: Stryker | Magellan Asset Management |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

6 Sep 2024 - August Reporting Season - Week Three Update

|

August Reporting Season - Week Three Update Tyndall Asset Management August 2024 The third week of reporting season is always busy, with some 110 companies reporting that represent $716bn of market capitalisation. A similar number of companies are expected to report over the final week. The 2024 earning season has been marked by a mix of optimism and caution, with distortions caused by the COVID-19 pandemic largely now dissipated. However, this normalisation has not been without its challenges, particularly as earnings expectations have generally trended downward. Some of the trends emerging include:

Earnings Performance and Market ReactionsReporting season has so far revealed a mixed performance across the ASX 300, with companies reporting a balanced mix of beats and misses. In aggregate across those ASX 300 companies that have reported (61%), profit before tax beats sit at 25% vs misses at 23%. It is worth reflecting that the final week tends to be more skewed to the downside (48% of results missed by >5% over the past two reporting seasons). Market reactions have been varied, with share prices responding accordingly to the earnings outcomes.

Sector Highlights

Where to next?The final two weeks of reporting season are always brutal, with the sheer number of companies reporting making it difficult to separate the noise from the underlying fundamentals. It is important to determine quickly whether the share price reaction is reflecting the long term, short term or simply how the market is positioned in the stock. As long-term fundamental value investors, excessive moves during earnings season typically bring opportunities. As Benjamin Graham, the father of value investing opined: "In the short run, the market is a voting machine but in the long run, it is a weighing machine." Fear and greed are some of the most powerful long-term alpha generators and thus it is important to have a patient and disciplined process that can find opportunities amongst the dislocations. Author: Brad Potter, Head of Australian Equities Funds operated by this manager: Tyndall Australian Share Concentrated Fund, Tyndall Australian Share Income Fund, Tyndall Australian Share Wholesale Fund |

5 Sep 2024 - Can utilities solve the renewable energy storage problem?

|

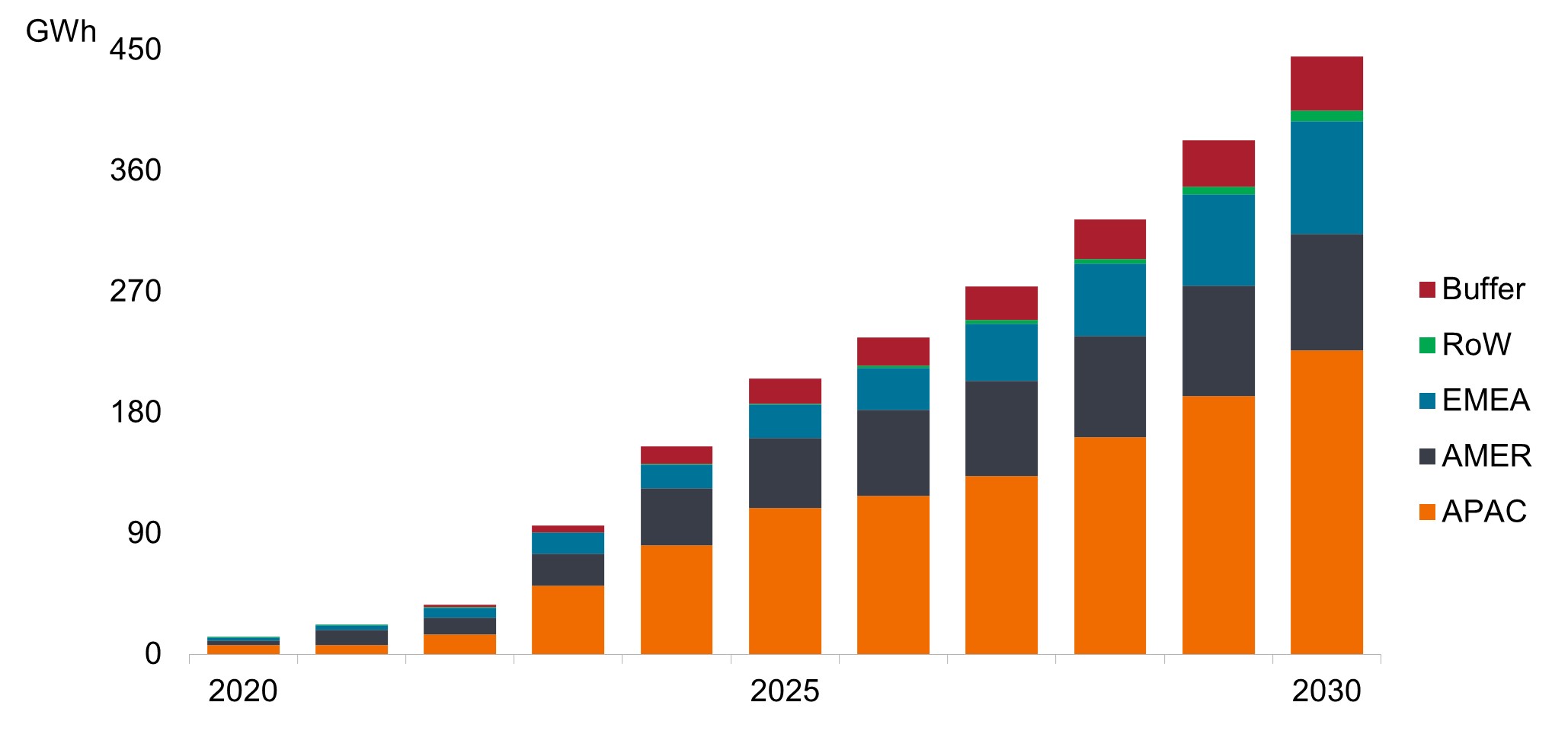

Can utilities solve the renewable energy storage problem? Janus Henderson Investors August 2024 The rapid growth of renewable energy sources like wind and solar power has brought a critical challenge to the forefront: how to effectively store and distribute this intermittent energy. As utilities grapple with increasing load growth and work toward net-zero decarbonization goals, they face a pressing question: How much renewable energy can they integrate before hitting practical limitations? The renewable integration ceilingBased on our discussions with utilities in various locations, the upper limit for renewable penetration in their energy mix without significant storage solutions or major interconnection improvements is somewhere between 30%-40%. Beyond this threshold, the intermittency of wind and solar power begins to pose challenges. While plans vary, many utilities aim for 70%-80% renewables by the early 2030s. While renewables penetration is already high in certain areas, like Texas and California, states in the mid-Atlantic, Northeast, and Pacific Northwest face bigger hurdles in achieving these goals due to less intense wind and solar power generation given weather conditions in those regions. The elusive long-duration storage solutionFor over a decade, utility-scale, long-duration battery storage has been the holy grail for increasing renewable energy penetration. Ideally, this solution would store power for more than 24 hours, and preferably up to a week. However, despite ongoing research, an economically viable option that works at the scale needed to power entire cities or regions has yet to emerge. Current storage solutions often work well on a small scale but struggle when scaled up. The physics may not work, or costs become prohibitive. While breakthroughs in technologies like solid-state batteries, sodium batteries, or hydrogen solutions occasionally make headlines, they often fall short of being able to power a major city during extended outages or prolonged periods of low renewable generation. The need for better storage is twofold: to prepare for multi-day renewable energy shortfalls and to reduce waste. In some regions, like California, excess renewable energy generated during peak times goes unused due to lack of storage capacity. Short-term solutions and alternative technologiesDespite these challenges, utilities are investing heavily in energy storage. The global market nearly tripled last year and is on track to surpass 100 gigawatt-hours of capacity for the first time in 2024 (Exhibit 1). Large regulated utilities like NextEra, Xcel, and AES are leading the charge in building out grid-scale storage. Exhibit 1: Annual global storage installations outlook by region

Current models typically use lithium-ion batteries that can hold only two to four hours of power. These short-duration solutions help manage daily fluctuations - storing electricity during peak renewable generation periods and discharging it back to the grid when electricity demand is high - but don't address longer-term power mismatches or resilience planning. As utilities recognize that lithium-ion batteries probably aren't the ultimate solution for their long-duration, large-scale storage needs, alternative technologies are gaining attention. Flow batteries and sodium ion batteries, for example, use cheap, abundant materials, potentially solving the sourcing and availability issues associated with lithium. While their weight and size make them impractical for electric vehicles, they could work well for stationary storage. Hydrogen is another frequently discussed option, though its promise has remained "10 years out" for some time. The main barriers to widespread adoption of these technologies are cost and efficiency. For instance, green hydrogen production needs consistent, high-uptime operation to be economically viable, which is challenging when relying on intermittent renewable energy sources. Implications and potential scenariosThe lack of a viable long-duration energy storage solution has far-reaching implications: 1. Utilities may need to delay fossil fuel plant retirements and rely more heavily on natural gas as a short-term solution, potentially building new gas-fired facilities. While this could slow progress toward decarbonization goals, it would help ensure grid reliability as electricity demands from AI data center growth and the move to a more electrified economy increase over the next decade. If regulated public utilities prioritize achieving net-zero goals over building new gas-fired facilities, power could potentially be generated by the private sector. Alternatively, electricity prices could increase, potentially slowing data center growth and bringing electricity demand back to a more manageable level. 2. The expansion of wind and solar installations may face limitations as grid operators struggle to balance intermittent supply and demand. This could potentially slow the pace of renewable energy adoption in some regions. Furthermore, installations could slow in regions with an abundance of renewable energy and negative power pricing. Adding more renewables could compound the oversaturation problem in these regions without favorable economics for developers. 3. Data centers, which need constant electricity and have Big Tech clients with ambitious sustainability goals, may explore alternative options like small-scale nuclear reactors to meet their energy needs while maintaining sustainability commitments. 4. Grid stability becomes more challenging without adequate storage capacity, potentially leading to increased volatility in power markets and reliability issues during extended periods of low renewable generation. Incentives could stoke further innovationThe road ahead for renewable energy storage remains uncertain, but incentives for developing and implementing large-scale, long-duration storage solutions are likely to grow. As utilities and tech companies push for solutions, and as the frequency and duration of power outages potentially increase with greater incidence of extreme weather, innovation in this space will be crucial. For investors, the energy storage market presents a complex landscape with very few pureplay public equity investment opportunities. Many companies are still in the early stages of development and face profitability challenges, particularly cash-intensive businesses in a high interest rate environment. The industry can also be volatile and dependent on government support, making it potentially better suited for diversified portfolios. We expect larger utility companies leading in renewable development such as NextEra, AES, and Iberdrola to drive long-term progress in energy storage. While regulated, they are at the forefront of current storage buildouts and are investing in next-generation storage technologies like hydrogen. We believe utilities can eventually solve the renewable energy storage problem. For now, however, despite their progress, the holy grail of energy storage remains just out of reach. Author: Noah Barrett, CFA |

|

Funds operated by this manager: Janus Henderson Australian Fixed Interest Fund, Janus Henderson Australian Fixed Interest Fund - Institutional, Janus Henderson Cash Fund - Institutional, Janus Henderson Conservative Fixed Interest Fund, Janus Henderson Conservative Fixed Interest Fund - Institutional, Janus Henderson Diversified Credit Fund, Janus Henderson Global Equity Income Fund, Janus Henderson Global Multi-Strategy Fund, Janus Henderson Global Natural Resources Fund, Janus Henderson Tactical Income Fund IMPORTANT INFORMATION Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned. Volatility measures risk using the dispersion of returns for a given investment. This information is issued by Janus Henderson Investors (Australia) Institutional Funds Management Limited (AFSL 444266, ABN 16 165 119 531). The information herein shall not in any way constitute advice or an invitation to invest. It is solely for information purposes and subject to change without notice. This information does not purport to be a comprehensive statement or description of any markets or securities referred to within. Any references to individual securities do not constitute a securities recommendation. Past performance is not indicative of future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Whilst Janus Henderson Investors (Australia) Institutional Funds Management Limited believe that the information is correct at the date of this document, no warranty or representation is given to this effect and no responsibility can be accepted by Janus Henderson Investors (Australia) Institutional Funds Management Limited to any end users for any action taken on the basis of this information. All opinions and estimates in this information are subject to change without notice and are the views of the author at the time of publication. Janus Henderson Investors (Australia) Institutional Funds Management Limited is not under any obligation to update this information to the extent that it is or becomes out of date or incorrect. |

4 Sep 2024 - RBA minutes - inside a meeting of two-handed economists

|

RBA minutes - inside a meeting of two-handed economists Pendal August 2024 |

|

IF anyone complains about RBA transparency, they are not paying attention. The minutes from the central bank's early August meeting were released today, though I am not sure minutes is the correct word - at 3,667 words, transcript might be a better term. Together, with the post-meeting press conference, the RBA is putting its best foot forward in communicating with the public, as encouraged by the RBA review. There was so much to say but so little confidence in anything. Even the new Deputy Governor Andrew Hauser chose a recent speech to warn of false prophets and said we should have little confidence in any forecasts. In the minutes we were treated to such gems as:

However, the one thing the RBA was keen to say is that if the Board was to do anything near term it is hiking - not cutting. It believes there is less spare capacity in the economy than previously thought. If that does not improve, then inflation will be too slow to fall. Very little spare capacity when GDP is barely growing? Sounds like the Board still believes we have a supply problem. Otherwise, its message could be summarised as "we need a recession to beat inflation", which is a variation of Paul Keating's "recession we had to have". I am not sure it would want that headline. We disagree with the RBA's current concerns, finding more agreement with the ex-RBA chief economist - now Westpac Chief economist - Luci Ellis. She describes the RBA as "skating to where the puck used to be" due to the fact that the RBA is focused on where the labour market was, not is. Recent data showing increasing participation and supply, falling hours worked per person, and improving real incomes means the puck has moved. In the months ahead, the RBA should be increasingly comfortable with labour market dynamics helping lower inflation. This should change its narrative and see it follow other central banks by cutting rates early next year. Remember, the RBA stated in February 2022 that "while inflation has picked up, it is too early to conclude it is sustainably within the target range" and that "there are uncertainties about how persistent the pick-up in inflation will be as supply side problems are resolved". In May 2022, it hiked. OutlookMarkets for now are largely ignoring the RBA anyway. Three-year bonds remain near 3.5% and ten-year bonds finally seem to be holding just below 4%. At these levels, bond markets are no longer super cheap but, at the risk of becoming a two-handed fund manager, they are also not expensive. It is important to remember the cycle has turned and, when that happens, yields will trend lower for an extended period. Author: Tim Hext |

|

Funds operated by this manager: Pendal Global Select Fund - Class R, Pendal Horizon Sustainable Australian Share Fund, Pendal MicroCap Opportunities Fund, Pendal Multi-Asset Target Return Fund, Pendal Sustainable Australian Fixed Interest Fund - Class R, Pendal Sustainable Australian Share Fund, Regnan Credit Impact Trust Fund, Regnan Global Equity Impact Solutions Fund - Class R |

|

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at December 8, 2021. PFSL is the responsible entity and issuer of units in the Pendal Multi-Asset Target Return Fund (Fund) ARSN: 623 987 968. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient's personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com |

3 Sep 2024 - What not being born and not dying is doing to investments

|

What not being born and not dying is doing to investments Insync Fund Managers August 2024 Are we experiencing a permanent change to a major economic driver that has underpinned an investor assumption for the past 100 years? That assumption being that ever more people would be working decade to decade? Most developed nations since the 2000's have been experiencing dramatic shifts in the makeup of their populations, spelling big challenges for societies and also for investors. It used to be commonplace that more younger people entered the workforce than left it, had two or more kids and did not live too long after retiring. This meant there was always a growing labour supply and growing tax revenues, and aged health and social care was a controllable tax-funded expense. Not anymore. Birth rates have been falling for decades. A 2.1 birth rate replenishes a population, anything less means decline. Australia's current 1.6 birth rate is down from 2 only 15 years ago. KPMG analysed Australian Bureau of Statistics (ABS) data and found 2023 had the lowest birth rate since 2006 and it is falling by 4.6% per year. Even though a drop of this magnitude occurred in the 1970s, the longer-term trend is one of decline. This finding is echoed across the globe in Korea, Japan, Ukraine, Germany, UK, USA, Russia, China, France, Italy, Scandinavia and so on. Back in 2011, the world experienced its 'peak child' maximum population count with most of these residing in poor nations. Many towns and regional cities globally are in decline. Reducing poverty, women being able to choose whether or not to have children, and being empowered economically, have impacted birth rates. India and Indonesia are as we used to be, but they're rapidly approaching the same situation. Declining birth rates however are just half the issue. The other half is that globally, according to the United Nations' UN75 project, the number of people aged 65 plus outnumber the number of children under five. They are the fastest growing age group and by 2050, will outnumber those aged 15-24. We may reach a point where older people not working will outnumber people who are. This is because the older are living much longer and fewer children are transitioning to adulthood. Today the life expectancy in Australia for men is around 81 and for women around 85. This compares to around 74 for men and 80 for women 30 or so years ago. Medical advances and technology mean that we are set to live older still. Stanford University research suggests that it won't be unusual for babies born in America in 2050 to live to 100. Other studies suggest that humans might one day live to 150. In a nutshell - we are not procreating like we used to, and we are not dying like we used to either. This means fewer people building economic growth, driving demand, consuming goods and services and - paying taxes. Older people consume less in almost everything except healthcare and rely on government support far more, while paying very little tax. To some extent a country can offset and delay the worst of demographic problems via strong immigration (Australia, Canada and the USA are examples). Over 8 years ago the German government forecast a need for a million immigrants a year for 20 years just to replace its current workforce. When they brought in the first million, riots and a government collapse was only narrowly averted. In an ever-divisive world, immigration is reliant on popular support and in any event, it is really just robbing Peter to pay Paul. What does this all have to do with investment? I'm glad you asked. Firstly, products, services and even entire industries that are dominant today can see their markets dry up or radically change in only a few years. Understanding how purchasing habits are shifting in the dominant working age population of GenZers is key. Their values, drivers and preferences are different to those that today's 60-year-olds hold, and likely held, back in their late 20's to early 30's. If you're an investor in companies reliant on old brands, products or services delivered in traditional ways you will need to be extra vigilant. Kraft is an example of a company that had not factored in the impact of demographic change. Its failure to properly invest in R&D, while pumping short term profits, spelt disaster in long term earnings as its decades old food brands no longer appealed to younger people. But secondly, there are positives for those who look well ahead and align their portfolios to what the economic ripple effect caused by demographic change is having. For example, the megatrend known as 'the Silver Economy' made up of companies specialising in products and services for older people, especially retirees. The most obvious of these are healthcare, leisure, and pharmaceutical, but there are more obscure companies behind the scenes in such megatrends that also have the capacity to deliver handsome rewards. The Silver Economy is only one megatrend benefiting from tectonic demographic shifts. Others include Pet Humanisation, Trading-Down and Emerging Middle Incomes. The challenge for investors is how to identify, then best ride the positive demographic driven megatrends already underway and reducing or even exiting those investments on the wrong side of demographic change. The rewards in doing both are substantial. Author: Grant Pearson, Head of Strategy and Distribution Funds operated by this manager: Insync Global Capital Aware Fund, Insync Global Quality Equity Fund Disclaimer |

2 Sep 2024 - Stock Story: Stryker

|

Stock Story: Stryker Magellan Asset Management August 2024 |

|

Stryker Corporation: transforming patient care for over 150 million patients annually. Innovation leadership is a key hallmark of a high-quality business. When we think about major innovation trends globally, the most prominent headlines usually spotlight the technology sector. Recent excitement about artificial intelligence and its many applications is a prime example. However, less visible yet equally transformative is the pace of innovation in a sector often considered more constant: healthcare. The pace of healthcare innovations has accelerated dramatically in recent decades, leading to significant advancements in healthcare services and improving quality of life. For instance, the world witnessed the rapid development of the mRNA vaccine platform, which played a crucial role in combating the covid-19 pandemic. Additionally, new GLP-1 agonists are showing potential in addressing the growing global obesity epidemic. The healthcare subsector of medical devices stands out as a vital contributor to enhanced medical treatments. This is due primarily to the adoption of new and innovative medical technologies by physicians and health systems worldwide. These technologies have been clinically proven to deliver superior patient outcomes, improved surgical techniques, and operating room efficiencies. A standout leader in the medical devices subsector is Stryker Corporation. With a diverse product portfolio spanning orthopaedics, medical and surgical equipment, and neurotechnology, Stryker's products are available in over 75 countries, affecting more than 150 million patients annually. If you have ever been treated in an operating room in a hospital, chances are you encountered one or more of Stryker's products.

Stryker's journey began in Michigan, USA, in 1941, founded by a prominent orthopaedic surgeon and medical device inventor Dr Homer Stryker - which is fitting given the company has been at the forefront of medical innovation in the orthopaedic surgical category over the past decade. Beyond continuous enhancements in knee and hip implant designs, such as cementless designs that better promote bone growth, Stryker revolutionised the field in 2017 with its Mako Robotic-Arm, assisting surgeons in performing knee and hip replacements with unprecedented precision. Clinical studies highlight that Mako Robotic procedures result in meaningfully higher patient satisfaction rates, with lower post-operative pain, faster recovery times, more accurate bone resections and implant placement and reduced soft tissue damage. This has accelerated surgeon adoption, with over 60% of knee and 30% of hip implants sold by Stryker in the US now implanted using a Mako Robot. Despite significant investments by competitors in R&D, they have struggled to dethrone Stryker's leadership. This underscores Stryker's R&D strength, driven by its unique 'bottom-up' capital allocation model and the 'innovation flywheel' effect stemming from long-standing relationships with leading surgeons and teaching hospitals. Stryker holds over 5,000 patents, 400 of which are in its digital robotics platform - a ten-fold increase in the past decade. Plans are underway to extend the Mako Robot to new surgical indications, including upper extremities (shoulder) and spine. Stryker's innovation is not limited to orthopaedics. The company is advancing surgical planning and navigational software for cranial and spine procedures with its Q Guidance System and improving surgical visualisation and fluorescence imaging for minimally invasive surgeries with its 1788 platform. The growing installed base of Stryker's systems, alongside the lack of superior alternatives from competitors, underscores the impressive nature of its advancements. Importantly, impactful innovation can lead to pricing power through a combination of patient/physician preferences and patent protection, and higher switching costs due to the invasive nature of surgical products and the growing clinical evidence of improved patient outcomes. This gives us confidence in Stryker's above-peer growth outlook, which is particularly bolstered by its ability to benefit three key stakeholders in health systems worldwide where expenditure continues to reach new heights: patients, surgeons, and hospitals. By Wilson Nghe, Investment Analyst |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund, Magellan Core ESG Fund Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

30 Aug 2024 - Hedge Clippings | 30 August 2024

|

|

|

|

Hedge Clippings | 30 August 2024 This week's July CPI figure was the first downward movement since last December, falling 0.3% to 3.5% depending on which indicator one chose - Headline (3.6%), Seasonally Adjusted (3.6%), Excluding Volatile Items (3.7%), or Trimmed Mean (3.8%). However, all fell, thanks in most part to the fall of 5.1% in electricity prices, which in turn fell thanks to a range of state and federal handouts. It seems unlikely that the improvement, while welcome, will sway the RBA at their next meeting, on 24 September, but Michele Bullock may give some clues when she's due to have a "fireside chat" next Thursday at a Women in Banking & Finance event in Sydney. In the mean-time we expect the phone lines will be running hot between Jim Chalmers and the RBA to encourage a rate fall, which is unlikely. All the Bank's prior comments and commitments suggest they won't be fooled by one-off numbers, however welcome, triggered by governments - state and federal intent on re-election. Today's flat July retail sales figures may assist somewhat, but the August CPI figure due inconveniently on 25th September, the day after the RBA's meeting and announcement, will also be impacted by further flows of government rebates. By which time of course we'll be totally focused on footy finals of one code or another, with the AFL plus the Wallabies second Bledisloe game on the 28th, and the NRL a week later. Prior to that of course, the Sydney Swans play the GWS Giants this week-end. Who would have thought that two Sydney teams playing in a final a possibility even 10 years ago? News & Insights 10k Words | Equitable Investors Market Commentary | Glenmore Asset Management July 2024 Performance News Seed Funds Management Hybrid Income Fund Bennelong Twenty20 Australian Equities Fund Insync Global Quality Equity Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

30 Aug 2024 - Performance Report: Delft Partners Global High Conviction Strategy

[Current Manager Report if available]

30 Aug 2024 - Performance Report: PURE Resources Fund

[Current Manager Report if available]

30 Aug 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

Source: BloombergNEF, 1H 2024 Energy Storage Market Outlook, April 25, 2024. Note: RoW = Rest of the World; EMEA = Europe, Middle East, and Africa; AMER = US, Canada, Latin America; APAC = Asia-Pacific; Buffer = headroom not explicitly allocated to an application.

Source: BloombergNEF, 1H 2024 Energy Storage Market Outlook, April 25, 2024. Note: RoW = Rest of the World; EMEA = Europe, Middle East, and Africa; AMER = US, Canada, Latin America; APAC = Asia-Pacific; Buffer = headroom not explicitly allocated to an application.