NEWS

19 Jan 2021 - Performance Report: Prime Value Emerging Opportunities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is comprised of a concentrated portfolio of securities outside the ASX100. The fund may invest up to 10% in global equities but for this portion typically only invests in New Zealand. Investments are primarily made in ASX listed and other exchange listed Australian securities, however, it may also invest up to 10% in unlisted Australian securities. The Fund is designed for investors seeking medium to long term capital growth who are prepared to accept fluctuations in short term returns. The suggested minimum investment time frame is 3 years. |

| Manager Comments | Key positive contributors in December included City Chic, Pinnacle Investment and Mainfreight. Key detractors were Helloworld Travel, United Malt Group and Austal. Prime Value noted the Fund's return over CY20 were broad-based with downside protection. 18 stocks contributed more than +1% to returns while no stocks detracted more than -1%. Prime Value remain positive on the outlook for 2021 while highlighting the challenge of forecasting the direction of markets in the short term. At the stock level they are still seeing many attractive investment opportunities and expect the coming year will provide more. To uncover these opportunities they continue to undertake an active company meeting program, averaging more than 2 meetings per day. |

| More Information |

18 Jan 2021 - Hedge Clippings | 15 January 2021

|

||||

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday

|

18 Jan 2021 - Performance Report: L1 Capital Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | L1 Capital uses a combination of discretionary and quantitative methods to identify securities with the potential to provide attractive risk-adjusted returns. The discretionary element of the investment process entails regular meetings with company management and other stakeholders as well as frequent reading and analysis of annual reports and other relevant publications and communications. The quantitative element of the investment process makes use of bottom-up research to maintain financial models such as the Discounted Cashflow model (DCF) which is used as a means of assessing the intrinsic value of a given security. Stocks with the best combination of qualitative factors and valuation upside are used as the basis for portfolio construction. The process is iterative and as business trends, industry structure, management quality or valuation changes, stock weights are adjusted accordingly. |

| Manager Comments | L1 Capital noted the Fund's robust returns in 2020 were driven by strong stock picking across a wide range of sectors. Returns were further supported by decisive buying during the crisis in March and positioning the portfolio for vaccine success in November. They believe the vaccine rollout will trigger a rotation into value and cyclical stocks (which lagged the market in 2020) and they expect this to be a major positive tailwind for performance heading into 2021. Key contributors to performance in December included Imdex Limited (long, +26%), Lyft (long, +23%), Teck Resources (long, +10%), Liberty Financial Group (long, +30%), Metcash (long, +17%), and Cenovus Energy (long, +16%). The portfolio ended the month most heavily weighted towards Australia/NZ, followed by Europe, North America and Asia. |

| More Information |

15 Jan 2021 - Performance Report: Bennelong Kardinia Absolute Return Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund's discretionary investment strategy commences with a macro view of the economy and direction to establish the portfolio's desired market exposure. Following this detailed sector and company research is gathered from knowledge of the individual stocks in the Fund's universe, with widespread use of broker research. Company visits, presentations and discussions with management at CEO and CFO level are used wherever possible to assess management quality across a range of criteria. Detailed analysis of company valuations using financial statements and forecasts, particularly focusing on free cash flow, is conducted. Technical analysis is used to validate the Manager's fundamental research and valuations and to manage market timing. A significant portion of the Fund's overall performance can be attributed to the attention and importance given to the macro economic outlook and the ability and willingness to adjust the Fund's market risk. |

| Manager Comments | Since inception in May 2006, the Fund has returned +8.77% p.a. with an annualised volatility of 7.66%. By contrast, the Index has returned +5.99% p.a. with an annualised volatility of 14.48% over the same period. The Fund's capacity to perform well in falling and volatile markets is highlighted by its Sortino ratio (since inception) of 1.22 vs the Index's 0.25 and down-capture ratio (since inception) of 48.7%. Key contributors for the month included Fenix Resources, Fortescue Metals, Harvest Technology, MACA and Xero. Detractors included Worley, Flight Centre, Ardent Leisure, Qantas and the Fund's short book. Kardinia highlighted in their latest report that a key contributor to the equity market's performance in CY20 has been global central bank monetary policy, including interest rate cuts and quantitative easing by the RBA. They expect this policy support to continue in CY21. |

| More Information |

14 Jan 2021 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

| Manager Comments | Positive contributors for December came from battery minerals (Pilbara), base metals (EM2) and precious metals (WAF & Investigator) holdings. Paragon noted supportive drivers for precious metals remain, with US real rates resuming a downtrend of -1.08%, coupled with US$ breaking 2-yr lows of 89.5c, pushing cycle lows. Gains in gold, silver, copper and Brent Oil collectively represent great tailwinds for the portfolio going into 2021. Paragon believe unprecedented US Fed monetary stimulus and US fiscal stimulus has markets well placed to continue their secular bull run into 2021. As at the end of December, the portfolio was most heavily weighted towards Electric Vehicles, Technology, Base Metals and Gold. |

| More Information |

13 Jan 2021 - Webinar | Paragon Australian Long Short Fund Performance Update & Outlook

|

In this webinar, John Deniz provides an update of the Fund's performance for 2020 along with Paragon's current market outlook and the Fund's positioning. |

13 Jan 2021 - Performance Report: Bennelong Long Short Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | In a typical environment the Fund will hold around 70 stocks comprising 35 pairs. Each pair contains one long and one short position each of which will have been thoroughly researched and are selected from the same market sector. Whilst in an ideal environment each stock's position will make a positive return, it is the relative performance of the pair that is important. As a result the Fund can make positive returns when each stock moves in the same direction provided the long position outperforms the short one in relative terms. However, if neither side of the trade is profitable, strict controls are required to ensure losses are limited. The Fund uses no derivatives and has no currency exposure. The Fund has no hard stop loss limits, instead relying on the small average position size per stock (1.5%) and per pair (3%) to limit exposure. Where practical pairs are always held within the same sector to limit cross sector risk, and positions can be held for months or years. The Bennelong Market Neutral Fund, with same strategy and liquidity is available for retail investors as a Listed Investment Company (LIC) on the ASX. |

| Manager Comments | The Fund returned -3.08% in December as the Australian equity market experienced a rally in cyclicals and laggards. The outperformance of the Fund's long portfolio by some of the cyclicals and laggards in the short portfolio contributed to the Fund's weaker finish for the year. Top pairs for the month included long Xero / short TechnologyOne, and long Mineral Resources / short BHP. Bottom pairs included long BlueScope Steel / short Sims (SGM), and long Woolworths / short Metcash/Treasury Wine. |

| More Information |

12 Jan 2021 - President Biden and the Share Market

11 Jan 2021 - Equities: I can't live with you, I can't live without you

10 Jan 2021 - 3 market myths that threaten to derail investors' long-term wealth

|

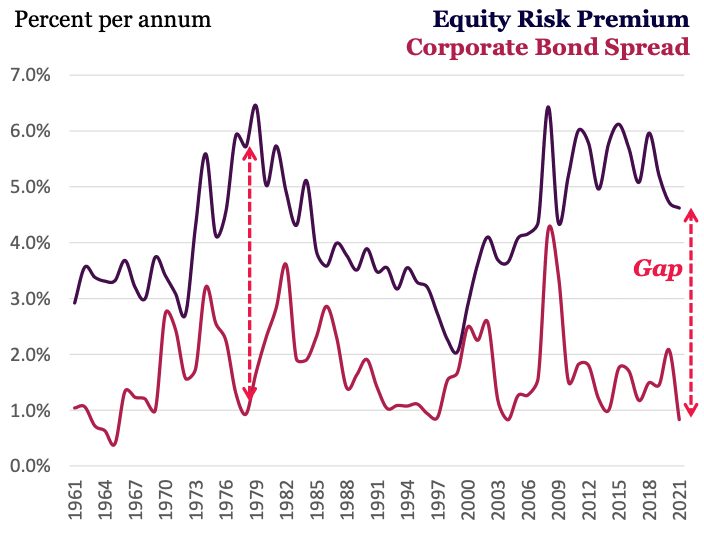

3 market myths that threaten to derail investors' long-term wealth Montaka Global Investments 10 January 2021 The US stock market recently hit fresh all-time highs. But then we learnt that US inflation in the month of October was 6.2%, the highest annual rate in 31 years. Many investors are naturally now fearing three 'facts' have emerged from the current situation: equities as an asset class are stretched and this is 'as good as it gets'; that likely interest rate rises will crunch stocks; and finally, that there are no undervalued stocks providing buying opportunities in the market today. But for strong, though perhaps counterintuitive, financial and economic reasons, these three fears are likely myths. We believe that equities continue to represent attractive, long-term value; structural deflationary forces will keep rates relatively low; and there are great companies available today at cheap prices. There is a danger that if investors fall for these myths they will bail out of equities and miss out on their long-term wealth-building potential. Myth 1: Equities are overvaluedWhile investors fear that equities are overvalued, the fact is that equities are better value than other asset classes. Investors are being paid unusually high returns for taking on equity risk compared with the likes of bonds. A good measure of the value of equities is the 'gap' between the equity risk premium (ERP) and the bond spread (how much corporate bonds yield above government bonds). The ERP is the extra return investors get for owning stocks, rather than risk-free government bonds. Historically, the gap between the ERP and bond spread has averaged around 2%. The gap has been as wide as 5% percent when equities were relatively cheap. It has also fallen close to zero when equities were expensive, such as during the 1999 tech bubble. (During this 20-year period of the gap closing, equities compounded at 18 percent per annum!) The 'Gap' between ERP and Corporate bond spread

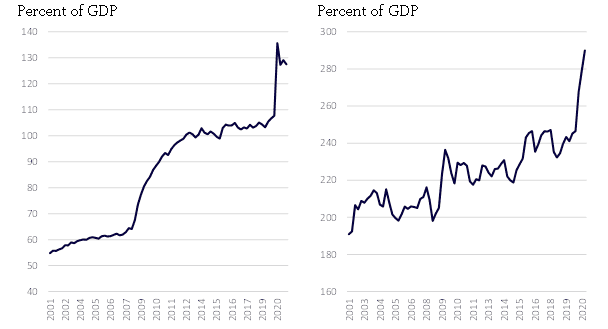

Source: NYU Stern (Damodaran); Bloomberg; Montaka Global The gap today is around 4%, so well above average. As equity prices have soared since the depths of the pandemic, the ERP has reduced. But spreads in other asset classes, such as bonds, have also reduced. On a relative basis, therefore, equities remain just as attractive as they did in 2019 when the S&P 500 was lower by one-third. Myth 2: We have entered a structural inflationary cycleThe second fear is that interest rates will keep rising and slam the breaks on equities. But equity prices are actually more likely to keep rising in the long term. For the gap between the equity and bond spread to normalise from 4% today to the long-term average of 2%, equities must perform better than bonds going forward. Despite the current inflation worries, equity prices are more likely to rise because higher bond yields (resulting lower bond prices) are unsustainable, in our view. Strong, long-term, structural disinflationary forces will continue to pressure interest rates to much lower levels than we've observed historically. For a start, populations are aging across the world. The working-age cohort in major economies, such as China and Europe, are shrinking as more people retire, which will logically reduce economic growth over time. Governments will also have to ramp up spending on pensions and healthcare. That lower economic growth will push down interest rates. The soaring power of compute and big data is also creating of an increasing array of intelligent applications which require few, if any, humans to operate. Less demand for labour over time is disinflationary. US Federal public debt Global, non-financial corporate debt

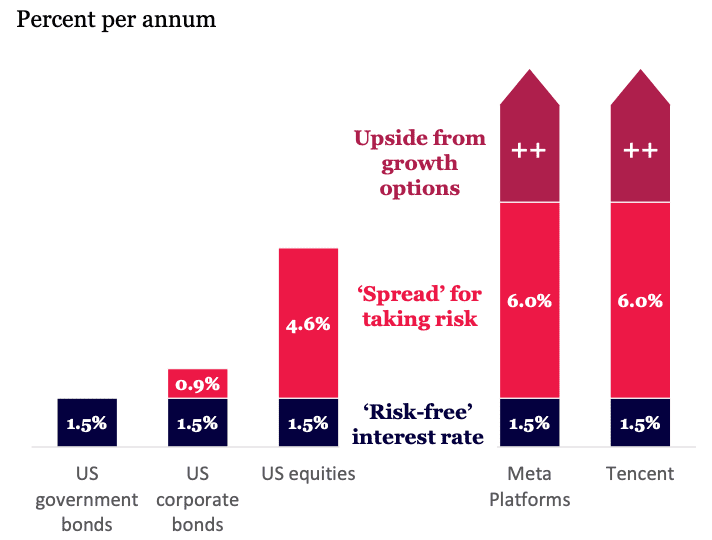

Source: Bank of International Settlements; Federal Reserve Bank of St. Louis And the huge debt loads of governments and corporates, which has surged post-pandemic, means interest rates cannot increase materially and sustainably. If rates do rise, consumers, corporates and governments will spend less - all at the same time - to meet higher interest costs, which in turn cuts economic growth and forces interest rates back down. So, notwithstanding short periods of slightly higher bond yields to reflect the economic cycle, a long-term regime of historically low interest rates appears likely. And if that is so, then the longer-term prospects for equities remain attractive. Myth 3: It feels like most stocks are overvalued todayDespite the positive outlook for equities, some investors will still argue that many stocks are overvalued. But while that is true, a subset of stocks are materially undervalued, including Meta Platforms (formerly Facebook) and China's Tencent. Even if you only considered their existing core businesses, both Meta and Tencent are cheap. Based on 2022 earnings, the earnings yield of both Meta and Tencent's core business is around 4.5%. If you subtract a risk-free rate of, say, 1.5% you get a spread of 3.0%. Not so attractive, you might suggest. But by 2025, that same spread has increased to more than 6.0% due to earnings growing organically over this time. Compensation for taking risk - comparison

Source: Bloomberg; Montaka Global estimates What's more, both Meta and Tencent have large, high-probability growth options tied to the 'metaverse', e-commerce, artificial intelligence and cloud computing. As these growth options are monetised, the 'spread' of the shares of these companies increases even further. On this basis, Meta and Tencent appear to be highly attractive investment opportunities. Hold the line on equitiesThe message to investors is to remain selective based on clear-minded, fact-based analysis. We continue to believe that equities offer materially better value than bonds, in general today. And this belief is based on detailed, 'first-principles' analysis. Of course, not all equity investments are created equal. Many stocks are overvalued today - but some are materially undervalued. If investors can patiently accumulate and own these undervalued businesses, it will steadily drive their compounding higher. And over the long-term, compounding in equities at rates of return well above those in cash or bonds, will lead to dramatically outsized wealth accumulation. Maintaining high exposure to equities is the key element to building wealth through investments. Don't fall for these 3 myths and give up on the remarkable long-term wealth building power of equities. Note: Montaka is invested in Meta & Tencent. Written By Lachlan Mackay Funds operated by this manager: |