NEWS

5 Feb 2021 - Why Inflation Might Return and Why You Need to Worry About It

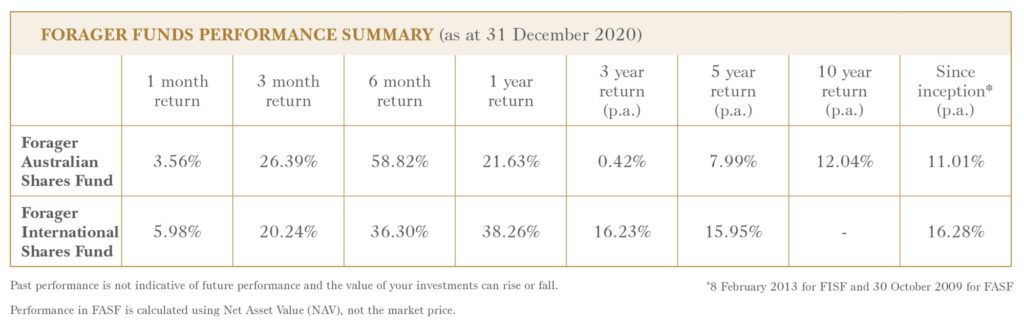

Why Inflation Might Return and Why You Need to Worry About ItSteve Johnson, Forager Funds Management 14 January 2021 Extraordinary. It is an overused word. It's also an odd word, to me at least. Why does something that is unusual or infrequent have an extra amount of ordinary? Anyway, we can safely use it to describe 2020 without being accused of hyperbole. Travel plans, living arrangements, schooling, workplaces and shopping were thrown into turmoil by a virus that spread around the world, caused governments to lock citizens in their homes and killed almost two million people. For those of us in financial markets, the March crash will sit alongside the 2008 Lehman-induced meltdown as a placemark in our careers. At Forager, it was an especially extraordinary year. The Forager International Shares Fund returned positive 38.3% for the year. In absolute terms, that is an outlier. Relative to the MSCI AC World Net Index in $A, which returned 5.8%, it is the sort of result you hope for once every couple of decades. The Forager Australian Shares Fund's 21.6% return is less of an outlier - you could argue it was overdue given the underperformance of the prior two years - but it was extraordinary nonetheless. That 21.6% encompasses a fall of 54% between 1 January and 23 March, followed by a 166% rise between that nadir and 31 December. You should expect us to perform well in volatile markets. But the magnitude of the performance is particularly pleasing. My thanks go out to the entire Forager team for their outstanding work in a difficult year and our loyal Forager clients, who allow us to do our jobs in dysfunctional markets. The game that never stopsOne thing I like about marathon running is the well defined end-point. You train hard for a few months, eat well, dial it back for a week and then it's race day. Once the finish line is behind you, it's time for a cold beverage, a few weeks of rest and all the pies you can eat. Running an investment portfolio in a year like 2020 is nothing like running a marathon. There is no finish line. Like a two year old child, it needs to be fed and monitored every single day. And the better your returns, the faster markets are moving, the more monitoring and feeding it needs. If 2020 proved anything, it was that predicting the future is extremely difficult, if not futile. Look no further than my February blog Corona no virus for global stocks, two weeks before a market meltdown. That also shows that prognostications are not a prerequisite for above average returns. When anything can happen, nothing is a surpriseWe didn't predict the market bottom in 2020. We didn't anticipate the fastest bear market recovery on record. We simply tried to construct the best portfolios we could with the opportunities that were in front of us. We recognised that the best opportunities on the 23rd of March were very different from those on the first of January, and made quite dramatic changes to both portfolios. In fact, writing a blog that looked foolish in hindsight was probably a blessing in disguise. It served as a timely reminder that great investment returns come from finding great investment opportunities. While many of those who predicted a market meltdown were wasting their time trying to identify the bottom, we were out there looking for stocks to buy. We will take the same approach in 2021. Start with the view that anything could happen, and we won't be surprised. A monetary epoch?One thing that could happen, that most people think won't, is that we look back on 2020 as more than just a market crash. It may be seen as the end of an era. Will inflation return? That was the question on the cover of the December 12 edition of The Economist. The answer will define the next decade, perhaps two, of returns on almost every asset class. In September 1981, the 30-year US government bond was yielding 15% for an investor who held it to maturity. In the early 1990s, my parents were still paying interest rates of 18% on their mortgage. Today's yield on a 30-year US bond is less than 2%. A mortgage loan in Australia can cost you less than that. For the past three decades, interest rates have inexorably fallen alongside inflation expectations. Today, central bankers are far more concerned about inflation never coming back than it ever getting out of control again. Investors are using low long-term interest rates, based on a lack of inflation concerns, to justify sky- high prices for property, infrastructure assets and Tesla shares. There are theories, from ageing populations to technological improvements and low cost labour substitution, that explain low inflation or even deflation as a permanent feature of the developed world. I don't have a strong view that those theories are wrong. But I know that when the whole market thinks something can't possibly happen, the consequences of that assumption being wrong are significant. Why might inflation return?Some investors and economists - particularly of the pessimistic kind - have been predicting the return of inflation ever since the financial crisis of 2008/9. It hasn't happened, the argument goes, and therefore it won't. Throughout the past decade, monetary policy was extremely accommodative. But it didn't have much help. The private sector - including consumers and banks - spent most of the decade in balance sheet repair mode. Fiscal policy wasn't helping, as politicians caved to austerity demands every time their economies started to recover. Just like the recovery from the Great Depression of the early 1930s, this recovery was mired in fits and starts. This pandemic-induced crisis might be more akin to a war than a financial crisis, though. By the end of 2021, all three components will be surging in the same direction. Morgan Stanley estimates the four largest economies will expand central bank balance sheets by some 38% of GDP in 2020, almost four times the amount of purchases following the financial crisis. And the same G4 economies will be running the largest fiscal deficits since the second world war at the same time. The US government deficit is expected to be 14.9% of GDP in 2020 and remain at 9% of GDP in 2021. Despite all of the bailouts in 2009, the US government deficit never exceeded 10% of GDP. Perhaps most surprisingly, consumers around the world are in rude health. Unemployment has not risen as much as expected, and the large stimulus programs and a lack of things to spend their money on means consumers are flush with cash (see chart below). The lockdowns have hit a small percentage of the population hard but, as a whole, the savings rate in Australia soared to more than 20% of disposable income, a level unprecedented in RBA records. Three-pronged inflation pushThe aggregate picture is one of substantial pent up demand meeting more monetary and fiscal stimulus in late 2021 and into the following years. Perhaps we look back on this period as the monetary equivalent of the Second World War, one giant stimulus program that finally brought the economy to life. Nonagenarian investor Charlie Munger once said "knowing what you don't know is more useful than being brilliant." Some of the brightest economics minds in the world have a patchy track record when it comes to macroeconomic forecasts. Perhaps demographics and technology do mean we never see inflation again. But the world is about to test the theory. And we won't be buying anything that assumes higher interest rates can't possibly happen.

|

4 Feb 2021 - Light at the end of the tunnel - But We're Still In The Tunnel

LIGHT AT THE END OF THE TUNNEL - BUT WE'RE STILL IN THE TUNNELMarcel von Pfyffer, Arminius Capital 20 January 2021

After the grim events of 2020, the November news of three coronavirus vaccines set off a surge of investor optimism about the future. But the existence of coronavirus vaccines does not guarantee that life will automatically return to normal in the near future. For Australia and the world, there are many hazards to be avoided or overcome before we can find our way out of the dark tunnel of the pandemic. First, there are the logistical complexities of distributing the vaccines throughout the world at very cold temperatures, followed by the administrative challenges of administering them to millions of people. In developed countries like Australia, the public health system will accomplish this task quickly and without difficulty. In poor countries with weaker healthcare systems, the task will be much slower and harder. We should not underestimate the size of vaccine wary members of the population. Recent polls indicate that more than 40% of US citizens are unwilling to get vaccinated at present, and even in Australia a quarter of survey respondents have expressed reservations. These numbers are important because - depending on the complex epidemiological assumptions and calculations - herd immunity may only be achievable if 80% of the population is vaccinated. The US has a history of being very slow to adopt public health measures, and the failures of the initial US response to the 2020 pandemic raises doubts about the speed, breadth, and adequacy of the US vaccination program. Globally, the recent double-digit deaths of people who had just been vaccinated has not helped the smooth marketing plan that the drug companies' PR machines were probably hoping for. Then there are the potential problems with the vaccines themselves. Although the clinical trials have been rigorous, they have not been large enough or long enough to remove all uncertainties about the vaccines. Therefore, as is obligatory with all newly approved drugs, the public health authorities in each country will track what happens to those who have been vaccinated. Clinical experience with new vaccines over the last century points to eight important risk areas:

Any setbacks in the global vaccination program would cause temporary damage to investor sentiment. In the longer term, other more effective vaccines will be developed - there are currently 18 candidates in Phase III trials. In the short term, travel and tourism stocks, as the sectors worst affected by COVID-19, would give up much of their recent gains. For these reasons, we continue to expect a W-shaped recovery in the Australian economy and share market. We forecast this sort of recovery back in June, when it became obvious that COVID-19 would have recurrent outbreaks until herd immunity was achieved. The subsequent outbreaks in Melbourne and Sydney have confirmed our forecast. The additional possibility of setbacks in the vaccine rollout reinforces our belief that two steps forward will often be followed by one step backward. For Australian investors, we recommend riding the Australian market up, buying the dips but avoiding risky sectors. Over the next six months, economic recovery will propel the Australian share market upward even if there are minor corrections. In the second half of 2021, however, the risks will increase as any vaccine problems emerge. In addition, the Australian government needs to find its way to a truce, if not a peace treaty, in the trade war with China. While the broad market will keep rising in the long term, some sectors will become over-priced as optimism outruns reality. As noted above, the longer herd immunity is delayed, the longer it will take the tourism and travel sectors to return to profitability. Speculative stocks, e.g. in fintech, mining, and biotech, have floated upward on a tide of stimulus money, and the withdrawal of stimulus payments means that the tide will go out and leave many investors stranded. Back in June, we forecast that the Australian dollar (AUD) would rise against the US dollar (USD) over the next three years, reaching at least USD 84 cents and possibly USD 90 cents. Since then, our prediction has been coming true faster than we expected. The AUD has risen 11% against the USD since end-June, and it could rise another 10% to 20% within twelve months, thanks to the US mishandling of the pandemic, debt-funded multi-trillion dollar stimulus packages en route in 2021 and the ongoing dysfunctionality of US politics.

|

3 Feb 2021 - GameStop

|

GameStop Michael Frazis, Frazis Capital Partners 31 January 2021 Well, that was one of the more engaging weeks in finance I can remember! Here is one of the original posts on r/wallstbets outlining the case before the stock went up over 100x.

Michael DisclaimerThe information in this note has been prepared and issued by Frazis Capital Partners Pty Ltd ABN 16 625 521 986 as a corporate authorised representative (CAR No. 1263393) of Frazis Capital Management Pty Ltd ABN 91 638 965 910 AFSL 521445. The Frazis Fund is open to wholesale investors only, as defined in the Corporations Act 2001 (Cth). The Company is not authorised to provide financial product advice to retail clients and information provided does not constitute financial product advice to retail clients. The information provided is for general information purposes only, and does not take into account the personal circumstances or needs of investors. The Company and its directors or employees or associates will use their endeavours to ensure that the information is accurate as at the time of its publication. Notwithstanding this, the Company excludes any representation or warranty as to the accuracy, reliability, or completeness of the information contained on the company website and published documents. The past results of the Company's investment strategy do not necessarily guarantee the future performance or profitability of any investment strategies devised or suggested by the Company. The Company, and its directors or employees or associates, do not guarantee the performance of any financial product or investment decision made in reliance of any material in this document. The Company does not accept any loss or liability which may be suffered by a reader of this document.

|

3 Feb 2021 - Performance Report: Insync Global Quality Equity Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync employs four simple screens to narrow the universe of over 40,000 listed companies globally to a focus group of high-quality companies that it believes have the potential to consistently grow their profits and dividends. These screens are: size of the company, balance sheet performance, valuation and dividend quality. Companies that pass this due diligence process are then valued using dividend discount models, free cash flow yield and proprietary implied growth and expected return models. The end result is a high conviction portfolio typically of 15-30 stocks. The principal investments will be in shares of companies listed on international stock exchanges (including the US, Europe and Asia). The Fund may also hold cash, derivatives (for example futures, options and swaps), currency contracts, American Depository Receipts and Global Depository Receipts. The Fund may also invest in various types of international pooled investment vehicles. |

| Manager Comments | The Fund's return was flat in December, in line with the Index. Insync believe the outperformance of neglected sectors over the past quarter (e.g. banks, energy & cyclicals) is primarily due to exuberant expectations of much higher growth (from vaccines) and inflation views for the near term. Insync noted Megatrends have proved resilient to the COVID-19 fallout, with many existing long-term trends having been accelerated by the pandemic. These include the move to e-commerce, uptake of contactless payment methods, expansion of cloud-based services, collision of biological science technology and the transition from carbon energy to electric. They added that megatrends are typically not determined by short-term shocks, even those as significant as COVID-19. The Fund's top 10 active holdings at month-end included Nintendo, Walt Disney, Domino's Pizza, PayPal, Dollar General, Qualcomm, Visa, S&P Global, Facebook and Nvidia. |

| More Information |

2 Feb 2021 - Performance Report: Delft Partners Global High Conviction

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The quantitative model is proprietary and designed in-house. The critical elements are Valuation, Momentum, and Quality (VMQ) and every stock in the global universe is scored and ranked. Verification of the quant model scores is then cross checked by fundamental analysis in which a company's Accounting policies, Governance, and Strategic positioning is evaluated. The manager believes strategy is suited to investors seeking returns from investing in global companies, diversification away from Australia and a risk aware approach to global investing. It should be noted that this is a strategy in an IMA format and is not offered as a fund. An IMA solution can be a more cost and tax effective solution, for clients who wish to own fewer stocks in a long only strategy. |

| Manager Comments | The Portfolio returned -0.9% in December. Delft highlighted that, following the results of the US election, the yield curve is steepening as fiscal spending is now likely to accompany ultra low interest rates which they noted typically leads to change in market leadership - Delft currently favour small and value. Delft remain very diversified, with underweight positions in banks and oils and overweight positions in 'true technology' companies and healthcare. Delft like Japan and Asia on valuation, fiscal resilience and improving governance. They see a poor outlook for European profits notwithstanding the 'cheap' market. Notable performers in the portfolio included AES (a US utility company, Shin-Etsu Chemical (Japanese high-end chemicals company), and Discovery (US provider of documentary content). Alibaba fell as investors worried about political interference, and Intel was hit by announcements regarding increased in-sourcing by Apple and Microsoft. The Strategy remains unhedged for AUD$ based investors. |

| More Information |

2 Feb 2021 - Performance Report: Bennelong Twenty20 Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is managed as one portfolio but comprises and combines two separately managed exposures: 1. An investment in the top 20 stocks of the markets, which the Fund achieves by taking an indexed position in the S&P/ASX 20 Index; and 2. An investment in the stocks beyond the S&P/ASX 20 Index. This exposure is managed on an active basis using a fundamental core approach. The Fund may also invest in securities expected to be listed on the ASX, securities listed or expected to be listed on other exchanges where such securities relate to ASX-listed securities.Derivative instruments may be used to replicate underlying positions and hedge market and company specific risks. The companies within the portfolio are primarily selected from, but not limited to, the S&P/ASX 300 Accumulation Index. The Fund typically holds between 40-55 stocks and thus is considered to be highly concentrated. This means that investors should expect to see high short-term volatility. The Fund seeks to achieve growth over the long-term, therefore the minimum suggested investment timeframe is 5 years. |

| Manager Comments | As at the end of December, the portfolio's weightings had been increased in the Communication, IT, Consumer Staples and Materials sectors, and decreased in the Discretionary, Industrials, Health Care, Financials and REIT's sectors. The portfolio is significantly overweight the Discretionary sector (Fund weight: 32.4%, benchmark weight: 7.7%). |

| More Information |

2 Feb 2021 - Performance Report: Quay Global Real Estate Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund will invest in a number of global listed real estate companies, groups or funds. The investment strategy is to make investments in real estate securities at a price that will deliver a real, after inflation, total return of 5% per annum (before costs and fees), inclusive of distributions over a longer-term period. The Investment Strategy is indifferent to the constraints of any index benchmarks and is relatively concentrated in its number of investments. The Fund is expected to own between 20 and 40 securities, and from time to time up to 20% of the portfolio maybe invested in cash. The Fund is $A un-hedged. |

| Manager Comments | Key positive contributors included Brixmor (US retail) and Whart REIC (Hong Kong retail). US apartments (Essex, Mid-America) were among the performance drags, along with Hysan (Hong Kong diversified). The Fund returned -9.8% over CY20 which Quay noted was disappointing, however, in constant currency terms the underlying investees delivered a return of -1.2%. This indicates that almost all of the negative returns this year were currency related. Quay added that this return should be seen in light of the extraordinary cost the real estate industry was asked to bear during the pandemic, essentially being asked to shut down, forgive or forgo rent, and in some jurisdictions prevented from evicting tenants whether they had the ability to pay rent or not. As was the case after the GFC in 2009, Quay believe attractive long-term total returns are available for investors in global listed real estate. Unlike 2009, they don't believe it is available across all sectors. They believe the best opportunities are those with mispriced quality real estate, with strong balance sheets, sensible dividend payout policies and best-in-class management. |

| More Information |

1 Feb 2021 - Performance Report: AIM Global High Conviction Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The strategy is long-only, with a mandate to be between 90% - 100% invested. The Fund also employs a construction framework that ensures there is a sensible mix of exposures within the limited number of businesses in the portfolio. These limits are: - Maximum individual position size 7.5% - Minimum individual position size 2.5% - Maximum sector exposure 30% The Fund targets a cash allocation of between 0-10% but can have as much as 20% of the portfolio in cash in the event of an unprecedented global shock. Liquidity is extremely important. The Fund will typically look to invest in businesses within a market cap range of US$7.5billion all the way up to the largest companies in the world with market capitalisations in excess of $200b. Occasionally, we may find a business that exhibits the traits of a quality investment, but it is much earlier in its business cycle. The Fund can invest in these businesses, but they must clear a much higher bar for inclusion. Individually, these future compounders cannot comprise more than 4% of the fund, these businesses cannot collectively exceed 10% of the fund. |

| Manager Comments | The Fund returned -0.71% in December. The biggest headwind to performance during the month was the relative strength of the AUD which AIM estimate reduced the absolute return by 4.7%. The top contributors to performance included Intuitive Surgical, Keyence, PayPal, LVMH and Estee Lauder. Key detractors included Salesforce.com, Alphabet, Prosus, Fastenal and ICON. AIM noted that in most cased (except Salesforce), the decline in local currency was relatively modest. The weak AUD returns were driven by the currency impact. The portfolio's top 10 holdings at month-end were Berkshire Hathaway, Microsoft Corp, Coca-Cola, Alphabet, Mastercard, UnitedHealth Group, ICON, Accenture, Nike and Heineken NV. The portfolio was most heavily weighted towards the USA (43.6% of the portfolio), followed by developed ex-USA markets (25.8% weighting). By sector, the portfolio was most heavily weighted towards the IT, Consumer Discretionary, Consumer Staples and Healthcare sectors. |

| More Information |

1 Feb 2021 - Performance Report: Bennelong Concentrated Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The overriding objective of the Concentrated Australian Equities Fund is to seek investment opportunities which are under-appreciated and have the potential to deliver positive earnings, while satisfying our stringent quality criteria. Bennelong's investment process combines bottom-up fundamental analysis together with proprietary investment tools which are used to build and maintain high quality portfolios that are risk aware. The portfolio typically consists of 20-35 high-conviction stocks from the S&P/ASX 300 Index. The Fund may invest in securities listed on other exchanges where such securities relate to ASX-listed securities. Derivative instruments are mainly used to replicate underlying positions and hedge market and company specific risks. |

| Manager Comments | The Fund's up-capture and down-capture ratios (since inception), 149.4% and 91.6% respectively, indicate that, on average, it has outperformed in both the market's positive and negative months. The Fund's Sortino ratio (since inception) of 1.36 vs the Index's 0.73 demonstrates its capacity to avoid the market's downside volatility over the long-term. As at the end of December, the portfolio's weightings had been increased in the IT, Communication, Industrials, Materials and Financials sectors, and decreased in the Discretionary, Health Care and REIT's sectors. The portfolio is significantly overweight the Discretionary sector (Fund weight: 39.8%, benchmark weight: 7.7%) and underweight the Financials sectors (Fund weight: 7.1%, benchmark weight: 27.1%). |

| More Information |

1 Feb 2021 - Performance Report: Insync Global Capital Aware Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Insync employs four simple screens to narrow the universe of over 40,000 listed companies globally to a focus group of high quality companies that it believes have the potential to consistently grow their profits and dividends. These screens are size of the company, balance sheet performance, valuation and dividend quality. Companies that pass this due diligence process are then valued using dividend discount models, free cash flow yield and proprietary implied growth and expected return models. The end result is a high conviction portfolio of typically 15-30 stocks. The principal investments will be in shares of companies listed on international stock exchanges (including the US, Europe and Asia). The Fund may also hold cash, derivatives (for example futures, options and swaps), currency contracts, American Depository Receipts and Global Depository Receipts. The Fund may also invest in various types of international pooled investment vehicles. At times, Insync may consider holding higher levels of cash if valuations are full and it is difficult to find attractive investment opportunities. When Insync believes markets to be overvalued, it may hold part of its resources in cash, or use derivatives as a way of reducing its equity exposure. Insync may use options, futures and other derivatives to reduce risk or gain exposure to underlying physical investments. The Fund may purchase put options on market indices or specific stocks to hedge against losses caused by declines in the prices of stocks in its portfolio. |

| Manager Comments | The Fund's return was flat in December, in line with the Index. Insync believe the outperformance of neglected sectors over the past quarter (e.g. banks, energy & cyclicals) is primarily due to exuberant expectations of much higher growth (from vaccines) and inflation views for the near term. Insync noted Megatrends have proved resilient to the COVID-19 fallout, with many existing long-term trends having been accelerated by the pandemic. These include the move to e-commerce, uptake of contactless payment methods, expansion of cloud-based services, collision of biological science technology and the transition from carbon energy to electric. They added that megatrends are typically not determined by short-term shocks, even those as significant as COVID-19. The Fund's top 10 active holdings at month-end included Nintendo, Walt Disney, Domino's Pizza, PayPal, Dollar General, Qualcomm, Visa, S&P Global, Facebook and Nvidia. |

| More Information |