NEWS

1 Nov 2024 - Australian Secure Capital Fund - Market Update

|

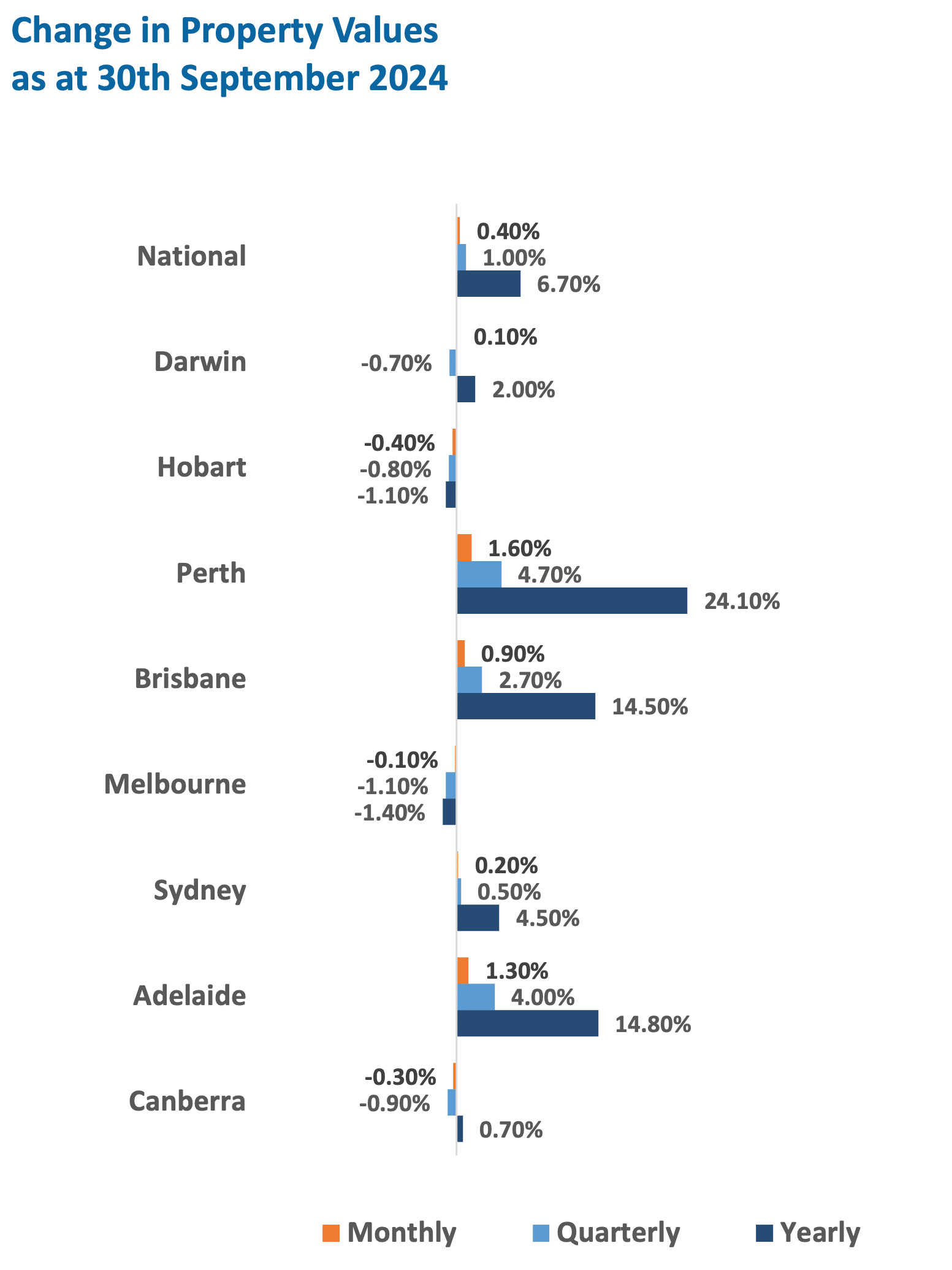

Australian Secure Capital Fund - Market Update Australian Secure Capital Fund October 2024 For the 20th consecutive month, headline national home values increased by a modest 0.4%, signalling that the strong momentum is beginning to leave the market. This is demonstrated by housing values rising just 1% for the September quarter, the lowest over a rolling three-month period since March 2023. Perth continues to be the strongest performer, growing by 1.6% for the month, followed by Adelaide and Brisbane with increases of 1.3% and 0.9%, respectively. Sydney and Darwin were the only other markets to see increases, rising by 0.2% and 0.1% for the month, while Melbourne, Canberra, and Hobart all saw housing values ease, with decreases of 0.1%, 0.3%, and 0.4%, respectively. Property Values as at 30th of September 2024

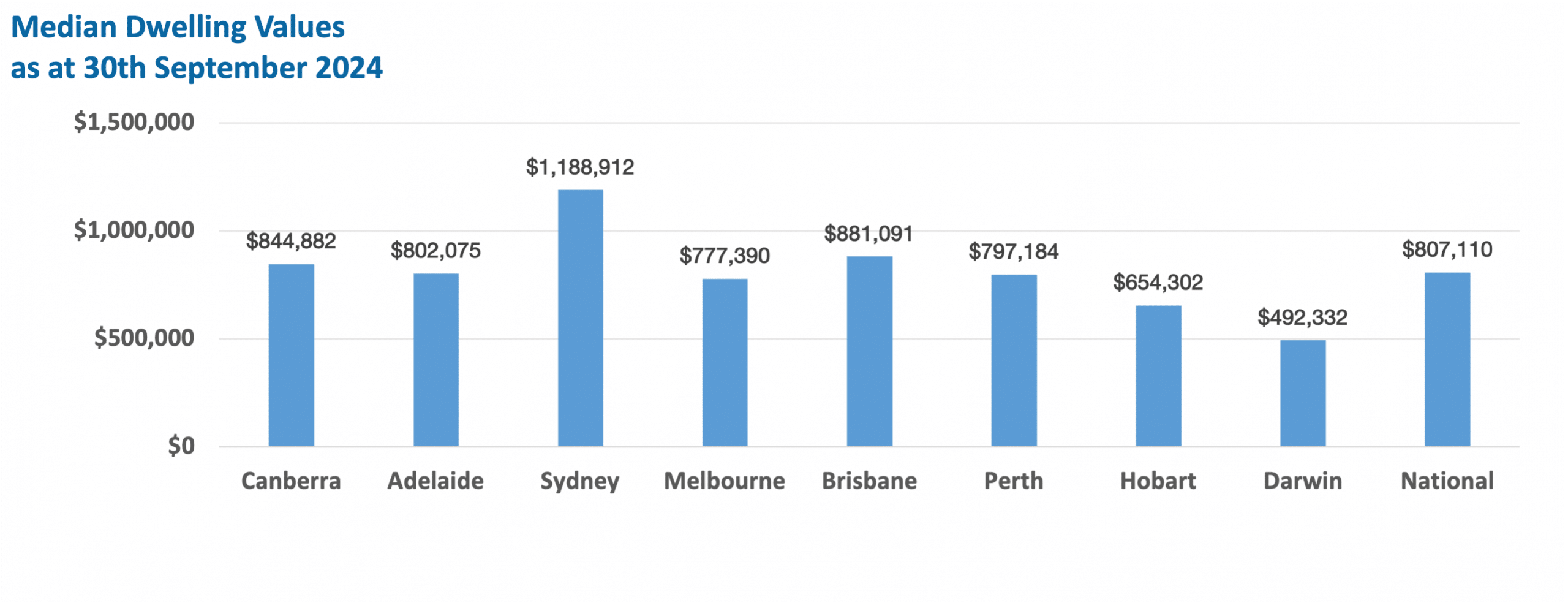

Median Dwelling Values as at 30th of September 2024

Quick InsightsRate hold slows buyers, but investor confidence remains strongProfits from home sales nationwide climbed to a record high of $285,000 on average in the June quarter. The RBA's decision to keep interest rates steady has left many homebuyers waiting, as borrowing power remains limited. While a future rate cut is anticipated, it won't significantly boost demand until it happens. Meanwhile, investors are showing renewed interest, particularly in Melbourne, where the market is stabilising despite an increase in listings. A rate cut could lead to a faster recovery than expected. Source: Australian Financial Review

Australia's housing market soars to record $11 trillionAustralia's housing market hit a record $11 trillion in September, with home values rising 6.7% over the past year, adding $900 billion in wealth. Despite higher interest rates, new listings and strong investor activity continue to drive the market. Over the past decade, house prices surged by 85.9% nationwide, with suburbs in Sydney, Brisbane, and Melbourne leading long-term growth. While price growth is expected to slow, strong demand and new housing developments will continue to support the market. Source: Australian Financial Review Author: Filippo Sciacca, Director - Investor Relations, Asset Management and Compliance Funds operated by this manager: ASCF High Yield Fund, ASCF Premium Capital Fund, ASCF Select Income Fund |

31 Oct 2024 - Go beyond the point of low returns

30 Oct 2024 - Performance Report: Insync Global Capital Aware Fund

[Current Manager Report if available]

30 Oct 2024 - Stock Story: Medibank

|

Stock Story: Medibank Airlie Funds Management October 2024 |

|

Playing a pivotal role in Australia's health transition. The Medibank and ahm private health insurance brands serve over 4.2m customers and play a vital role in funding medical care in Australia. In the most recent financial year, Medibank paid out $6.3bn in health insurance claims, taking a significant burden off the public healthcare system. Yet recently, the sector has come under fire from both the government and hospitals accused of making too much profit. In this article, we explore this regulatory tension and why we think Medibank looks an attractive investment opportunity. Private hospital profits affected by new models of careThere is no doubt the past few years have been challenging for hospitals - labour shortages have affected service levels and inflation has been rampant. Private hospital operators have responded by launching a campaign against the health insurers and pressuring the government for a bailout. While additional payments or a tax may provide short-term relief to hospitals, they do not solve the structural issues facing the sector and ultimately would drive up the cost of healthcare and premiums for millions of Australians. To build a sustainable private healthcare system, all participants must work together to find efficiencies and drive down the overall cost of care. Medibank is doing its part to lower costs by investing in new models of care away from overnight stays in expensive acute care hospitals to virtual, short-stay hospitals and home care. Without this transition, Medibank estimates the government will need to spend 50% more on healthcare as a percentage of GDP in forty years. While this transition does come at the expense of hospitals that typically earn more for longer in-hospital stays, it is beneficial for the wider healthcare system. Higher hospital costs would simply translate to higher premiums, which are likely to push more members out of private health insurance and place further strain on an already stretched public healthcare system. It is for this reason the Federal Health Minister following a review has conceded, "There's no silver bullet from Canberra or funding solution from taxpayers to deal with what are essentially private pressures in the system". Ultimately, it is not the government's job to prop up unprofitable business models and in some cases it is healthy for some private hospitals to shut where there is overcapacity in the system. Has Medibank profited at the expense of hospitals? Medibank has stuck to its promise not to profit from the pandemic and returned a total of $1.46bn in givebacks to customers for permanent claims savings due to COVID-19. This is evident in the chart below which shows Medibank's health insurance gross profit margin is still below FY19 levels.

Source: Company filings

|

29 Oct 2024 - Performance Report: TAMIM Fund: Global High Conviction Unit Class

[Current Manager Report if available]

29 Oct 2024 - Performance Report: Insync Global Quality Equity Fund

[Current Manager Report if available]

29 Oct 2024 - Magellan Global Quarterly Update

|

Magellan Global Quarterly Update Magellan Asset Management October 2024 |

|

Arvid Streimann, Nikki Thomas and Alan Pullen discuss key market themes and how the global strategy is positioned to capitalise on emerging opportunities, whilst monitoring the risks. Arvid also discusses the potential market impacts of the upcoming US election based on various possible outcomes. |

|

Funds operated by this manager: Magellan Global Fund (Hedged), Magellan Global Fund (Open Class Units) ASX:MGOC, Magellan High Conviction Fund, Magellan Infrastructure Fund, Magellan Infrastructure Fund (Unhedged), MFG Core Infrastructure Fund, Magellan Core ESG Fund Important Information: Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 ('Magellan') and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement ('PDS') and Target Market Determination ('TMD') and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain 'forward-looking statements'. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan. |

28 Oct 2024 - New Funds on Fundmonitors.com

|

New Funds on FundMonitors.com |

|

Below are some of the funds we've recently added to our database. Follow the links to view each fund's profile, where you'll have access to their offer documents, monthly reports, historical returns, performance analytics, rankings, research, platform availability, and news & insights. |

|

||||||||||||||||||||||

| Dimensional Sustainability World Equity Trust | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

| Dimensional World Equity Trust | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| TAMIM Australia All Cap | ||||||||||||||||||||||

|

||||||||||||||||||||||

|

||||||||||||||||||||||

| EQT Nexus Fund (AUD) | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

||||||||||||||||||||||

| Realm Strategic Income Fund | ||||||||||||||||||||||

|

||||||||||||||||||||||

| View Profile | ||||||||||||||||||||||

|

Want to see more funds? |

||||||||||||||||||||||

|

Subscribe for full access to these funds and over 850 others |

25 Oct 2024 - Hedge Clippings | 25 October 2024

|

|

|

|

Hedge Clippings | 25 October 2024 It's going down to the wire, and seemingly too close to call. The US election is now less than two weeks away, and with it will come all the drama, speculation, and, of course, the potential for significant economic consequences across the globe, and potentially social upheaval in the US itself. Here in Australia we're no strangers to feeling the ripple effects of US political shifts. If Donald Trump regains the presidency, we may be looking at a return to the good (or not so good) old days of trade tensions and tariffs, particularly with China. This could spell trouble for our commodities sector and create turbulence for market confidence - after all, the last thing our economy needs is another round of "trade war" antics. Meanwhile, back at home, the Reserve Bank of Australia and Treasurer Jim Chalmers are not exactly on the same page about inflation. Chalmers has been cautiously optimistic, pointing to the halving of inflation since Labor took office. But the RBA, led by Deputy Governor Andrew Hauser, isn't ready to declare victory just yet. The RBA remains wary, maintaining that inflation is still proving to be a persistent thorn, and it'll take a while before we can truly say it's tamed. The cash rate, held at 4.35% for eleven months now, is staying put - the RBA wants more evidence before even considering an ease in rates. And it's no wonder they're being cautious. Global uncertainties, including the turmoil in the Middle East, are pushing investors into safe-haven assets like gold, which has reached record highs. The financial world might be feeling "spectacularly optimistic," but Hauser has made it clear that the RBA isn't buying into the hype just yet. Inflation forecasts from the RBA and the IMF are now closely aligned, underscoring the complexity of the current situation. Chalmers might be waving the flag of optimism, but the RBA is sticking to a message of patience - steady does it, until they're sure the inflation beast is fully under control. One thing's for sure: there's no shortage of interesting times ahead for the world, and with it, the Australian economy. News & Insights New Funds on FundMonitors.com Investment Perspectives: 10 charts that recently caught our eye | Quay Global Investors September 2024 Performance News Digital Income Fund (Digital Income Class) Equitable Investors Dragonfly Fund Bennelong Twenty20 Australian Equities Fund |

|

|

If you'd like to receive Hedge Clippings direct to your inbox each Friday |

25 Oct 2024 - Performance Report: Digital Income Fund (Digital Income Class)

[Current Manager Report if available]