NEWS

14 Nov 2024 - Performance Report: Airlie Australian Share Fund

[Current Manager Report if available]

14 Nov 2024 - Have ASX iron ore stocks found their floor?

|

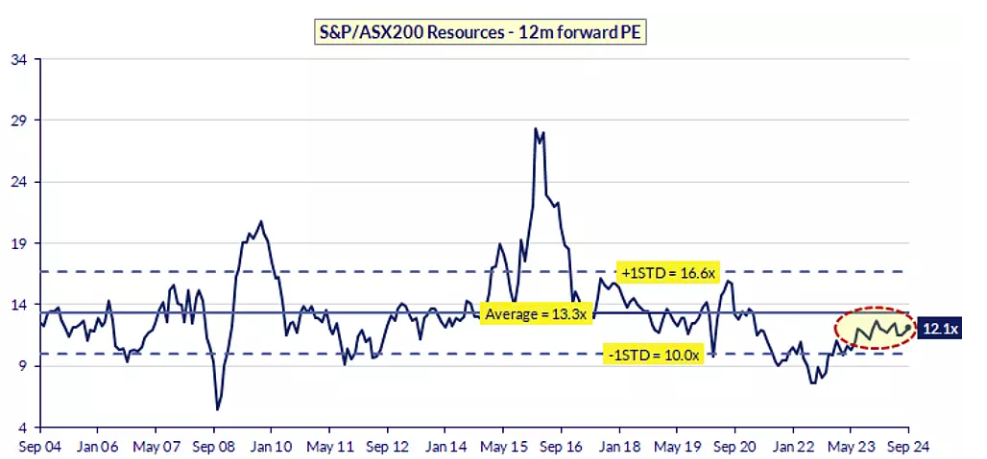

Have ASX iron ore stocks found their floor? Tyndall Asset Management October 2024 Iron ore prices may have finally found some stability moving forwardRecently, the People's Bank of China (PBOC) rolled out its most significant set of monetary easing policies since 2015. These measures were designed to address China's ongoing property sector challenges and provide a broader boost to economic growth. Interest rates and reserve requirement ratios have been cut to historically low levels, signalling the government's commitment to maintaining liquidity and preventing a deeper slowdown. While this has spurred a rally in both Chinese equities and Australian resource stocks, the question remains: Is this a short-term sentiment-driven bounce, or the start of something more sustainable? While opinions may vary on the longevity of this rally, one thing is clear: China's looser monetary policy has created an environment ripe for further fiscal and property policy adjustments. The current positioning of the market is quite negative on China and thus underweight stocks that are exposed to China such as Australian Resources. This helps explain the recent strong market reaction. Have iron ore stocks found their floor?The common reaction to China's slowdown often involves calls to sell big miners like BHP (ASX: BHP) and Rio Tinto (ASX: RIO). However, that kind of knee-jerk reaction doesn't align with a value-based investing approach. While sentiment undeniably influences short-term market movements, the real question is: How much steel is the global economy demanding, and what is the marginal cost of supply? At current prices, iron ore is likely sitting at a support level, hovering around US$95/t, which is underpinned by break-even costs. Prices have dipped below US$95/t for only 16 days this year, compared to 50 days over the last three years. The cost curve supports this level, as many producers would be unprofitable at lower prices. Additionally, trader mentality tends to kick in once prices break the US$100/t threshold, adding further support to this range. On a more fundamental level, we believe there is currently around 120mt of supply in the market that requires a price of over So, the question we have to ask is whether China's economic weakness is severe enough to remove another 120Mt of iron ore demand from the market. We don't think so. While the Chinese government has signalled its willingness to address demand concerns through coordinated policies, the China Iron & Steel Association (CISA) has projected that crude steel production will remain flat year-on-year in 2024. This suggests stability moving forward at current levels. Supply-side adjustments: Rebalancing the marketOn the supply side, significant cuts in iron ore production from both India and China have already done much to rebalance the market. India's output has fallen from 70Mtpa earlier this year to 30Mtpa due to price sensitivity, while China's domestic production has similarly dropped from 200mtpa to 80mtpa on a 62% Fe basis. In Australia, we have seen Mineral Resources (ASX: MIN) shut down the Yilgarn operations (8Mt) and the Sino Iron Project decreased from 21Mt to 14mt. These adjustments further underscore the market's price elasticity. The greatest long-term supply risk remains the Brazilian mining giant, Vale. Although Vale has increased its production guidance for the year, Brazilian exports typically flatten out in the final quarters of the year due to seasonality, so massive increases in output are unlikely. Longer term, another potential supply-side disruptor that has long spooked the market is the Simandou project in Guinea. The rail line is expected to be operational by Q1 2026, with the port to be staged thereafter. The complexity of the project poses a significant risk of delays. We expect the operation to ramp up through 2028. Additionally, the wet season in Guinea introduces challenges with stockpile management and moisture control. For now, the risk of an oversupply glut in the iron ore market seems overplayed by the bears in the market. Seasonality and SentimentAnother factor working in iron ore's favour is seasonality. Historically, iron ore prices have shown strength from December through February, as China's domestic production falls during the winter months. This forces the country to rely more on seaborne supply, which is often disrupted by wet weather conditions in Brazil and the Pilbara region in Australia. Port inventories are currently sitting at 150Mt, which is on the higher end of the seasonal average. However, this doesn't pose a significant threat to the market, as a portion of these inventories are now controlled by major iron ore players for blending purposes. Moreover, low-grade discounts have narrowed, and rebar spreads have rebounded from their September lows, signalling that much of the bearish sentiment may already be priced in. It is also difficult to assess the full supply chain inventories in China including stockpiles at steel mills. Recent discussions with China companies suggest that this inventory may be at the lower end of history. Where is the opportunity in iron ore equities?In terms of equities, Fortescue Metals Group (ASX: FMG) is a recent addition to the portfolio. It offers an attractive entry point, and its lack of gearing makes it a pure play on a rebound in iron ore prices while paying an attractive fully franked distribution. BHP and Rio Tinto offer more diversified exposure, with their base metals businesses providing some downside protection. While the market remains cautious due to weak Chinese sentiment, the fundamental factors supporting iron ore prices--cost support and seasonality--paint a more optimistic picture. As long as demand holds and supply remains in check, iron ore prices are likely to stabilise around current levels, if not rise slightly through the remainder of the year. Given this, an overweight position in iron ore equities, particularly FMG, appears to be a solid investment in the months ahead. Is this the start of a larger rotation out of the banks into the miners?We are seeing a significant valuation gap between the Bank and Resource sectors. The Banks sector has surged to an all-time high P/E of 18.4x (refer to Figure 1), well above its historical average of 12.8x, even exceeding the +1 standard deviation level of 14.5x, indicating stretched valuations. Figure 1: ASX200 Banks - trading at 18.4x forward concensus earnings (all-time high) |

13 Nov 2024 - Performance Report: Quay Global Real Estate Fund (Unhedged)

[Current Manager Report if available]

13 Nov 2024 - Performance Report: DS Capital Growth Fund

[Current Manager Report if available]

13 Nov 2024 - Green AI

|

Green AI Eiger Capital October 2024 AI has certainly created a buzz over the past couple of years. While a lot of attention has been focussed on Nvidia, the global poster child for the AI sector, there has been a raft of cascading effects that have trickled down to related industries. An obvious one is data centres. According to McKinsey, data centre capacity in the US alone is expected to double to 35GW by 2030 from 17GW in 2022. To put that in perspective, this is approximately equivalent to the entire installed capacity of Malaysia and up to 9% of US generating capacity. In terms of global electricity production, the International Energy Agency (IEA) estimates that data centres worldwide used up to 460TWh of electricity in 2022 (equivalent to France, or ~2% of global production) and could be as high as 1,000TWh by 2026 (equivalent to Japan today). Global data centre industry power consumption forecasts

Source: McKinsey & Company Companies like NextDC were already benefiting from high demand for their services. However, the ever-increasing digitisation of society is expected to see a supercharging of data requirements driven by AI advances. Consider the use of ChatGPT. This technology consumes up to ten times the electricity that a standard Google search does. The need to process vast quantities of data from multiple sources has resulted in evermore powerful processing units. In Nvidia's case, newer GPUs like the B100 use up to 1,200W, or about three times that of the earlier A100 unit. So, while the efficiency may also increase, i.e., data per watt, absolute power consumption is skyrocketing as more users engage with this technology. Current Asia Pacific data centre capacity and planned growth

This in turn leads us to a less obvious derivative of AI and digitisation in general - power supply as the critical enabling factor for these advances in technology, including cooling technology. The issue of power supply was recently raised by NextDC's management and reported in the local press (e.g., The Australian Financial Review, 28 May 2024). At the company's recent annual results presentation, the CEO referred to the growing size of potential contracts in Australia of at least 100MW and alluded to new data centres being up to 500MW in size versus their current maximum of around 300MW at S4. Outside Australia, individual, planned data centres now exceed 1GW capacity, e.g., Oracle is looking at a potential centre of this size in the US. Whilst there is currently adequate capacity for new data centres, the looming problem is in the vastly divergent rates of technology adoption by the population and the planning, permitting and construction of new power supply. For data centre companies that are planning for indicated future demand, there is clearly a concern that their need for incremental power is a bridge too far for the grid as it stands. In addition to grid capacity, grid age is a concern in mature markets. Analysis by Goldman Sachs points to Europe as being particularly vulnerable with an average grid age of 50 years and hence additional investment is needed to support a larger, more intensive power draw. Average age of Electricity grids around the world Beyond access to additional raw power, another challenge with the growth of AI and data centres globally is the expanded grid transmission needed. Not only do more renewables require very expensive and politically fraught expansions of transmission grids into (wind and solar) regions previously not serviced by existing grids, the grids themselves are rapidly aging, especially in developed economies. Nuclear again provides an elegant solution to this grid challenge, via co-location. We are starting to see data centre owners co-locate new planned facilities with a power source, eliminating the need for more grid transmission. Alongside proposing a 1GW plant, Oracle is reported to have floated the idea of building three Small Modular Reactors (SMRs) to power it. Elsewhere, Amazon purchased a US$650m data centre in March 2024 that is adjacent to a 2,500MW nuclear power plant, which provides electricity to the centre. Nuclear is increasingly attractive to the data centre industry because it is an exceptionally reliable source of baseload power - a must for data centres - and helps them tackle the problem of CO2 emissions. If SMR's become a viable technology, they are in turn more attractive due their small size and relative quick construction, and there are fewer issues with the wider grid. On the issue of CO2, data centres have indeed caught the eye of ESG analysts as companies report more detailed data. For example, Google revealed that its carbon emissions grew 48% over the five years ending 2023 to over 14Mt, driven largely by computing intensity to support its AI data centres. The emissions profiles of data facilities are an area of concern for many of these companies, who buy offsets to reduce their carbon footprint or supplement their energy needs with renewable power. However, it is not just the data centre industry that is looking to nuclear energy to solve the twin problems of large power draw and lower emissions profiles. Steelmakers, cement manufacturers, chemicals companies and refiners have proposed SMR solutions to their CO2 problems. For example, DOW Inc plans to replace gas generators with an SMR to become carbon neutral by 2050. Steel makers in Italy and cement companies in India are also investigating nuclear power and SMRs to decarbonise their operations without compromising on their power needs. Even some Australian miners such as Lynas Rare Earths believe that nuclear could be a viable option to power some of their remote mining sites using future SMR technology. While the world works towards renewable solutions to permanently reduce CO2 emissions, nuclear energy is being resurrected on a global basis as a key part of the solution to climate change. The principal reason for this renaissance is its role as the only base-load source of zero emission power available. For this to happen the world will need a lot more uranium. The challenge, however, is that the historic chronic underinvestment in the mining side of the industry means that meaningful new uranium supply will be absent from the market until at least around 2030 in our view. In light of this absence of new production we prefer those companies that are already in production, such as Boss Energy (BOE) and Paladin Energy (PDN). Both companies are now producing yellowcake and beginning to generate cash sales. In the case of Boss, it is ramping up to ~2.5Mlbs p.a. (plus up to 0.5Mlbs p.a. from the Alta Mesa mine in Texas) while Paladin will produce around 6Mlbs p.a. from the Langer Heinrich mine in Namibia. With the term price of U3O8 sitting at about US$80/lb, Boss and Paladin can make healthy returns given guidance on cash costs of US$30-40/lb. However, if demand projections are correct and there is a significant shortfall in uranium supply over the next several years, then current producers are extremely well-placed to benefit. We saw the same dynamic at play with Pilbara Minerals when the lithium price spiked on a strong rebound in demand for lithium. While the rise in the uranium term price to US$80/lb represents a significant increase from the low US$30s/lb four years ago, we note that on an inflation adjusted basis, previous price spikes have been as high as US$200/lb. We are not predicting that this will occur but as the rise in data centres show, the demand for power is not going down, and in this environment, global industry is looking for stable, low CO2 power supply. How Australia deals with this problem remains to be seen. Internationally, however, nuclear is increasingly being seen as an integral part of the power supply solution. For this reason, we retain an exposure to Boss and Paladin anticipating increased cash flows as sales ramp-up into a strong pricing environment. Author: David Haddad, Principal and Portfolio Manager Funds operated by this manager: |

12 Nov 2024 - Performance Report: Bennelong Concentrated Australian Equities Fund

[Current Manager Report if available]

world we live in. Importantly, they shape communities, but they

also create investment opportunities and risks.

12 Nov 2024 - Megatrends for 2025 and beyond...

11 Nov 2024 - Performance Report: 4D Global Infrastructure Fund (Unhedged)

[Current Manager Report if available]

11 Nov 2024 - Performance Report: ASCF High Yield Fund

[Current Manager Report if available]

11 Nov 2024 - Performance Report: Bennelong Australian Equities Fund

[Current Manager Report if available]