NEWS

22 Jul 2021 - Performance Report: Paragon Australian Long Short Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | Paragon's unique investment style, comprising thematic led idea generation followed with an in depth research effort, results in a concentrated portfolio of high conviction stocks. Conviction in bottom up analysis drives the investment case and ultimate position sizing: * Both quantitative analysis - probability weighted high/low/base case valuations - and qualitative analysis - company meetings, assessing management, the business model, balance sheet strength and likely direction of returns - collectively form Paragon's overall view for each investment case. * Paragon will then allocate weighting to each investment opportunity based on a risk/reward profile, capped to defined investment parameters by market cap, which are continually monitored as part of Paragon's overall risk management framework. The objective of the Paragon Fund is to produce absolute returns in excess of 10% p.a. over a 3-5 year time horizon with a low correlation to the Australian equities market. |

| Manager Comments | The fund has an up-capture ratio ranging between 210.12% (2 years) and 93.81% (since inception), and over the most recent 12 months has provided an up-capture ratio of 177.96%. It has a down-capture ratio since inception of 74.72%. This highlights its capacity to outperform in both rising and falling markets over the long-term. The Fund rose +14.37% over the June quarter. It ended the month with 29 long positions and 6 short positions. |

| More Information |

22 Jul 2021 - Performance Report: Bennelong Twenty20 Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is managed as one portfolio but comprises and combines two separately managed exposures: 1. An investment in the top 20 stocks of the markets, which the Fund achieves by taking an indexed position in the S&P/ASX 20 Index; and 2. An investment in the stocks beyond the S&P/ASX 20 Index. This exposure is managed on an active basis using a fundamental core approach. The Fund may also invest in securities expected to be listed on the ASX, securities listed or expected to be listed on other exchanges where such securities relate to ASX-listed securities.Derivative instruments may be used to replicate underlying positions and hedge market and company specific risks. The companies within the portfolio are primarily selected from, but not limited to, the S&P/ASX 300 Accumulation Index. The Fund typically holds between 40-55 stocks and thus is considered to be highly concentrated. This means that investors should expect to see high short-term volatility. The Fund seeks to achieve growth over the long-term, therefore the minimum suggested investment timeframe is 5 years. |

| Manager Comments | Over the past 12 months, the fund's volatility has been 10.33% compared with the index's volatility of 10.42%. Since inception the fund's volatility has been 13.76% vs the index's volatility of 13.31%. Since inception in the months when the market was positive the fund provided positive returns 97% of the time. It has an up-capture ratio of 125.88% since inception and 142.78 over the past 12 months. Across all other time periods, it has ranged between 138.64% (2 years) and 121.05% (5 years). |

| More Information |

22 Jul 2021 - What to learn from the last year's IPO Winners and Losers

|

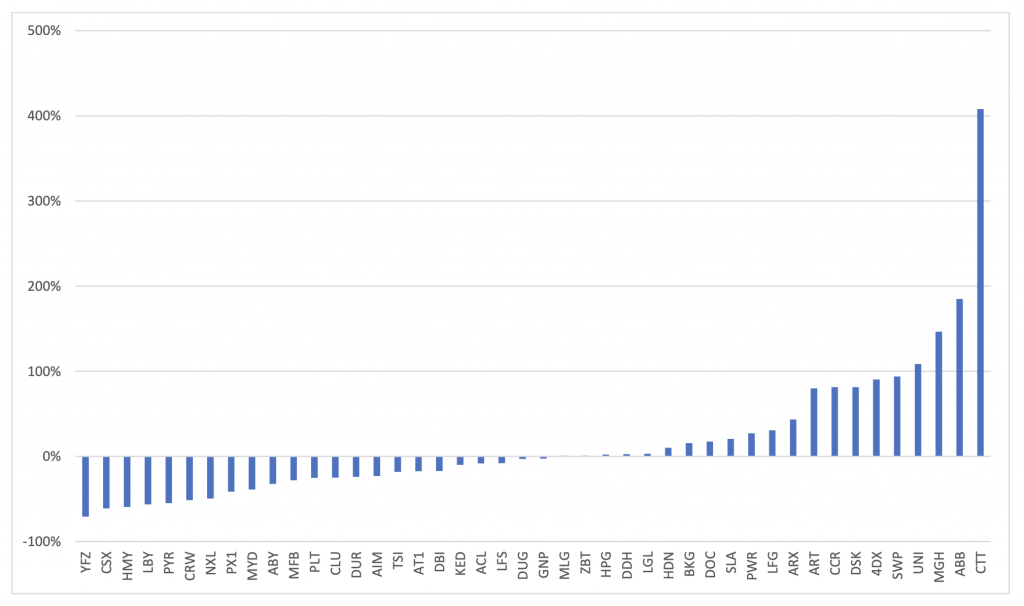

What to learn from the last year's IPO Winners and Losers Gary Rollo, Montgomery Investment Management June 2021 IPOs can give you wonderful returns if you get them right, but burn your money if you don't. And that's clearly shown in the trajectories of the companies that have listed since the COVID-induced market lows in March 2020. Because, while there were some big winners - like Cettire (ASX:CTT), Aussie Broadband (ASX:ABB) and Universal Stores (ASX:UNI), there were also some clear losers. Our process at the Montgomery Small Companies Fund is designed to seek out companies with an under-appreciated or undiscovered competitive advantage with capable management teams that are early in their value creation journey. The IPO market can be a good place to look. So what's been happening in this area of the market since the market's COVID lows and what did we do? The IPO market since COVID The first IPO out of the blocks in the COVID market depths was a $30 million raise for Atomo Diagnostics (ASX:AT1) at 20c a share. AT1 listed with an agreement already in place to provide COVID diagnostic kits to needy European Government type customers. It seems that whatever solace the market is looking for at any given moment in time, there is an IPO for that! Day 1 turned out to be AT1's best day (so far) - trading at over 50c, but it's been downhill ever since, with the stock now trading 20 per cent below issue price at 16c or so today. Quite a journey. There is a message in the AT1 story. The valuation regime of an IPO is an unknown, brokers do a good job to select IPOs that they can "get away" essentially giving the investor crowd what its craving, the flavour of the month. And brokers work hard to whip up demand, this can result in extreme pricing dislocation events. Our job is to be on the right side of that event. Picking those businesses that can go on to create that value for our investors in the Fund. The ones that go up and stay up. There are many IPO events - we go through the stats below - so our process involves an initial screen, to see if the IPO candidate likely has the characteristics that we are looking for in the portfolio, before selecting which ones to spend the time and effort doing proper due diligence on. Doing the work at IPO helps get an understanding of a company that can pay dividends down the track, even if we don't decide to invest on IPO, we try to do the work on as many as we can. The stats: By our count there have been 110 IPOs since the market COVID lows in March 2020. 39 of these have been resource exploration plays, all but 2 have been sub $50 million market cap. Microcap resource exploration plays is not an area of the market the Fund goes hunting in. Too speculative. We don't look at those. There have been 71 non-resource exploration IPOs that have listed since the COVID lows, 44 of these have had a market cap on IPO of greater than $50 million. That's our investible universe. Of these 44 listings, the median return since IPO is -3 per cent. 21 are above IPO price, 23 are under. The data says IPOs are not a one way bet, but the chart below also shows that if you get them right there are good returns available. Distribution of IPO Returns post March 2020: IPO price to date

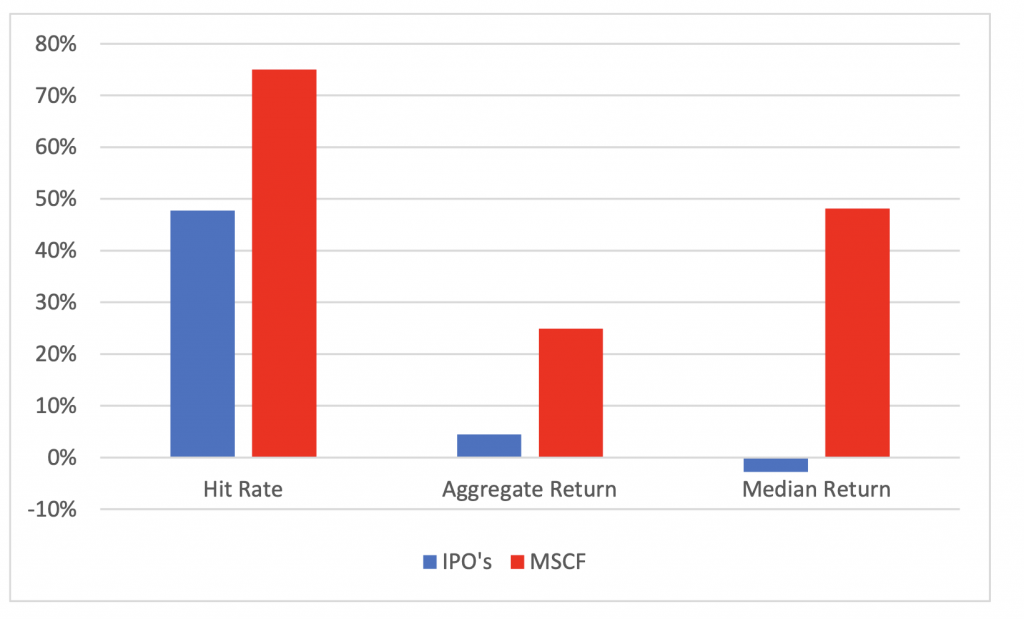

Characteristics of IPO losers One of the most common IPO errors observed in recent times is investors look to play "hot themes" of the moment. Remember if you want it, there is an IPO banking team that has got the deal for you and during COVID times this was meal kits, e-commerce and buy-now-pay-later, amongst other things. An IPO on a "hot theme" can look good in the short run, but can come with longer term pain, as the hot money that chases these "hot" deals does what it does best and moves on to the next shiny thing. Consequently, most if not all of these types of new issues don't find a real investor base anywhere near their IPO price and end up firmly under water. Youfoodz (ASX:YFZ), tried to capitalise on the market's appetite for meal kit delivery that boomed during COVID. Its IPO was "priced" at $1.50, it never traded within cooee of that, best print was $1.32. One way traffic since then. It's 71 per cent down, trading at 44c on my screen as I write, and takes the award for the worst post COVID IPO (to date anyway). My Food Bag (NXZ:MFB), New Zealand's "Youfoodz" provides further illustration of hot theme/hot money loser and is trading 28 per cent below its issue price. Another that looked to cash in on the "moment" was internet retailer Adore Beauty (ASX:ABY). The business was listed on a high valuation, after being acquired by private equity for a much, much lower price only a short time before. At best you could say this was opportunistic. Nevertheless "investors" fluttered like moths around the e-commerce flame when it IPOd at $6.75 in October 2020. That did slightly better than YFZ, however like many moths the "upside" there didn't last long, ABY closed above issue on its first day, but never since and is now down 32 per cent on that IPO price. ABY is arguably now an illiquid micro-cap with a lot to do to re-build its reputation with investors after its warning that it's not growing at the rate investors expected. A downgrade in expectations before it even delivered its first set of full year financials as a listed company is a sin not easily forgiven by institutional investors. A blog on IPOs wouldn't be complete without reference to Nuix (AX:NXL), but given the AFR has done such a good job of disclosure there (better than the prospectus it appears...), we don't feel the need to explain. Caveat Emptor. We didn't do the work on any of the above. Screened out early. The Winners IPOs can be lucrative too, as just as the price discovery process can be difficult for investors, that's the case for the IPO brokers and advisers too, and the business can be sold too cheaply at IPO. IPOs that have performed well include Cettire (ASX:CTT), Aussie Broadband (ASX:ABB), Maas Group (ASX:MGH) and Universal Stores (ASX:UNI). We didn't look at CTT (we thought the e-commerce model was just a child of the times and would quickly slow, time will tell) or ABB (sometimes we miss things). We looked at MGH but thought it was expensive, it's up 150 per cent so I suppose you'd classify that as getting it wrong! We invested in UNI. Of the bottom 10 IPO stocks, 9 of those were "hot theme" stocks, only Harmoney probably doesn't manage to fit that description, although arguably it may have been pitched as such. On the flip side of the top 10 performing IPOs only 2 of them could be considered to be "hot themes" and 1 is a bio-tech (tough to value), the rest have proven business models, some with competitive advantage, many are well run by talented management teams. That's what you need to look for. Montgomery Small Companies Fund IPO report card Of the 44 non-resource exploration IPOs since COVID with a market cap of greater than $50 million, we have looked at 23 of them, the rest we screened out, for one reason or another. We also looked at one sub that market cap level as we thought it could be interesting - a total of 24 active IPO investment decisions were made. We decided to invest in 8, of the 24 we reviewed. Of the 8 we invested in, we made money in 6 of them, sometimes with very good returns. As an aggregate across those 8 we have made 25 per cent return on total capital deployed, with the median return being 48 per cent. It's worth pointing out that only a small fraction of the Fund at any one time is committed to IPOs, for instance of the 8 IPOs we invested in, 5 have been sold, and we hold 3 which are collectively circa 2 per cent of the portfolio. Risk management is always important, especially with IPOs. Early stage companies have higher risk, so we size these in the portfolio so that if they go right we make good returns (see chart below), but if they don't work you won't see us telling you we have underperformed because an IPO didn't go the way we planned. We acknowledge the work done by the advisors and brokers who partner with us, in bringing these companies to market, for the good ones that is, you can keep the bad ones! What about our losers? Of the two IPOs we invested in that didn't work, we made minor losses on one, the other is Cashrewards (ASX:CRW), which hasn't worked (so far) but we continue to hold. We certainly don't get them all right. Montgomery Small Companies Fund IPO report card: 75 per cent hit rate

Of the other 16 decisions where we looked but decided not to invest, 10 of those are under water, 6 made money, although 3 only just. We did miss 3 good opportunities that we did the due diligence on but for various reasons we didn't get over the line. Next time. And we think that there will be a next time for quite some time. IPO banking teams at the banks and brokers report many IPOs in their pipeline, all looking for the right time to come to market. Whilst it's clear to us that investor appetite has moderated, particularly for loss making businesses, we see that as some "heat" coming out of the market. That's healthy and we expect a steady flow of IPOs for us to scrutinise over the coming months. Funds operated by this manager: Montgomery (Private) Fund, Montgomery Small Companies Fund, The Montgomery Fund |

21 Jul 2021 - Performance Report: Longlead Pan-Asian Absolute Return Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | |

| Manager Comments | Longlead believe peak global economic growth has likely passed in the second quarter. Their view is that a number of key macroeconomic variables are currently signalling a mid-cycle slowdown. Bond yields and inflation expectations are falling and some early cycle commodities that led the reflation trend late last year such as lumber, copper, plastic resins and soft commodities are now reversing. They noted current economic activity however remains strong, supported by global monetary and fiscal stimulus, and consequently a sharp slowdown presents as unlikely. For the Fund, this late recovery was not enough to offset the impact of the decline in Taiwan in May, and the Fund accordingly experienced losses across the quarter in the Technology sector as well as non-sector hedges, partially offset by gains in Consumer Discretionary positions. Across countries in the quarter, the Fund saw a drawdown from positions in China, the United States, and Taiwan, with offsetting gains in both Hong Kong and Korea. |

| More Information |

21 Jul 2021 - Performance Report: Prime Value Emerging Opportunities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The Fund is comprised of a concentrated portfolio of securities outside the ASX100. The fund may invest up to 10% in global equities but for this portion typically only invests in New Zealand. Investments are primarily made in ASX listed and other exchange listed Australian securities, however, it may also invest up to 10% in unlisted Australian securities. The Fund is designed for investors seeking medium to long term capital growth who are prepared to accept fluctuations in short term returns. The suggested minimum investment time frame is 3 years. |

| Manager Comments | Over the past 12 months, the fund's volatility has been 9.68% compared with the index's volatility of 10.42%. Since inception the fund's volatility has been 14.68% vs the index's volatility of 14.07%. The fund's Sharpe ratio has ranged from a high of 3.71 over the most recent 12 months, to a low of 0.98 over the past 5 years. Since inception the fund's Sharpe ratio has been 1.03 vs the index which has a Sharpe ratio of 0.74. Since inception in the months when the market was positive the fund provided positive returns 83% of the time. It has a down-capture ratio of 45.74% since inception, and ranging between 68.03% (3 years) and -4.64% (12 months), highlighting its capacity to outperform in falling markets. |

| More Information |

21 Jul 2021 - The cannabis theme, currently up in smoke

|

The cannabis theme, currently up in smoke Harry Heaney, Frame Funds Management June 2021 Why we invested The cannabis theme first caught our attention in December, when a United Nations (UN) commission voted to remove cannabis from Schedule IV of the 1961 Single Convention on Narcotic Drugs. The decision removed it from being in the company of more dangerous and addictive substances like heroin and cocaine. Many investors around the world looked at this move and saw it as a major step to normalising the substance. Immediately after this announcement, prices of cannabis-related stocks began to climb. While the change had no immediate material effect on the space, it was seen as a symbolic victory and a sign to nations that it was acceptable to reconsider punitive criminalision policies. Days later, the US House of Representatives passed the Marijuana Opportunity Reinvestment and Expungement Act (MORE) which decriminalised cannabis on a federal level. In January 2021, some states in America began renewed efforts to legalise cannabis locally. Lawmakers in New Mexico, New York, and Connecticut all made overtures to either medicinal or recreational legalisation. A strong first day of legal sales in Illinois also spurred the belief the industry was profitable. In February, a group of German researchers published a study demonstrating the benefits of medicinal cannabis on patients with Parkinson's disease. By this time, the continued stream of positive news flow had reached equity markets - from the start of November to the 10th February, AdvisorShares Pure Cannabis ETF had appreciated approximately 183%. We began to initiate investments in the theme during the month of December and continued to build positions in companies such as Creso Pharma (ASX:CPH), ECS Botanics Holdings (ASX:ECS) and Elixinol Wellness (ASX:EXL) throughout January. Towards the end of January, it became clear Joe Biden would enter the White House with a Democratic House and Senate. In theory, this would make it easier to pass legislative priorities which strengthened thematic tailwinds and confirmed our view that immanent short-term volatility would present opportunities. Why we exited We have since exited our investments in the cannabis theme for multiple reasons. After significant runs into March, we saw most businesses in the sector become over valued without any real shift in company fundamentals. We also saw a slowing of progress from a governmental and legislation perspective. When it became apparent further legal developments in the industry would be delayed by Congress, prices began to return to more normalized levels, though still inflated. In February, companies issued their half-yearly reports and financial statements. The general market reaction was negative, as business fundamentals could not justify current trading levels across the board. As companies within the sector saw their share price continue to decline in late February and early March, it became apparent the theme required further developments to be in play once again. We subsequently exited our investments. What we want to see next To begin reaccumulating investments in the cannabis sector, we would like to see several developments. The most important is legalisation, not just in the United States but around the world where there are significant markets for medicinal and recreational cannabis. In the United States, legalisation of cannabis would break the regulatory shackles that has been holding the industry back. It would open access to funding from federally registered banks and allow companies who sell cannabis to trade on national stock exchanges (thereby providing easier access to capital). Further developments in the medicinal space would also be beneficial for the theme. If positive research continues to be published around the globe, we expect to see renewed investor interest. Mergers or acquisitions in the sector would also be positive - this would allow larger companies to gain access to better distribution channels and expand market access. Ultimately the objective is to improve business profits and margins, which will make the companies more attractive investments. Funds operated by this manager: |

Can't make it? Sign up anyway and receive a recording after the webinar.

20 Jul 2021 - Webinar Invitation | Laureola Advisors

|

|

Laureola Review: Q2 2021 Wed, July 28, 2021 5:00 PM AEST Please join us for our quarterly webinar where we will discuss the following: 1. Introduction: Laureola Advisors 2. Q2 2021 performance review 3. Analysis of current portfolio and where we are now 4. Upcoming developments 5. Q&A

ABOUT LAUREOLA ADVISORS Laureola Advisors was founded with the belief that investors deserve access to the unique benefits of Life Settlements, with the advantages of a specialist and focused asset manager. The best feature of the asset class is the genuine non-correlation with stocks, bonds, real estate, or hedge funds. Life Settlement investors will make money when others can't. Like many asset classes, Life Settlements provides experienced and competent boutique managers like Laureola with significant advantages over larger institutional players. In Life Settlements, the boutique manager can identify and close more opportunities in a cost effective manner, can move quickly when necessary, and can instantly adapt when opportunities dry up in one segment but appear in another. Larger investors are restricted not only by their size and natural inertia, but by self-imposed rules and criteria, which are typically designed by committees. The Laureola Advisors team has transacted over $1 billion (US dollars) in face value of life insurance policies. |

20 Jul 2021 - Nike: Pulling Ahead of the Pack

|

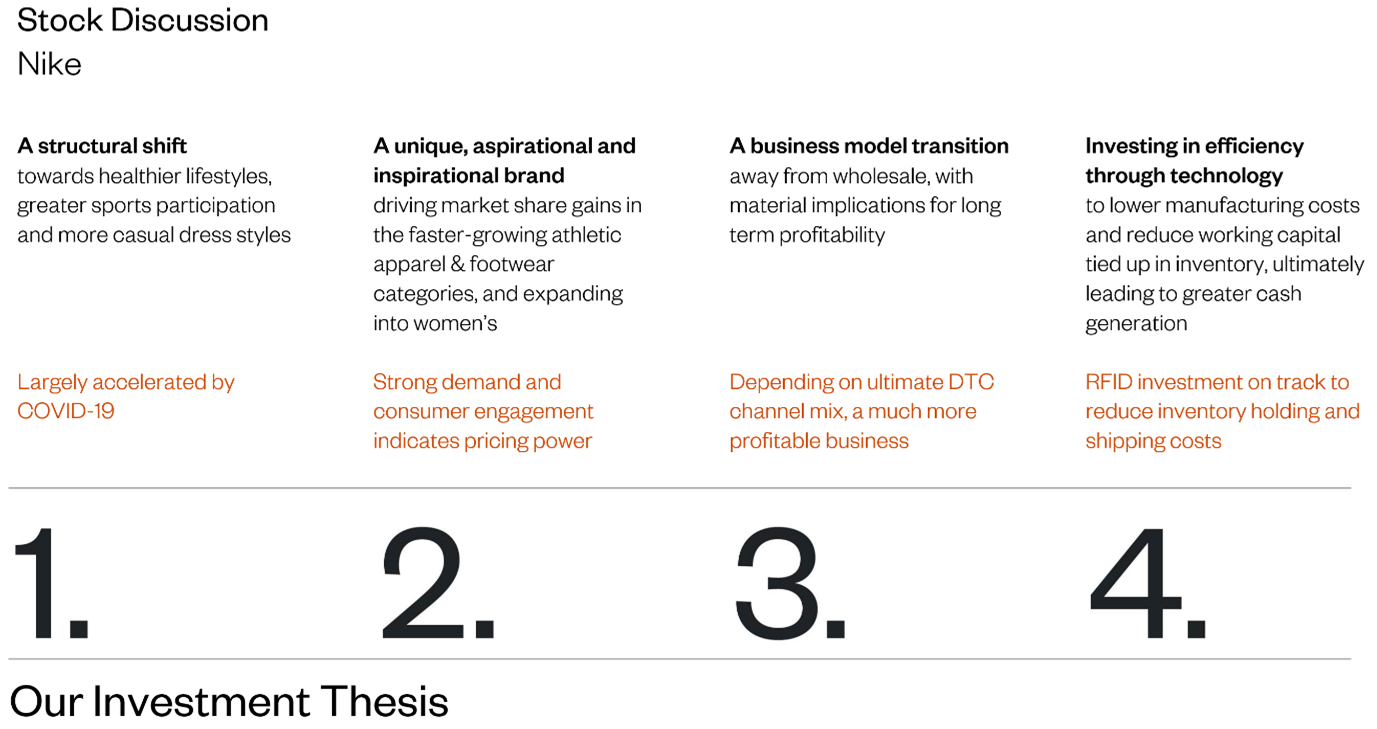

Nike: Pulling Ahead of the Pack Charlie Aitken, AIM June 2021 Approximately nine months ago, we provided a review of our investment case for Nike in 'A Marathon, Not A Sprint'. With the benefit of time, vaccines, additional data points illuminating how consumer behaviour has shifted as a result of the pandemic, and further clarity on Nike's operational performance, it is a good time to take stock and revisit the business again. The slide below is taken from our investor update presented in October 2020, and summarizes the key points underpinning our initial investment thesis for Nike back in August of 2019. While the narrative around Nike for much of the last 18 months has been 'work-from-and-stay-at-home-winner', our view was always that this misses a much more pertinent fact: that the company is undergoing a structural change in its business model that would mean its margin profile would materially increase over the next three to five years. From our October 2020 note:

The valuation impact of this margin uplift is material. In theory, by simply shifting the destination where consumers choose to purchase goods from Nike, the business could end up selling the same number of products at the same retail price but end up dramatically increasing profits. By vertically integrating its distribution to be more in-house, Nike is effectively reclaiming margin back from the wholesale channel. Pulling Ahead of the Pack Last week, Nike reported quarterly results for the period ended 31 May 2021, where management discussed many of the key drivers of performance for the businesses over the next several years. We were happy to hear that an increased focus on Women's shoes and apparel is bearing fruit, as this was a market Nike has historically underserved. (Turns out there's money to be made in specifically catering to the needs of ~50% of the population!) As this trend matures, we expect it to drive faster organic revenue growth for several years, underpinning market share gains. Of further interest was the fact that Nike sees the changing positive attitude towards healthier lifestyles coming out of the pandemic as an opportunity to grow the overall market by promoting sports participation, particularly among younger consumers. The combination of greater insight into consumer preferences is driving not only more targeted product development, but also more targeted (and effective) marketing spend. The interaction of these factors (a structural shift towards healthier lifestyles, expanding into underserved market segments, the shift towards a DTC-business model, and other efficiency gains from investing in technology over the past several years) lead to management issuing the following medium-term (2025) guidance:

Of late, the market has been focused on short-term issues, such as port disruptions in the US (meaning inventory was not able to be timeously distributed to consumers for a period), or a consumer boycott of Nike product in China (which seems to be dissipating already). Historically, such short-term 'glitches' are when long-term investors have the opportunity to purchase great businesses with a margin of safety. (Our initial investment in August 2019 was made at the height of the US/China trade war rhetoric; buying a US brand with a meaningful percentage of sales into China was not exactly the flavour of the month.) By focusing on the longer-term developments that were not yet obvious in the reported numbers - specifically, the change in profitability enabled by the channel mix shift - and understanding the benefits of Nike's 'portfolio' approach to its business (across regions, categories, brands, and sporting codes), the long-term investor would have found much to like. As the margin uplift driven by the DTC shift is now better understood by the market at large, the market valuation has begun to reflect this; in fact, it rallied by nearly 15% on the day following its most recent result as the market capitalised the long-term margin structure into the valuation today. To us, Nike is a case in point where short-term market volatility can benefit the patient investor in buying a quality business at a margin of safety. While we are sure there are still many unforeseen and unexpected challenges Nike will have to navigate out to 2025, the combination of its strong competitive advantages in brand (and, we believe, in execution), strong cash generation, a conservative balance sheet and a high-quality management team steering the ship gives us comfort that the business is a high-quality compounder, and will be for many years to come. Funds operated by this manager: |

20 Jul 2021 - Performance Report: Glenmore Australian Equities Fund

| Report Date | |

| Manager | |

| Fund Name | |

| Strategy | |

| Latest Return Date | |

| Latest Return | |

| Latest 6 Months | |

| Latest 12 Months | |

| Latest 24 Months (pa) | |

| Annualised Since Inception | |

| Inception Date | |

| FUM (millions) | |

| Fund Overview | The main driver of identifying potential investments will be bottom up company analysis, however macro-economic conditions will be considered as part of the investment thesis for each stock. |

| Manager Comments | The fund's Sharpe ratio has ranged from a high of 3.15 over the most recent 12 months, to a low of 0.69 over the past 2 years. Since inception the fund's Sharpe ratio has been 1.03 vs the index which has a Sharpe ratio of 0.66. The fund's Sortino ratio (which excludes volatility in positive months) vs its index has ranged from a maximum of 26.48 over the most recent 12 months, to a low of 0.7 over the past 2 years. Since inception the fund's Sortino ratio has been 1.26 vs the index's 0.75. Since inception in the months when the market was positive the fund provided positive returns 91% of the time. It has an up-capture ratio ranging between 207.09% (since inception) and 159.24% (2 years), and over the most recent 12 months has provided an up-capture ratio of 158.46%. |

| More Information |

19 Jul 2021 - Manager Insights | Prime Value Asset Management

|

Damen Purcell, COO of Australian Fund Monitors, speaks with Richard Ivers, Portfolio Manager at Prime Value Asset Management. The Prime Value Emerging Opportunities Fund invests in companies in the diversified emerging companies sector. Since inception in October 2015, it has returned +16.30% p.a. against the ASX200 Accumulation Index's annualised return over the same period of +11.05%. The Fund has demonstrated superior performance in falling and volatile markets, with a Sortino ratio (since inception) of 1.45 vs the Index's 0.89, and a down-capture ratio (since inception) of 46%. Over the most recent 12 months, the Fund has risen +42.01% vs the Index's +27.80%, and has achieved a down-capture ratio of -4.64%.

|

||

|

Prime Value will be running a webinar on 21 July at 12:30pm AEST. This webinar will be hosted by Phil Morgan, Director Investor Relations & Capital Raising, and presented by their Equities Portfolio Managers, ST Wong and Richard Ivers. What they will discuss:

Please click the link below to RSVP and you will receive an email confirmation with the zoom link to attend the webinar. Register for the webinar on Wednesday 21 July at 12:30pm

|